Mini LED vs OLED: Brightness and Efficiency Comparison

SEP 12, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Display Technology Evolution and Objectives

Display technology has undergone significant evolution over the past decades, transitioning from cathode ray tubes (CRTs) to liquid crystal displays (LCDs), and now advancing toward more sophisticated technologies like Mini LED and OLED. This technological progression has been driven by the continuous pursuit of improved visual performance, energy efficiency, and form factor versatility.

The journey began with CRT displays, which dominated the market until the early 2000s. LCDs then emerged as the preferred technology due to their thinner profile and lower power consumption. The introduction of LED backlighting for LCD panels marked another significant milestone, enhancing brightness capabilities while reducing energy requirements.

In recent years, two advanced display technologies have gained prominence: Mini LED and OLED. Mini LED represents an evolution of traditional LED-backlit LCD technology, utilizing significantly smaller LED chips (typically 100-200 micrometers) arranged in thousands of dimming zones. This configuration enables more precise local dimming, resulting in improved contrast ratios and reduced blooming effects compared to conventional LED displays.

OLED (Organic Light Emitting Diode) technology represents a fundamentally different approach, where each pixel generates its own light without requiring a backlight. This self-emissive characteristic allows for perfect blacks, infinite contrast ratios, and extremely thin form factors, revolutionizing display capabilities across multiple device categories.

The primary objectives in comparing Mini LED and OLED technologies center on brightness capabilities and energy efficiency—two critical parameters that significantly impact user experience and device functionality. Brightness performance directly influences visibility in various lighting conditions, particularly in high ambient light environments, while also affecting HDR content reproduction quality.

Efficiency considerations extend beyond mere power consumption metrics to include manufacturing efficiency, thermal management requirements, and long-term reliability factors. These aspects collectively determine the technology's suitability for different applications ranging from mobile devices to large-format displays and automotive implementations.

The industry aims to achieve an optimal balance between visual performance and power efficiency, with particular emphasis on peak brightness capabilities exceeding 1,000 nits while maintaining reasonable power consumption profiles. Additionally, there are ongoing efforts to address technology-specific challenges such as OLED's burn-in susceptibility and Mini LED's zone-based dimming limitations.

Understanding the fundamental differences between these technologies and their respective evolution trajectories provides essential context for evaluating their current capabilities and projecting future developments in the display technology landscape.

The journey began with CRT displays, which dominated the market until the early 2000s. LCDs then emerged as the preferred technology due to their thinner profile and lower power consumption. The introduction of LED backlighting for LCD panels marked another significant milestone, enhancing brightness capabilities while reducing energy requirements.

In recent years, two advanced display technologies have gained prominence: Mini LED and OLED. Mini LED represents an evolution of traditional LED-backlit LCD technology, utilizing significantly smaller LED chips (typically 100-200 micrometers) arranged in thousands of dimming zones. This configuration enables more precise local dimming, resulting in improved contrast ratios and reduced blooming effects compared to conventional LED displays.

OLED (Organic Light Emitting Diode) technology represents a fundamentally different approach, where each pixel generates its own light without requiring a backlight. This self-emissive characteristic allows for perfect blacks, infinite contrast ratios, and extremely thin form factors, revolutionizing display capabilities across multiple device categories.

The primary objectives in comparing Mini LED and OLED technologies center on brightness capabilities and energy efficiency—two critical parameters that significantly impact user experience and device functionality. Brightness performance directly influences visibility in various lighting conditions, particularly in high ambient light environments, while also affecting HDR content reproduction quality.

Efficiency considerations extend beyond mere power consumption metrics to include manufacturing efficiency, thermal management requirements, and long-term reliability factors. These aspects collectively determine the technology's suitability for different applications ranging from mobile devices to large-format displays and automotive implementations.

The industry aims to achieve an optimal balance between visual performance and power efficiency, with particular emphasis on peak brightness capabilities exceeding 1,000 nits while maintaining reasonable power consumption profiles. Additionally, there are ongoing efforts to address technology-specific challenges such as OLED's burn-in susceptibility and Mini LED's zone-based dimming limitations.

Understanding the fundamental differences between these technologies and their respective evolution trajectories provides essential context for evaluating their current capabilities and projecting future developments in the display technology landscape.

Market Demand Analysis for High-Performance Displays

The display technology market has witnessed significant growth in recent years, driven by increasing consumer demand for superior visual experiences across various devices. High-performance displays featuring enhanced brightness, improved energy efficiency, and superior color accuracy have become essential components in premium smartphones, televisions, laptops, and automotive interfaces. Market research indicates that the global high-performance display market reached approximately $143 billion in 2022 and is projected to grow at a compound annual growth rate of 7.8% through 2028.

Consumer preferences are increasingly shifting toward displays that offer better outdoor visibility, reduced power consumption, and longer device lifespans. This trend is particularly evident in the smartphone segment, where manufacturers compete intensely on display quality as a key differentiating factor. Survey data reveals that over 65% of consumers consider display quality among the top three factors influencing their purchasing decisions for premium electronic devices.

The commercial sector represents another significant market driver, with businesses investing in high-performance displays for digital signage, control rooms, and professional workstations. These applications demand displays with exceptional brightness, color accuracy, and operational longevity. The healthcare and automotive industries have emerged as rapidly growing segments, with specialized requirements for displays that maintain visibility under varying lighting conditions while minimizing power consumption.

Regional analysis shows Asia-Pacific leading the market demand, accounting for approximately 42% of global consumption, followed by North America and Europe at 28% and 22% respectively. China, South Korea, and Japan dominate manufacturing capacity, while North American and European markets drive innovation through research and premium product adoption.

The competitive landscape between Mini LED and OLED technologies has intensified as manufacturers seek optimal solutions for different application scenarios. Mini LED displays have gained traction in the television and large-format display markets, where their superior brightness capabilities address consumer demands for HDR content viewing. Meanwhile, OLED maintains strong positioning in premium smartphones and wearables, where power efficiency and form factor flexibility are paramount.

Market forecasts suggest a period of technology coexistence rather than outright replacement, with Mini LED and OLED each capturing specific market segments based on their respective strengths. The gaming market represents a particularly contested battleground, with gamers demanding both the high brightness of Mini LED and the fast response times of OLED. Industry analysts project that manufacturers who successfully optimize the brightness-to-efficiency ratio will capture premium market segments and command higher profit margins.

Consumer preferences are increasingly shifting toward displays that offer better outdoor visibility, reduced power consumption, and longer device lifespans. This trend is particularly evident in the smartphone segment, where manufacturers compete intensely on display quality as a key differentiating factor. Survey data reveals that over 65% of consumers consider display quality among the top three factors influencing their purchasing decisions for premium electronic devices.

The commercial sector represents another significant market driver, with businesses investing in high-performance displays for digital signage, control rooms, and professional workstations. These applications demand displays with exceptional brightness, color accuracy, and operational longevity. The healthcare and automotive industries have emerged as rapidly growing segments, with specialized requirements for displays that maintain visibility under varying lighting conditions while minimizing power consumption.

Regional analysis shows Asia-Pacific leading the market demand, accounting for approximately 42% of global consumption, followed by North America and Europe at 28% and 22% respectively. China, South Korea, and Japan dominate manufacturing capacity, while North American and European markets drive innovation through research and premium product adoption.

The competitive landscape between Mini LED and OLED technologies has intensified as manufacturers seek optimal solutions for different application scenarios. Mini LED displays have gained traction in the television and large-format display markets, where their superior brightness capabilities address consumer demands for HDR content viewing. Meanwhile, OLED maintains strong positioning in premium smartphones and wearables, where power efficiency and form factor flexibility are paramount.

Market forecasts suggest a period of technology coexistence rather than outright replacement, with Mini LED and OLED each capturing specific market segments based on their respective strengths. The gaming market represents a particularly contested battleground, with gamers demanding both the high brightness of Mini LED and the fast response times of OLED. Industry analysts project that manufacturers who successfully optimize the brightness-to-efficiency ratio will capture premium market segments and command higher profit margins.

Mini LED and OLED Technical Challenges

Both Mini LED and OLED technologies face distinct technical challenges that impact their performance, manufacturing processes, and market adoption. These challenges directly influence their brightness and efficiency capabilities, which are critical factors in display technology selection.

Mini LED technology confronts several significant hurdles. The primary challenge lies in achieving precise control over thousands of dimming zones. As Mini LEDs decrease in size (typically 100-200 micrometers), manufacturers struggle with placement precision during the transfer process from epitaxial wafers to substrates. This challenge directly impacts brightness uniformity across the display panel and affects overall efficiency.

Thermal management represents another critical obstacle for Mini LED displays. The high density of LEDs generates considerable heat during operation, potentially reducing lifespan and efficiency if not properly managed. Engineering effective heat dissipation systems without increasing device thickness significantly remains problematic, especially for portable devices where form factor is crucial.

Additionally, Mini LED faces yield challenges in mass production. The manufacturing process requires handling thousands of tiny LED chips with minimal defects, which increases production complexity and costs. Current yield rates impact the technology's price competitiveness against established alternatives like conventional LCD and emerging OLED displays.

For OLED technology, material degradation remains the foremost challenge. Blue OLED materials particularly suffer from shorter lifespans compared to red and green counterparts, leading to color shift over time. This degradation directly impacts long-term brightness consistency and power efficiency, especially in high-brightness applications.

OLED also struggles with brightness limitations in high ambient light conditions. While OLED excels in producing perfect blacks and contrast, it typically cannot match the peak brightness levels of Mini LED displays, which can reach 2000-4000 nits compared to OLED's typical 600-1000 nits. This brightness ceiling restricts OLED's performance in bright environments and HDR content display.

Manufacturing scalability presents another significant challenge for OLED. Large-size OLED panels face yield issues and higher defect rates during production, contributing to their premium pricing. The complex vapor deposition processes used in OLED manufacturing require extremely precise control, further complicating high-volume production.

Both technologies also face efficiency challenges related to power consumption. Mini LED backlight systems require sophisticated local dimming algorithms to balance brightness and power usage, while OLED displays must manage pixel-level power distribution to prevent uneven aging and maintain efficiency over time.

These technical challenges directly influence the brightness-efficiency equation that manufacturers and consumers must consider when evaluating display technologies for specific applications, from mobile devices to large-format displays and automotive implementations.

Mini LED technology confronts several significant hurdles. The primary challenge lies in achieving precise control over thousands of dimming zones. As Mini LEDs decrease in size (typically 100-200 micrometers), manufacturers struggle with placement precision during the transfer process from epitaxial wafers to substrates. This challenge directly impacts brightness uniformity across the display panel and affects overall efficiency.

Thermal management represents another critical obstacle for Mini LED displays. The high density of LEDs generates considerable heat during operation, potentially reducing lifespan and efficiency if not properly managed. Engineering effective heat dissipation systems without increasing device thickness significantly remains problematic, especially for portable devices where form factor is crucial.

Additionally, Mini LED faces yield challenges in mass production. The manufacturing process requires handling thousands of tiny LED chips with minimal defects, which increases production complexity and costs. Current yield rates impact the technology's price competitiveness against established alternatives like conventional LCD and emerging OLED displays.

For OLED technology, material degradation remains the foremost challenge. Blue OLED materials particularly suffer from shorter lifespans compared to red and green counterparts, leading to color shift over time. This degradation directly impacts long-term brightness consistency and power efficiency, especially in high-brightness applications.

OLED also struggles with brightness limitations in high ambient light conditions. While OLED excels in producing perfect blacks and contrast, it typically cannot match the peak brightness levels of Mini LED displays, which can reach 2000-4000 nits compared to OLED's typical 600-1000 nits. This brightness ceiling restricts OLED's performance in bright environments and HDR content display.

Manufacturing scalability presents another significant challenge for OLED. Large-size OLED panels face yield issues and higher defect rates during production, contributing to their premium pricing. The complex vapor deposition processes used in OLED manufacturing require extremely precise control, further complicating high-volume production.

Both technologies also face efficiency challenges related to power consumption. Mini LED backlight systems require sophisticated local dimming algorithms to balance brightness and power usage, while OLED displays must manage pixel-level power distribution to prevent uneven aging and maintain efficiency over time.

These technical challenges directly influence the brightness-efficiency equation that manufacturers and consumers must consider when evaluating display technologies for specific applications, from mobile devices to large-format displays and automotive implementations.

Current Brightness and Efficiency Solutions

01 Mini LED backlight technology for improved brightness and efficiency

Mini LED technology utilizes thousands of tiny LED chips as a backlight source for LCD displays, offering significantly improved brightness, contrast ratio, and energy efficiency compared to traditional LED backlights. The smaller size and greater number of LEDs allow for more precise local dimming zones, enhancing contrast while reducing power consumption. This technology bridges the gap between conventional LED displays and OLED, providing better HDR performance and deeper blacks without the burn-in issues associated with OLED.- Mini LED backlight technology for enhanced brightness: Mini LED technology utilizes thousands of tiny LED chips as backlights for LCD displays, offering significantly improved brightness levels compared to traditional LED backlighting. This technology enables higher peak brightness, better local dimming capabilities, and improved contrast ratios while maintaining power efficiency. The smaller size of Mini LEDs allows for more precise control of backlight zones, resulting in enhanced HDR performance and reduced blooming effects.

- OLED efficiency improvements through material innovations: OLED display technology continues to evolve through innovations in organic materials and pixel structures that improve light emission efficiency. These advancements include new emitter materials, improved electron transport layers, and optimized pixel architectures that reduce power consumption while maintaining or enhancing brightness levels. Such improvements address one of OLED's historical challenges compared to LED-based displays, making them more competitive in terms of energy efficiency while preserving their inherent advantages in contrast and color reproduction.

- Hybrid display technologies combining Mini LED and OLED benefits: Hybrid display solutions that integrate aspects of both Mini LED and OLED technologies aim to leverage the strengths of each approach. These hybrid designs typically use Mini LED backlighting with quantum dot enhancement layers or combine zones of different display technologies within a single panel. This approach seeks to achieve the high brightness capabilities of Mini LED technology while incorporating the perfect blacks and wide viewing angles characteristic of OLED displays, resulting in improved overall efficiency and visual performance.

- Thermal management solutions for brightness and efficiency optimization: Advanced thermal management systems are critical for both Mini LED and OLED displays to maintain optimal brightness and efficiency. These solutions include innovative heat dissipation structures, thermal interface materials, and cooling systems that prevent performance degradation under high-brightness conditions. Effective thermal management allows displays to operate at higher brightness levels for longer periods without compromising power efficiency or device lifespan, addressing a key challenge in high-performance display applications.

- Power management and driving circuit innovations: Sophisticated power management systems and driving circuit designs significantly impact the brightness and efficiency of both Mini LED and OLED displays. These innovations include adaptive brightness control algorithms, voltage regulation techniques, and pixel driving schemes that optimize power distribution based on content and ambient conditions. Advanced driving circuits enable more precise control of individual pixels or backlight zones, reducing power consumption while maintaining visual quality across varying brightness levels and usage scenarios.

02 OLED display efficiency and brightness enhancement techniques

OLED displays achieve high efficiency through self-emissive pixels that eliminate the need for backlighting. Various techniques are employed to enhance OLED brightness and efficiency, including improved organic materials, optimized pixel structures, and advanced driving methods. Innovations focus on reducing power consumption while maintaining or increasing brightness levels through better electron transport layers, more efficient light-emitting compounds, and refined manufacturing processes that minimize energy loss during operation.Expand Specific Solutions03 Hybrid display technologies combining Mini LED and OLED advantages

Hybrid display solutions incorporate elements from both Mini LED and OLED technologies to maximize brightness and efficiency benefits. These approaches include dual-panel designs, tandem structures, or complementary pixel arrangements that leverage the high brightness capability of Mini LEDs with the perfect blacks and wide viewing angles of OLEDs. Such hybrid technologies aim to overcome the individual limitations of each display type while combining their respective strengths for superior overall performance.Expand Specific Solutions04 Thermal management solutions for display efficiency

Effective thermal management is crucial for maintaining brightness and efficiency in both Mini LED and OLED displays. Advanced heat dissipation structures, thermal interface materials, and cooling systems are implemented to prevent performance degradation at high brightness levels. These solutions include specialized heat sinks, graphene-based thermal conductors, and innovative panel designs that efficiently distribute and remove heat, thereby extending display lifespan and allowing for sustained high-brightness operation without efficiency loss.Expand Specific Solutions05 Power management and driving circuits for display efficiency

Sophisticated power management systems and driving circuits significantly impact the brightness and efficiency of both Mini LED and OLED displays. Advanced voltage regulation, current control mechanisms, and adaptive brightness algorithms optimize power delivery based on content and ambient conditions. These systems include dynamic refresh rate adjustment, pixel compensation circuits, and intelligent dimming controls that maintain visual quality while minimizing energy consumption, resulting in displays that deliver higher brightness with lower power requirements.Expand Specific Solutions

Key Industry Players and Manufacturers

The Mini LED vs OLED display technology landscape is currently in a transitional growth phase, with the global market expected to reach $175 billion by 2025. While OLED technology has achieved maturity with established players like Samsung Electronics and BOE Technology Group leading adoption in premium devices, Mini LED is emerging as a competitive alternative offering superior brightness and energy efficiency. Companies including TCL China Star Optoelectronics and Tianma Microelectronics are rapidly advancing Mini LED technology, narrowing the performance gap with OLED. The competitive dynamics are intensifying as both technologies evolve, with BOE, Samsung, and TCL investing heavily in manufacturing capabilities to address different market segments based on their respective efficiency and brightness advantages.

BOE Technology Group Co., Ltd.

Technical Solution: BOE has pioneered an innovative Mini LED backlight technology called "Active Matrix Mini LED" (AM Mini LED) that integrates driving circuits directly onto the backplane, enabling more precise control of thousands of dimming zones. Their latest Mini LED displays achieve brightness levels exceeding 2,500 nits while maintaining power efficiency through advanced local dimming algorithms[3]. BOE's proprietary "Crystal Silicon Mini LED" technology reduces the LED chip size to below 100 micrometers, allowing for more densely packed arrays that improve brightness uniformity and reduce power consumption by up to 25% compared to first-generation Mini LED displays[4]. For commercial applications, BOE has developed hybrid solutions that combine Mini LED backlighting with quantum dot color enhancement technology, achieving 95% DCI-P3 color gamut coverage while maintaining brightness efficiency. Their power management system incorporates AI-driven content analysis to dynamically adjust backlight intensity across different screen regions, further optimizing the brightness-to-power ratio.

Strengths: Excellent brightness-to-power consumption ratio; superior HDR performance with precise local dimming; better color volume at high brightness than OLED; significantly longer lifespan without degradation issues. Weaknesses: Cannot achieve the perfect blacks of OLED technology; slightly slower response times compared to OLED; more complex manufacturing process leading to higher initial costs; thicker overall display profile than OLED panels.

TCL China Star Optoelectronics Technology Co., Ltd.

Technical Solution: TCL CSOT has developed a proprietary Mini LED technology branded as "Vidrian Mini LED" that integrates the backlight directly into a glass substrate, allowing for more precise light control and improved thermal management. Their latest Mini LED displays feature over 25,000 individual LEDs organized into thousands of local dimming zones, achieving peak brightness levels of 3,000+ nits while maintaining power efficiency through sophisticated zone-based dimming algorithms[5]. TCL's implementation utilizes mini LEDs smaller than 200 micrometers, enabling higher density placement and more uniform brightness distribution. Their power management system incorporates ambient light sensing to automatically adjust brightness levels based on viewing conditions, reducing power consumption by up to 40% compared to traditional LED displays[6]. TCL has also developed a unique "Mini LED on Silicon" (MiLOS) technology that further reduces LED size and improves manufacturing precision, resulting in better light control and energy efficiency ratios approaching 2.5x that of conventional OLED displays at peak brightness levels.

Strengths: Exceptional brightness capabilities exceeding most OLED displays; superior power efficiency at high brightness levels; better resistance to image retention and burn-in; excellent HDR performance with minimal blooming. Weaknesses: Higher manufacturing complexity than traditional LCD; slightly less perfect black levels than OLED; thicker panel construction; higher initial production costs that impact consumer pricing.

Core Patents in Display Illumination Technology

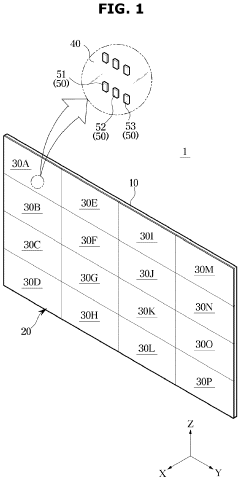

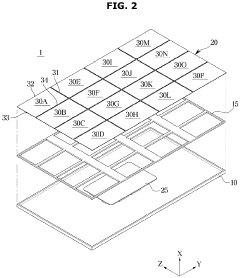

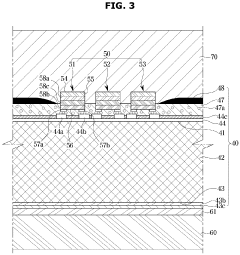

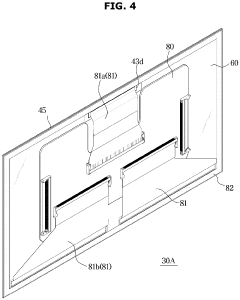

Display device comprising display module, and manufacturing method therefor

PatentPendingEP4401159A1

Innovation

- The display apparatus incorporates a substrate with inorganic light-emitting diodes, a front cover, a metal plate, a side cover, and a side end member with ribs for enhanced conductivity and sealing, which improves electrostatic discharge protection and reduces gaps between modules, making the display apparatus more robust and visually seamless.

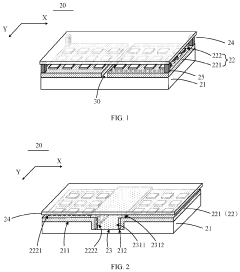

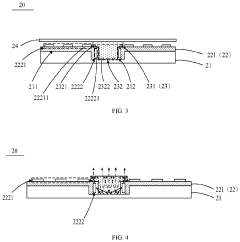

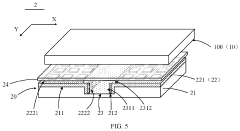

Backlight module and display device

PatentActiveUS20240053636A1

Innovation

- A backlight module design featuring a back plate with protrusions and grooves, where a light guide plate directs light emitted from the groove away from the back plate, and an optical film is used to improve light distribution and reduce shadows, while the light source substrate is arranged to minimize heat and alignment problems.

Power Consumption Metrics and Optimization

Power consumption is a critical factor in display technology evaluation, particularly when comparing Mini LED and OLED technologies. Mini LED displays typically consume more power than OLED panels when displaying bright content due to their backlight architecture. In Mini LED displays, the backlight must illuminate all pixels regardless of content, though local dimming zones can mitigate this effect by selectively reducing brightness in darker areas. This results in varying power consumption patterns depending on the displayed content.

OLED displays demonstrate superior efficiency when displaying darker content since each pixel emits its own light and can be completely turned off when displaying black. This pixel-level control creates significant power savings in real-world usage scenarios where content frequently contains dark elements. Measurements indicate that OLED displays can consume up to 30-40% less power than Mini LED displays when showing predominantly dark content.

However, when displaying full-screen bright content, Mini LEDs can achieve better efficiency ratios. Recent advancements in Mini LED backlight technology have improved power efficiency through enhanced light guide plates and more precise local dimming algorithms. These innovations have reduced power consumption by approximately 15-20% compared to earlier Mini LED implementations.

Power optimization techniques differ significantly between these technologies. For Mini LEDs, optimization focuses on improving backlight efficiency, refining local dimming algorithms, and enhancing light transmission through display layers. Advanced thermal management systems are also being implemented to maintain efficiency during extended high-brightness operation.

OLED power optimization centers on addressing the differential aging of organic materials and improving the efficiency of blue subpixels, which traditionally consume more power and degrade faster than red and green counterparts. Recent developments in OLED materials have improved quantum efficiency, resulting in lower voltage requirements and reduced heat generation.

Both technologies implement adaptive brightness controls that adjust display output based on ambient lighting conditions. However, OLED implementations typically offer more granular control due to their pixel-level dimming capabilities. Mini LED displays are increasingly adopting AI-driven power management systems that analyze content in real-time to optimize backlight distribution across dimming zones.

The industry is moving toward standardized power consumption metrics that better reflect real-world usage patterns rather than maximum power ratings. These metrics incorporate varied content types and brightness levels to provide more accurate efficiency comparisons between Mini LED and OLED technologies.

OLED displays demonstrate superior efficiency when displaying darker content since each pixel emits its own light and can be completely turned off when displaying black. This pixel-level control creates significant power savings in real-world usage scenarios where content frequently contains dark elements. Measurements indicate that OLED displays can consume up to 30-40% less power than Mini LED displays when showing predominantly dark content.

However, when displaying full-screen bright content, Mini LEDs can achieve better efficiency ratios. Recent advancements in Mini LED backlight technology have improved power efficiency through enhanced light guide plates and more precise local dimming algorithms. These innovations have reduced power consumption by approximately 15-20% compared to earlier Mini LED implementations.

Power optimization techniques differ significantly between these technologies. For Mini LEDs, optimization focuses on improving backlight efficiency, refining local dimming algorithms, and enhancing light transmission through display layers. Advanced thermal management systems are also being implemented to maintain efficiency during extended high-brightness operation.

OLED power optimization centers on addressing the differential aging of organic materials and improving the efficiency of blue subpixels, which traditionally consume more power and degrade faster than red and green counterparts. Recent developments in OLED materials have improved quantum efficiency, resulting in lower voltage requirements and reduced heat generation.

Both technologies implement adaptive brightness controls that adjust display output based on ambient lighting conditions. However, OLED implementations typically offer more granular control due to their pixel-level dimming capabilities. Mini LED displays are increasingly adopting AI-driven power management systems that analyze content in real-time to optimize backlight distribution across dimming zones.

The industry is moving toward standardized power consumption metrics that better reflect real-world usage patterns rather than maximum power ratings. These metrics incorporate varied content types and brightness levels to provide more accurate efficiency comparisons between Mini LED and OLED technologies.

Manufacturing Cost Analysis and Scalability

The manufacturing cost structure of Mini LED and OLED technologies reveals significant differences that impact their market adoption and scalability. Mini LED production leverages existing LCD manufacturing infrastructure, requiring additional processes for mounting thousands of tiny LED chips onto backlight units. This adaptation of established production lines represents a cost advantage, with estimates showing 15-25% lower initial capital investment compared to building new OLED facilities.

Material costs present contrasting scenarios. Mini LED requires more raw materials per display unit, particularly in the quantity of LED chips needed (typically 1,000-10,000 per display). However, these materials are generally less expensive than the organic compounds and thin-film transistors used in OLED production. Industry data indicates that material costs for Mini LED displays have decreased by approximately 30% between 2019 and 2023, improving cost competitiveness.

Production yield rates significantly impact manufacturing economics. OLED manufacturing continues to face yield challenges, particularly for larger panels, with industry averages ranging from 60-85% depending on display size and manufacturer expertise. Mini LED technology demonstrates more favorable yield rates of 85-95%, contributing to better cost efficiency at scale.

Scalability considerations favor Mini LED in the near term. The technology benefits from established supply chains and manufacturing processes adapted from traditional LED production. Major display manufacturers have reported 40-60% production capacity increases for Mini LED between 2021 and 2023, indicating robust scalability. Conversely, OLED expansion requires substantial capital investment in specialized equipment and facilities, creating higher barriers to rapid scaling.

Regional manufacturing distribution shows distinct patterns. Mini LED production has expanded rapidly in East Asia, particularly Taiwan and China, where approximately 70% of global capacity is concentrated. OLED manufacturing remains dominated by South Korean firms, with emerging capacity in China. This geographic concentration creates different supply chain vulnerabilities and scaling opportunities for each technology.

Energy consumption during manufacturing presents another differentiating factor. OLED production processes require more stringent environmental controls and vacuum deposition systems, consuming approximately 30-40% more energy per square meter of display produced compared to Mini LED manufacturing. This difference impacts both production costs and environmental sustainability considerations as manufacturers scale operations to meet growing market demand.

Material costs present contrasting scenarios. Mini LED requires more raw materials per display unit, particularly in the quantity of LED chips needed (typically 1,000-10,000 per display). However, these materials are generally less expensive than the organic compounds and thin-film transistors used in OLED production. Industry data indicates that material costs for Mini LED displays have decreased by approximately 30% between 2019 and 2023, improving cost competitiveness.

Production yield rates significantly impact manufacturing economics. OLED manufacturing continues to face yield challenges, particularly for larger panels, with industry averages ranging from 60-85% depending on display size and manufacturer expertise. Mini LED technology demonstrates more favorable yield rates of 85-95%, contributing to better cost efficiency at scale.

Scalability considerations favor Mini LED in the near term. The technology benefits from established supply chains and manufacturing processes adapted from traditional LED production. Major display manufacturers have reported 40-60% production capacity increases for Mini LED between 2021 and 2023, indicating robust scalability. Conversely, OLED expansion requires substantial capital investment in specialized equipment and facilities, creating higher barriers to rapid scaling.

Regional manufacturing distribution shows distinct patterns. Mini LED production has expanded rapidly in East Asia, particularly Taiwan and China, where approximately 70% of global capacity is concentrated. OLED manufacturing remains dominated by South Korean firms, with emerging capacity in China. This geographic concentration creates different supply chain vulnerabilities and scaling opportunities for each technology.

Energy consumption during manufacturing presents another differentiating factor. OLED production processes require more stringent environmental controls and vacuum deposition systems, consuming approximately 30-40% more energy per square meter of display produced compared to Mini LED manufacturing. This difference impacts both production costs and environmental sustainability considerations as manufacturers scale operations to meet growing market demand.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!