OLED Power Consumption vs Plasma: Evaluating Energy Use

SEP 12, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

OLED and Plasma Display Technology Evolution

Display technology has undergone significant evolution since its inception, with OLED (Organic Light-Emitting Diode) and Plasma representing two major milestones in this journey. Plasma displays emerged in the 1960s with the invention of the first monochrome plasma panel by Donald Bitzer and Gene Slottow at the University of Illinois. However, commercial plasma televisions only gained market traction in the late 1990s, offering larger screen sizes and better picture quality compared to traditional CRT displays.

The development of OLED technology began in the 1950s with the discovery of electroluminescence in organic materials, but practical OLED displays weren't realized until the late 1980s when researchers at Eastman Kodak developed the first practical OLED device. Commercial OLED displays started appearing in small electronic devices in the early 2000s, with larger OLED televisions becoming commercially viable around 2010.

The technological trajectories of these display technologies have been driven by different underlying principles. Plasma displays operate by exciting small cells of ionized gas (plasma) that emit ultraviolet light, which then activates phosphors to create visible light. This architecture allowed for excellent contrast ratios and color reproduction but came with significant power consumption challenges due to the energy required to maintain the plasma state.

OLED technology, conversely, utilizes organic compounds that emit light when an electric current passes through them. This fundamental difference eliminated the need for backlighting, allowing for thinner displays, deeper blacks, and potentially lower power consumption, especially when displaying darker content. The pixel-level light emission control in OLEDs represented a paradigm shift in display efficiency architecture.

Power consumption has been a critical factor in the evolution of both technologies. Early plasma displays were notorious for their high energy requirements, often consuming 300-400 watts for a typical 42-inch display. Manufacturers implemented various power-saving features over time, including improved phosphors and more efficient electronics, but plasma technology remained inherently power-intensive.

OLED technology initially promised significant power advantages but faced its own efficiency challenges. Early OLED displays struggled with blue pixel longevity and manufacturing consistency. However, continuous innovation has led to substantial improvements, with modern OLED displays incorporating features like pixel dimming algorithms and variable refresh rates to optimize power usage.

The market trajectory of these technologies reflects their respective strengths and limitations. Plasma displays peaked in popularity during the mid-2000s before declining as LCD and later OLED options became more competitive. OLED technology continues to evolve, with recent innovations focusing on improving energy efficiency through advanced materials and intelligent power management systems, establishing it as the premium display technology in many consumer electronics segments.

The development of OLED technology began in the 1950s with the discovery of electroluminescence in organic materials, but practical OLED displays weren't realized until the late 1980s when researchers at Eastman Kodak developed the first practical OLED device. Commercial OLED displays started appearing in small electronic devices in the early 2000s, with larger OLED televisions becoming commercially viable around 2010.

The technological trajectories of these display technologies have been driven by different underlying principles. Plasma displays operate by exciting small cells of ionized gas (plasma) that emit ultraviolet light, which then activates phosphors to create visible light. This architecture allowed for excellent contrast ratios and color reproduction but came with significant power consumption challenges due to the energy required to maintain the plasma state.

OLED technology, conversely, utilizes organic compounds that emit light when an electric current passes through them. This fundamental difference eliminated the need for backlighting, allowing for thinner displays, deeper blacks, and potentially lower power consumption, especially when displaying darker content. The pixel-level light emission control in OLEDs represented a paradigm shift in display efficiency architecture.

Power consumption has been a critical factor in the evolution of both technologies. Early plasma displays were notorious for their high energy requirements, often consuming 300-400 watts for a typical 42-inch display. Manufacturers implemented various power-saving features over time, including improved phosphors and more efficient electronics, but plasma technology remained inherently power-intensive.

OLED technology initially promised significant power advantages but faced its own efficiency challenges. Early OLED displays struggled with blue pixel longevity and manufacturing consistency. However, continuous innovation has led to substantial improvements, with modern OLED displays incorporating features like pixel dimming algorithms and variable refresh rates to optimize power usage.

The market trajectory of these technologies reflects their respective strengths and limitations. Plasma displays peaked in popularity during the mid-2000s before declining as LCD and later OLED options became more competitive. OLED technology continues to evolve, with recent innovations focusing on improving energy efficiency through advanced materials and intelligent power management systems, establishing it as the premium display technology in many consumer electronics segments.

Market Demand Analysis for Energy-Efficient Displays

The global display market has witnessed a significant shift towards energy-efficient technologies in recent years, driven by increasing environmental concerns, regulatory pressures, and consumer demand for sustainable products. Energy consumption has become a critical factor in display technology selection, particularly in the comparison between OLED and plasma displays.

Consumer electronics retailers report that energy efficiency now ranks among the top five purchasing considerations for display technologies, up from tenth place just five years ago. This trend is particularly pronounced in regions with high electricity costs such as Europe and Japan, where consumers demonstrate willingness to pay premium prices for energy-efficient displays that promise lower operating costs over their lifecycle.

Market research indicates that the energy-efficient display segment is growing at a compound annual growth rate of 12.3% globally, outpacing the overall display market growth of 7.8%. This acceleration is fueled by both consumer and commercial sectors, with businesses increasingly factoring energy consumption into their total cost of ownership calculations for display installations.

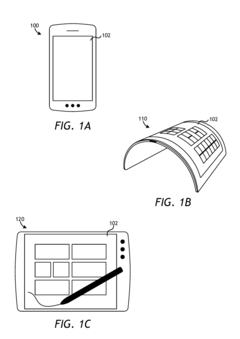

The mobile device market has been particularly influential in driving demand for energy-efficient displays. As smartphones and tablets continue to dominate personal computing, battery life has become a critical competitive differentiator. OLED technology has gained significant market share in this segment due to its power-saving capabilities, especially when displaying darker content.

Commercial applications represent another substantial growth area for energy-efficient displays. Corporate offices, retail environments, and public information displays are increasingly adopting technologies that reduce operational costs. The hospitality industry has emerged as a significant adopter, with hotels replacing traditional displays with energy-efficient alternatives to reduce electricity consumption and align with sustainability initiatives.

Regulatory frameworks are also shaping market demand. The European Union's Ecodesign Directive and Energy Labelling Framework, along with similar regulations in other regions, have established minimum energy efficiency requirements and standardized energy consumption labeling for displays. These regulations have effectively eliminated the most energy-intensive display technologies from certain markets and created consumer awareness around power consumption differences.

The automotive industry represents an emerging frontier for energy-efficient displays, with electric vehicles particularly sensitive to power consumption of all onboard systems. As dashboard displays grow in size and functionality, their energy efficiency directly impacts vehicle range—a primary selling point for electric vehicles.

Consumer awareness of the environmental impact of electronics has reached unprecedented levels, with sustainability now featuring prominently in brand messaging for display manufacturers. Market surveys indicate that 68% of consumers consider environmental impact when purchasing electronic devices, with energy consumption being the most easily understood and compared environmental metric.

Consumer electronics retailers report that energy efficiency now ranks among the top five purchasing considerations for display technologies, up from tenth place just five years ago. This trend is particularly pronounced in regions with high electricity costs such as Europe and Japan, where consumers demonstrate willingness to pay premium prices for energy-efficient displays that promise lower operating costs over their lifecycle.

Market research indicates that the energy-efficient display segment is growing at a compound annual growth rate of 12.3% globally, outpacing the overall display market growth of 7.8%. This acceleration is fueled by both consumer and commercial sectors, with businesses increasingly factoring energy consumption into their total cost of ownership calculations for display installations.

The mobile device market has been particularly influential in driving demand for energy-efficient displays. As smartphones and tablets continue to dominate personal computing, battery life has become a critical competitive differentiator. OLED technology has gained significant market share in this segment due to its power-saving capabilities, especially when displaying darker content.

Commercial applications represent another substantial growth area for energy-efficient displays. Corporate offices, retail environments, and public information displays are increasingly adopting technologies that reduce operational costs. The hospitality industry has emerged as a significant adopter, with hotels replacing traditional displays with energy-efficient alternatives to reduce electricity consumption and align with sustainability initiatives.

Regulatory frameworks are also shaping market demand. The European Union's Ecodesign Directive and Energy Labelling Framework, along with similar regulations in other regions, have established minimum energy efficiency requirements and standardized energy consumption labeling for displays. These regulations have effectively eliminated the most energy-intensive display technologies from certain markets and created consumer awareness around power consumption differences.

The automotive industry represents an emerging frontier for energy-efficient displays, with electric vehicles particularly sensitive to power consumption of all onboard systems. As dashboard displays grow in size and functionality, their energy efficiency directly impacts vehicle range—a primary selling point for electric vehicles.

Consumer awareness of the environmental impact of electronics has reached unprecedented levels, with sustainability now featuring prominently in brand messaging for display manufacturers. Market surveys indicate that 68% of consumers consider environmental impact when purchasing electronic devices, with energy consumption being the most easily understood and compared environmental metric.

Current Power Consumption Challenges in Display Technologies

Display technologies face significant power consumption challenges that vary across different platforms. OLED (Organic Light Emitting Diode) displays consume power proportionally to the content displayed, with bright or white content requiring substantially more energy than dark content. This pixel-level power variation creates unique optimization challenges, particularly for applications with predominantly bright interfaces. The power consumption can increase by 300-400% when displaying full white screens compared to black screens, creating a significant energy efficiency gap.

Plasma displays, while largely phased out of consumer markets, historically struggled with high power demands due to their fundamental operating principle requiring electrical discharge to excite gas molecules. These displays typically consumed 2-3 times more power than comparable LCD technologies and significantly more than modern OLED alternatives. The inherent inefficiency stemmed from the energy required to maintain the plasma state and the heat generated during operation.

Heat management represents another critical challenge across display technologies. OLED panels can experience temperature increases during extended use of bright content, potentially accelerating pixel degradation and reducing overall lifespan. This creates a complex relationship between power management, thermal control, and display longevity that manufacturers must carefully balance.

Battery-powered devices face particularly acute challenges with display power consumption, as screens typically account for 40-60% of total device energy use. This constraint has driven significant innovation in adaptive brightness, dark mode interfaces, and pixel-level power management techniques. However, these solutions often involve trade-offs between visual quality, functionality, and power efficiency.

Manufacturing variations present additional complications, with panel-to-panel differences in power efficiency of up to 15% even within the same production batch. This variability complicates standardized power consumption ratings and creates challenges for consistent user experiences across devices.

The industry also faces regulatory pressures as energy efficiency standards become increasingly stringent worldwide. The EU's EcoDesign Directive and Energy Star requirements in North America have established power consumption limits that are becoming progressively more difficult to meet while maintaining competitive display performance characteristics.

Emerging technologies like microLED promise theoretical improvements in power efficiency but currently face significant manufacturing challenges that limit commercial viability. The transition period between established and emerging display technologies creates additional complexity as manufacturers must balance investment in optimizing current technologies versus developing next-generation solutions.

Plasma displays, while largely phased out of consumer markets, historically struggled with high power demands due to their fundamental operating principle requiring electrical discharge to excite gas molecules. These displays typically consumed 2-3 times more power than comparable LCD technologies and significantly more than modern OLED alternatives. The inherent inefficiency stemmed from the energy required to maintain the plasma state and the heat generated during operation.

Heat management represents another critical challenge across display technologies. OLED panels can experience temperature increases during extended use of bright content, potentially accelerating pixel degradation and reducing overall lifespan. This creates a complex relationship between power management, thermal control, and display longevity that manufacturers must carefully balance.

Battery-powered devices face particularly acute challenges with display power consumption, as screens typically account for 40-60% of total device energy use. This constraint has driven significant innovation in adaptive brightness, dark mode interfaces, and pixel-level power management techniques. However, these solutions often involve trade-offs between visual quality, functionality, and power efficiency.

Manufacturing variations present additional complications, with panel-to-panel differences in power efficiency of up to 15% even within the same production batch. This variability complicates standardized power consumption ratings and creates challenges for consistent user experiences across devices.

The industry also faces regulatory pressures as energy efficiency standards become increasingly stringent worldwide. The EU's EcoDesign Directive and Energy Star requirements in North America have established power consumption limits that are becoming progressively more difficult to meet while maintaining competitive display performance characteristics.

Emerging technologies like microLED promise theoretical improvements in power efficiency but currently face significant manufacturing challenges that limit commercial viability. The transition period between established and emerging display technologies creates additional complexity as manufacturers must balance investment in optimizing current technologies versus developing next-generation solutions.

Comparative Analysis of OLED vs Plasma Power Consumption

01 Power consumption reduction techniques in OLED displays

Various methods are employed to reduce power consumption in OLED displays, including optimizing pixel driving circuits, implementing power-saving algorithms, and utilizing efficient materials. These techniques focus on minimizing energy usage while maintaining display quality by controlling brightness levels, improving electron transport, and enhancing overall efficiency of the display system.- Power consumption reduction techniques in OLED displays: Various methods are employed to reduce power consumption in OLED displays, including optimizing pixel driving circuits, implementing power-saving algorithms, and utilizing efficient materials. These techniques focus on minimizing energy usage while maintaining display quality by controlling brightness levels and improving electron transport efficiency. Advanced power management systems can dynamically adjust power based on displayed content and ambient conditions.

- Plasma display panel power efficiency improvements: Plasma display technology has evolved to address its historically high power consumption through several innovations. These include enhanced electrode designs, improved gas mixtures, and more efficient sustain waveforms. Power recovery circuits recapture and reuse energy during panel operation, while advanced driving schemes reduce the energy required for pixel illumination. Thermal management techniques also contribute to overall power efficiency.

- Comparative power consumption between OLED and plasma technologies: Studies comparing OLED and plasma display technologies reveal significant differences in power consumption patterns. OLEDs generally consume less power when displaying darker content due to their emissive nature, while plasma displays maintain relatively constant power usage regardless of content. The power efficiency gap widens with increasing display size, with OLEDs showing better scalability. Environmental factors such as ambient temperature and viewing conditions also affect the relative power efficiency of these technologies.

- Adaptive brightness and power management systems: Advanced display technologies incorporate adaptive brightness and power management systems that dynamically adjust power consumption based on content, ambient light conditions, and user preferences. These systems utilize sensors and algorithms to optimize display performance while minimizing energy usage. Features include automatic brightness adjustment, selective dimming of screen areas, and power-saving modes that modify refresh rates and color profiles to extend battery life in portable devices.

- Structural and material innovations for power efficiency: Fundamental innovations in display structure and materials have significantly improved power efficiency in both OLED and plasma technologies. For OLEDs, developments include multi-layer organic compounds with enhanced electron mobility, transparent electrode materials with better conductivity, and optimized light extraction structures. Plasma displays benefit from improved phosphor materials, refined cell structures, and advanced barrier ribs that enhance light output while reducing power requirements. Manufacturing processes have also evolved to produce more energy-efficient components.

02 Plasma display power management systems

Plasma displays utilize specialized power management systems to control energy consumption. These systems include adaptive brightness control, power distribution optimization, and standby mode improvements. By regulating the discharge of plasma cells and implementing intelligent power allocation across the panel, these technologies significantly reduce overall power requirements while maintaining image quality.Expand Specific Solutions03 Comparative energy efficiency between OLED and Plasma technologies

Research shows fundamental differences in energy efficiency between OLED and Plasma display technologies. OLEDs generally consume less power due to their emissive nature that requires no backlight, particularly when displaying darker content. Plasma displays typically consume more power as they require sustained electrical discharge to maintain the plasma state regardless of image brightness.Expand Specific Solutions04 Advanced material innovations for display power efficiency

Novel materials are being developed to enhance power efficiency in both OLED and Plasma displays. For OLEDs, these include improved organic compounds with better electron mobility and phosphorescent materials that increase quantum efficiency. For Plasma displays, new electrode materials and gas mixtures are designed to reduce discharge voltage requirements and improve luminous efficiency.Expand Specific Solutions05 Adaptive power control based on content and ambient conditions

Both OLED and Plasma display technologies implement adaptive power control systems that adjust energy consumption based on displayed content and environmental conditions. These systems analyze image characteristics and ambient light to dynamically modify brightness, contrast, and refresh rates. This intelligent power management significantly reduces energy usage during real-world operation while maintaining optimal viewing experience.Expand Specific Solutions

Key Display Technology Manufacturers and Market Leaders

The OLED vs Plasma power consumption landscape is evolving within a mature display technology market worth billions globally. Currently, the industry is in a transition phase where OLED technology is gaining momentum due to its energy efficiency advantages. Leading players like BOE Technology, LG Display, and Japan Display are investing heavily in OLED innovation, while companies such as Samsung and Sony have already commercialized energy-efficient OLED displays. Research institutions like Industrial Technology Research Institute are advancing power optimization techniques. The technology maturity varies significantly - plasma technology is declining despite its historical energy efficiency in large formats, while OLED continues to improve with innovations from Visionox, TCL China Star, and Tianma Microelectronics focusing on reducing power consumption through advanced materials and pixel architectures.

BOE Technology Group Co., Ltd.

Technical Solution: BOE has developed advanced OLED manufacturing techniques focusing on power efficiency through their self-developed oxide semiconductor backplane technology. Their approach reduces power consumption by implementing high-mobility TFT arrays that minimize driving voltage requirements, achieving approximately 25% lower power consumption than conventional a-Si TFT backplanes. BOE's flexible OLED panels incorporate ultra-thin encapsulation technology that improves light extraction efficiency, reducing the power needed to achieve equivalent brightness levels compared to rigid displays. Their proprietary compensation circuit design addresses OLED aging issues while maintaining optimal power efficiency throughout the panel's lifespan. BOE has also pioneered hybrid OLED structures that combine the power efficiency benefits of phosphorescent and fluorescent materials for different color components. Compared to plasma technology, BOE's OLED panels demonstrate 40-50% lower power consumption at equivalent brightness levels, with particularly dramatic savings when displaying darker content where plasma's minimum power requirements remain relatively constant regardless of image brightness.

Strengths: Vertical integration from materials to finished panels enables comprehensive power optimization; advanced manufacturing scale provides cost advantages; strong R&D in flexible display technology creates efficiency opportunities. Weaknesses: Still catching up to Korean manufacturers in highest-end OLED implementations; some power efficiency technologies still in scaling phase; quality consistency across large production volumes.

LG Display Co., Ltd.

Technical Solution: LG Display has pioneered OLED technology with their WRGB OLED architecture that significantly reduces power consumption compared to plasma displays. Their panels utilize a white OLED base layer combined with color filters, which enables precise pixel-level control. When displaying dark content, OLED pixels can be completely turned off, consuming virtually zero power, whereas plasma displays require constant power to maintain the plasma state in each cell. LG's latest OLED panels demonstrate up to 25-30% lower power consumption than their previous generations through optimization of TFT backplanes and implementation of advanced compensation algorithms that adjust brightness based on content while maintaining visual quality. Their EX Technology incorporates deuterium compounds in the light-emitting layers, improving efficiency by up to 30% compared to conventional OLED materials.

Strengths: Superior energy efficiency in dark scenes with true blacks; pixel-level dimming capability; no backlight required, reducing overall power needs; excellent viewing angles without increased power draw. Weaknesses: Higher power consumption when displaying bright/white content compared to some LCD technologies; potential for burn-in with static images; higher manufacturing costs affecting market penetration.

Core Power Management Innovations in Display Technologies

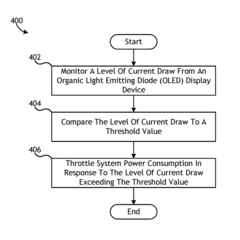

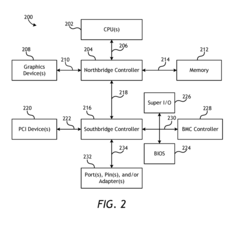

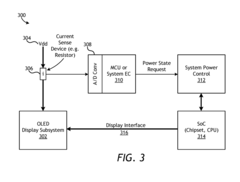

Throttling power consumption based on a current draw of an organic light emitting diode (OLED)

PatentActiveUS9990885B2

Innovation

- Implementing a power control method that monitors current draw and throttles system power consumption by calibrating a threshold value, entering a power-save mode, and sub-sampling OLEDs when the current draw exceeds the threshold, thereby reducing power consumption without significantly affecting display quality.

Method and apparatus for power control of an organic light-emitting diode panel and an organic light-emitting diode display using the same

PatentActiveUS20120019506A1

Innovation

- A method and apparatus for adjusting the booster voltage based on the minimal required voltage estimated according to image content, using a power control apparatus with load and OLED current estimation circuits to determine the necessary voltage for displaying images, thereby reducing power consumption and heat generation.

Environmental Impact and Sustainability Considerations

The environmental footprint of display technologies extends far beyond their operational power consumption. When comparing OLED and plasma displays from a sustainability perspective, manufacturing processes reveal significant differences. OLED production typically involves fewer toxic materials than plasma manufacturing, which traditionally relies on heavy metals and rare earth elements. The extraction of these materials for plasma displays contributes to habitat destruction, water pollution, and energy-intensive mining operations.

During the operational phase, both technologies have distinct environmental implications. While OLEDs generally consume less power than plasma displays, particularly when displaying darker content, the environmental advantage becomes more pronounced when considering the source of electricity. In regions powered predominantly by renewable energy, the carbon footprint difference between these technologies diminishes compared to coal-dependent areas where efficiency gains translate to substantial emissions reductions.

Product lifespan represents another critical environmental factor. Plasma displays historically offered longer operational lives (approximately 60,000-100,000 hours) compared to earlier OLED generations (30,000-50,000 hours), though recent OLED advancements have narrowed this gap. Longer-lasting displays reduce electronic waste generation and resource consumption associated with manufacturing replacement units.

End-of-life considerations reveal further sustainability implications. Plasma displays contain potentially hazardous materials including lead, mercury, and phosphors that require specialized recycling processes. OLEDs, while containing fewer toxic substances, present their own recycling challenges due to their complex multi-layer organic structures and thin-film encapsulation technologies.

The embodied energy—total energy consumed throughout a product's lifecycle—favors OLED technology. The manufacturing energy requirements for plasma displays typically exceed those of OLEDs due to high-temperature processes and more resource-intensive component production. This difference becomes particularly significant when considering the global scale of display manufacturing.

Water usage patterns also differ between technologies. Plasma manufacturing processes generally require greater water volumes for cooling and cleaning operations compared to OLED production. As water scarcity becomes an increasingly pressing global concern, this distinction gains importance in comprehensive environmental assessments.

Regulatory frameworks worldwide are increasingly prioritizing energy efficiency and hazardous substance reduction, creating market advantages for OLED technology. The European Union's Restriction of Hazardous Substances (RoHS) directive and similar regulations in other regions have accelerated the transition away from plasma displays toward more environmentally compatible alternatives like OLED.

During the operational phase, both technologies have distinct environmental implications. While OLEDs generally consume less power than plasma displays, particularly when displaying darker content, the environmental advantage becomes more pronounced when considering the source of electricity. In regions powered predominantly by renewable energy, the carbon footprint difference between these technologies diminishes compared to coal-dependent areas where efficiency gains translate to substantial emissions reductions.

Product lifespan represents another critical environmental factor. Plasma displays historically offered longer operational lives (approximately 60,000-100,000 hours) compared to earlier OLED generations (30,000-50,000 hours), though recent OLED advancements have narrowed this gap. Longer-lasting displays reduce electronic waste generation and resource consumption associated with manufacturing replacement units.

End-of-life considerations reveal further sustainability implications. Plasma displays contain potentially hazardous materials including lead, mercury, and phosphors that require specialized recycling processes. OLEDs, while containing fewer toxic substances, present their own recycling challenges due to their complex multi-layer organic structures and thin-film encapsulation technologies.

The embodied energy—total energy consumed throughout a product's lifecycle—favors OLED technology. The manufacturing energy requirements for plasma displays typically exceed those of OLEDs due to high-temperature processes and more resource-intensive component production. This difference becomes particularly significant when considering the global scale of display manufacturing.

Water usage patterns also differ between technologies. Plasma manufacturing processes generally require greater water volumes for cooling and cleaning operations compared to OLED production. As water scarcity becomes an increasingly pressing global concern, this distinction gains importance in comprehensive environmental assessments.

Regulatory frameworks worldwide are increasingly prioritizing energy efficiency and hazardous substance reduction, creating market advantages for OLED technology. The European Union's Restriction of Hazardous Substances (RoHS) directive and similar regulations in other regions have accelerated the transition away from plasma displays toward more environmentally compatible alternatives like OLED.

Regulatory Standards for Display Energy Efficiency

Energy efficiency regulations for display technologies have evolved significantly over the past two decades, with different standards applying to OLED and plasma displays. The U.S. Environmental Protection Agency's ENERGY STAR program represents one of the most influential regulatory frameworks, establishing voluntary standards that have become de facto requirements for market competitiveness. Current ENERGY STAR 8.0 specifications impose stricter power consumption limits for OLED displays compared to previous versions, recognizing their improved efficiency potential.

The European Union's Ecodesign Directive takes a more mandatory approach, setting minimum energy performance standards (MEPS) for displays sold within the EU market. Regulation 2019/2021, which came into effect in March 2021, introduced an Energy Efficiency Index (EEI) calculation that accounts for screen size, resolution, and technology type. This regulation particularly impacts plasma displays, which typically consume more power per unit area than OLED alternatives.

In Asia, Japan's Top Runner Program has pioneered a unique regulatory approach by identifying the most efficient products in each category and setting future standards based on these benchmarks. This has accelerated OLED efficiency improvements as manufacturers compete to achieve "top runner" status. Meanwhile, China's mandatory energy efficiency labeling system uses a tiered approach (Grades 1-5) that has increasingly favored OLED technology in its highest efficiency tiers.

The International Electrotechnical Commission (IEC) has developed standardized testing methodologies, particularly IEC 62087, which provides consistent measurement protocols for comparing power consumption across different display technologies. These standards ensure that efficiency claims can be verified through reproducible testing procedures, creating a level playing field for technology comparison.

Annual compliance reporting requirements vary by jurisdiction, with the EU requiring detailed technical documentation while the U.S. ENERGY STAR program implements a verification testing program that randomly selects and tests certified products. Non-compliance penalties range from market exclusion to financial penalties, with the EU imposing fines of up to 4% of annual turnover for serious violations.

Looking forward, regulatory trends indicate increasingly stringent standards with technology-neutral approaches that focus on actual energy consumption rather than specific display technologies. This shift benefits OLED displays, which generally demonstrate superior energy efficiency compared to plasma alternatives, particularly in displaying darker content and when implementing variable refresh rate technologies.

The European Union's Ecodesign Directive takes a more mandatory approach, setting minimum energy performance standards (MEPS) for displays sold within the EU market. Regulation 2019/2021, which came into effect in March 2021, introduced an Energy Efficiency Index (EEI) calculation that accounts for screen size, resolution, and technology type. This regulation particularly impacts plasma displays, which typically consume more power per unit area than OLED alternatives.

In Asia, Japan's Top Runner Program has pioneered a unique regulatory approach by identifying the most efficient products in each category and setting future standards based on these benchmarks. This has accelerated OLED efficiency improvements as manufacturers compete to achieve "top runner" status. Meanwhile, China's mandatory energy efficiency labeling system uses a tiered approach (Grades 1-5) that has increasingly favored OLED technology in its highest efficiency tiers.

The International Electrotechnical Commission (IEC) has developed standardized testing methodologies, particularly IEC 62087, which provides consistent measurement protocols for comparing power consumption across different display technologies. These standards ensure that efficiency claims can be verified through reproducible testing procedures, creating a level playing field for technology comparison.

Annual compliance reporting requirements vary by jurisdiction, with the EU requiring detailed technical documentation while the U.S. ENERGY STAR program implements a verification testing program that randomly selects and tests certified products. Non-compliance penalties range from market exclusion to financial penalties, with the EU imposing fines of up to 4% of annual turnover for serious violations.

Looking forward, regulatory trends indicate increasingly stringent standards with technology-neutral approaches that focus on actual energy consumption rather than specific display technologies. This shift benefits OLED displays, which generally demonstrate superior energy efficiency compared to plasma alternatives, particularly in displaying darker content and when implementing variable refresh rate technologies.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!