OLED vs MicroLED: Longevity Comparison in Consumer Electronics

SEP 12, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Display Technology Evolution and Objectives

Display technology has undergone remarkable evolution since the introduction of cathode ray tubes (CRTs) in the early 20th century. The progression from CRTs to liquid crystal displays (LCDs) marked the first major shift toward flatter, more energy-efficient screens. This transition set the foundation for subsequent innovations including plasma display panels, which offered improved contrast ratios and viewing angles but suffered from high power consumption and screen burn-in issues.

The introduction of Organic Light-Emitting Diode (OLED) technology in the early 2000s represented a paradigm shift in display technology. Unlike LCDs that require backlighting, OLED pixels emit their own light when electrical current passes through organic compounds. This self-emissive property enabled thinner displays, perfect blacks, wider viewing angles, and potentially lower power consumption, particularly when displaying darker content.

Despite OLED's advantages, the technology faces significant longevity challenges. The organic materials degrade over time, leading to reduced brightness and color shifts. Blue OLEDs, in particular, have shorter lifespans compared to red and green subpixels, creating potential color imbalance as displays age. Additionally, OLED displays are susceptible to permanent burn-in when static images are displayed for extended periods.

MicroLED technology emerged as a promising alternative that addresses many of OLED's limitations. Utilizing inorganic gallium nitride-based LEDs at a microscopic scale, MicroLED displays combine OLED's self-emissive properties with significantly improved longevity. These displays offer higher brightness, better energy efficiency, and substantially longer lifespans without the degradation issues inherent to organic materials.

The primary objective in comparing OLED and MicroLED technologies is to determine which offers superior longevity in consumer electronics applications while maintaining competitive performance characteristics. This evaluation must consider multiple factors including brightness retention over time, resistance to burn-in, color stability, and overall expected lifespan under typical usage conditions.

Secondary objectives include assessing the environmental impact of both technologies throughout their lifecycle, analyzing manufacturing scalability and cost trajectories, and identifying potential hybrid approaches that might combine the strengths of both technologies. Understanding these factors is crucial for manufacturers making strategic investments in display technology and for consumers seeking devices with optimal long-term performance.

The ultimate goal is to establish a comprehensive framework for evaluating display technology longevity that can guide future research and development efforts, inform industry standards, and provide clear metrics for consumer education regarding expected display performance over time.

The introduction of Organic Light-Emitting Diode (OLED) technology in the early 2000s represented a paradigm shift in display technology. Unlike LCDs that require backlighting, OLED pixels emit their own light when electrical current passes through organic compounds. This self-emissive property enabled thinner displays, perfect blacks, wider viewing angles, and potentially lower power consumption, particularly when displaying darker content.

Despite OLED's advantages, the technology faces significant longevity challenges. The organic materials degrade over time, leading to reduced brightness and color shifts. Blue OLEDs, in particular, have shorter lifespans compared to red and green subpixels, creating potential color imbalance as displays age. Additionally, OLED displays are susceptible to permanent burn-in when static images are displayed for extended periods.

MicroLED technology emerged as a promising alternative that addresses many of OLED's limitations. Utilizing inorganic gallium nitride-based LEDs at a microscopic scale, MicroLED displays combine OLED's self-emissive properties with significantly improved longevity. These displays offer higher brightness, better energy efficiency, and substantially longer lifespans without the degradation issues inherent to organic materials.

The primary objective in comparing OLED and MicroLED technologies is to determine which offers superior longevity in consumer electronics applications while maintaining competitive performance characteristics. This evaluation must consider multiple factors including brightness retention over time, resistance to burn-in, color stability, and overall expected lifespan under typical usage conditions.

Secondary objectives include assessing the environmental impact of both technologies throughout their lifecycle, analyzing manufacturing scalability and cost trajectories, and identifying potential hybrid approaches that might combine the strengths of both technologies. Understanding these factors is crucial for manufacturers making strategic investments in display technology and for consumers seeking devices with optimal long-term performance.

The ultimate goal is to establish a comprehensive framework for evaluating display technology longevity that can guide future research and development efforts, inform industry standards, and provide clear metrics for consumer education regarding expected display performance over time.

Market Demand Analysis for Advanced Display Technologies

The display technology market has witnessed significant growth in recent years, driven by increasing consumer demand for superior visual experiences across various electronic devices. OLED (Organic Light Emitting Diode) technology has dominated premium segments, while MicroLED emerges as a promising alternative with potential longevity advantages. Current market analysis indicates the global advanced display market reached approximately $148 billion in 2022, with projections suggesting growth to $206 billion by 2027, representing a compound annual growth rate of 6.8%.

Consumer electronics, particularly smartphones and televisions, constitute the largest application segments for these advanced display technologies. OLED displays currently hold approximately 63% market share in premium smartphones, with major manufacturers like Samsung, Apple, and Huawei incorporating this technology into their flagship devices. The television segment shows similar trends, with OLED TVs commanding a 20% value share of the premium TV market despite representing only 3% of unit sales.

Market research indicates shifting consumer preferences toward displays offering longer lifespans, reduced power consumption, and enhanced brightness capabilities. A recent industry survey revealed that 78% of consumers consider display quality among the top three factors influencing purchasing decisions for smartphones and televisions. Additionally, 67% expressed willingness to pay premium prices for devices with superior display longevity and performance characteristics.

MicroLED technology, though currently in early commercialization stages, demonstrates strong market potential due to its theoretical advantages in longevity and brightness. Market forecasts suggest MicroLED displays could capture 15% of the premium display market by 2028, primarily in high-end televisions, smartwatches, and AR/VR devices. Early adopters have demonstrated willingness to pay 30-40% price premiums for MicroLED's potential benefits.

Regional analysis reveals differentiated market demands. North American and European consumers prioritize display longevity and quality, while Asian markets show greater sensitivity to price-performance ratios. Commercial sectors, including digital signage and automotive displays, represent rapidly growing segments with 12% and 18% annual growth rates respectively, driven by requirements for displays with extended operational lifespans in challenging environments.

Industry forecasts indicate that as manufacturing processes mature and economies of scale improve, the cost differential between OLED and MicroLED technologies will narrow significantly by 2026. This convergence will likely accelerate market adoption across broader consumer segments, potentially reshaping competitive dynamics in the display technology landscape and creating new opportunities for device manufacturers focused on longevity as a key differentiator.

Consumer electronics, particularly smartphones and televisions, constitute the largest application segments for these advanced display technologies. OLED displays currently hold approximately 63% market share in premium smartphones, with major manufacturers like Samsung, Apple, and Huawei incorporating this technology into their flagship devices. The television segment shows similar trends, with OLED TVs commanding a 20% value share of the premium TV market despite representing only 3% of unit sales.

Market research indicates shifting consumer preferences toward displays offering longer lifespans, reduced power consumption, and enhanced brightness capabilities. A recent industry survey revealed that 78% of consumers consider display quality among the top three factors influencing purchasing decisions for smartphones and televisions. Additionally, 67% expressed willingness to pay premium prices for devices with superior display longevity and performance characteristics.

MicroLED technology, though currently in early commercialization stages, demonstrates strong market potential due to its theoretical advantages in longevity and brightness. Market forecasts suggest MicroLED displays could capture 15% of the premium display market by 2028, primarily in high-end televisions, smartwatches, and AR/VR devices. Early adopters have demonstrated willingness to pay 30-40% price premiums for MicroLED's potential benefits.

Regional analysis reveals differentiated market demands. North American and European consumers prioritize display longevity and quality, while Asian markets show greater sensitivity to price-performance ratios. Commercial sectors, including digital signage and automotive displays, represent rapidly growing segments with 12% and 18% annual growth rates respectively, driven by requirements for displays with extended operational lifespans in challenging environments.

Industry forecasts indicate that as manufacturing processes mature and economies of scale improve, the cost differential between OLED and MicroLED technologies will narrow significantly by 2026. This convergence will likely accelerate market adoption across broader consumer segments, potentially reshaping competitive dynamics in the display technology landscape and creating new opportunities for device manufacturers focused on longevity as a key differentiator.

OLED and MicroLED Current Status and Technical Challenges

OLED technology has reached a mature stage in the consumer electronics market, with widespread adoption in smartphones, TVs, and wearable devices. The technology offers excellent color reproduction, perfect black levels, and flexibility in design. However, OLED displays continue to face significant challenges related to longevity. Organic materials in OLED panels degrade over time, particularly blue subpixels which have shorter lifespans than red and green counterparts. This differential aging leads to color shifts and reduced brightness, typically manifesting after 3-5 years of regular use in consumer devices.

Burn-in remains a persistent issue for OLED displays, where static images can cause permanent ghost images on screens. While manufacturers have implemented various compensation algorithms and pixel-shifting techniques, these solutions only mitigate rather than eliminate the problem. Additionally, OLED's sensitivity to moisture and oxygen necessitates complex encapsulation technologies, adding to manufacturing costs and complexity.

MicroLED technology, though still in early commercialization phases, demonstrates promising advantages in longevity metrics. Unlike OLED, MicroLED utilizes inorganic materials that are inherently more stable and resistant to degradation. Laboratory tests indicate potential lifespans exceeding 100,000 hours without significant brightness deterioration, compared to OLED's typical 30,000-60,000 hours before noticeable degradation.

The primary technical challenges for MicroLED revolve around manufacturing processes rather than inherent material limitations. Mass transfer of millions of microscopic LED chips presents significant yield challenges, with current defect rates still too high for cost-effective mass production. The industry is exploring various approaches including pick-and-place technologies, fluid assembly, and laser transfer methods, but none have yet achieved the necessary combination of speed, accuracy, and cost-effectiveness for mainstream adoption.

Miniaturization represents another significant hurdle for MicroLED. Creating LED elements small enough for high-resolution displays while maintaining brightness uniformity and electrical efficiency remains technically challenging. Current MicroLED prototypes typically feature pixel sizes of 10-50 micrometers, whereas high-resolution smartphone displays require sub-10 micrometer pixels.

From a global perspective, OLED manufacturing expertise is concentrated primarily in East Asia, with South Korean and Chinese manufacturers dominating production capacity. MicroLED research and development shows a more distributed pattern, with significant innovation occurring in North America, Europe, and Asia, though commercialization efforts remain limited to a handful of major technology companies and specialized startups.

The efficiency gap between laboratory demonstrations and mass production capabilities represents the most significant barrier to MicroLED adoption in consumer electronics, despite its superior longevity characteristics compared to OLED technology.

Burn-in remains a persistent issue for OLED displays, where static images can cause permanent ghost images on screens. While manufacturers have implemented various compensation algorithms and pixel-shifting techniques, these solutions only mitigate rather than eliminate the problem. Additionally, OLED's sensitivity to moisture and oxygen necessitates complex encapsulation technologies, adding to manufacturing costs and complexity.

MicroLED technology, though still in early commercialization phases, demonstrates promising advantages in longevity metrics. Unlike OLED, MicroLED utilizes inorganic materials that are inherently more stable and resistant to degradation. Laboratory tests indicate potential lifespans exceeding 100,000 hours without significant brightness deterioration, compared to OLED's typical 30,000-60,000 hours before noticeable degradation.

The primary technical challenges for MicroLED revolve around manufacturing processes rather than inherent material limitations. Mass transfer of millions of microscopic LED chips presents significant yield challenges, with current defect rates still too high for cost-effective mass production. The industry is exploring various approaches including pick-and-place technologies, fluid assembly, and laser transfer methods, but none have yet achieved the necessary combination of speed, accuracy, and cost-effectiveness for mainstream adoption.

Miniaturization represents another significant hurdle for MicroLED. Creating LED elements small enough for high-resolution displays while maintaining brightness uniformity and electrical efficiency remains technically challenging. Current MicroLED prototypes typically feature pixel sizes of 10-50 micrometers, whereas high-resolution smartphone displays require sub-10 micrometer pixels.

From a global perspective, OLED manufacturing expertise is concentrated primarily in East Asia, with South Korean and Chinese manufacturers dominating production capacity. MicroLED research and development shows a more distributed pattern, with significant innovation occurring in North America, Europe, and Asia, though commercialization efforts remain limited to a handful of major technology companies and specialized startups.

The efficiency gap between laboratory demonstrations and mass production capabilities represents the most significant barrier to MicroLED adoption in consumer electronics, despite its superior longevity characteristics compared to OLED technology.

Current Longevity Solutions in Display Technologies

01 OLED Degradation Prevention Mechanisms

Various mechanisms are employed to prevent degradation in OLED displays, extending their operational lifespan. These include specialized encapsulation techniques to protect organic materials from moisture and oxygen, implementation of compensation circuits that adjust for pixel aging, and the use of more stable organic compounds. These approaches help maintain brightness and color accuracy over time, addressing one of the primary longevity concerns with OLED technology.- Lifespan enhancement techniques for OLED displays: Various methods are employed to extend the operational life of OLED displays, including improved organic materials, encapsulation technologies to prevent moisture and oxygen degradation, and optimized driving schemes. These techniques address common issues like pixel degradation and color shift over time, significantly improving the longevity of OLED displays for commercial applications.

- MicroLED reliability and durability advancements: MicroLED displays offer inherent longevity advantages due to their inorganic nature, making them less susceptible to degradation compared to OLEDs. Recent advancements focus on improving manufacturing processes, enhancing thermal management, and developing more robust LED structures to further extend their operational lifetime. These improvements address challenges related to differential aging and maintain consistent brightness over extended periods.

- Comparative longevity between OLED and MicroLED technologies: Research indicates that MicroLED displays generally offer superior longevity compared to OLEDs, with potential lifespans exceeding 100,000 hours versus 30,000-60,000 hours for premium OLEDs. This advantage stems from MicroLEDs' inorganic semiconductor materials that resist degradation from environmental factors. However, OLEDs continue to improve through advanced materials and manufacturing techniques, narrowing this gap for certain applications.

- Thermal management solutions for extended display life: Effective thermal management is crucial for extending the operational life of both OLED and MicroLED displays. Innovations include advanced heat dissipation structures, thermally conductive substrates, and intelligent temperature monitoring systems. These solutions prevent performance degradation caused by heat accumulation, which can accelerate aging processes in display technologies, particularly in high-brightness applications.

- Pixel compensation and driving techniques for uniform aging: Sophisticated compensation algorithms and driving techniques have been developed to ensure uniform aging across OLED and MicroLED displays. These methods include real-time monitoring of pixel performance, predictive aging models, and adaptive brightness control systems that adjust individual pixel characteristics over time. Such approaches significantly extend the useful life of displays by maintaining consistent visual quality throughout their operational lifespan.

02 MicroLED Manufacturing Techniques for Durability

Advanced manufacturing techniques for MicroLED displays focus on enhancing durability and extending operational life. These include improved transfer methods for placing microscopic LED elements, specialized substrate materials that provide better thermal management, and robust interconnection technologies. The inorganic nature of MicroLEDs inherently offers better resistance to degradation compared to OLEDs, with manufacturing innovations further enhancing this advantage for long-term display performance.Expand Specific Solutions03 Thermal Management Solutions for Display Longevity

Effective thermal management is crucial for extending the lifespan of both OLED and MicroLED displays. Innovations include advanced heat dissipation structures, thermally conductive materials integrated into display panels, and intelligent power management systems that reduce heat generation. These solutions prevent temperature-related degradation of display components, particularly important for high-brightness applications where heat can significantly impact operational lifetime.Expand Specific Solutions04 Pixel Architecture Innovations for Extended Lifetime

Novel pixel architectures have been developed to extend the operational lifetime of display technologies. These include sub-pixel arrangements that distribute wear more evenly, redundant circuit designs that maintain functionality even if individual components fail, and pixel structures that operate at lower current densities. Such innovations are particularly important for OLED displays where uneven pixel aging can lead to image retention issues over time.Expand Specific Solutions05 Hybrid Display Technologies for Optimized Longevity

Hybrid approaches combining elements of different display technologies aim to maximize longevity while maintaining performance advantages. These include OLED-MicroLED hybrid displays, composite pixel structures using complementary materials, and multi-layer display architectures. By leveraging the strengths of each technology while mitigating their respective weaknesses, these hybrid solutions offer improved lifetime characteristics compared to single-technology approaches.Expand Specific Solutions

Key Industry Players in OLED and MicroLED Development

The OLED vs MicroLED display technology landscape is currently in a transitional phase, with OLED being mature and widely commercialized while MicroLED remains in early commercialization stages. The global market for these advanced display technologies is projected to exceed $200 billion by 2025, driven by consumer electronics applications. Samsung Electronics and LG Display lead OLED production, with established manufacturing infrastructure and significant market share. Meanwhile, companies like Samsung, BOE Technology, and Apple are heavily investing in MicroLED development. Though MicroLED promises superior longevity, brightness, and energy efficiency, manufacturing challenges persist, with companies like X Display Co. and Lumileds working on mass production solutions. The competitive landscape will likely evolve as MicroLED manufacturing costs decrease and adoption increases across premium consumer electronics segments.

Samsung Electronics Co., Ltd.

Technical Solution: Samsung has developed dual-track strategies for both OLED and MicroLED technologies. For OLED, Samsung utilizes quantum dot (QD-OLED) technology that combines quantum dots with blue OLED emitters to achieve superior color accuracy and wider color gamut. Their OLED panels incorporate advanced thin-film encapsulation (TFE) techniques and multi-layer barrier films that significantly reduce moisture and oxygen penetration, extending panel lifespan to approximately 100,000 hours under standard usage conditions. For MicroLED, Samsung has pioneered modular MicroLED displays using flip-chip technology with inorganic gallium nitride (GaN) LEDs measuring under 50 micrometers, achieving theoretical lifespans exceeding 100,000 hours with minimal brightness degradation (less than 5% after 100,000 hours). Their proprietary mass transfer process enables precise placement of millions of microscopic LEDs with 99.999% accuracy, addressing one of the key manufacturing challenges in MicroLED production.

Strengths: Samsung's dual expertise in both technologies provides comprehensive market coverage. Their QD-OLED technology mitigates traditional OLED burn-in issues while their MicroLED manufacturing innovations address production scalability challenges. Weaknesses: MicroLED solutions remain prohibitively expensive for mainstream consumer electronics, with costs approximately 5-10x higher than premium OLED displays, limiting near-term market penetration.

BOE Technology Group Co., Ltd.

Technical Solution: BOE has developed comprehensive solutions in both OLED and MicroLED technologies. Their OLED technology utilizes advanced thin-film transistor (TFT) backplanes with oxide semiconductor materials that improve electron mobility and reduce power consumption by approximately 30% compared to conventional a-Si TFTs. BOE's OLED panels incorporate multi-layer thin-film encapsulation with alternating inorganic and organic layers that extend panel lifespan to approximately 30,000-40,000 hours before significant brightness degradation occurs. For MicroLED, BOE has developed an active-matrix driving technology using low-temperature polysilicon (LTPS) backplanes that enable individual pixel control with high precision. Their MicroLED manufacturing process employs a mass transfer technique with electrostatic assembly that achieves placement accuracy of over 99.9%, allowing for displays with pixel pitches below 100 micrometers and theoretical lifespans exceeding 100,000 hours with minimal color shift over time.

Strengths: BOE's vertical integration from backplane manufacturing to module assembly enables cost-effective production scaling. Their OLED encapsulation technology has demonstrated superior moisture resistance in high-humidity testing environments. Weaknesses: Their MicroLED technology still faces yield challenges in mass production, with defect rates approximately 2-3x higher than their mature OLED production lines, resulting in significantly higher costs for consumer applications.

Critical Patents and Innovations in Display Lifespan Enhancement

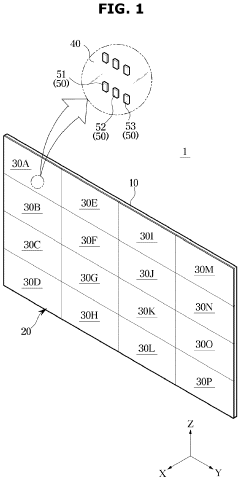

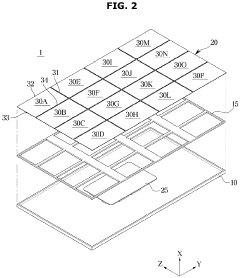

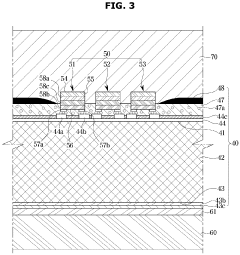

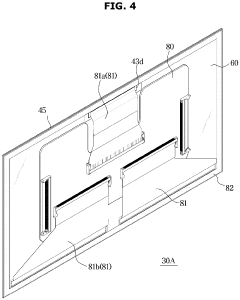

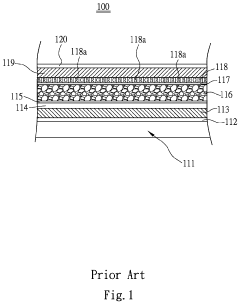

Display device comprising display module, and manufacturing method therefor

PatentPendingEP4401159A1

Innovation

- The display apparatus incorporates a substrate with inorganic light-emitting diodes, a front cover, a metal plate, a side cover, and a side end member with ribs for enhanced conductivity and sealing, which improves electrostatic discharge protection and reduces gaps between modules, making the display apparatus more robust and visually seamless.

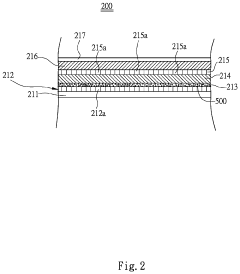

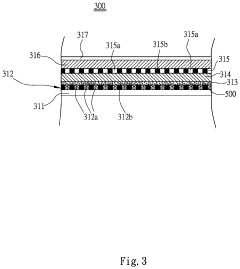

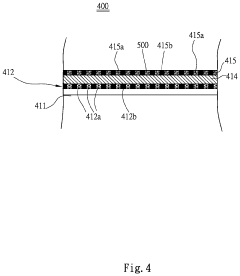

Micro LED display device

PatentInactiveUS20210167123A1

Innovation

- A micro LED display device incorporating a micro LED array, a light enhancing layer with quantum dots, a color filter, and a polarizer, where quantum dots convert and enhance the light properties of micro LEDs to produce high-definition images without the need for a backlight, offering improved color saturation and efficiency.

Environmental Impact and Sustainability Considerations

The environmental impact of display technologies has become increasingly important as consumer electronics manufacturers face growing pressure to reduce their carbon footprint. OLED and MicroLED technologies present different environmental challenges and benefits throughout their lifecycle, from production to disposal.

Manufacturing processes for OLED displays typically require fewer materials and less energy compared to MicroLED production. OLED fabrication involves organic compounds that can be deposited in thin layers, while MicroLED manufacturing demands precise placement of millions of microscopic LEDs, resulting in higher energy consumption and potential material waste during production. However, MicroLED manufacturing is rapidly evolving toward more efficient processes that may eventually reduce this gap.

During the usage phase, MicroLED displays demonstrate superior energy efficiency, particularly when displaying bright content. Studies indicate that MicroLED can be up to 30% more energy efficient than OLED when operating at full brightness, potentially reducing the carbon footprint over the device's lifetime. This efficiency advantage becomes particularly significant for large-format displays like televisions and public information screens.

The longevity difference between these technologies also has substantial environmental implications. MicroLED's extended lifespan—potentially 2-3 times longer than OLED—means fewer replacement cycles and consequently reduced electronic waste generation. This aspect is particularly relevant as global e-waste continues to grow at alarming rates, with display technologies contributing significantly to this problem.

End-of-life considerations reveal further distinctions. OLED panels contain organic materials that may be more biodegradable than the inorganic compounds in MicroLED displays. However, MicroLED's modular design potentially allows for easier repair and component replacement, extending the effective lifespan beyond the initial manufacturing specifications and reducing overall waste.

Rare earth elements and precious metals used in both technologies present recycling challenges, though in different proportions. MicroLED typically requires more gallium and indium, while OLED production uses more precious metals in its thin-film transistor backplanes. The availability and environmental impact of extracting these materials must be considered in sustainability assessments.

Water usage during manufacturing also differs significantly between technologies. OLED production typically requires extensive cleaning processes using ultra-pure water, while MicroLED manufacturing may have lower water requirements but higher precision equipment needs, creating different environmental trade-offs in resource consumption.

As regulatory frameworks around electronic waste and carbon emissions continue to evolve globally, manufacturers' choices between OLED and MicroLED will increasingly be influenced by environmental compliance requirements and sustainability goals, beyond mere performance and cost considerations.

Manufacturing processes for OLED displays typically require fewer materials and less energy compared to MicroLED production. OLED fabrication involves organic compounds that can be deposited in thin layers, while MicroLED manufacturing demands precise placement of millions of microscopic LEDs, resulting in higher energy consumption and potential material waste during production. However, MicroLED manufacturing is rapidly evolving toward more efficient processes that may eventually reduce this gap.

During the usage phase, MicroLED displays demonstrate superior energy efficiency, particularly when displaying bright content. Studies indicate that MicroLED can be up to 30% more energy efficient than OLED when operating at full brightness, potentially reducing the carbon footprint over the device's lifetime. This efficiency advantage becomes particularly significant for large-format displays like televisions and public information screens.

The longevity difference between these technologies also has substantial environmental implications. MicroLED's extended lifespan—potentially 2-3 times longer than OLED—means fewer replacement cycles and consequently reduced electronic waste generation. This aspect is particularly relevant as global e-waste continues to grow at alarming rates, with display technologies contributing significantly to this problem.

End-of-life considerations reveal further distinctions. OLED panels contain organic materials that may be more biodegradable than the inorganic compounds in MicroLED displays. However, MicroLED's modular design potentially allows for easier repair and component replacement, extending the effective lifespan beyond the initial manufacturing specifications and reducing overall waste.

Rare earth elements and precious metals used in both technologies present recycling challenges, though in different proportions. MicroLED typically requires more gallium and indium, while OLED production uses more precious metals in its thin-film transistor backplanes. The availability and environmental impact of extracting these materials must be considered in sustainability assessments.

Water usage during manufacturing also differs significantly between technologies. OLED production typically requires extensive cleaning processes using ultra-pure water, while MicroLED manufacturing may have lower water requirements but higher precision equipment needs, creating different environmental trade-offs in resource consumption.

As regulatory frameworks around electronic waste and carbon emissions continue to evolve globally, manufacturers' choices between OLED and MicroLED will increasingly be influenced by environmental compliance requirements and sustainability goals, beyond mere performance and cost considerations.

Manufacturing Cost Analysis and Economic Viability

The manufacturing cost structure for OLED and MicroLED technologies reveals significant differences that impact their economic viability in consumer electronics markets. OLED manufacturing has benefited from over a decade of industrial scaling, with current production costs ranging from $100-150 per square meter for mainstream applications. This relatively mature production ecosystem has enabled economies of scale, particularly for small to medium-sized displays used in smartphones and tablets.

In contrast, MicroLED manufacturing remains substantially more expensive, with current estimates placing costs at 5-8 times higher than equivalent OLED panels. This cost differential stems primarily from the complex transfer process required to place millions of microscopic LED chips precisely onto substrates. Yield rates for MicroLED production currently hover between 60-70%, compared to OLED's more established 85-90% yield rates in high-volume manufacturing facilities.

Capital expenditure requirements further differentiate these technologies. Establishing a new Gen 8.5 OLED production line typically requires $1-1.5 billion investment, whereas comparable MicroLED facilities demand $2-3 billion due to specialized equipment needs and more complex production processes. This higher barrier to entry has limited MicroLED production to specialized facilities focused on premium applications.

Material costs constitute another significant factor in the economic equation. OLED relies on organic compounds that, while less expensive per unit, require replacement more frequently due to degradation. MicroLED utilizes inorganic materials with higher initial costs but potentially lower lifetime ownership costs due to superior longevity. Analysis indicates that the crossover point where MicroLED becomes more economical than OLED occurs at approximately 30,000-50,000 hours of operation, depending on usage patterns.

The economic viability assessment must also consider market positioning. OLED currently dominates mid-to-high-end consumer electronics with established supply chains and manufacturing expertise. MicroLED, despite higher costs, shows promising economics for specific applications where longevity and brightness are paramount, such as public information displays, automotive interfaces, and premium television segments where price sensitivity is lower.

Industry forecasts suggest MicroLED manufacturing costs could decrease by 45-60% over the next five years as production techniques mature and economies of scale develop. This projected cost reduction would significantly expand MicroLED's economically viable application range, potentially challenging OLED's current market position in premium consumer electronics segments by 2027-2028.

In contrast, MicroLED manufacturing remains substantially more expensive, with current estimates placing costs at 5-8 times higher than equivalent OLED panels. This cost differential stems primarily from the complex transfer process required to place millions of microscopic LED chips precisely onto substrates. Yield rates for MicroLED production currently hover between 60-70%, compared to OLED's more established 85-90% yield rates in high-volume manufacturing facilities.

Capital expenditure requirements further differentiate these technologies. Establishing a new Gen 8.5 OLED production line typically requires $1-1.5 billion investment, whereas comparable MicroLED facilities demand $2-3 billion due to specialized equipment needs and more complex production processes. This higher barrier to entry has limited MicroLED production to specialized facilities focused on premium applications.

Material costs constitute another significant factor in the economic equation. OLED relies on organic compounds that, while less expensive per unit, require replacement more frequently due to degradation. MicroLED utilizes inorganic materials with higher initial costs but potentially lower lifetime ownership costs due to superior longevity. Analysis indicates that the crossover point where MicroLED becomes more economical than OLED occurs at approximately 30,000-50,000 hours of operation, depending on usage patterns.

The economic viability assessment must also consider market positioning. OLED currently dominates mid-to-high-end consumer electronics with established supply chains and manufacturing expertise. MicroLED, despite higher costs, shows promising economics for specific applications where longevity and brightness are paramount, such as public information displays, automotive interfaces, and premium television segments where price sensitivity is lower.

Industry forecasts suggest MicroLED manufacturing costs could decrease by 45-60% over the next five years as production techniques mature and economies of scale develop. This projected cost reduction would significantly expand MicroLED's economically viable application range, potentially challenging OLED's current market position in premium consumer electronics segments by 2027-2028.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!