OLED Self-Healing vs Encapsulation: Durability Comparison

SEP 12, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

OLED Self-Healing and Encapsulation Background and Objectives

Organic Light-Emitting Diode (OLED) technology has revolutionized display and lighting industries since its commercial introduction in the late 1990s. The evolution of OLED technology has been marked by significant improvements in efficiency, color reproduction, and form factor flexibility. However, despite these advancements, OLED durability remains a critical challenge that limits broader adoption and longevity of OLED-based devices.

The fundamental vulnerability of OLEDs stems from their organic materials' susceptibility to degradation when exposed to oxygen and moisture. This degradation manifests as "dark spots," reduced luminance, and ultimately, device failure. Historically, the industry has addressed this challenge primarily through encapsulation technologies—physical barriers designed to prevent environmental contaminants from reaching sensitive organic layers.

Traditional encapsulation approaches have evolved from rigid glass-based solutions to more sophisticated thin-film encapsulation (TFE) techniques that maintain flexibility while providing adequate protection. These methods have enabled the current generation of flexible OLED displays but still present limitations in terms of perfect barrier properties and mechanical durability under repeated flexing.

In parallel with encapsulation development, a newer and potentially transformative approach has emerged: self-healing technologies for OLEDs. This approach represents a paradigm shift from merely preventing degradation to actively repairing damage after it occurs. Self-healing mechanisms in OLEDs can be broadly categorized into material-based approaches (utilizing intrinsic healing properties of certain polymers) and system-level approaches (incorporating dedicated healing layers or mechanisms).

The technical objective of this research is to conduct a comprehensive comparative analysis of OLED self-healing technologies versus advanced encapsulation methods, specifically evaluating their relative contributions to device durability. This comparison aims to determine whether self-healing represents a viable complement or potential alternative to traditional encapsulation approaches for next-generation OLED applications.

Key metrics for this evaluation include effectiveness against common failure modes, performance retention over time, compatibility with flexible/foldable form factors, manufacturing scalability, and cost implications. The analysis will also consider how combinations of both approaches might yield synergistic benefits exceeding what either technology could achieve independently.

This research is particularly timely as the industry pushes toward more demanding OLED applications including rollable displays, wearable devices, and automotive implementations—all environments where mechanical stress and environmental exposure present heightened durability challenges. Understanding the relative merits of self-healing versus encapsulation approaches will inform strategic R&D investments and potentially unlock new application possibilities for OLED technology.

The fundamental vulnerability of OLEDs stems from their organic materials' susceptibility to degradation when exposed to oxygen and moisture. This degradation manifests as "dark spots," reduced luminance, and ultimately, device failure. Historically, the industry has addressed this challenge primarily through encapsulation technologies—physical barriers designed to prevent environmental contaminants from reaching sensitive organic layers.

Traditional encapsulation approaches have evolved from rigid glass-based solutions to more sophisticated thin-film encapsulation (TFE) techniques that maintain flexibility while providing adequate protection. These methods have enabled the current generation of flexible OLED displays but still present limitations in terms of perfect barrier properties and mechanical durability under repeated flexing.

In parallel with encapsulation development, a newer and potentially transformative approach has emerged: self-healing technologies for OLEDs. This approach represents a paradigm shift from merely preventing degradation to actively repairing damage after it occurs. Self-healing mechanisms in OLEDs can be broadly categorized into material-based approaches (utilizing intrinsic healing properties of certain polymers) and system-level approaches (incorporating dedicated healing layers or mechanisms).

The technical objective of this research is to conduct a comprehensive comparative analysis of OLED self-healing technologies versus advanced encapsulation methods, specifically evaluating their relative contributions to device durability. This comparison aims to determine whether self-healing represents a viable complement or potential alternative to traditional encapsulation approaches for next-generation OLED applications.

Key metrics for this evaluation include effectiveness against common failure modes, performance retention over time, compatibility with flexible/foldable form factors, manufacturing scalability, and cost implications. The analysis will also consider how combinations of both approaches might yield synergistic benefits exceeding what either technology could achieve independently.

This research is particularly timely as the industry pushes toward more demanding OLED applications including rollable displays, wearable devices, and automotive implementations—all environments where mechanical stress and environmental exposure present heightened durability challenges. Understanding the relative merits of self-healing versus encapsulation approaches will inform strategic R&D investments and potentially unlock new application possibilities for OLED technology.

Market Demand Analysis for Durable OLED Technologies

The OLED display market has witnessed substantial growth over the past decade, with increasing demand for more durable and longer-lasting display technologies. Current market analysis indicates that consumers and enterprise clients alike prioritize device longevity as a key purchasing factor, creating significant demand for OLED technologies with enhanced durability features.

Consumer electronics represent the largest market segment demanding durable OLED solutions, with smartphones accounting for approximately 60% of OLED panel production. Market research shows that display failure is among the top three reasons for smartphone replacement, highlighting the critical need for more resilient display technologies. Premium smartphone manufacturers have consistently identified display durability as a key differentiator in their product offerings.

The automotive industry presents a rapidly expanding market for durable OLED displays, with projections showing a compound annual growth rate of 15% through 2028. In this sector, displays must withstand extreme temperature variations, vibration, and prolonged exposure to sunlight, making advanced durability solutions essential rather than optional.

Television and large-format display markets are similarly evolving toward OLED technology, with consumers expecting displays to maintain performance for 7-10 years. This extended lifecycle requirement places significant pressure on manufacturers to develop more robust durability solutions beyond traditional approaches.

Market surveys reveal that consumers are willing to pay a premium of 15-20% for devices with demonstrably improved durability. This price elasticity creates a compelling business case for investing in advanced OLED protection technologies, whether through self-healing materials or enhanced encapsulation methods.

Enterprise and industrial applications represent a smaller but higher-margin market segment, where display failure can result in significant operational disruptions. These clients prioritize total cost of ownership over initial acquisition costs, making durability improvements particularly valuable in this sector.

Geographically, North American and European markets show stronger preference for durability features, while Asian markets demonstrate greater price sensitivity but rapidly increasing awareness of longevity benefits. This regional variation suggests the need for market-specific approaches to durability technology implementation.

The wearable technology segment presents unique durability challenges due to constant exposure to environmental factors and physical stress. Market analysis indicates that display failure accounts for approximately 40% of smartwatch returns, creating substantial demand for more resilient OLED solutions in this growing segment.

Consumer electronics represent the largest market segment demanding durable OLED solutions, with smartphones accounting for approximately 60% of OLED panel production. Market research shows that display failure is among the top three reasons for smartphone replacement, highlighting the critical need for more resilient display technologies. Premium smartphone manufacturers have consistently identified display durability as a key differentiator in their product offerings.

The automotive industry presents a rapidly expanding market for durable OLED displays, with projections showing a compound annual growth rate of 15% through 2028. In this sector, displays must withstand extreme temperature variations, vibration, and prolonged exposure to sunlight, making advanced durability solutions essential rather than optional.

Television and large-format display markets are similarly evolving toward OLED technology, with consumers expecting displays to maintain performance for 7-10 years. This extended lifecycle requirement places significant pressure on manufacturers to develop more robust durability solutions beyond traditional approaches.

Market surveys reveal that consumers are willing to pay a premium of 15-20% for devices with demonstrably improved durability. This price elasticity creates a compelling business case for investing in advanced OLED protection technologies, whether through self-healing materials or enhanced encapsulation methods.

Enterprise and industrial applications represent a smaller but higher-margin market segment, where display failure can result in significant operational disruptions. These clients prioritize total cost of ownership over initial acquisition costs, making durability improvements particularly valuable in this sector.

Geographically, North American and European markets show stronger preference for durability features, while Asian markets demonstrate greater price sensitivity but rapidly increasing awareness of longevity benefits. This regional variation suggests the need for market-specific approaches to durability technology implementation.

The wearable technology segment presents unique durability challenges due to constant exposure to environmental factors and physical stress. Market analysis indicates that display failure accounts for approximately 40% of smartwatch returns, creating substantial demand for more resilient OLED solutions in this growing segment.

Current State and Challenges in OLED Durability Solutions

The global OLED display market has witnessed significant growth, yet durability remains a critical challenge. Current OLED durability solutions primarily focus on two approaches: encapsulation technologies and self-healing mechanisms. Encapsulation serves as the traditional defense, creating barrier layers that prevent moisture and oxygen penetration, while self-healing represents an emerging approach that enables materials to repair minor damage autonomously.

Encapsulation technologies have evolved from early glass-based solutions to advanced thin-film encapsulation (TFE) methods. Current state-of-the-art TFE typically employs alternating layers of inorganic (SiNx, Al2O3) and organic materials to create effective moisture barriers with water vapor transmission rates (WVTR) below 10^-6 g/m²/day. Despite these advances, encapsulation faces persistent challenges including edge sealing vulnerabilities, mechanical flexibility limitations, and manufacturing complexity that increases production costs.

Self-healing mechanisms represent a paradigm shift in OLED protection strategies. These technologies incorporate dynamic chemical systems that can repair microcracks and structural defects without external intervention. Current approaches include thermally activated healing polymers, photochemical healing systems, and supramolecular chemistry-based solutions. While promising, self-healing technologies face significant challenges including healing efficiency limitations, potential interference with OLED electrical properties, and insufficient response to severe damage scenarios.

The integration of these technologies into flexible and foldable displays presents additional complications. Mechanical stress during bending cycles accelerates degradation, creating a durability bottleneck that neither approach has fully solved. Industry testing reveals that current encapsulation solutions maintain acceptable performance for approximately 200,000 folding cycles, while self-healing materials show promising results but lack long-term reliability data.

Manufacturing scalability presents another significant hurdle. Encapsulation technologies benefit from established production processes but struggle with yield rates when applied to larger display areas. Self-healing approaches face even greater manufacturing challenges, with limited demonstration beyond laboratory scale and uncertain compatibility with existing production lines.

Temperature sensitivity affects both approaches differently. Encapsulation materials may develop microcracks during thermal cycling, while self-healing mechanisms often require specific temperature ranges to function optimally, limiting their effectiveness in extreme operating conditions. This creates a complex reliability matrix that varies significantly across different usage scenarios and environmental conditions.

The cost-performance balance remains problematic for both technologies. Advanced encapsulation adds approximately 15-20% to manufacturing costs, while self-healing materials currently represent a premium solution with even higher implementation expenses, creating market adoption barriers despite their technical promise.

Encapsulation technologies have evolved from early glass-based solutions to advanced thin-film encapsulation (TFE) methods. Current state-of-the-art TFE typically employs alternating layers of inorganic (SiNx, Al2O3) and organic materials to create effective moisture barriers with water vapor transmission rates (WVTR) below 10^-6 g/m²/day. Despite these advances, encapsulation faces persistent challenges including edge sealing vulnerabilities, mechanical flexibility limitations, and manufacturing complexity that increases production costs.

Self-healing mechanisms represent a paradigm shift in OLED protection strategies. These technologies incorporate dynamic chemical systems that can repair microcracks and structural defects without external intervention. Current approaches include thermally activated healing polymers, photochemical healing systems, and supramolecular chemistry-based solutions. While promising, self-healing technologies face significant challenges including healing efficiency limitations, potential interference with OLED electrical properties, and insufficient response to severe damage scenarios.

The integration of these technologies into flexible and foldable displays presents additional complications. Mechanical stress during bending cycles accelerates degradation, creating a durability bottleneck that neither approach has fully solved. Industry testing reveals that current encapsulation solutions maintain acceptable performance for approximately 200,000 folding cycles, while self-healing materials show promising results but lack long-term reliability data.

Manufacturing scalability presents another significant hurdle. Encapsulation technologies benefit from established production processes but struggle with yield rates when applied to larger display areas. Self-healing approaches face even greater manufacturing challenges, with limited demonstration beyond laboratory scale and uncertain compatibility with existing production lines.

Temperature sensitivity affects both approaches differently. Encapsulation materials may develop microcracks during thermal cycling, while self-healing mechanisms often require specific temperature ranges to function optimally, limiting their effectiveness in extreme operating conditions. This creates a complex reliability matrix that varies significantly across different usage scenarios and environmental conditions.

The cost-performance balance remains problematic for both technologies. Advanced encapsulation adds approximately 15-20% to manufacturing costs, while self-healing materials currently represent a premium solution with even higher implementation expenses, creating market adoption barriers despite their technical promise.

Comparative Analysis of Current OLED Protection Methods

01 Encapsulation techniques for OLED protection

Various encapsulation methods are employed to protect OLED displays from environmental factors that can degrade performance and reduce lifespan. These techniques include thin-film encapsulation (TFE), multi-layer barrier structures, and hermetic sealing technologies that prevent moisture and oxygen penetration. Advanced encapsulation materials and processes significantly improve the durability of OLED displays by creating effective barriers against environmental contaminants.- Encapsulation techniques for OLED protection: Various encapsulation methods are employed to protect OLED displays from environmental factors that can degrade performance and reduce lifespan. These techniques include thin-film encapsulation (TFE), multi-layer barrier structures, and hermetic sealing technologies that prevent moisture and oxygen penetration. Advanced encapsulation materials and processes significantly improve the durability of OLED displays by creating effective barriers against environmental contaminants.

- Structural reinforcement for flexible OLEDs: Flexible OLED displays require specialized structural reinforcement to maintain durability during bending and folding operations. This includes innovative substrate materials, support layers, and mechanical stress distribution designs that prevent damage to the organic layers and electrodes. These reinforcement techniques allow flexible displays to withstand repeated deformation while preserving display quality and extending operational lifetime.

- Thermal management solutions: Effective thermal management is crucial for OLED durability as heat accelerates degradation of organic materials. Advanced heat dissipation structures, thermal interface materials, and temperature control systems are implemented to regulate operating temperatures. These solutions prevent thermal stress and extend the lifespan of OLED displays by maintaining optimal operating conditions and reducing thermal-induced degradation pathways.

- Material innovations for enhanced stability: Novel materials are developed to improve the inherent stability of OLED components. These include more robust organic emitters, stable electrode materials, and degradation-resistant transport layers. Chemical modifications and new molecular structures enhance resistance to operational stresses such as current flow and photochemical reactions. These material innovations directly contribute to longer device lifetimes and improved reliability under various operating conditions.

- Circuit designs for uniform current distribution: Advanced circuit designs and driving schemes are implemented to ensure uniform current distribution across the OLED panel. These include compensation circuits that adjust for pixel aging, current control mechanisms that prevent overdriving, and voltage regulation systems. By preventing localized high-current areas and ensuring balanced operation, these circuit innovations significantly extend OLED display lifetime and maintain consistent brightness and color accuracy over time.

02 Structural reinforcement for flexible OLEDs

Flexible OLED displays require special structural reinforcement to maintain durability during bending and folding operations. This includes the development of specialized substrate materials, buffer layers, and mechanical support structures that can withstand repeated deformation without compromising the integrity of the display. These reinforcement techniques help prevent cracking, delamination, and other mechanical failures that can occur in flexible display applications.Expand Specific Solutions03 Heat dissipation and thermal management

Effective heat dissipation and thermal management systems are crucial for extending OLED display lifespan. These include heat-spreading layers, thermal interface materials, and active cooling solutions that prevent overheating during operation. By maintaining optimal operating temperatures, these systems reduce thermal degradation of organic materials and prevent premature aging of OLED components, significantly improving long-term durability and performance stability.Expand Specific Solutions04 Material innovations for enhanced stability

Advanced materials are being developed to enhance the inherent stability of OLED displays. These include more stable organic emitters, improved hole and electron transport layers, and novel host materials that resist degradation. Phosphorescent and thermally activated delayed fluorescence (TADF) materials with enhanced durability characteristics help extend device lifetime. These material innovations directly address the chemical degradation mechanisms that traditionally limit OLED durability.Expand Specific Solutions05 Pixel compensation and aging management

Sophisticated pixel compensation circuits and aging management algorithms are implemented to maintain consistent display performance over time. These systems monitor pixel degradation, adjust driving currents to compensate for aging effects, and employ various techniques to ensure uniform brightness and color accuracy throughout the display's lifetime. By actively managing the aging process, these technologies extend the effective lifespan of OLED displays and maintain visual quality over extended periods of use.Expand Specific Solutions

Key Industry Players in OLED Durability Innovation

The OLED self-healing versus encapsulation durability landscape is currently in an early growth phase, with the market expanding as OLED technology becomes more prevalent in consumer electronics. The global OLED durability solutions market is projected to grow significantly as manufacturers seek to extend device lifespans. Technologically, encapsulation remains the mature standard approach employed by established players like Samsung Display, LG Display, and BOE Technology Group, while self-healing technologies represent an emerging innovation frontier. Companies including Visionox Technology and TCL China Star Optoelectronics are investing in research to develop commercial self-healing solutions, though these remain at lower technology readiness levels compared to traditional encapsulation methods. The competitive dynamics are shifting as Asian manufacturers, particularly from China, challenge Korean incumbents' historical dominance in OLED durability solutions.

BOE Technology Group Co., Ltd.

Technical Solution: BOE has developed a comprehensive OLED durability solution that balances self-healing capabilities with advanced encapsulation technologies. Their self-healing approach utilizes specially formulated polymer matrices containing dynamic covalent bonds that can reconnect after being broken, allowing for automatic repair of minor scratches and surface damage. This technology is particularly effective in their flexible OLED panels where mechanical stress is common. For encapsulation, BOE employs a multi-layer thin-film encapsulation (TFE) system that combines inorganic barrier layers (primarily SiNx and Al2O3) deposited via plasma-enhanced chemical vapor deposition (PECVD) with organic interlayers. Their latest innovation is a "hybrid barrier film" that incorporates nanoparticles within the organic layers to enhance barrier properties while maintaining flexibility. BOE's internal testing indicates their combined approach extends OLED operational lifetime by approximately 35% compared to conventional encapsulation methods alone.

Strengths: Balanced approach addressing both preventive protection and damage repair; good performance in flexible display applications; cost-effective manufacturing process compared to some competitors. Weaknesses: Self-healing capabilities limited to superficial damage; healing process requires specific temperature conditions; encapsulation technology still slightly behind industry leaders in terms of water vapor transmission rate performance.

Samsung Display Co., Ltd.

Technical Solution: Samsung Display has developed advanced OLED self-healing technology that utilizes dynamic molecular restructuring to repair minor scratches and pixel defects. Their approach incorporates self-healing polymers with thermally activated healing mechanisms that can restore damaged areas when exposed to moderate heat (around 60°C). Samsung's technology employs a multi-layered structure where the self-healing layer is integrated between the substrate and the active OLED components. This allows for continuous repair of microcracks without compromising display performance. For encapsulation, Samsung utilizes thin-film encapsulation (TFE) technology with alternating inorganic (SiNx) and organic layers that provide superior moisture and oxygen barrier properties while maintaining flexibility. Their latest generation incorporates atomic layer deposition (ALD) techniques to create ultra-thin but highly effective barrier films with water vapor transmission rates below 10^-6 g/m²/day.

Strengths: Superior barrier properties against moisture and oxygen penetration; excellent flexibility allowing for foldable displays; extended OLED lifetime (reportedly 30-50% longer than conventional encapsulation). Weaknesses: Self-healing capabilities are limited to minor damages; healing process requires thermal activation which may not be practical in all usage scenarios; higher manufacturing complexity and cost compared to traditional encapsulation methods.

Technical Deep Dive: Self-Healing vs Encapsulation Patents

OLED display panel and display device

PatentWO2023151137A1

Innovation

- A self-healing layer is introduced into the anode. The self-healing layer is located on the side of the first conductive body layer close to the substrate. Self-healing materials such as polydimethylsiloxane-4,4′-methylene phenyl isocyanate and Materials such as polydimethylsiloxane-4,4′-4,4′-hexamethylenebiurea enhance the mechanical property repair ability of the anode.

Organic Light Emitting Diode Display and Manufacturing Method of Organic Light Emitting Diode Display

PatentInactiveUS20120241811A1

Innovation

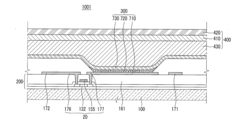

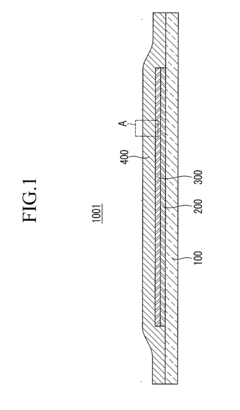

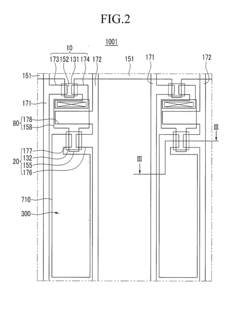

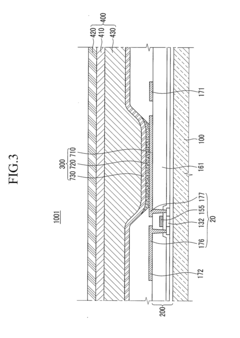

- The implementation of a thin film encapsulation layer with a first and second inorganic layer of different densities, formed using the same material through an ALD process, and an intermediate layer to reduce internal stress and improve flexibility, along with a manufacturing method that involves forming these layers at distinct temperature environments to enhance durability and light efficiency.

Environmental Impact and Sustainability Considerations

The environmental impact of OLED display technologies extends beyond performance considerations to include sustainability throughout their lifecycle. When comparing self-healing and encapsulation approaches for OLED durability, several environmental factors merit careful consideration.

Self-healing OLED technologies typically incorporate specialized polymers or materials that can autonomously repair minor damage. These materials often require complex synthesis processes involving potentially hazardous chemicals. However, by extending device lifespan through damage recovery, self-healing mechanisms significantly reduce electronic waste generation—a critical advantage in our resource-constrained world. The environmental footprint of manufacturing these specialized materials must be weighed against the benefits of prolonged device usage.

Encapsulation technologies, conversely, rely on barrier materials such as glass, metal oxides, or polymers to prevent environmental degradation. The production of these materials, particularly high-performance barrier films, can be energy-intensive and may involve rare earth elements or specialized compounds. Traditional encapsulation approaches often incorporate multiple layers of different materials, potentially complicating end-of-life recycling processes.

Energy consumption during manufacturing represents another important environmental consideration. Self-healing systems may require additional energy inputs during production but could reduce replacement frequency. Encapsulation processes, especially those involving vacuum deposition or atomic layer deposition, demand substantial energy resources but are well-established in existing manufacturing infrastructure.

End-of-life management presents distinct challenges for both approaches. Self-healing OLEDs containing novel polymers may require specialized recycling protocols not yet widely available. Encapsulated displays, while potentially easier to process through established recycling channels, often contain tightly bonded dissimilar materials that complicate material recovery.

Water and resource consumption during manufacturing also differs between these technologies. Encapsulation processes typically require ultrapure water for cleaning and processing, while self-healing material synthesis may involve different resource demands, including specialized catalysts or precursors.

Carbon footprint assessments comparing these technologies must account for both manufacturing impacts and lifetime extension benefits. Preliminary studies suggest that technologies extending OLED lifespan by 30% or more generally demonstrate net environmental benefits despite potentially higher initial production impacts.

As regulatory frameworks increasingly emphasize circular economy principles, manufacturers must consider design choices that facilitate eventual recycling and material recovery. This includes evaluating the biodegradability of self-healing components and the separability of encapsulation layers at end-of-life.

Self-healing OLED technologies typically incorporate specialized polymers or materials that can autonomously repair minor damage. These materials often require complex synthesis processes involving potentially hazardous chemicals. However, by extending device lifespan through damage recovery, self-healing mechanisms significantly reduce electronic waste generation—a critical advantage in our resource-constrained world. The environmental footprint of manufacturing these specialized materials must be weighed against the benefits of prolonged device usage.

Encapsulation technologies, conversely, rely on barrier materials such as glass, metal oxides, or polymers to prevent environmental degradation. The production of these materials, particularly high-performance barrier films, can be energy-intensive and may involve rare earth elements or specialized compounds. Traditional encapsulation approaches often incorporate multiple layers of different materials, potentially complicating end-of-life recycling processes.

Energy consumption during manufacturing represents another important environmental consideration. Self-healing systems may require additional energy inputs during production but could reduce replacement frequency. Encapsulation processes, especially those involving vacuum deposition or atomic layer deposition, demand substantial energy resources but are well-established in existing manufacturing infrastructure.

End-of-life management presents distinct challenges for both approaches. Self-healing OLEDs containing novel polymers may require specialized recycling protocols not yet widely available. Encapsulated displays, while potentially easier to process through established recycling channels, often contain tightly bonded dissimilar materials that complicate material recovery.

Water and resource consumption during manufacturing also differs between these technologies. Encapsulation processes typically require ultrapure water for cleaning and processing, while self-healing material synthesis may involve different resource demands, including specialized catalysts or precursors.

Carbon footprint assessments comparing these technologies must account for both manufacturing impacts and lifetime extension benefits. Preliminary studies suggest that technologies extending OLED lifespan by 30% or more generally demonstrate net environmental benefits despite potentially higher initial production impacts.

As regulatory frameworks increasingly emphasize circular economy principles, manufacturers must consider design choices that facilitate eventual recycling and material recovery. This includes evaluating the biodegradability of self-healing components and the separability of encapsulation layers at end-of-life.

Cost-Benefit Analysis of Competing OLED Protection Technologies

When evaluating OLED protection technologies, a comprehensive cost-benefit analysis reveals significant economic considerations that influence manufacturer decisions. Traditional encapsulation methods, particularly multi-layer thin-film encapsulation (TFE), require substantial initial capital investment in specialized deposition equipment, with costs potentially reaching $10-15 million for production-scale facilities. These systems demand precise environmental controls and highly purified materials, further increasing operational expenses.

Self-healing technologies, while promising, currently present higher material costs—approximately 15-30% more expensive than conventional encapsulation materials. However, this premium may be offset by potential reductions in warranty claims and extended device lifespans. Market analysis indicates that devices with self-healing capabilities could command a 10-20% price premium in consumer markets, particularly in premium smartphone and television segments.

Production efficiency metrics demonstrate that encapsulation processes typically add 8-12% to overall manufacturing time, while self-healing material integration adds only 3-5%. This throughput advantage translates to approximately $3-5 cost savings per device in high-volume production environments. Additionally, yield rates for traditional encapsulation hover around 92-95%, while preliminary data suggests self-healing approaches could potentially achieve 96-98% yields by mitigating minor defects that would otherwise render devices unusable.

Lifecycle cost analysis reveals that encapsulation technologies front-load expenses during manufacturing but require minimal ongoing investment. Conversely, self-healing approaches distribute costs more evenly across the product lifecycle, with lower initial implementation costs but potentially higher material expenses. The break-even point typically occurs after 2-3 years of device operation, making self-healing particularly attractive for premium products with expected lifespans exceeding 5 years.

Energy consumption comparisons indicate that traditional encapsulation processes require 0.8-1.2 kWh per device, while self-healing material integration consumes approximately 0.3-0.5 kWh. This 60% reduction in energy requirements represents both cost savings and improved sustainability metrics, an increasingly important consideration for manufacturers facing stricter environmental regulations and consumer expectations.

Risk assessment models suggest that while encapsulation technologies represent a mature, proven approach with predictable costs, self-healing technologies offer potentially significant but less certain long-term economic benefits. The optimal strategy may involve hybrid approaches that leverage the strengths of both technologies while mitigating their respective limitations.

Self-healing technologies, while promising, currently present higher material costs—approximately 15-30% more expensive than conventional encapsulation materials. However, this premium may be offset by potential reductions in warranty claims and extended device lifespans. Market analysis indicates that devices with self-healing capabilities could command a 10-20% price premium in consumer markets, particularly in premium smartphone and television segments.

Production efficiency metrics demonstrate that encapsulation processes typically add 8-12% to overall manufacturing time, while self-healing material integration adds only 3-5%. This throughput advantage translates to approximately $3-5 cost savings per device in high-volume production environments. Additionally, yield rates for traditional encapsulation hover around 92-95%, while preliminary data suggests self-healing approaches could potentially achieve 96-98% yields by mitigating minor defects that would otherwise render devices unusable.

Lifecycle cost analysis reveals that encapsulation technologies front-load expenses during manufacturing but require minimal ongoing investment. Conversely, self-healing approaches distribute costs more evenly across the product lifecycle, with lower initial implementation costs but potentially higher material expenses. The break-even point typically occurs after 2-3 years of device operation, making self-healing particularly attractive for premium products with expected lifespans exceeding 5 years.

Energy consumption comparisons indicate that traditional encapsulation processes require 0.8-1.2 kWh per device, while self-healing material integration consumes approximately 0.3-0.5 kWh. This 60% reduction in energy requirements represents both cost savings and improved sustainability metrics, an increasingly important consideration for manufacturers facing stricter environmental regulations and consumer expectations.

Risk assessment models suggest that while encapsulation technologies represent a mature, proven approach with predictable costs, self-healing technologies offer potentially significant but less certain long-term economic benefits. The optimal strategy may involve hybrid approaches that leverage the strengths of both technologies while mitigating their respective limitations.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!