OLED vs AMOLED: Evaluating Cost-Effectiveness for Displays

SEP 12, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

OLED and AMOLED Display Technology Evolution

The evolution of display technology has witnessed significant advancements over the past few decades, with OLED (Organic Light Emitting Diode) and AMOLED (Active Matrix Organic Light Emitting Diode) emerging as revolutionary technologies that have transformed visual experiences across devices. The journey began in the 1950s with the discovery of electroluminescence in organic materials, but it wasn't until the 1980s that Eastman Kodak researchers created the first practical OLED device.

The initial PMOLED (Passive Matrix OLED) technology suffered from limitations in resolution and power efficiency, leading to the development of AMOLED in the late 1990s. This technological leap incorporated thin-film transistors (TFTs) that actively maintained pixel states, enabling higher resolution, improved response times, and better power efficiency for larger displays.

The 2000s marked the commercialization phase, with Samsung and LG pioneering AMOLED production for mobile devices and televisions. By 2010, AMOLED displays had become mainstream in premium smartphones, offering superior color reproduction, contrast ratios, and viewing angles compared to LCD alternatives. The technology's ability to selectively illuminate pixels resulted in true blacks and significant power savings for dark-themed content.

Technological evolution continued with the introduction of flexible AMOLED displays around 2013, enabling curved screens and foldable devices. Samsung's Galaxy Round and LG's G Flex represented early commercial applications of this innovation. The flexibility stemmed from replacing rigid glass substrates with plastic polymers, opening new form factor possibilities while maintaining display performance.

Recent years have seen further refinements in manufacturing processes, with developments in RGB pixel arrangements, quantum dot enhancement layers (QD-OLED), and micro-LED hybrid technologies. These advancements have addressed historical challenges such as blue pixel degradation, screen burn-in, and production yields.

The cost trajectory has followed a typical technology adoption curve, with initial high production costs gradually decreasing through economies of scale and manufacturing innovations. Early AMOLED displays cost significantly more than LCD counterparts, but the price gap has narrowed considerably, particularly for mid-range applications.

Looking forward, the evolution continues toward transparent and stretchable OLED displays, with research focusing on improving lifetime, brightness, and energy efficiency while reducing production costs. The integration of in-display sensors and cameras represents another frontier, with under-display fingerprint readers already commercialized and under-display cameras emerging in premium devices.

This evolutionary path demonstrates how OLED and AMOLED technologies have matured from experimental concepts to mainstream display solutions, with ongoing innovations continuing to expand their applications and cost-effectiveness across consumer electronics, automotive interfaces, and emerging wearable technologies.

The initial PMOLED (Passive Matrix OLED) technology suffered from limitations in resolution and power efficiency, leading to the development of AMOLED in the late 1990s. This technological leap incorporated thin-film transistors (TFTs) that actively maintained pixel states, enabling higher resolution, improved response times, and better power efficiency for larger displays.

The 2000s marked the commercialization phase, with Samsung and LG pioneering AMOLED production for mobile devices and televisions. By 2010, AMOLED displays had become mainstream in premium smartphones, offering superior color reproduction, contrast ratios, and viewing angles compared to LCD alternatives. The technology's ability to selectively illuminate pixels resulted in true blacks and significant power savings for dark-themed content.

Technological evolution continued with the introduction of flexible AMOLED displays around 2013, enabling curved screens and foldable devices. Samsung's Galaxy Round and LG's G Flex represented early commercial applications of this innovation. The flexibility stemmed from replacing rigid glass substrates with plastic polymers, opening new form factor possibilities while maintaining display performance.

Recent years have seen further refinements in manufacturing processes, with developments in RGB pixel arrangements, quantum dot enhancement layers (QD-OLED), and micro-LED hybrid technologies. These advancements have addressed historical challenges such as blue pixel degradation, screen burn-in, and production yields.

The cost trajectory has followed a typical technology adoption curve, with initial high production costs gradually decreasing through economies of scale and manufacturing innovations. Early AMOLED displays cost significantly more than LCD counterparts, but the price gap has narrowed considerably, particularly for mid-range applications.

Looking forward, the evolution continues toward transparent and stretchable OLED displays, with research focusing on improving lifetime, brightness, and energy efficiency while reducing production costs. The integration of in-display sensors and cameras represents another frontier, with under-display fingerprint readers already commercialized and under-display cameras emerging in premium devices.

This evolutionary path demonstrates how OLED and AMOLED technologies have matured from experimental concepts to mainstream display solutions, with ongoing innovations continuing to expand their applications and cost-effectiveness across consumer electronics, automotive interfaces, and emerging wearable technologies.

Market Demand Analysis for Advanced Display Technologies

The display technology market has witnessed significant growth in recent years, driven primarily by increasing consumer demand for high-quality visual experiences across multiple device categories. The global display market size reached approximately $148 billion in 2022, with OLED and AMOLED technologies collectively accounting for over 30% of this market share. Industry forecasts project this segment to grow at a compound annual growth rate (CAGR) of 12.9% through 2028, outpacing traditional LCD technology growth rates.

Consumer electronics remains the dominant application sector for advanced display technologies, with smartphones representing the largest single product category. In 2022, over 1.4 billion smartphones were shipped globally, with AMOLED displays featured in approximately 45% of premium devices. This penetration is expected to increase to 60% by 2025 as manufacturing costs decrease and yield rates improve.

Television and large-format displays constitute the second-largest market segment, with OLED TVs experiencing 20% year-over-year growth despite their premium pricing. Market research indicates that consumers are increasingly willing to pay premium prices for superior visual quality, with 65% of high-income consumers citing display quality as a "very important" factor in purchasing decisions.

The automotive sector represents the fastest-growing application market for advanced display technologies, with a projected CAGR of 24.3% through 2027. This growth is driven by increasing integration of digital cockpits, heads-up displays, and entertainment systems in modern vehicles. AMOLED technology is particularly well-suited for automotive applications due to its superior visibility in varied lighting conditions and operational temperature ranges.

Regional analysis reveals that Asia-Pacific dominates both production and consumption of advanced display technologies, accounting for 68% of global manufacturing capacity. North America and Europe follow as major consumption markets, with particularly strong demand in premium product segments where display quality serves as a key differentiator.

Market research indicates shifting consumer preferences toward devices with higher color accuracy, contrast ratios, and energy efficiency. In blind comparison tests, 78% of consumers preferred AMOLED displays over traditional LCD screens, citing "more vibrant colors" and "deeper blacks" as primary factors. This preference translates to measurable market premiums, with manufacturers able to command 15-25% higher prices for devices featuring advanced display technologies.

Corporate and enterprise markets show increasing demand for advanced display technologies in professional settings, particularly in creative industries, healthcare, and financial services where color accuracy and reduced eye strain provide tangible productivity benefits. This B2B segment is projected to grow at 18.2% annually through 2026, representing a significant diversification opportunity beyond consumer applications.

Consumer electronics remains the dominant application sector for advanced display technologies, with smartphones representing the largest single product category. In 2022, over 1.4 billion smartphones were shipped globally, with AMOLED displays featured in approximately 45% of premium devices. This penetration is expected to increase to 60% by 2025 as manufacturing costs decrease and yield rates improve.

Television and large-format displays constitute the second-largest market segment, with OLED TVs experiencing 20% year-over-year growth despite their premium pricing. Market research indicates that consumers are increasingly willing to pay premium prices for superior visual quality, with 65% of high-income consumers citing display quality as a "very important" factor in purchasing decisions.

The automotive sector represents the fastest-growing application market for advanced display technologies, with a projected CAGR of 24.3% through 2027. This growth is driven by increasing integration of digital cockpits, heads-up displays, and entertainment systems in modern vehicles. AMOLED technology is particularly well-suited for automotive applications due to its superior visibility in varied lighting conditions and operational temperature ranges.

Regional analysis reveals that Asia-Pacific dominates both production and consumption of advanced display technologies, accounting for 68% of global manufacturing capacity. North America and Europe follow as major consumption markets, with particularly strong demand in premium product segments where display quality serves as a key differentiator.

Market research indicates shifting consumer preferences toward devices with higher color accuracy, contrast ratios, and energy efficiency. In blind comparison tests, 78% of consumers preferred AMOLED displays over traditional LCD screens, citing "more vibrant colors" and "deeper blacks" as primary factors. This preference translates to measurable market premiums, with manufacturers able to command 15-25% higher prices for devices featuring advanced display technologies.

Corporate and enterprise markets show increasing demand for advanced display technologies in professional settings, particularly in creative industries, healthcare, and financial services where color accuracy and reduced eye strain provide tangible productivity benefits. This B2B segment is projected to grow at 18.2% annually through 2026, representing a significant diversification opportunity beyond consumer applications.

Current Technical Limitations and Cost Challenges

Despite significant advancements in OLED and AMOLED display technologies, several technical limitations and cost challenges continue to impact their widespread adoption and cost-effectiveness. Manufacturing yield rates remain a persistent challenge, particularly for larger display panels. The complex fabrication process involves multiple precise steps where even minor defects can render an entire panel unusable. Current industry yield rates for high-end AMOLED displays hover between 60-70%, significantly lower than the mature LCD technology's 90%+ yields, directly increasing per-unit costs.

Material degradation presents another significant technical hurdle. Organic materials in both OLED and AMOLED displays suffer from limited lifespans, with blue subpixels degrading faster than red and green counterparts. This differential aging leads to color shifts over time and reduces overall panel longevity. While AMOLED displays typically offer 30,000-50,000 hours of operational life, this remains shorter than competing technologies, necessitating more frequent replacements in commercial applications.

Power efficiency variations between OLED and AMOLED technologies impact their cost-effectiveness in different use scenarios. While AMOLEDs offer superior power management through their active matrix backplane, this advantage diminishes when displaying predominantly white content, where they can consume up to 40% more power than comparable LCD displays. This characteristic creates application-specific cost considerations beyond the initial purchase price.

Manufacturing complexity represents a substantial cost driver. AMOLED production requires specialized equipment including high-precision vapor deposition systems and clean room facilities with contamination levels below one particle per cubic meter. The thin-film transistor (TFT) backplane in AMOLEDs adds further complexity with its multiple semiconductor layers. Current production facilities require capital investments exceeding $8-10 billion for a state-of-the-art Gen 10.5 fab, limiting production capacity expansion.

Supply chain constraints further exacerbate cost challenges. Key materials including organic compounds and rare metals face limited supplier diversity, with approximately 70% of certain critical materials controlled by a handful of manufacturers. This supply concentration creates pricing vulnerabilities and potential bottlenecks. Additionally, intellectual property fragmentation across the OLED ecosystem necessitates complex licensing arrangements that add 5-8% to production costs.

Scaling difficulties persist particularly for larger display formats. As panel size increases, maintaining uniform current distribution becomes exponentially more challenging, resulting in brightness variations across the display. This technical limitation requires additional compensation circuitry and quality control measures, further increasing production costs for larger panels by approximately 15-20% per square meter compared to smaller formats.

Material degradation presents another significant technical hurdle. Organic materials in both OLED and AMOLED displays suffer from limited lifespans, with blue subpixels degrading faster than red and green counterparts. This differential aging leads to color shifts over time and reduces overall panel longevity. While AMOLED displays typically offer 30,000-50,000 hours of operational life, this remains shorter than competing technologies, necessitating more frequent replacements in commercial applications.

Power efficiency variations between OLED and AMOLED technologies impact their cost-effectiveness in different use scenarios. While AMOLEDs offer superior power management through their active matrix backplane, this advantage diminishes when displaying predominantly white content, where they can consume up to 40% more power than comparable LCD displays. This characteristic creates application-specific cost considerations beyond the initial purchase price.

Manufacturing complexity represents a substantial cost driver. AMOLED production requires specialized equipment including high-precision vapor deposition systems and clean room facilities with contamination levels below one particle per cubic meter. The thin-film transistor (TFT) backplane in AMOLEDs adds further complexity with its multiple semiconductor layers. Current production facilities require capital investments exceeding $8-10 billion for a state-of-the-art Gen 10.5 fab, limiting production capacity expansion.

Supply chain constraints further exacerbate cost challenges. Key materials including organic compounds and rare metals face limited supplier diversity, with approximately 70% of certain critical materials controlled by a handful of manufacturers. This supply concentration creates pricing vulnerabilities and potential bottlenecks. Additionally, intellectual property fragmentation across the OLED ecosystem necessitates complex licensing arrangements that add 5-8% to production costs.

Scaling difficulties persist particularly for larger display formats. As panel size increases, maintaining uniform current distribution becomes exponentially more challenging, resulting in brightness variations across the display. This technical limitation requires additional compensation circuitry and quality control measures, further increasing production costs for larger panels by approximately 15-20% per square meter compared to smaller formats.

Cost-Benefit Analysis of OLED vs AMOLED Solutions

01 Manufacturing cost reduction techniques for OLED/AMOLED displays

Various manufacturing techniques have been developed to reduce the production costs of OLED and AMOLED displays. These include simplified fabrication processes, improved material utilization, and optimized production workflows. By reducing the number of manufacturing steps and improving yield rates, manufacturers can significantly lower the cost of OLED and AMOLED displays while maintaining performance standards.- Manufacturing cost reduction techniques for OLED/AMOLED displays: Various manufacturing techniques have been developed to reduce the production costs of OLED and AMOLED displays. These include simplified fabrication processes, improved material deposition methods, and optimized production workflows. By reducing the number of manufacturing steps and improving yield rates, manufacturers can significantly lower the cost of OLED and AMOLED displays while maintaining performance quality.

- Power efficiency improvements in OLED/AMOLED technology: Innovations in OLED and AMOLED display technologies have focused on improving power efficiency to reduce operational costs. These improvements include optimized pixel structures, advanced driving schemes, and enhanced light emission efficiency. Lower power consumption not only extends battery life in portable devices but also reduces the total cost of ownership, making these display technologies more cost-effective over their lifetime.

- Display lifetime and durability enhancements: Extending the operational lifetime of OLED and AMOLED displays is crucial for cost-effectiveness. Technological advancements have addressed issues like pixel degradation, color shifting, and burn-in through improved materials, encapsulation techniques, and compensation algorithms. These enhancements result in displays that maintain performance longer, reducing replacement frequency and improving the return on investment for both manufacturers and consumers.

- Integration of cost-effective materials and components: Research has focused on developing and incorporating more affordable materials and components in OLED and AMOLED displays without compromising quality. This includes alternative organic compounds, electrode materials, and substrate technologies. By replacing expensive rare materials with more abundant alternatives and optimizing component design, manufacturers can reduce material costs while maintaining or even improving display performance.

- Production scaling and yield improvement strategies: Scaling up production and improving manufacturing yields are critical factors in reducing the cost of OLED and AMOLED displays. Advanced quality control systems, automated inspection processes, and defect prediction algorithms help identify and address manufacturing issues early. Larger substrate sizes and improved equipment efficiency enable economies of scale, resulting in lower per-unit costs and making these advanced display technologies more accessible to broader market segments.

02 Power efficiency improvements in OLED/AMOLED technology

Innovations in OLED and AMOLED display technologies have focused on improving power efficiency to reduce operational costs. These improvements include optimized pixel structures, advanced driving schemes, and enhanced light emission efficiency. By reducing power consumption, these technologies not only extend battery life in portable devices but also lower the total cost of ownership for consumers and commercial applications.Expand Specific Solutions03 Pixel circuit designs for cost-effective AMOLED displays

Advanced pixel circuit designs have been developed to improve the cost-effectiveness of AMOLED displays. These designs include simplified pixel structures, reduced component counts, and integrated driving circuits. By optimizing the pixel architecture, manufacturers can achieve better display performance with fewer materials and processing steps, resulting in more affordable AMOLED displays without compromising quality.Expand Specific Solutions04 Material innovations for cost-effective OLED production

New materials have been developed to reduce the cost of OLED display production while maintaining or improving performance. These innovations include alternative organic compounds, more efficient emitters, and durable electrode materials. By replacing expensive materials with more cost-effective alternatives and improving material stability, manufacturers can reduce both initial production costs and long-term maintenance expenses for OLED displays.Expand Specific Solutions05 Production scaling and yield improvement methods

Methods for scaling up production and improving manufacturing yields have been developed to enhance the cost-effectiveness of OLED and AMOLED displays. These methods include automated quality control systems, defect detection algorithms, and process optimization techniques. By increasing production volumes and reducing defect rates, manufacturers can achieve economies of scale and lower the per-unit cost of OLED and AMOLED displays, making them more competitive with alternative display technologies.Expand Specific Solutions

Key Display Manufacturers and Market Competition

The OLED vs AMOLED display technology market is currently in a mature growth phase, with an estimated global market size exceeding $30 billion and projected to grow at a CAGR of 12-15% through 2027. Samsung Display and BOE Technology lead the competitive landscape, with significant contributions from TCL China Star, Innolux, and Visionox. The technology maturity varies between segments, with AMOLED technology reaching higher maturity levels due to Samsung's extensive commercialization efforts, while specialized innovations from IGNIS Innovation address persistent challenges like image sticking and burn-in. Companies like Novaled and Cambridge Display Technology continue advancing OLED material science, while major players including Sony, Google, and IBM integrate these technologies into consumer and enterprise products.

BOE Technology Group Co., Ltd.

Technical Solution: BOE has developed a comprehensive OLED and AMOLED technology portfolio focusing on cost-effective manufacturing processes. Their technical approach includes implementing oxide TFT backplanes (IGZO) instead of more expensive LTPS options for certain applications, achieving a balance between performance and cost. BOE has pioneered inkjet printing techniques for OLED material deposition, which significantly reduces material waste compared to traditional vapor deposition methods, with material utilization rates improving from approximately 10% to over 90% in targeted applications. Their flexible AMOLED production incorporates innovative laser lift-off (LLO) processes that enable the use of temporary glass carriers during manufacturing before transferring to flexible substrates, improving yield rates while maintaining flexibility. BOE has also developed proprietary compensation algorithms that address pixel non-uniformity issues, extending the effective lifespan of their displays while maintaining consistent brightness across the panel.

Strengths: Cost-competitive manufacturing capabilities, rapidly expanding production capacity, and strong government backing for technology development. Their diverse product portfolio allows for technology sharing across different display applications. Weaknesses: Still catching up to Samsung and LG in terms of high-end AMOLED quality, particularly in color accuracy and lifetime. Higher defect rates in initial production runs compared to more established manufacturers.

Samsung Electronics Co., Ltd.

Technical Solution: Samsung Electronics has pioneered AMOLED technology through significant R&D investment, developing their proprietary Super AMOLED displays. Their technical approach focuses on integrating the touch sensors directly into the display rather than as a separate layer, reducing overall thickness and improving optical performance. Samsung's AMOLED panels utilize low-temperature polycrystalline silicon (LTPS) backplanes for higher electron mobility and lower power consumption compared to traditional amorphous silicon. Their displays feature pixel-level current control mechanisms that enable true blacks by completely turning off individual pixels when displaying black content, resulting in infinite contrast ratios. Samsung has also developed advanced color management systems that allow their AMOLED displays to cover over 100% of the DCI-P3 color gamut, significantly wider than typical OLED displays.

Strengths: Superior contrast ratios, faster response times (under 0.1ms), wider viewing angles, and better power efficiency when displaying darker content. Samsung's vertical integration allows for tighter quality control and manufacturing optimization. Weaknesses: Higher production costs compared to LCD technologies, potential for burn-in with static images, and color accuracy degradation over extended usage periods.

Patent Landscape and Intellectual Property Considerations

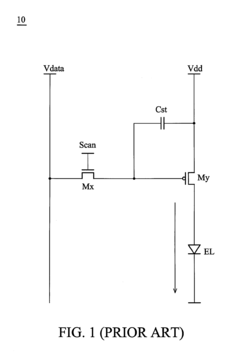

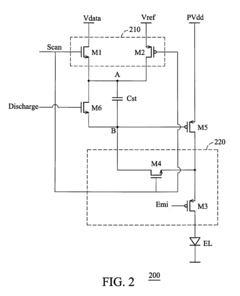

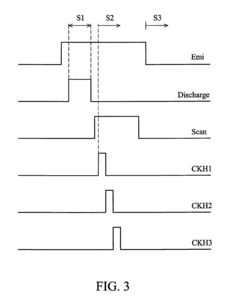

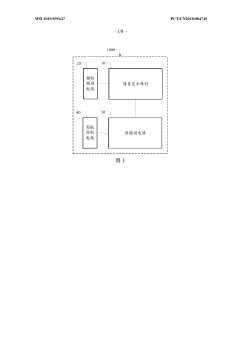

Display system and pixel driving circuit thereof

PatentActiveUS20080088547A1

Innovation

- A pixel driving circuit is designed with a storage capacitor, a transistor, a transfer circuit, and a switch circuit that compensates for threshold voltage and power supply voltage variations, allowing the driving current to be independent of these voltages by operating as a diode and using polysilicon thin film transistors for higher current driving capability.

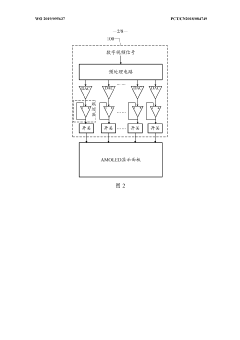

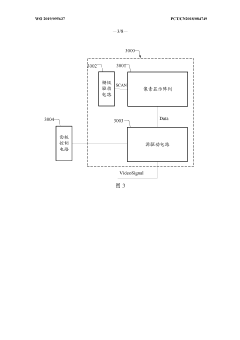

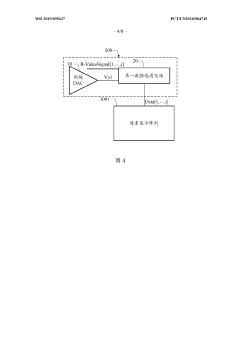

Amoled display panel and image display apparatus

PatentWO2019095637A1

Innovation

- The pixel display array, gate drive circuit and source drive circuit are integrated on the same chip substrate, and the panel control circuit is set outside the chip substrate. The medium-voltage process is used to reduce process complexity, while the ramp DAC and data strobe circuit are used to improve Data voltage accuracy and conversion efficiency.

Manufacturing Process Comparison and Yield Rates

The manufacturing processes for OLED and AMOLED displays differ significantly, impacting both production costs and yield rates. Traditional OLED manufacturing begins with substrate preparation, typically glass coated with indium tin oxide (ITO) as the transparent electrode. This is followed by the deposition of organic layers through thermal evaporation under vacuum conditions, a process requiring precise control of layer thickness at the nanometer scale. The final steps include cathode deposition and encapsulation to protect the organic materials from moisture and oxygen.

AMOLED manufacturing incorporates additional complexity with the integration of thin-film transistor (TFT) backplanes. These backplanes require multiple photolithography steps, increasing both production time and material costs. The TFT layer fabrication alone can account for approximately 40% of the total manufacturing cost for AMOLED displays. However, this additional investment enables pixel-level control, resulting in superior display performance.

Yield rates represent a critical factor in cost-effectiveness analysis. OLED manufacturing typically achieves yield rates between 70-80% for smaller displays, while AMOLED production historically struggled with yields below 60% for larger panels. Recent technological advancements have improved AMOLED yields to 85-90% for smartphone-sized displays, though larger television panels still face challenges with yields around 60-70%. Each percentage point improvement in yield can translate to approximately 1-2% reduction in final unit cost.

Manufacturing equipment represents another significant cost differential. AMOLED production requires specialized photolithography and thin-film deposition equipment, with a typical production line costing $200-300 million more than comparable OLED facilities. This capital expenditure necessitates higher production volumes to achieve cost amortization, creating a barrier to entry for smaller manufacturers.

Material utilization efficiency also differs between technologies. OLED manufacturing typically achieves 30-40% material utilization for organic compounds during vapor deposition, while newer AMOLED facilities implementing advanced deposition techniques can reach 60-70% efficiency. This difference significantly impacts production costs, as organic materials represent approximately 20% of the bill of materials for both display types.

Production throughput presents another distinction, with OLED manufacturing generally achieving 15-20% higher throughput rates compared to AMOLED for equivalent display sizes. This throughput advantage partially offsets OLED's lower performance characteristics when evaluating overall cost-effectiveness, particularly for applications where absolute display quality is less critical than unit economics.

AMOLED manufacturing incorporates additional complexity with the integration of thin-film transistor (TFT) backplanes. These backplanes require multiple photolithography steps, increasing both production time and material costs. The TFT layer fabrication alone can account for approximately 40% of the total manufacturing cost for AMOLED displays. However, this additional investment enables pixel-level control, resulting in superior display performance.

Yield rates represent a critical factor in cost-effectiveness analysis. OLED manufacturing typically achieves yield rates between 70-80% for smaller displays, while AMOLED production historically struggled with yields below 60% for larger panels. Recent technological advancements have improved AMOLED yields to 85-90% for smartphone-sized displays, though larger television panels still face challenges with yields around 60-70%. Each percentage point improvement in yield can translate to approximately 1-2% reduction in final unit cost.

Manufacturing equipment represents another significant cost differential. AMOLED production requires specialized photolithography and thin-film deposition equipment, with a typical production line costing $200-300 million more than comparable OLED facilities. This capital expenditure necessitates higher production volumes to achieve cost amortization, creating a barrier to entry for smaller manufacturers.

Material utilization efficiency also differs between technologies. OLED manufacturing typically achieves 30-40% material utilization for organic compounds during vapor deposition, while newer AMOLED facilities implementing advanced deposition techniques can reach 60-70% efficiency. This difference significantly impacts production costs, as organic materials represent approximately 20% of the bill of materials for both display types.

Production throughput presents another distinction, with OLED manufacturing generally achieving 15-20% higher throughput rates compared to AMOLED for equivalent display sizes. This throughput advantage partially offsets OLED's lower performance characteristics when evaluating overall cost-effectiveness, particularly for applications where absolute display quality is less critical than unit economics.

Energy Efficiency and Environmental Impact Assessment

Energy efficiency represents a critical factor in display technology evaluation, with OLED and AMOLED technologies demonstrating distinct performance characteristics. OLED displays generally consume less power than traditional LCD screens because they don't require backlighting—each pixel emits its own light and can be completely turned off when displaying black. This pixel-level control enables significant power savings, particularly when displaying darker content.

AMOLED, as an advanced implementation of OLED technology, further enhances energy efficiency through its active matrix system. The thin-film transistor (TFT) backplane in AMOLED displays provides more precise current control to each pixel, resulting in 20-30% better power management compared to passive matrix OLED displays. This efficiency becomes particularly evident in mobile applications where battery life is paramount.

Environmental impact assessment of these technologies reveals several important considerations across their lifecycle. Manufacturing processes for both OLED and AMOLED displays involve potentially hazardous materials, including heavy metals and organic compounds. However, AMOLED production typically requires fewer process steps and potentially fewer toxic substances than traditional LCD manufacturing.

The carbon footprint comparison between these technologies shows that OLED/AMOLED displays generally consume less electricity during operation, potentially reducing greenhouse gas emissions by 15-25% over the device lifetime compared to equivalent LCD displays. This advantage becomes more pronounced in regions where electricity generation relies heavily on fossil fuels.

End-of-life considerations present challenges for both technologies. The organic materials in OLED and AMOLED displays degrade over time and are difficult to recycle effectively. Current recycling rates for these display components remain below 20% globally, with most units ending up in landfills or being incinerated, releasing potentially harmful substances.

Recent advancements in manufacturing techniques have improved the environmental profile of newer generation OLED and AMOLED displays. Reduced material usage, lower processing temperatures, and more efficient production lines have decreased the embodied energy in these displays by approximately 30% over the past five years. Several manufacturers have also implemented take-back programs and are exploring bio-based materials for future display generations.

When evaluating total environmental impact, lifecycle assessments indicate that the operational energy savings of OLED and AMOLED displays generally offset their manufacturing impacts within 1-2 years of typical use, making them increasingly attractive options from both economic and environmental perspectives.

AMOLED, as an advanced implementation of OLED technology, further enhances energy efficiency through its active matrix system. The thin-film transistor (TFT) backplane in AMOLED displays provides more precise current control to each pixel, resulting in 20-30% better power management compared to passive matrix OLED displays. This efficiency becomes particularly evident in mobile applications where battery life is paramount.

Environmental impact assessment of these technologies reveals several important considerations across their lifecycle. Manufacturing processes for both OLED and AMOLED displays involve potentially hazardous materials, including heavy metals and organic compounds. However, AMOLED production typically requires fewer process steps and potentially fewer toxic substances than traditional LCD manufacturing.

The carbon footprint comparison between these technologies shows that OLED/AMOLED displays generally consume less electricity during operation, potentially reducing greenhouse gas emissions by 15-25% over the device lifetime compared to equivalent LCD displays. This advantage becomes more pronounced in regions where electricity generation relies heavily on fossil fuels.

End-of-life considerations present challenges for both technologies. The organic materials in OLED and AMOLED displays degrade over time and are difficult to recycle effectively. Current recycling rates for these display components remain below 20% globally, with most units ending up in landfills or being incinerated, releasing potentially harmful substances.

Recent advancements in manufacturing techniques have improved the environmental profile of newer generation OLED and AMOLED displays. Reduced material usage, lower processing temperatures, and more efficient production lines have decreased the embodied energy in these displays by approximately 30% over the past five years. Several manufacturers have also implemented take-back programs and are exploring bio-based materials for future display generations.

When evaluating total environmental impact, lifecycle assessments indicate that the operational energy savings of OLED and AMOLED displays generally offset their manufacturing impacts within 1-2 years of typical use, making them increasingly attractive options from both economic and environmental perspectives.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!