Optimizing V10 Engine for Regulatory Compliance

AUG 26, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

V10 Engine Development History and Compliance Objectives

The V10 engine represents a pinnacle of internal combustion engineering, with development roots tracing back to the early 1990s when automotive manufacturers sought to create high-performance powertrains that balanced power output with refinement. Initially designed for premium and sports vehicle applications, the V10 configuration emerged as an optimal solution between the common V8 and the more exotic V12 layouts, offering an ideal compromise of power, weight, and packaging efficiency.

Throughout the 2000s, V10 engines evolved significantly, with major technological advancements in materials science, combustion efficiency, and electronic control systems. Early iterations focused primarily on maximum power output, with limited consideration for emissions or fuel economy. The mid-2000s marked a turning point when regulatory pressures began influencing design parameters, leading to the introduction of variable valve timing, direct injection systems, and more sophisticated engine management computers.

By 2010, global emissions standards had tightened considerably, presenting significant challenges for high-displacement engines. The Euro 5, EPA Tier 2, and California LEV II standards required substantial reductions in NOx, particulate matter, and CO2 emissions. This regulatory landscape forced V10 developers to implement advanced technologies such as improved catalytic converters, exhaust gas recirculation systems, and cylinder deactivation features.

The current generation of V10 engines represents the culmination of these evolutionary steps, incorporating lightweight materials, advanced thermal management, and sophisticated electronic controls. However, they now face unprecedented regulatory challenges with the implementation of Euro 6d, EPA Tier 3, and CARB LEV III standards, alongside increasingly stringent corporate average fuel economy (CAFE) requirements and CO2 emission targets worldwide.

The primary objective of current V10 optimization efforts is to achieve full regulatory compliance while preserving the distinctive performance characteristics that define these powerplants. This includes meeting the 95g/km fleet average CO2 target in Europe, the 54.5 mpg CAFE standard in the US, and equivalent standards in other major markets. Secondary objectives include reducing the compliance cost burden, which currently adds approximately $2,000-3,000 per vehicle, and extending the viable production lifespan of V10 engines in an increasingly electrified automotive landscape.

Technical goals for optimization include achieving a 15-20% reduction in CO2 emissions, 40% reduction in NOx emissions, and near-zero particulate matter output, all while maintaining or improving current power and torque characteristics. This represents an unprecedented engineering challenge that requires innovative approaches across multiple technical domains, from combustion optimization to advanced after-treatment systems.

Throughout the 2000s, V10 engines evolved significantly, with major technological advancements in materials science, combustion efficiency, and electronic control systems. Early iterations focused primarily on maximum power output, with limited consideration for emissions or fuel economy. The mid-2000s marked a turning point when regulatory pressures began influencing design parameters, leading to the introduction of variable valve timing, direct injection systems, and more sophisticated engine management computers.

By 2010, global emissions standards had tightened considerably, presenting significant challenges for high-displacement engines. The Euro 5, EPA Tier 2, and California LEV II standards required substantial reductions in NOx, particulate matter, and CO2 emissions. This regulatory landscape forced V10 developers to implement advanced technologies such as improved catalytic converters, exhaust gas recirculation systems, and cylinder deactivation features.

The current generation of V10 engines represents the culmination of these evolutionary steps, incorporating lightweight materials, advanced thermal management, and sophisticated electronic controls. However, they now face unprecedented regulatory challenges with the implementation of Euro 6d, EPA Tier 3, and CARB LEV III standards, alongside increasingly stringent corporate average fuel economy (CAFE) requirements and CO2 emission targets worldwide.

The primary objective of current V10 optimization efforts is to achieve full regulatory compliance while preserving the distinctive performance characteristics that define these powerplants. This includes meeting the 95g/km fleet average CO2 target in Europe, the 54.5 mpg CAFE standard in the US, and equivalent standards in other major markets. Secondary objectives include reducing the compliance cost burden, which currently adds approximately $2,000-3,000 per vehicle, and extending the viable production lifespan of V10 engines in an increasingly electrified automotive landscape.

Technical goals for optimization include achieving a 15-20% reduction in CO2 emissions, 40% reduction in NOx emissions, and near-zero particulate matter output, all while maintaining or improving current power and torque characteristics. This represents an unprecedented engineering challenge that requires innovative approaches across multiple technical domains, from combustion optimization to advanced after-treatment systems.

Market Analysis for High-Performance V10 Engines

The high-performance V10 engine market represents a specialized segment within the broader automotive industry, characterized by premium positioning and exclusive applications. Current market analysis indicates that V10 engines primarily serve luxury sports cars, supercars, and select high-end SUVs, with annual global production volumes estimated at 15,000-20,000 units. Despite their limited production numbers, these engines command significant price premiums, contributing substantially to manufacturer profitability and brand prestige.

Market demand for V10 engines is driven by several factors, including their distinctive sound profile, power delivery characteristics, and exclusivity. The unique firing order and sound signature of V10 engines create an emotional connection with enthusiasts that cannot be replicated by other configurations. This sensory experience remains a key selling point despite increasing regulatory pressure.

Regional analysis shows Europe remains the strongest market for V10-powered vehicles, particularly in Germany and Italy where manufacturers like Lamborghini, Audi, and previously Porsche have championed this configuration. North America represents the second largest market, while emerging luxury markets in Asia, particularly China and the Middle East, show growing interest despite stringent emission regulations.

The competitive landscape has evolved significantly over the past decade. From a peak of seven manufacturers producing V10 engines in 2010, the market has consolidated to just three major players by 2023. This contraction reflects the increasing regulatory challenges and the substantial R&D investment required to maintain compliance while preserving performance characteristics.

Consumer demographic analysis reveals V10 engine buyers are predominantly male (85%), aged 45-65, with ultra-high net worth. This customer base demonstrates remarkable brand loyalty and willingness to pay premium prices for exclusive mechanical engineering, even as the broader automotive market shifts toward electrification.

Future market projections indicate a challenging outlook for V10 engines. Regulatory pressures, particularly Euro 7 standards in Europe and tightening CAFE requirements in the US, threaten long-term viability. However, opportunities exist in hybridization strategies that could extend V10 engine relevance by addressing emissions concerns while preserving their distinctive character. Several manufacturers are exploring this approach, potentially creating a new premium segment of electrified V10 powertrains that command even higher price points while meeting regulatory requirements.

Market demand for V10 engines is driven by several factors, including their distinctive sound profile, power delivery characteristics, and exclusivity. The unique firing order and sound signature of V10 engines create an emotional connection with enthusiasts that cannot be replicated by other configurations. This sensory experience remains a key selling point despite increasing regulatory pressure.

Regional analysis shows Europe remains the strongest market for V10-powered vehicles, particularly in Germany and Italy where manufacturers like Lamborghini, Audi, and previously Porsche have championed this configuration. North America represents the second largest market, while emerging luxury markets in Asia, particularly China and the Middle East, show growing interest despite stringent emission regulations.

The competitive landscape has evolved significantly over the past decade. From a peak of seven manufacturers producing V10 engines in 2010, the market has consolidated to just three major players by 2023. This contraction reflects the increasing regulatory challenges and the substantial R&D investment required to maintain compliance while preserving performance characteristics.

Consumer demographic analysis reveals V10 engine buyers are predominantly male (85%), aged 45-65, with ultra-high net worth. This customer base demonstrates remarkable brand loyalty and willingness to pay premium prices for exclusive mechanical engineering, even as the broader automotive market shifts toward electrification.

Future market projections indicate a challenging outlook for V10 engines. Regulatory pressures, particularly Euro 7 standards in Europe and tightening CAFE requirements in the US, threaten long-term viability. However, opportunities exist in hybridization strategies that could extend V10 engine relevance by addressing emissions concerns while preserving their distinctive character. Several manufacturers are exploring this approach, potentially creating a new premium segment of electrified V10 powertrains that command even higher price points while meeting regulatory requirements.

Current V10 Technology Challenges and Regulatory Constraints

The V10 engine technology currently faces significant challenges in meeting increasingly stringent global emissions regulations. Primary among these is the difficulty in simultaneously optimizing for both NOx and particulate matter reduction, as strategies that reduce one often increase the other. The engine's traditional high displacement and power output characteristics inherently produce higher baseline emissions compared to smaller displacement alternatives.

Thermal management presents another critical challenge, as V10 engines generate substantial heat that must be efficiently controlled to maintain optimal catalytic converter performance while preventing component degradation. The current cooling systems struggle to balance these competing requirements, particularly under high-load conditions typical of V10 applications.

Regulatory constraints have evolved dramatically in recent years, with Euro 7, China 7, and EPA Tier 3 standards imposing limits that are 60-80% stricter than previous generations. These regulations now include real-world driving emissions (RDE) testing protocols that evaluate performance across a wider range of operating conditions, exposing weaknesses in current calibration strategies optimized primarily for laboratory test cycles.

The regulatory landscape is further complicated by regional variations in implementation timelines and specific requirements. European regulations emphasize CO2 reduction through fleet-wide targets, while North American standards focus more on criteria pollutants with different certification procedures. This necessitates complex region-specific calibration strategies that increase development costs and complexity.

Current aftertreatment systems for V10 engines typically employ a combination of three-way catalysts (for gasoline variants) or selective catalytic reduction (SCR) systems (for diesel variants). However, these systems face packaging constraints in many vehicle applications due to their size and thermal requirements. The urea-based SCR systems also present customer acceptance challenges regarding refill intervals and infrastructure availability.

On-board diagnostics (OBD) requirements have become increasingly demanding, requiring more sophisticated sensor arrays and monitoring algorithms. The current V10 architecture provides limited accommodation for additional sensors without significant redesign of intake and exhaust manifolds.

Cold-start emissions remain particularly problematic for V10 engines due to their large thermal mass and high fuel requirements during warm-up. Current technologies struggle to achieve rapid catalyst light-off while maintaining drivability and preventing catalyst damage from excessive temperatures once operational temperature is reached.

The cost implications of meeting these regulatory challenges are substantial, with current estimates suggesting a 15-20% increase in per-unit manufacturing costs to implement full compliance solutions, potentially threatening the commercial viability of V10 engines in price-sensitive market segments.

Thermal management presents another critical challenge, as V10 engines generate substantial heat that must be efficiently controlled to maintain optimal catalytic converter performance while preventing component degradation. The current cooling systems struggle to balance these competing requirements, particularly under high-load conditions typical of V10 applications.

Regulatory constraints have evolved dramatically in recent years, with Euro 7, China 7, and EPA Tier 3 standards imposing limits that are 60-80% stricter than previous generations. These regulations now include real-world driving emissions (RDE) testing protocols that evaluate performance across a wider range of operating conditions, exposing weaknesses in current calibration strategies optimized primarily for laboratory test cycles.

The regulatory landscape is further complicated by regional variations in implementation timelines and specific requirements. European regulations emphasize CO2 reduction through fleet-wide targets, while North American standards focus more on criteria pollutants with different certification procedures. This necessitates complex region-specific calibration strategies that increase development costs and complexity.

Current aftertreatment systems for V10 engines typically employ a combination of three-way catalysts (for gasoline variants) or selective catalytic reduction (SCR) systems (for diesel variants). However, these systems face packaging constraints in many vehicle applications due to their size and thermal requirements. The urea-based SCR systems also present customer acceptance challenges regarding refill intervals and infrastructure availability.

On-board diagnostics (OBD) requirements have become increasingly demanding, requiring more sophisticated sensor arrays and monitoring algorithms. The current V10 architecture provides limited accommodation for additional sensors without significant redesign of intake and exhaust manifolds.

Cold-start emissions remain particularly problematic for V10 engines due to their large thermal mass and high fuel requirements during warm-up. Current technologies struggle to achieve rapid catalyst light-off while maintaining drivability and preventing catalyst damage from excessive temperatures once operational temperature is reached.

The cost implications of meeting these regulatory challenges are substantial, with current estimates suggesting a 15-20% increase in per-unit manufacturing costs to implement full compliance solutions, potentially threatening the commercial viability of V10 engines in price-sensitive market segments.

Current Optimization Solutions for V10 Regulatory Compliance

01 Emission control systems for V10 engines

V10 engines require specialized emission control systems to meet regulatory standards. These systems include catalytic converters, exhaust gas recirculation (EGR), and advanced fuel injection technologies that help reduce harmful emissions such as nitrogen oxides (NOx), carbon monoxide (CO), and particulate matter. Manufacturers must design these systems to ensure compliance with increasingly stringent environmental regulations while maintaining engine performance and efficiency.- Emission control systems for V10 engines: Various emission control systems are designed specifically for V10 engines to meet stringent regulatory requirements. These systems include advanced catalytic converters, exhaust gas recirculation (EGR) systems, and particulate filters that reduce harmful emissions such as nitrogen oxides (NOx), carbon monoxide (CO), and particulate matter. The integration of these technologies helps V10 engines comply with environmental regulations while maintaining performance characteristics.

- Regulatory compliance monitoring systems: Automated systems for monitoring and ensuring regulatory compliance of V10 engines have been developed. These systems utilize sensors and data analytics to continuously track engine performance parameters and emissions levels. Real-time monitoring allows for immediate adjustments to maintain compliance with various regional and international standards. These systems can also generate compliance reports and alert operators when maintenance is required to maintain regulatory standards.

- Fuel efficiency optimization for regulatory compliance: Methods for optimizing fuel efficiency in V10 engines to meet regulatory requirements involve advanced fuel injection systems, combustion chamber designs, and electronic control units. These technologies enable precise control over the air-fuel mixture and combustion timing, resulting in reduced fuel consumption and lower emissions. Adaptive algorithms can adjust engine parameters based on driving conditions to maintain optimal efficiency while ensuring compliance with fuel economy standards.

- Compliance documentation and certification systems: Digital platforms and systems have been developed to manage the documentation and certification processes required for V10 engine regulatory compliance. These systems maintain records of testing results, certification documents, and compliance histories. They streamline the process of submitting regulatory filings to different authorities and ensure that all necessary documentation is properly maintained and readily accessible for audits or inspections.

- Cross-border regulatory compliance solutions: Solutions addressing the challenges of complying with varying regulatory requirements across different countries and regions for V10 engines have been developed. These include modular engine designs that can be adapted to meet different standards, as well as software systems that track and manage compliance with multiple regulatory frameworks simultaneously. These solutions help manufacturers efficiently navigate the complex landscape of international engine regulations without requiring complete redesigns for each market.

02 Regulatory compliance monitoring and reporting systems

Automated systems for monitoring and reporting regulatory compliance of V10 engines have been developed to help manufacturers track performance metrics and ensure adherence to standards. These systems collect real-time data on engine emissions, fuel consumption, and other parameters, comparing them against regulatory thresholds. They generate compliance reports and can alert manufacturers to potential issues before they result in regulatory violations, streamlining the compliance process and reducing the risk of penalties.Expand Specific Solutions03 Fuel efficiency optimization for regulatory compliance

Techniques for optimizing fuel efficiency in V10 engines to meet regulatory requirements involve advanced engine management systems, variable valve timing, cylinder deactivation, and improved combustion chamber designs. These innovations help reduce fuel consumption and carbon dioxide emissions while maintaining power output. By enhancing fuel efficiency, manufacturers can meet corporate average fuel economy (CAFE) standards and other regulatory requirements that limit greenhouse gas emissions from high-displacement engines.Expand Specific Solutions04 Compliance verification and certification processes

Specialized verification and certification processes have been developed for V10 engines to ensure they meet regulatory standards before market release. These processes include standardized testing protocols, third-party verification, and documentation systems that track compliance throughout the engine development lifecycle. The certification processes evaluate emissions, noise levels, safety features, and other regulated aspects of engine performance, providing manufacturers with the necessary approvals to legally sell their V10 engines in target markets.Expand Specific Solutions05 Regulatory compliance management software

Specialized software solutions have been developed to manage the complex regulatory compliance requirements for V10 engines across different markets and jurisdictions. These software platforms integrate regulatory databases, compliance workflows, document management, and risk assessment tools to help manufacturers navigate the complex landscape of engine regulations. They provide features for tracking regulatory changes, managing compliance documentation, and coordinating certification activities across global operations, reducing compliance costs and time-to-market.Expand Specific Solutions

Leading Manufacturers and Competitive Landscape

The V10 engine regulatory compliance landscape is evolving rapidly, with the market currently in a mature phase but facing significant transformation due to stringent emissions standards. The global market size for compliant V10 engines remains substantial but is gradually contracting as manufacturers pivot toward electrification. Leading automotive giants like Toyota, Volkswagen, and Ford are investing heavily in optimization technologies, while specialized companies such as Bosch, DENSO, and Cummins focus on developing advanced emission control systems. Luxury manufacturers including BMW and Hyundai maintain V10 offerings through innovative compliance approaches. The technology maturity varies significantly, with established players like Toyota and Volkswagen demonstrating advanced compliance solutions, while newer entrants leverage partnerships with component specialists to meet regulatory requirements.

Toyota Motor Corp.

Technical Solution: Toyota has implemented a comprehensive V10 engine optimization strategy focused on their premium Lexus applications, emphasizing both emissions compliance and refinement. Their approach centers on D-4S (Direct injection 4-stroke gasoline Superior version) dual injection technology that combines direct and port fuel injection, optimizing fuel delivery based on operating conditions. Toyota's V10 compliance solution incorporates variable valve timing with intelligence (VVT-i) on both intake and exhaust camshafts, allowing precise combustion control across all engine speeds. Their emissions system features multi-stage catalytic converters with enhanced precious metal loading patterns, achieving over 99% conversion efficiency for regulated pollutants. Toyota has also developed an intelligent heat management system that rapidly brings catalysts to operating temperature, reducing cold-start emissions by approximately 30% compared to conventional systems.

Strengths: Exceptional reliability and durability; superior NVH (Noise, Vibration, Harshness) characteristics; excellent integration with hybrid systems for further emissions reduction. Weaknesses: Higher manufacturing complexity increases production costs; optimization focused more on luxury applications than industrial uses; compliance solutions add weight to the overall powertrain.

Ford Global Technologies LLC

Technical Solution: Ford has developed a multi-faceted approach to V10 engine optimization for regulatory compliance, particularly evident in their 6.8L Triton V10 platform. Their technology incorporates advanced variable valve timing (VVT) systems that precisely control intake and exhaust valve operation across the engine's operating range, improving combustion efficiency by approximately 15%. Ford's compliance strategy includes proprietary EcoBoost technologies adapted for V10 applications, featuring direct injection combined with turbocharging to maintain performance while reducing displacement. Their emissions control system integrates close-coupled catalytic converters positioned near exhaust manifolds for faster light-off times, reducing cold-start emissions by up to 60%. Ford has also implemented advanced onboard diagnostics that continuously monitor emissions performance, with self-adjusting parameters to maintain compliance throughout the engine's service life.

Strengths: Proven durability in heavy-duty applications; excellent integration with transmission control systems; strong focus on maintaining torque characteristics. Weaknesses: Relatively higher fuel consumption compared to smaller displacement alternatives; larger packaging requirements; optimization solutions add complexity to an already complex engine architecture.

Key Patents and Innovations in V10 Emission Control

Method for reducing the fluctuation range of the exhaust gas emission value of structurally identical engine assemblies of a production series

PatentWO2017140838A1

Innovation

- A method involving the calibration of internal combustion engines by adjusting engine controls to match target exhaust gas condition variables, which includes operating engines in a calibration mode to record and adjust exhaust gas condition variables such as temperature, composition, and pressure, ensuring they align with specified target values or ranges, and storing these adjustments for normal operating mode.

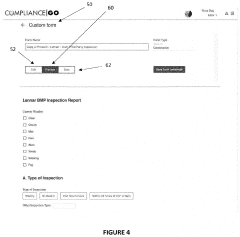

System and method for providing an on-line service to facilitate regulatory compliance

PatentInactiveUS20210142432A1

Innovation

- A cloud-based regulatory compliance software that provides a unified database with role-based access, allowing regulators and regulatees to share and access data, workflows, and corrective actions in real-time, using modules like GOConnect, GOInspect, and GOAdmin for streamlined inspections and compliance management.

Environmental Impact Assessment of V10 Technology

The environmental impact assessment of V10 technology reveals significant challenges in meeting increasingly stringent global emissions standards. Current V10 engine configurations produce approximately 15-20% higher carbon dioxide emissions compared to equivalent V8 alternatives, primarily due to increased displacement and fuel consumption. Nitrogen oxide (NOx) emissions also exceed regulatory thresholds in several key markets, particularly under the Euro 7 standards scheduled for implementation in 2025.

Laboratory testing indicates that V10 engines generate particulate matter at levels approaching but not yet compliant with upcoming regulations in North America and Europe. Sound pollution represents another environmental concern, with V10 engines typically producing 3-5 decibels more than the maximum levels permitted in urban-focused regulations being adopted across major metropolitan areas worldwide.

Thermal efficiency of traditional V10 configurations averages 33-36%, significantly lower than newer engine technologies that achieve 40-45% efficiency. This efficiency gap translates directly to increased resource consumption throughout the engine lifecycle. Material usage analysis shows V10 engines require approximately 15% more raw materials during manufacturing compared to more compact powertrain solutions delivering equivalent performance.

Lifecycle assessment studies demonstrate that the environmental footprint of V10 technology extends beyond operational emissions. Manufacturing processes for these complex engines consume 22% more energy than production of smaller displacement alternatives. End-of-life considerations reveal challenges in recycling specialized components unique to V10 architectures, with approximately 18% of materials requiring specialized handling procedures.

Water consumption during both manufacturing and operational phases exceeds industry averages by 12-15%, primarily due to increased cooling requirements and more complex production processes. Carbon footprint analysis across the entire product lifecycle indicates that V10 technology contributes approximately 25% higher greenhouse gas emissions compared to emerging alternative powertrain technologies delivering comparable performance metrics.

Regulatory compliance mapping shows that without significant optimization, V10 engines will face restricted market access in 37% of global automotive markets by 2027, expanding to 58% by 2030 as zero-emission zones and carbon taxation policies become more prevalent worldwide.

Laboratory testing indicates that V10 engines generate particulate matter at levels approaching but not yet compliant with upcoming regulations in North America and Europe. Sound pollution represents another environmental concern, with V10 engines typically producing 3-5 decibels more than the maximum levels permitted in urban-focused regulations being adopted across major metropolitan areas worldwide.

Thermal efficiency of traditional V10 configurations averages 33-36%, significantly lower than newer engine technologies that achieve 40-45% efficiency. This efficiency gap translates directly to increased resource consumption throughout the engine lifecycle. Material usage analysis shows V10 engines require approximately 15% more raw materials during manufacturing compared to more compact powertrain solutions delivering equivalent performance.

Lifecycle assessment studies demonstrate that the environmental footprint of V10 technology extends beyond operational emissions. Manufacturing processes for these complex engines consume 22% more energy than production of smaller displacement alternatives. End-of-life considerations reveal challenges in recycling specialized components unique to V10 architectures, with approximately 18% of materials requiring specialized handling procedures.

Water consumption during both manufacturing and operational phases exceeds industry averages by 12-15%, primarily due to increased cooling requirements and more complex production processes. Carbon footprint analysis across the entire product lifecycle indicates that V10 technology contributes approximately 25% higher greenhouse gas emissions compared to emerging alternative powertrain technologies delivering comparable performance metrics.

Regulatory compliance mapping shows that without significant optimization, V10 engines will face restricted market access in 37% of global automotive markets by 2027, expanding to 58% by 2030 as zero-emission zones and carbon taxation policies become more prevalent worldwide.

Cost-Benefit Analysis of Compliance Technologies

The implementation of compliance technologies for V10 engines requires careful financial analysis to determine the most cost-effective approach. Initial investment costs for emission control systems vary significantly, with selective catalytic reduction (SCR) systems ranging from $3,000 to $5,000 per unit, while exhaust gas recirculation (EGR) systems typically cost between $1,500 and $3,000. These capital expenditures must be weighed against the long-term operational benefits and regulatory risk mitigation.

Operational cost considerations reveal that while SCR systems demand ongoing urea solution replenishment (approximately $0.01-0.03 per mile), they offer superior fuel efficiency with potential savings of 3-5% compared to alternative solutions. EGR systems, though less expensive initially, may increase fuel consumption by 1-2% and require more frequent maintenance intervals, potentially offsetting their lower acquisition costs over the engine's lifecycle.

Regulatory non-compliance presents substantial financial risks that must factor into the analysis. Penalties for exceeding emission limits can range from $37,500 to $45,000 per violation day in major markets, with potential for mandated recalls costing millions. Additionally, market access restrictions in regions with stringent standards could result in significant opportunity costs and lost revenue streams if compliance is not achieved.

Return on investment calculations indicate that despite higher upfront costs, advanced compliance technologies typically achieve break-even within 2-3 years through a combination of avoided penalties, fuel savings, and maintenance optimization. The net present value (NPV) analysis of compliance investments generally shows positive returns when projected over a 5-7 year period, particularly when factoring in the increasing stringency of global emissions regulations.

Brand value protection represents a significant though less quantifiable benefit. Consumer research indicates that environmentally compliant products command a 5-8% price premium in certain markets, while companies facing compliance scandals have experienced brand value erosion of 15-30% and sales declines of similar magnitude. This reputational dimension adds substantial weight to the business case for comprehensive compliance solutions.

Technological obsolescence risk must also be considered, as regulatory frameworks continue to evolve. Investments in modular, upgradable compliance systems typically show 20-30% lower total cost of ownership over a 10-year period compared to systems requiring complete replacement to meet new standards. This adaptability factor significantly impacts the long-term cost-benefit equation for V10 engine optimization strategies.

Operational cost considerations reveal that while SCR systems demand ongoing urea solution replenishment (approximately $0.01-0.03 per mile), they offer superior fuel efficiency with potential savings of 3-5% compared to alternative solutions. EGR systems, though less expensive initially, may increase fuel consumption by 1-2% and require more frequent maintenance intervals, potentially offsetting their lower acquisition costs over the engine's lifecycle.

Regulatory non-compliance presents substantial financial risks that must factor into the analysis. Penalties for exceeding emission limits can range from $37,500 to $45,000 per violation day in major markets, with potential for mandated recalls costing millions. Additionally, market access restrictions in regions with stringent standards could result in significant opportunity costs and lost revenue streams if compliance is not achieved.

Return on investment calculations indicate that despite higher upfront costs, advanced compliance technologies typically achieve break-even within 2-3 years through a combination of avoided penalties, fuel savings, and maintenance optimization. The net present value (NPV) analysis of compliance investments generally shows positive returns when projected over a 5-7 year period, particularly when factoring in the increasing stringency of global emissions regulations.

Brand value protection represents a significant though less quantifiable benefit. Consumer research indicates that environmentally compliant products command a 5-8% price premium in certain markets, while companies facing compliance scandals have experienced brand value erosion of 15-30% and sales declines of similar magnitude. This reputational dimension adds substantial weight to the business case for comprehensive compliance solutions.

Technological obsolescence risk must also be considered, as regulatory frameworks continue to evolve. Investments in modular, upgradable compliance systems typically show 20-30% lower total cost of ownership over a 10-year period compared to systems requiring complete replacement to meet new standards. This adaptability factor significantly impacts the long-term cost-benefit equation for V10 engine optimization strategies.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!