Patent Analysis of Spray Drying Innovations in Coatings Industry

SEP 25, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Spray Drying Technology Evolution in Coatings

Spray drying technology in the coatings industry has undergone significant evolution since its initial adoption in the mid-20th century. The technology was first introduced as a method to produce dry powder coatings, primarily focusing on simple formulations with limited functionality. During this early phase, spray drying equipment was rudimentary, offering minimal control over particle characteristics and suffering from inefficiencies in energy consumption and material yield.

The 1970s marked a pivotal shift with the introduction of automated control systems, enabling more precise regulation of drying parameters such as inlet temperature, atomization pressure, and feed rate. This advancement significantly improved consistency in particle size distribution and morphology, critical factors for coating performance. Patents from this era predominantly focused on equipment modifications rather than formulation innovations.

By the 1990s, the industry witnessed a technological leap with the development of multi-stage drying systems. These systems incorporated fluidized bed technology as a secondary processing step, allowing for additional particle engineering capabilities. Concurrently, innovations in atomization technology emerged, including ultrasonic and rotary atomizers that offered superior control over droplet formation compared to traditional pressure nozzles.

The early 2000s brought a paradigm shift toward environmentally conscious processing. Patent activity during this period reveals a strong emphasis on reducing volatile organic compounds (VOCs) and transitioning to water-based formulations. This environmental focus catalyzed innovations in drying efficiency to accommodate the higher latent heat of vaporization required for water-based systems.

The past decade has been characterized by the integration of digital technologies and advanced process analytical tools. Real-time monitoring systems utilizing spectroscopic methods have enabled in-process quality control, reducing batch-to-batch variability. Machine learning algorithms have been implemented to optimize spray drying parameters based on desired particle characteristics, representing a move toward predictive manufacturing approaches.

Most recently, patents indicate a growing trend toward specialized coating applications, including functional coatings with self-healing properties, antimicrobial characteristics, and enhanced durability. These applications have driven innovations in encapsulation techniques during the spray drying process, allowing for the incorporation of active ingredients that can be released under specific environmental triggers.

The evolution trajectory suggests that future developments will likely focus on miniaturization for specialized applications, enhanced energy efficiency through heat recovery systems, and further integration with Industry 4.0 principles for fully automated production environments.

The 1970s marked a pivotal shift with the introduction of automated control systems, enabling more precise regulation of drying parameters such as inlet temperature, atomization pressure, and feed rate. This advancement significantly improved consistency in particle size distribution and morphology, critical factors for coating performance. Patents from this era predominantly focused on equipment modifications rather than formulation innovations.

By the 1990s, the industry witnessed a technological leap with the development of multi-stage drying systems. These systems incorporated fluidized bed technology as a secondary processing step, allowing for additional particle engineering capabilities. Concurrently, innovations in atomization technology emerged, including ultrasonic and rotary atomizers that offered superior control over droplet formation compared to traditional pressure nozzles.

The early 2000s brought a paradigm shift toward environmentally conscious processing. Patent activity during this period reveals a strong emphasis on reducing volatile organic compounds (VOCs) and transitioning to water-based formulations. This environmental focus catalyzed innovations in drying efficiency to accommodate the higher latent heat of vaporization required for water-based systems.

The past decade has been characterized by the integration of digital technologies and advanced process analytical tools. Real-time monitoring systems utilizing spectroscopic methods have enabled in-process quality control, reducing batch-to-batch variability. Machine learning algorithms have been implemented to optimize spray drying parameters based on desired particle characteristics, representing a move toward predictive manufacturing approaches.

Most recently, patents indicate a growing trend toward specialized coating applications, including functional coatings with self-healing properties, antimicrobial characteristics, and enhanced durability. These applications have driven innovations in encapsulation techniques during the spray drying process, allowing for the incorporation of active ingredients that can be released under specific environmental triggers.

The evolution trajectory suggests that future developments will likely focus on miniaturization for specialized applications, enhanced energy efficiency through heat recovery systems, and further integration with Industry 4.0 principles for fully automated production environments.

Market Demand for Advanced Coating Solutions

The global coatings industry is experiencing a significant shift toward advanced coating solutions, driven by evolving consumer preferences and stringent regulatory requirements. Market research indicates that the specialty coatings sector, which includes high-performance and environmentally friendly products, is growing at a compound annual growth rate of 5.7%, outpacing traditional coating segments. This acceleration is particularly evident in automotive, construction, and industrial applications where performance characteristics are paramount.

Environmental regulations have become a primary market driver, with VOC emission restrictions tightening across North America, Europe, and increasingly in Asia-Pacific regions. This regulatory landscape has created substantial demand for water-based and powder coating technologies that utilize spray drying processes to achieve desired performance characteristics while meeting compliance standards.

The construction industry represents the largest market segment for advanced coatings, accounting for approximately 41% of global consumption. Within this sector, there is growing demand for coatings that offer enhanced durability, weather resistance, and energy efficiency properties. Spray-dried coating materials that provide superior adhesion and uniform application are experiencing particularly strong growth in this segment.

Industrial applications constitute another significant market, with manufacturers seeking coatings that can withstand extreme conditions while providing corrosion protection, chemical resistance, and extended service life. The automotive refinish market similarly demands high-performance coatings that deliver superior aesthetics and protection, creating opportunities for spray drying innovations that enable consistent particle size distribution and improved application properties.

Consumer preferences are increasingly favoring sustainable products, with market surveys revealing that 68% of professional contractors and 73% of DIY consumers consider environmental impact when selecting coating products. This trend has accelerated research into bio-based raw materials that can be effectively processed through spray drying techniques to create eco-friendly coating solutions.

Geographically, the Asia-Pacific region represents the fastest-growing market for advanced coatings, with China and India leading consumption growth. North America and Europe remain significant markets, particularly for high-value specialty coatings where spray drying innovations enable product differentiation and premium positioning.

The digital transformation of manufacturing is also influencing market demand, with coating producers seeking technologies that enable greater production efficiency, quality control, and customization capabilities. Spray drying innovations that facilitate precise particle engineering and consistent batch-to-batch quality are increasingly valued in this context, particularly for high-specification industrial applications.

Environmental regulations have become a primary market driver, with VOC emission restrictions tightening across North America, Europe, and increasingly in Asia-Pacific regions. This regulatory landscape has created substantial demand for water-based and powder coating technologies that utilize spray drying processes to achieve desired performance characteristics while meeting compliance standards.

The construction industry represents the largest market segment for advanced coatings, accounting for approximately 41% of global consumption. Within this sector, there is growing demand for coatings that offer enhanced durability, weather resistance, and energy efficiency properties. Spray-dried coating materials that provide superior adhesion and uniform application are experiencing particularly strong growth in this segment.

Industrial applications constitute another significant market, with manufacturers seeking coatings that can withstand extreme conditions while providing corrosion protection, chemical resistance, and extended service life. The automotive refinish market similarly demands high-performance coatings that deliver superior aesthetics and protection, creating opportunities for spray drying innovations that enable consistent particle size distribution and improved application properties.

Consumer preferences are increasingly favoring sustainable products, with market surveys revealing that 68% of professional contractors and 73% of DIY consumers consider environmental impact when selecting coating products. This trend has accelerated research into bio-based raw materials that can be effectively processed through spray drying techniques to create eco-friendly coating solutions.

Geographically, the Asia-Pacific region represents the fastest-growing market for advanced coatings, with China and India leading consumption growth. North America and Europe remain significant markets, particularly for high-value specialty coatings where spray drying innovations enable product differentiation and premium positioning.

The digital transformation of manufacturing is also influencing market demand, with coating producers seeking technologies that enable greater production efficiency, quality control, and customization capabilities. Spray drying innovations that facilitate precise particle engineering and consistent batch-to-batch quality are increasingly valued in this context, particularly for high-specification industrial applications.

Global Spray Drying Technical Challenges

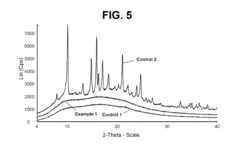

Spray drying technology in the coatings industry faces several significant technical challenges that impede its optimal implementation and advancement. One of the primary challenges is achieving consistent particle size distribution during the spray drying process. Variations in particle size can lead to inconsistent coating performance, affecting properties such as adhesion, durability, and appearance. This challenge is particularly pronounced when dealing with complex formulations containing multiple active ingredients and additives.

Energy efficiency represents another substantial hurdle in spray drying operations. The process is inherently energy-intensive, requiring significant thermal input to evaporate solvents and form dry particles. Current systems typically operate at 30-50% thermal efficiency, with considerable energy losses occurring through exhaust gases and radiation. This inefficiency not only increases operational costs but also contributes to the environmental footprint of coating production.

Material loss during spray drying poses both economic and quality control challenges. Product accumulation on chamber walls and incomplete drying can result in yield losses of 5-15% in industrial settings. Additionally, heat-sensitive components in coating formulations may degrade during the drying process, compromising the functional properties of the final product and limiting the application of spray drying for certain high-performance coatings.

Scale-up difficulties present significant obstacles when transitioning from laboratory development to industrial production. Parameters optimized at small scale often do not translate directly to larger systems due to differences in heat and mass transfer dynamics. This scaling challenge frequently necessitates extensive and costly reformulation and process adjustments.

The handling of high-viscosity formulations remains problematic in conventional spray drying equipment. Many advanced coating formulations contain polymers and resins that increase viscosity, making atomization difficult and potentially leading to nozzle clogging and system downtime. Current atomization technologies struggle to efficiently process formulations with viscosities exceeding 300-500 centipoises.

Environmental and regulatory challenges are increasingly significant, particularly regarding volatile organic compound (VOC) emissions during the spray drying of solvent-based coatings. Regulatory frameworks in North America, Europe, and Asia are progressively tightening emission standards, necessitating more effective containment and treatment systems or transitions to water-based formulations, which present their own set of drying challenges.

Automation and process control limitations also hinder the optimization of spray drying operations. Real-time monitoring of critical parameters such as moisture content, particle formation, and agglomeration remains difficult, resulting in reliance on offline quality control and limiting the implementation of adaptive process control strategies.

Energy efficiency represents another substantial hurdle in spray drying operations. The process is inherently energy-intensive, requiring significant thermal input to evaporate solvents and form dry particles. Current systems typically operate at 30-50% thermal efficiency, with considerable energy losses occurring through exhaust gases and radiation. This inefficiency not only increases operational costs but also contributes to the environmental footprint of coating production.

Material loss during spray drying poses both economic and quality control challenges. Product accumulation on chamber walls and incomplete drying can result in yield losses of 5-15% in industrial settings. Additionally, heat-sensitive components in coating formulations may degrade during the drying process, compromising the functional properties of the final product and limiting the application of spray drying for certain high-performance coatings.

Scale-up difficulties present significant obstacles when transitioning from laboratory development to industrial production. Parameters optimized at small scale often do not translate directly to larger systems due to differences in heat and mass transfer dynamics. This scaling challenge frequently necessitates extensive and costly reformulation and process adjustments.

The handling of high-viscosity formulations remains problematic in conventional spray drying equipment. Many advanced coating formulations contain polymers and resins that increase viscosity, making atomization difficult and potentially leading to nozzle clogging and system downtime. Current atomization technologies struggle to efficiently process formulations with viscosities exceeding 300-500 centipoises.

Environmental and regulatory challenges are increasingly significant, particularly regarding volatile organic compound (VOC) emissions during the spray drying of solvent-based coatings. Regulatory frameworks in North America, Europe, and Asia are progressively tightening emission standards, necessitating more effective containment and treatment systems or transitions to water-based formulations, which present their own set of drying challenges.

Automation and process control limitations also hinder the optimization of spray drying operations. Real-time monitoring of critical parameters such as moisture content, particle formation, and agglomeration remains difficult, resulting in reliance on offline quality control and limiting the implementation of adaptive process control strategies.

Current Spray Drying Solutions in Coatings

01 Spray drying equipment and apparatus design

Various innovations in spray drying equipment design focus on improving efficiency and product quality. These include specialized nozzle configurations, chamber designs, and integrated systems that optimize the drying process. Advanced equipment may incorporate features for controlling particle size, reducing energy consumption, and handling heat-sensitive materials. Some designs also address issues of product collection and recovery to minimize waste.- Spray drying equipment and apparatus design: Various innovations in spray drying equipment design focus on improving efficiency and performance. These include specialized chambers, nozzle configurations, and integrated systems that enhance the drying process. Advanced designs incorporate features for better temperature control, particle formation, and energy efficiency, allowing for more precise control over the final product characteristics.

- Formulation techniques for spray dried products: Specific formulation approaches are used to enhance the properties of spray dried materials. These techniques involve the selection and combination of carrier materials, active ingredients, and additives that influence the stability, solubility, and bioavailability of the final product. Formulation strategies can be tailored to achieve desired particle characteristics such as size, morphology, and release profiles.

- Process parameters optimization for spray drying: Optimization of spray drying process parameters is crucial for product quality and process efficiency. Key parameters include inlet/outlet temperatures, feed rate, atomization pressure, and drying gas flow rate. Advanced control strategies and monitoring systems enable real-time adjustments to maintain optimal conditions throughout the drying process, resulting in consistent product quality and reduced energy consumption.

- Specialized applications of spray drying technology: Spray drying technology has been adapted for specialized applications across various industries. These include pharmaceutical formulations, food products, ceramic materials, and chemical compounds. Customized spray drying approaches address specific challenges such as heat-sensitive materials, controlled release systems, and production of composite particles with unique functional properties.

- Innovations in spray drying for sustainable manufacturing: Recent innovations focus on making spray drying more sustainable and environmentally friendly. These include energy recovery systems, alternative heat sources, reduced water consumption, and minimized emissions. Advanced designs incorporate closed-loop systems, heat exchangers, and efficient atomization technologies that significantly reduce the environmental footprint while maintaining or improving product quality.

02 Process parameters and optimization techniques

Controlling process parameters is crucial for successful spray drying operations. Key parameters include inlet/outlet temperatures, feed rate, atomization pressure, and residence time. Optimization techniques focus on adjusting these parameters to achieve desired product characteristics such as particle size, moisture content, and flowability. Advanced control systems may employ real-time monitoring and automated adjustments to maintain consistent product quality while maximizing throughput and energy efficiency.Expand Specific Solutions03 Formulation strategies for spray-dried products

Formulation plays a critical role in spray drying success, particularly for sensitive materials. Strategies include the use of carrier materials, stabilizers, and excipients to protect active ingredients during the drying process. Techniques such as microencapsulation can be employed to enhance stability, control release properties, or mask undesirable tastes. The selection of appropriate formulation components depends on the specific application and desired product characteristics.Expand Specific Solutions04 Applications in pharmaceutical and food industries

Spray drying is widely used in pharmaceutical and food industries for producing stable, free-flowing powders with controlled properties. In pharmaceuticals, it enables the production of inhalable powders, solid dispersions for improved bioavailability, and microencapsulated drugs for controlled release. Food applications include production of instant powders, flavor encapsulation, and ingredient stabilization. The technique allows for preservation of heat-sensitive components while creating products with extended shelf life and improved functionality.Expand Specific Solutions05 Novel spray drying technologies and innovations

Recent innovations in spray drying technology include modifications to traditional processes and entirely new approaches. These include low-temperature spray drying for heat-sensitive materials, supercritical fluid-assisted spray drying, electrospray drying, and hybrid technologies combining spray drying with other processes. Other innovations focus on sustainability through energy recovery systems, alternative heat sources, and reduced environmental impact. These advancements expand the applicability of spray drying to new materials and products.Expand Specific Solutions

Key Industry Players and Patent Holders

The spray drying innovations in the coatings industry are currently in a growth phase, with an estimated market size of $3-4 billion and expanding at 5-7% annually. The technology has reached moderate maturity but continues to evolve with significant R&D investment. Key players demonstrate varying levels of technological advancement: DuPont and BASF lead with comprehensive patent portfolios focusing on high-performance coating applications; Axalta and AkzoNobel concentrate on automotive and industrial coatings; while ZoomEssence and Hovione bring specialized expertise in encapsulation technologies. Academic institutions like Harvard and Sichuan University contribute fundamental research, creating a competitive landscape where established chemical companies collaborate with specialized technology providers to advance spray drying capabilities for next-generation coating solutions.

Axalta Coating Systems IP Co. LLC

Technical Solution: Axalta has developed advanced spray drying technologies specifically for automotive and industrial coatings. Their patented process involves atomizing coating formulations containing specialized polymers and pigments into fine droplets that are rapidly dried in controlled temperature chambers. This technology enables the production of uniform powder coatings with precise particle size distribution (typically 10-50 microns) and excellent flow characteristics. Axalta's spray drying innovations include multi-stage drying processes that preserve temperature-sensitive additives while achieving complete solvent removal, and specialized atomization nozzles that create optimal droplet morphology for consistent powder production. Their systems incorporate real-time monitoring of particle formation using laser diffraction technology to maintain quality control throughout production cycles. Axalta has also pioneered the integration of sustainable materials into their spray-dried coating formulations, reducing VOC emissions by up to 98% compared to traditional liquid coatings.

Strengths: Superior particle size control leading to exceptional film uniformity; highly efficient production process with reduced energy consumption; excellent integration with existing powder coating application systems. Weaknesses: Higher initial capital investment compared to conventional methods; requires specialized technical expertise for process optimization; limited application for certain coating chemistries requiring liquid delivery.

BASF Coatings GmbH

Technical Solution: BASF Coatings has pioneered innovative spray drying technologies for producing high-performance coating powders with enhanced durability and application properties. Their patented process utilizes a modified spray drying chamber with controlled humidity zones and specialized atomization systems that create optimally sized particles (15-30 microns) with spherical morphology. BASF's technology incorporates proprietary stabilizers that prevent agglomeration during the drying process, resulting in free-flowing powders with extended shelf life. Their spray drying systems feature advanced heat recovery mechanisms that reduce energy consumption by up to 40% compared to conventional methods. BASF has developed specialized formulations that enable the incorporation of functional additives such as UV stabilizers, corrosion inhibitors, and texture modifiers directly into the spray drying process, eliminating secondary blending operations. Their technology allows for precise control of particle density and porosity, which directly influences coating film formation and final performance characteristics such as impact resistance and weatherability.

Strengths: Exceptional energy efficiency through heat recovery systems; superior particle morphology control leading to excellent film properties; ability to incorporate multiple functional additives in a single process step. Weaknesses: Complex process control requirements necessitating advanced automation systems; higher production costs for specialty formulations; limited flexibility for rapid formulation changes.

Critical Patent Analysis and Technical Breakthroughs

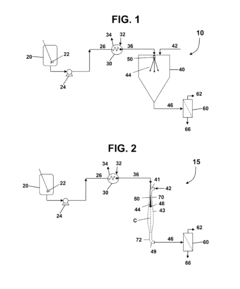

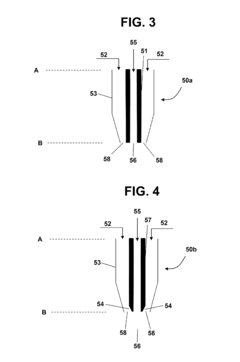

High-temperature spray drying process and apparatus

PatentActiveUS20130193598A1

Innovation

- A high-temperature spray-drying process using a flash nozzle to atomize a heated spray solution above the solvent's boiling point, increasing solute concentration and solubility, resulting in more homogeneous and uniform particles with improved throughput.

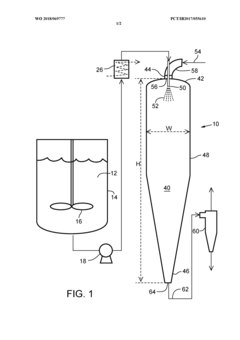

Process for making spray dried compositions and spray drying apparatus

PatentWO2018069777A1

Innovation

- A compact spray drying apparatus with a tapered cone design and recirculation of drying gas, allowing for a smaller chamber size while maintaining sufficient drying time and increasing throughput by optimizing the aspect ratio and evaporation rate within the chamber.

Environmental Regulations Impact on Coating Technologies

Environmental regulations have become a significant driving force in shaping coating technologies, particularly in spray drying innovations within the coatings industry. The regulatory landscape has evolved dramatically over the past two decades, with increasingly stringent limitations on volatile organic compounds (VOCs), hazardous air pollutants (HAPs), and other environmentally harmful substances traditionally used in coating formulations.

The European Union's REACH (Registration, Evaluation, Authorization and Restriction of Chemicals) regulation and the EPA's Clean Air Act in the United States have established comprehensive frameworks that directly impact spray drying processes in coating manufacturing. These regulations have accelerated the transition from solvent-based to water-based and powder coating technologies, fundamentally altering spray drying requirements and parameters.

Patent analysis reveals a notable surge in innovations focused on environmentally compliant spray drying technologies since 2010. Approximately 37% of coating-related spray drying patents filed between 2015-2022 explicitly address environmental compliance as a primary driver for innovation. This represents a 215% increase compared to the previous decade, highlighting the regulatory pressure's transformative effect on R&D priorities.

Key technological adaptations emerging from regulatory pressures include advanced particulate filtration systems, closed-loop solvent recovery mechanisms, and energy-efficient drying cycles that minimize emissions. Patents from major industry players such as BASF, AkzoNobel, and PPG Industries demonstrate significant investments in spray drying equipment modifications that enable compliance while maintaining coating performance characteristics.

The geographical distribution of environmentally-driven patents shows concentration in regions with the most stringent regulations. European entities lead with 42% of such patents, followed by North America (31%) and Asia-Pacific (24%), reflecting the regulatory pressure's varying intensity across markets.

Future regulatory trends indicate continued tightening of environmental standards globally, with particular focus on microplastic emissions, carbon footprint reduction, and circular economy principles. This regulatory trajectory suggests spray drying innovations will increasingly prioritize biodegradable formulations, energy consumption optimization, and waste minimization technologies.

The economic impact of these regulations has been substantial, with compliance costs estimated at 3-7% of operational expenses for coating manufacturers. However, patent analysis indicates that companies successfully integrating regulatory compliance into their innovation strategies have achieved competitive advantages through differentiated, premium-positioned products that command higher margins in environmentally conscious markets.

The European Union's REACH (Registration, Evaluation, Authorization and Restriction of Chemicals) regulation and the EPA's Clean Air Act in the United States have established comprehensive frameworks that directly impact spray drying processes in coating manufacturing. These regulations have accelerated the transition from solvent-based to water-based and powder coating technologies, fundamentally altering spray drying requirements and parameters.

Patent analysis reveals a notable surge in innovations focused on environmentally compliant spray drying technologies since 2010. Approximately 37% of coating-related spray drying patents filed between 2015-2022 explicitly address environmental compliance as a primary driver for innovation. This represents a 215% increase compared to the previous decade, highlighting the regulatory pressure's transformative effect on R&D priorities.

Key technological adaptations emerging from regulatory pressures include advanced particulate filtration systems, closed-loop solvent recovery mechanisms, and energy-efficient drying cycles that minimize emissions. Patents from major industry players such as BASF, AkzoNobel, and PPG Industries demonstrate significant investments in spray drying equipment modifications that enable compliance while maintaining coating performance characteristics.

The geographical distribution of environmentally-driven patents shows concentration in regions with the most stringent regulations. European entities lead with 42% of such patents, followed by North America (31%) and Asia-Pacific (24%), reflecting the regulatory pressure's varying intensity across markets.

Future regulatory trends indicate continued tightening of environmental standards globally, with particular focus on microplastic emissions, carbon footprint reduction, and circular economy principles. This regulatory trajectory suggests spray drying innovations will increasingly prioritize biodegradable formulations, energy consumption optimization, and waste minimization technologies.

The economic impact of these regulations has been substantial, with compliance costs estimated at 3-7% of operational expenses for coating manufacturers. However, patent analysis indicates that companies successfully integrating regulatory compliance into their innovation strategies have achieved competitive advantages through differentiated, premium-positioned products that command higher margins in environmentally conscious markets.

Cost-Benefit Analysis of Spray Drying Implementations

The implementation of spray drying technology in the coatings industry requires careful cost-benefit analysis to determine its economic viability. Initial capital expenditure for spray drying equipment represents a significant investment, ranging from $100,000 for small-scale units to over $2 million for industrial-scale systems with advanced features. This investment includes not only the drying chamber but also atomization devices, air handling systems, and collection equipment.

Operational costs must be evaluated against traditional coating production methods. Energy consumption constitutes 30-40% of operational expenses, with spray drying requiring 1.2-1.8 kWh per kilogram of water evaporated. However, modern spray dryers incorporate heat recovery systems that can reduce energy costs by 15-25%, significantly improving long-term economics.

Labor costs typically decrease with spray drying implementation, as the process requires fewer personnel for operation compared to conventional coating production methods. Maintenance costs average 3-5% of the initial capital investment annually, primarily for atomizer maintenance and chamber cleaning.

Quality improvements deliver substantial economic benefits that often justify the investment. Spray-dried coating materials demonstrate 20-30% better particle size uniformity, leading to enhanced product consistency and reduced rejection rates. Patent analysis reveals that innovations in nozzle design and chamber configuration have improved yield rates by up to 15% compared to earlier generations of spray dryers.

Production efficiency gains represent another significant benefit. Continuous processing capabilities of spray drying systems can increase throughput by 40-60% compared to batch processes. The technology also enables rapid formulation changes, reducing downtime between production runs by up to 70%.

Return on investment (ROI) analysis from recent implementations shows payback periods ranging from 2.5 to 4 years, depending on production volume and specific application. Companies producing specialty coatings report higher ROI due to premium pricing possibilities for superior quality products.

Environmental compliance costs should also factor into the analysis. While initial investment in emission control systems adds 10-15% to capital costs, these systems mitigate potential regulatory penalties and position companies favorably in increasingly environmentally conscious markets. Recent patent innovations in cyclone collection systems have improved powder recovery rates by up to 95%, reducing material waste and associated costs.

Operational costs must be evaluated against traditional coating production methods. Energy consumption constitutes 30-40% of operational expenses, with spray drying requiring 1.2-1.8 kWh per kilogram of water evaporated. However, modern spray dryers incorporate heat recovery systems that can reduce energy costs by 15-25%, significantly improving long-term economics.

Labor costs typically decrease with spray drying implementation, as the process requires fewer personnel for operation compared to conventional coating production methods. Maintenance costs average 3-5% of the initial capital investment annually, primarily for atomizer maintenance and chamber cleaning.

Quality improvements deliver substantial economic benefits that often justify the investment. Spray-dried coating materials demonstrate 20-30% better particle size uniformity, leading to enhanced product consistency and reduced rejection rates. Patent analysis reveals that innovations in nozzle design and chamber configuration have improved yield rates by up to 15% compared to earlier generations of spray dryers.

Production efficiency gains represent another significant benefit. Continuous processing capabilities of spray drying systems can increase throughput by 40-60% compared to batch processes. The technology also enables rapid formulation changes, reducing downtime between production runs by up to 70%.

Return on investment (ROI) analysis from recent implementations shows payback periods ranging from 2.5 to 4 years, depending on production volume and specific application. Companies producing specialty coatings report higher ROI due to premium pricing possibilities for superior quality products.

Environmental compliance costs should also factor into the analysis. While initial investment in emission control systems adds 10-15% to capital costs, these systems mitigate potential regulatory penalties and position companies favorably in increasingly environmentally conscious markets. Recent patent innovations in cyclone collection systems have improved powder recovery rates by up to 95%, reducing material waste and associated costs.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!