Polyurethane's Role in Advancing Industry Sustainability

JUN 25, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

PU Sustainability Background and Objectives

Polyurethane (PU) has been a cornerstone in various industries for decades, known for its versatility and durability. However, as global awareness of environmental issues grows, the focus has shifted towards sustainable practices in all sectors, including the polyurethane industry. This technological evolution aims to address the increasing demand for eco-friendly materials while maintaining the high performance that PU products are known for.

The primary objective in advancing PU sustainability is to reduce the environmental impact throughout the material's lifecycle. This encompasses everything from raw material sourcing to production processes, product use, and end-of-life management. A key goal is to develop bio-based polyurethanes, which utilize renewable resources instead of petroleum-based feedstocks, thereby reducing dependency on fossil fuels and decreasing carbon footprint.

Another critical aspect of PU sustainability is the improvement of recycling and biodegradation processes. Traditional polyurethanes have been challenging to recycle, often ending up in landfills. The industry is now focusing on creating PU formulations that are easier to break down and reuse, as well as developing more efficient recycling technologies. This aligns with the circular economy concept, where materials are kept in use for as long as possible.

Energy efficiency in production is also a significant objective. Manufacturers are exploring ways to reduce energy consumption during PU synthesis and processing, which not only lowers costs but also minimizes the carbon footprint of PU products. This includes optimizing reaction conditions, improving equipment efficiency, and utilizing renewable energy sources in production facilities.

The development of non-toxic and low-VOC (Volatile Organic Compound) polyurethanes is another crucial goal. This addresses concerns about indoor air quality and worker safety, particularly in applications such as furniture, bedding, and construction materials. The industry is working on formulations that maintain performance while eliminating or reducing harmful substances.

Lastly, there's a growing emphasis on extending the lifespan of PU products. By enhancing durability and resistance to degradation, the overall sustainability of polyurethane use is improved. This involves research into new additives, improved molecular structures, and innovative manufacturing techniques that can create longer-lasting products, reducing the need for frequent replacements and thus conserving resources.

These objectives collectively represent a paradigm shift in the polyurethane industry, moving from a linear "take-make-dispose" model to a more circular and sustainable approach. The technological advancements in this field are not only driven by environmental concerns but also by regulatory pressures, consumer demands, and the potential for long-term economic benefits in an increasingly eco-conscious market.

The primary objective in advancing PU sustainability is to reduce the environmental impact throughout the material's lifecycle. This encompasses everything from raw material sourcing to production processes, product use, and end-of-life management. A key goal is to develop bio-based polyurethanes, which utilize renewable resources instead of petroleum-based feedstocks, thereby reducing dependency on fossil fuels and decreasing carbon footprint.

Another critical aspect of PU sustainability is the improvement of recycling and biodegradation processes. Traditional polyurethanes have been challenging to recycle, often ending up in landfills. The industry is now focusing on creating PU formulations that are easier to break down and reuse, as well as developing more efficient recycling technologies. This aligns with the circular economy concept, where materials are kept in use for as long as possible.

Energy efficiency in production is also a significant objective. Manufacturers are exploring ways to reduce energy consumption during PU synthesis and processing, which not only lowers costs but also minimizes the carbon footprint of PU products. This includes optimizing reaction conditions, improving equipment efficiency, and utilizing renewable energy sources in production facilities.

The development of non-toxic and low-VOC (Volatile Organic Compound) polyurethanes is another crucial goal. This addresses concerns about indoor air quality and worker safety, particularly in applications such as furniture, bedding, and construction materials. The industry is working on formulations that maintain performance while eliminating or reducing harmful substances.

Lastly, there's a growing emphasis on extending the lifespan of PU products. By enhancing durability and resistance to degradation, the overall sustainability of polyurethane use is improved. This involves research into new additives, improved molecular structures, and innovative manufacturing techniques that can create longer-lasting products, reducing the need for frequent replacements and thus conserving resources.

These objectives collectively represent a paradigm shift in the polyurethane industry, moving from a linear "take-make-dispose" model to a more circular and sustainable approach. The technological advancements in this field are not only driven by environmental concerns but also by regulatory pressures, consumer demands, and the potential for long-term economic benefits in an increasingly eco-conscious market.

Market Demand for Sustainable PU Solutions

The market demand for sustainable polyurethane (PU) solutions has been steadily increasing in recent years, driven by growing environmental concerns and stringent regulations across various industries. This shift towards sustainability is reshaping the PU market, with consumers and businesses alike seeking eco-friendly alternatives to traditional PU products.

In the automotive sector, there is a significant demand for lightweight, durable, and sustainable materials to improve fuel efficiency and reduce carbon emissions. Sustainable PU foams and coatings are being increasingly adopted in vehicle interiors, seating, and insulation. The construction industry is another major driver of sustainable PU demand, with a focus on energy-efficient building materials. PU-based insulation products that offer superior thermal performance while minimizing environmental impact are gaining traction in both residential and commercial construction projects.

The furniture and bedding industry is also experiencing a surge in demand for sustainable PU solutions. Consumers are increasingly seeking eco-friendly mattresses, cushions, and upholstery that maintain comfort and durability while reducing their environmental footprint. This has led to the development of bio-based PU foams and recyclable PU materials that meet these requirements.

In the packaging industry, there is a growing need for sustainable PU alternatives to replace traditional plastic packaging materials. Biodegradable PU foams and films are being explored as potential solutions to address the global plastic waste crisis. The electronics industry is another sector driving demand for sustainable PU materials, particularly in the production of casings, insulation, and protective coatings for electronic devices.

The healthcare sector is also contributing to the market demand for sustainable PU solutions. There is an increasing focus on developing biocompatible and environmentally friendly PU materials for medical devices, implants, and wound care products. This trend is driven by both regulatory pressures and a growing awareness of the importance of sustainability in healthcare.

The textile industry is another significant market for sustainable PU solutions, with a rising demand for eco-friendly coatings and finishes for fabrics. Water-based PU systems and bio-based alternatives are gaining popularity in this sector, offering improved sustainability profiles without compromising performance.

As the global focus on sustainability intensifies, the market for sustainable PU solutions is expected to continue its growth trajectory. Companies investing in research and development of innovative, eco-friendly PU technologies are likely to gain a competitive edge in this evolving market landscape. The demand for sustainable PU solutions spans across multiple industries, presenting significant opportunities for growth and innovation in the coming years.

In the automotive sector, there is a significant demand for lightweight, durable, and sustainable materials to improve fuel efficiency and reduce carbon emissions. Sustainable PU foams and coatings are being increasingly adopted in vehicle interiors, seating, and insulation. The construction industry is another major driver of sustainable PU demand, with a focus on energy-efficient building materials. PU-based insulation products that offer superior thermal performance while minimizing environmental impact are gaining traction in both residential and commercial construction projects.

The furniture and bedding industry is also experiencing a surge in demand for sustainable PU solutions. Consumers are increasingly seeking eco-friendly mattresses, cushions, and upholstery that maintain comfort and durability while reducing their environmental footprint. This has led to the development of bio-based PU foams and recyclable PU materials that meet these requirements.

In the packaging industry, there is a growing need for sustainable PU alternatives to replace traditional plastic packaging materials. Biodegradable PU foams and films are being explored as potential solutions to address the global plastic waste crisis. The electronics industry is another sector driving demand for sustainable PU materials, particularly in the production of casings, insulation, and protective coatings for electronic devices.

The healthcare sector is also contributing to the market demand for sustainable PU solutions. There is an increasing focus on developing biocompatible and environmentally friendly PU materials for medical devices, implants, and wound care products. This trend is driven by both regulatory pressures and a growing awareness of the importance of sustainability in healthcare.

The textile industry is another significant market for sustainable PU solutions, with a rising demand for eco-friendly coatings and finishes for fabrics. Water-based PU systems and bio-based alternatives are gaining popularity in this sector, offering improved sustainability profiles without compromising performance.

As the global focus on sustainability intensifies, the market for sustainable PU solutions is expected to continue its growth trajectory. Companies investing in research and development of innovative, eco-friendly PU technologies are likely to gain a competitive edge in this evolving market landscape. The demand for sustainable PU solutions spans across multiple industries, presenting significant opportunities for growth and innovation in the coming years.

Current PU Sustainability Challenges

Polyurethane (PU) has been a cornerstone in various industries due to its versatility and performance. However, as sustainability becomes increasingly crucial, the PU industry faces significant challenges in aligning with environmental goals. One of the primary concerns is the raw materials used in PU production, particularly the reliance on fossil fuel-based feedstocks. This dependence not only contributes to carbon emissions but also raises questions about long-term resource availability and price stability.

The end-of-life management of PU products presents another major sustainability challenge. Many PU materials are difficult to recycle or biodegrade, leading to accumulation in landfills or incineration, both of which have negative environmental impacts. The complexity of PU formulations, often including additives and blends, further complicates recycling efforts and limits the potential for circular economy practices.

Energy consumption during PU production and processing is another area of concern. The manufacturing processes often require high temperatures and pressures, resulting in significant energy use and associated greenhouse gas emissions. Improving energy efficiency in production facilities and exploring alternative, low-energy manufacturing techniques are critical challenges facing the industry.

The use of potentially harmful chemicals in PU production, such as isocyanates and certain catalysts, poses risks to both human health and the environment. Developing safer alternatives or improving handling and containment methods are ongoing challenges that need to be addressed to enhance the sustainability profile of PU.

Water usage and pollution are additional sustainability issues in PU manufacturing. Some production processes consume substantial amounts of water and may generate wastewater containing pollutants. Implementing water-efficient technologies and effective treatment systems are essential steps towards more sustainable practices.

The durability of PU products, while often seen as an advantage, can also be a double-edged sword from a sustainability perspective. Long-lasting products reduce the need for replacements but can also delay the adoption of more sustainable alternatives. Balancing durability with recyclability or biodegradability is a complex challenge that requires innovative material design and lifecycle thinking.

Addressing these sustainability challenges requires a multifaceted approach, involving collaboration across the value chain, investment in research and development, and potentially significant changes to established manufacturing processes and business models. The PU industry must navigate these challenges while maintaining the performance characteristics that have made polyurethane such a valuable material in numerous applications.

The end-of-life management of PU products presents another major sustainability challenge. Many PU materials are difficult to recycle or biodegrade, leading to accumulation in landfills or incineration, both of which have negative environmental impacts. The complexity of PU formulations, often including additives and blends, further complicates recycling efforts and limits the potential for circular economy practices.

Energy consumption during PU production and processing is another area of concern. The manufacturing processes often require high temperatures and pressures, resulting in significant energy use and associated greenhouse gas emissions. Improving energy efficiency in production facilities and exploring alternative, low-energy manufacturing techniques are critical challenges facing the industry.

The use of potentially harmful chemicals in PU production, such as isocyanates and certain catalysts, poses risks to both human health and the environment. Developing safer alternatives or improving handling and containment methods are ongoing challenges that need to be addressed to enhance the sustainability profile of PU.

Water usage and pollution are additional sustainability issues in PU manufacturing. Some production processes consume substantial amounts of water and may generate wastewater containing pollutants. Implementing water-efficient technologies and effective treatment systems are essential steps towards more sustainable practices.

The durability of PU products, while often seen as an advantage, can also be a double-edged sword from a sustainability perspective. Long-lasting products reduce the need for replacements but can also delay the adoption of more sustainable alternatives. Balancing durability with recyclability or biodegradability is a complex challenge that requires innovative material design and lifecycle thinking.

Addressing these sustainability challenges requires a multifaceted approach, involving collaboration across the value chain, investment in research and development, and potentially significant changes to established manufacturing processes and business models. The PU industry must navigate these challenges while maintaining the performance characteristics that have made polyurethane such a valuable material in numerous applications.

Existing Sustainable PU Technologies

01 Bio-based polyurethane materials

Development of sustainable polyurethane materials using renewable resources such as plant-based oils, cellulose, and other bio-based feedstocks. These materials aim to reduce dependence on petroleum-based raw materials and lower the carbon footprint of polyurethane production.- Bio-based polyurethane materials: Development of sustainable polyurethane materials using bio-based raw materials, such as plant-derived polyols or isocyanates. These materials reduce dependence on fossil fuels and can have a lower carbon footprint compared to traditional polyurethanes.

- Recycling and upcycling of polyurethane waste: Innovative methods for recycling and upcycling polyurethane waste, including chemical and mechanical processes to break down and reuse polyurethane materials. This approach helps to reduce landfill waste and conserve resources.

- Energy-efficient polyurethane production: Development of energy-efficient processes for polyurethane production, including optimized reaction conditions, improved catalysts, and innovative manufacturing techniques that reduce energy consumption and greenhouse gas emissions.

- Water-based and solvent-free polyurethane systems: Formulation of water-based and solvent-free polyurethane systems that reduce or eliminate the use of volatile organic compounds (VOCs) and other harmful solvents, improving environmental and health safety in production and application.

- Biodegradable and compostable polyurethanes: Research and development of biodegradable and compostable polyurethane materials that can break down naturally in the environment, reducing long-term environmental impact and addressing end-of-life concerns for polyurethane products.

02 Recycling and upcycling of polyurethane waste

Innovative methods for recycling and upcycling polyurethane waste, including mechanical recycling, chemical recycling, and thermochemical processes. These techniques aim to reduce landfill waste and create a circular economy for polyurethane materials.Expand Specific Solutions03 Energy-efficient polyurethane production

Development of energy-efficient manufacturing processes for polyurethane production, including optimized reaction conditions, improved catalysts, and innovative equipment designs. These advancements aim to reduce energy consumption and greenhouse gas emissions in the production phase.Expand Specific Solutions04 Biodegradable polyurethane formulations

Creation of biodegradable polyurethane formulations that can break down naturally in the environment, reducing long-term environmental impact. These formulations often incorporate specially designed chemical structures or additives to enhance biodegradability.Expand Specific Solutions05 Sustainable additives and fillers for polyurethanes

Incorporation of sustainable additives and fillers in polyurethane formulations to enhance performance and reduce environmental impact. These may include natural fibers, recycled materials, or bio-based additives that improve properties such as strength, flame retardancy, or thermal insulation.Expand Specific Solutions

Key Players in Sustainable PU Industry

The polyurethane industry is in a mature stage but experiencing renewed growth due to sustainability initiatives. The global market size is projected to reach $79 billion by 2025, driven by increasing demand in construction, automotive, and furniture sectors. Technological maturity varies across applications, with bio-based and recyclable polyurethanes emerging as key focus areas. Companies like Covestro Deutschland AG, Evonik Operations GmbH, and DuPont de Nemours, Inc. are leading innovation in sustainable polyurethanes, while academic institutions such as Sichuan University and the University of California are contributing to fundamental research. Collaborations between industry players and research organizations are accelerating the development of eco-friendly polyurethane solutions, positioning the sector for long-term sustainable growth.

Evonik Operations GmbH

Technical Solution: Evonik has developed VESTENAMER®, a polyoctalene terephthalate (POT) that acts as a process additive for rubber recycling. This technology allows for the incorporation of higher amounts of recycled rubber in new products, improving the sustainability of rubber and polyurethane composites. They also offer bio-based polyester polyols and isocyanates for more sustainable polyurethane production, as well as additives that enhance the performance and durability of polyurethane products.

Strengths: Expertise in specialty chemicals, focus on circular economy solutions, wide range of sustainable additives. Weaknesses: Limited direct involvement in end-product manufacturing, reliance on partnerships for full product implementation.

Covestro Deutschland AG

Technical Solution: Covestro has developed a range of sustainable polyurethane solutions, including CO2-based polyols for flexible foams, bio-based raw materials for coatings and adhesives, and recyclable thermoplastic polyurethanes. Their cardyon® technology uses CO2 as a raw material, replacing up to 20% of fossil-based resources. They also focus on developing fully recyclable mattresses and improving the biodegradability of polyurethane products.

Strengths: Strong focus on sustainability, innovative CO2 utilization technology, wide range of applications. Weaknesses: Potential higher costs compared to traditional polyurethanes, limited biodegradability achievements so far.

Innovative PU Sustainability Approaches

Aqueous dispersion

PatentWO2019129111A1

Innovation

- Development of a polyurethane polymer-based aqueous dispersion using sustainable and renewable materials, reducing reliance on petroleum-derived resources.

- Utilization of carbon dioxide as a raw material in the production process, improving carbon efficiency and reducing carbon footprint.

- Creation of a versatile aqueous polyurethane dispersion applicable across multiple industries, including coatings, sealants, binders, and printing inks.

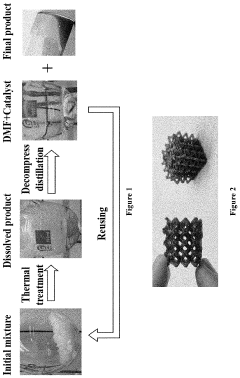

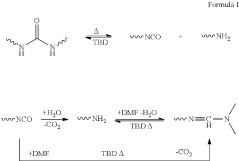

Method for recycling and reusing polyurethane foam

PatentActiveUS20230002585A1

Innovation

- A method involving the use of solvents and catalysts to convert polyurethane foam into functionalized oligomers, which are then chemically modified to introduce photosensitive groups, forming high-value added photocurable resins suitable for coatings and 3D printing, with adjustable properties and efficient recycling processes.

Life Cycle Assessment of PU Products

Life Cycle Assessment (LCA) of polyurethane (PU) products is a crucial tool for evaluating their environmental impact and sustainability throughout their entire lifecycle. This comprehensive analysis encompasses raw material extraction, manufacturing processes, product use, and end-of-life disposal or recycling. The assessment typically considers multiple environmental indicators, including greenhouse gas emissions, energy consumption, water usage, and waste generation.

In the production phase, the LCA examines the environmental footprint of sourcing and processing raw materials for PU, such as polyols and isocyanates. This stage often accounts for a significant portion of the product's overall environmental impact due to the energy-intensive nature of chemical synthesis and the potential for emissions during production.

The manufacturing process itself is scrutinized for its energy efficiency, waste management practices, and potential for optimization. Advanced manufacturing techniques, such as precision dispensing systems and computer-controlled mixing, have shown promise in reducing material waste and improving overall efficiency.

During the use phase, PU products often demonstrate favorable environmental performance due to their durability, insulation properties, and lightweight nature. For instance, PU insulation in buildings can significantly reduce energy consumption over the structure's lifetime. Similarly, PU components in vehicles can contribute to fuel efficiency through weight reduction.

End-of-life considerations are particularly important in the LCA of PU products. While traditional disposal methods like landfilling have negative environmental impacts, emerging recycling technologies offer more sustainable alternatives. Chemical recycling processes, which break down PU into its constituent components for reuse, show particular promise in closing the material loop.

Comparative LCAs often reveal that PU products outperform alternative materials in many applications when considering the full lifecycle. For example, PU insulation typically demonstrates lower overall environmental impact compared to other insulation materials when accounting for its superior thermal performance over time.

However, challenges remain in accurately quantifying certain aspects of PU's lifecycle, particularly in long-term use scenarios and emerging recycling technologies. Ongoing research aims to refine LCA methodologies and data collection to provide more precise assessments of PU's environmental footprint.

As industries strive for greater sustainability, the insights gained from LCAs of PU products are invaluable in guiding product development, process optimization, and end-of-life management strategies. These assessments not only help manufacturers improve their environmental performance but also inform policy decisions and consumer choices in the pursuit of more sustainable industrial practices.

In the production phase, the LCA examines the environmental footprint of sourcing and processing raw materials for PU, such as polyols and isocyanates. This stage often accounts for a significant portion of the product's overall environmental impact due to the energy-intensive nature of chemical synthesis and the potential for emissions during production.

The manufacturing process itself is scrutinized for its energy efficiency, waste management practices, and potential for optimization. Advanced manufacturing techniques, such as precision dispensing systems and computer-controlled mixing, have shown promise in reducing material waste and improving overall efficiency.

During the use phase, PU products often demonstrate favorable environmental performance due to their durability, insulation properties, and lightweight nature. For instance, PU insulation in buildings can significantly reduce energy consumption over the structure's lifetime. Similarly, PU components in vehicles can contribute to fuel efficiency through weight reduction.

End-of-life considerations are particularly important in the LCA of PU products. While traditional disposal methods like landfilling have negative environmental impacts, emerging recycling technologies offer more sustainable alternatives. Chemical recycling processes, which break down PU into its constituent components for reuse, show particular promise in closing the material loop.

Comparative LCAs often reveal that PU products outperform alternative materials in many applications when considering the full lifecycle. For example, PU insulation typically demonstrates lower overall environmental impact compared to other insulation materials when accounting for its superior thermal performance over time.

However, challenges remain in accurately quantifying certain aspects of PU's lifecycle, particularly in long-term use scenarios and emerging recycling technologies. Ongoing research aims to refine LCA methodologies and data collection to provide more precise assessments of PU's environmental footprint.

As industries strive for greater sustainability, the insights gained from LCAs of PU products are invaluable in guiding product development, process optimization, and end-of-life management strategies. These assessments not only help manufacturers improve their environmental performance but also inform policy decisions and consumer choices in the pursuit of more sustainable industrial practices.

Regulatory Framework for Sustainable PU

The regulatory framework for sustainable polyurethane (PU) is evolving rapidly as governments and international organizations recognize the need to address environmental concerns and promote circular economy principles. At the global level, the United Nations Sustainable Development Goals (SDGs) provide a broad framework that influences policy-making across industries, including the PU sector. Specifically, SDG 12 (Responsible Consumption and Production) and SDG 13 (Climate Action) have direct implications for PU manufacturers and users.

In the European Union, the European Green Deal sets ambitious targets for reducing greenhouse gas emissions and promoting sustainable practices. The EU's Circular Economy Action Plan, a key component of the Green Deal, emphasizes the importance of product design for durability, reusability, and recyclability. This has led to the development of specific regulations affecting PU production and use, such as the EU's Registration, Evaluation, Authorization, and Restriction of Chemicals (REACH) regulation, which aims to protect human health and the environment from chemical risks.

The United States has also implemented regulations that impact sustainable PU production. The Environmental Protection Agency (EPA) enforces the Toxic Substances Control Act (TSCA), which regulates the introduction of new or already existing chemicals. Additionally, individual states like California have introduced their own stringent regulations, such as Proposition 65, which requires businesses to provide warnings about significant exposures to chemicals that cause cancer, birth defects, or other reproductive harm.

In Asia, countries like China and Japan are strengthening their environmental regulations. China's Environmental Protection Law and its subsequent amendments have set stricter standards for industrial pollution and waste management, affecting PU manufacturers. Japan's Chemical Substances Control Law (CSCL) regulates the manufacture and import of chemical substances, including those used in PU production.

These regulatory frameworks are driving innovation in sustainable PU technologies. Manufacturers are increasingly focusing on developing bio-based polyols, improving recycling technologies, and reducing the use of harmful chemicals in PU production. The push for extended producer responsibility is also encouraging companies to consider the entire lifecycle of PU products, from raw material sourcing to end-of-life management.

As the regulatory landscape continues to evolve, industry stakeholders must stay informed and proactive in adapting their practices. Collaboration between industry, government, and research institutions is crucial for developing effective and feasible regulations that balance environmental protection with economic viability. The future of sustainable PU will likely see more harmonized global standards, stricter reporting requirements, and increased emphasis on circular economy principles in regulatory frameworks.

In the European Union, the European Green Deal sets ambitious targets for reducing greenhouse gas emissions and promoting sustainable practices. The EU's Circular Economy Action Plan, a key component of the Green Deal, emphasizes the importance of product design for durability, reusability, and recyclability. This has led to the development of specific regulations affecting PU production and use, such as the EU's Registration, Evaluation, Authorization, and Restriction of Chemicals (REACH) regulation, which aims to protect human health and the environment from chemical risks.

The United States has also implemented regulations that impact sustainable PU production. The Environmental Protection Agency (EPA) enforces the Toxic Substances Control Act (TSCA), which regulates the introduction of new or already existing chemicals. Additionally, individual states like California have introduced their own stringent regulations, such as Proposition 65, which requires businesses to provide warnings about significant exposures to chemicals that cause cancer, birth defects, or other reproductive harm.

In Asia, countries like China and Japan are strengthening their environmental regulations. China's Environmental Protection Law and its subsequent amendments have set stricter standards for industrial pollution and waste management, affecting PU manufacturers. Japan's Chemical Substances Control Law (CSCL) regulates the manufacture and import of chemical substances, including those used in PU production.

These regulatory frameworks are driving innovation in sustainable PU technologies. Manufacturers are increasingly focusing on developing bio-based polyols, improving recycling technologies, and reducing the use of harmful chemicals in PU production. The push for extended producer responsibility is also encouraging companies to consider the entire lifecycle of PU products, from raw material sourcing to end-of-life management.

As the regulatory landscape continues to evolve, industry stakeholders must stay informed and proactive in adapting their practices. Collaboration between industry, government, and research institutions is crucial for developing effective and feasible regulations that balance environmental protection with economic viability. The future of sustainable PU will likely see more harmonized global standards, stricter reporting requirements, and increased emphasis on circular economy principles in regulatory frameworks.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!