Polyurethane Solutions: Addressing Industrial Challenges

JUN 25, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

PU Tech Background & Objectives

Polyurethane (PU) technology has evolved significantly since its inception in the 1930s, revolutionizing various industries with its versatile properties. This synthetic polymer, formed by the reaction between polyols and diisocyanates, has become an integral part of modern manufacturing and consumer products. The development of PU technology has been driven by the need for materials with superior performance characteristics, including durability, flexibility, and insulation properties.

The journey of PU technology began with Otto Bayer's groundbreaking work at IG Farben in Germany. Initially developed as a substitute for rubber during World War II, PU quickly found applications in coatings, adhesives, and foam products. The post-war era saw rapid advancements in PU chemistry, leading to the development of flexible and rigid foams, elastomers, and specialized coatings.

In recent decades, the focus of PU technology has shifted towards addressing environmental concerns and improving sustainability. This has led to the development of bio-based polyols, water-blown foams, and recyclable PU materials. The industry has also made strides in reducing the use of harmful chemicals, such as chlorofluorocarbons (CFCs) and their replacements, in PU production.

The current objectives of PU technology research are multifaceted. One primary goal is to enhance the sustainability of PU products through the development of bio-based and recyclable materials. This includes exploring renewable feedstocks for polyol production and improving end-of-life recycling processes for PU products. Another key objective is to optimize PU formulations for specific industrial applications, such as improving the thermal insulation properties of PU foams for energy-efficient buildings or enhancing the durability of PU coatings for automotive applications.

Additionally, there is a growing focus on developing PU materials with advanced functionalities. This includes self-healing PU elastomers, shape-memory PU foams, and PU composites with enhanced mechanical and thermal properties. The integration of nanotechnology with PU chemistry is also an area of active research, aiming to create materials with unprecedented performance characteristics.

The PU industry is also addressing challenges related to health and safety concerns. This involves developing alternatives to potentially harmful isocyanates and reducing volatile organic compound (VOC) emissions from PU products. Furthermore, there is ongoing research into improving the fire resistance of PU materials, particularly in construction and automotive applications.

As we look to the future, the objectives of PU technology research are likely to align closely with global sustainability goals and emerging industrial needs. This may include the development of PU materials for advanced energy storage systems, biomedical applications, and next-generation aerospace components. The continued evolution of PU technology promises to deliver innovative solutions to a wide range of industrial challenges, cementing its position as a critical material in the 21st century.

The journey of PU technology began with Otto Bayer's groundbreaking work at IG Farben in Germany. Initially developed as a substitute for rubber during World War II, PU quickly found applications in coatings, adhesives, and foam products. The post-war era saw rapid advancements in PU chemistry, leading to the development of flexible and rigid foams, elastomers, and specialized coatings.

In recent decades, the focus of PU technology has shifted towards addressing environmental concerns and improving sustainability. This has led to the development of bio-based polyols, water-blown foams, and recyclable PU materials. The industry has also made strides in reducing the use of harmful chemicals, such as chlorofluorocarbons (CFCs) and their replacements, in PU production.

The current objectives of PU technology research are multifaceted. One primary goal is to enhance the sustainability of PU products through the development of bio-based and recyclable materials. This includes exploring renewable feedstocks for polyol production and improving end-of-life recycling processes for PU products. Another key objective is to optimize PU formulations for specific industrial applications, such as improving the thermal insulation properties of PU foams for energy-efficient buildings or enhancing the durability of PU coatings for automotive applications.

Additionally, there is a growing focus on developing PU materials with advanced functionalities. This includes self-healing PU elastomers, shape-memory PU foams, and PU composites with enhanced mechanical and thermal properties. The integration of nanotechnology with PU chemistry is also an area of active research, aiming to create materials with unprecedented performance characteristics.

The PU industry is also addressing challenges related to health and safety concerns. This involves developing alternatives to potentially harmful isocyanates and reducing volatile organic compound (VOC) emissions from PU products. Furthermore, there is ongoing research into improving the fire resistance of PU materials, particularly in construction and automotive applications.

As we look to the future, the objectives of PU technology research are likely to align closely with global sustainability goals and emerging industrial needs. This may include the development of PU materials for advanced energy storage systems, biomedical applications, and next-generation aerospace components. The continued evolution of PU technology promises to deliver innovative solutions to a wide range of industrial challenges, cementing its position as a critical material in the 21st century.

Industrial PU Market Analysis

The global polyurethane (PU) market has experienced significant growth in recent years, driven by increasing demand across various industrial sectors. The versatility and adaptability of polyurethane materials have positioned them as crucial components in numerous applications, ranging from construction and automotive to furniture and electronics.

In the construction industry, polyurethane-based insulation materials have gained prominence due to their superior thermal properties and energy efficiency benefits. The growing emphasis on sustainable building practices and stringent energy regulations have further propelled the adoption of PU-based solutions in this sector. Similarly, the automotive industry has embraced polyurethane materials for their lightweight characteristics and ability to enhance fuel efficiency, particularly in the production of vehicle interiors and exterior components.

The furniture sector represents another significant market for polyurethane, with PU foams being widely used in mattresses, upholstery, and seating applications. The increasing consumer preference for comfortable and durable furniture has contributed to the steady growth of PU demand in this segment. Additionally, the electronics industry has found valuable applications for polyurethane in the production of protective coatings, adhesives, and encapsulants for electronic components.

Geographically, Asia-Pacific has emerged as the largest and fastest-growing market for polyurethane, driven by rapid industrialization, urbanization, and infrastructure development in countries like China and India. North America and Europe continue to be significant markets, with a focus on high-performance and sustainable PU solutions.

The market landscape is characterized by the presence of several major players, including BASF, Covestro, Huntsman Corporation, and Dow Chemical Company. These companies are actively investing in research and development to innovate new PU formulations and address evolving industry challenges. Key areas of focus include improving the sustainability profile of polyurethane products, enhancing performance characteristics, and developing bio-based alternatives.

Despite the positive growth trajectory, the polyurethane market faces challenges related to raw material price volatility and environmental concerns associated with traditional PU production processes. However, ongoing efforts to develop more sustainable and eco-friendly PU solutions are expected to address these issues and open up new opportunities in the market.

In the construction industry, polyurethane-based insulation materials have gained prominence due to their superior thermal properties and energy efficiency benefits. The growing emphasis on sustainable building practices and stringent energy regulations have further propelled the adoption of PU-based solutions in this sector. Similarly, the automotive industry has embraced polyurethane materials for their lightweight characteristics and ability to enhance fuel efficiency, particularly in the production of vehicle interiors and exterior components.

The furniture sector represents another significant market for polyurethane, with PU foams being widely used in mattresses, upholstery, and seating applications. The increasing consumer preference for comfortable and durable furniture has contributed to the steady growth of PU demand in this segment. Additionally, the electronics industry has found valuable applications for polyurethane in the production of protective coatings, adhesives, and encapsulants for electronic components.

Geographically, Asia-Pacific has emerged as the largest and fastest-growing market for polyurethane, driven by rapid industrialization, urbanization, and infrastructure development in countries like China and India. North America and Europe continue to be significant markets, with a focus on high-performance and sustainable PU solutions.

The market landscape is characterized by the presence of several major players, including BASF, Covestro, Huntsman Corporation, and Dow Chemical Company. These companies are actively investing in research and development to innovate new PU formulations and address evolving industry challenges. Key areas of focus include improving the sustainability profile of polyurethane products, enhancing performance characteristics, and developing bio-based alternatives.

Despite the positive growth trajectory, the polyurethane market faces challenges related to raw material price volatility and environmental concerns associated with traditional PU production processes. However, ongoing efforts to develop more sustainable and eco-friendly PU solutions are expected to address these issues and open up new opportunities in the market.

PU Tech Challenges & Limitations

Polyurethane (PU) technology, while versatile and widely used, faces several significant challenges and limitations in industrial applications. One of the primary issues is the environmental impact of traditional PU production methods. The use of isocyanates, a key component in PU synthesis, poses health risks to workers and contributes to environmental pollution. This has led to increased regulatory pressure and a growing demand for more sustainable alternatives.

Another major challenge lies in the recyclability and end-of-life management of PU products. The complex chemical structure of polyurethanes makes them difficult to recycle effectively, leading to substantial waste accumulation. This issue is particularly pronounced in industries such as automotive and construction, where large volumes of PU materials are used.

The performance limitations of PU in extreme conditions also present ongoing challenges. While PU exhibits excellent properties in many applications, it can degrade under prolonged exposure to high temperatures, UV radiation, or certain chemicals. This restricts its use in some high-performance applications and necessitates frequent replacement in others, increasing overall costs and environmental impact.

Customization and consistency in PU formulations pose another set of challenges. The properties of PU can vary significantly based on minor changes in composition or processing conditions. Achieving consistent quality across large-scale production runs, especially for specialized applications, remains a technical hurdle for many manufacturers.

The rising costs of raw materials, particularly petroleum-based polyols, present economic challenges to the PU industry. Fluctuations in oil prices directly impact production costs, making it difficult for manufacturers to maintain stable pricing and profit margins. This has spurred research into bio-based alternatives, but these often come with their own set of technical limitations and scalability issues.

Adhesion properties of PU, while generally good, can be problematic in certain applications. Improving adhesion to difficult substrates without compromising other desirable properties of the material remains an ongoing area of research and development.

Lastly, the curing process of PU systems, especially in large or complex applications, can be time-consuming and energy-intensive. Developing faster-curing formulations without sacrificing performance characteristics is a key focus area for improving efficiency and reducing production costs in various industries utilizing PU technologies.

Another major challenge lies in the recyclability and end-of-life management of PU products. The complex chemical structure of polyurethanes makes them difficult to recycle effectively, leading to substantial waste accumulation. This issue is particularly pronounced in industries such as automotive and construction, where large volumes of PU materials are used.

The performance limitations of PU in extreme conditions also present ongoing challenges. While PU exhibits excellent properties in many applications, it can degrade under prolonged exposure to high temperatures, UV radiation, or certain chemicals. This restricts its use in some high-performance applications and necessitates frequent replacement in others, increasing overall costs and environmental impact.

Customization and consistency in PU formulations pose another set of challenges. The properties of PU can vary significantly based on minor changes in composition or processing conditions. Achieving consistent quality across large-scale production runs, especially for specialized applications, remains a technical hurdle for many manufacturers.

The rising costs of raw materials, particularly petroleum-based polyols, present economic challenges to the PU industry. Fluctuations in oil prices directly impact production costs, making it difficult for manufacturers to maintain stable pricing and profit margins. This has spurred research into bio-based alternatives, but these often come with their own set of technical limitations and scalability issues.

Adhesion properties of PU, while generally good, can be problematic in certain applications. Improving adhesion to difficult substrates without compromising other desirable properties of the material remains an ongoing area of research and development.

Lastly, the curing process of PU systems, especially in large or complex applications, can be time-consuming and energy-intensive. Developing faster-curing formulations without sacrificing performance characteristics is a key focus area for improving efficiency and reducing production costs in various industries utilizing PU technologies.

Current PU Solutions Overview

01 Polyurethane synthesis and composition

This category focuses on the synthesis and composition of polyurethane materials. It includes various methods for producing polyurethane with specific properties, such as improved durability, flexibility, or chemical resistance. The synthesis may involve different types of isocyanates, polyols, and additives to achieve desired characteristics.- Polyurethane synthesis and composition: This category focuses on the synthesis and composition of polyurethane materials. It includes various methods for producing polyurethane with specific properties, such as improved durability, flexibility, or chemical resistance. The synthesis may involve different types of isocyanates, polyols, and additives to achieve desired characteristics.

- Polyurethane applications in coatings and adhesives: This point covers the use of polyurethane in various coating and adhesive applications. It includes formulations for protective coatings, decorative finishes, and high-performance adhesives. The polyurethane-based products in this category may offer properties such as weather resistance, chemical resistance, and strong bonding capabilities.

- Polyurethane foam technology: This category encompasses innovations in polyurethane foam production and properties. It includes techniques for creating various types of foam, such as flexible, rigid, or viscoelastic foams. The focus is on improving foam characteristics like density, insulation properties, and fire resistance for applications in furniture, automotive, and construction industries.

- Polyurethane in textile and fiber applications: This point covers the use of polyurethane in textile and fiber-related applications. It includes methods for incorporating polyurethane into fabrics, creating polyurethane fibers, and developing polyurethane-based coatings for textiles. The focus is on enhancing properties such as elasticity, moisture management, and durability in clothing and technical textiles.

- Environmentally friendly polyurethane innovations: This category focuses on developing more sustainable and environmentally friendly polyurethane materials and processes. It includes bio-based polyurethanes, recyclable formulations, and production methods with reduced environmental impact. The innovations aim to address concerns about the use of fossil-based raw materials and end-of-life disposal of polyurethane products.

02 Polyurethane applications in coatings and adhesives

This category covers the use of polyurethane in coatings and adhesives. It includes formulations for various applications such as automotive coatings, industrial adhesives, and protective finishes. The focus is on developing polyurethane-based products with enhanced adhesion, durability, and resistance to environmental factors.Expand Specific Solutions03 Polyurethane foam technology

This category encompasses innovations in polyurethane foam technology. It includes methods for producing various types of foam, such as flexible, rigid, or spray foams, with specific properties like improved insulation, fire resistance, or biodegradability. The focus is on optimizing foam formulations and manufacturing processes.Expand Specific Solutions04 Polyurethane in medical and biomedical applications

This category focuses on the use of polyurethane in medical and biomedical applications. It includes the development of biocompatible polyurethane materials for implants, wound dressings, and drug delivery systems. The emphasis is on creating materials with specific biological properties and interactions with living tissues.Expand Specific Solutions05 Sustainable and eco-friendly polyurethane

This category covers innovations in sustainable and eco-friendly polyurethane materials. It includes the development of bio-based polyurethanes, recyclable formulations, and environmentally friendly production processes. The focus is on reducing the environmental impact of polyurethane production and use while maintaining or improving material performance.Expand Specific Solutions

Key PU Industry Players

The polyurethane solutions market is in a mature growth stage, with a global market size expected to reach $79.2 billion by 2027. The industry is characterized by intense competition among established players like BASF, Covestro, and Dow Global Technologies, who are focusing on innovation to address industrial challenges. Emerging companies such as Wanhua Chemical and Jiaxing Hexin Chemical are also making significant strides. The technology maturity varies across applications, with advanced developments in areas like bio-based polyurethanes and smart materials. Companies like PPG Industries and 3M are leading in specialized coatings, while Henkel and UBE Corp are innovating in adhesives and elastomers. The market is driven by increasing demand in construction, automotive, and healthcare sectors, with a growing emphasis on sustainable solutions.

Covestro Deutschland AG

Technical Solution: Covestro has developed advanced polyurethane technologies to address industrial challenges. Their Baypreg® F NF technology offers a lightweight, strong, and recyclable composite material for automotive applications. Covestro's Desmodur® and Desmophen® product lines provide high-performance raw materials for polyurethane coatings, adhesives, and sealants. They have also introduced cardyon®, a CO2-based polyol that reduces the carbon footprint of polyurethane production.

Strengths: Focus on sustainability, innovative product portfolio, strong market position. Weaknesses: Exposure to raw material price fluctuations, regulatory challenges in some markets.

BASF Corp.

Technical Solution: BASF has developed a range of innovative polyurethane solutions to address industrial challenges. Their Elastollan® thermoplastic polyurethane (TPU) offers excellent mechanical properties, high abrasion resistance, and good chemical stability. BASF's Elastopan® polyurethane systems provide tailored solutions for various applications, including automotive, construction, and furniture industries. They have also introduced bio-based polyols, such as Palatinol® ELECT, to enhance sustainability in polyurethane production.

Strengths: Wide range of customizable solutions, strong R&D capabilities, global presence. Weaknesses: Dependence on petrochemical feedstocks, potential environmental concerns.

PU Core Patents & Innovations

Polyurethane polymer

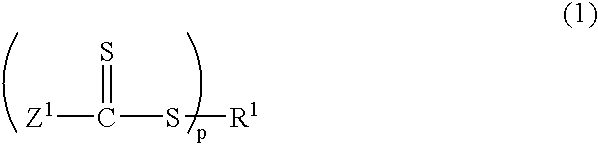

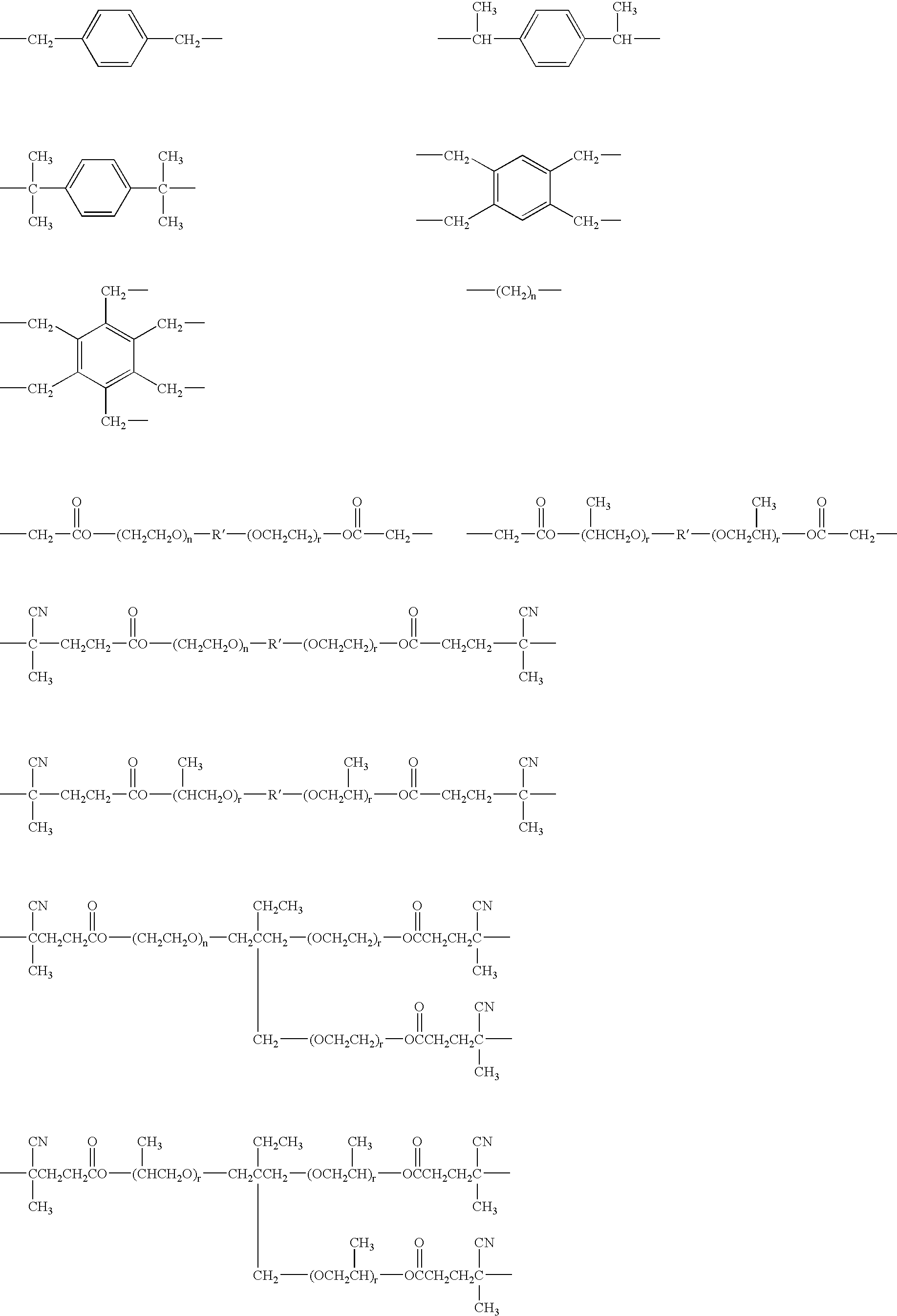

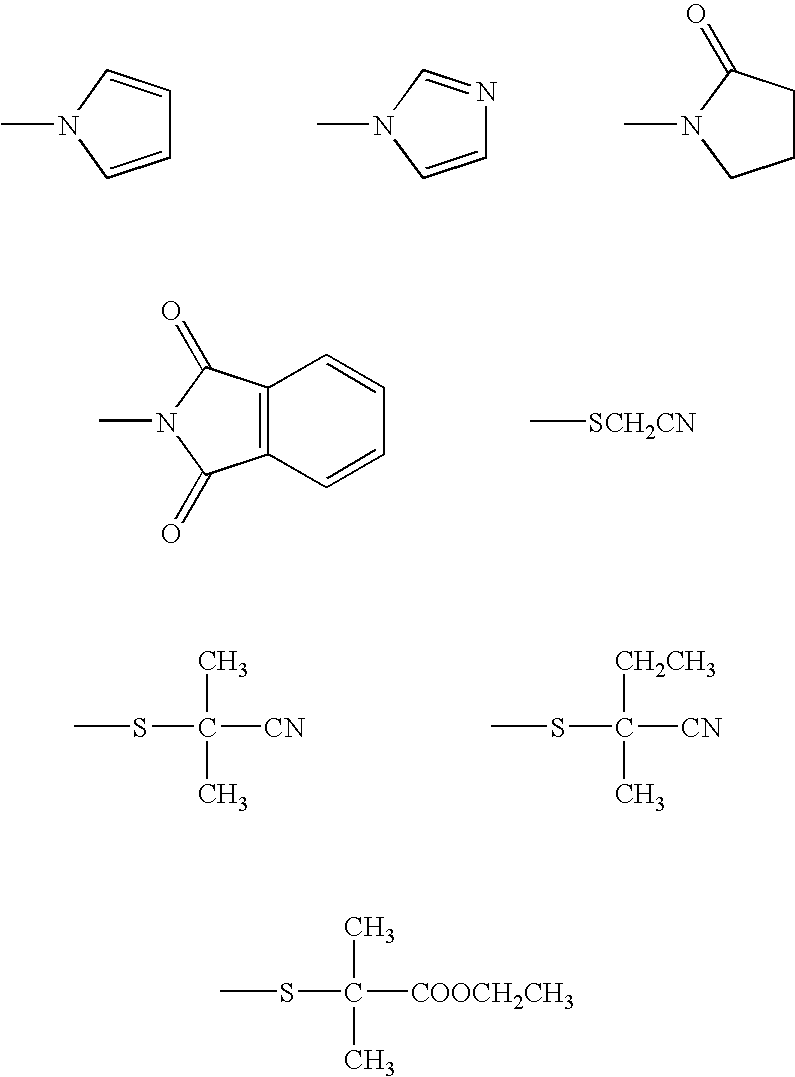

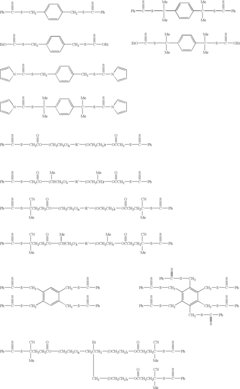

PatentInactiveUS20040171765A1

Innovation

- A polyurethane polymer is produced using a mercapto group-containing vinyl polymer, prepared by reversible addition-fragmentation chain transfer (RAFT) polymerization, combined with an organic polyisocyanate, to enhance the polymer's resistance properties and simplify production.

Polyurethane polymer solution and method for manufacturing the same

PatentWO2010140566A1

Innovation

- A polyurethane polymer solution is developed by reacting a polycarbonate polyol with specific repeating units and a polyisocyanate compound in an organic solvent, enhancing dispersibility and resulting in a coating film with improved hardness, hydrolysis resistance, durability, and heat resistance.

Environmental Impact of PU

Polyurethane (PU) has become an integral part of numerous industries, but its environmental impact remains a significant concern. The production, use, and disposal of PU materials contribute to various environmental challenges that require careful consideration and innovative solutions.

During the manufacturing process, PU production often involves the use of isocyanates and polyols, which can release volatile organic compounds (VOCs) and other potentially harmful substances into the atmosphere. These emissions contribute to air pollution and may pose health risks to workers and nearby communities. Additionally, the energy-intensive nature of PU production contributes to greenhouse gas emissions, further exacerbating climate change concerns.

The durability and versatility of PU products have led to their widespread use in various applications, from automotive parts to construction materials. However, this longevity becomes problematic at the end of the product lifecycle. Many PU products are not biodegradable and can persist in the environment for extended periods, contributing to the growing issue of plastic pollution in landfills and oceans.

Recycling PU materials presents significant challenges due to their complex chemical composition and the difficulty in separating different components. Traditional recycling methods often prove ineffective or economically unfeasible for PU products, leading to increased waste accumulation. This issue is particularly pronounced in industries such as automotive and construction, where large volumes of PU materials are used and eventually discarded.

Water pollution is another environmental concern associated with PU. The production process can generate wastewater containing chemical residues, which, if not properly treated, may contaminate local water sources. Furthermore, the breakdown of PU products in the environment can release microplastics and potentially toxic chemicals, posing risks to aquatic ecosystems and entering the food chain.

Despite these challenges, efforts are underway to mitigate the environmental impact of PU. Research into bio-based polyurethanes, utilizing renewable resources as raw materials, shows promise in reducing the reliance on petroleum-based inputs. Additionally, advancements in recycling technologies, such as chemical recycling and depolymerization, offer potential solutions for more effective PU waste management.

The development of more environmentally friendly production processes, including the use of water-based systems and low-VOC formulations, is helping to reduce the environmental footprint of PU manufacturing. Moreover, increased focus on product design for recyclability and the implementation of circular economy principles in the PU industry are paving the way for more sustainable practices throughout the material's lifecycle.

During the manufacturing process, PU production often involves the use of isocyanates and polyols, which can release volatile organic compounds (VOCs) and other potentially harmful substances into the atmosphere. These emissions contribute to air pollution and may pose health risks to workers and nearby communities. Additionally, the energy-intensive nature of PU production contributes to greenhouse gas emissions, further exacerbating climate change concerns.

The durability and versatility of PU products have led to their widespread use in various applications, from automotive parts to construction materials. However, this longevity becomes problematic at the end of the product lifecycle. Many PU products are not biodegradable and can persist in the environment for extended periods, contributing to the growing issue of plastic pollution in landfills and oceans.

Recycling PU materials presents significant challenges due to their complex chemical composition and the difficulty in separating different components. Traditional recycling methods often prove ineffective or economically unfeasible for PU products, leading to increased waste accumulation. This issue is particularly pronounced in industries such as automotive and construction, where large volumes of PU materials are used and eventually discarded.

Water pollution is another environmental concern associated with PU. The production process can generate wastewater containing chemical residues, which, if not properly treated, may contaminate local water sources. Furthermore, the breakdown of PU products in the environment can release microplastics and potentially toxic chemicals, posing risks to aquatic ecosystems and entering the food chain.

Despite these challenges, efforts are underway to mitigate the environmental impact of PU. Research into bio-based polyurethanes, utilizing renewable resources as raw materials, shows promise in reducing the reliance on petroleum-based inputs. Additionally, advancements in recycling technologies, such as chemical recycling and depolymerization, offer potential solutions for more effective PU waste management.

The development of more environmentally friendly production processes, including the use of water-based systems and low-VOC formulations, is helping to reduce the environmental footprint of PU manufacturing. Moreover, increased focus on product design for recyclability and the implementation of circular economy principles in the PU industry are paving the way for more sustainable practices throughout the material's lifecycle.

PU Regulatory Compliance

Regulatory compliance in the polyurethane (PU) industry has become increasingly complex and stringent, reflecting growing concerns about environmental impact, worker safety, and consumer protection. The global nature of PU production and distribution necessitates adherence to a diverse array of regulations across different regions and markets.

In the United States, the Environmental Protection Agency (EPA) plays a crucial role in regulating PU-related chemicals under the Toxic Substances Control Act (TSCA). The agency has implemented stricter controls on isocyanates, a key component in PU production, due to their potential health hazards. Manufacturers must comply with reporting requirements, exposure limits, and risk management practices to ensure worker safety and environmental protection.

The European Union's REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) regulation has significantly impacted the PU industry. Companies operating in or exporting to the EU must register their chemical substances, evaluate potential risks, and implement appropriate safety measures. The regulation has led to increased transparency in the supply chain and encouraged the development of safer alternatives to certain PU chemicals.

In Asia, countries like China and Japan have also strengthened their chemical regulations. China's Measures for Environmental Management of New Chemical Substances and Japan's Chemical Substances Control Law impose registration and reporting requirements on PU manufacturers and importers. These regulations aim to assess and mitigate potential risks associated with new and existing chemical substances used in PU production.

The automotive industry, a major consumer of PU products, faces additional regulatory challenges. Stringent emissions standards and end-of-life vehicle directives in various countries have prompted manufacturers to develop PU materials that are more easily recyclable and have lower environmental impact. This has led to innovations in bio-based polyols and PU recycling technologies.

Flame retardancy regulations have also evolved, particularly in the construction and furniture sectors. Standards such as California's Technical Bulletin 117-2013 have shifted focus towards eliminating harmful flame retardants while maintaining fire safety. PU manufacturers have responded by developing new formulations that meet these requirements without compromising performance or safety.

As sustainability becomes a global priority, regulations around the circular economy and waste management are influencing PU production. The EU's Circular Economy Action Plan, for instance, emphasizes the need for recyclable and reusable materials, pushing the PU industry towards more sustainable practices and product designs.

In the United States, the Environmental Protection Agency (EPA) plays a crucial role in regulating PU-related chemicals under the Toxic Substances Control Act (TSCA). The agency has implemented stricter controls on isocyanates, a key component in PU production, due to their potential health hazards. Manufacturers must comply with reporting requirements, exposure limits, and risk management practices to ensure worker safety and environmental protection.

The European Union's REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) regulation has significantly impacted the PU industry. Companies operating in or exporting to the EU must register their chemical substances, evaluate potential risks, and implement appropriate safety measures. The regulation has led to increased transparency in the supply chain and encouraged the development of safer alternatives to certain PU chemicals.

In Asia, countries like China and Japan have also strengthened their chemical regulations. China's Measures for Environmental Management of New Chemical Substances and Japan's Chemical Substances Control Law impose registration and reporting requirements on PU manufacturers and importers. These regulations aim to assess and mitigate potential risks associated with new and existing chemical substances used in PU production.

The automotive industry, a major consumer of PU products, faces additional regulatory challenges. Stringent emissions standards and end-of-life vehicle directives in various countries have prompted manufacturers to develop PU materials that are more easily recyclable and have lower environmental impact. This has led to innovations in bio-based polyols and PU recycling technologies.

Flame retardancy regulations have also evolved, particularly in the construction and furniture sectors. Standards such as California's Technical Bulletin 117-2013 have shifted focus towards eliminating harmful flame retardants while maintaining fire safety. PU manufacturers have responded by developing new formulations that meet these requirements without compromising performance or safety.

As sustainability becomes a global priority, regulations around the circular economy and waste management are influencing PU production. The EU's Circular Economy Action Plan, for instance, emphasizes the need for recyclable and reusable materials, pushing the PU industry towards more sustainable practices and product designs.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!