Recycling And Reuse Of DIW Ceramic Waste Streams

DIW Ceramic Waste Background and Objectives

Direct Ink Writing (DIW) ceramic manufacturing has emerged as a significant additive manufacturing technique over the past two decades, offering unprecedented design freedom and material efficiency compared to traditional ceramic processing methods. This technology enables the fabrication of complex ceramic structures through the controlled deposition of ceramic-loaded inks, layer by layer, without the need for molds or extensive machining. However, the evolution of DIW has brought forth a critical environmental challenge: the management and disposal of ceramic waste streams generated during production.

The ceramic waste from DIW processes primarily consists of failed prints, support structures, trimming residues, and expired or contaminated ceramic inks. These waste streams contain valuable ceramic materials, organic binders, dispersants, and sometimes toxic additives that pose environmental concerns when disposed of improperly. Historically, ceramic manufacturing has treated waste as an inevitable byproduct with limited recovery options, leading to significant material losses and environmental impact.

Recent technological advancements and growing environmental awareness have shifted focus toward developing sustainable practices within the ceramic industry. The circular economy concept has gained traction, emphasizing the importance of keeping materials in use for as long as possible through recycling and reuse strategies. This paradigm shift is particularly relevant for DIW ceramics, where high-value materials are often utilized.

The primary objective of this technical research is to comprehensively explore viable methods for recycling and reusing DIW ceramic waste streams. This includes investigating techniques for separating ceramic particles from organic components, purifying recovered materials, and reincorporating them into new production cycles without compromising product quality or performance characteristics.

Additionally, this research aims to quantify the potential economic benefits of implementing recycling systems within DIW ceramic manufacturing operations. By establishing closed-loop material flows, manufacturers can potentially reduce raw material costs, minimize waste disposal expenses, and enhance their environmental sustainability profile—factors increasingly valued by consumers and regulatory bodies alike.

Technical challenges to be addressed include maintaining consistent material properties in recycled feedstock, developing energy-efficient separation processes, and ensuring that recycling operations themselves do not generate secondary waste streams of concern. The research will also explore how digital manufacturing technologies might facilitate waste reduction through optimized design and process parameters.

Furthermore, this investigation will examine regulatory frameworks governing ceramic waste management across different regions, identifying compliance requirements and potential incentives for adopting recycling technologies. Understanding these factors is crucial for developing implementable solutions that align with both environmental regulations and business objectives.

Market Analysis for Ceramic Waste Recycling

The global market for ceramic waste recycling is experiencing significant growth driven by increasing environmental regulations, sustainability initiatives, and economic incentives. The ceramic manufacturing industry generates substantial waste, with estimates suggesting that approximately 30% of production becomes waste before reaching consumers. Direct Ink Writing (DIW) ceramic processes, while offering precision manufacturing capabilities, contribute to this waste stream through failed prints, support materials, and post-processing residues.

The ceramic waste recycling market can be segmented into several key application areas: construction materials (utilizing ceramic waste as aggregates in concrete or as raw materials for bricks), abrasives and polishing compounds, refractory materials, and technical ceramics. Among these, the construction sector represents the largest market share due to its ability to absorb large volumes of recycled ceramic materials.

Regional analysis reveals varying market maturity levels. Europe leads in ceramic waste recycling adoption, driven by stringent EU waste management directives and circular economy policies. North America follows with growing implementation rates, while Asia-Pacific represents the fastest-growing market due to rapid industrialization and increasing environmental awareness in countries like China, Japan, and South Korea.

Market dynamics are influenced by several factors. Cost considerations remain paramount, as recycling processes must demonstrate economic viability against virgin material usage. The quality and consistency of recycled ceramic materials significantly impact market acceptance, particularly in high-performance applications. Additionally, regulatory frameworks play a crucial role in market development, with countries implementing extended producer responsibility policies showing accelerated market growth.

Industry stakeholders include ceramic manufacturers, waste management companies, recycling technology providers, and end-users of recycled materials. The competitive landscape features both established waste management corporations expanding into specialized ceramic recycling and innovative startups developing proprietary technologies specifically for DIW ceramic waste streams.

Future market projections indicate continued growth, with compound annual growth rates expected to exceed general waste management market averages. Key growth drivers include technological advancements in recycling processes, increasing landfill costs, and growing consumer preference for products with recycled content. The DIW ceramic waste recycling market specifically shows promise due to the high-value nature of the materials involved and the precision manufacturing context, which creates opportunities for closed-loop recycling systems within production facilities.

Technical Challenges in DIW Ceramic Recycling

Despite significant advancements in Direct Ink Writing (DIW) ceramic manufacturing, the recycling and reuse of waste streams from this process present numerous technical challenges. The primary obstacle lies in the heterogeneous nature of DIW ceramic waste, which often contains a mixture of partially cured materials, support structures, failed prints, and contaminated feedstock. These materials frequently incorporate various additives such as binders, plasticizers, and dispersants that complicate separation and reprocessing efforts.

Material degradation during the initial processing cycle represents another significant challenge. Ceramic particles may undergo structural changes or agglomeration during the DIW process, altering their rheological properties and making them unsuitable for direct reintroduction into the manufacturing stream without extensive reconditioning. The presence of cross-linked polymers in binder systems further complicates recycling, as these materials cannot be easily broken down through conventional methods.

Contamination control presents a persistent technical hurdle in DIW ceramic recycling. Even minute impurities can significantly impact the performance characteristics of high-precision ceramic components, particularly in applications requiring specific electrical, thermal, or mechanical properties. Developing effective purification protocols that can restore waste material to virgin-equivalent quality remains technically challenging and often economically prohibitive.

The energy intensity of ceramic reprocessing constitutes another major barrier. Conventional recycling approaches typically require high-temperature treatments to remove organic components and restore ceramic powder functionality. These energy-intensive processes can offset the environmental benefits of recycling and create economic disincentives for waste stream recovery.

Scale-appropriate technology development represents a critical challenge, particularly for smaller manufacturing operations. While large ceramic producers may justify investment in sophisticated recycling systems, small-to-medium enterprises often lack access to cost-effective recycling solutions scaled to their production volumes. This technological gap impedes industry-wide adoption of circular economy principles in ceramic manufacturing.

Quality assurance and standardization of recycled feedstock remain underdeveloped. The variability in recycled material properties creates significant challenges for process engineers attempting to maintain consistent print quality and final part specifications. Current analytical methods often prove insufficient for rapid, in-line characterization of recycled material suitability for specific applications.

Regulatory frameworks and certification pathways for products containing recycled ceramic materials are also lacking in many sectors, creating market barriers even when technical solutions exist. This regulatory uncertainty discourages investment in advanced recycling technologies and limits potential applications for products containing recycled content.

Current DIW Ceramic Waste Recovery Methods

01 Methods for recycling ceramic waste into construction materials

Various techniques for transforming ceramic waste streams into valuable construction materials. These methods involve processing ceramic waste from demolition, industrial, and waste (DIW) sources to create sustainable building products such as bricks, tiles, and concrete aggregates. The processes typically include crushing, grinding, and incorporating the processed ceramic waste into new construction material formulations, reducing the need for virgin raw materials while addressing waste management challenges.- Methods for recycling ceramic waste into construction materials: Various processes have been developed to recycle ceramic waste streams into useful construction materials. These methods involve crushing, grinding, and processing ceramic waste to create aggregates or fillers that can be incorporated into concrete, mortar, or other building materials. This approach not only reduces waste disposal but also creates value-added products with comparable or enhanced properties compared to conventional materials.

- Ceramic waste transformation into functional products: Ceramic waste can be transformed into various functional products through innovative processing techniques. These include converting waste into ceramic tiles, bricks, or specialized materials with specific properties. The transformation processes often involve heat treatment, pressing, and other manufacturing techniques to create new products that meet industry standards while utilizing waste materials that would otherwise be discarded.

- Systems for collection and processing of ceramic waste: Comprehensive systems have been developed for the efficient collection, sorting, and processing of ceramic waste streams. These systems include specialized equipment and methodologies for handling different types of ceramic waste, from industrial production scraps to demolition waste. The systems often incorporate automated sorting technologies, crushing equipment, and logistics solutions to optimize the recycling process and ensure consistent quality of the recovered materials.

- Chemical and thermal treatment methods for ceramic waste recovery: Advanced chemical and thermal treatment methods have been developed to recover valuable components from ceramic waste streams. These processes include chemical leaching, thermal decomposition, and other techniques that enable the extraction of valuable minerals, metals, or compounds from ceramic waste. The recovered materials can then be reused in the production of new ceramics or other industrial applications, creating a circular economy approach.

- Environmental impact reduction through ceramic waste reuse: Various approaches focus specifically on reducing the environmental impact of ceramic waste through innovative reuse strategies. These include incorporating ceramic waste into environmental remediation projects, using it as a substitute for natural resources in various applications, and developing closed-loop manufacturing systems. These methods not only divert waste from landfills but also reduce the need for raw material extraction, lowering the overall environmental footprint of ceramic production and use.

02 Ceramic waste conversion into geopolymers and cementitious materials

Innovative approaches for converting ceramic waste into geopolymers and alternative cementitious materials. These processes utilize the pozzolanic properties of ceramic waste to create sustainable binding agents that can partially or fully replace traditional Portland cement. The methods typically involve alkaline activation of finely ground ceramic waste, resulting in materials with comparable or superior performance characteristics while significantly reducing the carbon footprint associated with cement production.Expand Specific Solutions03 Systems for automated sorting and processing of ceramic waste

Advanced technological systems for the automated sorting, classification, and processing of ceramic waste streams. These systems employ sensors, artificial intelligence, and mechanical separation techniques to efficiently sort mixed waste streams, identifying and segregating ceramic materials for appropriate recycling pathways. The automation increases processing efficiency, improves the quality of recovered materials, and enhances the economic viability of ceramic waste recycling operations.Expand Specific Solutions04 Thermal and chemical treatment methods for ceramic waste recovery

Specialized thermal and chemical treatment processes designed specifically for ceramic waste recovery and reuse. These methods include high-temperature treatments, chemical activation, and novel extraction techniques to recover valuable components from ceramic waste streams. The processes enable the recovery of rare earth elements, metals, and other valuable materials embedded in ceramic waste, while also preparing the remaining materials for reuse in various applications.Expand Specific Solutions05 Circular economy approaches for ceramic industry waste management

Comprehensive circular economy frameworks and business models for managing ceramic waste streams. These approaches integrate waste prevention, collection, processing, and reuse strategies throughout the ceramic product lifecycle. The systems include industrial symbiosis networks where one industry's ceramic waste becomes another's raw material, closed-loop manufacturing processes, and innovative product designs that facilitate eventual recycling and reuse of ceramic components.Expand Specific Solutions

Key Industry Players in Ceramic Recycling

The ceramic waste recycling and reuse market is currently in a growth phase, with increasing environmental regulations driving adoption across manufacturing sectors. The global market for ceramic waste recycling is estimated at $3.5-4 billion, expanding at approximately 6-8% annually as sustainability initiatives gain momentum. Technologically, the field shows varying maturity levels, with companies like Eastman Chemical and SABIC Global Technologies leading in advanced chemical recycling processes, while ceramic specialists such as New Pearl Group, Guangdong Brunei Taoci, and Hubei Xingcheng Building Ceramic focus on direct reuse applications. Waste management innovators like Milgro Groep and AVANTech are developing specialized separation technologies, while research institutions including Pondicherry University collaborate with manufacturers to improve recycling efficiency. The industry is witnessing increased cross-sector partnerships as companies seek to establish circular economy solutions for DIW ceramic waste streams.

Hubei Xingcheng Building Ceramic Co. Ltd.

Ceramatec, Inc.

Innovative Recycling Technologies Analysis

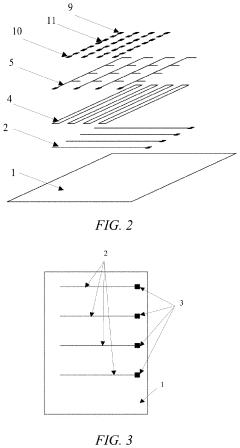

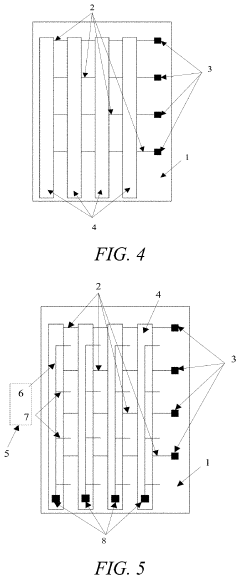

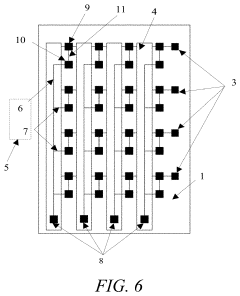

- A direct-ink-writing method is employed to print strain gauge array circuits using insulating strips, where a first insulating layer is formed, followed by parallel silver lines, then insulating strips perpendicular to these lines, and finally a second circuit layer with branches, all while ensuring the functional layer does not contact the insulating strips, with specific parameters for paste preparation and printing.

Environmental Impact Assessment

The environmental impact assessment of DIW (Direct Ink Writing) ceramic waste streams reveals significant ecological implications across multiple dimensions. The manufacturing process of ceramic components through DIW technology generates substantial waste materials, including rejected prints, support structures, and expired inks, which traditionally end up in landfills, contributing to environmental degradation.

Primary analysis indicates that ceramic waste from DIW processes contains various potentially harmful substances, including heavy metals, organic binders, and dispersants that can leach into soil and groundwater systems when improperly disposed of. The environmental footprint extends beyond waste disposal to include the energy-intensive nature of ceramic production, with high-temperature sintering processes contributing significantly to carbon emissions.

Water consumption represents another critical environmental concern, as ceramic processing typically requires substantial amounts of water for material preparation and cleaning operations. Without proper recycling systems, this leads to increased pressure on local water resources and potential contamination through wastewater discharge containing ceramic particles and chemical additives.

Life cycle assessment studies demonstrate that implementing comprehensive recycling and reuse strategies for DIW ceramic waste can reduce environmental impact by up to 40-60% compared to conventional disposal methods. These benefits manifest primarily through reduced raw material extraction, decreased energy consumption, and minimized landfill utilization.

The assessment also highlights the positive impact of closed-loop manufacturing systems, where ceramic waste is reprocessed into new feedstock. Such systems have demonstrated potential to reduce virgin material requirements by 30-45%, depending on the specific ceramic composition and application requirements. This circular approach significantly reduces the ecological burden associated with mining and processing raw ceramic materials.

Air quality considerations reveal that traditional ceramic waste disposal methods can contribute to particulate matter emissions, especially when waste materials are crushed or processed without proper containment systems. Recycling processes must therefore incorporate appropriate filtration and dust collection technologies to prevent secondary environmental contamination.

Regulatory compliance analysis shows increasing global pressure toward sustainable waste management practices, with several jurisdictions implementing extended producer responsibility frameworks that will likely impact ceramic manufacturing operations in the near future. Companies implementing proactive waste recycling strategies may gain competitive advantages through regulatory compliance positioning and enhanced sustainability credentials.

Economic Viability of Recycling Systems

The economic viability of recycling systems for DIW (Direct Ink Writing) ceramic waste streams represents a critical factor in determining the feasibility of implementing sustainable practices in ceramic manufacturing. Initial cost-benefit analyses indicate that establishing recycling infrastructure requires significant capital investment, ranging from $50,000 to $500,000 depending on the scale and sophistication of the operation. However, these systems typically demonstrate positive return on investment within 2-4 years when properly implemented.

Material recovery economics show promising results, with recycled ceramic materials potentially reducing raw material costs by 15-30%. This is particularly significant considering that material costs can represent up to 40% of total production expenses in ceramic manufacturing. The economic equation becomes more favorable as virgin material prices increase due to resource scarcity and environmental regulations.

Operational cost considerations reveal that energy consumption for processing recycled ceramic waste is approximately 20-40% lower than that required for processing virgin materials. Labor costs associated with waste sorting and processing can be offset by automation technologies, though these require additional upfront investment. Maintenance costs for recycling equipment typically range from 5-10% of the initial capital expenditure annually.

Market dynamics for recycled ceramic materials have evolved significantly, with premium pricing emerging for products containing recycled content. This market-driven incentive enhances the economic case for recycling systems. Additionally, waste disposal cost avoidance represents a substantial economic benefit, with landfill tipping fees for industrial waste ranging from $50 to $200 per ton in developed economies, and increasing at rates of 3-8% annually in many regions.

Regulatory economics play an increasingly important role, with extended producer responsibility (EPR) schemes and waste taxes creating financial incentives for recycling. Companies implementing effective recycling systems can avoid compliance costs and potential penalties, which can range from thousands to millions of dollars depending on jurisdiction and violation severity.

Scale economics demonstrate that larger recycling operations typically achieve better economic performance through economies of scale. Collaborative industry approaches, such as centralized recycling facilities serving multiple manufacturers, can distribute capital costs while maximizing throughput. Economic modeling suggests that facilities processing at least 500 tons of ceramic waste annually typically achieve optimal economic efficiency.

Long-term economic projections indicate that recycling systems become increasingly viable as technology advances reduce processing costs and as regulatory pressures on virgin material extraction intensify. Sensitivity analyses suggest that even with fluctuations in material prices, the economic case for recycling remains robust when considering the full spectrum of benefits, including brand value enhancement and corporate sustainability performance.