Regulatory Framework for Bio-based Polymer in EU Market

OCT 21, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Bio-based Polymer Regulatory Evolution and Objectives

Bio-based polymers have emerged as a sustainable alternative to conventional petroleum-based plastics, gaining significant attention in the European Union over the past three decades. The regulatory landscape governing these materials has evolved considerably, reflecting the EU's increasing commitment to sustainability, circular economy principles, and reduction of environmental impacts from plastics.

The initial regulatory framework for bio-based polymers in the EU began taking shape in the early 1990s, primarily focusing on waste management rather than material composition. The 1994 Packaging and Packaging Waste Directive (94/62/EC) marked one of the first significant steps, establishing recovery and recycling targets without specific provisions for bio-based materials.

A paradigm shift occurred in the early 2000s with the introduction of the EU's first Bioeconomy Strategy in 2002, which recognized the potential of bio-based products to contribute to sustainable development. This was followed by the REACH Regulation (EC 1907/2006), which, while not specifically targeting bio-based polymers, established comprehensive chemical safety requirements applicable to all materials, including novel bio-based alternatives.

The 2015 Circular Economy Action Plan represented a crucial milestone, explicitly promoting bio-based materials as part of the solution to plastic waste challenges. This was reinforced by the 2018 European Strategy for Plastics in a Circular Economy, which specifically acknowledged the role of bio-based plastics in reducing dependency on fossil resources and potentially offering biodegradability benefits.

Most recently, the European Green Deal (2019) and the new Circular Economy Action Plan (2020) have further elevated the importance of bio-based materials in achieving climate neutrality and resource efficiency. The Single-Use Plastics Directive (EU 2019/904) has created additional momentum by restricting certain conventional plastic products, thereby opening market opportunities for sustainable alternatives.

The current regulatory objectives for bio-based polymers in the EU market are multifaceted. Primary goals include establishing clear definitions and standards for bio-based content measurement (such as EN 16785-1:2015), ensuring environmental performance through life cycle assessment requirements, and developing harmonized end-of-life management protocols, particularly for biodegradable and compostable variants.

Additionally, the EU aims to create market incentives for bio-based products through green public procurement policies and eco-design requirements. The forthcoming Sustainable Products Initiative is expected to further strengthen these objectives by potentially introducing mandatory sustainability criteria for products placed on the EU market, including minimum bio-based content requirements for certain applications.

The initial regulatory framework for bio-based polymers in the EU began taking shape in the early 1990s, primarily focusing on waste management rather than material composition. The 1994 Packaging and Packaging Waste Directive (94/62/EC) marked one of the first significant steps, establishing recovery and recycling targets without specific provisions for bio-based materials.

A paradigm shift occurred in the early 2000s with the introduction of the EU's first Bioeconomy Strategy in 2002, which recognized the potential of bio-based products to contribute to sustainable development. This was followed by the REACH Regulation (EC 1907/2006), which, while not specifically targeting bio-based polymers, established comprehensive chemical safety requirements applicable to all materials, including novel bio-based alternatives.

The 2015 Circular Economy Action Plan represented a crucial milestone, explicitly promoting bio-based materials as part of the solution to plastic waste challenges. This was reinforced by the 2018 European Strategy for Plastics in a Circular Economy, which specifically acknowledged the role of bio-based plastics in reducing dependency on fossil resources and potentially offering biodegradability benefits.

Most recently, the European Green Deal (2019) and the new Circular Economy Action Plan (2020) have further elevated the importance of bio-based materials in achieving climate neutrality and resource efficiency. The Single-Use Plastics Directive (EU 2019/904) has created additional momentum by restricting certain conventional plastic products, thereby opening market opportunities for sustainable alternatives.

The current regulatory objectives for bio-based polymers in the EU market are multifaceted. Primary goals include establishing clear definitions and standards for bio-based content measurement (such as EN 16785-1:2015), ensuring environmental performance through life cycle assessment requirements, and developing harmonized end-of-life management protocols, particularly for biodegradable and compostable variants.

Additionally, the EU aims to create market incentives for bio-based products through green public procurement policies and eco-design requirements. The forthcoming Sustainable Products Initiative is expected to further strengthen these objectives by potentially introducing mandatory sustainability criteria for products placed on the EU market, including minimum bio-based content requirements for certain applications.

EU Market Demand Analysis for Bio-based Polymers

The European Union market for bio-based polymers has demonstrated significant growth in recent years, driven by increasing environmental awareness and regulatory pressures. Current market analysis indicates that the EU bio-based polymer market reached approximately 2.4 million tonnes in 2022, representing about 4.5% of the total polymer market in the region. This segment has been growing at a compound annual growth rate of 8-10% over the past five years, outpacing conventional petroleum-based polymers.

Consumer demand for sustainable packaging solutions has emerged as a primary market driver, particularly in food and beverage, cosmetics, and personal care sectors. Research shows that 67% of European consumers now consider environmental impact when making purchasing decisions, with 42% willing to pay premium prices for products with sustainable packaging. This shift in consumer behavior has prompted major brands to commit to incorporating bio-based materials into their packaging strategies.

The industrial sector represents another significant demand segment, with automotive manufacturers increasingly adopting bio-based polymers for interior components to meet sustainability targets and comply with end-of-life vehicle regulations. The construction industry has also begun integrating these materials into insulation, flooring, and structural components, driven by green building certifications and energy efficiency requirements.

Regional analysis reveals varying adoption rates across EU member states. Northern European countries, particularly Germany, France, and the Nordic region, demonstrate the highest per capita consumption of bio-based polymers, correlating with stronger environmental policies and consumer awareness. Southern and Eastern European markets show accelerating growth rates as regulatory alignment progresses throughout the EU.

Market forecasts project continued strong growth, with the EU bio-based polymer market expected to double in volume by 2030. This expansion will be supported by the European Green Deal initiatives and circular economy action plans that specifically target plastic waste reduction and sustainable material adoption.

Price sensitivity remains a challenge, as bio-based alternatives typically command a 15-30% premium over conventional polymers. However, this price gap has been narrowing due to economies of scale, technological improvements, and increasing costs for petroleum-based alternatives through carbon pricing mechanisms. Industry analysts predict price parity for several key bio-based polymer categories by 2028, which would significantly accelerate market penetration.

Supply chain considerations are increasingly influencing market dynamics, with European brands prioritizing regionally-sourced bio-based materials to reduce carbon footprints and enhance supply chain resilience. This trend has stimulated investment in European bio-refineries and processing facilities, creating a more robust regional supply ecosystem.

Consumer demand for sustainable packaging solutions has emerged as a primary market driver, particularly in food and beverage, cosmetics, and personal care sectors. Research shows that 67% of European consumers now consider environmental impact when making purchasing decisions, with 42% willing to pay premium prices for products with sustainable packaging. This shift in consumer behavior has prompted major brands to commit to incorporating bio-based materials into their packaging strategies.

The industrial sector represents another significant demand segment, with automotive manufacturers increasingly adopting bio-based polymers for interior components to meet sustainability targets and comply with end-of-life vehicle regulations. The construction industry has also begun integrating these materials into insulation, flooring, and structural components, driven by green building certifications and energy efficiency requirements.

Regional analysis reveals varying adoption rates across EU member states. Northern European countries, particularly Germany, France, and the Nordic region, demonstrate the highest per capita consumption of bio-based polymers, correlating with stronger environmental policies and consumer awareness. Southern and Eastern European markets show accelerating growth rates as regulatory alignment progresses throughout the EU.

Market forecasts project continued strong growth, with the EU bio-based polymer market expected to double in volume by 2030. This expansion will be supported by the European Green Deal initiatives and circular economy action plans that specifically target plastic waste reduction and sustainable material adoption.

Price sensitivity remains a challenge, as bio-based alternatives typically command a 15-30% premium over conventional polymers. However, this price gap has been narrowing due to economies of scale, technological improvements, and increasing costs for petroleum-based alternatives through carbon pricing mechanisms. Industry analysts predict price parity for several key bio-based polymer categories by 2028, which would significantly accelerate market penetration.

Supply chain considerations are increasingly influencing market dynamics, with European brands prioritizing regionally-sourced bio-based materials to reduce carbon footprints and enhance supply chain resilience. This trend has stimulated investment in European bio-refineries and processing facilities, creating a more robust regional supply ecosystem.

Current Regulatory Landscape and Compliance Challenges

The European Union has established one of the most comprehensive regulatory frameworks for bio-based polymers globally, creating a complex landscape that manufacturers must navigate. The cornerstone of this framework is the European Green Deal, which aims to make Europe climate-neutral by 2050 and has significant implications for materials production and waste management. Within this broader context, several specific regulations directly impact bio-based polymers.

The EU Plastics Strategy, adopted in 2018, explicitly promotes the development and use of sustainable bio-based feedstocks for polymer production while establishing targets for plastic recycling and reduction of single-use plastics. This is complemented by Directive (EU) 2019/904 on Single-Use Plastics, which mandates the reduction of certain plastic products and promotes alternatives, creating market opportunities for bio-based polymers.

REACH (Registration, Evaluation, Authorization and Restriction of Chemicals) regulation presents significant compliance challenges for bio-based polymer manufacturers. Despite their potentially lower environmental impact, these materials must undergo the same rigorous safety assessments as conventional polymers, requiring extensive data on toxicological and ecotoxicological properties.

The EU's Circular Economy Action Plan further influences the regulatory landscape by emphasizing product durability, reusability, and recyclability. This creates a dual challenge for bio-based polymer producers: demonstrating both biodegradability and recyclability where appropriate, with clear end-of-life pathways.

Certification and labeling requirements represent another compliance hurdle. The EU has established standards such as EN 13432 for compostable packaging and EN 17228 for bio-based polymers. However, the proliferation of certification schemes across member states creates market fragmentation and increases compliance costs, particularly for SMEs.

Waste management regulations, including the Waste Framework Directive (2008/98/EC) and Packaging and Packaging Waste Directive (94/62/EC), impose additional requirements regarding collection, sorting, and processing of bio-based polymers. The classification of these materials within waste hierarchies remains inconsistent across member states, creating operational challenges.

Food contact applications face particularly stringent regulations under Framework Regulation (EC) No 1935/2004 and Plastics Regulation (EU) No 10/2011, requiring extensive migration testing and safety assessments before market approval. For bio-based polymers, demonstrating equivalent safety profiles to conventional materials while highlighting sustainability benefits creates a complex regulatory balancing act.

The evolving nature of EU regulations presents perhaps the greatest compliance challenge. The European Chemicals Strategy for Sustainability and ongoing revisions to waste legislation signal continued regulatory development, requiring manufacturers to maintain vigilance and adaptability in their compliance strategies.

The EU Plastics Strategy, adopted in 2018, explicitly promotes the development and use of sustainable bio-based feedstocks for polymer production while establishing targets for plastic recycling and reduction of single-use plastics. This is complemented by Directive (EU) 2019/904 on Single-Use Plastics, which mandates the reduction of certain plastic products and promotes alternatives, creating market opportunities for bio-based polymers.

REACH (Registration, Evaluation, Authorization and Restriction of Chemicals) regulation presents significant compliance challenges for bio-based polymer manufacturers. Despite their potentially lower environmental impact, these materials must undergo the same rigorous safety assessments as conventional polymers, requiring extensive data on toxicological and ecotoxicological properties.

The EU's Circular Economy Action Plan further influences the regulatory landscape by emphasizing product durability, reusability, and recyclability. This creates a dual challenge for bio-based polymer producers: demonstrating both biodegradability and recyclability where appropriate, with clear end-of-life pathways.

Certification and labeling requirements represent another compliance hurdle. The EU has established standards such as EN 13432 for compostable packaging and EN 17228 for bio-based polymers. However, the proliferation of certification schemes across member states creates market fragmentation and increases compliance costs, particularly for SMEs.

Waste management regulations, including the Waste Framework Directive (2008/98/EC) and Packaging and Packaging Waste Directive (94/62/EC), impose additional requirements regarding collection, sorting, and processing of bio-based polymers. The classification of these materials within waste hierarchies remains inconsistent across member states, creating operational challenges.

Food contact applications face particularly stringent regulations under Framework Regulation (EC) No 1935/2004 and Plastics Regulation (EU) No 10/2011, requiring extensive migration testing and safety assessments before market approval. For bio-based polymers, demonstrating equivalent safety profiles to conventional materials while highlighting sustainability benefits creates a complex regulatory balancing act.

The evolving nature of EU regulations presents perhaps the greatest compliance challenge. The European Chemicals Strategy for Sustainability and ongoing revisions to waste legislation signal continued regulatory development, requiring manufacturers to maintain vigilance and adaptability in their compliance strategies.

Current Compliance Strategies and Certification Pathways

01 Bio-based polymers from renewable resources

Bio-based polymers derived from renewable resources such as plant oils, cellulose, and other biomass sources offer sustainable alternatives to petroleum-based polymers. These polymers can be synthesized through various processes including polymerization of bio-monomers, modification of natural polymers, or microbial fermentation. They provide environmental benefits through reduced carbon footprint and biodegradability while maintaining comparable performance characteristics to conventional polymers.- Bio-based polymer production methods: Various methods for producing bio-based polymers from renewable resources, including fermentation processes, chemical modifications of natural polymers, and enzymatic polymerization. These methods focus on converting biomass or bio-derived monomers into polymers with properties comparable to petroleum-based alternatives while reducing environmental impact and carbon footprint.

- Biodegradable polymer compositions: Formulations of biodegradable polymers derived from renewable resources that offer enhanced degradability in various environments. These compositions typically include bio-based polymers blended with additives to improve their mechanical properties, processing characteristics, and degradation rates, making them suitable for applications where end-of-life disposal is a concern.

- Bio-based polymer applications in packaging: Implementation of bio-based polymers in packaging materials to replace conventional plastics. These applications focus on developing films, containers, and other packaging solutions that maintain required barrier properties, mechanical strength, and shelf life while being derived from renewable resources and potentially offering improved end-of-life options.

- Bio-based polymer composites: Development of composite materials incorporating bio-based polymers with natural fibers or other reinforcing agents. These composites aim to achieve enhanced mechanical properties, thermal stability, and durability while maintaining the environmental benefits of bio-based materials, making them suitable for applications in automotive, construction, and consumer goods.

- Modified bio-based polymers with enhanced properties: Chemical or physical modification of bio-based polymers to enhance specific properties such as water resistance, thermal stability, mechanical strength, or processability. These modifications address the limitations of unmodified bio-based polymers while maintaining their renewable nature, enabling their use in more demanding applications that would otherwise require petroleum-based materials.

02 Biodegradable polymer composites and blends

Biodegradable polymer composites and blends combine bio-based polymers with other materials to enhance specific properties such as mechanical strength, thermal stability, or processing characteristics. These composites often incorporate natural fibers, nanoparticles, or other bio-based polymers to create materials with tailored properties for specific applications. The resulting materials maintain biodegradability while offering improved performance compared to single-component bio-polymers.Expand Specific Solutions03 Processing technologies for bio-based polymers

Specialized processing technologies have been developed to address the unique characteristics of bio-based polymers. These include modified extrusion techniques, specialized molding processes, and novel curing methods that accommodate the thermal sensitivity and processing requirements of bio-polymers. These technologies enable the efficient production of bio-based polymer products with consistent quality and properties, facilitating their adoption in various industrial applications.Expand Specific Solutions04 Bio-based polymers for medical and pharmaceutical applications

Bio-based polymers offer unique advantages for medical and pharmaceutical applications due to their biocompatibility, controlled degradation profiles, and potential for drug delivery. These polymers can be formulated into various forms including films, scaffolds, microspheres, and hydrogels for applications such as tissue engineering, wound healing, and controlled drug release. Their natural origin often results in reduced immunogenicity and improved integration with biological systems.Expand Specific Solutions05 Functionalized bio-based polymers with enhanced properties

Chemical modification and functionalization of bio-based polymers can significantly enhance their properties and expand their application range. Techniques such as grafting, crosslinking, and introduction of functional groups can improve properties like water resistance, thermal stability, mechanical strength, and compatibility with other materials. These modifications enable bio-based polymers to meet performance requirements for demanding applications while maintaining their environmental benefits.Expand Specific Solutions

Key Stakeholders in EU Bio-polymer Regulatory Framework

The EU regulatory framework for bio-based polymers is evolving within a growing market currently in its early growth phase. The bio-based polymer sector is expected to expand significantly, driven by the EU's sustainability goals and circular economy initiatives, though it represents less than 1% of global plastic production. Technical maturity varies considerably across players: established chemical companies like Eastman Chemical, Clariant, and Evonik have advanced commercial-scale production capabilities, while specialized bio-polymer innovators such as Novamont, BIOTEC, and Algenesis are driving material innovation. Research institutions including University of Aveiro and CSIR are developing next-generation solutions. The regulatory landscape is becoming more structured with the implementation of standards for biodegradability, compostability, and bio-content verification, though harmonization challenges remain across member states.

BIOTEC Biologische Naturverpackungen GmbH & Co. KG

Technical Solution: BIOTEC has pioneered BIOPLAST®, a family of starch-based biopolymers specifically designed to meet EU regulatory requirements for biodegradability and compostability. Their technology transforms renewable agricultural resources into biopolymers that comply with EN 13432 standards, a key requirement under EU regulations. BIOTEC's approach includes developing customized formulations that address specific application needs while maintaining regulatory compliance across the EU market. The company has established a comprehensive certification program ensuring their products meet the requirements of the EU's bioplastics regulatory framework, including home and industrial compostability certifications. BIOTEC actively collaborates with European research institutions and participates in EU-funded projects to advance biopolymer technology and contribute to regulatory development. Their products align with the EU's Single-Use Plastics Directive and support the transition away from conventional plastics as outlined in the European Strategy for Plastics in a Circular Economy.

Strengths: Specialized focus on biodegradable and compostable materials; established presence in European markets; strong technical expertise in starch-based polymers. Weaknesses: Limited scale compared to conventional polymer producers; performance limitations in certain applications requiring high heat or moisture resistance; potential vulnerability to changes in EU composting infrastructure policies.

Clariant International AG

Technical Solution: Clariant has developed a comprehensive approach to bio-based polymers through its EcoTain® portfolio, which includes additives, masterbatches, and processing aids specifically designed for biopolymers. Their technology focuses on enhancing the performance and processability of bio-based polymers to meet EU regulatory requirements while maintaining functionality. Clariant's additives are designed to work with various biopolymers including PLA, PHA, and starch-based materials, enabling these materials to meet the performance standards required by EU regulations. The company has invested in developing additives that maintain the biodegradability and compostability of the base biopolymers, ensuring compliance with EN 13432 and other relevant EU standards. Clariant actively participates in EU-funded research projects aimed at advancing bio-based polymer technology and establishing appropriate regulatory frameworks. Their solutions support the EU's Bioeconomy Strategy and contribute to the goals outlined in the European Green Deal by enabling the transition from fossil-based to bio-based materials.

Strengths: Extensive expertise in polymer additives; global reach with strong European presence; comprehensive understanding of EU regulatory landscape for chemicals and materials. Weaknesses: Dependent on biopolymer producers' market success; complex regulatory compliance requirements for additives in food contact applications; potential for regulatory changes affecting additive approvals.

Critical EU Directives and Standards for Bio-polymers

Citric acid-modified polypropylene glycols

PatentActiveUS20240174940A1

Innovation

- Citric acid-modified polypropylene glycols, represented by a specific chemical formula, are used as emulsifying agents, which can be easily prepared through condensation reactions with polypropylene glycols and additional alcohol components, providing versatile applications as additives in cooling lubricants and cosmetic products.

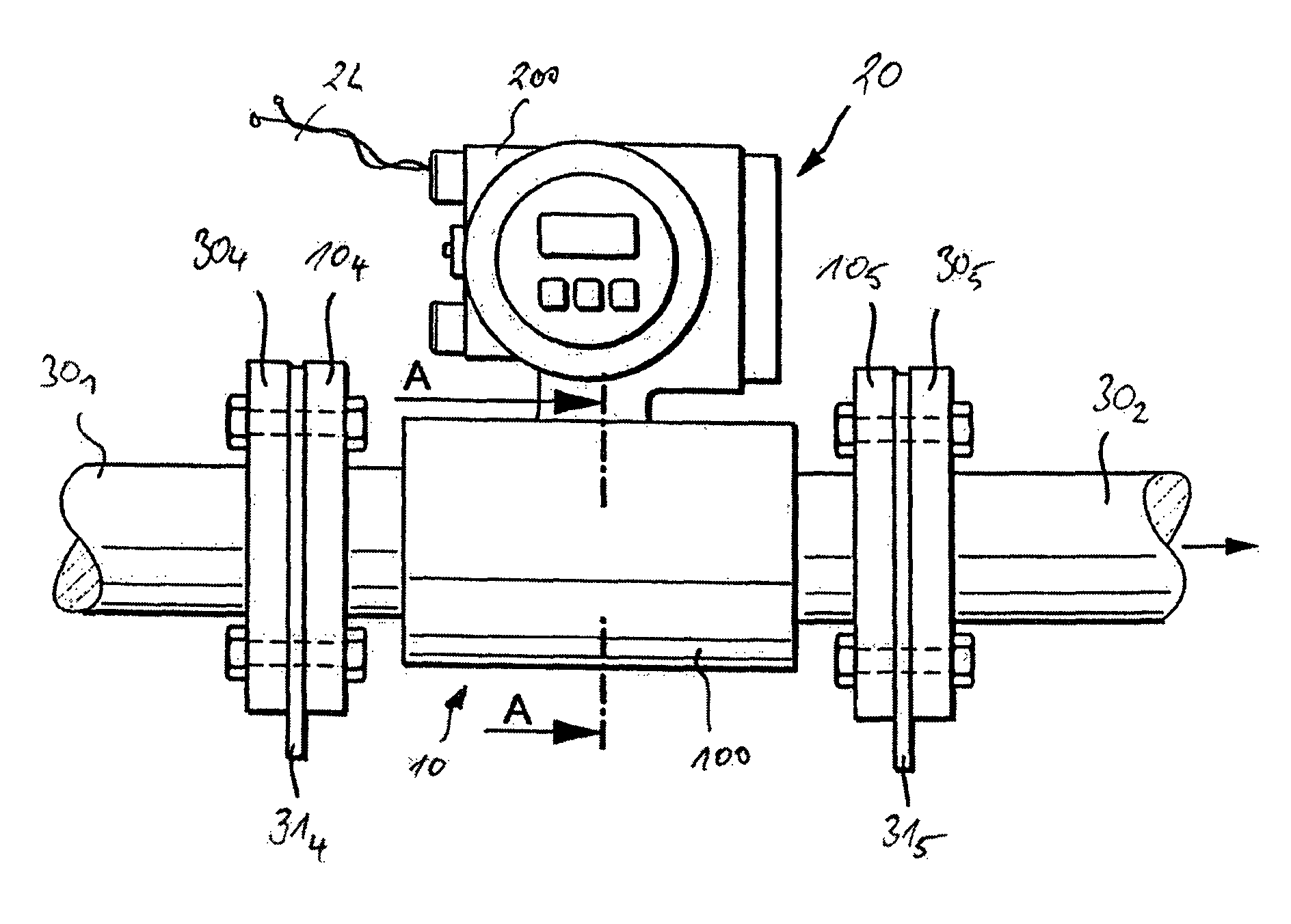

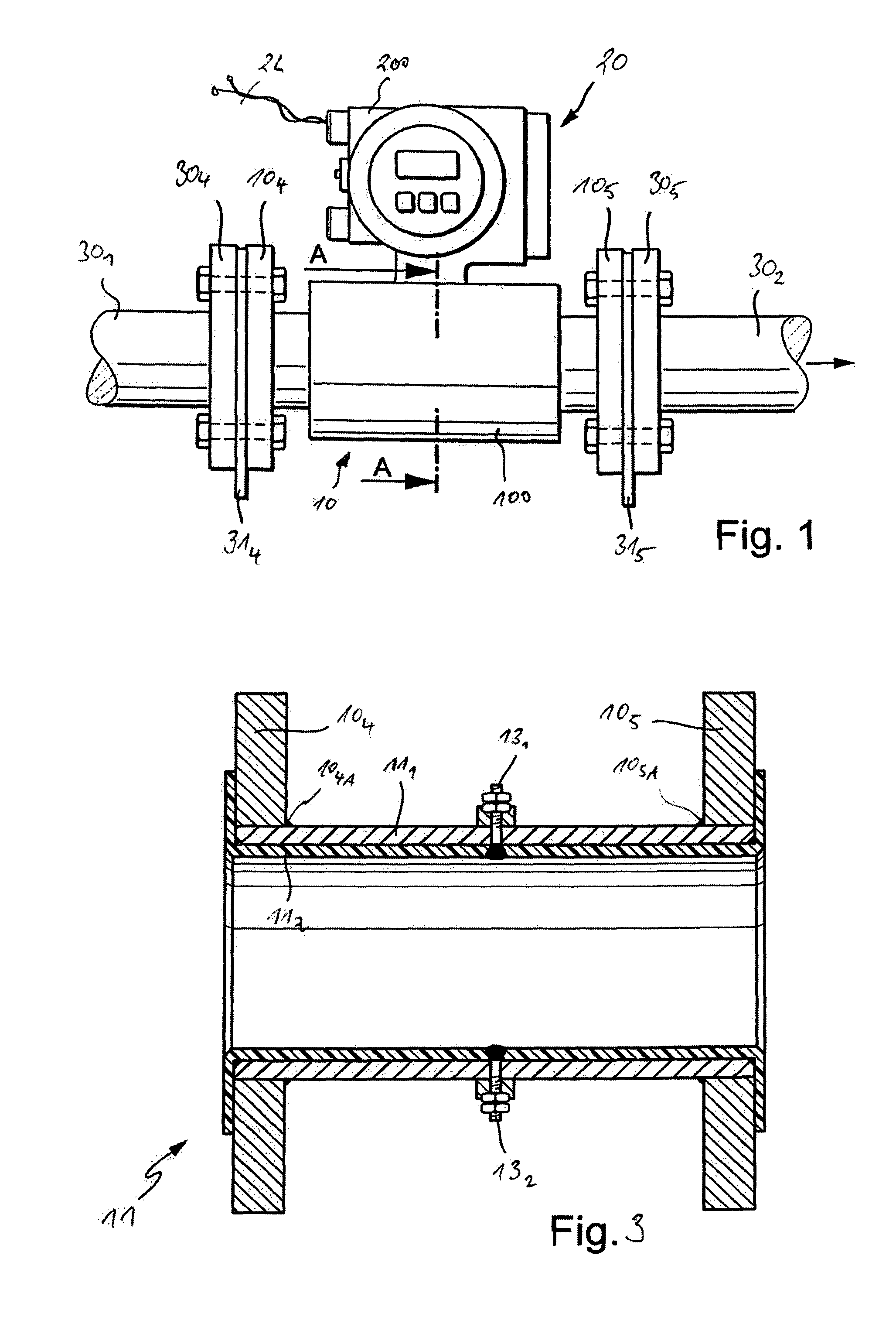

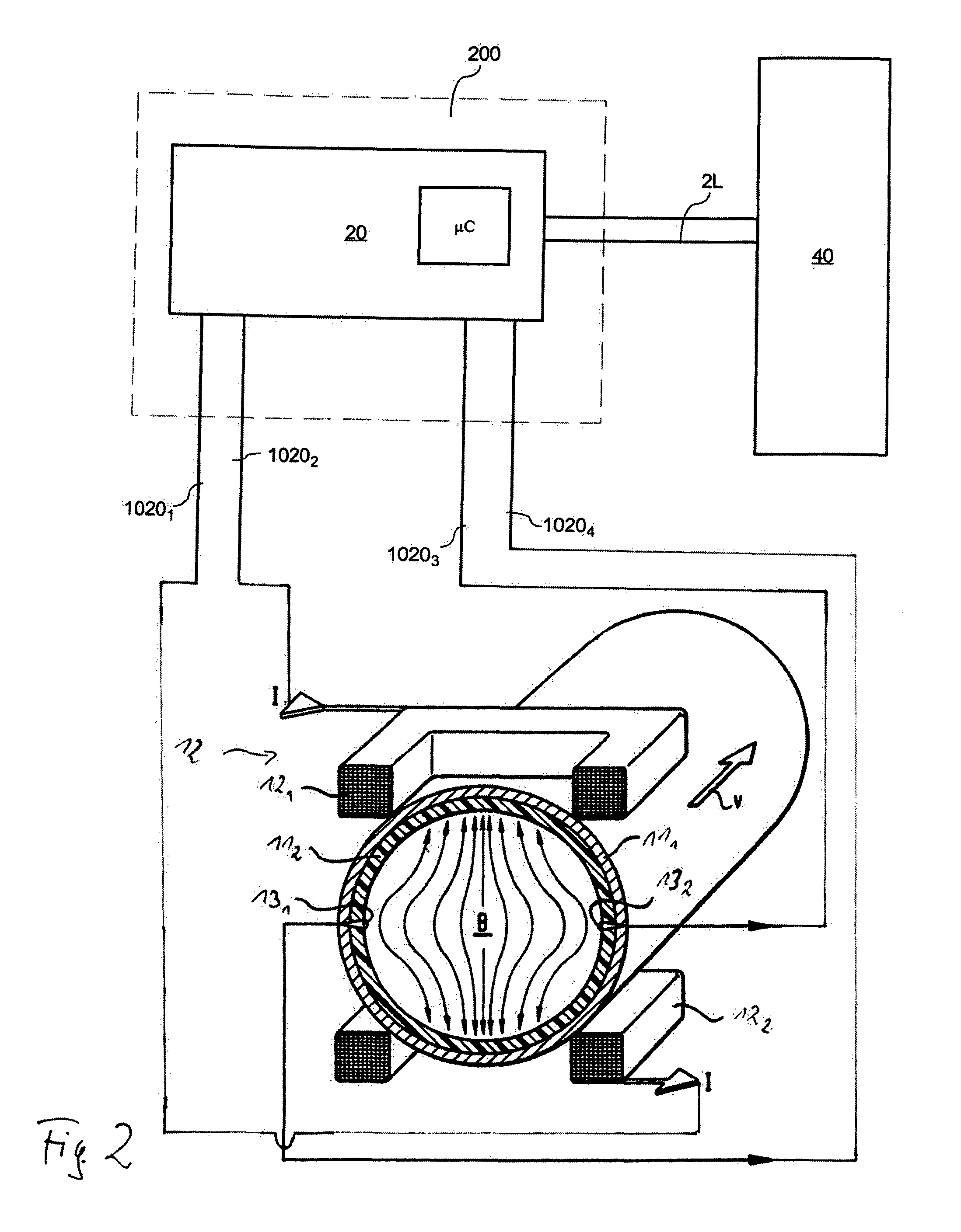

Measuring device

PatentActiveUS7845238B2

Innovation

- The use of biologically degradable synthetic materials (BDM) for at least partially constructing the measuring device components, including the measuring tube and transducer, which can be composted or decomposed by microorganisms, meeting standards such as EN 13432:2000 and ASTM D6400, allowing for easier disposal and recycling.

Environmental Impact Assessment Requirements

The Environmental Impact Assessment (EIA) requirements for bio-based polymers in the EU market represent a critical component of the regulatory framework governing these sustainable materials. Under Directive 2014/52/EU, manufacturers must conduct comprehensive assessments that evaluate the entire lifecycle environmental footprint of bio-based polymer products. These assessments typically include analysis of greenhouse gas emissions, land use impacts, water consumption, biodiversity effects, and potential pollution risks throughout the production, use, and disposal phases.

The EU has established specific methodologies for conducting these assessments, including the Product Environmental Footprint (PEF) and Organisation Environmental Footprint (OEF) approaches, which provide standardized methods for quantifying environmental impacts. For bio-based polymers specifically, these assessments must address unique considerations such as agricultural practices used in feedstock production, chemical processing methods, and end-of-life management options.

Recent regulatory developments have strengthened these requirements, with the European Green Deal and Circular Economy Action Plan emphasizing the need for robust environmental impact data to support claims of sustainability. The EU Taxonomy Regulation further establishes technical screening criteria that determine whether economic activities, including bio-based polymer production, can be classified as environmentally sustainable.

Compliance with these requirements necessitates extensive documentation and third-party verification. Manufacturers must maintain detailed records of raw material sourcing, production processes, and disposal instructions. The EU Ecolabel and other certification schemes often incorporate these EIA findings as part of their evaluation criteria, creating additional market incentives for thorough environmental assessment.

For market entry, companies must submit their EIA documentation to relevant national authorities, who evaluate compliance with both EU-wide standards and any additional country-specific requirements. This process typically involves stakeholder consultation periods during which environmental organizations, community representatives, and other interested parties may provide input on the assessment findings.

The financial implications of these requirements are significant, with EIA costs typically ranging from €50,000 to €200,000 depending on product complexity and scale. However, these investments often yield long-term benefits through improved resource efficiency, enhanced brand reputation, and access to green procurement opportunities within the EU market.

The EU has established specific methodologies for conducting these assessments, including the Product Environmental Footprint (PEF) and Organisation Environmental Footprint (OEF) approaches, which provide standardized methods for quantifying environmental impacts. For bio-based polymers specifically, these assessments must address unique considerations such as agricultural practices used in feedstock production, chemical processing methods, and end-of-life management options.

Recent regulatory developments have strengthened these requirements, with the European Green Deal and Circular Economy Action Plan emphasizing the need for robust environmental impact data to support claims of sustainability. The EU Taxonomy Regulation further establishes technical screening criteria that determine whether economic activities, including bio-based polymer production, can be classified as environmentally sustainable.

Compliance with these requirements necessitates extensive documentation and third-party verification. Manufacturers must maintain detailed records of raw material sourcing, production processes, and disposal instructions. The EU Ecolabel and other certification schemes often incorporate these EIA findings as part of their evaluation criteria, creating additional market incentives for thorough environmental assessment.

For market entry, companies must submit their EIA documentation to relevant national authorities, who evaluate compliance with both EU-wide standards and any additional country-specific requirements. This process typically involves stakeholder consultation periods during which environmental organizations, community representatives, and other interested parties may provide input on the assessment findings.

The financial implications of these requirements are significant, with EIA costs typically ranging from €50,000 to €200,000 depending on product complexity and scale. However, these investments often yield long-term benefits through improved resource efficiency, enhanced brand reputation, and access to green procurement opportunities within the EU market.

Cross-border Trade Implications and Harmonization

The European Union's regulatory framework for bio-based polymers significantly impacts cross-border trade both within the EU and with external partners. The harmonization of standards across member states creates a unified market approach, yet introduces complexities for international trade partners who must navigate these collective requirements. Currently, bio-based polymer products entering the EU market must comply with regulations such as the Registration, Evaluation, Authorization and Restriction of Chemicals (REACH), the Packaging and Packaging Waste Directive, and emerging circular economy legislation.

These regulatory frameworks create both barriers and opportunities for cross-border trade. On one hand, stringent EU requirements for sustainability documentation, lifecycle assessment, and biodegradability verification increase compliance costs for non-EU manufacturers. On the other hand, the harmonized approach reduces the need to meet 27 different national standards, creating efficiency for companies that successfully navigate the regulatory landscape.

The EU's leadership in sustainable materials regulation has created a "Brussels Effect," whereby EU standards increasingly influence global practices. Countries including Japan, South Korea, and Canada have developed regulatory frameworks that align with EU approaches to facilitate smoother trade relations. This regulatory convergence is gradually creating a more standardized global marketplace for bio-based polymers, though significant regional differences persist.

Trade agreements play a crucial role in harmonization efforts. The EU has incorporated sustainability chapters in recent trade agreements, including provisions for regulatory cooperation on bio-based materials. The EU-Mercosur agreement, for instance, contains specific provisions for sustainable materials trade, while negotiations with ASEAN countries increasingly focus on aligning approaches to bio-based product certification.

Mutual recognition agreements (MRAs) represent another important harmonization mechanism. These agreements allow conformity assessments performed in one jurisdiction to be accepted in another, reducing duplicate testing requirements. The EU has established MRAs with several key trading partners for certain categories of bio-based materials, though comprehensive coverage remains limited.

Customs classification presents ongoing challenges for bio-based polymer trade. The Harmonized System (HS) codes used globally for customs purposes have not kept pace with innovations in bio-based materials, creating inconsistent classification and tariff application. Industry stakeholders are advocating for updated HS codes that better reflect the unique properties and environmental benefits of bio-based polymers to facilitate more accurate tracking and potentially preferential treatment in international trade.

These regulatory frameworks create both barriers and opportunities for cross-border trade. On one hand, stringent EU requirements for sustainability documentation, lifecycle assessment, and biodegradability verification increase compliance costs for non-EU manufacturers. On the other hand, the harmonized approach reduces the need to meet 27 different national standards, creating efficiency for companies that successfully navigate the regulatory landscape.

The EU's leadership in sustainable materials regulation has created a "Brussels Effect," whereby EU standards increasingly influence global practices. Countries including Japan, South Korea, and Canada have developed regulatory frameworks that align with EU approaches to facilitate smoother trade relations. This regulatory convergence is gradually creating a more standardized global marketplace for bio-based polymers, though significant regional differences persist.

Trade agreements play a crucial role in harmonization efforts. The EU has incorporated sustainability chapters in recent trade agreements, including provisions for regulatory cooperation on bio-based materials. The EU-Mercosur agreement, for instance, contains specific provisions for sustainable materials trade, while negotiations with ASEAN countries increasingly focus on aligning approaches to bio-based product certification.

Mutual recognition agreements (MRAs) represent another important harmonization mechanism. These agreements allow conformity assessments performed in one jurisdiction to be accepted in another, reducing duplicate testing requirements. The EU has established MRAs with several key trading partners for certain categories of bio-based materials, though comprehensive coverage remains limited.

Customs classification presents ongoing challenges for bio-based polymer trade. The Harmonized System (HS) codes used globally for customs purposes have not kept pace with innovations in bio-based materials, creating inconsistent classification and tariff application. Industry stakeholders are advocating for updated HS codes that better reflect the unique properties and environmental benefits of bio-based polymers to facilitate more accurate tracking and potentially preferential treatment in international trade.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!