Research on Bio-based Polymer Coatings for Electronics

OCT 21, 202510 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Bio-Polymer Coating Technology Background and Objectives

Bio-based polymer coatings represent a significant paradigm shift in electronics manufacturing, emerging from the convergence of sustainable materials science and advanced electronics. These coatings have evolved from rudimentary plant-derived substances to sophisticated biomaterials capable of providing protection and functionality to electronic components. The historical trajectory began in the early 2000s with basic research into natural polymers, accelerating dramatically after 2010 when environmental regulations and corporate sustainability initiatives created market pull for greener alternatives to traditional petroleum-based coatings.

The technological evolution of bio-based polymer coatings has been characterized by progressive improvements in key performance parameters including moisture resistance, thermal stability, and adhesion properties. Initial bio-polymers suffered from inconsistent performance and limited durability, but recent advancements in chemical modification techniques and nano-composite formulations have substantially narrowed the performance gap with conventional synthetic coatings.

Current research focuses on developing multi-functional bio-based coatings that not only protect electronic components but also provide additional benefits such as electromagnetic interference (EMI) shielding, thermal management, and self-healing capabilities. The integration of cellulose nanocrystals, modified starches, chitosan derivatives, and other renewable resources has expanded the application potential significantly.

The primary technical objectives for bio-based polymer coatings in electronics include achieving comparable or superior performance to petroleum-based alternatives while maintaining biodegradability and reducing environmental impact. Specific performance targets include water vapor transmission rates below 1 g/m²/day, thermal stability up to 200°C, and adhesion strength exceeding 15 N/mm².

Another critical objective is cost competitiveness, as bio-based materials currently command a premium over conventional alternatives. Research aims to develop scalable production methods that can reduce manufacturing costs while maintaining consistent quality and performance characteristics.

The technology roadmap anticipates several breakthrough areas, including the development of fully biodegradable electronic substrates with integrated bio-based protective layers, advanced barrier properties through biomimetic approaches, and smart coatings that respond to environmental stimuli. These innovations align with broader industry trends toward flexible electronics, wearable devices, and Internet of Things (IoT) applications where traditional rigid encapsulation methods are unsuitable.

As electronic devices become more ubiquitous and product lifecycles shorten, the environmental impact of electronic waste presents a growing challenge. Bio-based polymer coatings offer a promising pathway toward more sustainable electronics manufacturing, potentially enabling easier recycling and reduced end-of-life environmental impact.

The technological evolution of bio-based polymer coatings has been characterized by progressive improvements in key performance parameters including moisture resistance, thermal stability, and adhesion properties. Initial bio-polymers suffered from inconsistent performance and limited durability, but recent advancements in chemical modification techniques and nano-composite formulations have substantially narrowed the performance gap with conventional synthetic coatings.

Current research focuses on developing multi-functional bio-based coatings that not only protect electronic components but also provide additional benefits such as electromagnetic interference (EMI) shielding, thermal management, and self-healing capabilities. The integration of cellulose nanocrystals, modified starches, chitosan derivatives, and other renewable resources has expanded the application potential significantly.

The primary technical objectives for bio-based polymer coatings in electronics include achieving comparable or superior performance to petroleum-based alternatives while maintaining biodegradability and reducing environmental impact. Specific performance targets include water vapor transmission rates below 1 g/m²/day, thermal stability up to 200°C, and adhesion strength exceeding 15 N/mm².

Another critical objective is cost competitiveness, as bio-based materials currently command a premium over conventional alternatives. Research aims to develop scalable production methods that can reduce manufacturing costs while maintaining consistent quality and performance characteristics.

The technology roadmap anticipates several breakthrough areas, including the development of fully biodegradable electronic substrates with integrated bio-based protective layers, advanced barrier properties through biomimetic approaches, and smart coatings that respond to environmental stimuli. These innovations align with broader industry trends toward flexible electronics, wearable devices, and Internet of Things (IoT) applications where traditional rigid encapsulation methods are unsuitable.

As electronic devices become more ubiquitous and product lifecycles shorten, the environmental impact of electronic waste presents a growing challenge. Bio-based polymer coatings offer a promising pathway toward more sustainable electronics manufacturing, potentially enabling easier recycling and reduced end-of-life environmental impact.

Market Analysis for Sustainable Electronics Coatings

The global market for sustainable electronics coatings is experiencing significant growth, driven by increasing environmental regulations and consumer demand for eco-friendly products. The current market size for bio-based polymer coatings in electronics is estimated at $2.3 billion, with projections indicating a compound annual growth rate of 8.7% through 2028. This growth trajectory significantly outpaces traditional petroleum-based coating alternatives, which are growing at only 3.2% annually.

Consumer electronics represents the largest application segment, accounting for approximately 42% of the sustainable coatings market. This is followed by telecommunications equipment (27%), medical devices (18%), and automotive electronics (13%). The dominance of consumer electronics is attributed to higher consumer awareness and willingness to pay premium prices for environmentally responsible products.

Regionally, Europe leads the market adoption with approximately 38% market share, followed by North America (29%), Asia-Pacific (24%), and rest of the world (9%). European leadership stems from stringent environmental regulations such as the Restriction of Hazardous Substances (RoHS) and Registration, Evaluation, Authorization and Restriction of Chemicals (REACH) directives, which have accelerated the transition toward sustainable materials.

Key market drivers include increasing electronic waste concerns, corporate sustainability initiatives, and the growing implementation of extended producer responsibility policies. Additionally, the rising cost of petroleum-based raw materials has narrowed the price gap between conventional and bio-based alternatives, making sustainable options more economically viable.

Market research indicates that consumers are willing to pay a premium of 15-20% for electronics with demonstrably sustainable components, though this premium acceptance varies significantly by region and product category. High-end consumer electronics and medical devices show the greatest premium tolerance.

Supply chain analysis reveals that material availability remains a challenge, with bio-based feedstocks subject to agricultural variability and competition from other industries. This has created opportunities for vertical integration, with several major electronics manufacturers investing in dedicated bio-polymer production facilities to ensure supply stability.

Market barriers include technical performance concerns, particularly regarding moisture resistance and thermal stability in extreme operating conditions. Additionally, certification complexities and inconsistent global standards for "bio-based" claims create market fragmentation and consumer confusion.

Emerging market opportunities exist in wearable electronics, where skin contact makes bio-compatibility particularly valuable, and in flexible electronics, where bio-based polymers can offer unique mechanical properties not easily achieved with conventional materials.

Consumer electronics represents the largest application segment, accounting for approximately 42% of the sustainable coatings market. This is followed by telecommunications equipment (27%), medical devices (18%), and automotive electronics (13%). The dominance of consumer electronics is attributed to higher consumer awareness and willingness to pay premium prices for environmentally responsible products.

Regionally, Europe leads the market adoption with approximately 38% market share, followed by North America (29%), Asia-Pacific (24%), and rest of the world (9%). European leadership stems from stringent environmental regulations such as the Restriction of Hazardous Substances (RoHS) and Registration, Evaluation, Authorization and Restriction of Chemicals (REACH) directives, which have accelerated the transition toward sustainable materials.

Key market drivers include increasing electronic waste concerns, corporate sustainability initiatives, and the growing implementation of extended producer responsibility policies. Additionally, the rising cost of petroleum-based raw materials has narrowed the price gap between conventional and bio-based alternatives, making sustainable options more economically viable.

Market research indicates that consumers are willing to pay a premium of 15-20% for electronics with demonstrably sustainable components, though this premium acceptance varies significantly by region and product category. High-end consumer electronics and medical devices show the greatest premium tolerance.

Supply chain analysis reveals that material availability remains a challenge, with bio-based feedstocks subject to agricultural variability and competition from other industries. This has created opportunities for vertical integration, with several major electronics manufacturers investing in dedicated bio-polymer production facilities to ensure supply stability.

Market barriers include technical performance concerns, particularly regarding moisture resistance and thermal stability in extreme operating conditions. Additionally, certification complexities and inconsistent global standards for "bio-based" claims create market fragmentation and consumer confusion.

Emerging market opportunities exist in wearable electronics, where skin contact makes bio-compatibility particularly valuable, and in flexible electronics, where bio-based polymers can offer unique mechanical properties not easily achieved with conventional materials.

Current Status and Challenges in Bio-based Polymer Development

The global landscape of bio-based polymer development has witnessed significant advancements in recent years, yet remains in a relatively nascent stage compared to conventional petroleum-based polymers. Currently, bio-based polymers represent approximately 2% of the global polymer market, with an annual growth rate of 15-20%, indicating promising but still limited market penetration. Major commercial bio-based polymers include polylactic acid (PLA), polyhydroxyalkanoates (PHAs), bio-polyethylene (bio-PE), and starch-based polymers, with varying degrees of commercial success.

For electronics applications specifically, the development status is even more preliminary. While conventional electronics rely heavily on petroleum-based polymers for insulation, substrate materials, and protective coatings, bio-based alternatives are only beginning to emerge in laboratory settings and niche commercial applications. Recent research has demonstrated potential for cellulose derivatives, lignin-based polymers, and protein-based materials as coating solutions for electronic components.

The primary technical challenges facing bio-based polymer development for electronics coatings center around performance limitations. Most bio-based polymers exhibit inferior thermal stability compared to their petroleum-based counterparts, with degradation often beginning at temperatures between 200-250°C, whereas electronics applications frequently require stability above 300°C. Additionally, moisture sensitivity remains problematic, as many bio-based polymers are hydrophilic by nature, potentially compromising electronic component integrity.

Mechanical property inconsistency presents another significant hurdle. Batch-to-batch variations in natural feedstocks lead to unpredictable mechanical properties, making quality control difficult for precision electronics applications. Furthermore, processing challenges exist as many bio-based polymers require specialized equipment or processing conditions that differ from established industrial practices for conventional polymers.

Scalability and cost-effectiveness represent substantial barriers to widespread adoption. Current production methods for high-performance bio-based polymers suitable for electronics applications remain costly, with prices typically 2-4 times higher than petroleum-based alternatives. Limited availability of consistent, high-quality bio-based feedstocks further complicates large-scale production efforts.

Regulatory frameworks and standardization for bio-based materials in electronics remain underdeveloped globally. The lack of unified standards for testing, certification, and end-of-life management creates uncertainty for manufacturers considering adoption of these materials. This regulatory gap is particularly pronounced in regions with stringent electronics safety requirements.

Geographically, research leadership in bio-based polymers for electronics is concentrated in specific regions. Europe leads in fundamental research and policy frameworks, particularly in Germany, the Netherlands, and Finland. North America demonstrates strength in commercialization efforts, while Asia, especially Japan and South Korea, excels in application-specific development for consumer electronics.

For electronics applications specifically, the development status is even more preliminary. While conventional electronics rely heavily on petroleum-based polymers for insulation, substrate materials, and protective coatings, bio-based alternatives are only beginning to emerge in laboratory settings and niche commercial applications. Recent research has demonstrated potential for cellulose derivatives, lignin-based polymers, and protein-based materials as coating solutions for electronic components.

The primary technical challenges facing bio-based polymer development for electronics coatings center around performance limitations. Most bio-based polymers exhibit inferior thermal stability compared to their petroleum-based counterparts, with degradation often beginning at temperatures between 200-250°C, whereas electronics applications frequently require stability above 300°C. Additionally, moisture sensitivity remains problematic, as many bio-based polymers are hydrophilic by nature, potentially compromising electronic component integrity.

Mechanical property inconsistency presents another significant hurdle. Batch-to-batch variations in natural feedstocks lead to unpredictable mechanical properties, making quality control difficult for precision electronics applications. Furthermore, processing challenges exist as many bio-based polymers require specialized equipment or processing conditions that differ from established industrial practices for conventional polymers.

Scalability and cost-effectiveness represent substantial barriers to widespread adoption. Current production methods for high-performance bio-based polymers suitable for electronics applications remain costly, with prices typically 2-4 times higher than petroleum-based alternatives. Limited availability of consistent, high-quality bio-based feedstocks further complicates large-scale production efforts.

Regulatory frameworks and standardization for bio-based materials in electronics remain underdeveloped globally. The lack of unified standards for testing, certification, and end-of-life management creates uncertainty for manufacturers considering adoption of these materials. This regulatory gap is particularly pronounced in regions with stringent electronics safety requirements.

Geographically, research leadership in bio-based polymers for electronics is concentrated in specific regions. Europe leads in fundamental research and policy frameworks, particularly in Germany, the Netherlands, and Finland. North America demonstrates strength in commercialization efforts, while Asia, especially Japan and South Korea, excels in application-specific development for consumer electronics.

Current Bio-based Polymer Coating Solutions for Electronics

01 Plant-derived polymer coatings

Bio-based polymer coatings derived from plant sources offer sustainable alternatives to petroleum-based materials. These coatings utilize natural polymers extracted from renewable plant resources such as cellulose, lignin, and plant oils. The resulting formulations provide environmentally friendly coating solutions with reduced carbon footprint while maintaining necessary performance characteristics like durability and protection.- Plant-derived polymer coatings: Bio-based polymer coatings derived from plant sources offer sustainable alternatives to petroleum-based products. These coatings utilize renewable resources such as cellulose, lignin, and plant oils to create environmentally friendly protective layers. The formulations typically involve processing plant materials to extract polymeric compounds that can be modified for specific coating applications, providing comparable performance to conventional coatings while reducing environmental impact.

- Biodegradable polymer coating compositions: These coating formulations focus on biodegradability as a key feature, allowing the coating to naturally decompose after its useful life. The compositions typically include bio-based polymers combined with biodegradation enhancers and plasticizers that maintain functionality while ensuring environmental breakdown. These coatings address end-of-life concerns for products by reducing waste accumulation and microplastic formation while maintaining required performance characteristics during use.

- Medical applications of bio-based polymer coatings: Bio-based polymer coatings have found significant applications in medical devices and implants due to their biocompatibility and reduced toxicity. These specialized coatings can incorporate antimicrobial properties, controlled drug release mechanisms, and tissue-friendly interfaces. The formulations are designed to interact positively with biological systems while providing necessary protection and functionality for medical applications, often utilizing polysaccharides, proteins, and other naturally derived polymers.

- Bio-based polymer coatings with enhanced durability: These formulations focus on improving the durability and performance characteristics of bio-based polymer coatings to match or exceed conventional petroleum-based alternatives. Through chemical modifications, cross-linking strategies, and composite approaches, these coatings achieve enhanced water resistance, UV stability, mechanical strength, and adhesion properties. The innovations enable bio-based coatings to perform in demanding applications where durability is critical while maintaining their environmental benefits.

- Composite bio-based polymer coating systems: Composite approaches combine bio-based polymers with other materials to create synergistic coating systems with enhanced properties. These formulations may incorporate nanoparticles, mineral fillers, or secondary biopolymers to improve specific characteristics such as barrier properties, flame retardancy, or mechanical strength. The composite nature allows formulators to overcome inherent limitations of single bio-based polymers while maintaining a high renewable content and environmental benefits.

02 Biodegradable polymer coating applications

Biodegradable polymer coatings are being developed for various applications including packaging, medical devices, and agricultural products. These coatings break down naturally in the environment after their useful life, reducing waste and environmental impact. The formulations often incorporate bio-based polymers with controlled degradation properties while maintaining necessary barrier and protective functions during their intended use period.Expand Specific Solutions03 Bio-based polymer blends for enhanced coating properties

Innovative blends of bio-based polymers with other materials create coatings with enhanced properties. These formulations combine different bio-polymers or incorporate additives to improve characteristics such as water resistance, adhesion, flexibility, and durability. The synergistic effects of these blends enable the development of high-performance sustainable coatings that can compete with conventional petroleum-based alternatives.Expand Specific Solutions04 Processing technologies for bio-based polymer coatings

Advanced processing technologies are being developed specifically for bio-based polymer coatings to optimize their application and performance. These include novel extrusion techniques, solvent systems, curing methods, and application processes tailored to the unique properties of bio-polymers. These technologies address challenges related to viscosity, thermal sensitivity, and compatibility with existing coating equipment.Expand Specific Solutions05 Functional bio-based coatings with special properties

Specialized bio-based polymer coatings are being engineered with additional functional properties beyond basic protection. These include antimicrobial activity, self-healing capabilities, controlled release of active ingredients, UV resistance, and smart responsive behaviors. The incorporation of functional additives derived from natural sources enhances the performance of these coatings while maintaining their bio-based nature and environmental benefits.Expand Specific Solutions

Key Industry Players in Bio-Polymer Electronics Coatings

The bio-based polymer coatings for electronics market is in an early growth phase, characterized by increasing R&D investments and emerging commercial applications. The global market size is projected to expand significantly due to growing demand for sustainable electronics packaging solutions. Technologically, the field shows moderate maturity with key players at different development stages. DuPont de Nemours and Sumitomo Chemical lead with established polymer expertise, while Samsung Electronics represents major end-users driving adoption. Academic institutions like University of Akron and Sichuan University contribute fundamental research, while specialized companies like Bioinicia SL offer niche technologies. Research organizations including CSIR and CSIRO are accelerating innovation through collaborative projects, creating a diverse ecosystem spanning materials science, electronics manufacturing, and sustainability domains.

DuPont de Nemours, Inc.

Technical Solution: DuPont has developed advanced bio-based polymer coatings for electronics through their Bio-Based Materials program. Their technology utilizes polylactic acid (PLA) derivatives modified with proprietary additives to enhance thermal stability and moisture resistance. DuPont's approach incorporates cellulose nanocrystals (CNCs) as reinforcement agents in their bio-polymer matrices, creating nanocomposite coatings with improved mechanical properties and barrier performance. Their recent innovation includes a bio-based polyurethane coating derived from vegetable oils that provides excellent adhesion to various electronic substrates while maintaining flexibility and dielectric properties. DuPont has also pioneered water-based formulations that eliminate volatile organic compounds (VOCs), addressing both environmental concerns and electronic performance requirements through careful control of coating morphology and crosslinking density.

Strengths: Extensive polymer chemistry expertise, established manufacturing infrastructure, and strong intellectual property portfolio. Their bio-based coatings demonstrate excellent adhesion and flexibility while maintaining electrical insulation properties. Weaknesses: Higher production costs compared to conventional petroleum-based alternatives, and some formulations may have limited high-temperature performance.

Samsung Electronics Co., Ltd.

Technical Solution: Samsung has developed proprietary bio-based polymer coatings specifically designed for consumer electronics applications. Their technology utilizes chitosan derivatives combined with cellulose-based materials to create thin, transparent protective layers for display components. Samsung's approach focuses on creating ultra-thin (sub-micron) coatings that maintain optical clarity while providing moisture barrier properties. Their bio-based formulations incorporate modified starch polymers with enhanced adhesion to metal and glass substrates commonly used in electronic devices. Samsung has also developed a bio-based anti-fingerprint coating derived from castor oil derivatives that maintains touch sensitivity while reducing smudges on display surfaces. Their research has demonstrated that these coatings can reduce the carbon footprint of electronic devices by up to 35% compared to traditional petroleum-based alternatives while maintaining or improving device longevity.

Strengths: Strong integration capabilities with existing electronics manufacturing processes, excellent optical properties, and proven scalability for mass production. Their coatings demonstrate superior adhesion to display materials. Weaknesses: Limited chemical resistance compared to synthetic alternatives, and potential long-term durability concerns in high-humidity environments.

Critical Patents and Research in Bio-Polymer Coating Technology

Bio-based conformal coating for sulfur sequestration using polyhydroxyalkanoates

PatentInactiveUS20170372814A1

Innovation

- A bio-based polyhydroxyalkanoate (PHA) polymer with sulfur-reactive substituents is mixed with a sulfurization catalyst and solvent to form a coating that reacts with environmental sulfur, forming a sulfur-resistant surface, preventing further sulfur penetration.

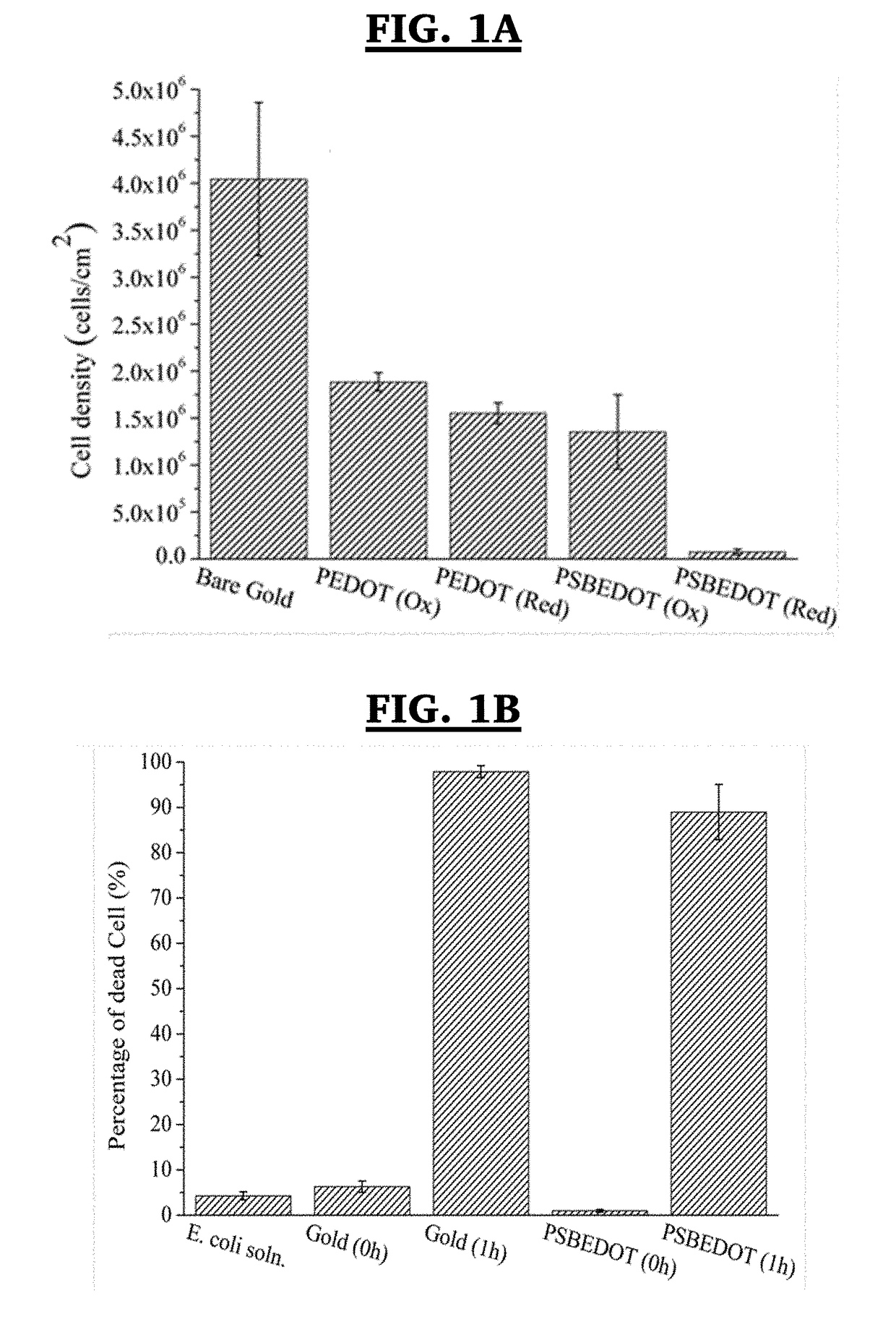

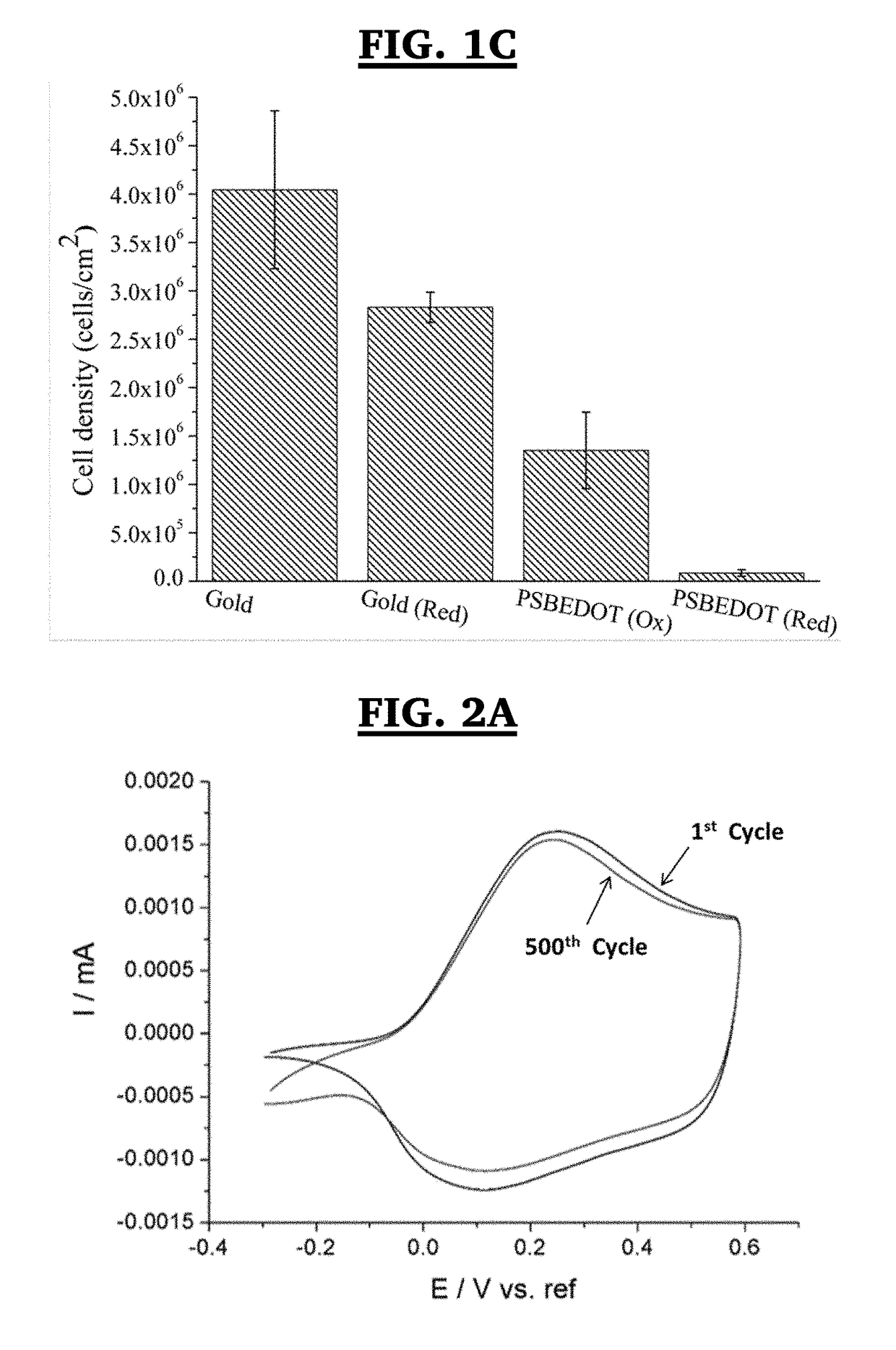

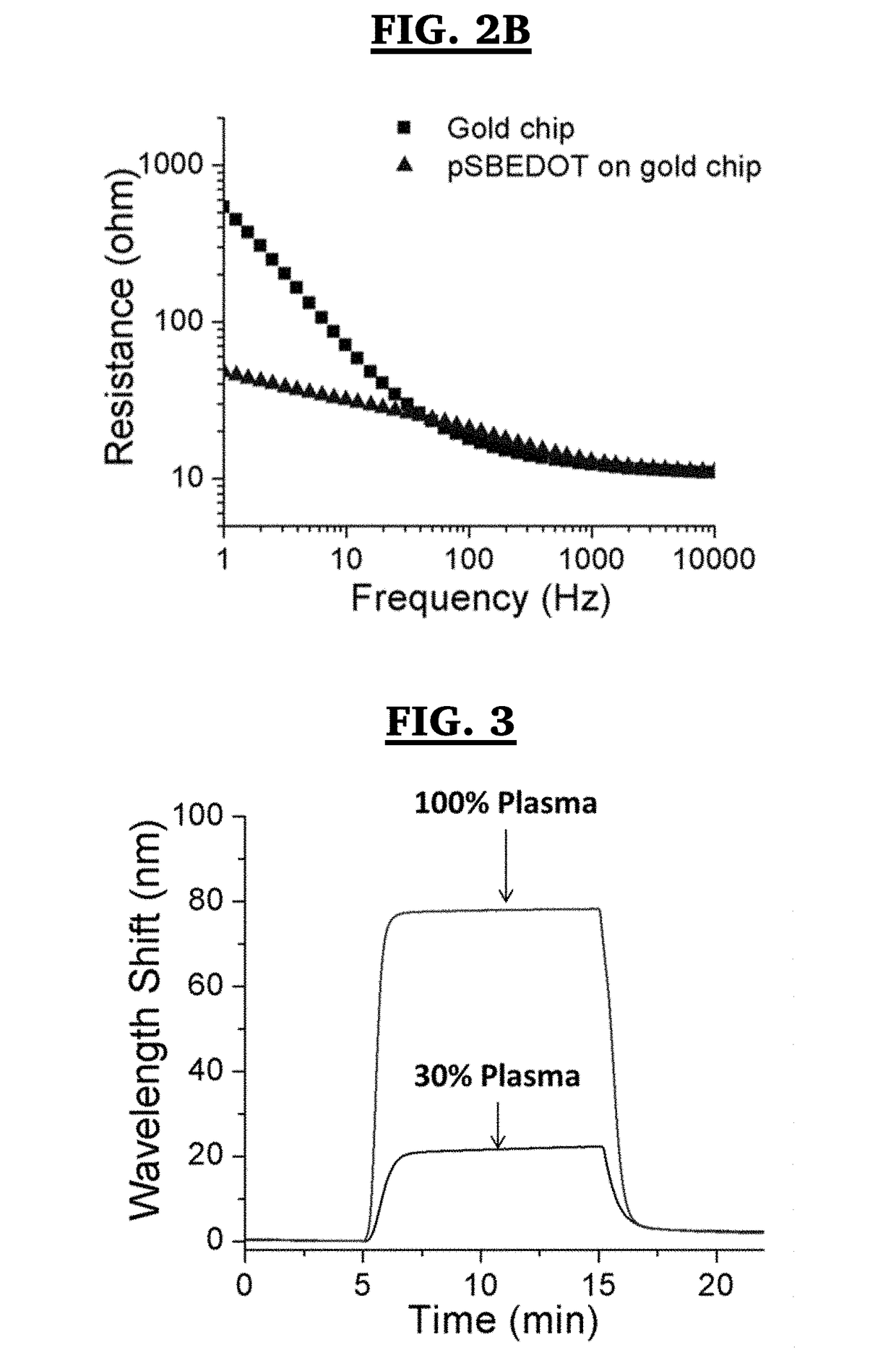

Method for electropolymerization of hydrophilic EDOT monomers in an aqueous solution

PatentInactiveUS20180282472A1

Innovation

- A method for forming a sulfobetaine-functionalized conjugated polymer film using 3,4-ethylenedioxythiophene (EDOT) monomers that can be directly polymerized in an aqueous solution without organic solvents or surfactants, resulting in a densely packed, electro-switchable antimicrobial/antifouling coating with excellent electrical conductivity and biocompatibility.

Environmental Impact and Sustainability Assessment

The environmental impact of conventional electronic coatings has become a critical concern in the electronics industry, with traditional petroleum-based polymers contributing significantly to carbon emissions and persistent waste. Bio-based polymer coatings represent a promising sustainable alternative, offering reduced environmental footprint throughout their lifecycle. Life Cycle Assessment (LCA) studies indicate that bio-based coatings can achieve 30-60% reduction in greenhouse gas emissions compared to their synthetic counterparts, depending on feedstock selection and processing methods.

Biodegradability characteristics of these materials vary considerably based on their molecular structure and additives. While some bio-based polymers like polylactic acid (PLA) and polyhydroxyalkanoates (PHAs) demonstrate excellent biodegradability under controlled conditions, others such as bio-based polyethylene maintain durability profiles similar to conventional polymers. This presents both opportunities and challenges for electronics applications where controlled end-of-life scenarios must be balanced with performance requirements during product use.

Resource efficiency metrics reveal significant advantages for bio-based polymer coatings. Agricultural feedstocks used in their production generally require 20-40% less non-renewable energy input compared to petroleum-based alternatives. However, land use considerations remain important, as expanded production could potentially compete with food crops or contribute to land conversion issues if not managed responsibly. Advanced feedstock options utilizing agricultural waste streams, algae, or cellulosic materials offer pathways to minimize these concerns.

Water consumption patterns differ markedly between bio-based and conventional polymer production. While bio-based systems typically require more water during the agricultural phase, they often demonstrate lower water pollution impacts during manufacturing and processing stages. Comprehensive water footprint analyses suggest that regional factors significantly influence the sustainability profile, with locally-adapted feedstock selection being crucial for optimizing water resource management.

Regulatory frameworks worldwide are increasingly recognizing the environmental benefits of bio-based materials. The European Union's Circular Economy Action Plan and similar initiatives in North America and Asia are creating market incentives for sustainable electronics components. Certification systems like USDA BioPreferred and TÜV Austria's "OK biobased" are providing standardized metrics for bio-content verification, though harmonization of these standards remains an ongoing challenge for global supply chains.

End-of-life management represents perhaps the most significant environmental advantage of bio-based polymer coatings. When properly designed, these materials can be integrated into existing recycling streams or composting infrastructure, reducing electronic waste accumulation. However, this potential benefit requires thoughtful product design and appropriate waste management infrastructure to be fully realized.

Biodegradability characteristics of these materials vary considerably based on their molecular structure and additives. While some bio-based polymers like polylactic acid (PLA) and polyhydroxyalkanoates (PHAs) demonstrate excellent biodegradability under controlled conditions, others such as bio-based polyethylene maintain durability profiles similar to conventional polymers. This presents both opportunities and challenges for electronics applications where controlled end-of-life scenarios must be balanced with performance requirements during product use.

Resource efficiency metrics reveal significant advantages for bio-based polymer coatings. Agricultural feedstocks used in their production generally require 20-40% less non-renewable energy input compared to petroleum-based alternatives. However, land use considerations remain important, as expanded production could potentially compete with food crops or contribute to land conversion issues if not managed responsibly. Advanced feedstock options utilizing agricultural waste streams, algae, or cellulosic materials offer pathways to minimize these concerns.

Water consumption patterns differ markedly between bio-based and conventional polymer production. While bio-based systems typically require more water during the agricultural phase, they often demonstrate lower water pollution impacts during manufacturing and processing stages. Comprehensive water footprint analyses suggest that regional factors significantly influence the sustainability profile, with locally-adapted feedstock selection being crucial for optimizing water resource management.

Regulatory frameworks worldwide are increasingly recognizing the environmental benefits of bio-based materials. The European Union's Circular Economy Action Plan and similar initiatives in North America and Asia are creating market incentives for sustainable electronics components. Certification systems like USDA BioPreferred and TÜV Austria's "OK biobased" are providing standardized metrics for bio-content verification, though harmonization of these standards remains an ongoing challenge for global supply chains.

End-of-life management represents perhaps the most significant environmental advantage of bio-based polymer coatings. When properly designed, these materials can be integrated into existing recycling streams or composting infrastructure, reducing electronic waste accumulation. However, this potential benefit requires thoughtful product design and appropriate waste management infrastructure to be fully realized.

Regulatory Framework for Bio-based Materials in Electronics

The regulatory landscape for bio-based materials in electronics is evolving rapidly as governments worldwide recognize the environmental benefits of sustainable alternatives to conventional petroleum-based polymers. In the European Union, the Eco-design Directive (2009/125/EC) has been expanded to include requirements for electronic product design that favor bio-based materials with lower environmental impacts. Additionally, the EU's Circular Economy Action Plan specifically encourages the use of bio-based, biodegradable materials in electronics manufacturing to reduce electronic waste.

In the United States, the Environmental Protection Agency (EPA) has established the Environmentally Preferable Purchasing (EPP) program, which provides guidelines for federal agencies to procure electronics with environmentally preferable attributes, including those made with bio-based materials. The USDA BioPreferred Program also certifies bio-based products, offering a procurement preference for federal agencies and their contractors.

Japan has implemented the Green Purchasing Law, which mandates government agencies to purchase environmentally friendly products, including electronics with bio-based components. Similarly, South Korea's Act on Promotion of Purchase of Green Products encourages the use of sustainable materials in electronics manufacturing.

Certification systems play a crucial role in the regulatory framework. Standards such as ASTM D6866 for measuring bio-based content and ISO 14040/14044 for life cycle assessment provide methodologies for verifying environmental claims related to bio-based polymer coatings. The UL 110 standard for environmentally preferable mobile phones and the IEEE 1680 family of standards for environmental assessment of electronic products are increasingly incorporating criteria for bio-based materials.

Challenges in the regulatory landscape include the lack of harmonization across different regions, creating compliance difficulties for global electronics manufacturers. Additionally, regulations often lag behind technological innovations in bio-based polymers, creating uncertainty for industry stakeholders. The absence of specific standards for bio-based coatings in electronics applications presents another regulatory gap.

Looking forward, regulatory trends indicate a move toward more stringent requirements for environmental performance of electronics, including mandatory minimum bio-based content requirements and extended producer responsibility schemes that incentivize the use of sustainable materials. The development of international standards specifically addressing bio-based polymer coatings for electronics is expected to accelerate as market demand for sustainable electronics continues to grow.

In the United States, the Environmental Protection Agency (EPA) has established the Environmentally Preferable Purchasing (EPP) program, which provides guidelines for federal agencies to procure electronics with environmentally preferable attributes, including those made with bio-based materials. The USDA BioPreferred Program also certifies bio-based products, offering a procurement preference for federal agencies and their contractors.

Japan has implemented the Green Purchasing Law, which mandates government agencies to purchase environmentally friendly products, including electronics with bio-based components. Similarly, South Korea's Act on Promotion of Purchase of Green Products encourages the use of sustainable materials in electronics manufacturing.

Certification systems play a crucial role in the regulatory framework. Standards such as ASTM D6866 for measuring bio-based content and ISO 14040/14044 for life cycle assessment provide methodologies for verifying environmental claims related to bio-based polymer coatings. The UL 110 standard for environmentally preferable mobile phones and the IEEE 1680 family of standards for environmental assessment of electronic products are increasingly incorporating criteria for bio-based materials.

Challenges in the regulatory landscape include the lack of harmonization across different regions, creating compliance difficulties for global electronics manufacturers. Additionally, regulations often lag behind technological innovations in bio-based polymers, creating uncertainty for industry stakeholders. The absence of specific standards for bio-based coatings in electronics applications presents another regulatory gap.

Looking forward, regulatory trends indicate a move toward more stringent requirements for environmental performance of electronics, including mandatory minimum bio-based content requirements and extended producer responsibility schemes that incentivize the use of sustainable materials. The development of international standards specifically addressing bio-based polymer coatings for electronics is expected to accelerate as market demand for sustainable electronics continues to grow.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!