Research on the Cost-Effectiveness of Titanium Alloy vs Stainless Steel

OCT 24, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Titanium Alloy vs Stainless Steel Background and Objectives

The evolution of materials in industrial applications has been marked by continuous innovation, with titanium alloys and stainless steel emerging as two prominent materials across various sectors. Titanium alloys, first commercially produced in the 1950s, have evolved from primarily aerospace applications to broader industrial use. Stainless steel, with its origins dating back to the early 20th century, has undergone significant refinements in composition and manufacturing processes, establishing itself as a versatile material across numerous industries.

The technological trajectory for both materials shows divergent yet complementary paths. Titanium alloys have seen advancements in processing techniques, alloy compositions, and surface treatments, enabling enhanced performance characteristics while gradually reducing production costs. Stainless steel development has focused on improving corrosion resistance, mechanical properties, and production efficiency, resulting in a diverse range of grades tailored to specific applications.

Current market trends indicate growing demand for materials that offer optimal performance-to-cost ratios, particularly in industries facing increasing pressure to reduce weight, enhance durability, and minimize maintenance costs. This shift necessitates a comprehensive reassessment of material selection paradigms, moving beyond traditional cost-per-unit metrics to more holistic lifecycle cost analyses.

The primary objective of this research is to establish a comprehensive framework for evaluating the cost-effectiveness of titanium alloys versus stainless steel across diverse application scenarios. This includes quantifying direct acquisition costs, fabrication expenses, installation requirements, maintenance needs, service life expectations, and end-of-life considerations. Additionally, the research aims to identify application thresholds where the transition from stainless steel to titanium alloys becomes economically justified.

Secondary objectives include mapping technological developments that may alter the cost-performance equation for both materials, analyzing emerging manufacturing techniques that could reduce production costs, and evaluating potential innovations in material science that might bridge the performance gap between these materials. The research will also explore hybrid solutions that strategically incorporate both materials to optimize system-level cost-effectiveness.

This investigation is particularly timely given the increasing emphasis on sustainable manufacturing practices, resource efficiency, and total cost of ownership considerations across industries. By establishing clear cost-benefit parameters for material selection, this research aims to provide decision-makers with robust analytical tools for material selection that align with both immediate budgetary constraints and long-term strategic objectives.

The technological trajectory for both materials shows divergent yet complementary paths. Titanium alloys have seen advancements in processing techniques, alloy compositions, and surface treatments, enabling enhanced performance characteristics while gradually reducing production costs. Stainless steel development has focused on improving corrosion resistance, mechanical properties, and production efficiency, resulting in a diverse range of grades tailored to specific applications.

Current market trends indicate growing demand for materials that offer optimal performance-to-cost ratios, particularly in industries facing increasing pressure to reduce weight, enhance durability, and minimize maintenance costs. This shift necessitates a comprehensive reassessment of material selection paradigms, moving beyond traditional cost-per-unit metrics to more holistic lifecycle cost analyses.

The primary objective of this research is to establish a comprehensive framework for evaluating the cost-effectiveness of titanium alloys versus stainless steel across diverse application scenarios. This includes quantifying direct acquisition costs, fabrication expenses, installation requirements, maintenance needs, service life expectations, and end-of-life considerations. Additionally, the research aims to identify application thresholds where the transition from stainless steel to titanium alloys becomes economically justified.

Secondary objectives include mapping technological developments that may alter the cost-performance equation for both materials, analyzing emerging manufacturing techniques that could reduce production costs, and evaluating potential innovations in material science that might bridge the performance gap between these materials. The research will also explore hybrid solutions that strategically incorporate both materials to optimize system-level cost-effectiveness.

This investigation is particularly timely given the increasing emphasis on sustainable manufacturing practices, resource efficiency, and total cost of ownership considerations across industries. By establishing clear cost-benefit parameters for material selection, this research aims to provide decision-makers with robust analytical tools for material selection that align with both immediate budgetary constraints and long-term strategic objectives.

Market Demand Analysis for Advanced Structural Materials

The global market for advanced structural materials has witnessed significant growth in recent years, driven by increasing demand across aerospace, automotive, medical, and industrial sectors. The combined market value for high-performance materials, including titanium alloys and stainless steel, reached approximately $175 billion in 2022, with projections indicating continued growth at a compound annual rate of 6.8% through 2028.

Titanium alloy demand has been particularly strong in aerospace applications, where its exceptional strength-to-weight ratio provides crucial performance advantages. The aerospace sector currently consumes about 42% of global titanium production, with commercial aircraft manufacturers increasing titanium content in new generation aircraft by 15-20% compared to previous models. This trend is expected to continue as fuel efficiency remains a primary concern for airlines.

In contrast, stainless steel maintains dominance in broader industrial applications, medical devices, and consumer products due to its cost advantage and established manufacturing infrastructure. The global stainless steel market volume exceeded 52 million metric tons in 2022, with industrial equipment and construction sectors accounting for nearly 60% of consumption.

Market analysis reveals growing interest in cost-effective titanium solutions, with manufacturers actively seeking ways to reduce production costs through improved extraction methods, advanced manufacturing techniques like additive manufacturing, and development of lower-cost titanium alloys. These innovations have potential to expand titanium applications into previously cost-prohibitive markets.

Regional demand patterns show distinct characteristics, with North America and Europe focusing on high-performance applications where titanium's superior properties justify premium pricing. Meanwhile, Asia-Pacific markets, particularly China and India, demonstrate accelerating demand for both materials, driven by rapid industrialization and expanding aerospace sectors.

Environmental regulations and sustainability concerns are increasingly influencing material selection decisions. Titanium's excellent corrosion resistance and longer service life provide advantages in lifecycle cost analyses, despite higher initial investment. Several industries report 30-40% longer service intervals for titanium components compared to stainless steel alternatives.

Market forecasts suggest specialized sectors including medical implants, offshore energy, and high-performance automotive components will drive future demand growth for both materials. The medical implant market alone is expected to grow at 7.2% annually through 2028, with material selection increasingly determined by biocompatibility and long-term performance rather than initial cost considerations.

Titanium alloy demand has been particularly strong in aerospace applications, where its exceptional strength-to-weight ratio provides crucial performance advantages. The aerospace sector currently consumes about 42% of global titanium production, with commercial aircraft manufacturers increasing titanium content in new generation aircraft by 15-20% compared to previous models. This trend is expected to continue as fuel efficiency remains a primary concern for airlines.

In contrast, stainless steel maintains dominance in broader industrial applications, medical devices, and consumer products due to its cost advantage and established manufacturing infrastructure. The global stainless steel market volume exceeded 52 million metric tons in 2022, with industrial equipment and construction sectors accounting for nearly 60% of consumption.

Market analysis reveals growing interest in cost-effective titanium solutions, with manufacturers actively seeking ways to reduce production costs through improved extraction methods, advanced manufacturing techniques like additive manufacturing, and development of lower-cost titanium alloys. These innovations have potential to expand titanium applications into previously cost-prohibitive markets.

Regional demand patterns show distinct characteristics, with North America and Europe focusing on high-performance applications where titanium's superior properties justify premium pricing. Meanwhile, Asia-Pacific markets, particularly China and India, demonstrate accelerating demand for both materials, driven by rapid industrialization and expanding aerospace sectors.

Environmental regulations and sustainability concerns are increasingly influencing material selection decisions. Titanium's excellent corrosion resistance and longer service life provide advantages in lifecycle cost analyses, despite higher initial investment. Several industries report 30-40% longer service intervals for titanium components compared to stainless steel alternatives.

Market forecasts suggest specialized sectors including medical implants, offshore energy, and high-performance automotive components will drive future demand growth for both materials. The medical implant market alone is expected to grow at 7.2% annually through 2028, with material selection increasingly determined by biocompatibility and long-term performance rather than initial cost considerations.

Current Status and Challenges in Metal Alloy Development

The global metal alloy industry is experiencing significant technological advancements, with titanium alloys and stainless steel remaining at the forefront of industrial materials. Currently, titanium alloy production has reached approximately 150,000 metric tons annually, while stainless steel production exceeds 50 million metric tons. This substantial difference in production volume directly impacts cost structures and availability across various sectors.

Titanium alloys have achieved remarkable progress in manufacturing efficiency, with recent innovations reducing production costs by 15-20% over the past decade. However, the Kroll process, the primary method for extracting titanium from its ores, remains energy-intensive and costly. The process requires multiple complex steps including chlorination, reduction with magnesium, and vacuum distillation, contributing to titanium's high base cost—typically 5-10 times that of stainless steel.

Stainless steel technology has matured considerably, with continuous casting and advanced rolling techniques achieving near-optimal efficiency levels. The 300 and 400 series stainless steels dominate the market due to their balanced cost-performance ratio. Recent developments have focused on improving corrosion resistance and mechanical properties rather than reducing production costs, which have largely plateaued.

A significant challenge in titanium alloy development is the energy-intensive nature of its production, accounting for approximately 50% of manufacturing costs. Research initiatives at institutions like the CSIRO in Australia and the Titanium Institute in Japan are exploring alternative extraction methods, including direct electrochemical reduction, which could potentially reduce energy consumption by up to 30%.

Geographic distribution of technology development presents another challenge. Titanium alloy innovation is concentrated in the United States, Russia, Japan, and increasingly China, creating knowledge silos and limiting collaborative advancement. Stainless steel technology, while more globally distributed, faces diminishing returns on research investment due to its mature development stage.

Material performance limitations also present ongoing challenges. Current titanium alloys struggle with surface hardness and wear resistance, while certain stainless steel grades face limitations in extreme temperature environments. The development of cost-effective surface treatment technologies for titanium and heat-resistant stainless steel variants represents a critical research frontier.

Regulatory and sustainability pressures are reshaping development priorities. Environmental regulations increasingly target the carbon footprint of metal production, with titanium manufacturing facing particular scrutiny due to its energy intensity. This has accelerated research into greener production methods, though commercially viable solutions remain elusive.

Titanium alloys have achieved remarkable progress in manufacturing efficiency, with recent innovations reducing production costs by 15-20% over the past decade. However, the Kroll process, the primary method for extracting titanium from its ores, remains energy-intensive and costly. The process requires multiple complex steps including chlorination, reduction with magnesium, and vacuum distillation, contributing to titanium's high base cost—typically 5-10 times that of stainless steel.

Stainless steel technology has matured considerably, with continuous casting and advanced rolling techniques achieving near-optimal efficiency levels. The 300 and 400 series stainless steels dominate the market due to their balanced cost-performance ratio. Recent developments have focused on improving corrosion resistance and mechanical properties rather than reducing production costs, which have largely plateaued.

A significant challenge in titanium alloy development is the energy-intensive nature of its production, accounting for approximately 50% of manufacturing costs. Research initiatives at institutions like the CSIRO in Australia and the Titanium Institute in Japan are exploring alternative extraction methods, including direct electrochemical reduction, which could potentially reduce energy consumption by up to 30%.

Geographic distribution of technology development presents another challenge. Titanium alloy innovation is concentrated in the United States, Russia, Japan, and increasingly China, creating knowledge silos and limiting collaborative advancement. Stainless steel technology, while more globally distributed, faces diminishing returns on research investment due to its mature development stage.

Material performance limitations also present ongoing challenges. Current titanium alloys struggle with surface hardness and wear resistance, while certain stainless steel grades face limitations in extreme temperature environments. The development of cost-effective surface treatment technologies for titanium and heat-resistant stainless steel variants represents a critical research frontier.

Regulatory and sustainability pressures are reshaping development priorities. Environmental regulations increasingly target the carbon footprint of metal production, with titanium manufacturing facing particular scrutiny due to its energy intensity. This has accelerated research into greener production methods, though commercially viable solutions remain elusive.

Current Cost-Effectiveness Solutions and Methodologies

01 Cost comparison between titanium alloys and stainless steel

Titanium alloys generally have higher material costs compared to stainless steel, but offer advantages in specific applications that may justify the price difference. The cost-effectiveness analysis considers not only the initial material costs but also factors such as longevity, maintenance requirements, and performance characteristics in various environments. In certain applications, the superior corrosion resistance and strength-to-weight ratio of titanium can offset the higher initial investment through extended service life and reduced maintenance.- Cost comparison between titanium alloys and stainless steel: Titanium alloys generally have higher material costs compared to stainless steel, but offer superior strength-to-weight ratios and corrosion resistance. The cost-effectiveness analysis must consider not only initial material costs but also long-term performance benefits, maintenance requirements, and lifecycle expenses. In applications where weight reduction is critical, titanium's higher cost may be justified by fuel savings or increased payload capacity.

- Manufacturing processes affecting cost-effectiveness: Manufacturing processes significantly impact the cost-effectiveness of both titanium alloys and stainless steel. Titanium typically requires more complex and expensive processing techniques including specialized welding environments, higher machining costs due to tool wear, and more sophisticated heat treatments. Innovations in manufacturing methods such as near-net-shape forming, additive manufacturing, and improved machining techniques can reduce the cost gap between titanium alloys and stainless steel.

- Composite and hybrid material solutions: Composite structures combining titanium alloys and stainless steel can optimize cost-effectiveness by utilizing each material where its properties are most beneficial. These hybrid approaches include clad materials, bimetallic joints, and selective reinforcement. By strategically placing titanium in high-stress or corrosion-prone areas while using stainless steel elsewhere, manufacturers can achieve performance targets at lower overall costs than using titanium exclusively.

- Application-specific cost-benefit analysis: The cost-effectiveness of titanium alloys versus stainless steel varies significantly by application. In aerospace and medical applications, titanium's lightweight properties and biocompatibility often justify its higher cost. For chemical processing equipment, titanium's superior corrosion resistance in certain environments provides longer service life and reduced maintenance costs. In consumer products and general industrial applications, stainless steel typically offers better cost-effectiveness unless specific performance requirements necessitate titanium.

- Surface treatment and coating technologies: Surface treatments and coatings can enhance the cost-effectiveness of both materials. For stainless steel, specialized coatings can improve corrosion resistance and wear properties, potentially allowing it to replace titanium in some applications. For titanium, surface treatments can enhance wear resistance and reduce friction, addressing some of its limitations. These technologies include PVD coatings, nitriding, carburizing, and various passivation treatments that can extend service life and improve performance-to-cost ratios.

02 Manufacturing processes affecting cost-effectiveness

The manufacturing processes for titanium alloys are typically more complex and energy-intensive than those for stainless steel, contributing to higher production costs. Specialized techniques such as vacuum arc remelting and precision machining are often required for titanium components. Innovations in manufacturing methods, including advanced forming techniques and additive manufacturing, are helping to reduce the cost gap between titanium and stainless steel production, making titanium more cost-competitive in certain applications.Expand Specific Solutions03 Composite and hybrid material solutions

Combining titanium alloys with stainless steel in composite or hybrid structures offers a cost-effective approach that leverages the advantages of both materials. These hybrid solutions allow designers to use titanium only where its properties are most beneficial, while using less expensive stainless steel in other areas. This strategic material allocation optimizes performance while managing costs, particularly in applications where weight reduction and corrosion resistance are critical but budget constraints exist.Expand Specific Solutions04 Application-specific cost-benefit analysis

The cost-effectiveness of titanium alloys versus stainless steel varies significantly depending on the specific application. In aerospace, marine, and medical applications, titanium's superior strength-to-weight ratio, biocompatibility, and corrosion resistance often justify its higher cost. For general industrial applications where weight is less critical and corrosion conditions are moderate, stainless steel typically offers better value. Life-cycle cost analysis, considering factors such as installation, maintenance, replacement frequency, and operational efficiency, provides a more comprehensive view of material cost-effectiveness than initial price alone.Expand Specific Solutions05 Surface treatment and coating technologies

Surface treatments and coating technologies can enhance the properties of both titanium alloys and stainless steel, affecting their cost-effectiveness. Advanced coatings can improve the wear resistance, corrosion protection, and durability of less expensive stainless steel, making it viable in applications that might otherwise require titanium. Conversely, surface treatments for titanium can extend its service life and performance capabilities, further justifying its higher initial cost in demanding environments. These technologies allow for more nuanced material selection decisions based on performance requirements and budget constraints.Expand Specific Solutions

Key Industry Players in Advanced Metallurgy

The titanium alloy versus stainless steel cost-effectiveness market is currently in a mature growth phase with an estimated global market size exceeding $150 billion. The competitive landscape features established industry leaders like Titanium Metals Corp. (TIMET) and Howmet Aerospace dominating titanium production, while NIPPON STEEL and Kobe Steel lead in stainless steel manufacturing. Technology maturity varies significantly across applications, with aerospace companies like Boeing leveraging advanced titanium alloys for weight reduction, while research institutions such as the Institute of Metal Research CAS and QuesTek Innovations are developing next-generation cost-effective titanium processing methods. The market shows regional concentration with major players in the US, Japan, and China competing through vertical integration and proprietary manufacturing technologies.

Titanium Metals Corp.

Technical Solution: Titanium Metals Corp. (TIMET) has developed proprietary cost-reduction technologies for titanium alloy production, focusing on the TIMET Optimized Production System (TOPS). This system integrates vacuum arc remelting with advanced process controls to reduce energy consumption by approximately 15-20% compared to conventional methods. Their research demonstrates that while titanium alloys have a higher initial cost (typically 3-5 times that of stainless steel), the total lifecycle cost analysis shows significant advantages in corrosion-resistant applications. TIMET's studies indicate that titanium components in chemical processing equipment can provide a 25-30 year service life compared to 5-7 years for stainless steel alternatives, resulting in a 40% reduction in total ownership costs for critical applications despite the higher upfront investment.

Strengths: Superior corrosion resistance leading to extended service life and reduced maintenance costs; higher strength-to-weight ratio enabling weight savings in transportation applications. Weaknesses: Significantly higher initial material costs; more complex and energy-intensive manufacturing processes; limited availability compared to stainless steel.

ATI Properties LLC

Technical Solution: ATI Properties has pioneered cost-effective titanium alloy solutions through their Precision Rolled Strip® technology, which enables the production of thinner gauge titanium with tighter tolerances than conventional methods. Their comparative research shows that their titanium strip products can achieve thickness reductions of up to 0.1mm while maintaining mechanical properties, resulting in material savings of 15-20% compared to traditional titanium processing. ATI's cost-effectiveness analysis demonstrates that their high-performance titanium alloys, while initially priced at a premium of 3-4 times over stainless steel, deliver superior performance in aggressive environments where stainless steel would require replacement 3-4 times over the same service period. Their proprietary heat treatment processes have also been shown to enhance the fatigue resistance of titanium alloys by up to 25%, further extending service life in critical applications.

Strengths: Advanced processing techniques that maximize material efficiency; superior corrosion resistance in aggressive environments; excellent fatigue properties for cyclic loading applications. Weaknesses: Higher initial investment costs; specialized welding and forming requirements; more limited supplier base compared to stainless steel.

Critical Technical Analysis of Material Properties

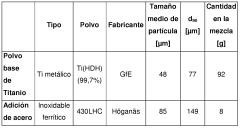

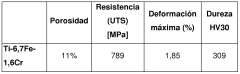

Low-cost titanium alloys and method for preparation thereof

PatentActiveES2341162A1

Innovation

- A titanium alloy comprising 1-9% iron and 0.2-3% chromium, produced by powder metallurgy using stainless steel powders, eliminating remelting stages and achieving mechanical properties comparable to Ti-6Al-4V without intermetallic compounds.

Low-cost titanium alloys and method for preparation thereof

PatentWO2010015723A1

Innovation

- A low-cost titanium alloy is developed using iron and chromium from stainless steel powders, with iron content ranging from 1-9% and chromium from 0.2-3% by weight, processed through powder metallurgy to eliminate remelting stages and intermetallic compounds, reducing costs and enhancing mechanical properties.

Lifecycle Cost Assessment Frameworks

Lifecycle cost assessment (LCA) frameworks provide a structured approach to evaluating the total economic impact of materials throughout their entire service life. When comparing titanium alloys with stainless steel, these frameworks become essential tools for making informed decisions that extend beyond initial acquisition costs.

Traditional cost assessment methods often focus primarily on purchase price, which significantly disadvantages titanium alloys due to their higher initial cost. However, comprehensive LCA frameworks incorporate multiple cost factors including acquisition, installation, operation, maintenance, replacement, and end-of-life disposal or recycling value.

Several established LCA methodologies have emerged as industry standards. The ISO 14040 series provides a standardized approach to lifecycle assessment that can be adapted for material selection processes. Similarly, the Society for Environmental Toxicology and Chemistry (SETAC) framework offers guidelines specifically tailored for materials comparison in industrial applications.

For engineering applications, the Total Cost of Ownership (TCO) model has gained significant traction. This framework is particularly relevant when evaluating titanium versus stainless steel, as it accounts for the extended service life and reduced maintenance requirements of titanium components, which often offset the higher initial investment.

The Building for Environmental and Economic Sustainability (BEES) model, developed by the National Institute of Standards and Technology, offers another valuable framework that balances environmental performance with economic considerations. This approach is especially useful in construction and infrastructure projects where both materials are frequently considered.

Industry-specific frameworks have also been developed. In aerospace, the Aerospace Material Specification (AMS) lifecycle cost models incorporate factors like weight savings and fuel efficiency. For marine applications, frameworks typically emphasize corrosion resistance and maintenance intervals, areas where titanium excels despite higher upfront costs.

Recent advancements in LCA frameworks include the integration of uncertainty analysis and probabilistic modeling. These techniques help account for market volatility in material prices, fluctuating energy costs, and variable maintenance schedules. Monte Carlo simulations are increasingly employed to generate probability distributions of lifecycle costs rather than single-point estimates, providing decision-makers with a more nuanced understanding of the cost-benefit relationship between titanium alloys and stainless steel across different operational scenarios and timeframes.

Traditional cost assessment methods often focus primarily on purchase price, which significantly disadvantages titanium alloys due to their higher initial cost. However, comprehensive LCA frameworks incorporate multiple cost factors including acquisition, installation, operation, maintenance, replacement, and end-of-life disposal or recycling value.

Several established LCA methodologies have emerged as industry standards. The ISO 14040 series provides a standardized approach to lifecycle assessment that can be adapted for material selection processes. Similarly, the Society for Environmental Toxicology and Chemistry (SETAC) framework offers guidelines specifically tailored for materials comparison in industrial applications.

For engineering applications, the Total Cost of Ownership (TCO) model has gained significant traction. This framework is particularly relevant when evaluating titanium versus stainless steel, as it accounts for the extended service life and reduced maintenance requirements of titanium components, which often offset the higher initial investment.

The Building for Environmental and Economic Sustainability (BEES) model, developed by the National Institute of Standards and Technology, offers another valuable framework that balances environmental performance with economic considerations. This approach is especially useful in construction and infrastructure projects where both materials are frequently considered.

Industry-specific frameworks have also been developed. In aerospace, the Aerospace Material Specification (AMS) lifecycle cost models incorporate factors like weight savings and fuel efficiency. For marine applications, frameworks typically emphasize corrosion resistance and maintenance intervals, areas where titanium excels despite higher upfront costs.

Recent advancements in LCA frameworks include the integration of uncertainty analysis and probabilistic modeling. These techniques help account for market volatility in material prices, fluctuating energy costs, and variable maintenance schedules. Monte Carlo simulations are increasingly employed to generate probability distributions of lifecycle costs rather than single-point estimates, providing decision-makers with a more nuanced understanding of the cost-benefit relationship between titanium alloys and stainless steel across different operational scenarios and timeframes.

Environmental Impact and Sustainability Considerations

The environmental impact of material selection in manufacturing and construction has become increasingly significant as industries strive for sustainability. When comparing titanium alloy and stainless steel, several environmental factors must be considered throughout their lifecycle, from extraction to disposal.

Titanium alloy production requires substantial energy input, with primary extraction and processing consuming approximately 361,000 MJ per ton compared to stainless steel's 87,000 MJ per ton. This energy-intensive process results in higher carbon emissions during the manufacturing phase. However, titanium's exceptional durability and corrosion resistance translate to longer service life, reducing the frequency of replacement and associated environmental impacts over time.

Stainless steel production, while less energy-intensive initially, involves significant mining operations for iron ore and chromium. These activities contribute to habitat destruction, water pollution, and soil degradation. The alloying process for stainless steel also releases considerable amounts of carbon dioxide and other greenhouse gases, though innovations in production techniques have reduced these emissions in recent years.

Recycling capabilities represent a critical sustainability factor. Stainless steel demonstrates excellent recyclability with recovery rates exceeding 80% in developed economies. The recycling process consumes approximately 33% less energy than primary production. Titanium also offers recyclability benefits, though its specialized nature and lower market volume have resulted in less developed recycling infrastructure, with current recovery rates averaging 50-60%.

Water usage presents another environmental consideration. Titanium processing requires substantial water for cooling and cleaning, consuming approximately 125-150 cubic meters per ton. Stainless steel manufacturing typically uses 70-90 cubic meters per ton, representing a lower water footprint. However, titanium's longer service life may offset this initial disadvantage when calculated on a lifecycle basis.

End-of-life considerations favor both materials compared to alternatives like plastics or composites. Neither material leaches harmful substances into the environment when properly disposed of, and both can be reclaimed for recycling. Titanium's exceptional corrosion resistance means minimal environmental contamination even after extended exposure to harsh conditions.

Recent life cycle assessment (LCA) studies indicate that despite titanium's higher initial environmental impact, applications requiring long service life or lightweight properties may demonstrate superior environmental performance over complete product lifecycles. For instance, titanium components in aerospace applications reduce fuel consumption through weight reduction, potentially offsetting the higher production emissions within 2-5 years of service.

Titanium alloy production requires substantial energy input, with primary extraction and processing consuming approximately 361,000 MJ per ton compared to stainless steel's 87,000 MJ per ton. This energy-intensive process results in higher carbon emissions during the manufacturing phase. However, titanium's exceptional durability and corrosion resistance translate to longer service life, reducing the frequency of replacement and associated environmental impacts over time.

Stainless steel production, while less energy-intensive initially, involves significant mining operations for iron ore and chromium. These activities contribute to habitat destruction, water pollution, and soil degradation. The alloying process for stainless steel also releases considerable amounts of carbon dioxide and other greenhouse gases, though innovations in production techniques have reduced these emissions in recent years.

Recycling capabilities represent a critical sustainability factor. Stainless steel demonstrates excellent recyclability with recovery rates exceeding 80% in developed economies. The recycling process consumes approximately 33% less energy than primary production. Titanium also offers recyclability benefits, though its specialized nature and lower market volume have resulted in less developed recycling infrastructure, with current recovery rates averaging 50-60%.

Water usage presents another environmental consideration. Titanium processing requires substantial water for cooling and cleaning, consuming approximately 125-150 cubic meters per ton. Stainless steel manufacturing typically uses 70-90 cubic meters per ton, representing a lower water footprint. However, titanium's longer service life may offset this initial disadvantage when calculated on a lifecycle basis.

End-of-life considerations favor both materials compared to alternatives like plastics or composites. Neither material leaches harmful substances into the environment when properly disposed of, and both can be reclaimed for recycling. Titanium's exceptional corrosion resistance means minimal environmental contamination even after extended exposure to harsh conditions.

Recent life cycle assessment (LCA) studies indicate that despite titanium's higher initial environmental impact, applications requiring long service life or lightweight properties may demonstrate superior environmental performance over complete product lifecycles. For instance, titanium components in aerospace applications reduce fuel consumption through weight reduction, potentially offsetting the higher production emissions within 2-5 years of service.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!