Scalability of Lithium Iron Phosphate Battery Technology for Industrial Applications

AUG 8, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

LFP Battery Evolution and Objectives

Lithium Iron Phosphate (LFP) battery technology has undergone significant evolution since its inception in the 1990s. Initially developed as a safer alternative to traditional lithium-ion batteries, LFP technology has steadily improved in terms of energy density, cycle life, and cost-effectiveness. The primary objective of LFP battery development has been to create a scalable, safe, and efficient energy storage solution for industrial applications.

The evolution of LFP batteries can be traced through several key milestones. In the early 2000s, researchers focused on improving the cathode material's structure and composition to enhance its electrochemical properties. This led to the development of nano-sized LFP particles, which significantly increased the battery's power density and charge-discharge rates. By the mid-2000s, advancements in manufacturing processes allowed for large-scale production of LFP batteries, making them more commercially viable for industrial use.

A crucial turning point in LFP battery evolution came with the introduction of carbon coating techniques. This innovation addressed the inherent low electrical conductivity of LFP materials, resulting in improved overall battery performance. Subsequent developments focused on optimizing the electrolyte composition and anode materials, further enhancing the battery's stability and longevity.

The objectives for LFP battery technology in industrial applications have been multifaceted. Foremost among these is the need for increased energy density to meet the demanding requirements of various industrial sectors. Researchers and manufacturers have been working towards achieving higher volumetric and gravimetric energy densities without compromising the inherent safety advantages of LFP chemistry.

Another key objective has been to improve the scalability of LFP battery production. This involves developing more efficient manufacturing processes, reducing material costs, and optimizing cell and pack designs for large-scale industrial applications. The goal is to make LFP batteries a cost-effective and readily available energy storage solution for a wide range of industrial uses, from grid-scale storage to electric vehicles and industrial equipment.

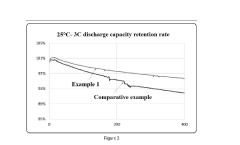

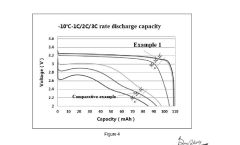

Enhancing the cycle life and overall lifespan of LFP batteries has also been a critical objective. Industrial applications often require energy storage solutions that can withstand frequent charge-discharge cycles over extended periods. Researchers have been focusing on improving the structural stability of LFP materials and developing advanced battery management systems to maximize the longevity of these batteries in demanding industrial environments.

As environmental concerns gain prominence, another objective in LFP battery evolution has been to improve their sustainability profile. This includes developing more environmentally friendly production methods, increasing the recyclability of battery components, and reducing the reliance on rare or potentially harmful materials in battery construction.

The evolution of LFP batteries can be traced through several key milestones. In the early 2000s, researchers focused on improving the cathode material's structure and composition to enhance its electrochemical properties. This led to the development of nano-sized LFP particles, which significantly increased the battery's power density and charge-discharge rates. By the mid-2000s, advancements in manufacturing processes allowed for large-scale production of LFP batteries, making them more commercially viable for industrial use.

A crucial turning point in LFP battery evolution came with the introduction of carbon coating techniques. This innovation addressed the inherent low electrical conductivity of LFP materials, resulting in improved overall battery performance. Subsequent developments focused on optimizing the electrolyte composition and anode materials, further enhancing the battery's stability and longevity.

The objectives for LFP battery technology in industrial applications have been multifaceted. Foremost among these is the need for increased energy density to meet the demanding requirements of various industrial sectors. Researchers and manufacturers have been working towards achieving higher volumetric and gravimetric energy densities without compromising the inherent safety advantages of LFP chemistry.

Another key objective has been to improve the scalability of LFP battery production. This involves developing more efficient manufacturing processes, reducing material costs, and optimizing cell and pack designs for large-scale industrial applications. The goal is to make LFP batteries a cost-effective and readily available energy storage solution for a wide range of industrial uses, from grid-scale storage to electric vehicles and industrial equipment.

Enhancing the cycle life and overall lifespan of LFP batteries has also been a critical objective. Industrial applications often require energy storage solutions that can withstand frequent charge-discharge cycles over extended periods. Researchers have been focusing on improving the structural stability of LFP materials and developing advanced battery management systems to maximize the longevity of these batteries in demanding industrial environments.

As environmental concerns gain prominence, another objective in LFP battery evolution has been to improve their sustainability profile. This includes developing more environmentally friendly production methods, increasing the recyclability of battery components, and reducing the reliance on rare or potentially harmful materials in battery construction.

Industrial Demand Analysis for LFP Batteries

The industrial demand for Lithium Iron Phosphate (LFP) batteries has been experiencing significant growth, driven by several key factors in the global energy and transportation sectors. The automotive industry, particularly the electric vehicle (EV) market, has emerged as a primary driver for LFP battery demand. Major automakers are increasingly adopting LFP batteries due to their lower cost, improved safety features, and longer cycle life compared to other lithium-ion battery chemistries.

In the energy storage sector, LFP batteries are gaining traction for both grid-scale and residential applications. The push for renewable energy integration and grid stabilization has created a substantial market for large-scale energy storage systems, where LFP batteries offer a cost-effective and reliable solution. Additionally, the growing popularity of residential solar-plus-storage systems has further boosted the demand for LFP batteries in smaller-scale applications.

The industrial equipment sector represents another significant market for LFP batteries. Forklifts, automated guided vehicles (AGVs), and other material handling equipment are transitioning from lead-acid batteries to LFP batteries, driven by the need for longer operational times, faster charging capabilities, and reduced maintenance requirements.

Market analysts project the global LFP battery market to grow at a compound annual growth rate (CAGR) of over 20% in the coming years. This growth is supported by increasing government initiatives promoting clean energy and electric mobility, as well as ongoing technological advancements that continue to improve LFP battery performance and reduce costs.

Geographically, China remains the largest market for LFP batteries, with a well-established supply chain and strong government support for EV adoption. However, other regions, including North America and Europe, are rapidly expanding their LFP battery production capabilities to meet growing domestic demand and reduce dependence on imports.

The scalability of LFP battery technology is a critical factor in meeting this industrial demand. Manufacturers are investing heavily in expanding production capacities and improving manufacturing processes to achieve economies of scale. This scaling up is essential to further reduce costs and meet the increasing demand across various industrial applications.

In the energy storage sector, LFP batteries are gaining traction for both grid-scale and residential applications. The push for renewable energy integration and grid stabilization has created a substantial market for large-scale energy storage systems, where LFP batteries offer a cost-effective and reliable solution. Additionally, the growing popularity of residential solar-plus-storage systems has further boosted the demand for LFP batteries in smaller-scale applications.

The industrial equipment sector represents another significant market for LFP batteries. Forklifts, automated guided vehicles (AGVs), and other material handling equipment are transitioning from lead-acid batteries to LFP batteries, driven by the need for longer operational times, faster charging capabilities, and reduced maintenance requirements.

Market analysts project the global LFP battery market to grow at a compound annual growth rate (CAGR) of over 20% in the coming years. This growth is supported by increasing government initiatives promoting clean energy and electric mobility, as well as ongoing technological advancements that continue to improve LFP battery performance and reduce costs.

Geographically, China remains the largest market for LFP batteries, with a well-established supply chain and strong government support for EV adoption. However, other regions, including North America and Europe, are rapidly expanding their LFP battery production capabilities to meet growing domestic demand and reduce dependence on imports.

The scalability of LFP battery technology is a critical factor in meeting this industrial demand. Manufacturers are investing heavily in expanding production capacities and improving manufacturing processes to achieve economies of scale. This scaling up is essential to further reduce costs and meet the increasing demand across various industrial applications.

LFP Technology Status and Scaling Challenges

Lithium Iron Phosphate (LFP) battery technology has gained significant traction in industrial applications due to its inherent safety, long cycle life, and cost-effectiveness. However, as the demand for large-scale energy storage solutions continues to grow, the scalability of LFP technology faces several challenges that need to be addressed.

The current status of LFP technology in industrial applications is characterized by its widespread adoption in electric vehicles, stationary energy storage systems, and various other sectors. LFP batteries have demonstrated their ability to provide reliable power in demanding environments, making them a preferred choice for many industrial users. The technology has matured considerably over the past decade, with improvements in energy density, charging rates, and overall performance.

Despite these advancements, scaling LFP technology for industrial applications presents several challenges. One of the primary obstacles is the relatively lower energy density compared to other lithium-ion chemistries. This limitation necessitates larger battery packs to achieve the same energy storage capacity, potentially increasing costs and space requirements for industrial installations.

Another significant challenge is the optimization of manufacturing processes to meet the growing demand. While LFP production has scaled up considerably, further improvements in production efficiency and automation are needed to reduce costs and increase output. This includes refining the synthesis of LFP cathode materials and developing more efficient cell assembly techniques.

The supply chain for raw materials, particularly iron and phosphate, also poses a scaling challenge. As demand increases, ensuring a stable and cost-effective supply of these materials becomes crucial. Additionally, the lithium supply, although less critical for LFP compared to other lithium-ion chemistries, still requires careful management to support large-scale production.

Thermal management remains a critical issue when scaling up LFP batteries for industrial use. While LFP chemistry is inherently safer and more stable than some alternatives, managing heat generation and dissipation in large battery systems is essential for maintaining performance and longevity. This challenge becomes more pronounced in high-power applications or extreme environmental conditions.

The integration of LFP batteries into existing industrial infrastructure presents another scaling hurdle. Developing standardized interfaces, control systems, and safety protocols that can accommodate the unique characteristics of LFP technology across various industrial settings is crucial for widespread adoption.

Lastly, the recycling and end-of-life management of LFP batteries at an industrial scale is an emerging challenge. As the first generation of large-scale LFP installations approaches the end of their operational life, developing efficient and environmentally friendly recycling processes becomes increasingly important. This aspect is critical for the long-term sustainability and scalability of LFP technology in industrial applications.

The current status of LFP technology in industrial applications is characterized by its widespread adoption in electric vehicles, stationary energy storage systems, and various other sectors. LFP batteries have demonstrated their ability to provide reliable power in demanding environments, making them a preferred choice for many industrial users. The technology has matured considerably over the past decade, with improvements in energy density, charging rates, and overall performance.

Despite these advancements, scaling LFP technology for industrial applications presents several challenges. One of the primary obstacles is the relatively lower energy density compared to other lithium-ion chemistries. This limitation necessitates larger battery packs to achieve the same energy storage capacity, potentially increasing costs and space requirements for industrial installations.

Another significant challenge is the optimization of manufacturing processes to meet the growing demand. While LFP production has scaled up considerably, further improvements in production efficiency and automation are needed to reduce costs and increase output. This includes refining the synthesis of LFP cathode materials and developing more efficient cell assembly techniques.

The supply chain for raw materials, particularly iron and phosphate, also poses a scaling challenge. As demand increases, ensuring a stable and cost-effective supply of these materials becomes crucial. Additionally, the lithium supply, although less critical for LFP compared to other lithium-ion chemistries, still requires careful management to support large-scale production.

Thermal management remains a critical issue when scaling up LFP batteries for industrial use. While LFP chemistry is inherently safer and more stable than some alternatives, managing heat generation and dissipation in large battery systems is essential for maintaining performance and longevity. This challenge becomes more pronounced in high-power applications or extreme environmental conditions.

The integration of LFP batteries into existing industrial infrastructure presents another scaling hurdle. Developing standardized interfaces, control systems, and safety protocols that can accommodate the unique characteristics of LFP technology across various industrial settings is crucial for widespread adoption.

Lastly, the recycling and end-of-life management of LFP batteries at an industrial scale is an emerging challenge. As the first generation of large-scale LFP installations approaches the end of their operational life, developing efficient and environmentally friendly recycling processes becomes increasingly important. This aspect is critical for the long-term sustainability and scalability of LFP technology in industrial applications.

Current LFP Scaling Solutions

01 Manufacturing process optimization

Improving the scalability of lithium iron phosphate (LFP) battery technology through optimized manufacturing processes. This includes developing more efficient production methods, automating key steps, and implementing quality control measures to ensure consistent performance at larger scales. These advancements help reduce production costs and increase output capacity, making LFP batteries more viable for mass production.- Improved manufacturing processes for LFP batteries: Advanced manufacturing techniques are being developed to enhance the scalability of Lithium Iron Phosphate (LFP) battery production. These processes focus on improving efficiency, reducing costs, and increasing production capacity. Innovations include automated assembly lines, precision control systems, and optimized material handling methods.

- Novel electrode materials and compositions: Research is ongoing to develop new electrode materials and compositions that can improve the performance and scalability of LFP batteries. These innovations aim to enhance energy density, cycle life, and charge/discharge rates while maintaining the inherent safety advantages of LFP chemistry.

- Scalable electrolyte solutions: Advancements in electrolyte formulations are being made to support the large-scale production of LFP batteries. These new electrolytes aim to improve ionic conductivity, thermal stability, and compatibility with high-voltage operation, all of which are crucial for scaling up LFP battery technology.

- Cell design optimization for mass production: Innovative cell designs are being developed to facilitate easier mass production of LFP batteries. These designs focus on simplifying assembly processes, improving thermal management, and enhancing overall battery pack integration, all of which contribute to increased scalability.

- Recycling and sustainability improvements: To support the large-scale adoption of LFP batteries, advancements are being made in recycling technologies and sustainable production methods. These innovations aim to reduce the environmental impact of battery manufacturing, improve resource utilization, and create a more circular economy for LFP battery materials.

02 Material composition enhancements

Enhancing the scalability of LFP batteries by improving the composition of active materials and electrolytes. This involves developing new formulations or modifying existing ones to improve energy density, cycle life, and overall performance. These advancements allow for more efficient use of materials and potentially reduce the overall size and weight of battery packs, making them more suitable for large-scale applications.Expand Specific Solutions03 Cell and pack design innovations

Innovating cell and pack designs to improve the scalability of LFP battery technology. This includes developing new cell formats, optimizing thermal management systems, and creating more efficient pack configurations. These design improvements help address challenges associated with scaling up battery production and integration into various applications, from electric vehicles to grid storage systems.Expand Specific Solutions04 Production equipment and technology advancements

Advancing production equipment and technology to enhance the scalability of LFP battery manufacturing. This involves developing specialized machinery, implementing advanced automation systems, and utilizing cutting-edge technologies such as artificial intelligence and machine learning in the production process. These advancements help increase production efficiency, reduce defects, and enable larger-scale manufacturing of LFP batteries.Expand Specific Solutions05 Supply chain and resource management

Improving supply chain and resource management to support the scalability of LFP battery technology. This includes developing strategies for securing raw materials, optimizing logistics, and implementing sustainable practices in battery production and recycling. Effective management of these aspects ensures a stable supply of materials and components, enabling consistent large-scale production of LFP batteries to meet growing demand.Expand Specific Solutions

Key LFP Battery Manufacturers and Competitors

The scalability of Lithium Iron Phosphate (LFP) battery technology for industrial applications is in a mature growth phase, with a rapidly expanding market driven by increasing demand for sustainable energy solutions. The global LFP battery market is projected to reach significant scale, fueled by advancements in energy density and cost reduction. Technologically, LFP batteries have reached a high level of maturity, with companies like BYD, CATL, and Guoxuan High-Tech leading innovation. These firms, along with others such as Johnson Matthey and Svolt Energy Technology, are continuously improving LFP chemistry, focusing on enhancing performance, longevity, and scalability for diverse industrial applications.

BYD Co., Ltd.

Technical Solution: BYD has developed a revolutionary Blade Battery technology based on lithium iron phosphate (LFP) chemistry. This innovation significantly improves the energy density and safety of LFP batteries, making them more suitable for industrial applications. The Blade Battery design allows for optimal space utilization, increasing energy density by up to 50% compared to traditional LFP batteries[1]. BYD's technology also incorporates advanced thermal management systems and uses a unique cell-to-pack (CTP) integration method, which eliminates the need for module housing, further improving energy density and reducing costs[2]. The company has demonstrated the scalability of this technology by implementing it in various applications, from electric vehicles to large-scale energy storage systems[3].

Strengths: High energy density, improved safety, cost-effective, and versatile for various applications. Weaknesses: Relatively new technology, potential supply chain dependencies, and competition from other emerging battery technologies.

Hefei Guoxuan High-Tech Power Energy Co., Ltd.

Technical Solution: Guoxuan High-Tech has developed a proprietary LFP battery technology called "JTM" (Jellyroll To Module), which enhances the scalability and performance of LFP batteries for industrial applications. This technology focuses on improving the energy density and cycle life of LFP batteries while maintaining their inherent safety advantages. Guoxuan's JTM design optimizes the internal structure of battery modules, resulting in a volumetric energy density increase of up to 20% compared to conventional designs[7]. The company has also implemented advanced manufacturing processes, including precision coating and stacking techniques, to ensure consistent quality and performance at scale. Guoxuan's LFP batteries have demonstrated excellent cycle life, with some models retaining over 80% capacity after 4,000 cycles[8], making them particularly suitable for demanding industrial applications such as grid energy storage and electric buses.

Strengths: Improved energy density, long cycle life, scalable manufacturing process, and suitability for large-scale industrial applications. Weaknesses: Potential higher initial costs due to advanced manufacturing techniques, and competition from more established players in the market.

Core LFP Scaling Patents and Innovations

Lithium iron phosphate composite material and preparation method therefor and use thereof

PatentPendingIN202437034828A

Innovation

- A lithium iron phosphate composite material is developed with a core of Li6MnO4 and a carbon-coated lithium iron phosphate shell, enhancing conductivity and tap density, and a sol-gel method is used to prepare the composite, optimizing the mass ratio and calcination process for improved performance.

LFP Battery Supply Chain Analysis

The LFP battery supply chain is a complex network of raw material suppliers, component manufacturers, cell producers, and end-product integrators. At the upstream level, key raw materials include lithium, iron, and phosphate. China dominates the global lithium processing industry, accounting for over 60% of the world's lithium refining capacity. Australia and Chile are major lithium miners, but most of their output is processed in China.

Iron and phosphate are more widely available, with multiple global suppliers. However, the production of high-purity iron phosphate for LFP batteries is concentrated in a few specialized chemical companies, primarily in China. This concentration creates potential supply chain vulnerabilities.

In the midstream, LFP cathode material production is heavily concentrated in China, with companies like BTR New Energy Materials and Guoxuan High-Tech leading the market. Japanese and South Korean firms are also active in this space, but with smaller market shares. The production of other key components, such as anodes, electrolytes, and separators, is more globally distributed, with significant capacity in Japan, South Korea, and increasingly in Europe and North America.

Cell manufacturing is another critical link in the supply chain. While Chinese companies like CATL and BYD dominate LFP cell production, there is growing interest from global players. Tesla, for instance, has been actively expanding its LFP battery production capabilities, both through partnerships and in-house development.

The downstream segment involves battery pack assembly and integration into end products. This part of the supply chain is more geographically diverse, with major automotive and industrial equipment manufacturers worldwide incorporating LFP batteries into their products.

A key challenge in scaling up the LFP battery supply chain is the current geographical concentration of critical components and processes. Efforts are underway in Europe and North America to develop more localized supply chains, but these will take time to mature. Another challenge is the need for significant capital investment to expand production capacity across the entire supply chain.

Sustainability and ethical sourcing are becoming increasingly important considerations in the LFP battery supply chain. There is growing pressure to ensure responsible mining practices and to develop recycling capabilities to create a more circular economy for battery materials.

Iron and phosphate are more widely available, with multiple global suppliers. However, the production of high-purity iron phosphate for LFP batteries is concentrated in a few specialized chemical companies, primarily in China. This concentration creates potential supply chain vulnerabilities.

In the midstream, LFP cathode material production is heavily concentrated in China, with companies like BTR New Energy Materials and Guoxuan High-Tech leading the market. Japanese and South Korean firms are also active in this space, but with smaller market shares. The production of other key components, such as anodes, electrolytes, and separators, is more globally distributed, with significant capacity in Japan, South Korea, and increasingly in Europe and North America.

Cell manufacturing is another critical link in the supply chain. While Chinese companies like CATL and BYD dominate LFP cell production, there is growing interest from global players. Tesla, for instance, has been actively expanding its LFP battery production capabilities, both through partnerships and in-house development.

The downstream segment involves battery pack assembly and integration into end products. This part of the supply chain is more geographically diverse, with major automotive and industrial equipment manufacturers worldwide incorporating LFP batteries into their products.

A key challenge in scaling up the LFP battery supply chain is the current geographical concentration of critical components and processes. Efforts are underway in Europe and North America to develop more localized supply chains, but these will take time to mature. Another challenge is the need for significant capital investment to expand production capacity across the entire supply chain.

Sustainability and ethical sourcing are becoming increasingly important considerations in the LFP battery supply chain. There is growing pressure to ensure responsible mining practices and to develop recycling capabilities to create a more circular economy for battery materials.

Environmental Impact of LFP Battery Scaling

The scaling of Lithium Iron Phosphate (LFP) battery technology for industrial applications brings significant environmental implications that warrant careful consideration. As production volumes increase to meet growing demand, the environmental footprint of LFP battery manufacturing processes becomes more pronounced. The extraction and processing of raw materials, particularly lithium and iron, can lead to habitat disruption and water pollution if not managed responsibly.

However, LFP batteries offer several environmental advantages compared to other lithium-ion chemistries. They are cobalt-free, reducing the reliance on this controversial mineral often associated with unethical mining practices. The phosphate component is also more abundant and less environmentally impactful to source than some alternative cathode materials.

The production of LFP batteries at scale can potentially lead to improved energy efficiency and reduced emissions in manufacturing processes. As economies of scale are achieved, manufacturers can invest in more advanced, cleaner technologies and optimize their production lines. This could result in a lower carbon footprint per unit of battery capacity produced.

The long cycle life of LFP batteries contributes positively to their environmental profile. With the ability to withstand more charge-discharge cycles than many other battery types, LFP batteries can remain in service longer, reducing the frequency of replacement and associated waste generation. This longevity is particularly beneficial in industrial applications where frequent battery replacements would be both costly and environmentally detrimental.

End-of-life considerations are crucial when assessing the environmental impact of LFP battery scaling. The recyclability of LFP batteries is generally favorable, with high recovery rates for key materials like lithium and iron. As the volume of spent batteries increases with wider adoption, it becomes economically viable to establish large-scale recycling facilities, potentially creating a more circular economy for battery materials.

The use of LFP batteries in industrial applications can indirectly contribute to environmental benefits by enabling the integration of renewable energy sources and electrification of industrial processes. This can lead to reduced reliance on fossil fuels and lower overall carbon emissions in various sectors.

However, the increased demand for electricity to charge these batteries at scale must be considered. If this additional power is sourced from fossil fuels, it could offset some of the environmental gains. Therefore, the environmental impact of LFP battery scaling is closely tied to the broader transition towards renewable energy sources in the power grid.

However, LFP batteries offer several environmental advantages compared to other lithium-ion chemistries. They are cobalt-free, reducing the reliance on this controversial mineral often associated with unethical mining practices. The phosphate component is also more abundant and less environmentally impactful to source than some alternative cathode materials.

The production of LFP batteries at scale can potentially lead to improved energy efficiency and reduced emissions in manufacturing processes. As economies of scale are achieved, manufacturers can invest in more advanced, cleaner technologies and optimize their production lines. This could result in a lower carbon footprint per unit of battery capacity produced.

The long cycle life of LFP batteries contributes positively to their environmental profile. With the ability to withstand more charge-discharge cycles than many other battery types, LFP batteries can remain in service longer, reducing the frequency of replacement and associated waste generation. This longevity is particularly beneficial in industrial applications where frequent battery replacements would be both costly and environmentally detrimental.

End-of-life considerations are crucial when assessing the environmental impact of LFP battery scaling. The recyclability of LFP batteries is generally favorable, with high recovery rates for key materials like lithium and iron. As the volume of spent batteries increases with wider adoption, it becomes economically viable to establish large-scale recycling facilities, potentially creating a more circular economy for battery materials.

The use of LFP batteries in industrial applications can indirectly contribute to environmental benefits by enabling the integration of renewable energy sources and electrification of industrial processes. This can lead to reduced reliance on fossil fuels and lower overall carbon emissions in various sectors.

However, the increased demand for electricity to charge these batteries at scale must be considered. If this additional power is sourced from fossil fuels, it could offset some of the environmental gains. Therefore, the environmental impact of LFP battery scaling is closely tied to the broader transition towards renewable energy sources in the power grid.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!