Self Healing Polymer Composites For Structural Repair Applications

AUG 29, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Self-Healing Polymer Evolution and Objectives

Self-healing polymers represent a revolutionary class of materials that can autonomously repair damage without external intervention. The concept emerged in the early 1990s when researchers began exploring biomimetic approaches to materials design, drawing inspiration from biological systems that naturally heal wounds. The field gained significant momentum in 2001 when White et al. published their groundbreaking work on microencapsulation-based self-healing polymers in Nature, establishing the first practical demonstration of autonomous healing in synthetic materials.

The evolution of self-healing polymer composites has progressed through several distinct phases. Initially, research focused on extrinsic healing mechanisms involving embedded healing agents in microcapsules or vascular networks. This approach, while effective, presented challenges related to limited healing cycles and potential structural compromise. The second generation explored intrinsic healing mechanisms based on reversible chemical bonds and supramolecular interactions, enabling multiple healing cycles without depleting healing agents.

Recent advancements have integrated multiple healing mechanisms and smart functionalities, creating hybrid systems that respond to various damage scenarios. The incorporation of nanotechnology has further enhanced healing efficiency and mechanical properties, with carbon nanotubes and graphene being particularly promising additives for structural applications.

The primary objective of self-healing polymer composite research for structural repair applications is to develop materials that maintain structural integrity throughout their service life, thereby extending operational lifespans and reducing maintenance costs. This goal addresses critical challenges in infrastructure, aerospace, automotive, and marine industries, where component failure can lead to catastrophic consequences.

Specific technical objectives include achieving rapid healing kinetics under ambient conditions, maintaining mechanical properties post-healing that approach or exceed the original material performance, and ensuring healing functionality persists throughout the material's intended service life. Additionally, researchers aim to develop systems capable of healing under load-bearing conditions and in harsh environmental settings.

From an industrial perspective, objectives extend to scalable manufacturing processes, cost-effectiveness, and compatibility with existing fabrication techniques. The ultimate goal is to transition from laboratory demonstrations to commercially viable products that meet regulatory standards and industry specifications.

The convergence of these objectives drives research toward multifunctional self-healing composites that not only repair damage but also incorporate sensing capabilities to detect damage onset, creating truly smart materials that can revolutionize structural applications across multiple sectors.

The evolution of self-healing polymer composites has progressed through several distinct phases. Initially, research focused on extrinsic healing mechanisms involving embedded healing agents in microcapsules or vascular networks. This approach, while effective, presented challenges related to limited healing cycles and potential structural compromise. The second generation explored intrinsic healing mechanisms based on reversible chemical bonds and supramolecular interactions, enabling multiple healing cycles without depleting healing agents.

Recent advancements have integrated multiple healing mechanisms and smart functionalities, creating hybrid systems that respond to various damage scenarios. The incorporation of nanotechnology has further enhanced healing efficiency and mechanical properties, with carbon nanotubes and graphene being particularly promising additives for structural applications.

The primary objective of self-healing polymer composite research for structural repair applications is to develop materials that maintain structural integrity throughout their service life, thereby extending operational lifespans and reducing maintenance costs. This goal addresses critical challenges in infrastructure, aerospace, automotive, and marine industries, where component failure can lead to catastrophic consequences.

Specific technical objectives include achieving rapid healing kinetics under ambient conditions, maintaining mechanical properties post-healing that approach or exceed the original material performance, and ensuring healing functionality persists throughout the material's intended service life. Additionally, researchers aim to develop systems capable of healing under load-bearing conditions and in harsh environmental settings.

From an industrial perspective, objectives extend to scalable manufacturing processes, cost-effectiveness, and compatibility with existing fabrication techniques. The ultimate goal is to transition from laboratory demonstrations to commercially viable products that meet regulatory standards and industry specifications.

The convergence of these objectives drives research toward multifunctional self-healing composites that not only repair damage but also incorporate sensing capabilities to detect damage onset, creating truly smart materials that can revolutionize structural applications across multiple sectors.

Market Analysis for Structural Repair Solutions

The global market for structural repair solutions is experiencing significant growth, driven by aging infrastructure, increasing safety regulations, and the need for cost-effective maintenance strategies. The structural repair market encompasses various sectors including civil infrastructure, aerospace, automotive, and marine industries, with each segment presenting unique requirements and growth trajectories.

In the infrastructure sector, which represents approximately 40% of the total structural repair market, there is an urgent need for innovative repair solutions due to deteriorating bridges, buildings, and tunnels worldwide. The American Society of Civil Engineers estimates that the United States alone needs to invest over $4.5 trillion by 2025 to address infrastructure deficiencies, creating substantial market opportunities for advanced repair technologies.

The aerospace industry constitutes another critical segment, valued at around $3.2 billion for structural repair materials and solutions. With aircraft fleets aging globally and manufacturers seeking to extend service life while reducing maintenance costs, self-healing polymer composites offer compelling value propositions. Major aerospace companies have increased R&D investments in smart materials by 15% annually over the past five years.

Automotive applications represent a rapidly growing segment with a compound annual growth rate of 7.8%, driven by the push for lightweight vehicles and extended durability. Self-healing materials are particularly attractive in this sector as they address the persistent challenge of microcrack formation in composite components used in modern vehicle designs.

Regional analysis reveals that North America currently leads the structural repair solutions market with approximately 35% share, followed by Europe (28%) and Asia-Pacific (25%). However, the Asia-Pacific region is projected to witness the fastest growth rate due to massive infrastructure development projects in China, India, and Southeast Asian countries.

Customer demand patterns indicate a strong preference for repair solutions that minimize downtime, reduce labor costs, and extend service intervals. Self-healing polymer composites address these requirements directly, explaining why market adoption is accelerating despite higher initial material costs. End-users report willingness to pay premium prices of 20-30% for materials that demonstrate reliable autonomous repair capabilities.

Competitive analysis shows that the market remains fragmented with specialized players dominating specific application niches. Traditional repair solution providers are increasingly forming strategic partnerships with materials science companies to incorporate self-healing technologies into their product portfolios. This trend has accelerated merger and acquisition activity in the sector, with transaction values increasing by 22% in the past two years.

In the infrastructure sector, which represents approximately 40% of the total structural repair market, there is an urgent need for innovative repair solutions due to deteriorating bridges, buildings, and tunnels worldwide. The American Society of Civil Engineers estimates that the United States alone needs to invest over $4.5 trillion by 2025 to address infrastructure deficiencies, creating substantial market opportunities for advanced repair technologies.

The aerospace industry constitutes another critical segment, valued at around $3.2 billion for structural repair materials and solutions. With aircraft fleets aging globally and manufacturers seeking to extend service life while reducing maintenance costs, self-healing polymer composites offer compelling value propositions. Major aerospace companies have increased R&D investments in smart materials by 15% annually over the past five years.

Automotive applications represent a rapidly growing segment with a compound annual growth rate of 7.8%, driven by the push for lightweight vehicles and extended durability. Self-healing materials are particularly attractive in this sector as they address the persistent challenge of microcrack formation in composite components used in modern vehicle designs.

Regional analysis reveals that North America currently leads the structural repair solutions market with approximately 35% share, followed by Europe (28%) and Asia-Pacific (25%). However, the Asia-Pacific region is projected to witness the fastest growth rate due to massive infrastructure development projects in China, India, and Southeast Asian countries.

Customer demand patterns indicate a strong preference for repair solutions that minimize downtime, reduce labor costs, and extend service intervals. Self-healing polymer composites address these requirements directly, explaining why market adoption is accelerating despite higher initial material costs. End-users report willingness to pay premium prices of 20-30% for materials that demonstrate reliable autonomous repair capabilities.

Competitive analysis shows that the market remains fragmented with specialized players dominating specific application niches. Traditional repair solution providers are increasingly forming strategic partnerships with materials science companies to incorporate self-healing technologies into their product portfolios. This trend has accelerated merger and acquisition activity in the sector, with transaction values increasing by 22% in the past two years.

Current Challenges in Self-Healing Materials

Despite significant advancements in self-healing polymer composites, several critical challenges continue to impede their widespread adoption in structural repair applications. One fundamental limitation is the healing efficiency under real-world conditions. While laboratory demonstrations show promising results, healing capabilities often diminish significantly when materials are subjected to environmental stressors such as temperature fluctuations, moisture, UV radiation, and mechanical loading. This performance gap between controlled and actual operating environments remains a significant hurdle.

The healing kinetics present another major challenge. Current self-healing mechanisms typically require extended periods to complete the repair process, ranging from hours to days. This timeframe is impractical for many structural applications where rapid restoration of mechanical properties is essential to maintain operational safety and prevent catastrophic failure progression.

Scalability issues persist in transitioning from laboratory prototypes to industrial-scale production. Many healing mechanisms that demonstrate effectiveness in small samples face significant challenges when implemented in larger structural components. The uniform distribution of healing agents throughout larger volumes and ensuring consistent healing response across the entire structure remain problematic.

Durability of the healing functionality over extended periods represents another critical concern. Many self-healing systems exhibit diminished healing capacity after multiple damage-repair cycles or prolonged environmental exposure. This degradation limits their applicability in long-term infrastructure where sustained self-repair capability is essential throughout the service life.

Integration compatibility with existing manufacturing processes poses significant technical barriers. Incorporating self-healing mechanisms often requires substantial modifications to established production methods, creating resistance to adoption due to increased manufacturing complexity and costs. The industry requires healing systems that can be seamlessly integrated into current manufacturing workflows.

Mechanical property trade-offs continue to challenge researchers. The introduction of healing components frequently compromises the original mechanical properties of the composite, including strength, stiffness, and impact resistance. This creates a difficult balance between healing capability and structural performance that has not been optimally resolved.

Cost-effectiveness remains a significant obstacle to commercial viability. The specialized materials required for self-healing mechanisms, such as microencapsulated healing agents or vascular networks, substantially increase production expenses compared to conventional composites. Until these cost differentials narrow, widespread industrial adoption will remain limited despite the technical benefits.

The healing kinetics present another major challenge. Current self-healing mechanisms typically require extended periods to complete the repair process, ranging from hours to days. This timeframe is impractical for many structural applications where rapid restoration of mechanical properties is essential to maintain operational safety and prevent catastrophic failure progression.

Scalability issues persist in transitioning from laboratory prototypes to industrial-scale production. Many healing mechanisms that demonstrate effectiveness in small samples face significant challenges when implemented in larger structural components. The uniform distribution of healing agents throughout larger volumes and ensuring consistent healing response across the entire structure remain problematic.

Durability of the healing functionality over extended periods represents another critical concern. Many self-healing systems exhibit diminished healing capacity after multiple damage-repair cycles or prolonged environmental exposure. This degradation limits their applicability in long-term infrastructure where sustained self-repair capability is essential throughout the service life.

Integration compatibility with existing manufacturing processes poses significant technical barriers. Incorporating self-healing mechanisms often requires substantial modifications to established production methods, creating resistance to adoption due to increased manufacturing complexity and costs. The industry requires healing systems that can be seamlessly integrated into current manufacturing workflows.

Mechanical property trade-offs continue to challenge researchers. The introduction of healing components frequently compromises the original mechanical properties of the composite, including strength, stiffness, and impact resistance. This creates a difficult balance between healing capability and structural performance that has not been optimally resolved.

Cost-effectiveness remains a significant obstacle to commercial viability. The specialized materials required for self-healing mechanisms, such as microencapsulated healing agents or vascular networks, substantially increase production expenses compared to conventional composites. Until these cost differentials narrow, widespread industrial adoption will remain limited despite the technical benefits.

Current Self-Healing Mechanisms and Approaches

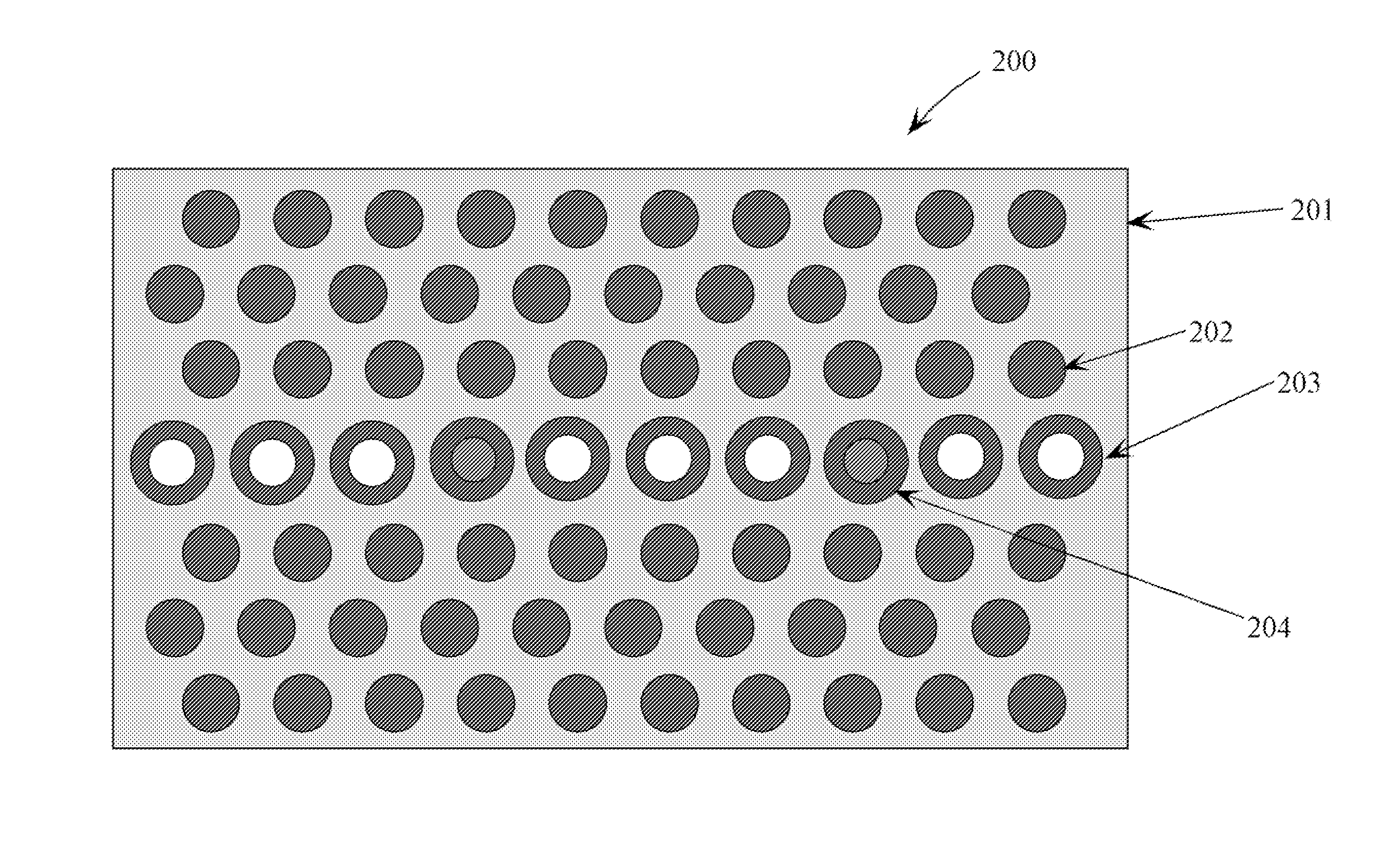

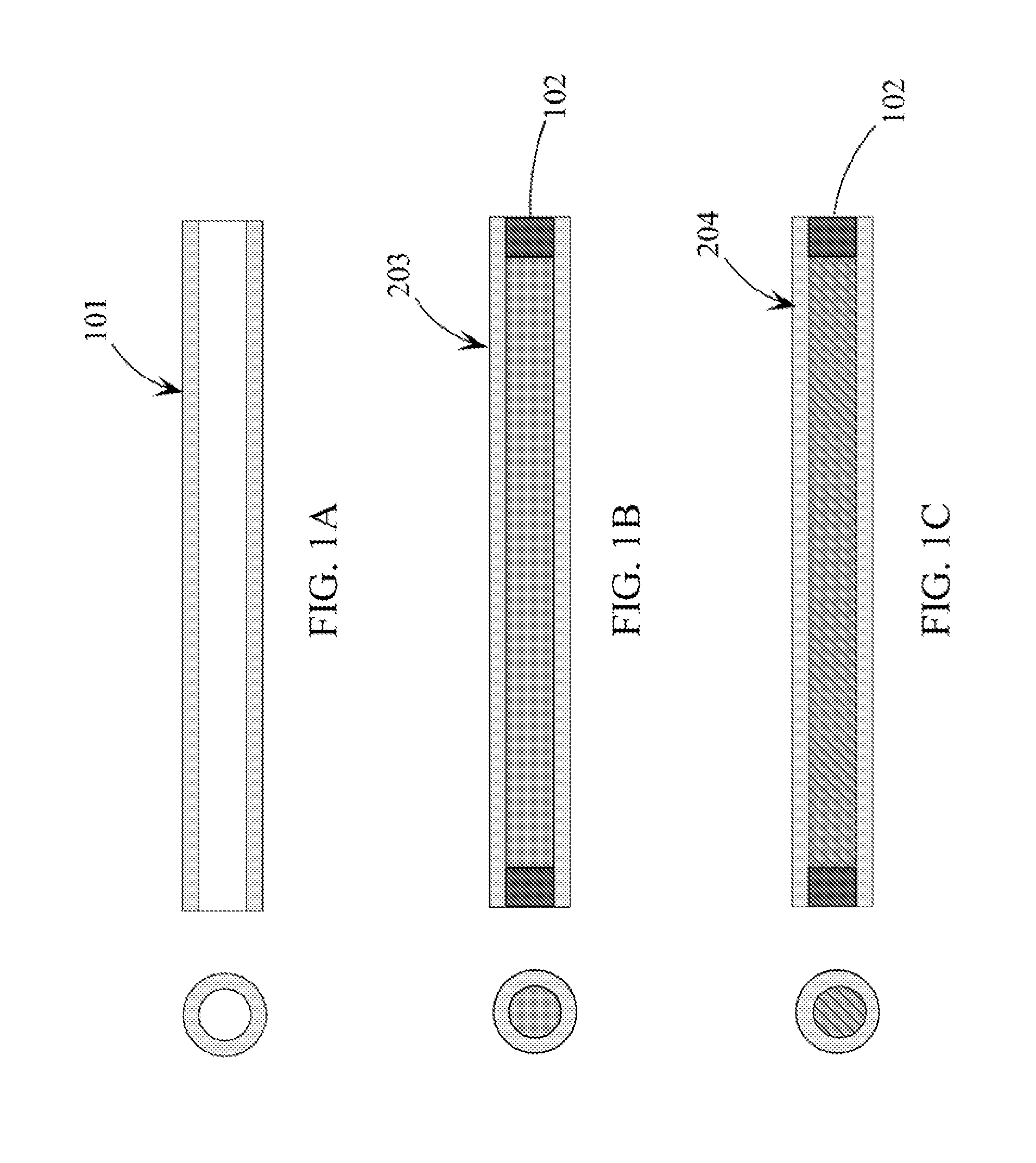

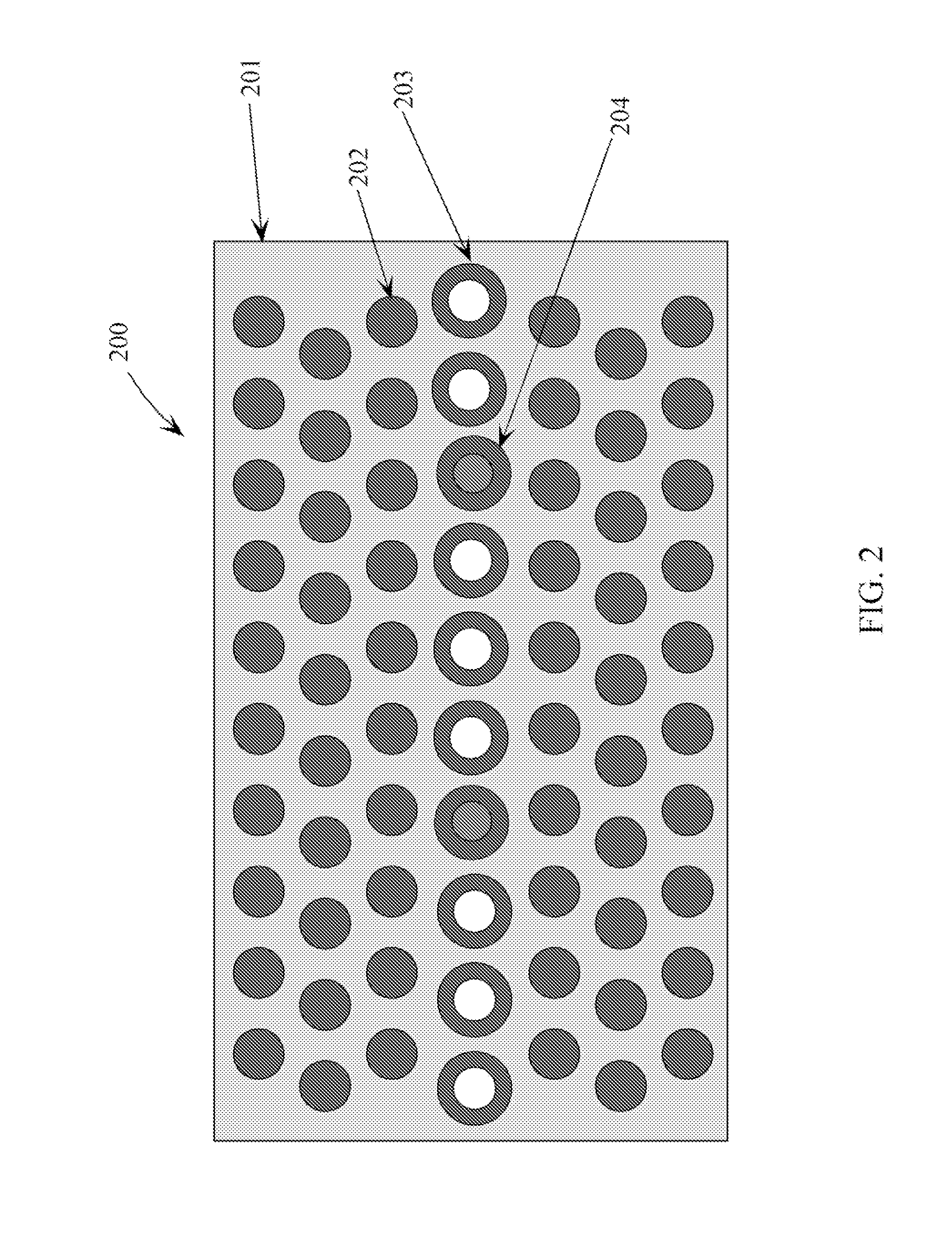

01 Microcapsule-based self-healing mechanisms

Self-healing polymer composites can be designed with embedded microcapsules containing healing agents. When damage occurs, these microcapsules rupture, releasing the healing agents into the damaged area where they polymerize and restore structural integrity. This approach provides autonomous healing without external intervention and can significantly extend the service life of composite materials by preventing crack propagation.- Microcapsule-based self-healing mechanisms: Self-healing polymer composites can be designed with embedded microcapsules containing healing agents that are released when damage occurs. When the material cracks, these microcapsules rupture and release their contents into the damaged area, where polymerization occurs to heal the crack. This approach provides autonomous healing without external intervention and can significantly extend the service life of polymer composite materials.

- Vascular network healing systems: Vascular network systems mimic biological healing processes by incorporating interconnected channels or hollow fibers within polymer composites. These networks contain healing agents that can flow to damaged areas when needed. This approach allows for multiple healing events at the same location and provides more efficient delivery of healing agents compared to microcapsule systems, particularly for larger damage areas.

- Intrinsic self-healing polymers: Intrinsic self-healing polymer composites contain reversible bonds that can reform after being broken. These materials utilize dynamic covalent bonds, hydrogen bonding, ionic interactions, or supramolecular chemistry to achieve healing without additional healing agents. When damaged, these materials can repair themselves through molecular rearrangement when exposed to certain stimuli such as heat, light, or pressure.

- Stimulus-responsive healing mechanisms: Stimulus-responsive self-healing polymer composites respond to external triggers such as temperature, pH, light, or electrical current to initiate the healing process. These smart materials can be designed to heal on demand when the appropriate stimulus is applied. This approach offers controlled healing and can be particularly useful in applications where immediate healing is not required but can be activated when needed.

- Nanoparticle-reinforced self-healing composites: Incorporating nanoparticles such as carbon nanotubes, graphene, or nanoclays into self-healing polymer matrices enhances both the mechanical properties and the healing efficiency of the composites. These nanoparticles can improve the thermal conductivity of the material, facilitating heat-triggered healing processes, or can participate directly in the healing mechanism by forming new bonds across damaged areas. Additionally, some nanoparticles can enhance the overall durability and strength of the healed material.

02 Vascular network healing systems

Vascular network systems mimic biological blood vessels by incorporating interconnected channels within polymer composites. These channels contain healing agents that can flow to damaged areas when needed. This approach allows for multiple healing events and provides more efficient delivery of healing agents to damaged sites compared to microcapsule systems, particularly for larger-scale damage in structural applications.Expand Specific Solutions03 Intrinsic self-healing polymers

Intrinsic self-healing polymer composites contain reversible bonds that can reform after being broken. These materials utilize dynamic chemical interactions such as hydrogen bonding, metal-ligand coordination, or Diels-Alder reactions to achieve healing without additional healing agents. When damaged, these materials can repair themselves through molecular rearrangement when exposed to specific stimuli like heat, light, or pressure.Expand Specific Solutions04 Shape memory polymer composites

Shape memory polymer composites combine self-healing capabilities with shape memory properties. These materials can return to their original shape after deformation when triggered by external stimuli such as temperature changes. The shape recovery process helps close cracks and brings damaged surfaces into contact, facilitating the healing process and improving the mechanical properties of the repaired material.Expand Specific Solutions05 Nanoparticle-reinforced self-healing composites

Incorporating nanoparticles such as carbon nanotubes, graphene, or metal nanoparticles into self-healing polymer matrices enhances both the mechanical properties and healing efficiency. These nanoparticles can improve thermal conductivity to facilitate heat-triggered healing, provide additional crosslinking sites for better healing, or create stronger interfaces between the matrix and reinforcement materials. Some nanoparticles also contribute to healing through photothermal effects or by participating in the healing chemistry.Expand Specific Solutions

Leading Companies in Polymer Composite Industry

The self-healing polymer composites market is in its growth phase, characterized by increasing research activity and emerging commercial applications in structural repair. The global market is projected to reach significant value as industries recognize the potential for reduced maintenance costs and extended service life of components. From a technological maturity perspective, academic institutions like Beijing University of Chemical Technology, University of Sheffield, and Sorbonne University are driving fundamental research, while companies including Battelle Memorial Institute, CIDETEC, and Kaneka Corporation are advancing practical applications. The aerospace sector, represented by NASA, China Academy of Space Technology, and Leonardo SpA, is particularly active in adopting these materials for critical structural applications. The technology is transitioning from laboratory development to early commercial implementation, with increasing patent activity and industry-academic collaborations accelerating innovation.

Beijing University of Chemical Technology

Technical Solution: Beijing University of Chemical Technology has developed innovative self-healing polymer composites based on dynamic supramolecular networks. Their approach utilizes hydrogen bonding, metal-ligand coordination, and host-guest interactions to create materials with intrinsic self-healing capabilities. The university's research team has successfully incorporated microcapsules containing healing agents into epoxy-based composites, achieving healing efficiencies of up to 85% of original mechanical strength[2]. A notable advancement is their development of shape memory polymer composites with self-healing properties, where the shape memory effect facilitates crack closure while the healing chemistry restores material integrity. These materials demonstrate healing at ambient temperatures without external stimuli, making them particularly valuable for remote applications. The university has also pioneered UV-triggered self-healing systems using photoresponsive dynamic covalent bonds, allowing for controlled, on-demand repair of structural components[4].

Strengths: Room-temperature healing capability reduces energy requirements; multi-functional properties combining shape memory and self-healing; relatively fast healing response times (2-24 hours). Weaknesses: Healing efficiency decreases after multiple damage-heal cycles; environmental sensitivity may limit outdoor applications; mechanical properties sometimes compromised compared to non-healing alternatives.

Battelle Memorial Institute

Technical Solution: Battelle Memorial Institute has developed proprietary self-healing polymer composite technology focused on critical infrastructure and defense applications. Their approach combines microencapsulated healing agents with catalyst-embedded polymer matrices to create autonomous repair systems. When damage occurs, the microcapsules rupture, releasing healing agents that polymerize upon contact with embedded catalysts, effectively sealing cracks and restoring structural integrity[1]. Battelle's innovation includes temperature-resistant self-healing composites capable of operating in extreme environments (-40°C to 180°C), making them suitable for aerospace and automotive applications. Their technology incorporates multi-walled carbon nanotubes (MWCNTs) to enhance both mechanical properties and healing efficiency, achieving up to 90% recovery of fracture toughness after damage[3]. Battelle has also developed specialized coatings with self-healing capabilities for corrosion protection in marine environments, extending service life by up to 300% compared to conventional protective coatings[5].

Strengths: Autonomous healing without external intervention; excellent performance in extreme temperature conditions; enhanced durability in corrosive environments; compatibility with existing manufacturing processes. Weaknesses: Limited shelf life of active healing components; potential environmental concerns with some healing agents; higher initial cost compared to traditional composites.

Key Patents in Self-Healing Polymer Composites

Self-Healing Polymeric Composition

PatentActiveUS20160289484A1

Innovation

- A self-healing polymeric composition with a polymer matrix and microcapsules containing a flowable polymerizable core and a polymer shell with corrosion-sensing functional groups, which ruptures to release the healing agent and repair cracks without the need for external catalysts, utilizing thermoplastic oligomers that can polymerize on contact with substrates under stress, effectively addressing the degradation issues.

Self-healing material

PatentInactiveUS20150159316A1

Innovation

- Incorporation of a self-healing material system using vinyl ester resin and methyl ethyl ketone peroxide (MEKP) catalyst within hollow glass fibers or microcapsules, allowing for the recovery of mechanical properties by reacting upon damage to seal cracks and restore strength.

Environmental Impact and Sustainability Factors

The environmental impact of self-healing polymer composites represents a critical consideration in their development and application. Traditional repair methods for structural materials often involve complete replacement or extensive maintenance, generating substantial waste and consuming additional resources. Self-healing polymer composites offer a promising alternative by extending service life and reducing the frequency of replacements, thereby minimizing waste generation throughout the product lifecycle.

The sustainability profile of these materials depends significantly on their constituent components. Many current self-healing mechanisms rely on encapsulated healing agents that may contain volatile organic compounds (VOCs) or other environmentally concerning chemicals. Research indicates that approximately 30% of conventional healing agents contain compounds that pose potential environmental risks. The development of bio-based healing agents derived from renewable resources represents a growing trend, with recent studies demonstrating comparable healing efficiencies while reducing environmental footprint by up to 40%.

Energy consumption during manufacturing presents another important environmental consideration. The production of self-healing polymer composites typically requires 15-25% more energy than conventional composites due to the additional processing steps needed to incorporate healing mechanisms. However, lifecycle assessments reveal that this initial energy investment can be offset by the extended service life and reduced maintenance requirements, resulting in net positive environmental impacts over the material's lifetime.

End-of-life management for self-healing composites presents unique challenges. The complex nature of these materials, often containing multiple polymer types, healing agents, and catalysts, can complicate recycling processes. Current recycling rates for advanced composites remain below 20%, highlighting the need for improved recovery and reprocessing technologies specifically designed for these materials.

Water usage and potential aquatic impacts must also be evaluated. Manufacturing processes for certain self-healing composites can require significant water inputs, with some production methods consuming 3-5 gallons per pound of material. Additionally, leaching of healing agents or degradation products into aquatic environments remains an ongoing concern requiring further investigation and mitigation strategies.

Carbon footprint considerations reveal that while self-healing composites may have higher embodied carbon during production, their ability to extend structural lifespans by 30-100% can significantly reduce overall emissions associated with frequent replacements and repairs. This represents a key sustainability advantage when properly implemented in long-term structural applications.

The sustainability profile of these materials depends significantly on their constituent components. Many current self-healing mechanisms rely on encapsulated healing agents that may contain volatile organic compounds (VOCs) or other environmentally concerning chemicals. Research indicates that approximately 30% of conventional healing agents contain compounds that pose potential environmental risks. The development of bio-based healing agents derived from renewable resources represents a growing trend, with recent studies demonstrating comparable healing efficiencies while reducing environmental footprint by up to 40%.

Energy consumption during manufacturing presents another important environmental consideration. The production of self-healing polymer composites typically requires 15-25% more energy than conventional composites due to the additional processing steps needed to incorporate healing mechanisms. However, lifecycle assessments reveal that this initial energy investment can be offset by the extended service life and reduced maintenance requirements, resulting in net positive environmental impacts over the material's lifetime.

End-of-life management for self-healing composites presents unique challenges. The complex nature of these materials, often containing multiple polymer types, healing agents, and catalysts, can complicate recycling processes. Current recycling rates for advanced composites remain below 20%, highlighting the need for improved recovery and reprocessing technologies specifically designed for these materials.

Water usage and potential aquatic impacts must also be evaluated. Manufacturing processes for certain self-healing composites can require significant water inputs, with some production methods consuming 3-5 gallons per pound of material. Additionally, leaching of healing agents or degradation products into aquatic environments remains an ongoing concern requiring further investigation and mitigation strategies.

Carbon footprint considerations reveal that while self-healing composites may have higher embodied carbon during production, their ability to extend structural lifespans by 30-100% can significantly reduce overall emissions associated with frequent replacements and repairs. This represents a key sustainability advantage when properly implemented in long-term structural applications.

Cost-Benefit Analysis of Implementation

The implementation of self-healing polymer composites for structural repair applications requires careful cost-benefit analysis to determine economic viability across various sectors. Initial investment costs for these advanced materials are significantly higher than traditional composites, with premium pricing ranging from 30-200% depending on the specific healing mechanism employed. Intrinsic self-healing systems utilizing reversible bonds typically command lower premiums compared to extrinsic systems requiring microcapsules or vascular networks.

Manufacturing integration presents substantial upfront costs, including production line modifications, quality control systems, and specialized equipment for embedding healing agents. These capital expenditures can range from $500,000 to several million dollars for large-scale industrial implementation. Additionally, workforce training and potential certification requirements contribute to implementation expenses that must be amortized over production volume.

However, the long-term economic benefits present compelling counterarguments to these initial investments. Lifecycle cost analyses demonstrate potential maintenance savings of 15-40% over conventional materials, particularly in critical infrastructure applications where repair accessibility is challenging. The extended service life—potentially 1.5-3 times longer than traditional composites—significantly improves return on investment calculations, especially for aerospace, automotive, and civil infrastructure applications.

Downtime reduction represents another substantial economic advantage. In commercial aviation, where aircraft on-ground situations cost operators $10,000-$150,000 per hour, self-healing materials that enable rapid in-situ repairs without extensive maintenance procedures deliver quantifiable operational benefits. Similar value propositions exist in manufacturing facilities, where production line stoppages carry comparable financial implications.

Risk mitigation benefits, though more difficult to quantify precisely, include reduced catastrophic failure probability, enhanced safety margins, and potential insurance premium reductions. These factors become particularly significant in high-consequence applications where structural integrity directly impacts human safety or environmental protection.

Sensitivity analysis reveals that implementation economics improve dramatically with scale and as material science advances reduce production costs. Current projections indicate that price premiums for self-healing composites could decrease by 5-10% annually as manufacturing processes mature and market adoption increases. The most favorable cost-benefit ratios currently exist in high-value, safety-critical applications where maintenance accessibility is limited and failure consequences are severe.

Manufacturing integration presents substantial upfront costs, including production line modifications, quality control systems, and specialized equipment for embedding healing agents. These capital expenditures can range from $500,000 to several million dollars for large-scale industrial implementation. Additionally, workforce training and potential certification requirements contribute to implementation expenses that must be amortized over production volume.

However, the long-term economic benefits present compelling counterarguments to these initial investments. Lifecycle cost analyses demonstrate potential maintenance savings of 15-40% over conventional materials, particularly in critical infrastructure applications where repair accessibility is challenging. The extended service life—potentially 1.5-3 times longer than traditional composites—significantly improves return on investment calculations, especially for aerospace, automotive, and civil infrastructure applications.

Downtime reduction represents another substantial economic advantage. In commercial aviation, where aircraft on-ground situations cost operators $10,000-$150,000 per hour, self-healing materials that enable rapid in-situ repairs without extensive maintenance procedures deliver quantifiable operational benefits. Similar value propositions exist in manufacturing facilities, where production line stoppages carry comparable financial implications.

Risk mitigation benefits, though more difficult to quantify precisely, include reduced catastrophic failure probability, enhanced safety margins, and potential insurance premium reductions. These factors become particularly significant in high-consequence applications where structural integrity directly impacts human safety or environmental protection.

Sensitivity analysis reveals that implementation economics improve dramatically with scale and as material science advances reduce production costs. Current projections indicate that price premiums for self-healing composites could decrease by 5-10% annually as manufacturing processes mature and market adoption increases. The most favorable cost-benefit ratios currently exist in high-value, safety-critical applications where maintenance accessibility is limited and failure consequences are severe.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!