Strategic Growth through Ethylene Vinyl Acetate Implementations

JUL 9, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

EVA Technology Evolution

Ethylene Vinyl Acetate (EVA) technology has undergone significant evolution since its inception in the 1950s. Initially developed as a copolymer of ethylene and vinyl acetate, EVA has transformed from a niche material to a versatile polymer with applications across various industries. The technology's evolution can be traced through several key phases, each marked by advancements in production processes, material properties, and application domains.

In the early stages, EVA was primarily used as a packaging material due to its flexibility and low-temperature toughness. The 1960s and 1970s saw improvements in polymerization techniques, leading to better control over the vinyl acetate content and molecular weight distribution. This enabled manufacturers to tailor EVA properties for specific applications, expanding its use in footwear, wire and cable insulation, and adhesives.

The 1980s marked a significant milestone in EVA technology with the introduction of metallocene catalysts. These single-site catalysts allowed for more precise control over the polymer structure, resulting in EVA grades with enhanced performance characteristics. This breakthrough led to the development of high-performance EVA foams and improved encapsulants for photovoltaic modules.

The 1990s and early 2000s witnessed a surge in EVA's use in the renewable energy sector, particularly in solar panel manufacturing. Advances in crosslinking technologies and UV stabilization improved EVA's durability and weather resistance, making it an ideal material for solar cell encapsulation. Concurrently, the development of EVA-based hot melt adhesives revolutionized the packaging and woodworking industries.

Recent years have seen a focus on sustainable EVA production methods and bio-based alternatives. Researchers are exploring ways to incorporate renewable feedstocks and develop biodegradable EVA variants to address environmental concerns. Additionally, nanotechnology has opened new avenues for EVA enhancement, with nanocomposites offering improved mechanical properties and flame retardancy.

The evolution of EVA technology has also been driven by advancements in processing techniques. Improved extrusion and injection molding technologies have enabled the production of complex EVA-based products with precise specifications. Furthermore, the integration of EVA into 3D printing materials has expanded its potential in rapid prototyping and customized manufacturing.

Looking ahead, the future of EVA technology is likely to be shaped by emerging trends such as smart materials and circular economy principles. Researchers are exploring the incorporation of conductive fillers to create EVA-based sensors and responsive materials. Simultaneously, efforts are underway to develop efficient recycling methods for EVA products, aligning with global sustainability goals.

In the early stages, EVA was primarily used as a packaging material due to its flexibility and low-temperature toughness. The 1960s and 1970s saw improvements in polymerization techniques, leading to better control over the vinyl acetate content and molecular weight distribution. This enabled manufacturers to tailor EVA properties for specific applications, expanding its use in footwear, wire and cable insulation, and adhesives.

The 1980s marked a significant milestone in EVA technology with the introduction of metallocene catalysts. These single-site catalysts allowed for more precise control over the polymer structure, resulting in EVA grades with enhanced performance characteristics. This breakthrough led to the development of high-performance EVA foams and improved encapsulants for photovoltaic modules.

The 1990s and early 2000s witnessed a surge in EVA's use in the renewable energy sector, particularly in solar panel manufacturing. Advances in crosslinking technologies and UV stabilization improved EVA's durability and weather resistance, making it an ideal material for solar cell encapsulation. Concurrently, the development of EVA-based hot melt adhesives revolutionized the packaging and woodworking industries.

Recent years have seen a focus on sustainable EVA production methods and bio-based alternatives. Researchers are exploring ways to incorporate renewable feedstocks and develop biodegradable EVA variants to address environmental concerns. Additionally, nanotechnology has opened new avenues for EVA enhancement, with nanocomposites offering improved mechanical properties and flame retardancy.

The evolution of EVA technology has also been driven by advancements in processing techniques. Improved extrusion and injection molding technologies have enabled the production of complex EVA-based products with precise specifications. Furthermore, the integration of EVA into 3D printing materials has expanded its potential in rapid prototyping and customized manufacturing.

Looking ahead, the future of EVA technology is likely to be shaped by emerging trends such as smart materials and circular economy principles. Researchers are exploring the incorporation of conductive fillers to create EVA-based sensors and responsive materials. Simultaneously, efforts are underway to develop efficient recycling methods for EVA products, aligning with global sustainability goals.

Market Demand Analysis

The market demand for Ethylene Vinyl Acetate (EVA) has been experiencing significant growth across various industries, driven by its versatile properties and wide range of applications. The global EVA market size was valued at USD 7.5 billion in 2020 and is projected to reach USD 11.2 billion by 2027, growing at a CAGR of 6.2% during the forecast period.

One of the primary drivers of EVA market demand is the increasing adoption in the solar photovoltaic industry. EVA is extensively used as an encapsulant material in solar panels due to its excellent transparency, weather resistance, and adhesion properties. With the growing focus on renewable energy and the rapid expansion of solar power installations worldwide, the demand for EVA in this sector is expected to continue its upward trajectory.

The packaging industry represents another significant market for EVA, particularly in flexible packaging applications. EVA's superior flexibility, toughness, and barrier properties make it an ideal choice for food packaging, shrink wrap, and stretch films. The rising demand for convenient and sustainable packaging solutions in the food and beverage sector is fueling the growth of EVA in this market segment.

In the footwear industry, EVA has gained substantial traction due to its lightweight nature, shock absorption capabilities, and durability. The material is widely used in the production of shoe soles, insoles, and midsoles, especially in sports and casual footwear. The growing health consciousness and increasing participation in sports activities are driving the demand for EVA-based footwear components.

The automotive sector is another key market for EVA, where it finds applications in interior components, wire and cable insulation, and sound deadening materials. The increasing focus on vehicle weight reduction and improved fuel efficiency is expected to boost the adoption of EVA in automotive applications.

Geographically, Asia Pacific dominates the EVA market, accounting for the largest share of global demand. The region's rapid industrialization, growing population, and increasing disposable income are driving the demand across various end-use industries. China, in particular, is a major consumer and producer of EVA, with significant investments in capacity expansion.

Despite the positive market outlook, the EVA industry faces challenges such as volatile raw material prices and environmental concerns related to its production and disposal. However, ongoing research and development efforts are focused on improving the sustainability of EVA production and exploring bio-based alternatives, which could open up new growth opportunities in the future.

One of the primary drivers of EVA market demand is the increasing adoption in the solar photovoltaic industry. EVA is extensively used as an encapsulant material in solar panels due to its excellent transparency, weather resistance, and adhesion properties. With the growing focus on renewable energy and the rapid expansion of solar power installations worldwide, the demand for EVA in this sector is expected to continue its upward trajectory.

The packaging industry represents another significant market for EVA, particularly in flexible packaging applications. EVA's superior flexibility, toughness, and barrier properties make it an ideal choice for food packaging, shrink wrap, and stretch films. The rising demand for convenient and sustainable packaging solutions in the food and beverage sector is fueling the growth of EVA in this market segment.

In the footwear industry, EVA has gained substantial traction due to its lightweight nature, shock absorption capabilities, and durability. The material is widely used in the production of shoe soles, insoles, and midsoles, especially in sports and casual footwear. The growing health consciousness and increasing participation in sports activities are driving the demand for EVA-based footwear components.

The automotive sector is another key market for EVA, where it finds applications in interior components, wire and cable insulation, and sound deadening materials. The increasing focus on vehicle weight reduction and improved fuel efficiency is expected to boost the adoption of EVA in automotive applications.

Geographically, Asia Pacific dominates the EVA market, accounting for the largest share of global demand. The region's rapid industrialization, growing population, and increasing disposable income are driving the demand across various end-use industries. China, in particular, is a major consumer and producer of EVA, with significant investments in capacity expansion.

Despite the positive market outlook, the EVA industry faces challenges such as volatile raw material prices and environmental concerns related to its production and disposal. However, ongoing research and development efforts are focused on improving the sustainability of EVA production and exploring bio-based alternatives, which could open up new growth opportunities in the future.

Technical Challenges

The implementation of Ethylene Vinyl Acetate (EVA) in various industries faces several technical challenges that need to be addressed for strategic growth. One of the primary obstacles is achieving consistent and uniform dispersion of EVA within composite materials. This issue can lead to inconsistencies in product quality and performance, particularly in applications such as solar panel encapsulation and footwear manufacturing.

Another significant challenge lies in optimizing the balance between EVA's flexibility and strength. While EVA is valued for its elastomeric properties, enhancing its mechanical strength without compromising flexibility remains a complex task. This is particularly crucial in industries such as packaging and automotive, where durability and impact resistance are paramount.

The thermal stability of EVA under various processing conditions presents another hurdle. At high temperatures, EVA can undergo degradation, leading to the release of acetic acid and potential changes in its physical properties. This thermal sensitivity limits its use in certain high-temperature applications and complicates processing methods.

Adhesion properties of EVA, while generally good, can be inconsistent across different substrates. Improving and maintaining consistent adhesion, especially in multi-layer structures or when bonding to polar materials, remains a technical challenge. This is particularly relevant in the packaging industry and in the production of laminated glass for construction and automotive use.

The environmental impact of EVA production and disposal also poses technical challenges. Developing more sustainable production methods and improving the recyclability of EVA-based products are areas that require significant research and development efforts. This includes finding ways to efficiently separate EVA from other materials in composite products at the end of their lifecycle.

Lastly, the customization of EVA properties for specific applications presents ongoing challenges. Different industries require EVA with varying levels of flexibility, transparency, and chemical resistance. Developing formulations that can meet these diverse requirements while maintaining cost-effectiveness and scalability in production remains a complex task for manufacturers.

Addressing these technical challenges is crucial for unlocking the full potential of EVA in various applications and driving strategic growth in industries relying on this versatile material. Overcoming these hurdles will require continued innovation in material science, processing technologies, and application-specific research and development efforts.

Another significant challenge lies in optimizing the balance between EVA's flexibility and strength. While EVA is valued for its elastomeric properties, enhancing its mechanical strength without compromising flexibility remains a complex task. This is particularly crucial in industries such as packaging and automotive, where durability and impact resistance are paramount.

The thermal stability of EVA under various processing conditions presents another hurdle. At high temperatures, EVA can undergo degradation, leading to the release of acetic acid and potential changes in its physical properties. This thermal sensitivity limits its use in certain high-temperature applications and complicates processing methods.

Adhesion properties of EVA, while generally good, can be inconsistent across different substrates. Improving and maintaining consistent adhesion, especially in multi-layer structures or when bonding to polar materials, remains a technical challenge. This is particularly relevant in the packaging industry and in the production of laminated glass for construction and automotive use.

The environmental impact of EVA production and disposal also poses technical challenges. Developing more sustainable production methods and improving the recyclability of EVA-based products are areas that require significant research and development efforts. This includes finding ways to efficiently separate EVA from other materials in composite products at the end of their lifecycle.

Lastly, the customization of EVA properties for specific applications presents ongoing challenges. Different industries require EVA with varying levels of flexibility, transparency, and chemical resistance. Developing formulations that can meet these diverse requirements while maintaining cost-effectiveness and scalability in production remains a complex task for manufacturers.

Addressing these technical challenges is crucial for unlocking the full potential of EVA in various applications and driving strategic growth in industries relying on this versatile material. Overcoming these hurdles will require continued innovation in material science, processing technologies, and application-specific research and development efforts.

Current EVA Solutions

01 Composition and properties of EVA

Ethylene Vinyl Acetate (EVA) is a copolymer of ethylene and vinyl acetate. It exhibits properties such as flexibility, toughness, and resistance to stress-cracking. The composition and ratio of ethylene to vinyl acetate can be adjusted to achieve specific material characteristics for various applications.- Composition and properties of EVA: Ethylene Vinyl Acetate (EVA) is a copolymer of ethylene and vinyl acetate. It exhibits properties such as flexibility, toughness, and resistance to stress-cracking. The composition and ratio of ethylene to vinyl acetate can be adjusted to modify the properties of the resulting material, making it suitable for various applications.

- EVA in adhesive applications: EVA is widely used in adhesive formulations due to its excellent adhesion properties and compatibility with various substrates. It can be used in hot melt adhesives, pressure-sensitive adhesives, and as a base polymer in adhesive blends. The adhesive strength and other properties can be tailored by adjusting the EVA composition and additives.

- EVA in foam and insulation materials: EVA is utilized in the production of foam and insulation materials due to its low density, good cushioning properties, and thermal insulation characteristics. It can be crosslinked or expanded to create closed-cell foams for applications such as footwear, sports equipment, and building insulation.

- EVA in solar panel encapsulation: EVA is commonly used as an encapsulant material in photovoltaic modules. It provides excellent transparency, weatherability, and protection against moisture and UV radiation. The material helps to enhance the durability and performance of solar panels by securely encapsulating the solar cells.

- Modifications and blends of EVA: EVA can be modified or blended with other polymers and additives to enhance its properties or create new materials with specific characteristics. This includes crosslinking, grafting, and blending with other polymers to improve heat resistance, mechanical properties, or compatibility with specific applications.

02 EVA in adhesive applications

EVA is widely used in adhesive formulations due to its excellent adhesion properties and compatibility with various substrates. It is particularly useful in hot melt adhesives, providing good bond strength and flexibility. EVA-based adhesives find applications in packaging, bookbinding, and construction industries.Expand Specific Solutions03 EVA in foam and insulation materials

EVA is utilized in the production of foam and insulation materials. Its closed-cell structure and low thermal conductivity make it suitable for applications such as footwear, sports equipment, and building insulation. EVA foams offer good shock absorption and cushioning properties.Expand Specific Solutions04 EVA in solar panel encapsulation

EVA is commonly used as an encapsulant material in photovoltaic modules. It provides excellent transparency, weatherability, and electrical insulation properties. EVA encapsulants help protect solar cells from environmental factors and enhance the overall performance and durability of solar panels.Expand Specific Solutions05 EVA in film and packaging applications

EVA is used in the production of flexible films and packaging materials. Its properties such as clarity, flexibility, and low-temperature toughness make it suitable for food packaging, agricultural films, and stretch wraps. EVA films offer good barrier properties and can be easily processed using various film extrusion techniques.Expand Specific Solutions

Key Industry Players

The strategic growth through Ethylene Vinyl Acetate (EVA) implementations is in a mature yet evolving phase, with a global market size expected to reach $12.8 billion by 2027. The industry is characterized by established players like China Petroleum & Chemical Corp., Celanese International Corp., and Wacker Chemie AG, alongside emerging competitors. Technological maturity varies, with companies like Air Products & Chemicals and ARLANXEO Deutschland GmbH driving innovation in EVA applications. The competitive landscape is intensifying as firms like Borealis AG and Versalis SpA invest in R&D to enhance product performance and sustainability, reflecting the industry's shift towards eco-friendly solutions and advanced material properties.

China Petroleum & Chemical Corp.

Technical Solution: China Petroleum & Chemical Corp. (Sinopec) has developed advanced EVA production technologies, including a proprietary high-pressure tubular reactor process. This process allows for precise control of ethylene and vinyl acetate (VA) content, resulting in EVA with tailored properties for various applications. Sinopec's EVA production capacity has reached over 300,000 tons per year [1], with products ranging from 3% to 40% VA content. The company has also invested in research to improve EVA's thermal stability and adhesion properties, particularly for solar panel encapsulation. Their EVA films have demonstrated excellent weatherability and low water absorption, extending the lifespan of photovoltaic modules [2]. Additionally, Sinopec has developed specialty EVA grades for high-performance footwear and packaging applications, leveraging their expertise in polymer science and process engineering.

Strengths: Large-scale production capacity, diverse product portfolio, and strong R&D capabilities. Weaknesses: Potential environmental concerns associated with petrochemical production and dependence on fossil fuel feedstocks.

Celanese International Corp.

Technical Solution: Celanese has pioneered innovative EVA technologies, focusing on high-performance grades for demanding applications. Their VitalDose® EVA drug delivery platform enables controlled release of active pharmaceutical ingredients, with customizable release profiles lasting from days to months [3]. This technology has found applications in implantable devices and long-acting injectables. Celanese has also developed EVA copolymers with enhanced melt strength and processability for extrusion coating and lamination processes. Their TufCOR™ EVA resins offer improved adhesion to various substrates and excellent low-temperature flexibility, making them suitable for automotive and construction applications [4]. The company's continuous investment in R&D has led to the development of EVA grades with improved heat resistance and reduced gel content, addressing key challenges in the industry.

Strengths: Strong focus on specialty EVA grades, expertise in pharmaceutical applications, and global manufacturing presence. Weaknesses: Higher production costs for specialty grades and potential vulnerability to raw material price fluctuations.

Core EVA Patents

Method for producing vinyl acetate

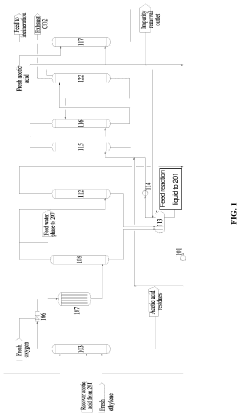

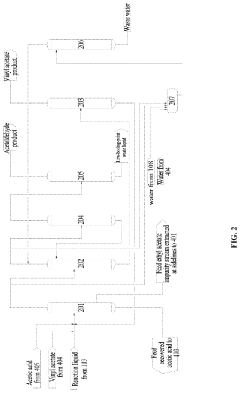

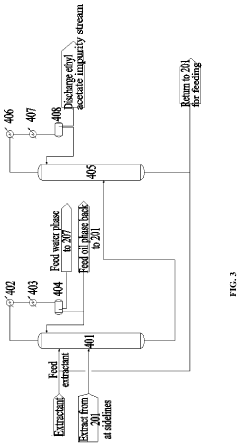

PatentActiveUS20230312452A1

Innovation

- A method involving a gas phase oxidation process with a system integration that includes specific towers and reactors for ethylene recovery, acetic acid evaporation, oxygen mixing, and separation processes, utilizing acetic acid as an extractant in the rectifying and separating towers to enhance the separation of vinyl acetate from ethyl acetate.

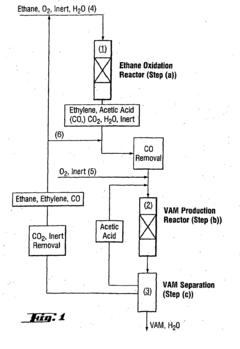

Integrated process for the production of vinyl acetate

PatentInactiveEP1286945B2

Innovation

- An integrated process that contacts a gaseous feedstock of ethane with molecular oxygen in the presence of specific catalysts to produce a mixture of acetic acid and ethylene, which is then converted to vinyl acetate in a second reaction zone, optimizing space/time yields and reducing infrastructure needs.

Environmental Impact

The environmental impact of Ethylene Vinyl Acetate (EVA) implementations is a critical consideration for strategic growth in various industries. EVA, a copolymer of ethylene and vinyl acetate, has gained significant attention due to its versatile properties and wide range of applications. However, its production, use, and disposal have notable environmental implications that must be carefully evaluated.

The manufacturing process of EVA involves the use of fossil fuel-derived raw materials, primarily ethylene and vinyl acetate. This reliance on non-renewable resources contributes to carbon emissions and the depletion of finite resources. Additionally, the production process requires substantial energy inputs, further increasing the carbon footprint associated with EVA manufacturing.

During its use phase, EVA products generally have a relatively low environmental impact. The material's durability and resistance to degradation can lead to extended product lifespans, potentially reducing the need for frequent replacements and associated resource consumption. However, this durability also presents challenges in terms of end-of-life management.

The disposal of EVA products poses significant environmental concerns. As a thermoplastic material, EVA can be recycled, but the recycling process is often complex and energy-intensive. Many EVA products end up in landfills or incineration facilities, contributing to waste accumulation and potential soil and air pollution. The slow degradation rate of EVA in natural environments can lead to long-term ecological impacts if not properly managed.

In recent years, there has been a growing focus on developing more sustainable alternatives and improving the environmental performance of EVA. Research efforts are directed towards incorporating bio-based materials in EVA production, enhancing recycling technologies, and exploring biodegradable variants. These initiatives aim to reduce the reliance on fossil fuels and mitigate the end-of-life environmental impacts of EVA products.

The environmental impact of EVA also extends to its applications in various industries. In the renewable energy sector, EVA is widely used in solar panel encapsulation, contributing to the growth of clean energy technologies. However, the long-term environmental implications of large-scale solar panel disposal, including EVA components, remain a concern that requires further attention and innovative solutions.

As industries pursue strategic growth through EVA implementations, it is crucial to adopt a lifecycle approach to environmental management. This involves considering the environmental impacts from raw material extraction to product disposal and seeking opportunities for improvement at each stage. Implementing circular economy principles, such as designing for recyclability and establishing effective take-back programs, can significantly reduce the overall environmental footprint of EVA applications.

The manufacturing process of EVA involves the use of fossil fuel-derived raw materials, primarily ethylene and vinyl acetate. This reliance on non-renewable resources contributes to carbon emissions and the depletion of finite resources. Additionally, the production process requires substantial energy inputs, further increasing the carbon footprint associated with EVA manufacturing.

During its use phase, EVA products generally have a relatively low environmental impact. The material's durability and resistance to degradation can lead to extended product lifespans, potentially reducing the need for frequent replacements and associated resource consumption. However, this durability also presents challenges in terms of end-of-life management.

The disposal of EVA products poses significant environmental concerns. As a thermoplastic material, EVA can be recycled, but the recycling process is often complex and energy-intensive. Many EVA products end up in landfills or incineration facilities, contributing to waste accumulation and potential soil and air pollution. The slow degradation rate of EVA in natural environments can lead to long-term ecological impacts if not properly managed.

In recent years, there has been a growing focus on developing more sustainable alternatives and improving the environmental performance of EVA. Research efforts are directed towards incorporating bio-based materials in EVA production, enhancing recycling technologies, and exploring biodegradable variants. These initiatives aim to reduce the reliance on fossil fuels and mitigate the end-of-life environmental impacts of EVA products.

The environmental impact of EVA also extends to its applications in various industries. In the renewable energy sector, EVA is widely used in solar panel encapsulation, contributing to the growth of clean energy technologies. However, the long-term environmental implications of large-scale solar panel disposal, including EVA components, remain a concern that requires further attention and innovative solutions.

As industries pursue strategic growth through EVA implementations, it is crucial to adopt a lifecycle approach to environmental management. This involves considering the environmental impacts from raw material extraction to product disposal and seeking opportunities for improvement at each stage. Implementing circular economy principles, such as designing for recyclability and establishing effective take-back programs, can significantly reduce the overall environmental footprint of EVA applications.

Regulatory Compliance

Regulatory compliance plays a crucial role in the strategic growth of Ethylene Vinyl Acetate (EVA) implementations across various industries. As EVA finds increasing applications in sectors such as packaging, solar panels, and footwear, manufacturers and distributors must navigate a complex landscape of regulations to ensure product safety, environmental protection, and market access.

In the packaging industry, EVA copolymers used in food contact materials are subject to stringent regulations. The U.S. Food and Drug Administration (FDA) and the European Food Safety Authority (EFSA) have established specific guidelines for EVA materials in food packaging. Compliance with these regulations requires extensive testing and documentation to demonstrate the safety of EVA-based products when in contact with food items.

For solar panel applications, EVA encapsulants must adhere to international standards such as IEC 61215 and IEC 61730. These standards ensure the long-term reliability and performance of photovoltaic modules. Manufacturers must obtain certification from recognized testing laboratories to verify compliance with these standards, which is essential for market acceptance and product warranties.

In the footwear industry, EVA foams used in shoe soles and insoles must comply with regulations related to chemical content and consumer safety. The European Union's REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) regulation imposes strict requirements on the use of certain substances in EVA formulations. Manufacturers must ensure their products do not contain restricted substances above specified thresholds.

Environmental regulations also significantly impact EVA production and use. Many countries have implemented policies to reduce greenhouse gas emissions and promote recycling. EVA manufacturers must adapt their processes to meet these requirements, potentially investing in cleaner production technologies or developing recycling programs for EVA-based products.

Occupational health and safety regulations govern the handling and processing of EVA materials in manufacturing facilities. Compliance with these regulations involves implementing proper ventilation systems, providing personal protective equipment, and establishing safety protocols for workers involved in EVA production and processing.

As global trade in EVA products continues to grow, compliance with import and export regulations becomes increasingly important. Different countries may have varying requirements for product labeling, documentation, and certification. Companies engaged in international trade of EVA materials must stay informed about these regulations to avoid delays or rejections at customs.

To ensure ongoing compliance and strategic growth, companies involved in EVA implementations should establish robust regulatory monitoring systems. This includes staying updated on changes in regulations, participating in industry associations, and engaging with regulatory bodies. Proactive compliance management can provide a competitive advantage by enabling faster market entry and building trust with customers and regulatory authorities.

In the packaging industry, EVA copolymers used in food contact materials are subject to stringent regulations. The U.S. Food and Drug Administration (FDA) and the European Food Safety Authority (EFSA) have established specific guidelines for EVA materials in food packaging. Compliance with these regulations requires extensive testing and documentation to demonstrate the safety of EVA-based products when in contact with food items.

For solar panel applications, EVA encapsulants must adhere to international standards such as IEC 61215 and IEC 61730. These standards ensure the long-term reliability and performance of photovoltaic modules. Manufacturers must obtain certification from recognized testing laboratories to verify compliance with these standards, which is essential for market acceptance and product warranties.

In the footwear industry, EVA foams used in shoe soles and insoles must comply with regulations related to chemical content and consumer safety. The European Union's REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) regulation imposes strict requirements on the use of certain substances in EVA formulations. Manufacturers must ensure their products do not contain restricted substances above specified thresholds.

Environmental regulations also significantly impact EVA production and use. Many countries have implemented policies to reduce greenhouse gas emissions and promote recycling. EVA manufacturers must adapt their processes to meet these requirements, potentially investing in cleaner production technologies or developing recycling programs for EVA-based products.

Occupational health and safety regulations govern the handling and processing of EVA materials in manufacturing facilities. Compliance with these regulations involves implementing proper ventilation systems, providing personal protective equipment, and establishing safety protocols for workers involved in EVA production and processing.

As global trade in EVA products continues to grow, compliance with import and export regulations becomes increasingly important. Different countries may have varying requirements for product labeling, documentation, and certification. Companies engaged in international trade of EVA materials must stay informed about these regulations to avoid delays or rejections at customs.

To ensure ongoing compliance and strategic growth, companies involved in EVA implementations should establish robust regulatory monitoring systems. This includes staying updated on changes in regulations, participating in industry associations, and engaging with regulatory bodies. Proactive compliance management can provide a competitive advantage by enabling faster market entry and building trust with customers and regulatory authorities.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!