Supply Chain Impacts Of Switching To Continuous Manufacturing

SEP 3, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Continuous Manufacturing Evolution and Objectives

Continuous manufacturing represents a paradigm shift in pharmaceutical and chemical production, evolving from traditional batch processing methods that have dominated manufacturing for centuries. This evolution began in the early 2000s when regulatory bodies, particularly the FDA, recognized the potential benefits of continuous processing for improving product quality and manufacturing efficiency. The transition gained momentum in 2004 when the FDA introduced its Process Analytical Technology (PAT) initiative, encouraging innovation in manufacturing technologies and quality control methods.

The historical trajectory of continuous manufacturing shows significant acceleration after 2011, when the FDA's Center for Drug Evaluation and Research (CDER) established the Office of Pharmaceutical Quality, specifically focusing on advanced manufacturing technologies. By 2015, the first FDA approval for a continuously manufactured drug (Vertex's Orkambi) marked a critical milestone, demonstrating regulatory acceptance of this approach.

The primary objectives of continuous manufacturing center around supply chain optimization and resilience. Unlike batch processing, which involves discrete production steps with intermediate storage and testing, continuous manufacturing integrates these steps into a seamless flow process. This integration aims to reduce production time from weeks to days, minimize inventory requirements, and decrease manufacturing footprint by up to 90%, resulting in more agile and responsive supply chains.

Quality improvement represents another fundamental objective, as continuous manufacturing enables real-time monitoring and control of critical process parameters. This capability allows for immediate detection and correction of deviations, reducing variability and enhancing product consistency. The implementation of Process Analytical Technology (PAT) tools further supports this objective by providing continuous quality verification rather than end-product testing.

Cost reduction emerges as a significant driver for continuous manufacturing adoption, with potential savings of 15-30% in operating costs through reduced labor requirements, decreased waste generation, lower energy consumption, and minimized inventory holding costs. These economic benefits become particularly compelling when considering long-term supply chain stability and resilience against disruptions.

Environmental sustainability objectives have gained prominence in recent years, with continuous manufacturing offering reduced solvent usage (up to 90% in some cases), decreased energy consumption, and smaller facility footprints. These advantages align with growing regulatory and market pressures for greener manufacturing practices across global supply chains.

The historical trajectory of continuous manufacturing shows significant acceleration after 2011, when the FDA's Center for Drug Evaluation and Research (CDER) established the Office of Pharmaceutical Quality, specifically focusing on advanced manufacturing technologies. By 2015, the first FDA approval for a continuously manufactured drug (Vertex's Orkambi) marked a critical milestone, demonstrating regulatory acceptance of this approach.

The primary objectives of continuous manufacturing center around supply chain optimization and resilience. Unlike batch processing, which involves discrete production steps with intermediate storage and testing, continuous manufacturing integrates these steps into a seamless flow process. This integration aims to reduce production time from weeks to days, minimize inventory requirements, and decrease manufacturing footprint by up to 90%, resulting in more agile and responsive supply chains.

Quality improvement represents another fundamental objective, as continuous manufacturing enables real-time monitoring and control of critical process parameters. This capability allows for immediate detection and correction of deviations, reducing variability and enhancing product consistency. The implementation of Process Analytical Technology (PAT) tools further supports this objective by providing continuous quality verification rather than end-product testing.

Cost reduction emerges as a significant driver for continuous manufacturing adoption, with potential savings of 15-30% in operating costs through reduced labor requirements, decreased waste generation, lower energy consumption, and minimized inventory holding costs. These economic benefits become particularly compelling when considering long-term supply chain stability and resilience against disruptions.

Environmental sustainability objectives have gained prominence in recent years, with continuous manufacturing offering reduced solvent usage (up to 90% in some cases), decreased energy consumption, and smaller facility footprints. These advantages align with growing regulatory and market pressures for greener manufacturing practices across global supply chains.

Supply Chain Market Dynamics Analysis

The pharmaceutical manufacturing landscape is experiencing a significant shift from traditional batch processing to continuous manufacturing (CM), creating ripple effects throughout the global supply chain. This transition is reshaping market dynamics across the pharmaceutical industry, with implications for raw material suppliers, equipment manufacturers, logistics providers, and end consumers.

Market demand for continuous manufacturing solutions has been growing at approximately 12% annually since 2018, driven primarily by pharmaceutical companies seeking greater efficiency and regulatory bodies encouraging adoption. The COVID-19 pandemic accelerated this trend, highlighting vulnerabilities in traditional supply chains and emphasizing the need for more resilient manufacturing approaches.

From a supplier perspective, continuous manufacturing requires different raw material specifications, particularly regarding particle size consistency and flow properties. This has created new market segments for specialized excipients and APIs designed specifically for continuous processes, with several major chemical suppliers developing dedicated product lines. Companies like BASF, Dow, and Evonik have established specialized divisions focused on materials optimized for continuous pharmaceutical manufacturing.

Equipment manufacturers have responded by developing integrated continuous manufacturing systems, creating a rapidly growing market segment valued at approximately $1.2 billion in 2022. Traditional equipment suppliers are either adapting their offerings or facing competition from new entrants specializing in continuous processing technologies. This has triggered consolidation within the equipment manufacturing sector, with several strategic acquisitions occurring between 2020-2023.

Logistics and distribution networks are also evolving in response to continuous manufacturing adoption. The shift from large, infrequent batch shipments to smaller, more frequent deliveries of raw materials has created demand for more agile logistics solutions. Just-in-time delivery systems are becoming increasingly important, with specialized pharmaceutical logistics providers reporting 15-20% growth in services supporting continuous manufacturing operations.

Geographically, North America and Europe currently lead in continuous manufacturing adoption, accounting for over 70% of global implementation. However, Asia-Pacific markets are showing the fastest growth rate, particularly in countries with established pharmaceutical manufacturing bases like India, Singapore, and China. This regional variation is creating different market dynamics across global supply chains, with equipment and service providers developing region-specific strategies.

The competitive landscape is increasingly characterized by strategic partnerships between pharmaceutical companies, equipment manufacturers, and material suppliers. These collaborations aim to develop integrated solutions that address the complex supply chain challenges associated with continuous manufacturing implementation.

Market demand for continuous manufacturing solutions has been growing at approximately 12% annually since 2018, driven primarily by pharmaceutical companies seeking greater efficiency and regulatory bodies encouraging adoption. The COVID-19 pandemic accelerated this trend, highlighting vulnerabilities in traditional supply chains and emphasizing the need for more resilient manufacturing approaches.

From a supplier perspective, continuous manufacturing requires different raw material specifications, particularly regarding particle size consistency and flow properties. This has created new market segments for specialized excipients and APIs designed specifically for continuous processes, with several major chemical suppliers developing dedicated product lines. Companies like BASF, Dow, and Evonik have established specialized divisions focused on materials optimized for continuous pharmaceutical manufacturing.

Equipment manufacturers have responded by developing integrated continuous manufacturing systems, creating a rapidly growing market segment valued at approximately $1.2 billion in 2022. Traditional equipment suppliers are either adapting their offerings or facing competition from new entrants specializing in continuous processing technologies. This has triggered consolidation within the equipment manufacturing sector, with several strategic acquisitions occurring between 2020-2023.

Logistics and distribution networks are also evolving in response to continuous manufacturing adoption. The shift from large, infrequent batch shipments to smaller, more frequent deliveries of raw materials has created demand for more agile logistics solutions. Just-in-time delivery systems are becoming increasingly important, with specialized pharmaceutical logistics providers reporting 15-20% growth in services supporting continuous manufacturing operations.

Geographically, North America and Europe currently lead in continuous manufacturing adoption, accounting for over 70% of global implementation. However, Asia-Pacific markets are showing the fastest growth rate, particularly in countries with established pharmaceutical manufacturing bases like India, Singapore, and China. This regional variation is creating different market dynamics across global supply chains, with equipment and service providers developing region-specific strategies.

The competitive landscape is increasingly characterized by strategic partnerships between pharmaceutical companies, equipment manufacturers, and material suppliers. These collaborations aim to develop integrated solutions that address the complex supply chain challenges associated with continuous manufacturing implementation.

Current State and Barriers in Continuous Manufacturing

Continuous manufacturing (CM) represents a paradigm shift from traditional batch processing in pharmaceutical and chemical industries. Currently, approximately 5% of pharmaceutical manufacturing facilities globally have implemented some form of continuous manufacturing, with adoption rates varying significantly across regions. The United States and Europe lead implementation efforts, driven by regulatory support from the FDA and EMA, while adoption in Asia and emerging markets remains limited but growing.

The technological landscape of continuous manufacturing has evolved substantially over the past decade. Advanced Process Analytical Technology (PAT) systems now enable real-time monitoring and control of critical quality attributes. Flow chemistry equipment has become more sophisticated, allowing for complex multi-step syntheses in continuous mode. However, implementation remains concentrated in large pharmaceutical companies with substantial R&D resources, while small and medium enterprises face significant adoption barriers.

From a supply chain perspective, current continuous manufacturing implementations demonstrate mixed results. Companies that have successfully transitioned report inventory reductions of 15-30%, manufacturing footprint reductions of up to 50%, and lead time reductions of 60-80% compared to batch processes. These improvements translate to enhanced supply chain responsiveness and reduced vulnerability to disruptions.

Despite these advantages, several significant barriers impede widespread adoption. Capital investment requirements represent a primary obstacle, with conversion costs ranging from $20-100 million depending on facility scale and complexity. The pharmaceutical industry's risk-averse culture further complicates adoption, as regulatory uncertainty and validation concerns create hesitation among decision-makers.

Technical challenges persist in several areas. Process integration difficulties arise when connecting multiple unit operations into a seamless continuous flow. Material handling issues, particularly with powders and highly viscous materials, create bottlenecks in continuous systems. Additionally, the development of robust control strategies that can manage process variability in real-time remains challenging.

Regulatory frameworks, while evolving to accommodate continuous manufacturing, still present barriers. Regulatory guidance documents often lag behind technological innovation, creating uncertainty in validation approaches. Different regional requirements complicate global implementation strategies, particularly for companies operating across multiple markets.

Workforce limitations constitute another significant barrier, as the industry faces a shortage of personnel with expertise in continuous manufacturing principles and technologies. Educational institutions have been slow to update curricula to address this skills gap, further constraining implementation capabilities across the industry.

The technological landscape of continuous manufacturing has evolved substantially over the past decade. Advanced Process Analytical Technology (PAT) systems now enable real-time monitoring and control of critical quality attributes. Flow chemistry equipment has become more sophisticated, allowing for complex multi-step syntheses in continuous mode. However, implementation remains concentrated in large pharmaceutical companies with substantial R&D resources, while small and medium enterprises face significant adoption barriers.

From a supply chain perspective, current continuous manufacturing implementations demonstrate mixed results. Companies that have successfully transitioned report inventory reductions of 15-30%, manufacturing footprint reductions of up to 50%, and lead time reductions of 60-80% compared to batch processes. These improvements translate to enhanced supply chain responsiveness and reduced vulnerability to disruptions.

Despite these advantages, several significant barriers impede widespread adoption. Capital investment requirements represent a primary obstacle, with conversion costs ranging from $20-100 million depending on facility scale and complexity. The pharmaceutical industry's risk-averse culture further complicates adoption, as regulatory uncertainty and validation concerns create hesitation among decision-makers.

Technical challenges persist in several areas. Process integration difficulties arise when connecting multiple unit operations into a seamless continuous flow. Material handling issues, particularly with powders and highly viscous materials, create bottlenecks in continuous systems. Additionally, the development of robust control strategies that can manage process variability in real-time remains challenging.

Regulatory frameworks, while evolving to accommodate continuous manufacturing, still present barriers. Regulatory guidance documents often lag behind technological innovation, creating uncertainty in validation approaches. Different regional requirements complicate global implementation strategies, particularly for companies operating across multiple markets.

Workforce limitations constitute another significant barrier, as the industry faces a shortage of personnel with expertise in continuous manufacturing principles and technologies. Educational institutions have been slow to update curricula to address this skills gap, further constraining implementation capabilities across the industry.

Current Supply Chain Integration Solutions

01 Real-time monitoring and control systems in continuous manufacturing

Continuous manufacturing supply chains benefit from real-time monitoring and control systems that enable immediate adjustments to production parameters. These systems collect data from various points in the manufacturing process, analyze it instantaneously, and make automatic adjustments to maintain product quality and process efficiency. This approach reduces variability, minimizes waste, and ensures consistent product quality throughout the continuous manufacturing process.- Real-time monitoring and control systems: Continuous manufacturing supply chains benefit from real-time monitoring and control systems that enable immediate adjustments to production processes. These systems collect data from various points in the manufacturing line, analyze it instantaneously, and make automated decisions to optimize production flow. This approach reduces downtime, minimizes waste, and ensures consistent product quality throughout the continuous manufacturing process.

- Integrated supply chain management platforms: Integrated platforms that connect all aspects of the supply chain are essential for continuous manufacturing. These platforms synchronize production planning, inventory management, logistics, and distribution to create a seamless flow of materials and products. By providing visibility across the entire supply chain, these systems enable better coordination between suppliers, manufacturers, and distributors, reducing bottlenecks and ensuring continuous operation.

- Demand-driven production scheduling: Demand-driven production scheduling systems enable continuous manufacturing by aligning production rates with actual market demand. These systems use advanced algorithms to forecast demand patterns and automatically adjust production schedules accordingly. This approach minimizes inventory holding costs while ensuring sufficient product availability, creating a more responsive and efficient continuous manufacturing supply chain.

- Digital twin technology for supply chain optimization: Digital twin technology creates virtual replicas of physical manufacturing processes and supply chains, allowing for simulation and optimization without disrupting actual operations. These digital models enable manufacturers to test different scenarios, identify potential bottlenecks, and optimize continuous production flows before implementation. By providing predictive insights, digital twins help maintain the continuity of manufacturing operations while improving efficiency and reducing risks.

- Blockchain-based supply chain traceability: Blockchain technology provides secure, transparent tracking of materials and products throughout the continuous manufacturing supply chain. This distributed ledger system creates immutable records of transactions and movements, enabling real-time visibility and authentication at each step of the process. For continuous manufacturing operations, blockchain ensures regulatory compliance, simplifies quality assurance, and facilitates rapid identification of issues when they arise, minimizing disruptions to the continuous flow.

02 Integrated supply chain management for continuous manufacturing

Integrated supply chain management systems specifically designed for continuous manufacturing environments coordinate raw material procurement, production scheduling, and distribution in a seamless flow. These systems synchronize upstream and downstream operations to maintain the continuous nature of the manufacturing process, reducing inventory buffers and lead times. The integration extends to suppliers and distributors, creating an end-to-end solution that optimizes resource utilization and responds quickly to market demands.Expand Specific Solutions03 Predictive analytics and demand forecasting for continuous operations

Advanced predictive analytics and demand forecasting tools help maintain the flow in continuous manufacturing supply chains by anticipating market needs and potential disruptions. These tools analyze historical data, market trends, and external factors to predict future demand patterns and supply chain risks. By providing accurate forecasts, these systems enable manufacturers to adjust production rates, raw material procurement, and maintenance schedules to prevent interruptions in the continuous manufacturing process.Expand Specific Solutions04 Digital twin technology for continuous manufacturing optimization

Digital twin technology creates virtual replicas of physical continuous manufacturing systems to simulate, optimize, and troubleshoot production processes without disrupting actual operations. These digital models incorporate real-time data from the physical system to reflect current conditions accurately. Manufacturers can use digital twins to test process changes, identify bottlenecks, optimize resource allocation, and train operators, all while maintaining the continuous flow of production in the physical environment.Expand Specific Solutions05 Sustainable and resilient continuous manufacturing supply chains

Sustainable and resilient continuous manufacturing supply chains incorporate environmental considerations and risk mitigation strategies while maintaining uninterrupted production. These systems optimize energy usage, reduce waste, and utilize renewable resources where possible. They also include redundancy measures, alternative sourcing strategies, and flexible production capabilities to quickly adapt to disruptions such as material shortages, equipment failures, or market changes without halting the continuous manufacturing process.Expand Specific Solutions

Leading Organizations in Continuous Manufacturing

The continuous manufacturing transition in supply chains is currently in an early growth phase, with the market expected to reach significant expansion due to efficiency and cost benefits. Technology maturity varies across sectors, with pharmaceutical companies like Merck Sharp & Dohme leading adoption for regulatory compliance and quality control advantages. Manufacturing giants including Caterpillar, Hitachi, and ABB Group are developing advanced automation solutions, while technology providers such as IBM, SAP, and Oracle are creating specialized software platforms to manage continuous production data flows. Consumer goods leaders like Procter & Gamble are implementing continuous manufacturing to reduce inventory costs and improve responsiveness, demonstrating the technology's cross-industry potential despite varying implementation challenges.

SAP SE

Technical Solution: SAP has developed a comprehensive digital supply chain platform specifically designed to support continuous manufacturing transitions. Their solution integrates real-time production data with enterprise resource planning systems to create a synchronized digital thread across the entire supply network. The platform features advanced analytics capabilities that model the impact of continuous manufacturing implementation on inventory levels, lead times, and working capital requirements. SAP's technology includes digital twin functionality that simulates continuous production flows before physical implementation, allowing companies to identify potential bottlenecks and optimize processes virtually. Their system incorporates machine learning algorithms that continuously analyze production patterns to identify optimization opportunities and predict maintenance needs. The platform also provides end-to-end visibility across the supply chain, enabling real-time tracking of materials from suppliers through production to customer delivery. SAP's solution includes specialized modules for regulatory compliance management that maintain detailed electronic records of continuous production parameters, critical for industries with strict documentation requirements.

Strengths: Seamless integration with existing enterprise systems; powerful predictive analytics capabilities for supply chain optimization; comprehensive visibility across the entire value chain. Weaknesses: Complex implementation requiring significant organizational change management; substantial data infrastructure requirements; potential challenges in achieving full supplier integration across the network.

Procter & Gamble Co.

Technical Solution: Procter & Gamble has developed an integrated continuous manufacturing platform that transforms traditional batch processing into a seamless flow production system. Their approach incorporates real-time quality monitoring using Process Analytical Technology (PAT) tools that enable immediate adjustments based on product parameters. P&G has implemented this technology across multiple product categories, achieving up to 30% reduction in production footprint and 20% decrease in energy consumption compared to traditional batch manufacturing. Their system includes advanced digital twins that simulate production scenarios before implementation, allowing for optimization without disrupting actual operations. P&G's continuous manufacturing platform also features modular design elements that enable rapid reconfiguration of production lines to accommodate different product formulations, significantly reducing changeover times from days to hours.

Strengths: Significantly reduced inventory holding costs due to just-in-time production capabilities; enhanced quality control through continuous monitoring; improved sustainability metrics through reduced waste and energy usage. Weaknesses: High initial capital investment required for technology transition; requires specialized workforce training; potential challenges in regulatory compliance during transition periods.

Key Technological Innovations in Continuous Processing

Printer systems and methods for global tracking of products in supply chains, authentication of products, and connecting with customers both before, during, and after a product sale

PatentInactiveEP2175409A3

Innovation

- Implementing a system of unique identification codes assigned to items of commerce using printers and servers, allowing for global tracking, authentication, and connection between manufacturers, retailers, and customers through a network of assignment devices and databases, enabling inquiries and information sharing.

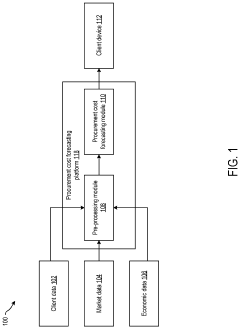

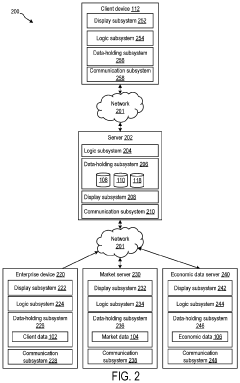

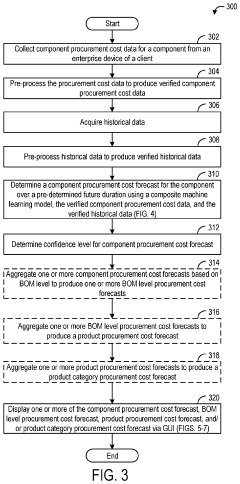

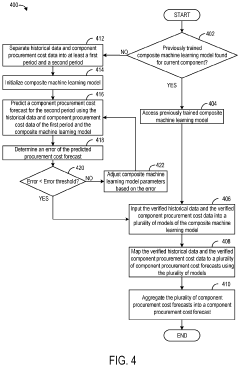

Systems and methods for procurement cost forecasting

PatentInactiveUS20220277331A1

Innovation

- A procurement cost forecasting platform using a composite machine learning model that collects and processes specific component data from companies, integrating historical and market data to provide granular, context-specific procurement cost forecasts through a graphical user interface.

Regulatory Framework for Continuous Manufacturing

The regulatory landscape for continuous manufacturing in pharmaceutical and other industries represents a complex and evolving framework that significantly impacts supply chain transformation efforts. Regulatory bodies worldwide, including the FDA in the United States and the EMA in Europe, have demonstrated increasing support for continuous manufacturing adoption through various initiatives and guidance documents.

The FDA's Emerging Technology Program, established in 2014, provides a collaborative framework for companies to engage with regulators early in the development of innovative manufacturing technologies, including continuous manufacturing. This proactive approach has facilitated regulatory approval for several continuous manufacturing processes, with Vertex Pharmaceuticals' Orkambi being the first FDA-approved product manufactured using this technology in 2015.

In Europe, the EMA has similarly developed guidelines specifically addressing continuous manufacturing implementation, focusing on process validation requirements, real-time release testing, and control strategy development. These guidelines emphasize the importance of process analytical technology (PAT) integration and quality-by-design principles when transitioning from batch to continuous operations.

International harmonization efforts through the International Council for Harmonisation (ICH) have resulted in several quality guidelines that, while not specifically developed for continuous manufacturing, provide applicable frameworks for implementation. The ICH Q8, Q9, Q10, and Q11 guidelines collectively address pharmaceutical development, quality risk management, and manufacturing system requirements that support continuous processing approaches.

Regulatory considerations for continuous manufacturing extend beyond approval processes to include ongoing compliance requirements. Companies must establish robust monitoring systems, validation protocols, and change management procedures that align with the dynamic nature of continuous operations. The regulatory framework increasingly recognizes the need for flexible approaches to process validation that accommodate the continuous improvement inherent in these systems.

Emerging markets present additional regulatory complexity, with varying levels of familiarity and acceptance of continuous manufacturing technologies. Companies pursuing global supply chain strategies must navigate these differences while maintaining consistent quality standards across manufacturing sites. Some regulatory authorities in developing economies have established expedited review pathways for products manufactured using advanced technologies, creating opportunities for market access advantages.

The evolving regulatory landscape also addresses data integrity requirements specific to continuous manufacturing, including validation of in-line monitoring systems, data management across extended production runs, and appropriate implementation of control strategies. These requirements necessitate sophisticated digital infrastructure and quality systems that can demonstrate consistent product quality throughout continuous operations.

The FDA's Emerging Technology Program, established in 2014, provides a collaborative framework for companies to engage with regulators early in the development of innovative manufacturing technologies, including continuous manufacturing. This proactive approach has facilitated regulatory approval for several continuous manufacturing processes, with Vertex Pharmaceuticals' Orkambi being the first FDA-approved product manufactured using this technology in 2015.

In Europe, the EMA has similarly developed guidelines specifically addressing continuous manufacturing implementation, focusing on process validation requirements, real-time release testing, and control strategy development. These guidelines emphasize the importance of process analytical technology (PAT) integration and quality-by-design principles when transitioning from batch to continuous operations.

International harmonization efforts through the International Council for Harmonisation (ICH) have resulted in several quality guidelines that, while not specifically developed for continuous manufacturing, provide applicable frameworks for implementation. The ICH Q8, Q9, Q10, and Q11 guidelines collectively address pharmaceutical development, quality risk management, and manufacturing system requirements that support continuous processing approaches.

Regulatory considerations for continuous manufacturing extend beyond approval processes to include ongoing compliance requirements. Companies must establish robust monitoring systems, validation protocols, and change management procedures that align with the dynamic nature of continuous operations. The regulatory framework increasingly recognizes the need for flexible approaches to process validation that accommodate the continuous improvement inherent in these systems.

Emerging markets present additional regulatory complexity, with varying levels of familiarity and acceptance of continuous manufacturing technologies. Companies pursuing global supply chain strategies must navigate these differences while maintaining consistent quality standards across manufacturing sites. Some regulatory authorities in developing economies have established expedited review pathways for products manufactured using advanced technologies, creating opportunities for market access advantages.

The evolving regulatory landscape also addresses data integrity requirements specific to continuous manufacturing, including validation of in-line monitoring systems, data management across extended production runs, and appropriate implementation of control strategies. These requirements necessitate sophisticated digital infrastructure and quality systems that can demonstrate consistent product quality throughout continuous operations.

Sustainability Impact Assessment

The transition to continuous manufacturing in pharmaceutical and other industries represents a significant paradigm shift with substantial sustainability implications. Continuous manufacturing processes demonstrate up to 30% reduction in energy consumption compared to traditional batch manufacturing, primarily due to more efficient heat transfer and reduced heating/cooling cycles. This energy efficiency translates directly to lower greenhouse gas emissions, with studies indicating potential reductions of 20-50% in carbon footprint depending on the specific product and process configuration.

Water usage patterns also change dramatically with continuous manufacturing adoption. The closed-loop nature of continuous systems can reduce water consumption by up to 40% through improved recycling capabilities and elimination of between-batch cleaning requirements. This is particularly significant in water-stressed regions where manufacturing facilities operate.

Raw material utilization improves substantially in continuous manufacturing environments, with yield improvements of 5-15% commonly reported across various industries. This efficiency gain directly reduces upstream environmental impacts associated with raw material extraction, processing, and transportation. The reduction in waste generation further enhances sustainability metrics, with some implementations reporting up to 80% reduction in solid waste production.

From a lifecycle perspective, continuous manufacturing facilities typically require 30-50% less physical space than equivalent batch production facilities. This reduced footprint minimizes land use impacts and construction material requirements. The compact nature of continuous manufacturing equipment also reduces embedded carbon in manufacturing infrastructure.

Supply chain resilience improves through localized production capabilities, reducing transportation-related emissions by up to 25% in documented case studies. The ability to rapidly scale production volumes in continuous systems also minimizes overproduction waste that commonly occurs in batch manufacturing when demand forecasts prove inaccurate.

Regulatory bodies including the FDA and EMA have recognized these sustainability benefits, with both organizations publishing guidance documents encouraging pharmaceutical manufacturers to consider environmental impacts in manufacturing method selection. Several major pharmaceutical companies have established sustainability targets specifically tied to continuous manufacturing implementation, with goals of reducing their operational carbon footprint by 40-60% by 2030 through manufacturing technology transitions.

Water usage patterns also change dramatically with continuous manufacturing adoption. The closed-loop nature of continuous systems can reduce water consumption by up to 40% through improved recycling capabilities and elimination of between-batch cleaning requirements. This is particularly significant in water-stressed regions where manufacturing facilities operate.

Raw material utilization improves substantially in continuous manufacturing environments, with yield improvements of 5-15% commonly reported across various industries. This efficiency gain directly reduces upstream environmental impacts associated with raw material extraction, processing, and transportation. The reduction in waste generation further enhances sustainability metrics, with some implementations reporting up to 80% reduction in solid waste production.

From a lifecycle perspective, continuous manufacturing facilities typically require 30-50% less physical space than equivalent batch production facilities. This reduced footprint minimizes land use impacts and construction material requirements. The compact nature of continuous manufacturing equipment also reduces embedded carbon in manufacturing infrastructure.

Supply chain resilience improves through localized production capabilities, reducing transportation-related emissions by up to 25% in documented case studies. The ability to rapidly scale production volumes in continuous systems also minimizes overproduction waste that commonly occurs in batch manufacturing when demand forecasts prove inaccurate.

Regulatory bodies including the FDA and EMA have recognized these sustainability benefits, with both organizations publishing guidance documents encouraging pharmaceutical manufacturers to consider environmental impacts in manufacturing method selection. Several major pharmaceutical companies have established sustainability targets specifically tied to continuous manufacturing implementation, with goals of reducing their operational carbon footprint by 40-60% by 2030 through manufacturing technology transitions.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!