V10 Engine vs Electric Powertrain: Efficiency Dynamics

AUG 26, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

V10 Engine and Electric Powertrain Evolution

The evolution of V10 engines and electric powertrains represents two distinct technological paths in automotive propulsion systems, each with its own developmental trajectory and efficiency characteristics. The V10 engine, a pinnacle of internal combustion engineering, emerged in the 1980s primarily in motorsport applications before finding its way into high-performance production vehicles. Its development was characterized by continuous refinements in materials science, combustion efficiency, and power density optimization.

Early V10 engines suffered from excessive weight, fuel inefficiency, and reliability issues. However, by the early 2000s, manufacturers like Audi, BMW, and Lamborghini had developed V10 variants that achieved remarkable power-to-weight ratios while meeting increasingly stringent emissions standards. The evolution included advancements such as variable valve timing, direct injection, and lightweight construction materials, pushing thermal efficiency from around 25% to nearly 35% in modern iterations.

In parallel, electric powertrain technology has undergone a revolutionary transformation. The first modern production electric vehicles of the early 2000s featured rudimentary systems with limited range and performance. The watershed moment came with Tesla's introduction of the Roadster in 2008, demonstrating that electric vehicles could deliver compelling performance characteristics.

Electric powertrain evolution has been marked by exponential improvements in battery energy density, power electronics efficiency, and motor design. Early systems operated at around 80% efficiency, while contemporary designs achieve 90-95% efficiency from battery to wheels. This progression has been enabled by breakthroughs in lithium-ion chemistry, silicon carbide inverters, and permanent magnet synchronous motors.

The efficiency dynamics between these technologies highlight a fundamental difference: V10 engines convert chemical energy to mechanical power through thermodynamic cycles inherently limited by Carnot efficiency principles, while electric systems avoid these thermal constraints. This fundamental advantage explains why electric powertrains can achieve nearly three times the energy conversion efficiency of even the most advanced V10 engines.

Recent developments show diverging evolutionary paths. V10 engines have become increasingly rare, preserved primarily in ultra-luxury and specialized performance vehicles, with development focused on hybridization to extend their viability. Meanwhile, electric powertrains continue rapid advancement with innovations in solid-state batteries, axial flux motors, and integrated power electronics, pushing the boundaries of power density and efficiency.

The technological timeline reveals a crossover point around 2020 when electric powertrains began to match or exceed V10 performance metrics in acceleration and top speed while maintaining their inherent efficiency advantage, signaling a pivotal moment in propulsion technology evolution.

Early V10 engines suffered from excessive weight, fuel inefficiency, and reliability issues. However, by the early 2000s, manufacturers like Audi, BMW, and Lamborghini had developed V10 variants that achieved remarkable power-to-weight ratios while meeting increasingly stringent emissions standards. The evolution included advancements such as variable valve timing, direct injection, and lightweight construction materials, pushing thermal efficiency from around 25% to nearly 35% in modern iterations.

In parallel, electric powertrain technology has undergone a revolutionary transformation. The first modern production electric vehicles of the early 2000s featured rudimentary systems with limited range and performance. The watershed moment came with Tesla's introduction of the Roadster in 2008, demonstrating that electric vehicles could deliver compelling performance characteristics.

Electric powertrain evolution has been marked by exponential improvements in battery energy density, power electronics efficiency, and motor design. Early systems operated at around 80% efficiency, while contemporary designs achieve 90-95% efficiency from battery to wheels. This progression has been enabled by breakthroughs in lithium-ion chemistry, silicon carbide inverters, and permanent magnet synchronous motors.

The efficiency dynamics between these technologies highlight a fundamental difference: V10 engines convert chemical energy to mechanical power through thermodynamic cycles inherently limited by Carnot efficiency principles, while electric systems avoid these thermal constraints. This fundamental advantage explains why electric powertrains can achieve nearly three times the energy conversion efficiency of even the most advanced V10 engines.

Recent developments show diverging evolutionary paths. V10 engines have become increasingly rare, preserved primarily in ultra-luxury and specialized performance vehicles, with development focused on hybridization to extend their viability. Meanwhile, electric powertrains continue rapid advancement with innovations in solid-state batteries, axial flux motors, and integrated power electronics, pushing the boundaries of power density and efficiency.

The technological timeline reveals a crossover point around 2020 when electric powertrains began to match or exceed V10 performance metrics in acceleration and top speed while maintaining their inherent efficiency advantage, signaling a pivotal moment in propulsion technology evolution.

Market Demand Analysis for Performance Powertrains

The performance powertrain market has undergone significant transformation in recent years, driven by shifting consumer preferences, regulatory pressures, and technological advancements. Traditional V10 engines, once the pinnacle of automotive performance, now face increasing competition from electric powertrains that deliver instant torque and impressive acceleration figures.

Market research indicates that the global high-performance vehicle segment is projected to grow at a compound annual growth rate of 6.8% between 2023 and 2028. Within this segment, electric performance vehicles are experiencing substantially faster growth, with some premium manufacturers reporting over 30% year-over-year sales increases for their electric performance models.

Consumer sentiment analysis reveals an evolving perception of performance. While traditional metrics like horsepower and engine displacement remain important to enthusiasts, acceleration times and overall driving experience are becoming more valued. Electric powertrains excel in these areas, with many premium electric vehicles achieving 0-60 mph times under 3 seconds - performance figures previously reserved for supercars.

Demographic analysis shows younger luxury buyers (25-40 age bracket) demonstrate stronger preference for electric performance vehicles, citing technological innovation and environmental considerations alongside performance capabilities. Meanwhile, traditional performance vehicle buyers (typically 45-65) continue to value the sensory experience of combustion engines, particularly the distinctive sound profiles of V10 and similar high-cylinder-count powertrains.

Regional market variations are pronounced. European markets show accelerating adoption of electric performance vehicles, driven by stringent emissions regulations and urban access restrictions. North American consumers maintain stronger preference for traditional powertrains but are increasingly receptive to hybrid and electric alternatives. Asian markets, particularly China, demonstrate the strongest growth trajectory for electric performance vehicles.

Fleet emissions targets and urban access restrictions are creating structural market shifts favoring electric powertrains. Several major metropolitan areas have announced future restrictions on combustion engine vehicles, creating long-term market uncertainty for traditional high-performance powertrains.

Price sensitivity analysis indicates consumers are willing to pay premium prices for electric performance vehicles, with average transaction prices approximately 15% higher than comparable combustion-engine alternatives. This premium is partially offset by lower operating costs, with electric powertrains offering reduced maintenance requirements and lower energy costs per mile.

Market research indicates that the global high-performance vehicle segment is projected to grow at a compound annual growth rate of 6.8% between 2023 and 2028. Within this segment, electric performance vehicles are experiencing substantially faster growth, with some premium manufacturers reporting over 30% year-over-year sales increases for their electric performance models.

Consumer sentiment analysis reveals an evolving perception of performance. While traditional metrics like horsepower and engine displacement remain important to enthusiasts, acceleration times and overall driving experience are becoming more valued. Electric powertrains excel in these areas, with many premium electric vehicles achieving 0-60 mph times under 3 seconds - performance figures previously reserved for supercars.

Demographic analysis shows younger luxury buyers (25-40 age bracket) demonstrate stronger preference for electric performance vehicles, citing technological innovation and environmental considerations alongside performance capabilities. Meanwhile, traditional performance vehicle buyers (typically 45-65) continue to value the sensory experience of combustion engines, particularly the distinctive sound profiles of V10 and similar high-cylinder-count powertrains.

Regional market variations are pronounced. European markets show accelerating adoption of electric performance vehicles, driven by stringent emissions regulations and urban access restrictions. North American consumers maintain stronger preference for traditional powertrains but are increasingly receptive to hybrid and electric alternatives. Asian markets, particularly China, demonstrate the strongest growth trajectory for electric performance vehicles.

Fleet emissions targets and urban access restrictions are creating structural market shifts favoring electric powertrains. Several major metropolitan areas have announced future restrictions on combustion engine vehicles, creating long-term market uncertainty for traditional high-performance powertrains.

Price sensitivity analysis indicates consumers are willing to pay premium prices for electric performance vehicles, with average transaction prices approximately 15% higher than comparable combustion-engine alternatives. This premium is partially offset by lower operating costs, with electric powertrains offering reduced maintenance requirements and lower energy costs per mile.

Current Technical Limitations and Challenges

Despite significant advancements in both V10 engine and electric powertrain technologies, several technical limitations and challenges persist in the efficiency dynamics comparison between these two power systems. The traditional V10 internal combustion engine faces inherent thermodynamic constraints, with thermal efficiency typically capped at 40% under optimal conditions. In real-world driving scenarios, this efficiency often drops to 20-30%, with the majority of energy lost as heat through exhaust gases and cooling systems. Additionally, V10 engines struggle with efficiency at partial loads, which represents most everyday driving conditions.

Mechanical complexity presents another significant challenge for V10 engines. With numerous moving parts requiring precise lubrication and maintenance, friction losses account for approximately 5-10% of total energy consumption. The multi-cylinder configuration, while delivering smooth power delivery and characteristic sound, introduces additional weight and complexity that impacts overall vehicle efficiency.

For electric powertrains, energy storage remains the primary limitation. Current lithium-ion battery technology offers energy densities of 250-300 Wh/kg, significantly lower than gasoline's approximately 12,000 Wh/kg. This fundamental difference creates range anxiety and necessitates larger, heavier battery packs that can comprise 25-30% of an electric vehicle's total weight.

Charging infrastructure presents another substantial challenge for electric vehicles. Despite growing networks, charging stations remain less ubiquitous than fuel stations, with varying charging speeds and connector standards complicating the user experience. Fast-charging capabilities, while improving, still require 20-40 minutes for substantial range replenishment, compared to minutes for refueling a V10-powered vehicle.

Temperature sensitivity affects both systems differently. V10 engines typically perform optimally at operating temperatures of 90-105°C, requiring warm-up periods in cold weather. Electric powertrains demonstrate reduced range in extreme temperatures, with studies showing up to 40% range reduction in sub-freezing conditions due to battery chemistry limitations and increased energy demands for cabin heating.

Manufacturing complexity and resource constraints affect both technologies. V10 engines require precision machining and assembly of hundreds of components, while electric powertrains demand significant quantities of critical minerals like lithium, cobalt, and rare earth elements, raising sustainability and supply chain concerns.

Regulatory challenges further complicate the landscape, with increasingly stringent emissions standards making V10 engine compliance costly and technically challenging, while electric vehicles face evolving regulations around battery recycling, charging infrastructure, and grid integration.

Mechanical complexity presents another significant challenge for V10 engines. With numerous moving parts requiring precise lubrication and maintenance, friction losses account for approximately 5-10% of total energy consumption. The multi-cylinder configuration, while delivering smooth power delivery and characteristic sound, introduces additional weight and complexity that impacts overall vehicle efficiency.

For electric powertrains, energy storage remains the primary limitation. Current lithium-ion battery technology offers energy densities of 250-300 Wh/kg, significantly lower than gasoline's approximately 12,000 Wh/kg. This fundamental difference creates range anxiety and necessitates larger, heavier battery packs that can comprise 25-30% of an electric vehicle's total weight.

Charging infrastructure presents another substantial challenge for electric vehicles. Despite growing networks, charging stations remain less ubiquitous than fuel stations, with varying charging speeds and connector standards complicating the user experience. Fast-charging capabilities, while improving, still require 20-40 minutes for substantial range replenishment, compared to minutes for refueling a V10-powered vehicle.

Temperature sensitivity affects both systems differently. V10 engines typically perform optimally at operating temperatures of 90-105°C, requiring warm-up periods in cold weather. Electric powertrains demonstrate reduced range in extreme temperatures, with studies showing up to 40% range reduction in sub-freezing conditions due to battery chemistry limitations and increased energy demands for cabin heating.

Manufacturing complexity and resource constraints affect both technologies. V10 engines require precision machining and assembly of hundreds of components, while electric powertrains demand significant quantities of critical minerals like lithium, cobalt, and rare earth elements, raising sustainability and supply chain concerns.

Regulatory challenges further complicate the landscape, with increasingly stringent emissions standards making V10 engine compliance costly and technically challenging, while electric vehicles face evolving regulations around battery recycling, charging infrastructure, and grid integration.

Comparative Efficiency Solutions

01 Hybrid powertrain systems combining V10 engines with electric motors

Hybrid powertrain systems that integrate V10 internal combustion engines with electric motors to improve overall efficiency. These systems utilize the power of the V10 engine alongside electric propulsion to reduce fuel consumption while maintaining performance. The integration includes power management systems that optimize the distribution of power between the combustion engine and electric motors based on driving conditions and power demands.- Hybrid powertrain systems combining V10 engines with electric motors: Hybrid powertrain systems that integrate V10 internal combustion engines with electric motors to improve overall efficiency. These systems utilize the power of the V10 engine alongside electric propulsion to reduce fuel consumption while maintaining high performance. The integration includes sophisticated control systems that determine optimal power distribution between the combustion engine and electric motors based on driving conditions and power demands.

- Energy recovery and regenerative braking systems: Systems designed to capture and convert kinetic energy during deceleration and braking into electrical energy that can be stored and reused. These regenerative braking systems significantly improve the overall efficiency of vehicles equipped with V10 engines and electric powertrains by reducing energy waste. The recovered energy is stored in batteries or capacitors and later used to power the electric motors, reducing the load on the V10 engine and decreasing fuel consumption.

- Power management and control strategies: Advanced control algorithms and power management strategies that optimize the operation of combined V10 engine and electric powertrain systems. These control systems continuously monitor vehicle parameters, driving conditions, and energy availability to determine the most efficient power distribution. They can automatically switch between different operating modes, such as electric-only, engine-only, or combined power, to maximize efficiency while meeting performance requirements.

- Thermal management and efficiency optimization: Specialized thermal management systems designed to maintain optimal operating temperatures for both the V10 engine and electric powertrain components. These systems help improve efficiency by ensuring that all components operate within their ideal temperature ranges. Advanced cooling circuits, heat exchangers, and thermal control strategies work together to manage waste heat, reduce friction losses, and improve overall powertrain efficiency.

- Transmission and power transfer innovations: Novel transmission systems and power transfer mechanisms specifically designed for V10 engine and electric powertrain combinations. These innovations include specialized gearboxes, clutch systems, and power split devices that efficiently transfer power from both the V10 engine and electric motors to the wheels. Advanced transmission designs enable seamless transitions between power sources and optimize gear ratios for different driving conditions, significantly improving overall powertrain efficiency.

02 Energy recovery and regenerative braking systems

Systems designed to capture and convert kinetic energy during deceleration and braking into electrical energy that can be stored and reused. These regenerative braking systems significantly improve the overall efficiency of vehicles equipped with V10 engines and electric powertrains by recapturing energy that would otherwise be lost as heat. The recovered energy is stored in batteries or capacitors for later use in powering the electric motors.Expand Specific Solutions03 Power management and control strategies

Advanced control algorithms and management strategies that optimize the operation of combined V10 engine and electric powertrain systems. These strategies determine the optimal power split between the combustion engine and electric motors, manage battery charging and discharging, and control engine start-stop functionality. The systems continuously monitor driving conditions, driver inputs, and vehicle status to maximize efficiency while meeting performance requirements.Expand Specific Solutions04 Transmission and drivetrain optimization

Specialized transmission and drivetrain configurations designed to efficiently transfer power from both the V10 engine and electric motors to the wheels. These systems include advanced continuously variable transmissions, multi-speed gearboxes, and power-split devices that optimize the operating points of both power sources. The optimized drivetrains reduce energy losses during power transmission and allow both power sources to operate in their most efficient ranges.Expand Specific Solutions05 Thermal management and efficiency enhancement

Systems designed to manage heat generation and dissipation in combined V10 engine and electric powertrain configurations. These thermal management systems optimize operating temperatures of both the combustion engine and electric components to maximize efficiency and longevity. Additional efficiency enhancements include reduced friction components, advanced materials, and aerodynamic improvements that work together with the hybrid powertrain to reduce energy consumption.Expand Specific Solutions

Key Manufacturers and Industry Leaders

The electric powertrain versus V10 engine competition represents a market in transition, with traditional automotive manufacturers adapting to shifting efficiency demands. The industry is in a mature yet evolving phase, with the global powertrain market valued at approximately $700-800 billion. While V10 engines remain relevant in high-performance applications, major players are increasingly investing in electric technology. Companies like GM, Ford, Toyota, and Hyundai-Kia lead this transition, with European manufacturers including Renault, Audi, and ZF Friedrichshafen focusing on hybrid solutions. Chinese companies such as Great Wall Motor and Geely are rapidly advancing in the electric space, while traditional suppliers like Bosch and Vitesco Technologies are developing components for both technologies to maintain market relevance during this technological shift.

Toyota Motor Corp.

Technical Solution: Toyota has developed a dual approach strategy for powertrain efficiency. Their V10 engines, primarily used in the Lexus LFA supercar, feature innovative technologies like titanium valves, dry-sump lubrication, and individual throttle bodies that achieve 9,000 RPM with 40% thermal efficiency. Simultaneously, Toyota has pioneered hybrid electric technology with their Hybrid Synergy Drive system that combines internal combustion engines with electric motors. Their latest developments include solid-state battery technology for electric vehicles promising 500+ km range and charging times under 10 minutes. Toyota's unique approach includes maintaining development in both traditional combustion engines and electric powertrains, allowing them to optimize efficiency across different vehicle segments and markets with varying infrastructure readiness.

Strengths: Industry-leading hybrid technology with over 20 years of refinement; solid-state battery development; global manufacturing scale. Weaknesses: Slower full EV adoption compared to some competitors; continued investment in ICE technology while some markets push for full electrification.

Robert Bosch GmbH

Technical Solution: Bosch has developed comprehensive solutions addressing both V10 engine optimization and electric powertrain advancement. For combustion engines, their direct injection systems achieve 15% fuel efficiency improvements while reducing emissions by up to 20% through precise fuel delivery and advanced engine control units. Their 48V mild hybrid systems bridge traditional engines and full electrification, recovering up to 8kW during braking and providing torque assistance that improves efficiency by 15%. For full electric powertrains, Bosch's integrated eAxle combines motor, power electronics, and transmission in a single unit, reducing weight by 20% compared to conventional designs. Their silicon carbide semiconductor technology in inverters improves power conversion efficiency to 99%, extending EV range by up to 6%. Bosch's unique position as a tier-one supplier allows them to implement cross-platform technologies that benefit both traditional engines and electric powertrains, with their systems currently deployed in over 20 million vehicles globally.

Strengths: Unmatched supplier relationships across all major automakers; comprehensive technology portfolio spanning both ICE and EV systems; advanced manufacturing capabilities. Weaknesses: Dependent on automaker adoption decisions; balancing investment across competing technologies; transition management from ICE to EV component business.

Core Innovations in Powertrain Technology

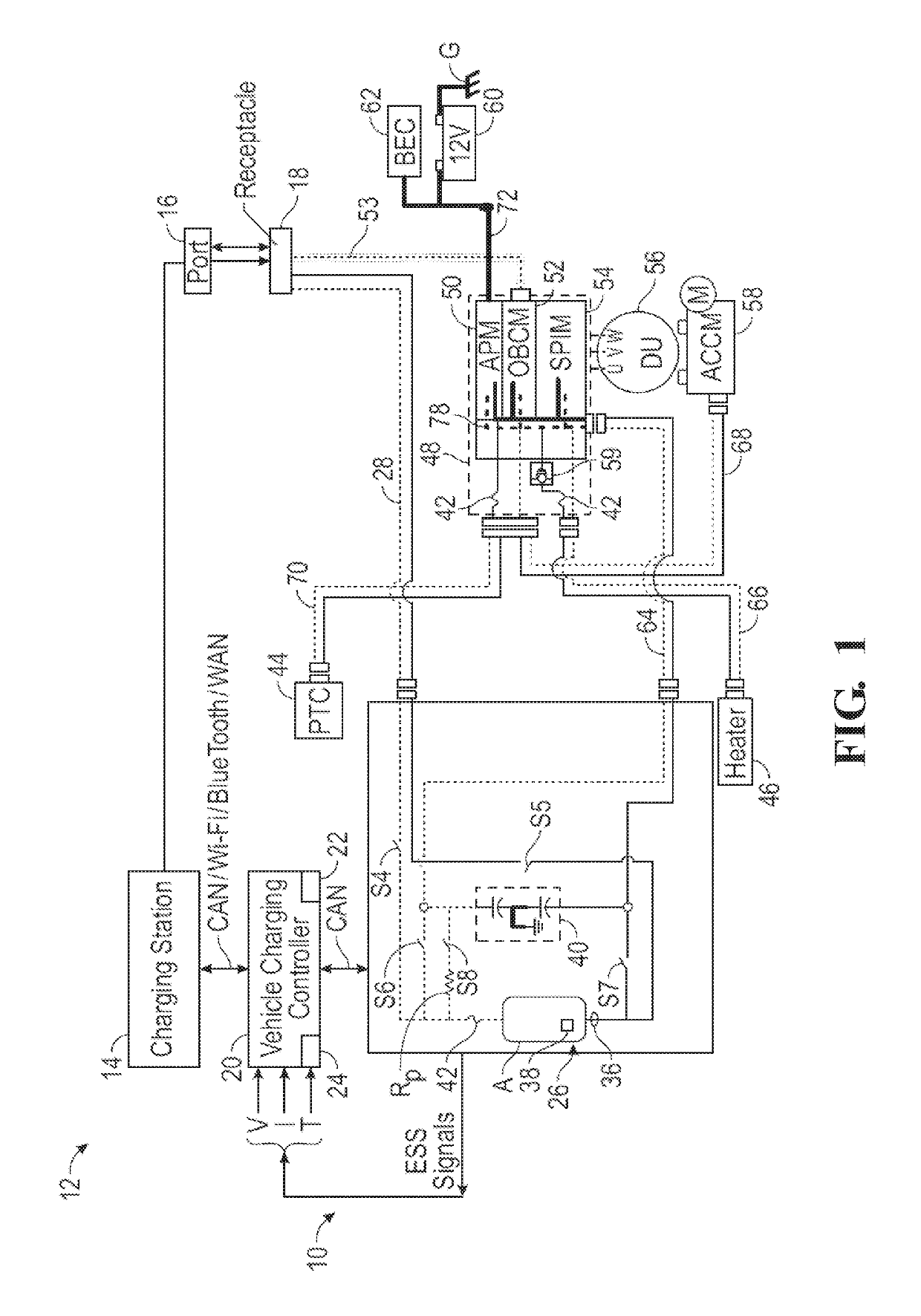

Electric powertrain system having bidirectional DC generator

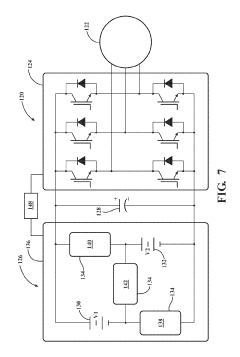

PatentInactiveUS8310180B2

Innovation

- An electric powertrain system utilizing a DC motor/generator that operates in both forward and dynamic braking modes, converting mechanical power to DC power and vice versa, with a drivetrain that includes a converter capable of bidirectional power conversion, minimizing the need for expensive AC power conversion components and optimizing space usage with a DC motor/generator.

Electric powertrain and a method of operating the same

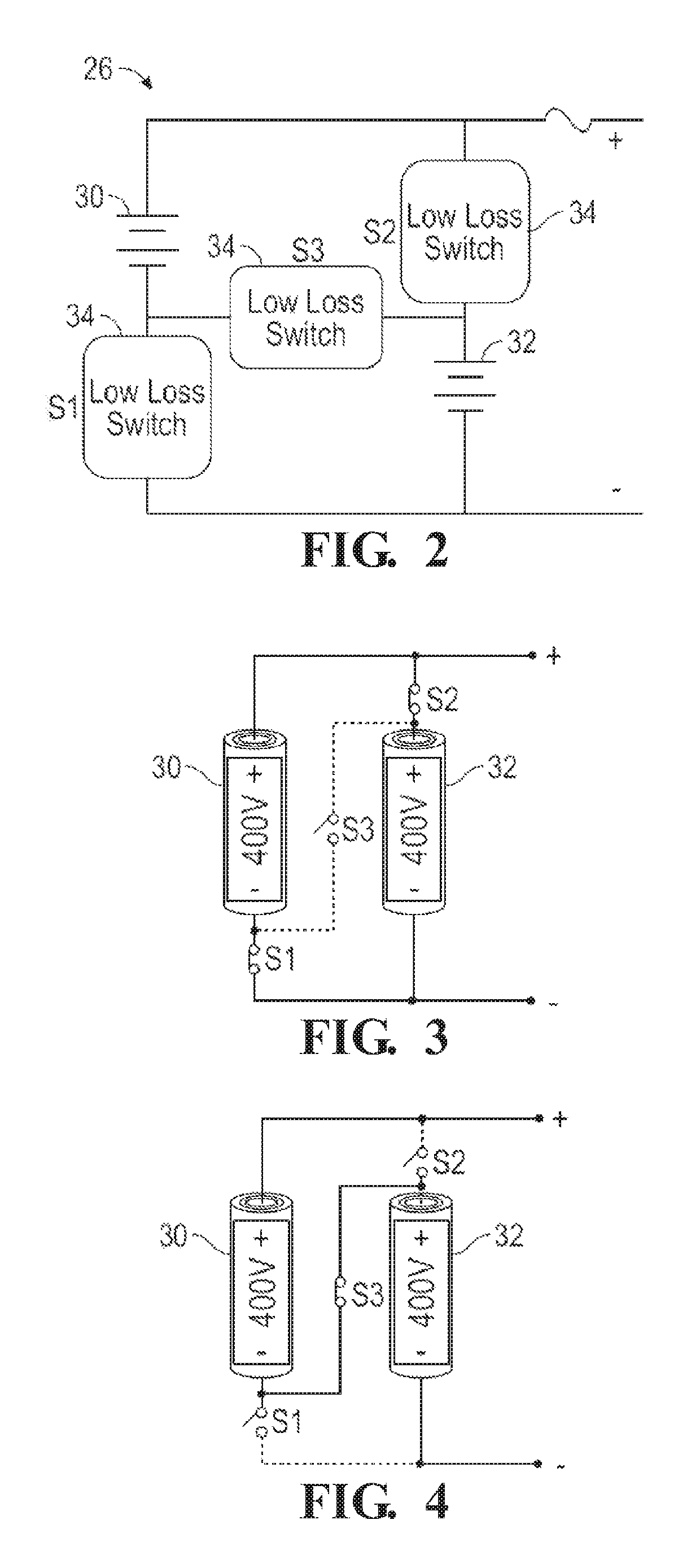

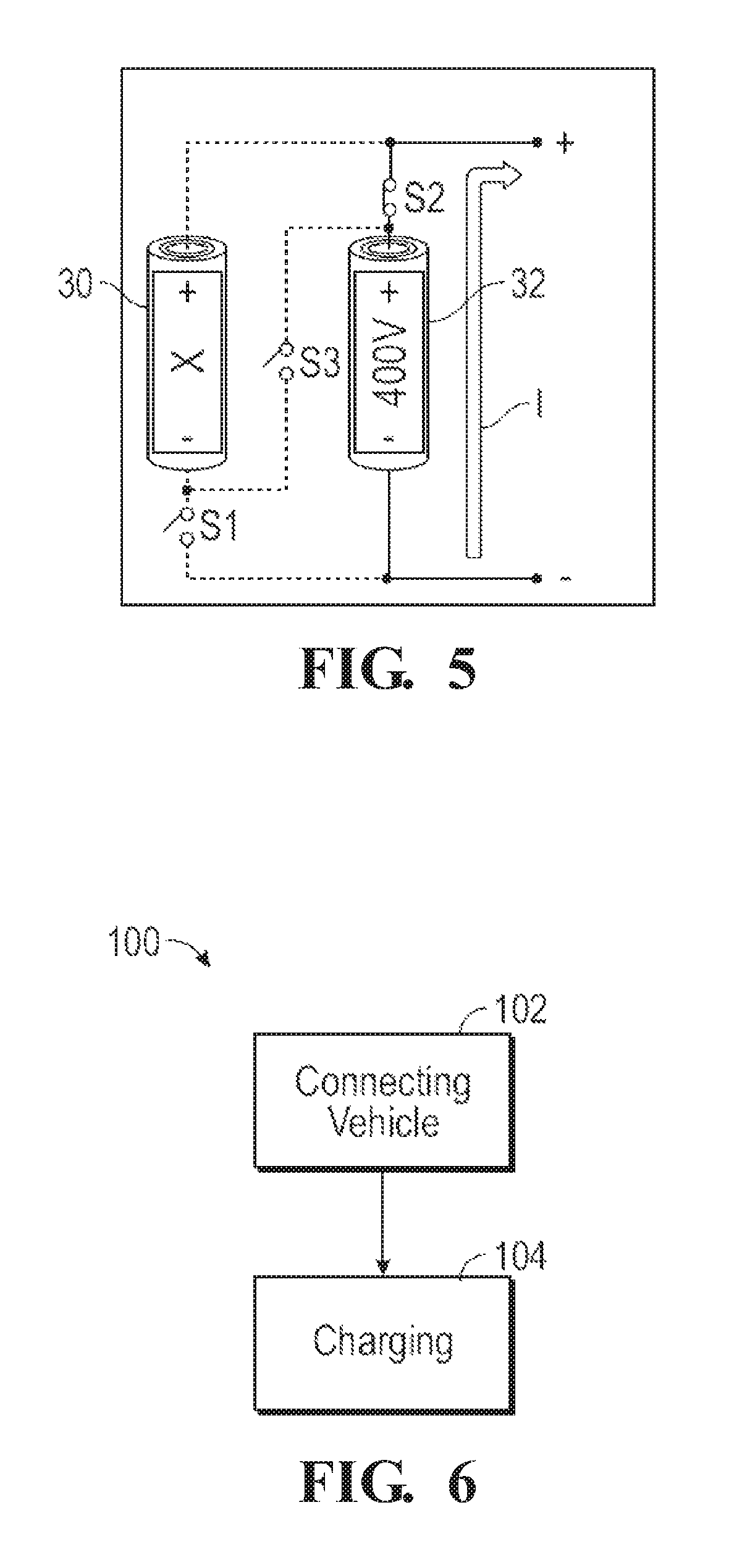

PatentActiveUS10432130B2

Innovation

- An electric powertrain system with a reconfigurable energy storage system comprising a first and second energy storage device operable at different voltages, connected via selectively controllable switching devices to switch between series and parallel configurations, allowing the system to provide different voltage outputs based on the rotational speed of the electric machine.

Environmental Impact Assessment

The environmental impact comparison between V10 engines and electric powertrains reveals significant differences in their ecological footprints throughout their respective lifecycles. Traditional V10 engines generate substantial greenhouse gas emissions during operation, with each liter of gasoline combustion producing approximately 2.3 kg of carbon dioxide. A typical V10 engine operating for 150,000 kilometers may generate upwards of 50 tons of CO2, contributing significantly to climate change.

Beyond carbon emissions, V10 engines release nitrogen oxides, particulate matter, and volatile organic compounds that degrade air quality and pose public health risks. These pollutants have been linked to respiratory diseases and contribute to urban smog formation. Additionally, the extraction, refinement, and transportation of petroleum products create environmental disruptions including habitat destruction, water contamination, and the risk of oil spills.

In contrast, electric powertrains produce zero tailpipe emissions during operation, dramatically reducing local air pollution. However, their environmental impact is shifted to electricity generation sources. When powered by renewable energy, electric vehicles can achieve near-zero operational emissions. Studies indicate that even when charged from coal-heavy grids, electric powertrains typically generate 17-30% lower lifecycle emissions than comparable internal combustion engines.

Manufacturing considerations reveal additional complexities. Electric vehicle battery production requires significant mineral extraction, including lithium, cobalt, and rare earth elements, creating localized environmental impacts in mining regions. The energy-intensive battery manufacturing process currently generates a carbon debt that electric vehicles must overcome through cleaner operation.

End-of-life management presents different challenges for both technologies. While traditional engines involve recycling of metals and proper disposal of lubricants, electric powertrains require specialized battery recycling infrastructure. Emerging battery recycling technologies promise to recover up to 95% of critical materials, potentially creating a circular economy for electric vehicle components.

Water usage patterns also differ significantly between the technologies. Petroleum refining for V10 fuels requires approximately 1-2.5 gallons of water per gallon of gasoline produced, while electricity generation water requirements vary dramatically by source—from negligible amounts for wind and solar to substantial quantities for thermoelectric plants.

AI-powered lifecycle assessment tools now enable more comprehensive environmental impact comparisons, accounting for regional electricity generation profiles, manufacturing processes, and end-of-life scenarios, providing a more nuanced understanding of the ecological tradeoffs between these competing powertrain technologies.

Beyond carbon emissions, V10 engines release nitrogen oxides, particulate matter, and volatile organic compounds that degrade air quality and pose public health risks. These pollutants have been linked to respiratory diseases and contribute to urban smog formation. Additionally, the extraction, refinement, and transportation of petroleum products create environmental disruptions including habitat destruction, water contamination, and the risk of oil spills.

In contrast, electric powertrains produce zero tailpipe emissions during operation, dramatically reducing local air pollution. However, their environmental impact is shifted to electricity generation sources. When powered by renewable energy, electric vehicles can achieve near-zero operational emissions. Studies indicate that even when charged from coal-heavy grids, electric powertrains typically generate 17-30% lower lifecycle emissions than comparable internal combustion engines.

Manufacturing considerations reveal additional complexities. Electric vehicle battery production requires significant mineral extraction, including lithium, cobalt, and rare earth elements, creating localized environmental impacts in mining regions. The energy-intensive battery manufacturing process currently generates a carbon debt that electric vehicles must overcome through cleaner operation.

End-of-life management presents different challenges for both technologies. While traditional engines involve recycling of metals and proper disposal of lubricants, electric powertrains require specialized battery recycling infrastructure. Emerging battery recycling technologies promise to recover up to 95% of critical materials, potentially creating a circular economy for electric vehicle components.

Water usage patterns also differ significantly between the technologies. Petroleum refining for V10 fuels requires approximately 1-2.5 gallons of water per gallon of gasoline produced, while electricity generation water requirements vary dramatically by source—from negligible amounts for wind and solar to substantial quantities for thermoelectric plants.

AI-powered lifecycle assessment tools now enable more comprehensive environmental impact comparisons, accounting for regional electricity generation profiles, manufacturing processes, and end-of-life scenarios, providing a more nuanced understanding of the ecological tradeoffs between these competing powertrain technologies.

Energy Infrastructure Requirements

The transition from V10 engines to electric powertrains necessitates a fundamental transformation of energy infrastructure. Traditional combustion engines rely on an established global network of petroleum extraction, refinement, transportation, and distribution systems that have evolved over more than a century. This infrastructure represents trillions of dollars in investment and employs millions worldwide, creating significant economic inertia against rapid change.

Electric powertrains, conversely, demand robust electrical generation and distribution networks capable of handling increased load demands. Current electrical grids in many regions lack sufficient capacity to support widespread electric vehicle adoption. Grid modernization requirements include enhanced transmission capabilities, smart load management systems, and increased generation capacity—particularly from renewable sources to maximize environmental benefits.

Charging infrastructure presents another critical challenge. While petroleum refueling typically takes minutes, even advanced fast-charging technologies require substantially longer periods. This necessitates a more distributed charging network with significantly more endpoints than the current fuel station model. Urban areas with limited off-street parking face particular difficulties in providing accessible charging solutions.

The materials supply chain for electric powertrains differs dramatically from combustion engines. Battery production requires lithium, cobalt, nickel, and rare earth elements, creating new geopolitical dependencies and potential supply bottlenecks. Mining and processing these materials present environmental challenges that must be addressed to maintain sustainability credentials.

Energy storage technologies represent a crucial infrastructure component unique to electric systems. Grid-scale storage solutions are essential for balancing supply fluctuations, particularly with increased renewable energy integration. Vehicle-to-grid (V2G) technologies offer promising opportunities for distributed storage but require sophisticated management systems and regulatory frameworks.

Transitional infrastructure supporting both technologies will be necessary during the multi-decade conversion period. This includes dual-purpose facilities, adaptable manufacturing capabilities, and workforce development programs to retrain petroleum industry workers for roles in electrical infrastructure.

The economic implications of this infrastructure shift are profound, requiring coordinated investment from public and private sectors. Government policy frameworks, including incentives, regulations, and direct investment, will significantly influence the pace and direction of infrastructure development, ultimately determining the timeline for electric powertrain adoption.

Electric powertrains, conversely, demand robust electrical generation and distribution networks capable of handling increased load demands. Current electrical grids in many regions lack sufficient capacity to support widespread electric vehicle adoption. Grid modernization requirements include enhanced transmission capabilities, smart load management systems, and increased generation capacity—particularly from renewable sources to maximize environmental benefits.

Charging infrastructure presents another critical challenge. While petroleum refueling typically takes minutes, even advanced fast-charging technologies require substantially longer periods. This necessitates a more distributed charging network with significantly more endpoints than the current fuel station model. Urban areas with limited off-street parking face particular difficulties in providing accessible charging solutions.

The materials supply chain for electric powertrains differs dramatically from combustion engines. Battery production requires lithium, cobalt, nickel, and rare earth elements, creating new geopolitical dependencies and potential supply bottlenecks. Mining and processing these materials present environmental challenges that must be addressed to maintain sustainability credentials.

Energy storage technologies represent a crucial infrastructure component unique to electric systems. Grid-scale storage solutions are essential for balancing supply fluctuations, particularly with increased renewable energy integration. Vehicle-to-grid (V2G) technologies offer promising opportunities for distributed storage but require sophisticated management systems and regulatory frameworks.

Transitional infrastructure supporting both technologies will be necessary during the multi-decade conversion period. This includes dual-purpose facilities, adaptable manufacturing capabilities, and workforce development programs to retrain petroleum industry workers for roles in electrical infrastructure.

The economic implications of this infrastructure shift are profound, requiring coordinated investment from public and private sectors. Government policy frameworks, including incentives, regulations, and direct investment, will significantly influence the pace and direction of infrastructure development, ultimately determining the timeline for electric powertrain adoption.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!