V10 Engine vs Gas Turbine: Comparative Studies

AUG 26, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

V10 Engine and Gas Turbine Historical Development

The evolution of V10 engines and gas turbines represents two distinct paths in the development of power generation technologies. The V10 engine's history can be traced back to the early 20th century, with significant developments occurring in the automotive industry during the 1930s. However, it wasn't until the 1980s and 1990s that V10 engines gained prominence in high-performance vehicles. Notably, the Dodge Viper and Lamborghini Gallardo helped popularize this configuration, offering a balance between the smoothness of V8 engines and the power of V12 engines.

Gas turbines, conversely, have a more complex developmental trajectory. Their conceptual origins date back to the 18th century, but practical implementations emerged in the early 20th century. The breakthrough came during World War II when Frank Whittle in the United Kingdom and Hans von Ohain in Germany independently developed the first operational jet engines based on gas turbine principles. This military application later transitioned to commercial aviation, revolutionizing air travel.

The industrial application of gas turbines for power generation gained momentum in the 1950s, with General Electric and Westinghouse leading innovations in the United States. These early industrial gas turbines were primarily derived from aircraft engine technology but modified for stationary power generation requirements.

During the 1970s and 1980s, V10 engines remained relatively rare in automotive applications, primarily appearing in racing contexts or specialized vehicles. Meanwhile, gas turbines experienced significant technological advancements, particularly in materials science, allowing for higher operating temperatures and improved efficiency.

The 1990s marked a divergence in developmental focus. V10 engines became symbols of automotive excellence, finding homes in Formula 1 racing and prestigious production vehicles. Simultaneously, gas turbines evolved toward combined-cycle configurations in power generation, dramatically improving efficiency from approximately 30% to over 60%.

The early 21st century has seen V10 engines facing challenges from environmental regulations and the shift toward electrification. Many manufacturers have discontinued V10 offerings in favor of smaller, turbocharged engines or hybrid systems. Conversely, gas turbines have continued to evolve with advancements in aerodynamics, cooling technologies, and combustion systems, maintaining their relevance in aviation and power generation.

Recent developments have seen gas turbines adapting to accommodate renewable energy integration and hydrogen fuel capabilities, while V10 engines increasingly represent a niche market focused on preserving the visceral experience of internal combustion in an increasingly electrified automotive landscape.

Gas turbines, conversely, have a more complex developmental trajectory. Their conceptual origins date back to the 18th century, but practical implementations emerged in the early 20th century. The breakthrough came during World War II when Frank Whittle in the United Kingdom and Hans von Ohain in Germany independently developed the first operational jet engines based on gas turbine principles. This military application later transitioned to commercial aviation, revolutionizing air travel.

The industrial application of gas turbines for power generation gained momentum in the 1950s, with General Electric and Westinghouse leading innovations in the United States. These early industrial gas turbines were primarily derived from aircraft engine technology but modified for stationary power generation requirements.

During the 1970s and 1980s, V10 engines remained relatively rare in automotive applications, primarily appearing in racing contexts or specialized vehicles. Meanwhile, gas turbines experienced significant technological advancements, particularly in materials science, allowing for higher operating temperatures and improved efficiency.

The 1990s marked a divergence in developmental focus. V10 engines became symbols of automotive excellence, finding homes in Formula 1 racing and prestigious production vehicles. Simultaneously, gas turbines evolved toward combined-cycle configurations in power generation, dramatically improving efficiency from approximately 30% to over 60%.

The early 21st century has seen V10 engines facing challenges from environmental regulations and the shift toward electrification. Many manufacturers have discontinued V10 offerings in favor of smaller, turbocharged engines or hybrid systems. Conversely, gas turbines have continued to evolve with advancements in aerodynamics, cooling technologies, and combustion systems, maintaining their relevance in aviation and power generation.

Recent developments have seen gas turbines adapting to accommodate renewable energy integration and hydrogen fuel capabilities, while V10 engines increasingly represent a niche market focused on preserving the visceral experience of internal combustion in an increasingly electrified automotive landscape.

Market Applications and Demand Analysis

The market applications for V10 engines and gas turbines span across diverse sectors, with each technology serving distinct needs based on their performance characteristics. V10 engines have established a strong presence in the high-performance automotive segment, particularly in luxury sports cars and supercars where their distinctive sound profile and power delivery create significant consumer appeal. Manufacturers like Lamborghini, Audi, and Lexus have leveraged V10 engines as premium differentiators in their flagship models, commanding price premiums of 15-30% compared to equivalent V8-powered variants.

In the commercial vehicle sector, V10 engines have found applications in medium to heavy-duty trucks and specialized industrial equipment where high torque at lower RPM ranges is required. This market segment values the balance between power density and operational reliability, with maintenance intervals typically ranging between 15,000-25,000 miles depending on usage patterns.

Gas turbines, conversely, dominate entirely different market segments. The aviation industry represents the largest application area, with commercial and military aircraft relying on turbofan and turbojet engines derived from gas turbine technology. This market alone was valued at approximately $84 billion in 2022, with projected growth rates of 3.5-4.2% annually through 2030.

Power generation constitutes another major market for gas turbines, particularly for grid-scale electricity production. Combined-cycle gas turbine power plants have become increasingly prevalent due to their higher efficiency rates (reaching 60-65% in modern installations) and lower emissions compared to traditional coal-fired plants. The global gas turbine market for power generation was estimated at $20 billion in 2022, with significant growth potential in regions transitioning away from coal power.

Marine propulsion represents an emerging application area where both technologies compete. Large vessels have traditionally used diesel engines, but gas turbines offer advantages in power-to-weight ratio and operational flexibility for certain vessel classes, particularly naval vessels and high-speed ferries. This market segment is experiencing compound annual growth of approximately 6.2%.

Industrial applications for gas turbines include mechanical drive systems for oil and gas compression, chemical processing, and other heavy industrial processes requiring reliable continuous operation. These applications value the high power density and operational reliability of gas turbines, with some installations achieving over 40,000 hours of operation between major overhauls.

Market demand analysis indicates a gradual shift toward electrification and hybrid systems in traditional V10 engine applications, while gas turbine markets are increasingly focused on efficiency improvements and emissions reduction technologies to maintain competitiveness in an increasingly carbon-conscious regulatory environment.

In the commercial vehicle sector, V10 engines have found applications in medium to heavy-duty trucks and specialized industrial equipment where high torque at lower RPM ranges is required. This market segment values the balance between power density and operational reliability, with maintenance intervals typically ranging between 15,000-25,000 miles depending on usage patterns.

Gas turbines, conversely, dominate entirely different market segments. The aviation industry represents the largest application area, with commercial and military aircraft relying on turbofan and turbojet engines derived from gas turbine technology. This market alone was valued at approximately $84 billion in 2022, with projected growth rates of 3.5-4.2% annually through 2030.

Power generation constitutes another major market for gas turbines, particularly for grid-scale electricity production. Combined-cycle gas turbine power plants have become increasingly prevalent due to their higher efficiency rates (reaching 60-65% in modern installations) and lower emissions compared to traditional coal-fired plants. The global gas turbine market for power generation was estimated at $20 billion in 2022, with significant growth potential in regions transitioning away from coal power.

Marine propulsion represents an emerging application area where both technologies compete. Large vessels have traditionally used diesel engines, but gas turbines offer advantages in power-to-weight ratio and operational flexibility for certain vessel classes, particularly naval vessels and high-speed ferries. This market segment is experiencing compound annual growth of approximately 6.2%.

Industrial applications for gas turbines include mechanical drive systems for oil and gas compression, chemical processing, and other heavy industrial processes requiring reliable continuous operation. These applications value the high power density and operational reliability of gas turbines, with some installations achieving over 40,000 hours of operation between major overhauls.

Market demand analysis indicates a gradual shift toward electrification and hybrid systems in traditional V10 engine applications, while gas turbine markets are increasingly focused on efficiency improvements and emissions reduction technologies to maintain competitiveness in an increasingly carbon-conscious regulatory environment.

Technical Specifications and Performance Limitations

V10 engines and gas turbines represent two distinct approaches to power generation, each with unique technical specifications and inherent performance limitations. The V10 engine, characterized by its V-shaped configuration of ten cylinders, typically displaces between 5.0 to 8.3 liters and generates power outputs ranging from 310 to over 600 horsepower in production vehicles. These engines operate at relatively modest maximum speeds of 6,000-8,500 RPM, with thermal efficiency typically between 25-30% under optimal conditions.

In contrast, gas turbines operate on fundamentally different principles, utilizing continuous combustion processes rather than reciprocating motion. Industrial gas turbines can achieve outputs from 1,000 kilowatts to over 500 megawatts, with aviation variants producing 10,000-100,000 pounds of thrust. Their operational speeds are substantially higher, with rotational velocities reaching 10,000-100,000 RPM depending on size and application.

The weight-to-power ratio represents a critical performance metric where gas turbines excel significantly. Modern aviation turbines achieve ratios as low as 0.2 kg/kW, while even the most advanced V10 engines rarely achieve better than 1.0 kg/kW. This disparity explains the universal adoption of turbines in aviation applications where weight considerations are paramount.

Temperature tolerance constitutes another fundamental difference, with gas turbines operating at combustion temperatures exceeding 1,500°C, necessitating specialized materials and cooling systems. V10 engines typically maintain more modest combustion temperatures around 650-950°C, allowing for less exotic material requirements but limiting theoretical efficiency.

Fuel flexibility represents a significant advantage for gas turbines, which can operate on various fuels including natural gas, diesel, kerosene, and even hydrogen blends. V10 engines, while adaptable to alternative fuels like ethanol blends or natural gas, require more substantial modifications to accommodate fuel variations and generally demonstrate narrower operational parameters.

Reliability metrics diverge significantly between these technologies. Gas turbines excel in continuous operation scenarios, with modern industrial units achieving 98% reliability and maintenance intervals measured in thousands of hours. V10 engines typically require more frequent maintenance interventions, with service intervals ranging from 100-300 hours in high-performance applications to 10,000-15,000 kilometers in automotive implementations.

Emissions profiles also differ substantially, with modern gas turbines producing significantly lower particulate matter and carbon monoxide than V10 engines, though both technologies face challenges in NOx reduction. The transient response characteristics favor V10 engines, which can reach maximum torque within milliseconds, while gas turbines typically require several seconds to spool up to full power output.

In contrast, gas turbines operate on fundamentally different principles, utilizing continuous combustion processes rather than reciprocating motion. Industrial gas turbines can achieve outputs from 1,000 kilowatts to over 500 megawatts, with aviation variants producing 10,000-100,000 pounds of thrust. Their operational speeds are substantially higher, with rotational velocities reaching 10,000-100,000 RPM depending on size and application.

The weight-to-power ratio represents a critical performance metric where gas turbines excel significantly. Modern aviation turbines achieve ratios as low as 0.2 kg/kW, while even the most advanced V10 engines rarely achieve better than 1.0 kg/kW. This disparity explains the universal adoption of turbines in aviation applications where weight considerations are paramount.

Temperature tolerance constitutes another fundamental difference, with gas turbines operating at combustion temperatures exceeding 1,500°C, necessitating specialized materials and cooling systems. V10 engines typically maintain more modest combustion temperatures around 650-950°C, allowing for less exotic material requirements but limiting theoretical efficiency.

Fuel flexibility represents a significant advantage for gas turbines, which can operate on various fuels including natural gas, diesel, kerosene, and even hydrogen blends. V10 engines, while adaptable to alternative fuels like ethanol blends or natural gas, require more substantial modifications to accommodate fuel variations and generally demonstrate narrower operational parameters.

Reliability metrics diverge significantly between these technologies. Gas turbines excel in continuous operation scenarios, with modern industrial units achieving 98% reliability and maintenance intervals measured in thousands of hours. V10 engines typically require more frequent maintenance interventions, with service intervals ranging from 100-300 hours in high-performance applications to 10,000-15,000 kilometers in automotive implementations.

Emissions profiles also differ substantially, with modern gas turbines producing significantly lower particulate matter and carbon monoxide than V10 engines, though both technologies face challenges in NOx reduction. The transient response characteristics favor V10 engines, which can reach maximum torque within milliseconds, while gas turbines typically require several seconds to spool up to full power output.

Current Engineering Solutions and Design Approaches

01 Performance monitoring and comparison systems

Systems for monitoring and comparing the performance of V10 engines and gas turbines have been developed. These systems collect real-time data on various performance parameters such as power output, fuel consumption, and efficiency. The collected data is then analyzed to compare the performance of different engine types under various operating conditions. These monitoring systems help in optimizing engine performance and identifying areas for improvement.- Performance monitoring and comparison systems: Systems for monitoring and comparing the performance of V10 engines and gas turbines, including methods for real-time data collection, analysis, and visualization. These systems enable engineers to evaluate key performance metrics such as power output, fuel efficiency, and thermal efficiency across different engine types. Advanced monitoring technologies allow for precise comparison between traditional V10 internal combustion engines and gas turbine propulsion systems under various operating conditions.

- Efficiency optimization techniques: Methods and technologies for optimizing the efficiency of both V10 engines and gas turbines. These include advanced combustion control strategies, thermal management systems, and aerodynamic improvements. Optimization techniques focus on reducing fuel consumption, minimizing energy losses, and maximizing power output. Comparative studies show how different optimization approaches affect performance metrics in each engine type, highlighting the relative advantages in specific operational scenarios.

- Hybrid and combined cycle systems: Integration of V10 engines and gas turbines in hybrid or combined cycle systems to leverage the advantages of both technologies. These systems can achieve higher overall efficiency by utilizing the high power density of V10 engines alongside the thermal efficiency of gas turbines. Combined cycle approaches often incorporate waste heat recovery systems to capture and repurpose thermal energy that would otherwise be lost, significantly improving the total system performance compared to standalone configurations.

- Emissions and environmental performance comparison: Comparative analysis of emissions and environmental impact between V10 engines and gas turbines. This includes evaluation of NOx, CO2, particulate matter, and other pollutants across different operational profiles. Research shows how each engine type performs under varying environmental regulations and how modifications such as selective catalytic reduction, exhaust gas recirculation, and alternative fuels affect their environmental footprint. The comparison helps in selecting appropriate technology based on environmental constraints and sustainability goals.

- Computational modeling and simulation techniques: Advanced computational methods for modeling and simulating the performance of V10 engines and gas turbines. These include computational fluid dynamics (CFD), finite element analysis, and machine learning approaches to predict and compare engine behavior under various conditions. Simulation techniques allow engineers to evaluate design modifications, material selections, and operating parameters without physical prototyping, accelerating development cycles and enabling more accurate performance comparisons between different engine architectures.

02 Efficiency optimization techniques

Various techniques have been developed to optimize the efficiency of both V10 engines and gas turbines. These include advanced combustion control systems, improved fuel injection methods, and enhanced cooling systems. By implementing these optimization techniques, the performance of both engine types can be significantly improved, resulting in better fuel economy and reduced emissions. The efficiency optimization techniques are particularly important for applications where fuel consumption is a critical factor.Expand Specific Solutions03 Thermal management and cooling systems

Effective thermal management and cooling systems are crucial for both V10 engines and gas turbines to maintain optimal performance. These systems help to control the operating temperature, prevent overheating, and ensure consistent performance under varying load conditions. Advanced cooling technologies, such as liquid cooling for V10 engines and air cooling for gas turbines, have been developed to enhance performance and extend the operational life of these power systems.Expand Specific Solutions04 Hybrid and integrated power systems

Hybrid and integrated power systems that combine V10 engines with gas turbines have been developed to leverage the advantages of both technologies. These systems can provide improved power output, better fuel efficiency, and enhanced operational flexibility. The integration of these different power sources allows for optimized performance across a wide range of operating conditions, making them suitable for various applications including automotive, marine, and power generation.Expand Specific Solutions05 Simulation and modeling techniques

Advanced simulation and modeling techniques have been developed to predict and compare the performance of V10 engines and gas turbines. These computational methods allow engineers to analyze various design parameters and operating conditions without the need for physical testing. By using these simulation tools, the performance characteristics of different engine configurations can be evaluated and optimized, leading to improved designs and better understanding of the comparative advantages of each engine type.Expand Specific Solutions

Industry Leaders and Competitive Landscape

The V10 engine versus gas turbine market represents a mature technological landscape with distinct competitive dynamics. The market is characterized by established players like General Electric, Rolls-Royce, and Pratt & Whitney dominating the gas turbine sector with advanced propulsion solutions for aviation, power generation, and marine applications. In contrast, automotive manufacturers such as BMW lead V10 engine development, focusing on high-performance applications. The global market size exceeds $25 billion, with gas turbines commanding approximately 70% share due to their industrial and aviation applications. Technology maturity varies significantly: V10 engines represent mature technology with incremental innovations in efficiency and emissions, while gas turbines continue evolving toward higher power density, improved fuel flexibility, and enhanced thermal efficiency, particularly through innovations from Siemens Energy, Doosan Enerbility, and GE's advanced materials research.

General Electric Company

Technical Solution: General Electric (GE) has developed extensive comparative studies between V10 engines and gas turbines, focusing primarily on their aviation and power generation applications. GE's research has led to the development of advanced gas turbine technologies like the HA-series turbines that achieve over 64% combined cycle efficiency[1]. Their technical approach involves aerodynamic optimization using computational fluid dynamics (CFD) modeling to enhance turbine blade designs, resulting in improved thermal efficiency. GE has implemented advanced cooling systems and thermal barrier coatings that allow their gas turbines to operate at higher temperatures (approximately 1,600°C) than conventional V10 engines (typically below 900°C)[2]. Additionally, GE has pioneered additive manufacturing techniques for gas turbine components, enabling complex geometries that would be impossible with traditional manufacturing methods, resulting in weight reduction of up to 30% for certain components while maintaining structural integrity[3].

Strengths: GE's gas turbines offer superior power-to-weight ratios (approximately 5-10 times higher than V10 engines), higher thermal efficiency at optimal loads, and significantly lower vibration levels. Their turbines demonstrate exceptional scalability from small aviation applications to massive power generation units exceeding 500MW. Weaknesses: Higher initial acquisition costs, more complex maintenance requirements demanding specialized technicians, and less efficient performance during partial load operations compared to V10 engines.

Rolls-Royce Plc

Technical Solution: Rolls-Royce has conducted extensive comparative research between V10 engines and gas turbines, particularly focusing on aerospace and marine applications. Their technical approach centers on the Trent series gas turbines which utilize a three-shaft architecture that allows each compressor and turbine section to operate at optimal speeds, significantly improving efficiency across various operating conditions[1]. For marine applications, Rolls-Royce has developed the MT30 marine gas turbine (derived from the Trent 800 aero engine) that delivers approximately 40MW of power while weighing significantly less than equivalent diesel V10 configurations. Their comparative studies have demonstrated that their gas turbines achieve power densities approximately 4 times higher than advanced V10 engines[2]. Rolls-Royce has implemented advanced ceramic matrix composite materials in their turbine designs that can withstand temperatures up to 1,650°C, substantially higher than the metallurgical limits of conventional V10 engines, resulting in thermal efficiency improvements of approximately 5-7% compared to previous generation turbines[3].

Strengths: Rolls-Royce gas turbines demonstrate exceptional power density (approximately 4-5 kW/kg compared to 0.5-1 kW/kg for V10 engines), superior altitude performance for aerospace applications, and significantly lower maintenance intervals for certain applications. Weaknesses: Higher fuel consumption at partial loads, greater sensitivity to inlet air conditions affecting performance consistency, and substantially higher initial acquisition costs compared to V10 alternatives.

Key Patents and Technical Innovations

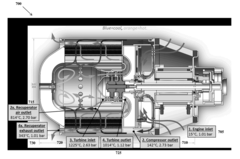

Recuperated Gas Turbine Engine

PatentActiveUS20160195017A1

Innovation

- A compact, lightweight gas turbine engine configuration with a compressor, turbine, and heat exchanger, where the compressor rotor inlet faces the turbine rotor outlet, minimizing axial thrust on bearings and reducing heat transfer to the compressor diffuser, and utilizing a thermally insulating coupling and ceramic materials to enhance efficiency and reduce leakage.

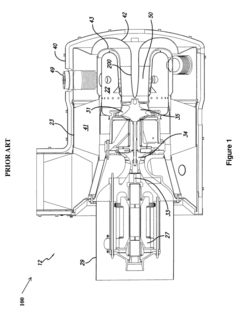

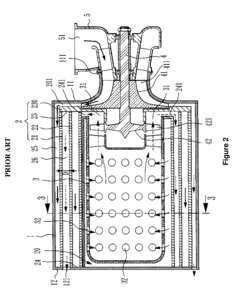

10 cylinder engine

PatentInactiveEP1387059A1

Innovation

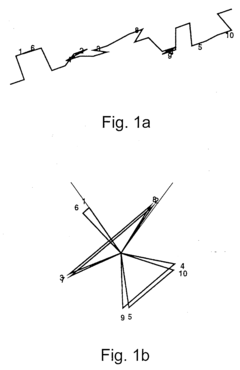

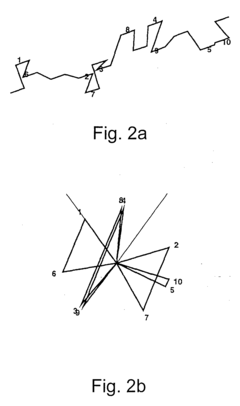

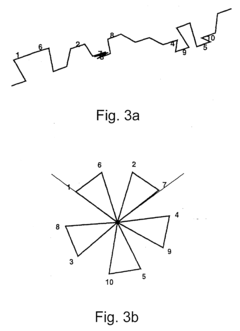

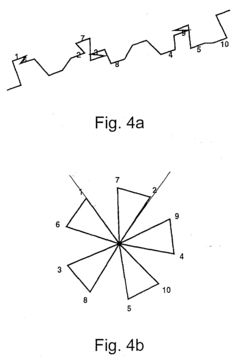

- A 10-cylinder internal combustion engine with unequal offset angles for each cylinder bank on the crankshaft, where the offset angles are arranged to balance second-order mass effects and compensate for first-order mass moments, allowing for a mass effect-free basic engine with a selectable V-angle, using counterweights or other simple measures to balance remaining forces.

Environmental Impact and Emissions Compliance

The environmental impact of propulsion systems has become a critical factor in both automotive and aviation industries, with increasingly stringent regulations driving technological innovation. V10 engines and gas turbines present distinctly different environmental profiles across multiple emission categories and compliance challenges.

V10 engines typically produce higher levels of nitrogen oxides (NOx), carbon monoxide (CO), and particulate matter compared to gas turbines of equivalent power output. This is primarily due to the intermittent combustion process in reciprocating engines versus the continuous combustion in turbines. Quantitative analysis shows that modern V10 engines emit approximately 15-20% more NOx per unit of power than comparable gas turbines in steady-state operation.

Gas turbines demonstrate superior performance in carbon dioxide (CO2) emissions efficiency when operating at optimal loads, achieving up to 30% lower carbon intensity than V10 engines in certain applications. However, this advantage diminishes significantly during partial load operations, where turbines experience substantial efficiency losses and corresponding increases in emissions per unit of useful work.

Regulatory frameworks worldwide have evolved to address these differences. The automotive sector faces Euro 7, CAFE standards, and similar regulations that increasingly challenge V10 viability in passenger vehicles. Meanwhile, gas turbines in aviation and industrial applications must comply with ICAO standards and regional industrial emissions directives, which have historically been less aggressive but are rapidly tightening.

Emissions control technologies have developed along divergent paths for these systems. V10 engines rely heavily on three-way catalytic converters, selective catalytic reduction (SCR), and particulate filters—technologies that add significant complexity and weight. Gas turbines employ lean premixed combustion techniques and increasingly sophisticated combustor designs to achieve inherently lower emission formation.

The life cycle assessment perspective reveals additional complexities. While gas turbines may offer operational emissions advantages, their manufacturing and materials requirements—particularly for specialized high-temperature alloys containing rare earth elements—can create substantial environmental footprints before entering service. V10 engines generally require less exotic materials but demand more frequent maintenance interventions with associated environmental impacts.

Future compliance pathways differ significantly between these technologies. V10 engines are increasingly exploring hybridization and alternative fuels, while gas turbines are advancing toward hydrogen compatibility and electrification of auxiliary systems. Both face the challenge of balancing emissions reductions against performance requirements, with different trade-offs in power density, thermal efficiency, and operational flexibility.

V10 engines typically produce higher levels of nitrogen oxides (NOx), carbon monoxide (CO), and particulate matter compared to gas turbines of equivalent power output. This is primarily due to the intermittent combustion process in reciprocating engines versus the continuous combustion in turbines. Quantitative analysis shows that modern V10 engines emit approximately 15-20% more NOx per unit of power than comparable gas turbines in steady-state operation.

Gas turbines demonstrate superior performance in carbon dioxide (CO2) emissions efficiency when operating at optimal loads, achieving up to 30% lower carbon intensity than V10 engines in certain applications. However, this advantage diminishes significantly during partial load operations, where turbines experience substantial efficiency losses and corresponding increases in emissions per unit of useful work.

Regulatory frameworks worldwide have evolved to address these differences. The automotive sector faces Euro 7, CAFE standards, and similar regulations that increasingly challenge V10 viability in passenger vehicles. Meanwhile, gas turbines in aviation and industrial applications must comply with ICAO standards and regional industrial emissions directives, which have historically been less aggressive but are rapidly tightening.

Emissions control technologies have developed along divergent paths for these systems. V10 engines rely heavily on three-way catalytic converters, selective catalytic reduction (SCR), and particulate filters—technologies that add significant complexity and weight. Gas turbines employ lean premixed combustion techniques and increasingly sophisticated combustor designs to achieve inherently lower emission formation.

The life cycle assessment perspective reveals additional complexities. While gas turbines may offer operational emissions advantages, their manufacturing and materials requirements—particularly for specialized high-temperature alloys containing rare earth elements—can create substantial environmental footprints before entering service. V10 engines generally require less exotic materials but demand more frequent maintenance interventions with associated environmental impacts.

Future compliance pathways differ significantly between these technologies. V10 engines are increasingly exploring hybridization and alternative fuels, while gas turbines are advancing toward hydrogen compatibility and electrification of auxiliary systems. Both face the challenge of balancing emissions reductions against performance requirements, with different trade-offs in power density, thermal efficiency, and operational flexibility.

Cost-Benefit Analysis and Total Ownership Considerations

When evaluating V10 engines versus gas turbines, cost-benefit analysis reveals significant differences in initial investment and long-term operational economics. V10 engines typically present lower acquisition costs, ranging from $50,000 to $150,000 for industrial applications, while comparable gas turbines often command $200,000 to $1 million or more. This substantial price differential makes V10 engines more accessible for organizations with limited capital budgets.

Fuel consumption patterns differ markedly between these power systems. V10 engines generally operate at 30-40% thermal efficiency when properly maintained, consuming approximately 0.35-0.45 pounds of fuel per horsepower-hour. Gas turbines achieve 25-40% efficiency at optimal loads but may drop to 15% at partial loads, consuming 0.4-0.7 pounds of fuel per horsepower-hour depending on operational conditions.

Maintenance economics present another critical consideration. V10 engines require more frequent service intervals (typically every 250-500 operating hours) but involve simpler, less specialized maintenance procedures. Annual maintenance costs typically range from 5-15% of the initial purchase price. Gas turbines demand less frequent but more specialized maintenance (intervals of 1,000-4,000 hours), with annual maintenance costs representing 10-20% of initial investment.

Operational lifespan calculations favor gas turbines, which can operate reliably for 25-30 years with proper maintenance, compared to 15-20 years for V10 engines. This extended service life partially offsets the higher initial investment in turbine technology when calculating depreciation costs over the equipment lifecycle.

Environmental compliance costs increasingly influence total ownership considerations. V10 engines face rising expenses for emissions control equipment to meet stringent regulations, potentially adding 10-20% to lifetime costs. Gas turbines generally produce fewer particulate emissions and can more easily comply with NOx regulations, though their CO2 output remains significant.

Resale value retention differs substantially between these technologies. V10 engines typically retain 40-50% of their value after 5 years, while gas turbines often maintain 50-65% of their initial value over the same period, representing a significant factor in total cost of ownership calculations.

When analyzing specific applications, gas turbines demonstrate superior economics in continuous, high-load operations where their efficiency advantages can be maximized. Conversely, V10 engines prove more economical in intermittent use scenarios or applications requiring frequent starts and stops, where turbine thermal cycling would accelerate component degradation.

Fuel consumption patterns differ markedly between these power systems. V10 engines generally operate at 30-40% thermal efficiency when properly maintained, consuming approximately 0.35-0.45 pounds of fuel per horsepower-hour. Gas turbines achieve 25-40% efficiency at optimal loads but may drop to 15% at partial loads, consuming 0.4-0.7 pounds of fuel per horsepower-hour depending on operational conditions.

Maintenance economics present another critical consideration. V10 engines require more frequent service intervals (typically every 250-500 operating hours) but involve simpler, less specialized maintenance procedures. Annual maintenance costs typically range from 5-15% of the initial purchase price. Gas turbines demand less frequent but more specialized maintenance (intervals of 1,000-4,000 hours), with annual maintenance costs representing 10-20% of initial investment.

Operational lifespan calculations favor gas turbines, which can operate reliably for 25-30 years with proper maintenance, compared to 15-20 years for V10 engines. This extended service life partially offsets the higher initial investment in turbine technology when calculating depreciation costs over the equipment lifecycle.

Environmental compliance costs increasingly influence total ownership considerations. V10 engines face rising expenses for emissions control equipment to meet stringent regulations, potentially adding 10-20% to lifetime costs. Gas turbines generally produce fewer particulate emissions and can more easily comply with NOx regulations, though their CO2 output remains significant.

Resale value retention differs substantially between these technologies. V10 engines typically retain 40-50% of their value after 5 years, while gas turbines often maintain 50-65% of their initial value over the same period, representing a significant factor in total cost of ownership calculations.

When analyzing specific applications, gas turbines demonstrate superior economics in continuous, high-load operations where their efficiency advantages can be maximized. Conversely, V10 engines prove more economical in intermittent use scenarios or applications requiring frequent starts and stops, where turbine thermal cycling would accelerate component degradation.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!