V10 Engine vs Turbocharged: Power Density Analysis

AUG 26, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

V10 Engine and Turbocharging Evolution

The evolution of V10 engines and turbocharging technology represents a fascinating journey through automotive engineering history, marked by continuous innovation and shifting design philosophies. V10 engines emerged in the 1980s in motorsport applications, particularly in Formula 1, before transitioning to production vehicles in the 1990s. These naturally aspirated powerplants offered an ideal balance between the smoothness of V8s and the power of V12s, with their distinctive firing order creating a unique, spine-tingling sound profile that became highly coveted among enthusiasts.

The development path of V10 engines reached its zenith in the early 2000s with iconic implementations in vehicles like the Dodge Viper, Audi R8, and Lamborghini Gallardo. These engines typically displaced between 5.0 and 8.4 liters, producing impressive power figures without forced induction. The engineering focus during this era centered on high-revving capability, with some performance V10s capable of reaching beyond 8,500 RPM.

Parallel to V10 development, turbocharging technology underwent its own significant evolution. While turbochargers have existed since the early 20th century, their mainstream automotive application accelerated in the 1970s and 1980s, driven by both performance demands and fuel economy concerns following the oil crisis. Early turbo systems suffered from significant lag and reliability issues, limiting their appeal in premium performance applications.

The 1990s and 2000s saw dramatic improvements in turbocharger design, with innovations like twin-scroll turbos, variable geometry turbochargers, and improved materials science addressing many previous limitations. By the 2010s, advanced computer modeling and electronic controls enabled precise boost management, virtually eliminating the turbo lag that had plagued earlier systems.

The convergence point between these technologies came as increasingly stringent emissions regulations and efficiency demands began forcing manufacturers away from large-displacement naturally aspirated engines. The industry pivot toward "downsizing and boosting" represented a fundamental shift in performance engineering philosophy. Smaller displacement turbocharged engines could deliver comparable or superior power with significantly improved fuel economy and reduced emissions.

This technological transition is exemplified by manufacturers like Ferrari, who abandoned their iconic naturally aspirated V10 in the F430 for twin-turbocharged V8s in subsequent models. Similarly, Audi's shift from the naturally aspirated V10 in early R8 models to turbocharged powertrains in their broader lineup demonstrates this industry-wide evolution. The timeline clearly shows how turbocharging technology matured precisely when regulatory and market forces began challenging the viability of naturally aspirated V10 engines.

The development path of V10 engines reached its zenith in the early 2000s with iconic implementations in vehicles like the Dodge Viper, Audi R8, and Lamborghini Gallardo. These engines typically displaced between 5.0 and 8.4 liters, producing impressive power figures without forced induction. The engineering focus during this era centered on high-revving capability, with some performance V10s capable of reaching beyond 8,500 RPM.

Parallel to V10 development, turbocharging technology underwent its own significant evolution. While turbochargers have existed since the early 20th century, their mainstream automotive application accelerated in the 1970s and 1980s, driven by both performance demands and fuel economy concerns following the oil crisis. Early turbo systems suffered from significant lag and reliability issues, limiting their appeal in premium performance applications.

The 1990s and 2000s saw dramatic improvements in turbocharger design, with innovations like twin-scroll turbos, variable geometry turbochargers, and improved materials science addressing many previous limitations. By the 2010s, advanced computer modeling and electronic controls enabled precise boost management, virtually eliminating the turbo lag that had plagued earlier systems.

The convergence point between these technologies came as increasingly stringent emissions regulations and efficiency demands began forcing manufacturers away from large-displacement naturally aspirated engines. The industry pivot toward "downsizing and boosting" represented a fundamental shift in performance engineering philosophy. Smaller displacement turbocharged engines could deliver comparable or superior power with significantly improved fuel economy and reduced emissions.

This technological transition is exemplified by manufacturers like Ferrari, who abandoned their iconic naturally aspirated V10 in the F430 for twin-turbocharged V8s in subsequent models. Similarly, Audi's shift from the naturally aspirated V10 in early R8 models to turbocharged powertrains in their broader lineup demonstrates this industry-wide evolution. The timeline clearly shows how turbocharging technology matured precisely when regulatory and market forces began challenging the viability of naturally aspirated V10 engines.

Market Demand for High-Performance Powertrains

The global market for high-performance powertrains has witnessed significant transformation over the past decade, driven by evolving consumer preferences, regulatory pressures, and technological advancements. The traditional V10 naturally aspirated engines, once the pinnacle of automotive engineering, are increasingly competing with modern turbocharged alternatives that promise comparable power with greater efficiency.

Consumer demand for high-performance vehicles remains robust, with the premium sports car segment showing resilience even during economic downturns. Market research indicates that the global high-performance car market was valued at approximately $30 billion in 2022, with projected annual growth rates between 5-7% through 2028. This growth is particularly pronounced in emerging markets such as China and the Middle East, where wealth accumulation has created new customer bases for performance vehicles.

Regulatory frameworks have become a dominant force shaping powertrain development. Stringent emissions standards in Europe, North America, and increasingly in Asia have pushed manufacturers toward more efficient solutions. This regulatory pressure has accelerated the adoption of turbocharged engines, which can deliver higher specific output while maintaining better fuel economy and lower emissions profiles compared to larger displacement naturally aspirated engines.

The customer demographic for high-performance powertrains is evolving. Traditional enthusiasts who valued the distinctive sound and linear power delivery of naturally aspirated engines are being joined by a new generation of buyers who prioritize overall performance metrics and technological sophistication. Market surveys reveal that while 78% of buyers over 50 still prefer the character of naturally aspirated engines, only 45% of buyers under 35 share this preference.

Manufacturer positioning has adapted to these market shifts. Brands historically known for their naturally aspirated engines, such as Ferrari, Lamborghini, and Aston Martin, have introduced turbocharged models to complement or replace their naturally aspirated offerings. Meanwhile, manufacturers with established expertise in turbocharging, like McLaren and Porsche, have leveraged this technology to enhance their market position.

The aftermarket and tuning segment represents another significant demand driver, with the global automotive aftermarket for performance parts exceeding $10 billion annually. Turbocharged engines offer greater potential for power enhancement through relatively simple modifications, creating a robust ecosystem of aftermarket suppliers and tuning specialists catering to this market.

Looking forward, market analysts predict continued growth in demand for high-performance powertrains that balance raw power with efficiency. The power density advantage of turbocharged engines positions them favorably in this evolving landscape, though naturally aspirated engines retain a premium position in ultra-luxury and collector segments where their unique characteristics command a price premium.

Consumer demand for high-performance vehicles remains robust, with the premium sports car segment showing resilience even during economic downturns. Market research indicates that the global high-performance car market was valued at approximately $30 billion in 2022, with projected annual growth rates between 5-7% through 2028. This growth is particularly pronounced in emerging markets such as China and the Middle East, where wealth accumulation has created new customer bases for performance vehicles.

Regulatory frameworks have become a dominant force shaping powertrain development. Stringent emissions standards in Europe, North America, and increasingly in Asia have pushed manufacturers toward more efficient solutions. This regulatory pressure has accelerated the adoption of turbocharged engines, which can deliver higher specific output while maintaining better fuel economy and lower emissions profiles compared to larger displacement naturally aspirated engines.

The customer demographic for high-performance powertrains is evolving. Traditional enthusiasts who valued the distinctive sound and linear power delivery of naturally aspirated engines are being joined by a new generation of buyers who prioritize overall performance metrics and technological sophistication. Market surveys reveal that while 78% of buyers over 50 still prefer the character of naturally aspirated engines, only 45% of buyers under 35 share this preference.

Manufacturer positioning has adapted to these market shifts. Brands historically known for their naturally aspirated engines, such as Ferrari, Lamborghini, and Aston Martin, have introduced turbocharged models to complement or replace their naturally aspirated offerings. Meanwhile, manufacturers with established expertise in turbocharging, like McLaren and Porsche, have leveraged this technology to enhance their market position.

The aftermarket and tuning segment represents another significant demand driver, with the global automotive aftermarket for performance parts exceeding $10 billion annually. Turbocharged engines offer greater potential for power enhancement through relatively simple modifications, creating a robust ecosystem of aftermarket suppliers and tuning specialists catering to this market.

Looking forward, market analysts predict continued growth in demand for high-performance powertrains that balance raw power with efficiency. The power density advantage of turbocharged engines positions them favorably in this evolving landscape, though naturally aspirated engines retain a premium position in ultra-luxury and collector segments where their unique characteristics command a price premium.

Technical Challenges in Engine Power Density

The pursuit of higher power density in internal combustion engines faces significant technical barriers that require innovative engineering solutions. Current power density limitations stem from thermodynamic constraints, material properties, and cooling system capabilities. As engines produce more power per unit volume, they generate exponentially more heat, creating thermal management challenges that can lead to component failure, reduced reliability, and diminished performance.

Material science presents a critical bottleneck in power density advancement. Engine components must withstand extreme temperatures and pressures while maintaining dimensional stability. Traditional materials like cast iron and aluminum alloys approach their physical limits in high-output applications, necessitating the development of advanced alloys, ceramics, and composite materials that can endure these harsh conditions without compromising durability or adding excessive weight.

Combustion efficiency represents another fundamental challenge. As compression ratios increase to extract more power, knock phenomena become more prevalent, limiting the practical compression ratios achievable in production engines. This is particularly evident when comparing naturally aspirated V10 engines with their turbocharged counterparts, where the latter must often operate with lower compression ratios to accommodate forced induction.

Friction and parasitic losses increase disproportionately with power density. Higher engine speeds and loads amplify frictional forces between moving components, converting valuable energy into heat rather than useful work. Advanced surface treatments, improved lubricants, and optimized component design can mitigate these losses but add complexity and cost to engine manufacturing.

Air management systems face substantial challenges in high-power-density engines. Ensuring adequate volumetric efficiency requires sophisticated intake geometries, valve timing strategies, and in turbocharged applications, precisely matched forced induction systems. The transient response characteristics of these systems often create trade-offs between low-end torque and high-end power that engineers must carefully balance.

Emissions compliance adds another layer of complexity to power density optimization. Higher combustion temperatures associated with increased power density tend to produce more nitrogen oxides (NOx), while strategies to mitigate these emissions can negatively impact performance. Engineers must navigate increasingly stringent regulatory requirements while maintaining the power characteristics consumers demand.

Packaging constraints further complicate power density improvements. High-output engines require more robust supporting systems—larger cooling radiators, oil coolers, intercoolers for forced induction, and strengthened drivetrain components—all competing for limited space within vehicle architectures designed for efficiency and aerodynamics.

Material science presents a critical bottleneck in power density advancement. Engine components must withstand extreme temperatures and pressures while maintaining dimensional stability. Traditional materials like cast iron and aluminum alloys approach their physical limits in high-output applications, necessitating the development of advanced alloys, ceramics, and composite materials that can endure these harsh conditions without compromising durability or adding excessive weight.

Combustion efficiency represents another fundamental challenge. As compression ratios increase to extract more power, knock phenomena become more prevalent, limiting the practical compression ratios achievable in production engines. This is particularly evident when comparing naturally aspirated V10 engines with their turbocharged counterparts, where the latter must often operate with lower compression ratios to accommodate forced induction.

Friction and parasitic losses increase disproportionately with power density. Higher engine speeds and loads amplify frictional forces between moving components, converting valuable energy into heat rather than useful work. Advanced surface treatments, improved lubricants, and optimized component design can mitigate these losses but add complexity and cost to engine manufacturing.

Air management systems face substantial challenges in high-power-density engines. Ensuring adequate volumetric efficiency requires sophisticated intake geometries, valve timing strategies, and in turbocharged applications, precisely matched forced induction systems. The transient response characteristics of these systems often create trade-offs between low-end torque and high-end power that engineers must carefully balance.

Emissions compliance adds another layer of complexity to power density optimization. Higher combustion temperatures associated with increased power density tend to produce more nitrogen oxides (NOx), while strategies to mitigate these emissions can negatively impact performance. Engineers must navigate increasingly stringent regulatory requirements while maintaining the power characteristics consumers demand.

Packaging constraints further complicate power density improvements. High-output engines require more robust supporting systems—larger cooling radiators, oil coolers, intercoolers for forced induction, and strengthened drivetrain components—all competing for limited space within vehicle architectures designed for efficiency and aerodynamics.

Current Power Density Solutions Comparison

01 V10 Engine Design and Performance Characteristics

V10 engines offer unique performance characteristics with their specific cylinder arrangement. These engines typically provide a balance of power, torque, and smoothness of operation. The V10 configuration allows for a compact design while delivering high power density. The arrangement of cylinders in a V-shape contributes to the engine's overall balance and vibration characteristics, making it suitable for high-performance applications where power density is a critical factor.- Turbocharging systems for V10 engines: Turbocharging systems specifically designed for V10 engines can significantly increase power density. These systems often include specialized turbocharger arrangements, intercoolers, and exhaust manifold designs that optimize airflow and pressure for the V-configuration. Advanced turbocharging technologies enable V10 engines to achieve higher power outputs while maintaining reliability and efficiency, resulting in improved power-to-weight ratios compared to naturally aspirated counterparts.

- Power density optimization through engine control systems: Engine control systems play a crucial role in optimizing power density for both V10 and turbocharged engines. Advanced electronic control units (ECUs) can precisely manage fuel injection timing, ignition timing, boost pressure, and air-fuel ratios to maximize power output while ensuring engine protection. These control systems can adapt to different operating conditions, allowing engines to achieve optimal performance across various speed and load ranges, thereby enhancing overall power density.

- Cooling and thermal management for high power density: Effective cooling and thermal management systems are essential for maintaining high power density in V10 and turbocharged engines. These systems include advanced intercoolers, oil coolers, and specialized cooling circuits that prevent overheating under high-load conditions. Efficient heat dissipation allows engines to operate at higher boost pressures and power outputs without compromising reliability or durability, directly contributing to increased power density capabilities.

- Combustion chamber design for enhanced power density: Innovative combustion chamber designs significantly impact power density in both V10 and turbocharged engines. Optimized chamber geometries, valve configurations, and piston designs can improve combustion efficiency, flame propagation, and thermal efficiency. These enhancements allow for higher compression ratios and more complete fuel burning, resulting in increased power output per unit of displacement, thereby improving overall engine power density.

- Multi-stage turbocharging for maximum power density: Multi-stage turbocharging systems represent an advanced approach to maximizing power density in engines. These systems utilize sequential or parallel turbochargers of different sizes to optimize boost across the entire RPM range. By eliminating turbo lag and providing consistent power delivery, multi-stage setups enable engines to achieve higher specific outputs. This technology is particularly effective when applied to V10 engines, where the inherent balance and firing order can be complemented by precisely controlled forced induction.

02 Turbocharging Systems for Enhanced Power Density

Turbocharging systems significantly increase engine power density by forcing more air into the combustion chamber, allowing for more fuel to be burned and generating more power from the same engine displacement. These systems utilize exhaust gases to drive a turbine connected to a compressor that pressurizes intake air. Advanced turbocharging technologies include variable geometry turbochargers, twin-scroll designs, and multi-stage turbocharging arrangements that optimize power delivery across different engine operating conditions.Expand Specific Solutions03 Cooling and Thermal Management for High Power Density Engines

Effective cooling and thermal management systems are crucial for high power density engines like turbocharged V10s. These systems prevent overheating and maintain optimal operating temperatures under high-load conditions. Advanced cooling solutions include precision oil cooling, integrated water-cooled intercoolers, optimized coolant flow paths, and thermal barrier coatings. Proper thermal management ensures engine durability and consistent performance while allowing for higher power outputs from compact engine designs.Expand Specific Solutions04 Electronic Control Systems for Power Optimization

Sophisticated electronic control systems are essential for maximizing power density in modern V10 and turbocharged engines. These systems precisely manage fuel injection timing, ignition timing, boost pressure, and valve timing to optimize combustion efficiency. Advanced engine control units (ECUs) utilize real-time sensor data to adjust operating parameters based on driving conditions, ensuring maximum power output while maintaining reliability and emissions compliance. Electronic boost control specifically helps prevent turbocharger overboost conditions while maximizing power delivery.Expand Specific Solutions05 Materials and Manufacturing Techniques for High-Performance Engines

Innovative materials and manufacturing techniques enable the development of engines with higher power density. Lightweight alloys, composite materials, and advanced coatings reduce engine weight while maintaining structural integrity under high thermal and mechanical stresses. Precision manufacturing methods such as 3D printing, advanced casting techniques, and computer-optimized designs allow for more efficient cooling passages, reduced friction, and improved combustion chamber geometry. These advancements enable engines to produce more power from smaller displacements while maintaining reliability.Expand Specific Solutions

Major Manufacturers and Competition Landscape

The V10 engine versus turbocharged technology competition landscape is evolving rapidly, with the market transitioning from traditional naturally aspirated engines toward more efficient forced induction solutions. Major automotive manufacturers including Ford, Toyota, BMW, and Hyundai are investing heavily in turbocharging technology to meet stringent emissions regulations while maintaining performance. Companies like BorgWarner, Garrett Motion, and Cummins lead the turbocharger component market with advanced solutions. The technology maturity varies significantly - V10 engines represent mature but declining technology, while turbocharging continues to advance with innovations in variable geometry, electric assistance, and materials science. Market growth is primarily in the turbocharged segment, driven by the global push for improved power density and fuel efficiency across passenger and commercial vehicle applications.

Ford Global Technologies LLC

Technical Solution: Ford has developed advanced EcoBoost technology that combines turbocharging with direct fuel injection to achieve V8-level performance from smaller displacement engines. Their 3.5L EcoBoost V6 delivers comparable power to naturally aspirated V8/V10 engines while achieving up to 20% better fuel efficiency. Ford's research shows that downsized turbocharged engines can match the power density of larger naturally aspirated engines while reducing weight by approximately 100 pounds. Their latest generation of turbocharging technology incorporates twin-scroll designs and integrated exhaust manifolds to minimize turbo lag and improve throttle response, addressing traditional drawbacks of turbocharged systems compared to naturally aspirated V10 engines.

Strengths: Superior fuel economy while maintaining high power output; reduced vehicle weight improves handling and efficiency; smaller packaging requirements. Weaknesses: Potential turbo lag at low RPMs compared to naturally aspirated V10s; more complex cooling requirements; potentially higher maintenance costs over vehicle lifetime.

BorgWarner, Inc.

Technical Solution: BorgWarner has pioneered advanced turbocharging solutions with their eTurbo™ technology that integrates an electric motor-generator within the turbocharger shaft, effectively eliminating turbo lag. Their dual-volute turbocharger design separates exhaust pulses to maintain energy efficiency while improving transient response by up to 40% compared to conventional single-scroll designs. BorgWarner's variable geometry turbochargers (VGT) dynamically adjust airflow based on engine conditions, providing optimal power density across the entire RPM range. Their research demonstrates that modern turbocharged 4-cylinder engines equipped with their technology can achieve power density exceeding 150 hp/liter, surpassing naturally aspirated V10 engines that typically deliver 80-100 hp/liter. BorgWarner's materials science advancements have also improved turbocharger durability with heat-resistant alloys capable of withstanding temperatures exceeding 1050°C.

Strengths: Industry-leading turbocharger efficiency; comprehensive range of solutions from small passenger cars to heavy-duty applications; advanced electric-assist technologies. Weaknesses: Higher initial system complexity and cost compared to naturally aspirated engines; requires sophisticated engine management systems to optimize performance.

Key Patents in Engine Power Enhancement

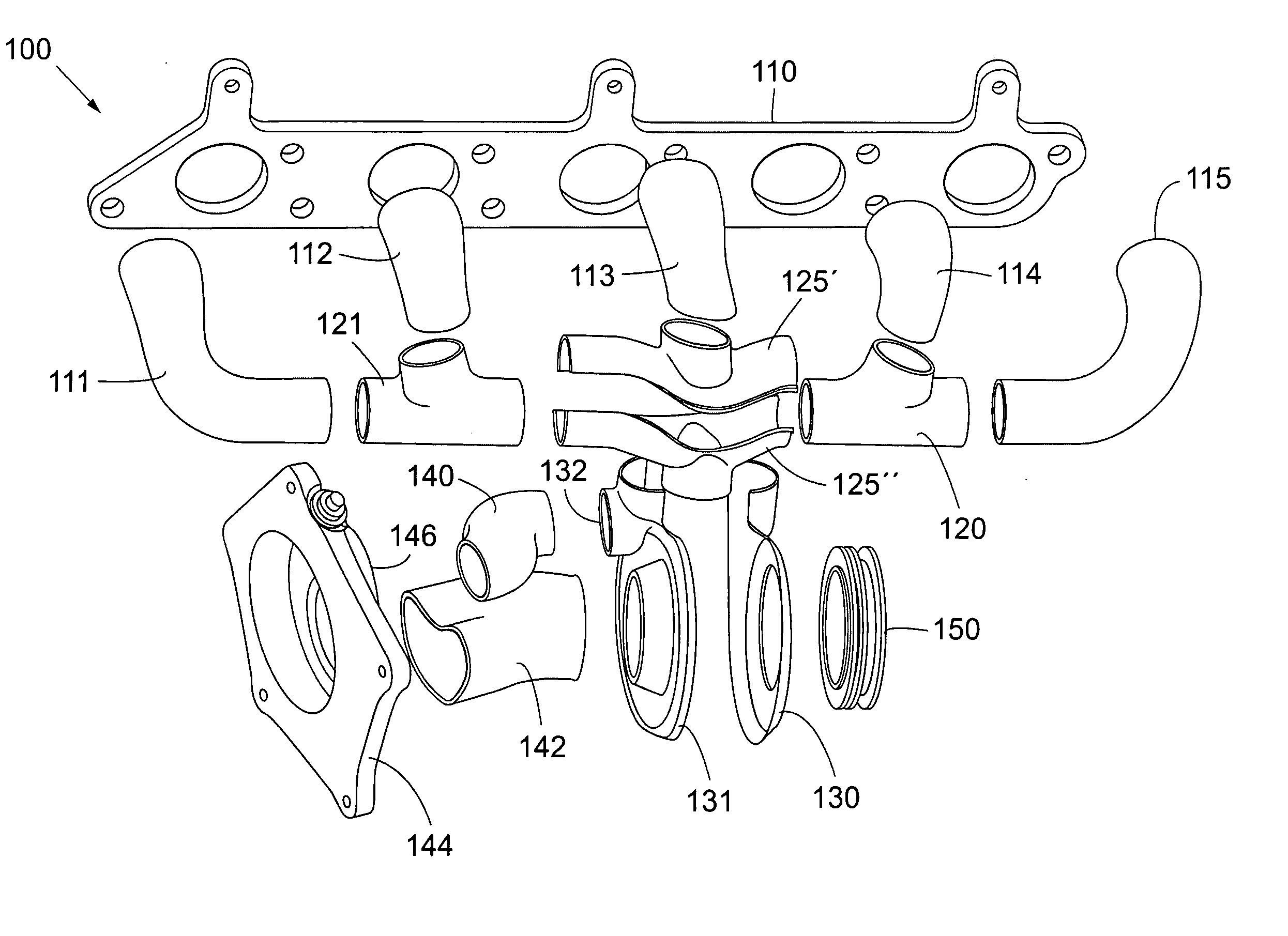

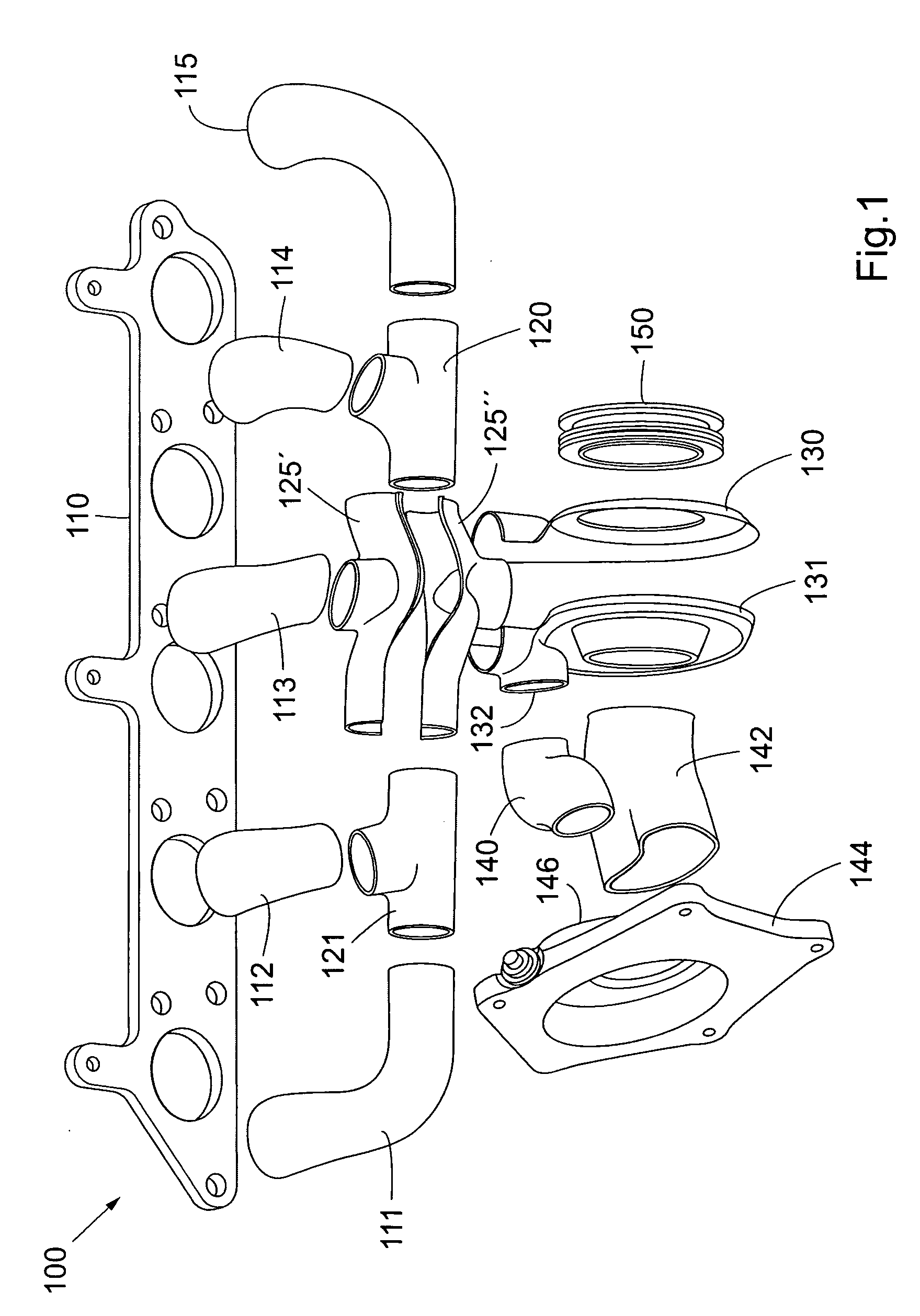

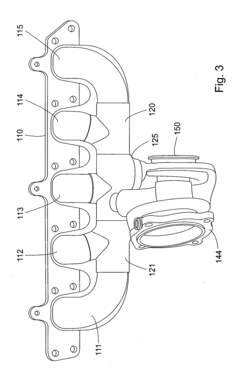

Turbocharger

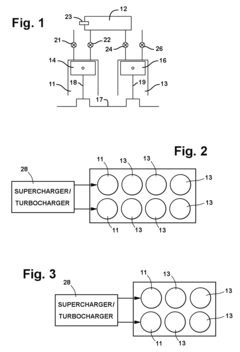

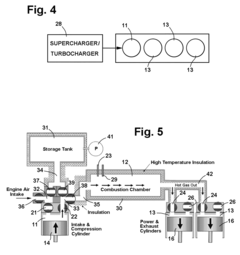

PatentInactiveUS20050126163A1

Innovation

- A jacketed integrated turbocharger/manifold design featuring an outer shell that covers the ductwork and turbine housing, creating an air insulating layer to reduce heat transfer and allowing for the use of cost-efficient materials, while maintaining high temperature capability.

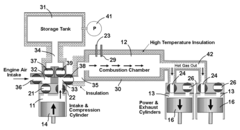

Split cycle engine and method with increased power density

PatentInactiveUS9074526B2

Innovation

- A split cycle engine design where air is compressed and stored, then used to drive an expansion chamber, allowing for increased power output by varying air intake and using a blower or pneumatic storage to recapture energy, thereby maintaining efficiency and reducing costs.

Emissions Regulations Impact on Engine Design

Emissions regulations have become a pivotal factor in modern engine design, fundamentally reshaping the landscape of automotive engineering. The transition from naturally aspirated V10 engines to turbocharged alternatives has been significantly accelerated by increasingly stringent global emissions standards. These regulations have established progressively lower thresholds for carbon dioxide, nitrogen oxides, and particulate matter emissions, compelling manufacturers to prioritize efficiency alongside performance.

The European Union's Euro 6d standards and the Corporate Average Fuel Economy (CAFE) regulations in the United States have been particularly influential, imposing substantial financial penalties on manufacturers whose fleets exceed emissions targets. This regulatory pressure has catalyzed the widespread adoption of turbocharging technology as a means to maintain power output while reducing engine displacement and emissions.

For V10 engines, which traditionally rely on large displacement to generate power, these regulations have posed existential challenges. The inherent inefficiency of naturally aspirated high-cylinder-count engines under partial load conditions has made them increasingly difficult to justify in production vehicles. Consequently, many manufacturers have abandoned V10 configurations entirely, with Ferrari's naturally aspirated V10 Formula 1 engines representing one of the last prominent applications before regulatory changes forced their discontinuation.

Turbocharged engines offer a regulatory compliance advantage through downsizing capabilities. By maintaining power density while reducing displacement, they can achieve lower emissions during standardized testing cycles. The ability to optimize boost pressure based on driving conditions allows turbocharged engines to deliver efficiency improvements of 15-30% compared to naturally aspirated counterparts of equivalent power output.

Advanced emissions control technologies have evolved alongside turbocharging, including integrated exhaust manifolds, water-cooled intercoolers, and electrically actuated wastegates. These innovations enable precise thermal management and boost control, further enhancing emissions compliance while preserving performance characteristics.

The regulatory landscape continues to evolve, with Euro 7 standards and increasingly ambitious CAFE targets on the horizon. These forthcoming regulations will likely further disadvantage naturally aspirated V10 engines while incentivizing additional refinements to turbocharged alternatives. The power density advantage of turbocharged engines becomes increasingly valuable as manufacturers strive to meet these escalating requirements without compromising vehicle performance expectations.

In this regulatory context, the comparative analysis of V10 and turbocharged engines must acknowledge that emissions compliance has become as crucial to commercial viability as traditional performance metrics like horsepower and torque.

The European Union's Euro 6d standards and the Corporate Average Fuel Economy (CAFE) regulations in the United States have been particularly influential, imposing substantial financial penalties on manufacturers whose fleets exceed emissions targets. This regulatory pressure has catalyzed the widespread adoption of turbocharging technology as a means to maintain power output while reducing engine displacement and emissions.

For V10 engines, which traditionally rely on large displacement to generate power, these regulations have posed existential challenges. The inherent inefficiency of naturally aspirated high-cylinder-count engines under partial load conditions has made them increasingly difficult to justify in production vehicles. Consequently, many manufacturers have abandoned V10 configurations entirely, with Ferrari's naturally aspirated V10 Formula 1 engines representing one of the last prominent applications before regulatory changes forced their discontinuation.

Turbocharged engines offer a regulatory compliance advantage through downsizing capabilities. By maintaining power density while reducing displacement, they can achieve lower emissions during standardized testing cycles. The ability to optimize boost pressure based on driving conditions allows turbocharged engines to deliver efficiency improvements of 15-30% compared to naturally aspirated counterparts of equivalent power output.

Advanced emissions control technologies have evolved alongside turbocharging, including integrated exhaust manifolds, water-cooled intercoolers, and electrically actuated wastegates. These innovations enable precise thermal management and boost control, further enhancing emissions compliance while preserving performance characteristics.

The regulatory landscape continues to evolve, with Euro 7 standards and increasingly ambitious CAFE targets on the horizon. These forthcoming regulations will likely further disadvantage naturally aspirated V10 engines while incentivizing additional refinements to turbocharged alternatives. The power density advantage of turbocharged engines becomes increasingly valuable as manufacturers strive to meet these escalating requirements without compromising vehicle performance expectations.

In this regulatory context, the comparative analysis of V10 and turbocharged engines must acknowledge that emissions compliance has become as crucial to commercial viability as traditional performance metrics like horsepower and torque.

Materials Science Advancements for Engine Technology

The evolution of engine technology has been significantly influenced by advancements in materials science. Traditional V10 engines and modern turbocharged alternatives represent different approaches to power generation, with material innovations playing a crucial role in their respective performance characteristics and power density metrics.

High-temperature alloys have revolutionized both engine types, with nickel-based superalloys enabling turbocharged engines to withstand extreme thermal conditions in the turbocharger housing and turbine wheels. These materials maintain structural integrity at temperatures exceeding 1000°C, a critical factor in turbocharger efficiency and longevity. Meanwhile, V10 engines benefit from advanced aluminum-silicon alloys in block construction, offering superior heat dissipation while reducing overall weight.

Ceramic matrix composites (CMCs) represent another breakthrough, particularly for turbocharged systems. These materials provide exceptional thermal insulation and wear resistance in turbocharger components, reducing heat transfer to surrounding engine parts and improving thermal efficiency. The implementation of silicon carbide and silicon nitride ceramics in turbocharger turbine wheels has enabled higher operating temperatures and rotational speeds, directly enhancing power density.

Coating technologies have evolved to address specific challenges in both engine configurations. Thermal barrier coatings (TBCs) applied to combustion chambers and piston crowns reduce heat transfer losses, while diamond-like carbon (DLC) coatings on valve train components minimize friction losses. These surface engineering solutions have contributed to efficiency gains of 2-5% in both engine types, though turbocharged engines typically demonstrate greater relative improvements due to their higher thermal loads.

Lightweight composite materials have transformed engine peripheral components, with carbon fiber reinforced polymers (CFRPs) replacing traditional materials in intake manifolds and engine covers. This weight reduction contributes to improved power-to-weight ratios, particularly beneficial for turbocharged engines where power density is a primary design objective.

Nano-engineered materials represent the cutting edge of engine material science, with nanoscale additives enhancing base material properties. Nano-ceramic particles dispersed in engine oils improve lubrication properties, while nanoscale surface texturing on cylinder walls reduces friction losses. These innovations have demonstrated particular value in turbocharged applications, where higher specific outputs place greater demands on material performance.

The comparative analysis of V10 and turbocharged engines reveals that material science advancements have disproportionately benefited turbocharged configurations, enabling them to achieve power density figures that now routinely surpass naturally aspirated V10 designs while maintaining acceptable durability and reliability metrics.

High-temperature alloys have revolutionized both engine types, with nickel-based superalloys enabling turbocharged engines to withstand extreme thermal conditions in the turbocharger housing and turbine wheels. These materials maintain structural integrity at temperatures exceeding 1000°C, a critical factor in turbocharger efficiency and longevity. Meanwhile, V10 engines benefit from advanced aluminum-silicon alloys in block construction, offering superior heat dissipation while reducing overall weight.

Ceramic matrix composites (CMCs) represent another breakthrough, particularly for turbocharged systems. These materials provide exceptional thermal insulation and wear resistance in turbocharger components, reducing heat transfer to surrounding engine parts and improving thermal efficiency. The implementation of silicon carbide and silicon nitride ceramics in turbocharger turbine wheels has enabled higher operating temperatures and rotational speeds, directly enhancing power density.

Coating technologies have evolved to address specific challenges in both engine configurations. Thermal barrier coatings (TBCs) applied to combustion chambers and piston crowns reduce heat transfer losses, while diamond-like carbon (DLC) coatings on valve train components minimize friction losses. These surface engineering solutions have contributed to efficiency gains of 2-5% in both engine types, though turbocharged engines typically demonstrate greater relative improvements due to their higher thermal loads.

Lightweight composite materials have transformed engine peripheral components, with carbon fiber reinforced polymers (CFRPs) replacing traditional materials in intake manifolds and engine covers. This weight reduction contributes to improved power-to-weight ratios, particularly beneficial for turbocharged engines where power density is a primary design objective.

Nano-engineered materials represent the cutting edge of engine material science, with nanoscale additives enhancing base material properties. Nano-ceramic particles dispersed in engine oils improve lubrication properties, while nanoscale surface texturing on cylinder walls reduces friction losses. These innovations have demonstrated particular value in turbocharged applications, where higher specific outputs place greater demands on material performance.

The comparative analysis of V10 and turbocharged engines reveals that material science advancements have disproportionately benefited turbocharged configurations, enabling them to achieve power density figures that now routinely surpass naturally aspirated V10 designs while maintaining acceptable durability and reliability metrics.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!