Why Bio-based Polymer is Essential for Reducing Carbon Footprint

OCT 21, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Bio-Polymer Evolution and Carbon Reduction Goals

Bio-based polymers have emerged as a critical solution in the global effort to reduce carbon footprints across industries. The evolution of these materials traces back to the early 20th century, but significant advancements have only materialized in recent decades as environmental concerns have intensified. Initially developed as alternatives to petroleum-based plastics, bio-polymers have evolved from simple starch-based compounds to sophisticated materials with tailored properties comparable to conventional plastics.

The trajectory of bio-polymer development has been shaped by increasing awareness of climate change and the urgent need to transition away from fossil fuel dependencies. Early iterations faced challenges in performance, durability, and cost-effectiveness, limiting widespread adoption. However, technological breakthroughs in fermentation processes, genetic engineering, and polymer chemistry have dramatically improved the quality and reduced production costs of these sustainable alternatives.

Current bio-polymer evolution is characterized by three distinct approaches: direct use of natural polymers (like cellulose and starch), microbial production of polymers (such as PHA), and conversion of bio-based monomers into polymers (as with PLA). Each pathway represents a different technological approach with varying carbon reduction potentials and application suitability.

The carbon reduction goals associated with bio-polymers are ambitious and multifaceted. Primary objectives include decreasing greenhouse gas emissions throughout the product lifecycle, reducing dependence on fossil resources, and creating carbon sinks through sustainable feedstock cultivation. Studies indicate that bio-based polymers can reduce carbon emissions by 30-80% compared to conventional plastics, depending on production methods and feedstock sources.

Industry targets align with broader climate initiatives such as the Paris Agreement and various national carbon neutrality pledges. Many leading chemical companies have committed to increasing their bio-polymer production capacity significantly by 2030, with some aiming for carbon-neutral operations by 2050. These goals are driving unprecedented investment in research and development of next-generation bio-polymers.

The technological roadmap for bio-polymers is increasingly focused on developing "carbon-negative" materials that sequester more carbon during their lifecycle than they emit. This involves innovations in feedstock selection, emphasizing non-food crops and agricultural waste, improvements in processing efficiency, and end-of-life considerations such as biodegradability and compostability. The ultimate goal is creating a circular bioeconomy where materials are continuously recycled or safely returned to natural systems.

The trajectory of bio-polymer development has been shaped by increasing awareness of climate change and the urgent need to transition away from fossil fuel dependencies. Early iterations faced challenges in performance, durability, and cost-effectiveness, limiting widespread adoption. However, technological breakthroughs in fermentation processes, genetic engineering, and polymer chemistry have dramatically improved the quality and reduced production costs of these sustainable alternatives.

Current bio-polymer evolution is characterized by three distinct approaches: direct use of natural polymers (like cellulose and starch), microbial production of polymers (such as PHA), and conversion of bio-based monomers into polymers (as with PLA). Each pathway represents a different technological approach with varying carbon reduction potentials and application suitability.

The carbon reduction goals associated with bio-polymers are ambitious and multifaceted. Primary objectives include decreasing greenhouse gas emissions throughout the product lifecycle, reducing dependence on fossil resources, and creating carbon sinks through sustainable feedstock cultivation. Studies indicate that bio-based polymers can reduce carbon emissions by 30-80% compared to conventional plastics, depending on production methods and feedstock sources.

Industry targets align with broader climate initiatives such as the Paris Agreement and various national carbon neutrality pledges. Many leading chemical companies have committed to increasing their bio-polymer production capacity significantly by 2030, with some aiming for carbon-neutral operations by 2050. These goals are driving unprecedented investment in research and development of next-generation bio-polymers.

The technological roadmap for bio-polymers is increasingly focused on developing "carbon-negative" materials that sequester more carbon during their lifecycle than they emit. This involves innovations in feedstock selection, emphasizing non-food crops and agricultural waste, improvements in processing efficiency, and end-of-life considerations such as biodegradability and compostability. The ultimate goal is creating a circular bioeconomy where materials are continuously recycled or safely returned to natural systems.

Market Demand Analysis for Sustainable Polymers

The global market for sustainable polymers has witnessed unprecedented growth in recent years, driven by increasing environmental concerns and regulatory pressures. The demand for bio-based polymers specifically has expanded at a compound annual growth rate of 20% between 2018 and 2022, significantly outpacing traditional petroleum-based plastics which grew at only 3-4% during the same period. This accelerated growth trajectory reflects a fundamental shift in consumer preferences and industrial priorities toward more environmentally responsible materials.

Consumer awareness regarding plastic pollution and carbon footprint has reached critical mass, with 78% of global consumers now expressing willingness to pay premium prices for sustainable packaging solutions. Major retail and consumer goods companies have responded by establishing ambitious sustainability targets, with over 400 companies worldwide committing to using 100% recyclable, reusable, or compostable packaging by 2025 through initiatives like the Ellen MacArthur Foundation's New Plastics Economy Global Commitment.

The regulatory landscape has evolved dramatically to favor bio-based polymers. The European Union's Single-Use Plastics Directive, China's National Sword Policy, and similar regulations in over 70 countries worldwide have created strong market incentives for alternatives to conventional plastics. Carbon pricing mechanisms implemented across 45 national jurisdictions further enhance the competitive position of bio-based polymers, which typically generate 25-75% less greenhouse gas emissions compared to their fossil-based counterparts.

Market segmentation analysis reveals particularly strong demand growth in packaging (36% of bio-based polymer consumption), consumer goods (24%), automotive components (18%), and building materials (12%). The food and beverage sector represents the most dynamic growth segment, with major brands committing billions to sustainable packaging transitions. The healthcare sector has emerged as a promising frontier, with bio-based polymers increasingly utilized in medical devices and pharmaceutical packaging.

Regional analysis indicates Europe leads in bio-based polymer adoption with approximately 38% of global market share, followed by North America (29%) and Asia-Pacific (26%). However, the highest growth rates are observed in emerging economies, particularly in Southeast Asia and Latin America, where expanding middle classes are increasingly environmentally conscious and governments are implementing progressive waste management policies.

Supply chain considerations remain critical to market development. Current production capacity for bio-based polymers stands at approximately 2.4 million metric tons annually, representing less than 1% of total global polymer production. Significant investments in manufacturing infrastructure and feedstock supply chains are underway, with announced capacity expansions expected to double production capability by 2026.

Consumer awareness regarding plastic pollution and carbon footprint has reached critical mass, with 78% of global consumers now expressing willingness to pay premium prices for sustainable packaging solutions. Major retail and consumer goods companies have responded by establishing ambitious sustainability targets, with over 400 companies worldwide committing to using 100% recyclable, reusable, or compostable packaging by 2025 through initiatives like the Ellen MacArthur Foundation's New Plastics Economy Global Commitment.

The regulatory landscape has evolved dramatically to favor bio-based polymers. The European Union's Single-Use Plastics Directive, China's National Sword Policy, and similar regulations in over 70 countries worldwide have created strong market incentives for alternatives to conventional plastics. Carbon pricing mechanisms implemented across 45 national jurisdictions further enhance the competitive position of bio-based polymers, which typically generate 25-75% less greenhouse gas emissions compared to their fossil-based counterparts.

Market segmentation analysis reveals particularly strong demand growth in packaging (36% of bio-based polymer consumption), consumer goods (24%), automotive components (18%), and building materials (12%). The food and beverage sector represents the most dynamic growth segment, with major brands committing billions to sustainable packaging transitions. The healthcare sector has emerged as a promising frontier, with bio-based polymers increasingly utilized in medical devices and pharmaceutical packaging.

Regional analysis indicates Europe leads in bio-based polymer adoption with approximately 38% of global market share, followed by North America (29%) and Asia-Pacific (26%). However, the highest growth rates are observed in emerging economies, particularly in Southeast Asia and Latin America, where expanding middle classes are increasingly environmentally conscious and governments are implementing progressive waste management policies.

Supply chain considerations remain critical to market development. Current production capacity for bio-based polymers stands at approximately 2.4 million metric tons annually, representing less than 1% of total global polymer production. Significant investments in manufacturing infrastructure and feedstock supply chains are underway, with announced capacity expansions expected to double production capability by 2026.

Bio-based Polymer Technology Status and Barriers

The global bio-based polymer market has witnessed significant growth in recent years, driven by increasing environmental concerns and regulatory pressures to reduce carbon emissions. Currently, bio-based polymers represent approximately 2% of the total polymer production worldwide, with an annual production capacity of around 4 million tonnes. This market is projected to grow at a CAGR of 16-18% through 2026, significantly outpacing conventional petroleum-based polymers.

Despite this promising trajectory, several technological barriers impede the widespread adoption of bio-based polymers. Production costs remain 20-100% higher than conventional polymers, primarily due to expensive feedstock, complex processing requirements, and smaller production scales. This cost differential presents a significant market entry barrier, particularly in price-sensitive applications and emerging economies.

Performance limitations constitute another major challenge. Many bio-based polymers exhibit inferior mechanical properties, thermal stability, and durability compared to their petroleum-based counterparts. For instance, PLA (Polylactic Acid), one of the most common bio-based polymers, has lower heat resistance and impact strength than conventional plastics like PET or PP, limiting its application in certain high-performance sectors.

Processing challenges further complicate the manufacturing landscape. Bio-based polymers often require specialized equipment or modified processing conditions, increasing production complexity and capital investment requirements. The variability in natural feedstock quality also introduces inconsistencies in the final product properties, making quality control more challenging than with synthetic feedstocks.

The feedstock supply chain represents another significant barrier. Competition with food crops for agricultural land raises sustainability concerns and price volatility issues. Additionally, the geographical concentration of biomass resources creates logistical challenges and regional disparities in production capabilities. Countries with abundant biomass resources like Brazil, Malaysia, and parts of North America have distinct advantages in this regard.

Regulatory frameworks across different regions show considerable variation, creating a fragmented market landscape. While the European Union has implemented supportive policies like the European Green Deal and Circular Economy Action Plan, many regions lack clear standards and certification systems for bio-based products, hampering market development and consumer confidence.

End-of-life management presents additional complications. While marketed as environmentally friendly, many bio-based polymers require specific industrial composting conditions to degrade properly. The lack of appropriate waste management infrastructure in many regions means these materials often end up in conventional waste streams, negating their environmental benefits.

Despite this promising trajectory, several technological barriers impede the widespread adoption of bio-based polymers. Production costs remain 20-100% higher than conventional polymers, primarily due to expensive feedstock, complex processing requirements, and smaller production scales. This cost differential presents a significant market entry barrier, particularly in price-sensitive applications and emerging economies.

Performance limitations constitute another major challenge. Many bio-based polymers exhibit inferior mechanical properties, thermal stability, and durability compared to their petroleum-based counterparts. For instance, PLA (Polylactic Acid), one of the most common bio-based polymers, has lower heat resistance and impact strength than conventional plastics like PET or PP, limiting its application in certain high-performance sectors.

Processing challenges further complicate the manufacturing landscape. Bio-based polymers often require specialized equipment or modified processing conditions, increasing production complexity and capital investment requirements. The variability in natural feedstock quality also introduces inconsistencies in the final product properties, making quality control more challenging than with synthetic feedstocks.

The feedstock supply chain represents another significant barrier. Competition with food crops for agricultural land raises sustainability concerns and price volatility issues. Additionally, the geographical concentration of biomass resources creates logistical challenges and regional disparities in production capabilities. Countries with abundant biomass resources like Brazil, Malaysia, and parts of North America have distinct advantages in this regard.

Regulatory frameworks across different regions show considerable variation, creating a fragmented market landscape. While the European Union has implemented supportive policies like the European Green Deal and Circular Economy Action Plan, many regions lack clear standards and certification systems for bio-based products, hampering market development and consumer confidence.

End-of-life management presents additional complications. While marketed as environmentally friendly, many bio-based polymers require specific industrial composting conditions to degrade properly. The lack of appropriate waste management infrastructure in many regions means these materials often end up in conventional waste streams, negating their environmental benefits.

Current Bio-Polymer Solutions for Carbon Footprint Reduction

01 Bio-based polymers with reduced carbon footprint

Bio-based polymers derived from renewable resources offer significant reductions in carbon footprint compared to petroleum-based alternatives. These polymers utilize biomass feedstocks such as plant oils, cellulose, and agricultural waste, which capture carbon during growth. The production processes for these polymers typically require less energy and generate fewer greenhouse gas emissions throughout their lifecycle, contributing to overall carbon footprint reduction.- Bio-based polymer production methods with reduced carbon footprint: Various production methods for bio-based polymers that specifically focus on reducing carbon footprint throughout the manufacturing process. These methods include optimized fermentation processes, energy-efficient polymerization techniques, and the use of renewable energy sources in production facilities. By implementing these methods, manufacturers can significantly decrease greenhouse gas emissions associated with polymer production while maintaining desired material properties.

- Life cycle assessment of bio-based polymers: Comprehensive life cycle assessment methodologies for evaluating the environmental impact of bio-based polymers from raw material extraction to end-of-life disposal. These assessments quantify carbon footprint metrics, energy consumption, and other environmental indicators throughout the polymer's life cycle. The methodologies enable accurate comparison between bio-based alternatives and conventional petroleum-based polymers, helping manufacturers and consumers make environmentally informed decisions.

- Biodegradable bio-based polymers with carbon sequestration properties: Development of biodegradable bio-based polymers that not only have reduced carbon footprints during production but also contribute to carbon sequestration at end-of-life. These polymers break down into compounds that can be incorporated into soil carbon pools or used as feedstock for further biological processes. The biodegradation process is designed to minimize methane emissions while maximizing carbon retention in environmental systems.

- Bio-based polymer feedstock selection for carbon footprint optimization: Strategic selection of renewable feedstocks for bio-based polymer production with emphasis on carbon footprint reduction. This includes evaluating agricultural practices for biomass production, considering land use changes, and selecting feedstocks that require minimal processing energy. The approach also incorporates considerations for regional availability of feedstocks to minimize transportation emissions and optimize the overall carbon balance of the resulting polymers.

- Carbon footprint monitoring and reporting systems for bio-based polymers: Advanced monitoring and reporting systems designed specifically for tracking the carbon footprint of bio-based polymers throughout their supply chain. These systems incorporate real-time data collection, blockchain verification, and standardized carbon accounting methodologies to provide transparent environmental impact information. The technologies enable manufacturers to identify hotspots for carbon reduction and allow consumers to make informed choices based on verified environmental performance data.

02 Carbon footprint assessment methodologies for polymers

Various methodologies have been developed to assess the carbon footprint of bio-based polymers. These include life cycle assessment (LCA) tools that evaluate environmental impacts from raw material extraction through manufacturing, use, and disposal. Advanced carbon accounting frameworks consider factors such as carbon sequestration during biomass growth, processing emissions, and end-of-life scenarios. These methodologies help quantify the environmental benefits of bio-based polymers compared to conventional materials.Expand Specific Solutions03 Biodegradable polymers and end-of-life carbon impact

Biodegradable bio-based polymers offer additional carbon footprint benefits through their end-of-life characteristics. Unlike conventional plastics that persist in the environment or require energy-intensive recycling, these polymers can decompose naturally, returning carbon to the soil. Some biodegradable polymers can be composted in industrial or home settings, further reducing waste management emissions and completing a more sustainable carbon cycle.Expand Specific Solutions04 Manufacturing processes for low-carbon bio-polymers

Innovative manufacturing processes have been developed to further reduce the carbon footprint of bio-based polymers. These include energy-efficient polymerization techniques, solvent-free processing, and catalytic systems that operate at lower temperatures. Some processes incorporate renewable energy sources or utilize waste heat recovery systems to minimize fossil fuel consumption during production, resulting in polymers with significantly lower embodied carbon.Expand Specific Solutions05 Carbon footprint optimization through polymer applications

The application of bio-based polymers in specific industries can optimize carbon footprint reductions beyond the material itself. When used in lightweight components for transportation, these polymers reduce vehicle weight and fuel consumption. In packaging applications, bio-based polymers can reduce food waste through improved preservation properties. Medical applications benefit from biocompatible polymers that require less energy-intensive sterilization processes, contributing to overall carbon footprint reduction across multiple sectors.Expand Specific Solutions

Key Industry Players in Bio-based Polymer Market

Bio-based polymer technology is currently in a growth phase, with increasing market adoption driven by sustainability demands. The global market for bio-based polymers is expanding rapidly, projected to reach $25 billion by 2025 with a CAGR of approximately 18%. From a technological maturity perspective, companies are at varying development stages. Industry leaders like BASF Corp., Arkema France SA, and Solvay Specialty Polymers have established commercial-scale production capabilities with advanced formulations, while innovative startups such as Teysha Technologies and Novomer are pioneering next-generation solutions. Academic institutions including Texas A&M University and Tuskegee University are contributing fundamental research. Traditional petrochemical companies like Sinopec and China Petroleum & Chemical Corp. are increasingly investing in bio-based alternatives, indicating a significant industry shift toward sustainable polymer technologies to address carbon footprint concerns.

Arkema France SA

Technical Solution: Arkema has developed an advanced portfolio of bio-based polymers centered around their Rilsan® polyamide 11 technology, derived entirely from castor oil. This renewable resource approach creates high-performance polymers with up to 97% bio-based content while maintaining exceptional mechanical properties. Their proprietary process converts castor oil into 11-aminoundecanoic acid, which is then polymerized into long-chain polyamides with excellent thermal and chemical resistance. Arkema has expanded this technology with their Pebax® Rnew elastomers, which incorporate bio-based blocks with flexible polyether segments, creating materials with 20-90% renewable content depending on grade[4]. The company has invested over €300 million in bio-based polymer production facilities in Singapore to meet growing demand. Their life cycle assessments demonstrate that Rilsan® production generates 40-50% less greenhouse gas emissions compared to conventional petroleum-based polyamides, while offering comparable or superior performance in demanding applications.

Strengths: Fully commercialized technology with decades of market presence; high-performance materials suitable for engineering applications; extensive product range with varying degrees of bio-content. Weaknesses: Reliance on castor oil creates potential supply chain vulnerabilities; higher cost compared to conventional polyamides; limited biodegradability at end-of-life.

Solvay Specialty Polymers USA LLC

Technical Solution: Solvay has developed a comprehensive bio-based polymer platform focused on partially bio-sourced polyamides under their Technyl® eXten technology. Their approach incorporates renewable materials derived from non-food crop biomass into high-performance engineering polymers. The technology utilizes sebacic acid produced from castor oil plants, which is then polymerized with conventional diamines to create polyamides with 36-60% bio-based content. Solvay's process achieves a carbon footprint reduction of approximately 30% compared to fully petroleum-based counterparts[5]. Their RhodiaSolv® Polarclean solvent, derived from bio-based sources, complements their polymer production by providing more sustainable processing aids. Solvay has also pioneered recycling technologies that work synergistically with their bio-based polymers, creating a dual approach to carbon footprint reduction. Their life cycle analyses demonstrate that their bio-based polymers maintain identical mechanical, thermal, and chemical resistance properties while significantly reducing environmental impact throughout the product lifecycle.

Strengths: Extensive application engineering support helps customers transition to bio-based alternatives; products meet stringent automotive and electrical specifications; global manufacturing footprint ensures supply chain resilience. Weaknesses: Not fully bio-based; requires blending with conventional materials for some applications; premium pricing compared to standard polymers limits adoption in cost-sensitive markets.

Critical Patents and Research in Bio-based Polymer Technology

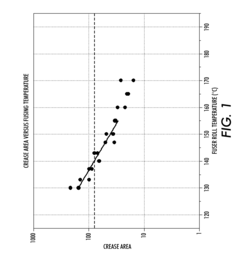

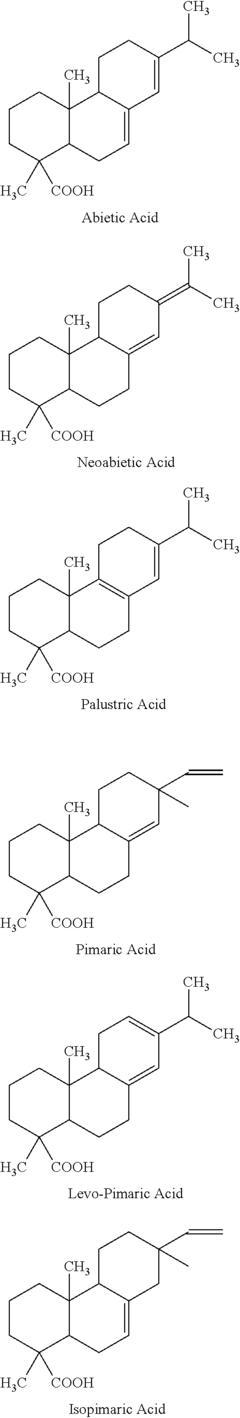

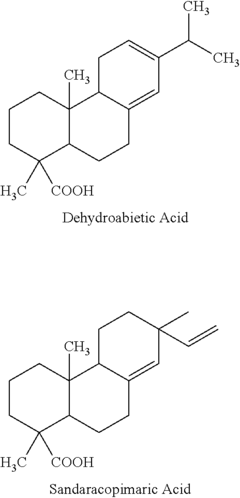

Rosin-Based Resin and Toner Containing Same

PatentActiveUS20120183897A1

Innovation

- The development of polyester resins through the polycondensation of rosin-derived diacids, acid esters, or diesters, and diols, where the rosin components can be functionalized or dimerized, forming core-shell structured toners with optional colorants, to achieve desired properties.

Polyester resin comprising a biopolyol

PatentActiveUS20120264047A1

Innovation

- A polyester resin comprising a biopolyol is used to produce toner particles, enhancing branching and crosslinking properties, which can be obtained from plant, microbial, or animal sources, and incorporated into imaging devices to create environmentally friendly toner systems.

Environmental Impact Assessment of Bio-based Polymers

The environmental impact assessment of bio-based polymers reveals significant advantages over conventional petroleum-based plastics across multiple ecological dimensions. Life cycle assessments (LCAs) consistently demonstrate that bio-based polymers can reduce greenhouse gas emissions by 30-80% compared to their fossil-fuel counterparts, depending on the specific polymer type and production methods employed. This substantial reduction stems primarily from the carbon sequestration that occurs during the growth phase of biomass feedstocks, which effectively offsets emissions generated during manufacturing processes.

Water consumption patterns also favor bio-based alternatives in many cases, though this advantage varies considerably by feedstock type. For instance, polymers derived from agricultural residues typically demonstrate superior water efficiency compared to those requiring dedicated crop cultivation. Recent advancements in production technologies have further improved water utilization metrics, with some next-generation bio-polymers achieving up to 60% reduction in water footprint compared to first-generation variants.

Land use considerations present a more complex picture, as bio-based polymers require agricultural or forestry resources that could potentially compete with food production or natural habitats. However, innovations in utilizing marginal lands, agricultural waste streams, and more efficient cultivation methods are progressively mitigating these concerns. The development of polymers from algae and cellulosic waste materials represents particularly promising approaches to minimizing land use impacts.

Biodegradability and end-of-life scenarios constitute another critical environmental dimension. Many bio-based polymers offer enhanced biodegradability compared to conventional plastics, potentially reducing microplastic pollution and landfill persistence. Studies indicate that properly designed bio-polymers can decompose in industrial composting facilities within 3-6 months, compared to the centuries required for conventional plastics to degrade in natural environments.

Toxicity profiles generally favor bio-based polymers, which typically contain fewer harmful additives and release less toxic substances during production, use, and disposal phases. This advantage translates to reduced ecological risk in both terrestrial and aquatic ecosystems, with particular benefits for marine environments currently suffering from plastic pollution.

Energy consumption during manufacturing remains a challenge for some bio-based polymers, occasionally exceeding that of conventional plastics. However, technological improvements and increasing use of renewable energy in production facilities are steadily improving this metric. Recent innovations in enzymatic processing and low-temperature catalysis have demonstrated potential energy savings of up to 45% compared to traditional bio-polymer synthesis methods.

Water consumption patterns also favor bio-based alternatives in many cases, though this advantage varies considerably by feedstock type. For instance, polymers derived from agricultural residues typically demonstrate superior water efficiency compared to those requiring dedicated crop cultivation. Recent advancements in production technologies have further improved water utilization metrics, with some next-generation bio-polymers achieving up to 60% reduction in water footprint compared to first-generation variants.

Land use considerations present a more complex picture, as bio-based polymers require agricultural or forestry resources that could potentially compete with food production or natural habitats. However, innovations in utilizing marginal lands, agricultural waste streams, and more efficient cultivation methods are progressively mitigating these concerns. The development of polymers from algae and cellulosic waste materials represents particularly promising approaches to minimizing land use impacts.

Biodegradability and end-of-life scenarios constitute another critical environmental dimension. Many bio-based polymers offer enhanced biodegradability compared to conventional plastics, potentially reducing microplastic pollution and landfill persistence. Studies indicate that properly designed bio-polymers can decompose in industrial composting facilities within 3-6 months, compared to the centuries required for conventional plastics to degrade in natural environments.

Toxicity profiles generally favor bio-based polymers, which typically contain fewer harmful additives and release less toxic substances during production, use, and disposal phases. This advantage translates to reduced ecological risk in both terrestrial and aquatic ecosystems, with particular benefits for marine environments currently suffering from plastic pollution.

Energy consumption during manufacturing remains a challenge for some bio-based polymers, occasionally exceeding that of conventional plastics. However, technological improvements and increasing use of renewable energy in production facilities are steadily improving this metric. Recent innovations in enzymatic processing and low-temperature catalysis have demonstrated potential energy savings of up to 45% compared to traditional bio-polymer synthesis methods.

Policy Frameworks Supporting Bio-Polymer Adoption

Policy frameworks across the globe have emerged as critical drivers for bio-polymer adoption, creating economic incentives and regulatory environments that accelerate the transition from conventional plastics. The European Union leads with its Circular Economy Action Plan and European Green Deal, which explicitly prioritize bio-based materials through targeted funding mechanisms and regulatory advantages. These frameworks establish concrete targets for reducing single-use plastics while providing financial support for research and commercialization of bio-polymer alternatives.

In North America, the United States has implemented the BioPreferred Program, mandating federal agencies to increase their purchase of bio-based products, thereby creating a substantial guaranteed market for bio-polymer manufacturers. This procurement-driven approach has proven effective in scaling production capacity and driving down costs through economies of scale. Canada complements this with its Bioproducts Value Chain initiative, which focuses on developing integrated supply chains for bio-based materials.

Asian economies, particularly Japan and China, have established comprehensive policy frameworks that combine research subsidies with manufacturing incentives. Japan's Biomass Nippon Strategy specifically targets plastic alternatives, while China's 13th and 14th Five-Year Plans include substantial investments in bio-based material production facilities, positioning the country as a future manufacturing hub for bio-polymers.

Tax incentives represent another powerful policy tool, with several jurisdictions implementing carbon taxes that indirectly benefit bio-polymers through their lower carbon footprint. Additionally, countries including France, Italy, and Thailand have introduced tax credits specifically for companies investing in bio-polymer production infrastructure or research activities, effectively reducing the capital barriers to market entry.

Extended Producer Responsibility (EPR) schemes have emerged as particularly effective policy mechanisms, requiring manufacturers to account for the end-of-life management of their products. These frameworks inherently favor bio-polymers due to their biodegradability and compostability characteristics. Countries with advanced EPR systems like Germany, South Korea, and Sweden have witnessed accelerated adoption of bio-polymers across multiple sectors.

International standards and certification systems, though not strictly policy frameworks, work in tandem with regulatory approaches to create market clarity. The development of ISO standards for bio-based content measurement and biodegradability verification has reduced market confusion and strengthened consumer confidence in bio-polymer products, demonstrating how technical standardization complements legislative efforts in creating favorable adoption conditions.

In North America, the United States has implemented the BioPreferred Program, mandating federal agencies to increase their purchase of bio-based products, thereby creating a substantial guaranteed market for bio-polymer manufacturers. This procurement-driven approach has proven effective in scaling production capacity and driving down costs through economies of scale. Canada complements this with its Bioproducts Value Chain initiative, which focuses on developing integrated supply chains for bio-based materials.

Asian economies, particularly Japan and China, have established comprehensive policy frameworks that combine research subsidies with manufacturing incentives. Japan's Biomass Nippon Strategy specifically targets plastic alternatives, while China's 13th and 14th Five-Year Plans include substantial investments in bio-based material production facilities, positioning the country as a future manufacturing hub for bio-polymers.

Tax incentives represent another powerful policy tool, with several jurisdictions implementing carbon taxes that indirectly benefit bio-polymers through their lower carbon footprint. Additionally, countries including France, Italy, and Thailand have introduced tax credits specifically for companies investing in bio-polymer production infrastructure or research activities, effectively reducing the capital barriers to market entry.

Extended Producer Responsibility (EPR) schemes have emerged as particularly effective policy mechanisms, requiring manufacturers to account for the end-of-life management of their products. These frameworks inherently favor bio-polymers due to their biodegradability and compostability characteristics. Countries with advanced EPR systems like Germany, South Korea, and Sweden have witnessed accelerated adoption of bio-polymers across multiple sectors.

International standards and certification systems, though not strictly policy frameworks, work in tandem with regulatory approaches to create market clarity. The development of ISO standards for bio-based content measurement and biodegradability verification has reduced market confusion and strengthened consumer confidence in bio-polymer products, demonstrating how technical standardization complements legislative efforts in creating favorable adoption conditions.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!