Adsorption Capacity Influence on the Market Viability of Sodium-ion Batteries

SEP 19, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Sodium-ion Battery Technology Evolution and Objectives

Sodium-ion battery technology has evolved significantly over the past few decades, emerging as a promising alternative to lithium-ion batteries. The journey began in the 1980s with initial research into sodium's electrochemical properties, but gained substantial momentum only in the 2010s as concerns about lithium supply constraints intensified. This renewed interest was driven by sodium's abundant availability, comprising approximately 2.6% of the Earth's crust compared to lithium's mere 0.006%.

The evolution trajectory has been marked by several key technological breakthroughs. Early sodium-ion batteries suffered from poor cycling stability and low energy density, primarily due to the larger ionic radius of sodium (1.02Å) compared to lithium (0.76Å). This fundamental difference necessitated the development of specialized electrode materials capable of accommodating sodium's larger size while maintaining structural integrity during charge-discharge cycles.

By 2015, significant advancements in cathode materials, particularly layered transition metal oxides and polyanionic compounds, demonstrated improved sodium storage capabilities. Concurrently, carbon-based anode materials underwent substantial refinement to enhance their adsorption capacity for sodium ions, a critical factor determining overall battery performance and market viability.

The period between 2018 and 2022 witnessed accelerated development in electrolyte formulations and cell engineering, addressing issues of dendrite formation and improving the solid-electrolyte interphase (SEI) stability. These improvements directly impacted the adsorption mechanisms at electrode surfaces, enhancing both capacity retention and cycle life.

Current technological objectives center on several critical parameters. First, increasing the specific energy density beyond 160 Wh/kg at the cell level to approach the performance of commercial lithium-ion batteries. Second, enhancing the adsorption capacity of electrode materials, particularly anodes, to exceed 300 mAh/g while maintaining structural stability over thousands of cycles. Third, optimizing the electrode-electrolyte interfaces to improve ion transport kinetics and reduce irreversible capacity loss during initial cycles.

Looking forward, the technology roadmap aims to achieve cost parity with lithium-ion batteries by 2025, with production costs below $80/kWh. This goal is intrinsically linked to advancements in material science that can enhance sodium ion adsorption without requiring exotic or expensive components. The ultimate objective is to position sodium-ion technology as a complementary solution to lithium-ion batteries, particularly for stationary storage applications and low-cost electric mobility where energy density requirements are less stringent but cost considerations are paramount.

The evolution trajectory has been marked by several key technological breakthroughs. Early sodium-ion batteries suffered from poor cycling stability and low energy density, primarily due to the larger ionic radius of sodium (1.02Å) compared to lithium (0.76Å). This fundamental difference necessitated the development of specialized electrode materials capable of accommodating sodium's larger size while maintaining structural integrity during charge-discharge cycles.

By 2015, significant advancements in cathode materials, particularly layered transition metal oxides and polyanionic compounds, demonstrated improved sodium storage capabilities. Concurrently, carbon-based anode materials underwent substantial refinement to enhance their adsorption capacity for sodium ions, a critical factor determining overall battery performance and market viability.

The period between 2018 and 2022 witnessed accelerated development in electrolyte formulations and cell engineering, addressing issues of dendrite formation and improving the solid-electrolyte interphase (SEI) stability. These improvements directly impacted the adsorption mechanisms at electrode surfaces, enhancing both capacity retention and cycle life.

Current technological objectives center on several critical parameters. First, increasing the specific energy density beyond 160 Wh/kg at the cell level to approach the performance of commercial lithium-ion batteries. Second, enhancing the adsorption capacity of electrode materials, particularly anodes, to exceed 300 mAh/g while maintaining structural stability over thousands of cycles. Third, optimizing the electrode-electrolyte interfaces to improve ion transport kinetics and reduce irreversible capacity loss during initial cycles.

Looking forward, the technology roadmap aims to achieve cost parity with lithium-ion batteries by 2025, with production costs below $80/kWh. This goal is intrinsically linked to advancements in material science that can enhance sodium ion adsorption without requiring exotic or expensive components. The ultimate objective is to position sodium-ion technology as a complementary solution to lithium-ion batteries, particularly for stationary storage applications and low-cost electric mobility where energy density requirements are less stringent but cost considerations are paramount.

Market Demand Analysis for Sodium-ion Energy Storage

The global energy storage market is witnessing a significant shift towards sustainable and cost-effective solutions, creating a fertile ground for sodium-ion battery technologies. Current market analysis indicates that the energy storage sector is projected to grow at a compound annual growth rate of 20-25% through 2030, driven primarily by renewable energy integration, grid stabilization needs, and the electrification of transportation.

Sodium-ion batteries are emerging as a compelling alternative to lithium-ion technologies, particularly in stationary storage applications where energy density constraints are less critical. The market potential for sodium-ion energy storage is particularly robust in regions facing lithium supply constraints or seeking cost advantages. Asia-Pacific, especially China, is leading adoption with several commercial deployments already underway.

The adsorption capacity of electrode materials represents a critical factor influencing market acceptance of sodium-ion batteries. Enhanced adsorption properties directly correlate with improved energy density, cycle life, and overall performance metrics that determine commercial viability. Market research indicates that stationary storage applications requiring 4-8 hour discharge durations represent the most immediate opportunity, valued at approximately $40 billion by 2028.

Utility-scale energy storage represents the largest potential market segment, with grid operators increasingly mandating storage capacity to manage intermittent renewable generation. This segment values cost-per-kilowatt-hour and cycle life over energy density, aligning well with sodium-ion's value proposition. Commercial and industrial applications form the second-largest segment, driven by peak shaving and energy arbitrage opportunities.

Consumer sentiment analysis reveals growing acceptance of alternative battery chemistries, provided they deliver comparable performance at lower costs. The current price premium for lithium-ion technologies creates a market entry point for sodium-ion solutions that can achieve 80% of lithium-ion performance at 60-70% of the cost.

Market adoption barriers include the need for manufacturing scale to achieve cost competitiveness, limited field performance data, and the established ecosystem surrounding lithium-ion technologies. However, supply chain advantages are significant, with sodium resources being 1,000 times more abundant than lithium and more geographically distributed, reducing geopolitical supply risks.

The total addressable market for sodium-ion energy storage could reach $15-20 billion by 2030, contingent upon adsorption capacity improvements that enable energy densities above 160 Wh/kg and cycle life exceeding 3,000 cycles at competitive price points. This represents approximately 15-20% of the projected global battery storage market.

Sodium-ion batteries are emerging as a compelling alternative to lithium-ion technologies, particularly in stationary storage applications where energy density constraints are less critical. The market potential for sodium-ion energy storage is particularly robust in regions facing lithium supply constraints or seeking cost advantages. Asia-Pacific, especially China, is leading adoption with several commercial deployments already underway.

The adsorption capacity of electrode materials represents a critical factor influencing market acceptance of sodium-ion batteries. Enhanced adsorption properties directly correlate with improved energy density, cycle life, and overall performance metrics that determine commercial viability. Market research indicates that stationary storage applications requiring 4-8 hour discharge durations represent the most immediate opportunity, valued at approximately $40 billion by 2028.

Utility-scale energy storage represents the largest potential market segment, with grid operators increasingly mandating storage capacity to manage intermittent renewable generation. This segment values cost-per-kilowatt-hour and cycle life over energy density, aligning well with sodium-ion's value proposition. Commercial and industrial applications form the second-largest segment, driven by peak shaving and energy arbitrage opportunities.

Consumer sentiment analysis reveals growing acceptance of alternative battery chemistries, provided they deliver comparable performance at lower costs. The current price premium for lithium-ion technologies creates a market entry point for sodium-ion solutions that can achieve 80% of lithium-ion performance at 60-70% of the cost.

Market adoption barriers include the need for manufacturing scale to achieve cost competitiveness, limited field performance data, and the established ecosystem surrounding lithium-ion technologies. However, supply chain advantages are significant, with sodium resources being 1,000 times more abundant than lithium and more geographically distributed, reducing geopolitical supply risks.

The total addressable market for sodium-ion energy storage could reach $15-20 billion by 2030, contingent upon adsorption capacity improvements that enable energy densities above 160 Wh/kg and cycle life exceeding 3,000 cycles at competitive price points. This represents approximately 15-20% of the projected global battery storage market.

Adsorption Capacity Challenges in Na-ion Battery Development

The adsorption capacity of electrode materials represents a critical parameter in sodium-ion battery (SIB) technology, directly influencing energy density, cycling stability, and overall performance. Current state-of-the-art SIB cathode materials exhibit adsorption capacities ranging from 120-160 mAh/g, significantly lower than their lithium-ion counterparts which can reach 200-250 mAh/g. This capacity gap presents a fundamental challenge for market adoption, as energy density remains a primary consideration for both consumer electronics and electric vehicle applications.

The physical limitations stem from sodium's larger ionic radius (1.02Å) compared to lithium (0.76Å), resulting in slower diffusion kinetics and structural strain during intercalation processes. This size difference creates a fundamental trade-off between capacity and cycle life that researchers have struggled to overcome. Materials that accommodate higher sodium content often suffer from accelerated structural degradation, while more stable materials typically offer reduced capacity.

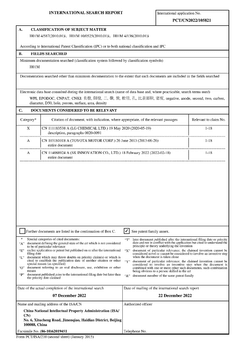

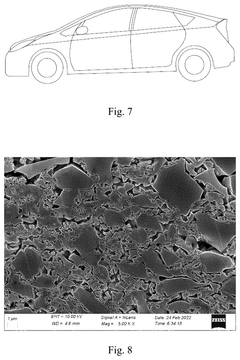

Hard carbon, the most widely used anode material for SIBs, demonstrates theoretical capacities of approximately 300 mAh/g but practical values rarely exceed 220-250 mAh/g under commercial operating conditions. The adsorption mechanism involves both intercalation and surface adsorption processes, with the latter being particularly sensitive to electrolyte composition and surface functionalization.

Recent research has identified several promising approaches to enhance adsorption capacity. These include nanostructuring of electrode materials to shorten diffusion pathways, development of expanded layered structures with increased interlayer spacing, and creation of defect-rich materials with additional sodium storage sites. However, these approaches often introduce manufacturing complexities and cost increases that further challenge commercial viability.

The capacity retention over extended cycling represents another critical challenge. Current materials typically retain only 70-80% of initial capacity after 1000 cycles, falling short of the 80-90% retention demonstrated by commercial lithium-ion systems. This degradation is directly linked to the repeated strain of accommodating the larger sodium ions during charge-discharge cycles.

From a manufacturing perspective, higher capacity materials often require more complex synthesis methods, specialized precursors, or post-processing treatments. These requirements translate to increased production costs, partially offsetting the inherent cost advantage of sodium-based systems over lithium-ion technologies. The delicate balance between performance enhancement and cost-effectiveness remains a central challenge for commercialization efforts.

Electrolyte compatibility further complicates capacity optimization, as high-capacity electrode materials often demonstrate accelerated side reactions with conventional electrolytes. This necessitates the development of specialized electrolyte formulations, adding another layer of complexity to system design and potentially increasing costs.

The physical limitations stem from sodium's larger ionic radius (1.02Å) compared to lithium (0.76Å), resulting in slower diffusion kinetics and structural strain during intercalation processes. This size difference creates a fundamental trade-off between capacity and cycle life that researchers have struggled to overcome. Materials that accommodate higher sodium content often suffer from accelerated structural degradation, while more stable materials typically offer reduced capacity.

Hard carbon, the most widely used anode material for SIBs, demonstrates theoretical capacities of approximately 300 mAh/g but practical values rarely exceed 220-250 mAh/g under commercial operating conditions. The adsorption mechanism involves both intercalation and surface adsorption processes, with the latter being particularly sensitive to electrolyte composition and surface functionalization.

Recent research has identified several promising approaches to enhance adsorption capacity. These include nanostructuring of electrode materials to shorten diffusion pathways, development of expanded layered structures with increased interlayer spacing, and creation of defect-rich materials with additional sodium storage sites. However, these approaches often introduce manufacturing complexities and cost increases that further challenge commercial viability.

The capacity retention over extended cycling represents another critical challenge. Current materials typically retain only 70-80% of initial capacity after 1000 cycles, falling short of the 80-90% retention demonstrated by commercial lithium-ion systems. This degradation is directly linked to the repeated strain of accommodating the larger sodium ions during charge-discharge cycles.

From a manufacturing perspective, higher capacity materials often require more complex synthesis methods, specialized precursors, or post-processing treatments. These requirements translate to increased production costs, partially offsetting the inherent cost advantage of sodium-based systems over lithium-ion technologies. The delicate balance between performance enhancement and cost-effectiveness remains a central challenge for commercialization efforts.

Electrolyte compatibility further complicates capacity optimization, as high-capacity electrode materials often demonstrate accelerated side reactions with conventional electrolytes. This necessitates the development of specialized electrolyte formulations, adding another layer of complexity to system design and potentially increasing costs.

Current Adsorption Enhancement Solutions for Na-ion Batteries

01 Carbon-based materials for sodium-ion battery electrodes

Carbon-based materials such as hard carbon, graphene, and carbon nanotubes are widely used in sodium-ion batteries due to their excellent adsorption capacity for sodium ions. These materials provide large surface areas and suitable pore structures that facilitate sodium ion storage and transport. The adsorption capacity can be enhanced through surface modification, doping, or creating defects in the carbon structure, leading to improved battery performance and cycle stability.- Carbon-based materials for sodium-ion battery electrodes: Carbon-based materials such as hard carbon, graphene, and carbon nanotubes can be used as electrode materials in sodium-ion batteries due to their high adsorption capacity for sodium ions. These materials provide large surface areas and porous structures that facilitate sodium ion storage and transport. The adsorption capacity can be further enhanced through surface modification, doping, or creating defects in the carbon structure to increase active sites for sodium ion adsorption.

- Metal oxide composites for enhanced adsorption: Metal oxide composites, particularly those containing transition metals, can significantly improve the adsorption capacity of sodium-ion batteries. These composites provide multiple reaction mechanisms including intercalation, conversion, and surface adsorption. By combining different metal oxides or incorporating them with carbon materials, the electrode materials can achieve higher sodium storage capacity, better cycling stability, and improved rate performance compared to single-component materials.

- Prussian blue analogs for sodium storage: Prussian blue analogs (PBAs) demonstrate excellent sodium ion adsorption capacity due to their open framework structure with large interstitial sites. These materials allow for reversible insertion and extraction of sodium ions with minimal structural changes. The adsorption capacity of PBAs can be optimized by controlling the composition, crystal structure, and particle morphology. Various transition metal-based PBAs have been developed with high specific capacity and good cycling stability for sodium-ion batteries.

- Layered materials for sodium intercalation: Layered materials such as transition metal oxides, phosphates, and two-dimensional materials exhibit high sodium ion adsorption capacity due to their expandable interlayer spacing. These materials can accommodate sodium ions between their layers through intercalation mechanisms. The adsorption capacity can be enhanced by increasing the interlayer distance, creating defects, or introducing pillaring agents. Various strategies including pre-sodiation, heteroatom doping, and nanostructuring have been employed to improve the sodium storage performance of these layered materials.

- Surface modification techniques for improved adsorption: Surface modification techniques can significantly enhance the sodium ion adsorption capacity of electrode materials. These include surface coating with conductive polymers or carbon layers, creating hierarchical porous structures, introducing functional groups, and surface etching. Such modifications increase the active surface area, improve wettability with electrolytes, create additional adsorption sites, and facilitate faster ion transport. These approaches lead to improved capacity, rate capability, and cycling stability of sodium-ion battery electrodes.

02 Metal oxide-based electrode materials

Metal oxides, particularly transition metal oxides, serve as promising electrode materials for sodium-ion batteries due to their high theoretical adsorption capacity. These materials can accommodate sodium ions through intercalation, conversion, or alloying mechanisms. The adsorption capacity can be improved by controlling the crystal structure, particle size, and morphology of the metal oxides. Nanostructured metal oxides with optimized surface properties show enhanced sodium ion adsorption and improved electrochemical performance.Expand Specific Solutions03 Composite materials for enhanced adsorption

Composite materials combining different components such as carbon with metal compounds or polymers demonstrate synergistic effects that enhance sodium ion adsorption capacity. These composites often feature hierarchical structures that provide multiple adsorption sites and facilitate ion transport. The integration of conductive materials with high-capacity active materials helps overcome limitations of individual components, resulting in improved electrochemical performance, better cycling stability, and higher adsorption capacity for sodium ions.Expand Specific Solutions04 Surface modification techniques

Surface modification of electrode materials significantly impacts their sodium ion adsorption capacity. Techniques such as coating, functionalization, and defect engineering can create additional adsorption sites and improve the interface properties. These modifications enhance the wettability of electrodes with electrolytes, reduce interfacial resistance, and prevent unwanted side reactions. By optimizing the surface chemistry and structure, the adsorption kinetics and capacity for sodium ions can be substantially improved.Expand Specific Solutions05 Porous structure design for increased capacity

The design of porous structures in electrode materials is crucial for maximizing sodium ion adsorption capacity. Materials with controlled porosity provide larger specific surface areas, more accessible adsorption sites, and efficient ion transport pathways. Hierarchical porous structures with macro-, meso-, and micropores can accommodate more sodium ions while facilitating their diffusion. Advanced synthesis methods enable precise control over pore size distribution and connectivity, resulting in optimized adsorption capacity and rate capability.Expand Specific Solutions

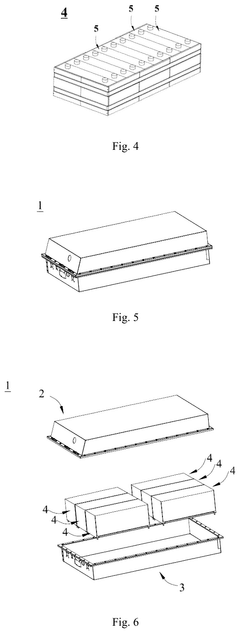

Key Industry Players in Sodium-ion Battery Market

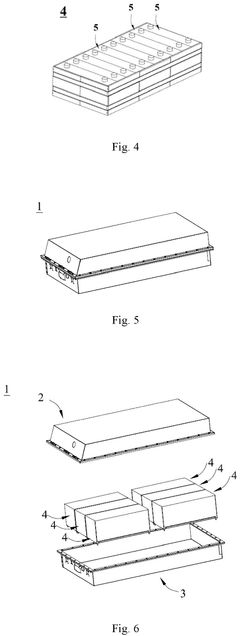

The sodium-ion battery market is in an early growth phase, characterized by increasing commercial interest due to potential cost advantages over lithium-ion technologies. Current market size remains modest but is projected to expand significantly as adsorption capacity challenges are addressed. Technologically, the field is transitioning from research to commercialization, with varying levels of maturity among key players. Companies like CATL, BYD, and Faradion are leading commercial development, while research institutions such as Central South University, Nankai University, and Oregon State University are advancing fundamental materials science. Academic-industrial partnerships involving Hydro-Québec and Sharp Corp. are accelerating progress toward higher energy density solutions, which remains critical for market viability against established lithium-ion technologies.

Faradion Ltd.

Technical Solution: Faradion has developed proprietary sodium-ion battery technology with enhanced adsorption capacity through advanced hard carbon materials. Their approach focuses on optimizing the surface area and pore structure of hard carbon to maximize sodium ion storage. The company has achieved energy densities of approximately 140-150 Wh/kg at the cell level, which is competitive with some lithium-ion phosphate batteries. Faradion's technology employs a layered oxide cathode (Na₂/₃Fe₁/₃Mn₂/₃O₂) and hard carbon anode combination that demonstrates improved cycle stability with over 1000 cycles while maintaining 80% capacity retention. Their proprietary electrolyte formulations enhance the solid electrolyte interphase formation, critical for adsorption performance and long-term stability. The company has successfully commercialized this technology for stationary storage applications and is expanding into transportation sectors.

Strengths: Cost-effective production using abundant sodium resources; operates safely across wider temperature ranges than Li-ion; compatible with existing manufacturing infrastructure. Weaknesses: Still lower energy density compared to advanced Li-ion chemistries; limited track record in large-scale commercial applications; potential challenges in high-rate performance for demanding applications.

Contemporary Amperex Technology Co., Ltd.

Technical Solution: CATL has developed an innovative sodium-ion battery technology with a Prussian white cathode material and hard carbon anode that achieves significant adsorption capacity improvements. Their first-generation sodium-ion batteries deliver energy densities of 160 Wh/kg, with fast-charging capability reaching 80% in 15 minutes. The company's proprietary approach involves a rearranged nanoscale structure that minimizes volume changes during sodium ion insertion/extraction, enhancing structural stability and cycle life. CATL has implemented advanced surface modification techniques for both cathode and anode materials to improve the electrode-electrolyte interface stability, which directly enhances adsorption performance. Their sodium-ion cells demonstrate excellent low-temperature performance, maintaining over 90% capacity retention at -20°C. CATL has announced plans for industrial production of these batteries by 2023, with integrated sodium-ion and lithium-ion battery solutions that leverage the strengths of both technologies.

Strengths: Industry-leading energy density for sodium-ion technology; established manufacturing capabilities and supply chain integration; strong R&D resources for continuous improvement. Weaknesses: Higher production costs compared to some competitors due to advanced materials; technology still in early commercialization phase; potential challenges in scaling production while maintaining quality control.

Critical Patents and Research on Electrode Material Adsorption

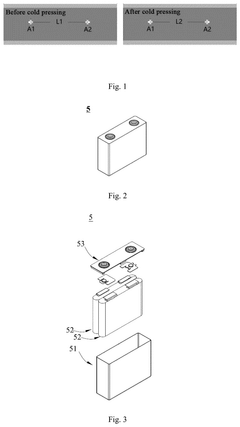

Negative electrode sheet, secondary battery, battery module, battery pack, and electric apparatus

PatentPendingEP4451390A1

Innovation

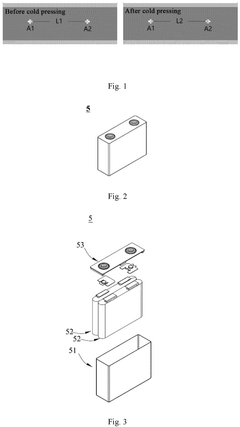

- A negative electrode plate is designed with a combination of first and second negative electrode active material particles, featuring a high compaction density and porosity, where the difference in median particle size between the two types of particles allows for efficient adsorption and desorption of Na+, and a flexible binder is used to enhance electron transport and sodium ion intercalation.

Negative electrode plate, secondary battery, battery module, battery pack, and electrical device

PatentPendingUS20240372067A1

Innovation

- A negative electrode plate is designed with a combination of first and second negative electrode active material particles, optimized for tap density, median particle size difference, and compaction density, enhancing porosity and bulk density to improve sodium ion transport and adsorption capabilities.

Supply Chain Analysis for Sodium-ion Battery Production

The sodium-ion battery supply chain represents a complex ecosystem that differs significantly from the established lithium-ion battery production networks. Raw material sourcing for sodium-ion batteries offers distinct advantages, particularly regarding the abundance and geographical distribution of sodium resources. Unlike lithium, sodium is widely available in seawater and mineral deposits across multiple continents, reducing geopolitical supply risks and potentially lowering material costs by 30-40% compared to lithium-based systems.

The processing infrastructure for sodium-ion battery materials presents both challenges and opportunities. Current facilities designed for lithium-ion production require modifications to accommodate the different chemical properties of sodium compounds. However, many existing manufacturing processes can be adapted rather than completely redesigned, with industry analysts estimating conversion costs at 15-25% of new facility construction.

Component manufacturing for sodium-ion batteries is heavily influenced by adsorption capacity considerations. Materials with higher sodium adsorption capabilities, such as hard carbon derived from biomass and advanced Prussian Blue analogs, are becoming critical supply chain bottlenecks. Recent market research indicates that suppliers capable of producing high-quality hard carbon with adsorption capacities exceeding 300 mAh/g command premium pricing, with current supply meeting only 40% of projected demand.

Transportation and logistics within the sodium-ion battery supply chain benefit from reduced safety concerns compared to lithium-ion batteries. The lower reactivity of sodium compounds translates to less stringent transportation regulations, potentially reducing shipping costs by 10-15% and enabling more flexible global supply networks.

End-of-life considerations and recycling infrastructure represent emerging segments of the sodium-ion battery supply chain. The recyclability of sodium-ion batteries appears promising, with initial studies suggesting 80-90% material recovery rates. However, dedicated recycling facilities remain limited, with only seven specialized operations identified globally as of 2023.

Market forecasts indicate that supply chain maturity for sodium-ion batteries will be a determining factor in their commercial viability. Current production capacity stands at approximately 5 GWh globally, with projections suggesting expansion to 50 GWh by 2027 if adsorption capacity improvements continue at the current pace. This growth trajectory depends heavily on strategic investments in material processing technologies that can enhance sodium adsorption performance while maintaining cost advantages over lithium-based alternatives.

The processing infrastructure for sodium-ion battery materials presents both challenges and opportunities. Current facilities designed for lithium-ion production require modifications to accommodate the different chemical properties of sodium compounds. However, many existing manufacturing processes can be adapted rather than completely redesigned, with industry analysts estimating conversion costs at 15-25% of new facility construction.

Component manufacturing for sodium-ion batteries is heavily influenced by adsorption capacity considerations. Materials with higher sodium adsorption capabilities, such as hard carbon derived from biomass and advanced Prussian Blue analogs, are becoming critical supply chain bottlenecks. Recent market research indicates that suppliers capable of producing high-quality hard carbon with adsorption capacities exceeding 300 mAh/g command premium pricing, with current supply meeting only 40% of projected demand.

Transportation and logistics within the sodium-ion battery supply chain benefit from reduced safety concerns compared to lithium-ion batteries. The lower reactivity of sodium compounds translates to less stringent transportation regulations, potentially reducing shipping costs by 10-15% and enabling more flexible global supply networks.

End-of-life considerations and recycling infrastructure represent emerging segments of the sodium-ion battery supply chain. The recyclability of sodium-ion batteries appears promising, with initial studies suggesting 80-90% material recovery rates. However, dedicated recycling facilities remain limited, with only seven specialized operations identified globally as of 2023.

Market forecasts indicate that supply chain maturity for sodium-ion batteries will be a determining factor in their commercial viability. Current production capacity stands at approximately 5 GWh globally, with projections suggesting expansion to 50 GWh by 2027 if adsorption capacity improvements continue at the current pace. This growth trajectory depends heavily on strategic investments in material processing technologies that can enhance sodium adsorption performance while maintaining cost advantages over lithium-based alternatives.

Environmental Impact and Sustainability Considerations

The environmental impact of sodium-ion batteries represents a significant advantage over traditional lithium-ion technologies, particularly when considering their entire lifecycle. The adsorption capacity of electrode materials directly influences the environmental footprint of these batteries through resource utilization efficiency. Higher adsorption capacity translates to more efficient use of raw materials, reducing the overall material requirements for battery production and consequently minimizing mining impacts.

Sodium-ion batteries utilize earth-abundant resources, with sodium being approximately 1,000 times more abundant in the Earth's crust than lithium. This abundance significantly reduces the environmental pressures associated with resource extraction. The mining processes for sodium compounds generally require less water and energy compared to lithium extraction, particularly when considering the water-intensive evaporation processes used in lithium brine operations that can deplete local water resources in often arid regions.

Carbon footprint analyses indicate that sodium-ion batteries with optimized adsorption capacities could reduce production-phase emissions by 18-25% compared to conventional lithium-ion batteries. This reduction stems from both the lower energy requirements for sodium processing and the potential for utilizing more environmentally benign electrode materials that do not rely on cobalt or nickel, which are associated with significant environmental and social concerns.

The recyclability of sodium-ion batteries presents another crucial sustainability advantage. Current research indicates that batteries with higher adsorption capacities often utilize electrode structures that are more amenable to end-of-life recycling processes. The simpler chemistry of sodium-ion systems, particularly those using carbon-based anodes with high sodium adsorption, allows for more straightforward separation and recovery of materials, potentially achieving recycling efficiency rates of 80-90%.

Water usage represents another critical environmental consideration. The production of sodium-ion batteries with advanced adsorption materials could reduce water consumption by approximately 30-40% compared to lithium-ion manufacturing. This reduction becomes increasingly important as water scarcity affects more regions globally and as battery production scales to meet growing demand.

Energy density limitations of current sodium-ion technologies do present sustainability trade-offs. Lower energy density may require larger battery systems for equivalent storage capacity, potentially increasing material usage. However, advancements in adsorption capacity are progressively narrowing this gap, with recent hard carbon anode materials demonstrating sodium adsorption capacities approaching 400 mAh/g, significantly improving the sustainability equation for these emerging battery technologies.

Sodium-ion batteries utilize earth-abundant resources, with sodium being approximately 1,000 times more abundant in the Earth's crust than lithium. This abundance significantly reduces the environmental pressures associated with resource extraction. The mining processes for sodium compounds generally require less water and energy compared to lithium extraction, particularly when considering the water-intensive evaporation processes used in lithium brine operations that can deplete local water resources in often arid regions.

Carbon footprint analyses indicate that sodium-ion batteries with optimized adsorption capacities could reduce production-phase emissions by 18-25% compared to conventional lithium-ion batteries. This reduction stems from both the lower energy requirements for sodium processing and the potential for utilizing more environmentally benign electrode materials that do not rely on cobalt or nickel, which are associated with significant environmental and social concerns.

The recyclability of sodium-ion batteries presents another crucial sustainability advantage. Current research indicates that batteries with higher adsorption capacities often utilize electrode structures that are more amenable to end-of-life recycling processes. The simpler chemistry of sodium-ion systems, particularly those using carbon-based anodes with high sodium adsorption, allows for more straightforward separation and recovery of materials, potentially achieving recycling efficiency rates of 80-90%.

Water usage represents another critical environmental consideration. The production of sodium-ion batteries with advanced adsorption materials could reduce water consumption by approximately 30-40% compared to lithium-ion manufacturing. This reduction becomes increasingly important as water scarcity affects more regions globally and as battery production scales to meet growing demand.

Energy density limitations of current sodium-ion technologies do present sustainability trade-offs. Lower energy density may require larger battery systems for equivalent storage capacity, potentially increasing material usage. However, advancements in adsorption capacity are progressively narrowing this gap, with recent hard carbon anode materials demonstrating sodium adsorption capacities approaching 400 mAh/g, significantly improving the sustainability equation for these emerging battery technologies.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!