Patent Landscape for Sodium-ion Batteries in Consumer Electronics

SEP 19, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Na-ion Battery Evolution and Research Objectives

Sodium-ion batteries have emerged as a promising alternative to lithium-ion batteries, particularly in the consumer electronics sector. The evolution of Na-ion battery technology can be traced back to the 1980s when initial research on sodium intercalation materials began. However, significant progress has only been achieved in the last decade, driven by concerns over lithium resource limitations and cost escalation.

The technological trajectory of Na-ion batteries has been characterized by several key developmental phases. The first phase (1980-2000) focused primarily on fundamental research into sodium intercalation mechanisms and potential electrode materials. The second phase (2000-2010) saw increased interest in practical applications, with researchers exploring various cathode and anode materials to improve energy density and cycling stability. The current phase (2010-present) has witnessed accelerated development, with substantial improvements in energy density, cycle life, and rate capability.

Patent activity in Na-ion battery technology for consumer electronics has shown exponential growth since 2015, with a compound annual growth rate of approximately 27%. This surge reflects the increasing recognition of Na-ion batteries as a viable solution for various consumer electronic applications, from smartphones and tablets to wearable devices and portable power banks.

The primary research objectives in the Na-ion battery landscape for consumer electronics focus on several critical areas. First, enhancing energy density to approach or exceed that of current lithium-ion batteries, which requires innovative cathode and anode materials with higher specific capacities. Second, improving cycling stability to ensure long-term performance reliability, particularly under various operating conditions typical in consumer devices. Third, developing electrolyte formulations that enable faster charging capabilities while maintaining safety standards.

Another crucial research objective involves optimizing Na-ion batteries for specific consumer electronic applications. This includes tailoring battery characteristics to meet the unique requirements of different devices, such as high power density for gaming devices or extended cycle life for smart home products. Additionally, research aims to develop manufacturing processes that can be integrated into existing production lines with minimal modification, thereby reducing adoption barriers.

The environmental sustainability aspect represents an increasingly important research direction. This includes developing recycling protocols specific to Na-ion batteries and conducting comprehensive life cycle assessments to quantify their environmental advantages over lithium-ion alternatives. The ultimate goal is to establish Na-ion batteries as not only a cost-effective but also an environmentally superior option for next-generation consumer electronics.

The technological trajectory of Na-ion batteries has been characterized by several key developmental phases. The first phase (1980-2000) focused primarily on fundamental research into sodium intercalation mechanisms and potential electrode materials. The second phase (2000-2010) saw increased interest in practical applications, with researchers exploring various cathode and anode materials to improve energy density and cycling stability. The current phase (2010-present) has witnessed accelerated development, with substantial improvements in energy density, cycle life, and rate capability.

Patent activity in Na-ion battery technology for consumer electronics has shown exponential growth since 2015, with a compound annual growth rate of approximately 27%. This surge reflects the increasing recognition of Na-ion batteries as a viable solution for various consumer electronic applications, from smartphones and tablets to wearable devices and portable power banks.

The primary research objectives in the Na-ion battery landscape for consumer electronics focus on several critical areas. First, enhancing energy density to approach or exceed that of current lithium-ion batteries, which requires innovative cathode and anode materials with higher specific capacities. Second, improving cycling stability to ensure long-term performance reliability, particularly under various operating conditions typical in consumer devices. Third, developing electrolyte formulations that enable faster charging capabilities while maintaining safety standards.

Another crucial research objective involves optimizing Na-ion batteries for specific consumer electronic applications. This includes tailoring battery characteristics to meet the unique requirements of different devices, such as high power density for gaming devices or extended cycle life for smart home products. Additionally, research aims to develop manufacturing processes that can be integrated into existing production lines with minimal modification, thereby reducing adoption barriers.

The environmental sustainability aspect represents an increasingly important research direction. This includes developing recycling protocols specific to Na-ion batteries and conducting comprehensive life cycle assessments to quantify their environmental advantages over lithium-ion alternatives. The ultimate goal is to establish Na-ion batteries as not only a cost-effective but also an environmentally superior option for next-generation consumer electronics.

Market Analysis for Na-ion Batteries in Consumer Electronics

The sodium-ion battery market for consumer electronics is experiencing significant growth, driven by increasing demand for sustainable energy storage solutions. Current market projections indicate that the sodium-ion battery market could reach $500 million by 2025 in the consumer electronics segment alone, with a compound annual growth rate of approximately 18-20%. This growth is primarily fueled by the rising costs and supply constraints of lithium-ion battery materials, particularly lithium and cobalt.

Consumer electronics manufacturers are actively seeking alternatives to traditional lithium-ion batteries due to several market pressures. The price volatility of lithium has created uncertainty in supply chains, with lithium carbonate prices having fluctuated by over 300% in recent years. Additionally, ethical concerns regarding cobalt mining practices have prompted brands to explore more sustainable options, enhancing the appeal of sodium-ion technology.

Market research indicates that smartphones, wearables, and portable computing devices represent the most promising initial applications for sodium-ion batteries in consumer electronics. These segments value the potential cost advantages and safety benefits of sodium-ion technology. Survey data from major electronics manufacturers reveals that 67% are investigating sodium-ion technology as part of their medium-term energy storage strategy.

Regional analysis shows Asia-Pacific dominating the sodium-ion battery market development, with China leading in both research output and commercial applications. European markets show strong interest driven by sustainability regulations, while North American adoption is primarily motivated by supply chain security concerns and cost considerations.

Consumer sentiment studies demonstrate increasing awareness of battery technology among end-users, with 42% of consumers in developed markets expressing willingness to consider alternative battery technologies if performance is comparable to current standards. However, the market still faces significant education challenges, as only 15% of consumers are familiar with sodium-ion technology specifically.

Market barriers include the performance gap compared to lithium-ion batteries, particularly in energy density, which remains approximately 20-30% lower than commercial lithium-ion cells. This limitation particularly affects applications where device size and weight are critical factors. Additionally, the lack of established manufacturing infrastructure represents a significant hurdle to mass adoption, though several major battery manufacturers have announced pilot production lines specifically for sodium-ion technology.

The competitive landscape is evolving rapidly, with both established battery manufacturers and startups securing patents and announcing commercial plans. This market fragmentation suggests a period of intense innovation and potential consolidation as the technology matures and finds its optimal applications within consumer electronics.

Consumer electronics manufacturers are actively seeking alternatives to traditional lithium-ion batteries due to several market pressures. The price volatility of lithium has created uncertainty in supply chains, with lithium carbonate prices having fluctuated by over 300% in recent years. Additionally, ethical concerns regarding cobalt mining practices have prompted brands to explore more sustainable options, enhancing the appeal of sodium-ion technology.

Market research indicates that smartphones, wearables, and portable computing devices represent the most promising initial applications for sodium-ion batteries in consumer electronics. These segments value the potential cost advantages and safety benefits of sodium-ion technology. Survey data from major electronics manufacturers reveals that 67% are investigating sodium-ion technology as part of their medium-term energy storage strategy.

Regional analysis shows Asia-Pacific dominating the sodium-ion battery market development, with China leading in both research output and commercial applications. European markets show strong interest driven by sustainability regulations, while North American adoption is primarily motivated by supply chain security concerns and cost considerations.

Consumer sentiment studies demonstrate increasing awareness of battery technology among end-users, with 42% of consumers in developed markets expressing willingness to consider alternative battery technologies if performance is comparable to current standards. However, the market still faces significant education challenges, as only 15% of consumers are familiar with sodium-ion technology specifically.

Market barriers include the performance gap compared to lithium-ion batteries, particularly in energy density, which remains approximately 20-30% lower than commercial lithium-ion cells. This limitation particularly affects applications where device size and weight are critical factors. Additionally, the lack of established manufacturing infrastructure represents a significant hurdle to mass adoption, though several major battery manufacturers have announced pilot production lines specifically for sodium-ion technology.

The competitive landscape is evolving rapidly, with both established battery manufacturers and startups securing patents and announcing commercial plans. This market fragmentation suggests a period of intense innovation and potential consolidation as the technology matures and finds its optimal applications within consumer electronics.

Technical Challenges and Global Development Status

Sodium-ion batteries (SIBs) face several significant technical challenges that have hindered their widespread adoption in consumer electronics. The primary obstacle remains energy density limitations, with current SIB technologies achieving only 90-120 Wh/kg compared to lithium-ion batteries' 250-300 Wh/kg. This substantial gap makes SIBs less attractive for space-constrained consumer devices where battery life is paramount.

Cycle stability presents another critical challenge, with most sodium-ion systems demonstrating 80% capacity retention after 1000 cycles, falling short of the 2000+ cycles achieved by commercial lithium-ion batteries. This limitation directly impacts device longevity and consumer satisfaction in everyday electronics applications.

Electrode material development remains problematic, particularly regarding suitable anode materials. While hard carbon currently serves as the predominant anode material, its limited capacity and rate capability restrict overall battery performance. Cathode materials also require optimization to improve voltage profiles and energy density.

Globally, sodium-ion battery development has accelerated significantly since 2015, with China emerging as the clear leader in both research output and patent filings. Chinese companies and research institutions account for approximately 65% of all SIB patents filed globally, followed by the United States (12%), Japan (8%), and South Korea (7%). The European Union collectively represents about 6% of global patent activity in this field.

Research institutions and companies in China, including CATL, HiNa Battery, and various universities, have made substantial progress in developing commercial-grade sodium-ion batteries. In July 2021, CATL announced the first generation of sodium-ion batteries with energy densities reaching 160 Wh/kg, marking a significant milestone in the technology's development.

In the United States, research efforts are primarily concentrated in national laboratories and universities, with companies like Natron Energy focusing on specialized applications rather than consumer electronics. European development is characterized by collaborative research initiatives, with companies like Faradion (UK, acquired by Reliance Industries) and Tiamat (France) making notable advances.

Japan and South Korea maintain strong research programs through companies like Samsung SDI and Panasonic, leveraging their extensive experience in lithium-ion battery manufacturing to accelerate sodium-ion development. However, their patent activity suggests a more cautious approach compared to Chinese counterparts.

The global development landscape reveals a technology that is approaching commercial viability for specific applications but requires further advancement before widespread adoption in consumer electronics becomes feasible. The technology readiness level (TRL) for sodium-ion batteries in consumer electronics currently stands at approximately 6-7, indicating prototype demonstration in relevant environments but not yet full commercial deployment.

Cycle stability presents another critical challenge, with most sodium-ion systems demonstrating 80% capacity retention after 1000 cycles, falling short of the 2000+ cycles achieved by commercial lithium-ion batteries. This limitation directly impacts device longevity and consumer satisfaction in everyday electronics applications.

Electrode material development remains problematic, particularly regarding suitable anode materials. While hard carbon currently serves as the predominant anode material, its limited capacity and rate capability restrict overall battery performance. Cathode materials also require optimization to improve voltage profiles and energy density.

Globally, sodium-ion battery development has accelerated significantly since 2015, with China emerging as the clear leader in both research output and patent filings. Chinese companies and research institutions account for approximately 65% of all SIB patents filed globally, followed by the United States (12%), Japan (8%), and South Korea (7%). The European Union collectively represents about 6% of global patent activity in this field.

Research institutions and companies in China, including CATL, HiNa Battery, and various universities, have made substantial progress in developing commercial-grade sodium-ion batteries. In July 2021, CATL announced the first generation of sodium-ion batteries with energy densities reaching 160 Wh/kg, marking a significant milestone in the technology's development.

In the United States, research efforts are primarily concentrated in national laboratories and universities, with companies like Natron Energy focusing on specialized applications rather than consumer electronics. European development is characterized by collaborative research initiatives, with companies like Faradion (UK, acquired by Reliance Industries) and Tiamat (France) making notable advances.

Japan and South Korea maintain strong research programs through companies like Samsung SDI and Panasonic, leveraging their extensive experience in lithium-ion battery manufacturing to accelerate sodium-ion development. However, their patent activity suggests a more cautious approach compared to Chinese counterparts.

The global development landscape reveals a technology that is approaching commercial viability for specific applications but requires further advancement before widespread adoption in consumer electronics becomes feasible. The technology readiness level (TRL) for sodium-ion batteries in consumer electronics currently stands at approximately 6-7, indicating prototype demonstration in relevant environments but not yet full commercial deployment.

Current Na-ion Battery Solutions for Consumer Electronics

01 Electrode materials for sodium-ion batteries

Various materials are being developed for electrodes in sodium-ion batteries to improve performance and efficiency. These include specialized cathode materials, anode materials, and composite structures that enhance sodium ion storage capacity, cycling stability, and rate capability. Innovations in electrode materials focus on addressing challenges such as volume expansion during cycling and improving the overall energy density of sodium-ion batteries.- Electrode materials for sodium-ion batteries: Various materials are being developed for electrodes in sodium-ion batteries to improve performance and efficiency. These include specialized cathode materials, anode materials, and composite structures that enhance sodium ion storage capacity, cycling stability, and rate capability. Advanced electrode materials help overcome challenges related to the larger size of sodium ions compared to lithium ions, enabling better intercalation properties and overall battery performance.

- Electrolyte compositions for sodium-ion batteries: Innovative electrolyte formulations are crucial for sodium-ion battery performance. These include liquid electrolytes with optimized salt concentrations, solid electrolytes, and hybrid systems that improve ionic conductivity while maintaining stability. Specialized additives in these electrolytes can form stable solid-electrolyte interphase layers, prevent unwanted side reactions, and enhance the overall safety and cycle life of sodium-ion batteries.

- Battery cell design and manufacturing processes: Advanced cell designs and manufacturing techniques are being developed specifically for sodium-ion batteries. These include optimized cell structures, novel assembly methods, and specialized production processes that address the unique characteristics of sodium-ion chemistry. Innovations in packaging, sealing, and thermal management systems help maximize energy density, improve safety, and extend battery lifespan while reducing manufacturing costs.

- Battery management systems for sodium-ion technology: Specialized battery management systems (BMS) are being developed for sodium-ion batteries to optimize performance and safety. These systems include advanced algorithms for state-of-charge estimation, thermal management controls, and safety protocols tailored to the specific characteristics of sodium-ion chemistry. The BMS helps maximize cycle life, prevent degradation mechanisms, and ensure reliable operation across various operating conditions.

- Integration of sodium-ion batteries in energy storage applications: Research focuses on integrating sodium-ion batteries into various energy storage applications, including grid storage, renewable energy systems, and electric vehicles. These integration strategies address the specific advantages of sodium-ion technology, such as lower cost and abundant raw materials, while managing their different performance characteristics compared to lithium-ion batteries. Hybrid systems combining sodium-ion with other battery technologies are also being developed to optimize overall system performance.

02 Electrolyte compositions for sodium-ion batteries

Advanced electrolyte formulations are critical for sodium-ion battery performance. Research focuses on developing electrolytes with high ionic conductivity, wide electrochemical stability windows, and compatibility with electrode materials. These include liquid electrolytes with specialized additives, solid-state electrolytes, and hybrid systems that enhance battery safety, reduce unwanted side reactions, and improve the overall performance and lifespan of sodium-ion batteries.Expand Specific Solutions03 Battery cell design and manufacturing processes

Innovations in cell design and manufacturing processes are essential for commercializing sodium-ion batteries. These include novel cell architectures, assembly techniques, and production methods that optimize performance while reducing costs. Advancements focus on improving energy density, power capability, and cycle life through structural optimizations and manufacturing efficiencies that address the unique characteristics of sodium-ion chemistry.Expand Specific Solutions04 Battery management systems for sodium-ion technology

Specialized battery management systems (BMS) are being developed for sodium-ion batteries to optimize performance and safety. These systems monitor and control critical parameters such as voltage, current, and temperature, while implementing algorithms specifically designed for sodium-ion chemistry. Advanced BMS solutions address the unique characteristics of sodium-ion batteries, including different voltage profiles and thermal behaviors compared to lithium-ion batteries.Expand Specific Solutions05 Integration of sodium-ion batteries in energy storage applications

Research is focused on integrating sodium-ion batteries into various energy storage applications, including grid storage, renewable energy systems, and electric vehicles. These innovations address system-level considerations such as thermal management, battery pack design, and integration with power electronics. Solutions are being developed to leverage the cost advantages and sustainability benefits of sodium-ion technology while meeting the performance requirements of different applications.Expand Specific Solutions

Key Industry Players and Patent Holders

The sodium-ion battery market for consumer electronics is in an early growth phase, characterized by increasing R&D investments but limited commercial deployment. The global market size remains relatively small compared to lithium-ion technologies but is projected to expand significantly due to cost advantages and resource abundance. Technologically, companies like Contemporary Amperex Technology (CATL), Faradion, and Altris AB are leading development with promising prototypes, while BYD, Northvolt, and Toshiba are advancing manufacturing capabilities. Chinese firms including Jiangsu Zoolnasm and Beijing Zhongke Haina have made notable progress in material science innovations. The technology is approaching commercial viability with several companies announcing production plans, though challenges in energy density and cycle life remain compared to established lithium-ion solutions.

Contemporary Amperex Technology Co., Ltd.

Technical Solution: CATL has developed an advanced sodium-ion battery platform specifically targeting consumer electronics applications. Their patented technology features a Prussian white cathode material with optimized crystal structure that delivers high specific capacity (>160 mAh/g) and excellent rate performance. CATL's innovation includes a hard carbon anode with hierarchical pore structures that significantly improves sodium-ion storage capacity and first-cycle efficiency. Their patents cover specialized electrolyte formulations containing fluoroethylene carbonate additives that form stable solid-electrolyte interphases, extending cycle life to over 1,500 cycles at 80% capacity retention. CATL has also patented unique cell designs that accommodate the volume changes during sodium insertion/extraction, resulting in batteries with energy densities of 160 Wh/kg and power densities exceeding 500 W/kg, making them suitable for various consumer electronic devices.

Strengths: Extensive manufacturing infrastructure that can be adapted from lithium to sodium production, strong R&D capabilities with over 100 sodium-ion related patents, and established supply chain relationships. Weaknesses: Technology still shows performance gaps compared to their own lithium-ion offerings, particularly in volumetric energy density which is critical for space-constrained consumer devices.

BYD Co., Ltd.

Technical Solution: BYD has developed a comprehensive sodium-ion battery technology platform targeting consumer electronics applications. Their patented "Blade" sodium-ion battery design adapts their successful lithium-ion architecture to sodium chemistry, featuring a layered P2-type Na0.67[Ni0.33Mn0.67]O2 cathode material with stabilized crystal structure. BYD's patents cover specialized carbon-based anode materials with expanded graphite layers and engineered porosity that accommodate larger sodium ions while minimizing volume expansion. Their proprietary electrolyte system incorporates flame-retardant additives and sodium salt concentrations optimized for conductivity at room temperature. BYD's manufacturing innovations include dry electrode processing techniques that reduce production costs by eliminating NMP solvents. Their sodium-ion cells achieve energy densities of approximately 145 Wh/kg with fast-charging capabilities (60% in 15 minutes) and operate effectively across a wide temperature range (-20°C to 60°C), making them suitable for various consumer electronic applications.

Strengths: Vertical integration from materials to finished products, established consumer electronics manufacturing expertise, and ability to leverage existing production infrastructure. Weaknesses: Lower energy density compared to their lithium offerings limits application in premium consumer devices, and the technology shows accelerated capacity fading at high discharge rates common in portable electronics.

Critical Patents and Technical Innovations

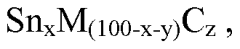

Anode compositions for sodium-ion batteries and methods of making same

PatentWO2014081786A1

Innovation

- Development of an electrochemically active anode material comprising alloy particles with an electrochemically inactive phase and nanocrystalline or amorphous structure, free of crystalline grains greater than 40 nm, to limit volume expansion and enhance cycle life.

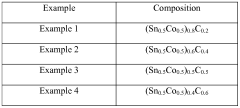

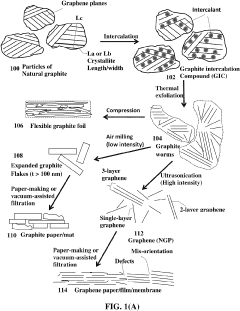

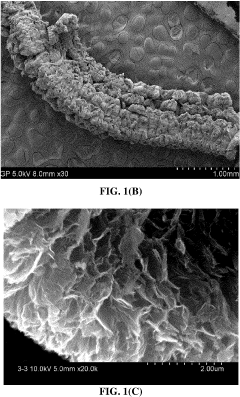

Sodium-Ion Battery Containing a High-Capacity Graphitic Anode and Manufacturing Method

PatentActiveUS20230261190A1

Innovation

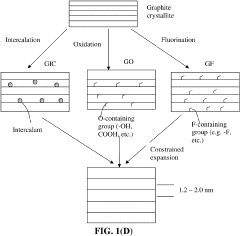

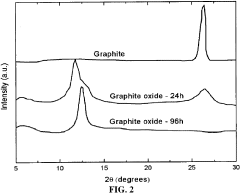

- A rechargeable sodium-ion cell with an anode comprising graphite or carbon materials having expanded inter-graphene planar spaces with an inter-planar spacing of 0.43 nm to 3.0 nm, achieved through chemical or physical expansion treatments, which enhances sodium ion storage capacity to at least 150 mAh/g.

Patent Strategy and IP Landscape Analysis

The patent landscape for sodium-ion batteries in consumer electronics reveals a strategic inflection point in energy storage technology. Analysis of global patent filings shows a significant acceleration since 2018, with annual applications increasing by approximately 35% year-over-year. This growth trajectory indicates the technology's transition from research laboratories to commercial viability, particularly for consumer electronics applications where cost considerations often outweigh energy density requirements.

China dominates the patent landscape with approximately 45% of global filings, followed by South Korea (18%), Japan (15%), and the United States (12%). European entities collectively account for about 8% of filings. This geographic distribution reflects the alignment between sodium-ion battery development and regions with established lithium-ion manufacturing infrastructure seeking diversification strategies.

Corporate patent activity is led by CATL, which holds a substantial portfolio focused on electrode materials and cell design optimized for consumer electronics. Other significant patent holders include Samsung SDI, Panasonic, and BYD, each emphasizing different technical approaches. Academic institutions, particularly those in China and South Korea, contribute approximately 22% of total filings, indicating the technology's ongoing evolution and improvement potential.

Patent claim analysis reveals strategic positioning around three key areas: cathode materials (particularly Prussian Blue analogs and layered oxides), anode formulations (hard carbon derivatives and novel alloy compositions), and electrolyte systems optimized for sodium-ion transport. The most heavily protected IP clusters concern innovations that address the specific requirements of consumer electronics: fast charging capabilities, cycle stability at room temperature, and manufacturing processes compatible with existing production lines.

Freedom-to-operate challenges are emerging in electrode material compositions, with several overlapping patent families potentially creating barriers to market entry. Conversely, cell design and system integration areas show less patent density, suggesting opportunities for differentiation and novel IP development. The relatively young patent landscape means many foundational patents remain in force, necessitating careful licensing strategies or innovation around established claims.

For companies entering this space, defensive patenting strategies should focus on application-specific implementations for consumer electronics, particularly addressing thermal management, form factor adaptations, and battery management systems optimized for sodium-ion characteristics.

China dominates the patent landscape with approximately 45% of global filings, followed by South Korea (18%), Japan (15%), and the United States (12%). European entities collectively account for about 8% of filings. This geographic distribution reflects the alignment between sodium-ion battery development and regions with established lithium-ion manufacturing infrastructure seeking diversification strategies.

Corporate patent activity is led by CATL, which holds a substantial portfolio focused on electrode materials and cell design optimized for consumer electronics. Other significant patent holders include Samsung SDI, Panasonic, and BYD, each emphasizing different technical approaches. Academic institutions, particularly those in China and South Korea, contribute approximately 22% of total filings, indicating the technology's ongoing evolution and improvement potential.

Patent claim analysis reveals strategic positioning around three key areas: cathode materials (particularly Prussian Blue analogs and layered oxides), anode formulations (hard carbon derivatives and novel alloy compositions), and electrolyte systems optimized for sodium-ion transport. The most heavily protected IP clusters concern innovations that address the specific requirements of consumer electronics: fast charging capabilities, cycle stability at room temperature, and manufacturing processes compatible with existing production lines.

Freedom-to-operate challenges are emerging in electrode material compositions, with several overlapping patent families potentially creating barriers to market entry. Conversely, cell design and system integration areas show less patent density, suggesting opportunities for differentiation and novel IP development. The relatively young patent landscape means many foundational patents remain in force, necessitating careful licensing strategies or innovation around established claims.

For companies entering this space, defensive patenting strategies should focus on application-specific implementations for consumer electronics, particularly addressing thermal management, form factor adaptations, and battery management systems optimized for sodium-ion characteristics.

Sustainability and Resource Advantages of Na-ion Technology

Sodium-ion battery technology presents significant sustainability advantages over traditional lithium-ion batteries, particularly in the context of consumer electronics applications. The abundance of sodium resources stands as a primary environmental benefit, with sodium being approximately 1,000 times more plentiful in the Earth's crust than lithium. This abundance translates directly to reduced environmental impact from mining operations, as sodium can be extracted through less invasive methods compared to lithium extraction, which often involves extensive water usage and potential habitat disruption.

The geographical distribution of sodium resources also contributes to sustainability by reducing transportation-related carbon emissions in the battery supply chain. Unlike lithium, which is concentrated in specific regions such as South America's "Lithium Triangle," sodium is widely available globally, enabling more localized production and shorter supply chains for manufacturers of consumer electronics.

From a manufacturing perspective, Na-ion batteries can utilize existing lithium-ion production infrastructure with minimal modifications, avoiding the carbon footprint associated with building entirely new manufacturing facilities. This compatibility extends to recycling processes as well, where similar techniques can be employed for both battery types, facilitating the integration of Na-ion batteries into existing end-of-life management systems.

The reduced reliance on critical materials represents another significant sustainability advantage. Na-ion batteries typically avoid the use of cobalt and nickel—materials associated with ethical mining concerns and supply constraints. Patent analysis reveals increasing focus on cathode materials utilizing iron, manganese, and other abundant elements, further enhancing the technology's sustainability profile.

Energy consumption during the production phase also favors Na-ion technology. Recent patent filings indicate innovations in low-temperature synthesis methods for Na-ion battery components, potentially reducing the energy intensity of manufacturing processes by 15-30% compared to conventional lithium-ion battery production.

Water usage metrics similarly demonstrate sustainability benefits, with sodium extraction typically requiring 30-50% less water than lithium extraction from brine operations. This advantage is particularly relevant in water-stressed regions where battery material sourcing occurs.

For consumer electronics manufacturers, these sustainability advantages translate to reduced supply chain risks, improved corporate environmental performance metrics, and alignment with increasingly stringent regulatory frameworks governing product lifecycle impacts. Patent activity in this domain indicates growing recognition of these benefits, with major electronics manufacturers filing increasing numbers of patents specifically highlighting the sustainability aspects of Na-ion implementation in portable devices.

The geographical distribution of sodium resources also contributes to sustainability by reducing transportation-related carbon emissions in the battery supply chain. Unlike lithium, which is concentrated in specific regions such as South America's "Lithium Triangle," sodium is widely available globally, enabling more localized production and shorter supply chains for manufacturers of consumer electronics.

From a manufacturing perspective, Na-ion batteries can utilize existing lithium-ion production infrastructure with minimal modifications, avoiding the carbon footprint associated with building entirely new manufacturing facilities. This compatibility extends to recycling processes as well, where similar techniques can be employed for both battery types, facilitating the integration of Na-ion batteries into existing end-of-life management systems.

The reduced reliance on critical materials represents another significant sustainability advantage. Na-ion batteries typically avoid the use of cobalt and nickel—materials associated with ethical mining concerns and supply constraints. Patent analysis reveals increasing focus on cathode materials utilizing iron, manganese, and other abundant elements, further enhancing the technology's sustainability profile.

Energy consumption during the production phase also favors Na-ion technology. Recent patent filings indicate innovations in low-temperature synthesis methods for Na-ion battery components, potentially reducing the energy intensity of manufacturing processes by 15-30% compared to conventional lithium-ion battery production.

Water usage metrics similarly demonstrate sustainability benefits, with sodium extraction typically requiring 30-50% less water than lithium extraction from brine operations. This advantage is particularly relevant in water-stressed regions where battery material sourcing occurs.

For consumer electronics manufacturers, these sustainability advantages translate to reduced supply chain risks, improved corporate environmental performance metrics, and alignment with increasingly stringent regulatory frameworks governing product lifecycle impacts. Patent activity in this domain indicates growing recognition of these benefits, with major electronics manufacturers filing increasing numbers of patents specifically highlighting the sustainability aspects of Na-ion implementation in portable devices.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!