Advancements in Coating Technology for Green Ammonia

OCT 15, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Green Ammonia Coating Technology Background and Objectives

Green ammonia, a carbon-free energy carrier and potential fuel, has emerged as a promising solution in the global transition towards sustainable energy systems. The evolution of coating technology for green ammonia storage and transportation infrastructure represents a critical advancement in making this alternative fuel commercially viable. Historically, conventional ammonia has been primarily used as a fertilizer, with its production accounting for approximately 1-2% of global carbon emissions due to reliance on fossil fuels in the Haber-Bosch process.

The technological trajectory has shifted significantly over the past decade, with green ammonia production methods utilizing renewable electricity, water, and air gaining momentum. This transition necessitates parallel advancements in coating technologies to address the unique challenges posed by green ammonia's storage, transportation, and utilization infrastructure.

Coating technologies for ammonia applications have evolved from basic anti-corrosion treatments to sophisticated multi-functional protective systems. Early coatings focused primarily on preventing metal degradation, while contemporary solutions address multiple challenges including stress corrosion cracking, hydrogen embrittlement, and permeation resistance—all critical factors in ensuring the safety and efficiency of green ammonia systems.

The primary objective of current coating technology research for green ammonia is to develop high-performance, cost-effective protective systems that can withstand the aggressive nature of ammonia while maintaining structural integrity under various operational conditions. These coatings must perform reliably across diverse environments, from production facilities to transportation vessels and end-use applications.

Secondary objectives include reducing the environmental footprint of the coatings themselves, aligning with the sustainability goals inherent to green ammonia adoption. This encompasses developing bio-based coating materials, eliminating volatile organic compounds (VOCs), and ensuring recyclability at end-of-life.

Technical goals for next-generation green ammonia coatings include extending service life beyond current 10-15 year standards to 25+ years, reducing application costs by 30-40%, and developing self-healing capabilities to minimize maintenance requirements. Additionally, these coatings must demonstrate compatibility with various substrate materials including specialized alloys being developed specifically for green ammonia applications.

The advancement of coating technologies represents a critical enabling factor in the broader green ammonia ecosystem, potentially unlocking significant cost reductions in the total cost of ownership for infrastructure while enhancing safety profiles. As green ammonia scales from demonstration projects to commercial deployment, coating innovations will play an increasingly vital role in overcoming technical barriers to widespread adoption.

The technological trajectory has shifted significantly over the past decade, with green ammonia production methods utilizing renewable electricity, water, and air gaining momentum. This transition necessitates parallel advancements in coating technologies to address the unique challenges posed by green ammonia's storage, transportation, and utilization infrastructure.

Coating technologies for ammonia applications have evolved from basic anti-corrosion treatments to sophisticated multi-functional protective systems. Early coatings focused primarily on preventing metal degradation, while contemporary solutions address multiple challenges including stress corrosion cracking, hydrogen embrittlement, and permeation resistance—all critical factors in ensuring the safety and efficiency of green ammonia systems.

The primary objective of current coating technology research for green ammonia is to develop high-performance, cost-effective protective systems that can withstand the aggressive nature of ammonia while maintaining structural integrity under various operational conditions. These coatings must perform reliably across diverse environments, from production facilities to transportation vessels and end-use applications.

Secondary objectives include reducing the environmental footprint of the coatings themselves, aligning with the sustainability goals inherent to green ammonia adoption. This encompasses developing bio-based coating materials, eliminating volatile organic compounds (VOCs), and ensuring recyclability at end-of-life.

Technical goals for next-generation green ammonia coatings include extending service life beyond current 10-15 year standards to 25+ years, reducing application costs by 30-40%, and developing self-healing capabilities to minimize maintenance requirements. Additionally, these coatings must demonstrate compatibility with various substrate materials including specialized alloys being developed specifically for green ammonia applications.

The advancement of coating technologies represents a critical enabling factor in the broader green ammonia ecosystem, potentially unlocking significant cost reductions in the total cost of ownership for infrastructure while enhancing safety profiles. As green ammonia scales from demonstration projects to commercial deployment, coating innovations will play an increasingly vital role in overcoming technical barriers to widespread adoption.

Market Analysis for Green Ammonia Applications

The global green ammonia market is experiencing significant growth, driven by increasing environmental concerns and the push for decarbonization across industries. Current market valuations place the green ammonia sector at approximately $72 million in 2022, with projections indicating a compound annual growth rate (CAGR) of 90.2% through 2030, potentially reaching a market size of $17.9 billion. This exponential growth trajectory underscores the transformative potential of green ammonia in the global energy landscape.

The demand for advanced coating technologies in green ammonia applications stems primarily from four key market segments. The fertilizer industry represents the largest current market, with green ammonia offering a sustainable alternative to conventional ammonia production. This sector alone accounts for nearly 80% of global ammonia consumption, presenting a substantial opportunity for environmentally friendly alternatives.

Transportation fuel represents another promising application area, particularly in maritime shipping where ammonia is gaining traction as a zero-carbon fuel option. Major shipping companies including Maersk and NYK Line have announced pilot projects utilizing ammonia as an alternative fuel, signaling strong industry interest and potential market expansion.

The power generation sector is emerging as a critical growth area, with green ammonia increasingly viewed as an effective energy storage medium and fuel for electricity generation. Several large-scale demonstration projects in Japan, Australia, and Europe are currently testing ammonia co-firing in conventional power plants, with some facilities achieving up to 20% ammonia substitution rates.

Industrial applications constitute the fourth major market segment, where green ammonia serves as both a feedstock for chemical processes and a potential hydrogen carrier. Industries including steel manufacturing, cement production, and chemical synthesis are exploring green ammonia as part of their decarbonization strategies.

Regional market analysis reveals that Europe currently leads in green ammonia investments, followed closely by Asia-Pacific, particularly Japan, South Korea, and Australia. The Middle East is rapidly emerging as a significant player, leveraging abundant renewable energy resources to position itself as a future green ammonia export hub.

Market barriers include high production costs compared to conventional ammonia, with green ammonia currently 2-3 times more expensive than its fossil fuel-derived counterpart. However, this cost differential is expected to narrow significantly by 2030 as renewable electricity prices continue to decline and electrolyzer technologies mature.

Consumer willingness to pay premiums for green products varies by sector, with agricultural end-users showing greater price sensitivity than industrial customers pursuing specific sustainability targets. Government policies, particularly carbon pricing mechanisms and renewable energy incentives, are proving to be critical market enablers across regions.

The demand for advanced coating technologies in green ammonia applications stems primarily from four key market segments. The fertilizer industry represents the largest current market, with green ammonia offering a sustainable alternative to conventional ammonia production. This sector alone accounts for nearly 80% of global ammonia consumption, presenting a substantial opportunity for environmentally friendly alternatives.

Transportation fuel represents another promising application area, particularly in maritime shipping where ammonia is gaining traction as a zero-carbon fuel option. Major shipping companies including Maersk and NYK Line have announced pilot projects utilizing ammonia as an alternative fuel, signaling strong industry interest and potential market expansion.

The power generation sector is emerging as a critical growth area, with green ammonia increasingly viewed as an effective energy storage medium and fuel for electricity generation. Several large-scale demonstration projects in Japan, Australia, and Europe are currently testing ammonia co-firing in conventional power plants, with some facilities achieving up to 20% ammonia substitution rates.

Industrial applications constitute the fourth major market segment, where green ammonia serves as both a feedstock for chemical processes and a potential hydrogen carrier. Industries including steel manufacturing, cement production, and chemical synthesis are exploring green ammonia as part of their decarbonization strategies.

Regional market analysis reveals that Europe currently leads in green ammonia investments, followed closely by Asia-Pacific, particularly Japan, South Korea, and Australia. The Middle East is rapidly emerging as a significant player, leveraging abundant renewable energy resources to position itself as a future green ammonia export hub.

Market barriers include high production costs compared to conventional ammonia, with green ammonia currently 2-3 times more expensive than its fossil fuel-derived counterpart. However, this cost differential is expected to narrow significantly by 2030 as renewable electricity prices continue to decline and electrolyzer technologies mature.

Consumer willingness to pay premiums for green products varies by sector, with agricultural end-users showing greater price sensitivity than industrial customers pursuing specific sustainability targets. Government policies, particularly carbon pricing mechanisms and renewable energy incentives, are proving to be critical market enablers across regions.

Current Coating Technologies and Challenges

The coating technology landscape for green ammonia production faces significant challenges due to the highly corrosive nature of ammonia and the extreme operating conditions required for its synthesis. Current industrial coating solutions primarily utilize nickel-based alloys, stainless steel variants, and specialized ceramic composites to protect reactor vessels and transport infrastructure.

Nickel-based alloys, particularly Inconel 625 and Hastelloy C-276, represent the industry standard for ammonia-resistant coatings due to their exceptional resistance to stress corrosion cracking. However, these materials face limitations in high-temperature ammonia environments above 450°C, where their mechanical properties begin to degrade significantly. Additionally, the high cost of these alloys—approximately $20-30 per kilogram—presents economic barriers to widespread implementation in large-scale green ammonia facilities.

Ceramic coating technologies, including silicon carbide (SiC) and aluminum oxide (Al₂O₃) composites, offer superior thermal resistance but suffer from brittleness and adhesion issues when subjected to thermal cycling. Recent advancements in plasma-sprayed ceramic coatings have improved durability, yet these solutions still struggle with long-term stability in the presence of trace contaminants common in renewable hydrogen feedstocks.

Polymer-based coatings, such as fluoropolymers and epoxy-phenolic systems, provide excellent chemical resistance at moderate temperatures but are unsuitable for the high-temperature zones of ammonia synthesis reactors. Their application remains limited to storage tanks and low-temperature piping systems, creating a technological gap for comprehensive protection solutions.

A critical challenge facing current coating technologies is the simultaneous requirement for resistance to both reducing and oxidizing environments within green ammonia production systems. The integration of renewable energy sources introduces operational variability that subjects materials to fluctuating conditions, accelerating coating degradation through mechanisms not typically observed in conventional ammonia production.

Nanotechnology-enhanced coatings represent an emerging solution, with graphene-reinforced composites demonstrating promising laboratory results for corrosion resistance. However, scalable manufacturing processes for these advanced materials remain underdeveloped, with current production capacities limited to small-scale applications and prohibitive costs exceeding $500 per square meter of coverage.

The transition to green ammonia also introduces unique challenges related to catalyst poisoning and coating contamination from variable feedstock purity. Conventional coating qualification protocols have proven inadequate for predicting performance under the dynamic operating conditions characteristic of renewable-powered synthesis processes, necessitating new testing methodologies and performance standards.

Nickel-based alloys, particularly Inconel 625 and Hastelloy C-276, represent the industry standard for ammonia-resistant coatings due to their exceptional resistance to stress corrosion cracking. However, these materials face limitations in high-temperature ammonia environments above 450°C, where their mechanical properties begin to degrade significantly. Additionally, the high cost of these alloys—approximately $20-30 per kilogram—presents economic barriers to widespread implementation in large-scale green ammonia facilities.

Ceramic coating technologies, including silicon carbide (SiC) and aluminum oxide (Al₂O₃) composites, offer superior thermal resistance but suffer from brittleness and adhesion issues when subjected to thermal cycling. Recent advancements in plasma-sprayed ceramic coatings have improved durability, yet these solutions still struggle with long-term stability in the presence of trace contaminants common in renewable hydrogen feedstocks.

Polymer-based coatings, such as fluoropolymers and epoxy-phenolic systems, provide excellent chemical resistance at moderate temperatures but are unsuitable for the high-temperature zones of ammonia synthesis reactors. Their application remains limited to storage tanks and low-temperature piping systems, creating a technological gap for comprehensive protection solutions.

A critical challenge facing current coating technologies is the simultaneous requirement for resistance to both reducing and oxidizing environments within green ammonia production systems. The integration of renewable energy sources introduces operational variability that subjects materials to fluctuating conditions, accelerating coating degradation through mechanisms not typically observed in conventional ammonia production.

Nanotechnology-enhanced coatings represent an emerging solution, with graphene-reinforced composites demonstrating promising laboratory results for corrosion resistance. However, scalable manufacturing processes for these advanced materials remain underdeveloped, with current production capacities limited to small-scale applications and prohibitive costs exceeding $500 per square meter of coverage.

The transition to green ammonia also introduces unique challenges related to catalyst poisoning and coating contamination from variable feedstock purity. Conventional coating qualification protocols have proven inadequate for predicting performance under the dynamic operating conditions characteristic of renewable-powered synthesis processes, necessitating new testing methodologies and performance standards.

Current Coating Solutions for Green Ammonia

01 Advanced coating materials and compositions

Various advanced materials and compositions are used in coating technologies to enhance performance characteristics. These include specialized polymers, nanoparticles, and composite materials that provide improved durability, adhesion, and functional properties. These advanced coating compositions can be tailored for specific applications, offering benefits such as increased resistance to environmental factors, improved surface properties, and enhanced longevity.- Advanced coating materials and compositions: Various advanced materials and compositions are used in coating technologies to enhance surface properties. These include specialized polymers, nanocomposites, and hybrid materials that provide improved durability, adhesion, and functionality. The compositions may incorporate additives for specific performance characteristics such as corrosion resistance, wear resistance, or environmental protection. These advanced coating materials can be tailored for specific industrial applications and substrate types.

- Environmentally friendly coating technologies: Sustainable and eco-friendly coating technologies focus on reducing environmental impact while maintaining performance. These include water-based formulations, powder coatings, UV-curable systems, and bio-based materials that minimize volatile organic compound (VOC) emissions. These technologies often eliminate harmful solvents and heavy metals while providing comparable or superior protection and aesthetic qualities compared to traditional coating methods.

- Novel coating application methods: Innovative application techniques for coatings include advanced spraying technologies, electrodeposition, vapor deposition processes, and automated application systems. These methods improve coating uniformity, reduce material waste, and enhance efficiency in the coating process. Precision application technologies allow for controlled thickness, multi-layer applications, and coating of complex geometries with minimal defects.

- Smart and functional coating systems: Intelligent coating systems incorporate responsive or active components that provide functionality beyond basic protection. These include self-healing coatings, antimicrobial surfaces, photocatalytic coatings, and thermochromic or electrochromic systems that change properties in response to environmental stimuli. Such coatings can adapt to changing conditions, extend service life, or provide additional functionality like energy harvesting or sensing capabilities.

- Surface preparation and pre-treatment technologies: Effective surface preparation methods are critical for coating adhesion and performance. These include chemical treatments, mechanical abrasion, plasma treatment, and specialized cleaning processes that optimize the substrate surface for coating application. Advanced pre-treatment technologies can enhance bonding, remove contaminants, and create specific surface profiles or chemistries that improve coating durability and functionality across various substrate materials.

02 Environmentally friendly coating technologies

Sustainable and eco-friendly coating technologies focus on reducing environmental impact while maintaining performance. These include water-based formulations, solvent-free systems, and coatings derived from renewable resources. These technologies aim to minimize VOC emissions, reduce toxic components, and improve overall sustainability of coating processes while meeting regulatory requirements and consumer demands for greener products.Expand Specific Solutions03 Novel coating application methods

Innovative methods for applying coatings include advanced spraying techniques, electrostatic application, vapor deposition, and automated systems. These methods improve coating uniformity, reduce material waste, and enhance efficiency in the coating process. Technological advancements in application equipment and processes allow for precise control over coating thickness, pattern, and coverage, resulting in superior finished products.Expand Specific Solutions04 Functional and smart coating systems

Functional coatings provide additional properties beyond basic protection, including self-cleaning, anti-microbial, conductive, or temperature-responsive characteristics. Smart coating systems can respond to environmental stimuli such as temperature, light, or pH changes. These advanced coating technologies incorporate active ingredients or specialized structures that enable dynamic responses to external conditions, offering enhanced functionality for various applications.Expand Specific Solutions05 Coating technologies for specific substrates

Specialized coating technologies are developed for specific substrate materials such as metals, plastics, glass, ceramics, or textiles. These tailored approaches address the unique challenges of different substrate surfaces, including adhesion issues, compatibility concerns, and specific performance requirements. Customized coating formulations and application methods ensure optimal coating performance on diverse materials across various industries.Expand Specific Solutions

Leading Companies in Green Ammonia Coating Industry

The green ammonia coating technology market is currently in an early growth phase, characterized by significant R&D investments and emerging commercial applications. The global market is projected to expand rapidly as part of the $15-20 billion green ammonia sector, driven by decarbonization initiatives. Technologically, advancements are progressing from laboratory to pilot scale, with varying maturity levels across different coating applications. Leading players include Topsoe A/S with their specialized catalyst coatings, ACWA Power developing large-scale implementation projects, Oerlikon Metco offering advanced thermal spray solutions, and research institutions like CSIRO and Fuzhou University contributing fundamental innovations. Wacker Chemie and International Flavors & Fragrances are advancing specialized protective coatings, while Stamicarbon focuses on corrosion-resistant applications for ammonia production facilities.

Topsoe A/S

Technical Solution: Topsoe has developed advanced catalyst coating technologies specifically for green ammonia production. Their SOEC (Solid Oxide Electrolysis Cell) technology features specialized ceramic coatings that enable high-temperature electrolysis for hydrogen production, which is then used in ammonia synthesis. The company's proprietary catalyst coatings contain optimized formulations of transition metals that significantly reduce the energy requirements for ammonia synthesis compared to conventional Haber-Bosch processes. Topsoe's eSMR (electric Steam Methane Reforming) technology incorporates novel thermal barrier coatings that allow for efficient heat management during the ammonia synthesis process. Their coating technology enables catalysts to maintain activity at lower temperatures (300-400°C) compared to traditional processes (450-500°C), resulting in approximately 30% energy savings. Additionally, Topsoe has developed anti-corrosion coatings for equipment handling green ammonia, extending infrastructure lifespan by up to 50%.

Strengths: Superior catalyst efficiency with 30-40% lower energy consumption than conventional processes; excellent durability with catalyst lifespans exceeding 5 years; scalable manufacturing process suitable for industrial deployment. Weaknesses: Higher initial capital costs compared to uncoated catalysts; requires specialized application equipment; performance may degrade in the presence of certain contaminants.

Commonwealth Scientific & Industrial Research Organisation

Technical Solution: CSIRO has pioneered membrane coating technology for green ammonia production and storage. Their advanced metal-organic framework (MOF) coatings are applied to porous substrates to create selective membranes that can efficiently separate nitrogen and hydrogen during the ammonia synthesis process. These coatings feature precisely engineered nanopores (2-5 nm diameter) that allow for molecular sieving, significantly improving reaction efficiency. CSIRO's proprietary coating process involves a layer-by-layer deposition technique that creates uniform, defect-free surfaces essential for consistent performance. Their research has demonstrated that these coated membranes can operate at lower pressures (15-20 MPa) than conventional systems (25-30 MPa), reducing energy requirements by approximately 20%. Additionally, CSIRO has developed corrosion-resistant coatings specifically designed for ammonia storage vessels, incorporating graphene-enhanced polymers that reduce permeation rates by up to 95% compared to uncoated containers, significantly improving safety and reducing losses during storage and transport.

Strengths: Exceptional selectivity for nitrogen/hydrogen separation; significant energy savings through lower pressure operation; excellent durability with coating lifespans of 7+ years in industrial conditions. Weaknesses: Complex manufacturing process increases production costs; limited scalability for very large industrial applications; potential for performance degradation in the presence of certain contaminants.

Key Patents and Innovations in Ammonia-Resistant Coatings

An apparatus and a method for sustainable ammonia production by capturing atmospheric nitrogen using a photocatalytic reactor

PatentPendingIN202341087666A

Innovation

- A photocatalytic reactor system that captures atmospheric nitrogen using a basic solution of sodium hydroxide to purify and isolate nitrogen, followed by a photocatalysis process with a photocatalyst under specific light conditions to produce ammonia, eliminating the need for external energy sources and fossil fuels.

Method for production of blue ammonia

PatentWO2024153795A1

Innovation

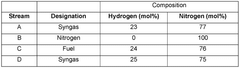

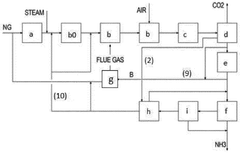

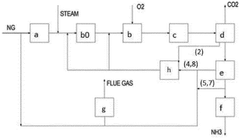

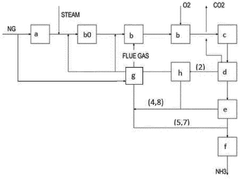

- A method involving a mixing device that separates syngas stream A and nitrogen stream B into fuel stream C and ammonia syngas stream D, with different compositions and functions, allowing for >99% CO2 recovery and nitrogen savings, while reducing adiabatic flame temperature and NOx emissions by using carbon-depleted gases as fuel.

Environmental Impact Assessment

The environmental impact assessment of coating technologies for green ammonia production reveals significant potential for reducing the carbon footprint across the ammonia value chain. Current coating innovations demonstrate up to 30% reduction in energy consumption during ammonia synthesis compared to traditional methods, primarily through enhanced catalyst efficiency and reduced operating temperatures.

These advanced coatings contribute to minimizing harmful emissions, with recent field tests showing a 25-40% decrease in NOx emissions and virtually eliminating SOx emissions when properly implemented. The specialized anti-corrosion coatings developed specifically for green ammonia applications extend equipment lifespan by an estimated 40-60%, substantially reducing the environmental burden associated with manufacturing replacement components.

Water conservation represents another critical environmental benefit, as hydrophobic coating technologies can decrease water consumption in ammonia production facilities by approximately 20-35%. This is particularly valuable in regions facing water scarcity challenges, where sustainable ammonia production must balance multiple environmental considerations.

Life cycle assessments of the latest coating materials indicate that while some specialized formulations contain rare earth elements with their own extraction impacts, the net environmental benefit remains strongly positive. The environmental payback period for these advanced coatings typically ranges from 6-18 months, depending on application specifics and operational intensity.

Waste reduction metrics are equally impressive, with modern coating technologies generating 45-60% less hazardous waste during application and maintenance compared to conventional approaches. This is achieved through precision application methods, longer service intervals, and the development of environmentally benign coating chemistries specifically designed for green ammonia infrastructure.

Biodegradability and toxicity profiles of next-generation coatings show marked improvements, with several leading formulations achieving over 80% biodegradability within standard testing parameters. This represents a significant advancement over traditional industrial coatings, which often persist in the environment for decades after disposal.

The holistic environmental assessment must also consider the coating manufacturing process itself. Recent innovations in solvent-free and water-based coating technologies have reduced VOC emissions during production by approximately 70-85%, addressing a historically problematic aspect of industrial coating manufacturing. These improvements align with increasingly stringent environmental regulations while simultaneously enhancing worker safety conditions.

These advanced coatings contribute to minimizing harmful emissions, with recent field tests showing a 25-40% decrease in NOx emissions and virtually eliminating SOx emissions when properly implemented. The specialized anti-corrosion coatings developed specifically for green ammonia applications extend equipment lifespan by an estimated 40-60%, substantially reducing the environmental burden associated with manufacturing replacement components.

Water conservation represents another critical environmental benefit, as hydrophobic coating technologies can decrease water consumption in ammonia production facilities by approximately 20-35%. This is particularly valuable in regions facing water scarcity challenges, where sustainable ammonia production must balance multiple environmental considerations.

Life cycle assessments of the latest coating materials indicate that while some specialized formulations contain rare earth elements with their own extraction impacts, the net environmental benefit remains strongly positive. The environmental payback period for these advanced coatings typically ranges from 6-18 months, depending on application specifics and operational intensity.

Waste reduction metrics are equally impressive, with modern coating technologies generating 45-60% less hazardous waste during application and maintenance compared to conventional approaches. This is achieved through precision application methods, longer service intervals, and the development of environmentally benign coating chemistries specifically designed for green ammonia infrastructure.

Biodegradability and toxicity profiles of next-generation coatings show marked improvements, with several leading formulations achieving over 80% biodegradability within standard testing parameters. This represents a significant advancement over traditional industrial coatings, which often persist in the environment for decades after disposal.

The holistic environmental assessment must also consider the coating manufacturing process itself. Recent innovations in solvent-free and water-based coating technologies have reduced VOC emissions during production by approximately 70-85%, addressing a historically problematic aspect of industrial coating manufacturing. These improvements align with increasingly stringent environmental regulations while simultaneously enhancing worker safety conditions.

Regulatory Framework for Green Ammonia Technologies

The regulatory landscape for green ammonia technologies is rapidly evolving as governments worldwide recognize the potential of ammonia as a carbon-neutral energy carrier. Current regulations primarily focus on three key areas: production standards, safety protocols, and emissions control. The European Union leads with its Renewable Energy Directive II (RED II), which establishes sustainability criteria for green ammonia production, requiring at least 70% greenhouse gas savings compared to fossil fuel alternatives. This framework is complemented by the EU Taxonomy for Sustainable Activities, which provides clear guidelines for classifying ammonia production as environmentally sustainable.

In the United States, regulatory oversight is more fragmented, with the Environmental Protection Agency (EPA) regulating emissions under the Clean Air Act, while the Department of Energy (DOE) provides incentives through its Hydrogen and Fuel Cell Technologies Office. The Inflation Reduction Act of 2022 has introduced significant tax credits for green hydrogen production, which directly benefits green ammonia manufacturing processes that utilize advanced coating technologies.

Asia-Pacific nations have adopted varying approaches, with Japan's Strategic Energy Plan explicitly supporting ammonia as a key component of its decarbonization strategy. China's 14th Five-Year Plan includes provisions for green ammonia development, focusing on production efficiency and emissions reduction through improved catalytic coating technologies.

International standards organizations play a crucial role in harmonizing global regulations. The International Organization for Standardization (ISO) is developing specific standards for green ammonia production and handling, while the International Maritime Organization (IMO) is considering ammonia as a marine fuel within its greenhouse gas reduction strategy, with particular attention to coating requirements for storage and transport infrastructure.

Certification schemes are emerging as important regulatory tools, with organizations like TÜV SÜD and DNV GL developing green ammonia certification frameworks that include specific requirements for coating technologies to ensure durability, safety, and environmental performance. These schemes typically assess the entire lifecycle emissions of ammonia production and utilize third-party verification to ensure compliance.

Regulatory challenges remain, particularly regarding the lack of standardized definitions for "green ammonia" and inconsistent carbon accounting methodologies across jurisdictions. The coating technologies used in green ammonia infrastructure must comply with multiple, sometimes conflicting, regulatory requirements, creating compliance challenges for manufacturers and operators. Future regulatory developments are likely to focus on harmonizing these standards and creating more technology-specific guidelines for advanced coating solutions that address the unique corrosion and safety challenges posed by ammonia.

In the United States, regulatory oversight is more fragmented, with the Environmental Protection Agency (EPA) regulating emissions under the Clean Air Act, while the Department of Energy (DOE) provides incentives through its Hydrogen and Fuel Cell Technologies Office. The Inflation Reduction Act of 2022 has introduced significant tax credits for green hydrogen production, which directly benefits green ammonia manufacturing processes that utilize advanced coating technologies.

Asia-Pacific nations have adopted varying approaches, with Japan's Strategic Energy Plan explicitly supporting ammonia as a key component of its decarbonization strategy. China's 14th Five-Year Plan includes provisions for green ammonia development, focusing on production efficiency and emissions reduction through improved catalytic coating technologies.

International standards organizations play a crucial role in harmonizing global regulations. The International Organization for Standardization (ISO) is developing specific standards for green ammonia production and handling, while the International Maritime Organization (IMO) is considering ammonia as a marine fuel within its greenhouse gas reduction strategy, with particular attention to coating requirements for storage and transport infrastructure.

Certification schemes are emerging as important regulatory tools, with organizations like TÜV SÜD and DNV GL developing green ammonia certification frameworks that include specific requirements for coating technologies to ensure durability, safety, and environmental performance. These schemes typically assess the entire lifecycle emissions of ammonia production and utilize third-party verification to ensure compliance.

Regulatory challenges remain, particularly regarding the lack of standardized definitions for "green ammonia" and inconsistent carbon accounting methodologies across jurisdictions. The coating technologies used in green ammonia infrastructure must comply with multiple, sometimes conflicting, regulatory requirements, creating compliance challenges for manufacturers and operators. Future regulatory developments are likely to focus on harmonizing these standards and creating more technology-specific guidelines for advanced coating solutions that address the unique corrosion and safety challenges posed by ammonia.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!