Green Ammonia Synthesis for Next-Gen Energy Solutions

OCT 15, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Green Ammonia Technology Evolution and Objectives

Ammonia has been traditionally produced through the Haber-Bosch process since its development in the early 20th century, requiring high temperatures (400-500°C), high pressures (150-300 bar), and fossil fuel-derived hydrogen. This energy-intensive process accounts for approximately 1-2% of global energy consumption and contributes significantly to greenhouse gas emissions. The evolution of green ammonia technology represents a paradigm shift toward sustainable ammonia production using renewable energy sources, water electrolysis for hydrogen generation, and environmentally friendly nitrogen separation methods.

The technological trajectory of green ammonia has accelerated significantly in the past decade, driven by advancements in renewable energy cost reduction, electrolysis efficiency improvements, and growing climate change concerns. Early experimental systems from 2010-2015 demonstrated proof-of-concept but suffered from low efficiency and high costs. The period between 2016-2020 saw substantial improvements in electrolyzer technologies, particularly with the development of more efficient proton exchange membrane (PEM) and solid oxide electrolyzer cells (SOEC).

Current technological objectives for green ammonia synthesis focus on several critical areas. First, improving the energy efficiency of the entire production chain to reduce the levelized cost of ammonia (LCOA) below $450/ton, making it competitive with conventional methods. Second, developing catalysts that can operate at lower temperatures and pressures than traditional iron-based catalysts, potentially enabling direct electrochemical ammonia synthesis. Third, creating modular and scalable production systems that can be deployed in distributed networks close to renewable energy sources.

Looking forward, the industry aims to achieve commercial-scale green ammonia production by 2025-2030, with projected capacities exceeding 1 million tons annually at multiple facilities worldwide. Technical targets include reducing energy consumption to below 7 MWh per ton of ammonia (compared to current 10-12 MWh/ton for green processes), achieving electrolyzer durability of over 80,000 operating hours, and developing novel synthesis routes that bypass the traditional Haber-Bosch process entirely.

The ultimate goal extends beyond merely replacing conventional ammonia production; green ammonia is positioned as a versatile energy carrier in the future renewable energy ecosystem. It offers potential applications in long-duration energy storage, carbon-free shipping fuel, and as a hydrogen carrier for export from regions rich in renewable resources to energy-importing nations. This multifunctional capability places green ammonia at the intersection of industrial chemistry and next-generation energy solutions, with the potential to contribute significantly to global decarbonization efforts.

The technological trajectory of green ammonia has accelerated significantly in the past decade, driven by advancements in renewable energy cost reduction, electrolysis efficiency improvements, and growing climate change concerns. Early experimental systems from 2010-2015 demonstrated proof-of-concept but suffered from low efficiency and high costs. The period between 2016-2020 saw substantial improvements in electrolyzer technologies, particularly with the development of more efficient proton exchange membrane (PEM) and solid oxide electrolyzer cells (SOEC).

Current technological objectives for green ammonia synthesis focus on several critical areas. First, improving the energy efficiency of the entire production chain to reduce the levelized cost of ammonia (LCOA) below $450/ton, making it competitive with conventional methods. Second, developing catalysts that can operate at lower temperatures and pressures than traditional iron-based catalysts, potentially enabling direct electrochemical ammonia synthesis. Third, creating modular and scalable production systems that can be deployed in distributed networks close to renewable energy sources.

Looking forward, the industry aims to achieve commercial-scale green ammonia production by 2025-2030, with projected capacities exceeding 1 million tons annually at multiple facilities worldwide. Technical targets include reducing energy consumption to below 7 MWh per ton of ammonia (compared to current 10-12 MWh/ton for green processes), achieving electrolyzer durability of over 80,000 operating hours, and developing novel synthesis routes that bypass the traditional Haber-Bosch process entirely.

The ultimate goal extends beyond merely replacing conventional ammonia production; green ammonia is positioned as a versatile energy carrier in the future renewable energy ecosystem. It offers potential applications in long-duration energy storage, carbon-free shipping fuel, and as a hydrogen carrier for export from regions rich in renewable resources to energy-importing nations. This multifunctional capability places green ammonia at the intersection of industrial chemistry and next-generation energy solutions, with the potential to contribute significantly to global decarbonization efforts.

Market Analysis for Green Ammonia Energy Applications

The global green ammonia market is experiencing unprecedented growth, driven by the urgent need for decarbonization across multiple sectors. Current market valuations place green ammonia at approximately $72 million in 2022, with projections indicating explosive growth to reach $16.5 billion by 2030, representing a compound annual growth rate (CAGR) of 90.2% between 2023 and 2030. This remarkable trajectory is primarily fueled by increasing governmental commitments to net-zero emissions targets and substantial investments in renewable energy infrastructure.

Energy storage represents one of the most promising application segments for green ammonia. As renewable energy sources like solar and wind continue to expand globally, the intermittency challenge becomes more pronounced, creating substantial demand for efficient, large-scale energy storage solutions. Green ammonia offers distinct advantages in this context, with an energy density of 12.7 MJ/L, significantly higher than compressed hydrogen at 4.5 MJ/L, making it particularly suitable for long-duration energy storage applications.

The transportation sector presents another substantial market opportunity, particularly in maritime shipping. Major shipping companies including Maersk, NYK Line, and MISC Berhad have announced pilot projects utilizing ammonia as a marine fuel. Industry analysts predict that ammonia could capture up to 25% of the maritime fuel market by 2050, representing a volume opportunity of approximately 200 million tons annually.

Regional market analysis reveals that Europe currently leads green ammonia development, with countries like Germany, the Netherlands, and Denmark spearheading major projects. The European Union's Hydrogen Strategy explicitly identifies green ammonia as a key vector for hydrogen transport and storage. Meanwhile, Australia is positioning itself as a potential export powerhouse, leveraging abundant renewable resources to develop massive green ammonia production facilities targeting Asian markets, particularly Japan and South Korea.

The agricultural sector, traditionally the largest consumer of conventional ammonia for fertilizer production, is gradually shifting toward green alternatives. This transition is accelerated by consumer demand for sustainably produced food products and corporate sustainability commitments throughout the agricultural value chain. Premium pricing for green fertilizers is emerging in environmentally conscious markets, particularly in Europe and North America.

Market barriers include the significant cost differential between green ammonia ($650-1,300/ton) and conventional ammonia ($200-450/ton), though this gap is expected to narrow substantially by 2030 as renewable electricity costs continue to decline and carbon pricing mechanisms become more widespread. Infrastructure limitations present another challenge, with substantial investments required in production facilities, specialized storage, and transportation systems to support market growth.

Energy storage represents one of the most promising application segments for green ammonia. As renewable energy sources like solar and wind continue to expand globally, the intermittency challenge becomes more pronounced, creating substantial demand for efficient, large-scale energy storage solutions. Green ammonia offers distinct advantages in this context, with an energy density of 12.7 MJ/L, significantly higher than compressed hydrogen at 4.5 MJ/L, making it particularly suitable for long-duration energy storage applications.

The transportation sector presents another substantial market opportunity, particularly in maritime shipping. Major shipping companies including Maersk, NYK Line, and MISC Berhad have announced pilot projects utilizing ammonia as a marine fuel. Industry analysts predict that ammonia could capture up to 25% of the maritime fuel market by 2050, representing a volume opportunity of approximately 200 million tons annually.

Regional market analysis reveals that Europe currently leads green ammonia development, with countries like Germany, the Netherlands, and Denmark spearheading major projects. The European Union's Hydrogen Strategy explicitly identifies green ammonia as a key vector for hydrogen transport and storage. Meanwhile, Australia is positioning itself as a potential export powerhouse, leveraging abundant renewable resources to develop massive green ammonia production facilities targeting Asian markets, particularly Japan and South Korea.

The agricultural sector, traditionally the largest consumer of conventional ammonia for fertilizer production, is gradually shifting toward green alternatives. This transition is accelerated by consumer demand for sustainably produced food products and corporate sustainability commitments throughout the agricultural value chain. Premium pricing for green fertilizers is emerging in environmentally conscious markets, particularly in Europe and North America.

Market barriers include the significant cost differential between green ammonia ($650-1,300/ton) and conventional ammonia ($200-450/ton), though this gap is expected to narrow substantially by 2030 as renewable electricity costs continue to decline and carbon pricing mechanisms become more widespread. Infrastructure limitations present another challenge, with substantial investments required in production facilities, specialized storage, and transportation systems to support market growth.

Green Ammonia Synthesis: Current Status and Barriers

Green ammonia synthesis represents a pivotal frontier in sustainable energy solutions, yet faces significant technological and economic barriers. Conventional ammonia production via the Haber-Bosch process consumes approximately 1-2% of global energy and generates substantial CO2 emissions—approximately 1.8 tons of CO2 per ton of ammonia produced. This environmental impact has driven intensive research into greener alternatives that utilize renewable electricity, sustainable hydrogen sources, and innovative catalytic systems.

The current technological landscape for green ammonia synthesis primarily revolves around three approaches: electrochemical synthesis, photocatalytic conversion, and modified Haber-Bosch processes powered by renewable energy. While these methods show promise in laboratory settings, scaling them to industrial capacities remains challenging. Electrochemical methods, for instance, demonstrate Faradaic efficiencies of only 10-30% under ambient conditions, significantly below commercial viability thresholds.

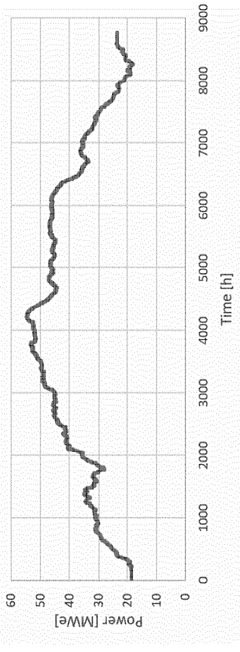

Infrastructure limitations present another substantial barrier. The intermittent nature of renewable energy sources creates operational challenges for continuous ammonia production processes. Current electrolysis systems for hydrogen production—a critical feedstock for ammonia synthesis—operate at efficiencies between 60-80%, but require substantial capital investment and face durability issues when subjected to variable power inputs from renewable sources.

Catalyst performance represents perhaps the most significant technical hurdle. Traditional iron-based catalysts require high temperatures (400-500°C) and pressures (150-300 bar) to achieve reasonable reaction rates. Research into ruthenium-based alternatives has shown promise with lower operating temperatures (300-400°C), but these materials face cost and availability constraints. Novel catalysts incorporating transition metal nitrides and lithium-modified materials have demonstrated activity at lower temperatures but suffer from stability issues and low conversion rates.

Economic barriers further complicate green ammonia's commercial viability. Current production costs range from $600-1,200 per ton for conventional ammonia, while green ammonia production estimates range from $900-1,800 per ton. This cost differential primarily stems from higher capital expenditures for renewable energy infrastructure and electrolysis equipment, coupled with lower system efficiencies and utilization rates.

Regulatory frameworks present an additional challenge, as carbon pricing mechanisms remain inconsistent across global markets, creating uneven economic incentives for green ammonia adoption. Furthermore, safety concerns regarding ammonia's toxicity and flammability necessitate specialized handling infrastructure, adding complexity to distribution networks and end-use applications.

The current technological landscape for green ammonia synthesis primarily revolves around three approaches: electrochemical synthesis, photocatalytic conversion, and modified Haber-Bosch processes powered by renewable energy. While these methods show promise in laboratory settings, scaling them to industrial capacities remains challenging. Electrochemical methods, for instance, demonstrate Faradaic efficiencies of only 10-30% under ambient conditions, significantly below commercial viability thresholds.

Infrastructure limitations present another substantial barrier. The intermittent nature of renewable energy sources creates operational challenges for continuous ammonia production processes. Current electrolysis systems for hydrogen production—a critical feedstock for ammonia synthesis—operate at efficiencies between 60-80%, but require substantial capital investment and face durability issues when subjected to variable power inputs from renewable sources.

Catalyst performance represents perhaps the most significant technical hurdle. Traditional iron-based catalysts require high temperatures (400-500°C) and pressures (150-300 bar) to achieve reasonable reaction rates. Research into ruthenium-based alternatives has shown promise with lower operating temperatures (300-400°C), but these materials face cost and availability constraints. Novel catalysts incorporating transition metal nitrides and lithium-modified materials have demonstrated activity at lower temperatures but suffer from stability issues and low conversion rates.

Economic barriers further complicate green ammonia's commercial viability. Current production costs range from $600-1,200 per ton for conventional ammonia, while green ammonia production estimates range from $900-1,800 per ton. This cost differential primarily stems from higher capital expenditures for renewable energy infrastructure and electrolysis equipment, coupled with lower system efficiencies and utilization rates.

Regulatory frameworks present an additional challenge, as carbon pricing mechanisms remain inconsistent across global markets, creating uneven economic incentives for green ammonia adoption. Furthermore, safety concerns regarding ammonia's toxicity and flammability necessitate specialized handling infrastructure, adding complexity to distribution networks and end-use applications.

Current Green Ammonia Production Methodologies

01 Production methods for green ammonia

Green ammonia is produced using renewable energy sources to power the electrolysis of water, generating hydrogen that is then combined with nitrogen from the air through the Haber-Bosch process. This approach eliminates the carbon emissions associated with traditional ammonia production methods that rely on fossil fuels. Various catalysts and process optimizations have been developed to improve efficiency and reduce energy requirements in green ammonia synthesis.- Production methods for green ammonia: Green ammonia is produced using renewable energy sources instead of fossil fuels, significantly reducing carbon emissions. The primary method involves water electrolysis to generate hydrogen, which is then combined with nitrogen from the air in the Haber-Bosch process. Various catalysts and process optimizations are being developed to improve efficiency and reduce energy requirements for sustainable ammonia production.

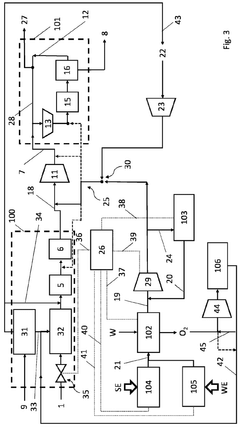

- Renewable energy integration systems: Integration of renewable energy sources such as solar, wind, and hydroelectric power is crucial for green ammonia production. These systems include advanced power management technologies, energy storage solutions, and grid connection mechanisms that handle the intermittent nature of renewable energy. Smart control systems optimize energy usage during production cycles, ensuring continuous operation despite fluctuating power inputs.

- Catalytic innovations for ammonia synthesis: Novel catalysts are being developed to improve the efficiency of the ammonia synthesis process at lower temperatures and pressures than traditional methods. These include ruthenium-based catalysts, iron-based catalysts with promoters, and nanostructured materials that enhance reaction rates and selectivity. Catalyst innovations reduce energy requirements and improve conversion efficiency in the nitrogen fixation process.

- Storage and transportation solutions: Specialized systems for storing and transporting green ammonia safely and efficiently are being developed. These include advanced pressure vessels, cryogenic storage technologies, and specialized materials resistant to ammonia's corrosive properties. Innovations in ammonia carriers, pipeline systems, and conversion technologies enable the use of ammonia as an energy vector and hydrogen carrier in the renewable energy ecosystem.

- End-use applications and conversion technologies: Technologies that enable the effective use of green ammonia as a carbon-free fuel and chemical feedstock are being developed. These include ammonia-powered engines, fuel cells that can directly use ammonia or extract hydrogen from it, and combustion systems optimized for ammonia. Conversion technologies that allow ammonia to serve as an energy storage medium and facilitate its use in various industrial processes are also being advanced.

02 Storage and transportation systems for green ammonia

Specialized storage and transportation systems have been developed for green ammonia to ensure safety and efficiency. These include advanced containment vessels, pipeline networks, and shipping solutions designed to handle ammonia's specific properties. Innovations in materials and monitoring systems help prevent leakage and maintain appropriate pressure and temperature conditions during storage and transport, addressing the challenges of ammonia's toxicity and corrosiveness.Expand Specific Solutions03 Green ammonia as a carbon-free fuel

Green ammonia serves as a promising carbon-free fuel alternative for various applications, including maritime shipping, power generation, and industrial processes. When combusted or used in fuel cells, it produces only nitrogen and water vapor, eliminating carbon emissions. Specialized engines, turbines, and combustion systems have been developed to efficiently utilize ammonia as a fuel while managing its lower energy density compared to conventional fuels and addressing NOx emission concerns.Expand Specific Solutions04 Catalytic systems for ammonia synthesis and decomposition

Advanced catalytic systems have been developed to enhance both the synthesis and decomposition of green ammonia. These catalysts improve reaction efficiency, operate at lower temperatures and pressures than traditional methods, and increase conversion rates. Novel materials including transition metals, metal nitrides, and supported nanoparticles have shown promise in reducing energy requirements and improving the economic viability of green ammonia production and utilization processes.Expand Specific Solutions05 Integration of green ammonia with renewable energy systems

Green ammonia production can be integrated with renewable energy systems to provide energy storage capabilities and grid balancing services. Excess renewable electricity can be used to produce ammonia during periods of high generation, which can later be used for power generation during low renewable output. This integration helps address the intermittency challenges of renewable energy sources and enables sector coupling between the electricity, transportation, and industrial sectors, creating more resilient and flexible energy systems.Expand Specific Solutions

Leading Organizations in Green Ammonia Development

Green ammonia synthesis is emerging as a critical technology for next-generation energy solutions, currently in the early growth phase with market projections exceeding $7 billion by 2030. The competitive landscape features established industrial giants like thyssenkrupp, Siemens, and Air Products & Chemicals developing large-scale production technologies alongside innovative startups such as AMOGY focusing on transportation applications. Academic institutions including Tianjin University and Monash University are advancing catalyst research, while energy companies like ACWA Power are integrating green ammonia into renewable energy portfolios. The technology is approaching commercial viability with several demonstration plants operational, though cost parity with conventional ammonia production remains a key challenge for widespread adoption.

Topsoe A/S

Technical Solution: Topsoe has developed the SynCOR Ammonia™ technology, a revolutionary green ammonia synthesis process that integrates renewable energy sources with advanced catalysts. Their system employs solid oxide electrolysis cells (SOECs) that can directly convert electricity, water, and nitrogen into ammonia at significantly lower temperatures and pressures than conventional Haber-Bosch processes. The technology achieves energy efficiency improvements of up to 30% compared to traditional methods by eliminating the need for separate hydrogen production steps. Topsoe's dynamic load response capabilities allow their systems to operate effectively with intermittent renewable energy sources, making it particularly suitable for integration with wind and solar power. Their proprietary catalysts demonstrate enhanced nitrogen activation at lower temperatures (300-400°C versus traditional 450-500°C), reducing energy requirements while maintaining high conversion rates. The company has successfully demonstrated this technology at pilot scale with plans for commercial deployment by 2025, targeting production capacities of 10-100 tons per day for distributed green ammonia production.

Strengths: Superior energy efficiency with 30% less energy consumption than conventional processes; excellent integration with renewable energy sources; proprietary catalyst technology enabling lower temperature operation. Weaknesses: Still requires scale-up validation for large industrial applications; higher capital costs compared to conventional ammonia plants; technology remains in pre-commercial demonstration phase.

ThyssenKrupp Uhde GmbH

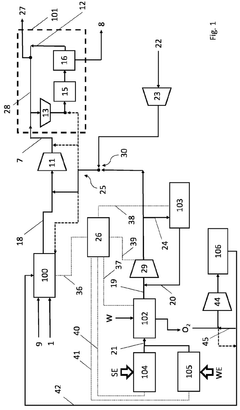

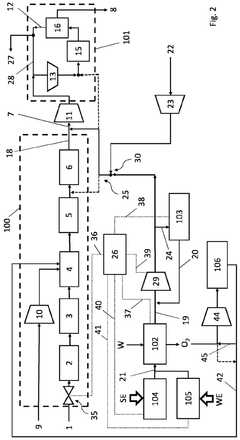

Technical Solution: ThyssenKrupp Uhde has developed the Uhde® Green Ammonia technology, an integrated solution for carbon-free ammonia production. Their approach combines water electrolysis powered by renewable electricity with their proprietary ammonia synthesis process. The system utilizes alkaline water electrolysis units to produce hydrogen, which is then fed into an optimized Haber-Bosch synthesis loop specifically designed for fluctuating hydrogen input from renewable sources. Their technology incorporates advanced process control systems that enable rapid response to variations in renewable energy availability, with ramp-up capabilities from 15% to 100% load within minutes. The synthesis loop operates at moderate pressure (60-80 bar) compared to conventional systems (100-200 bar), reducing energy consumption while maintaining conversion efficiency through specially designed catalysts. ThyssenKrupp's modular plant design allows for scalable implementation from 50 to 300 MW capacity, with projected production costs of 450-600 €/ton when powered by dedicated renewable energy sources. The company has successfully implemented this technology in demonstration projects across Europe and is currently developing commercial-scale plants with capacities of up to 50,000 tons per year.

Strengths: Modular design allowing flexible scaling; rapid load-following capability ideal for renewable integration; reduced operating pressure requirements lowering energy consumption. Weaknesses: Still faces efficiency challenges compared to conventional ammonia production; requires significant renewable electricity infrastructure; higher capital expenditure than traditional ammonia plants.

Key Innovations in Catalyst and Electrochemical Systems

Process for ammonia synthesis using green hydrogen and method for revamping an ammonia plant

PatentPendingAU2024257970A1

Innovation

- A process that adjusts the flow rate of hydrocarbon sources and hydrogen from storage based on expected and actual hydrogen production, maintaining desired ratios and reducing mechanical stresses by integrating a flexible hydrogen storage system with ammonia synthesis.

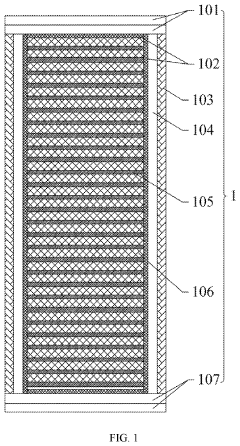

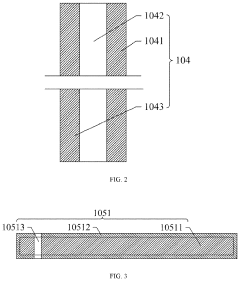

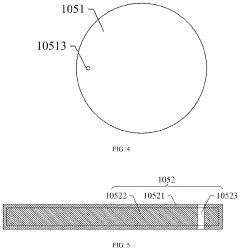

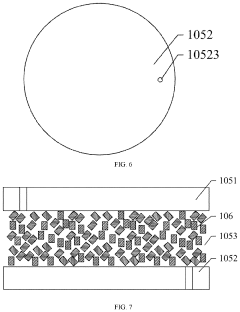

Catalytic synthesis method, device and system for ammonia synthesis through orderly regulation of the electronic domain of nitrogen

PatentActiveUS20240199435A1

Innovation

- A catalytic synthesis method using a multi-component magnetic material catalyst with a thermal, magnetic, or electromagnetic field to regulate the electronic domain of nitrogen and hydrogen, allowing for ammonia synthesis at low temperatures and pressures, enhancing the efficiency and sustainability of the process.

Environmental Impact Assessment of Green Ammonia Production

The environmental impact assessment of green ammonia production reveals significant advantages over conventional methods. Traditional ammonia synthesis via the Haber-Bosch process accounts for approximately 1.8% of global CO2 emissions, releasing 1.5-1.8 tons of CO2 per ton of ammonia produced. In contrast, green ammonia production utilizing renewable electricity for hydrogen generation can potentially reduce these emissions by 80-95%, depending on the renewable energy source.

Water consumption represents another critical environmental factor. While electrolysis requires 9-10 tons of water per ton of ammonia, approximately half of this can be recovered during the process. This consumption must be contextualized against regional water stress indicators, particularly in arid regions where solar power is abundant but water resources are scarce.

Land use considerations vary significantly between production methods. Wind-powered green ammonia facilities require approximately 160-240 hectares per 100,000 tons of annual production capacity, while solar-powered facilities demand 480-640 hectares for equivalent output. This spatial footprint must be evaluated against competing land uses, including agriculture and conservation.

Lifecycle assessment studies indicate that green ammonia's environmental benefits extend beyond operational emissions. The embodied carbon in manufacturing electrolyzers and other equipment represents 5-8% of the total lifecycle emissions, with these values expected to decrease as manufacturing scales and incorporates more renewable energy.

Potential environmental risks include ammonia leakage, which can cause localized air quality issues and nitrogen deposition in sensitive ecosystems. Modern containment systems typically limit these risks to 0.2-0.5% of production volume, but comprehensive monitoring protocols remain essential for environmental protection.

Regulatory frameworks are evolving to address these environmental dimensions. The EU's Carbon Border Adjustment Mechanism and similar policies worldwide are creating economic incentives that favor green ammonia's lower carbon footprint. Several jurisdictions now require environmental impact assessments that specifically evaluate ammonia production's contribution to regional nitrogen budgets and potential eutrophication impacts.

The net environmental benefit calculation must also consider the displacement of fossil fuels when green ammonia serves as an energy carrier. Each ton of ammonia used for energy storage or as shipping fuel can displace approximately 0.8 tons of conventional fuel, providing additional environmental benefits beyond the production phase comparison.

Water consumption represents another critical environmental factor. While electrolysis requires 9-10 tons of water per ton of ammonia, approximately half of this can be recovered during the process. This consumption must be contextualized against regional water stress indicators, particularly in arid regions where solar power is abundant but water resources are scarce.

Land use considerations vary significantly between production methods. Wind-powered green ammonia facilities require approximately 160-240 hectares per 100,000 tons of annual production capacity, while solar-powered facilities demand 480-640 hectares for equivalent output. This spatial footprint must be evaluated against competing land uses, including agriculture and conservation.

Lifecycle assessment studies indicate that green ammonia's environmental benefits extend beyond operational emissions. The embodied carbon in manufacturing electrolyzers and other equipment represents 5-8% of the total lifecycle emissions, with these values expected to decrease as manufacturing scales and incorporates more renewable energy.

Potential environmental risks include ammonia leakage, which can cause localized air quality issues and nitrogen deposition in sensitive ecosystems. Modern containment systems typically limit these risks to 0.2-0.5% of production volume, but comprehensive monitoring protocols remain essential for environmental protection.

Regulatory frameworks are evolving to address these environmental dimensions. The EU's Carbon Border Adjustment Mechanism and similar policies worldwide are creating economic incentives that favor green ammonia's lower carbon footprint. Several jurisdictions now require environmental impact assessments that specifically evaluate ammonia production's contribution to regional nitrogen budgets and potential eutrophication impacts.

The net environmental benefit calculation must also consider the displacement of fossil fuels when green ammonia serves as an energy carrier. Each ton of ammonia used for energy storage or as shipping fuel can displace approximately 0.8 tons of conventional fuel, providing additional environmental benefits beyond the production phase comparison.

Policy Frameworks Supporting Green Ammonia Adoption

The global policy landscape for green ammonia is rapidly evolving as governments recognize its potential as a carbon-neutral energy carrier and feedstock. The European Union leads with its comprehensive Hydrogen Strategy, which explicitly includes green ammonia production within its framework. The EU's Carbon Border Adjustment Mechanism (CBAM) and Emissions Trading System (ETS) create economic incentives by placing a price on carbon emissions, making green ammonia more competitive against conventional production methods. Additionally, the EU's REPowerEU plan allocates substantial funding for hydrogen and derivative technologies, including green ammonia projects.

In Asia, Japan's Green Innovation Fund has earmarked over $10 billion for decarbonization technologies, with specific provisions for green ammonia as part of its strategy to achieve carbon neutrality by 2050. Similarly, South Korea's Hydrogen Economy Roadmap includes green ammonia as a key component in its transition to clean energy, offering tax incentives and subsidies for related infrastructure development.

Australia has positioned itself as a potential green ammonia export powerhouse through its National Hydrogen Strategy, which includes regulatory frameworks to facilitate large-scale production and export facilities. The country's Renewable Energy Zones (REZs) designation provides ideal locations for green ammonia production facilities with access to abundant renewable resources.

The United States has implemented the Inflation Reduction Act, which provides production tax credits for clean hydrogen that can be applied to green ammonia synthesis. The Department of Energy's Hydrogen Shot initiative aims to reduce clean hydrogen costs by 80% within a decade, indirectly benefiting green ammonia economics. Several states have also introduced their own incentive programs, creating regional hubs for innovation.

Developing nations are increasingly incorporating green ammonia into their climate policies, with India's National Hydrogen Mission and Morocco's Green Hydrogen Strategy serving as notable examples. These frameworks often include provisions for technology transfer and international cooperation to accelerate adoption.

Multilateral initiatives such as the International Partnership for Hydrogen and Fuel Cells in the Economy (IPHE) and the Clean Energy Ministerial Hydrogen Initiative are fostering global collaboration on standards, regulations, and best practices for green ammonia deployment. The Mission Innovation program has established dedicated innovation challenges focused on integrating renewable ammonia into existing energy systems.

Despite this progress, policy harmonization remains a challenge, with inconsistent definitions, certification schemes, and incentive structures across jurisdictions creating market fragmentation. Future policy development will likely focus on standardizing green ammonia certification, establishing international trade frameworks, and creating more predictable long-term investment environments to scale up production and utilization.

In Asia, Japan's Green Innovation Fund has earmarked over $10 billion for decarbonization technologies, with specific provisions for green ammonia as part of its strategy to achieve carbon neutrality by 2050. Similarly, South Korea's Hydrogen Economy Roadmap includes green ammonia as a key component in its transition to clean energy, offering tax incentives and subsidies for related infrastructure development.

Australia has positioned itself as a potential green ammonia export powerhouse through its National Hydrogen Strategy, which includes regulatory frameworks to facilitate large-scale production and export facilities. The country's Renewable Energy Zones (REZs) designation provides ideal locations for green ammonia production facilities with access to abundant renewable resources.

The United States has implemented the Inflation Reduction Act, which provides production tax credits for clean hydrogen that can be applied to green ammonia synthesis. The Department of Energy's Hydrogen Shot initiative aims to reduce clean hydrogen costs by 80% within a decade, indirectly benefiting green ammonia economics. Several states have also introduced their own incentive programs, creating regional hubs for innovation.

Developing nations are increasingly incorporating green ammonia into their climate policies, with India's National Hydrogen Mission and Morocco's Green Hydrogen Strategy serving as notable examples. These frameworks often include provisions for technology transfer and international cooperation to accelerate adoption.

Multilateral initiatives such as the International Partnership for Hydrogen and Fuel Cells in the Economy (IPHE) and the Clean Energy Ministerial Hydrogen Initiative are fostering global collaboration on standards, regulations, and best practices for green ammonia deployment. The Mission Innovation program has established dedicated innovation challenges focused on integrating renewable ammonia into existing energy systems.

Despite this progress, policy harmonization remains a challenge, with inconsistent definitions, certification schemes, and incentive structures across jurisdictions creating market fragmentation. Future policy development will likely focus on standardizing green ammonia certification, establishing international trade frameworks, and creating more predictable long-term investment environments to scale up production and utilization.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!