Patent Analysis in Breakthrough Ammonia Synthesis Technologies

OCT 15, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Ammonia Synthesis Evolution and Research Objectives

Ammonia synthesis represents one of the most significant industrial processes developed in the 20th century, fundamentally transforming global agriculture and chemical manufacturing. The evolution of ammonia synthesis began with the groundbreaking Haber-Bosch process in the early 1900s, which enabled the fixation of atmospheric nitrogen under high pressure and temperature conditions using iron-based catalysts. This innovation addressed the critical nitrogen shortage in agriculture and marked the beginning of modern fertilizer production.

Over the decades, ammonia synthesis technology has progressed through several distinct phases. The initial commercialization period (1913-1950) focused on optimizing the original Haber-Bosch process. The second wave (1950-1980) saw significant improvements in catalyst efficiency and process engineering, reducing energy requirements. The third phase (1980-2000) introduced advanced control systems and further catalyst refinements, while the current phase (post-2000) is characterized by the pursuit of sustainable, low-carbon ammonia production methods.

Despite these advancements, conventional ammonia synthesis remains energy-intensive, consuming approximately 1-2% of global energy production and generating substantial CO2 emissions. This environmental impact has driven research toward breakthrough technologies that can overcome the fundamental limitations of traditional processes.

Current research objectives in ammonia synthesis technology focus on several key areas. First, developing catalysts that can operate efficiently at lower temperatures and pressures to reduce energy consumption. Second, exploring electrochemical and photocatalytic pathways that utilize renewable electricity or solar energy directly. Third, investigating biological and biomimetic approaches that mimic natural nitrogen fixation processes occurring in nature.

Patent analysis reveals an accelerating trend in breakthrough ammonia synthesis technologies, with particular concentration in electrochemical ammonia synthesis, novel catalyst development, and green ammonia production systems. These innovations aim to address the triple challenge of energy efficiency, carbon emissions reduction, and production scalability.

The ultimate goal of current research efforts is to develop ammonia synthesis technologies that can operate under ambient conditions with minimal energy input and zero carbon emissions. Success in this endeavor would revolutionize not only fertilizer production but potentially establish ammonia as a viable carbon-free energy carrier and fuel, supporting the global transition to renewable energy systems.

Understanding the historical trajectory and current research objectives provides essential context for evaluating emerging technologies and identifying the most promising pathways for future development in this critical field.

Over the decades, ammonia synthesis technology has progressed through several distinct phases. The initial commercialization period (1913-1950) focused on optimizing the original Haber-Bosch process. The second wave (1950-1980) saw significant improvements in catalyst efficiency and process engineering, reducing energy requirements. The third phase (1980-2000) introduced advanced control systems and further catalyst refinements, while the current phase (post-2000) is characterized by the pursuit of sustainable, low-carbon ammonia production methods.

Despite these advancements, conventional ammonia synthesis remains energy-intensive, consuming approximately 1-2% of global energy production and generating substantial CO2 emissions. This environmental impact has driven research toward breakthrough technologies that can overcome the fundamental limitations of traditional processes.

Current research objectives in ammonia synthesis technology focus on several key areas. First, developing catalysts that can operate efficiently at lower temperatures and pressures to reduce energy consumption. Second, exploring electrochemical and photocatalytic pathways that utilize renewable electricity or solar energy directly. Third, investigating biological and biomimetic approaches that mimic natural nitrogen fixation processes occurring in nature.

Patent analysis reveals an accelerating trend in breakthrough ammonia synthesis technologies, with particular concentration in electrochemical ammonia synthesis, novel catalyst development, and green ammonia production systems. These innovations aim to address the triple challenge of energy efficiency, carbon emissions reduction, and production scalability.

The ultimate goal of current research efforts is to develop ammonia synthesis technologies that can operate under ambient conditions with minimal energy input and zero carbon emissions. Success in this endeavor would revolutionize not only fertilizer production but potentially establish ammonia as a viable carbon-free energy carrier and fuel, supporting the global transition to renewable energy systems.

Understanding the historical trajectory and current research objectives provides essential context for evaluating emerging technologies and identifying the most promising pathways for future development in this critical field.

Market Analysis for Sustainable Ammonia Production

The global market for sustainable ammonia production is experiencing significant growth, driven by increasing environmental concerns and the push for decarbonization across industries. Traditional ammonia synthesis via the Haber-Bosch process accounts for approximately 1-2% of global carbon emissions, creating an urgent need for greener alternatives. This market is projected to expand at a compound annual growth rate of 7.8% through 2030, with the sustainable ammonia segment growing even faster at nearly 12% annually.

Demand for sustainable ammonia spans multiple sectors. The agricultural industry remains the largest consumer, with ammonia-based fertilizers essential for global food security. Industrial applications, including mining, textiles, and pharmaceuticals, constitute the second-largest market segment. Emerging applications in energy storage and as a carbon-free fuel for shipping and power generation are creating new demand vectors, particularly in regions with ambitious climate targets.

Geographically, Europe leads in sustainable ammonia market development, driven by stringent emissions regulations and substantial government support for green technologies. The European Union's Green Deal has established concrete targets for reducing industrial emissions, directly benefiting sustainable ammonia technologies. North America follows closely, with significant investments in renewable hydrogen infrastructure that complements green ammonia production.

Asia-Pacific represents the fastest-growing regional market, with China, Japan, and Australia making substantial investments in sustainable ammonia production facilities. China's dual focus on food security and emissions reduction has accelerated adoption, while Australia is positioning itself as a potential export hub for green ammonia to energy-hungry Asian markets.

Market barriers include the significant cost differential between conventional and sustainable ammonia production methods. Current green ammonia production costs range from $600-1,200 per ton compared to $200-400 per ton for conventional methods. However, this gap is narrowing as renewable electricity costs decline and carbon pricing mechanisms become more widespread.

Consumer willingness to pay premiums for sustainably produced agricultural products is creating pull-through demand for green fertilizers. Major food producers and retailers are increasingly incorporating scope 3 emissions into their sustainability targets, creating market incentives for sustainable ammonia adoption throughout the supply chain.

Investment in the sector has surged, with venture capital and corporate funding exceeding $2 billion in 2022 alone. Strategic partnerships between technology developers, renewable energy providers, and traditional ammonia producers are accelerating commercialization timelines and creating new business models that share both risks and rewards across the value chain.

Demand for sustainable ammonia spans multiple sectors. The agricultural industry remains the largest consumer, with ammonia-based fertilizers essential for global food security. Industrial applications, including mining, textiles, and pharmaceuticals, constitute the second-largest market segment. Emerging applications in energy storage and as a carbon-free fuel for shipping and power generation are creating new demand vectors, particularly in regions with ambitious climate targets.

Geographically, Europe leads in sustainable ammonia market development, driven by stringent emissions regulations and substantial government support for green technologies. The European Union's Green Deal has established concrete targets for reducing industrial emissions, directly benefiting sustainable ammonia technologies. North America follows closely, with significant investments in renewable hydrogen infrastructure that complements green ammonia production.

Asia-Pacific represents the fastest-growing regional market, with China, Japan, and Australia making substantial investments in sustainable ammonia production facilities. China's dual focus on food security and emissions reduction has accelerated adoption, while Australia is positioning itself as a potential export hub for green ammonia to energy-hungry Asian markets.

Market barriers include the significant cost differential between conventional and sustainable ammonia production methods. Current green ammonia production costs range from $600-1,200 per ton compared to $200-400 per ton for conventional methods. However, this gap is narrowing as renewable electricity costs decline and carbon pricing mechanisms become more widespread.

Consumer willingness to pay premiums for sustainably produced agricultural products is creating pull-through demand for green fertilizers. Major food producers and retailers are increasingly incorporating scope 3 emissions into their sustainability targets, creating market incentives for sustainable ammonia adoption throughout the supply chain.

Investment in the sector has surged, with venture capital and corporate funding exceeding $2 billion in 2022 alone. Strategic partnerships between technology developers, renewable energy providers, and traditional ammonia producers are accelerating commercialization timelines and creating new business models that share both risks and rewards across the value chain.

Global Landscape of Ammonia Synthesis Technologies

The global ammonia synthesis landscape has evolved significantly since the development of the Haber-Bosch process in the early 20th century. This century-old technology still dominates industrial ammonia production, accounting for approximately 80% of global capacity. The geographical distribution of ammonia production facilities shows concentration in regions with abundant natural gas resources, with China, Russia, the United States, and Middle Eastern countries being major producers.

Traditional ammonia synthesis technologies are primarily distributed across industrialized nations and emerging economies with significant agricultural sectors. China leads global production with approximately 30% of worldwide capacity, followed by Russia (10%), the United States (8%), and India (7%). The technology distribution correlates strongly with regional energy policies and access to feedstock resources.

Recent technological advancements have emerged from diverse geographical sources. European research institutions lead in electrochemical ammonia synthesis innovations, with notable contributions from Germany, Denmark, and the Netherlands. North American entities, particularly in the United States and Canada, demonstrate strength in catalyst development and process intensification technologies. Japan and South Korea show significant patent activity in plasma-assisted and photocatalytic ammonia synthesis methods.

The Asia-Pacific region has witnessed rapid growth in ammonia technology development, with China filing the highest number of patents related to novel catalysts and energy-efficient processes in the past decade. Australia has positioned itself as a leader in green ammonia production technologies, leveraging its abundant renewable energy resources.

Emerging economies in South America and Africa are increasingly participating in ammonia technology development, focusing on adaptations suitable for distributed, smaller-scale production systems that align with local agricultural needs and infrastructure limitations.

The global patent landscape reveals distinct regional specializations. European patents predominantly focus on electrochemical methods and system integration technologies. North American patents emphasize catalyst innovations and process optimization. Asian patents show strength in novel reactor designs and alternative energy integration approaches.

International collaboration patterns indicate increasing cross-border research initiatives, with multinational consortia addressing the technical challenges of next-generation ammonia synthesis. University-industry partnerships span continents, with notable collaborations between European research institutions and Asian manufacturing entities, as well as between North American technology developers and Middle Eastern energy companies seeking to diversify their portfolios.

Traditional ammonia synthesis technologies are primarily distributed across industrialized nations and emerging economies with significant agricultural sectors. China leads global production with approximately 30% of worldwide capacity, followed by Russia (10%), the United States (8%), and India (7%). The technology distribution correlates strongly with regional energy policies and access to feedstock resources.

Recent technological advancements have emerged from diverse geographical sources. European research institutions lead in electrochemical ammonia synthesis innovations, with notable contributions from Germany, Denmark, and the Netherlands. North American entities, particularly in the United States and Canada, demonstrate strength in catalyst development and process intensification technologies. Japan and South Korea show significant patent activity in plasma-assisted and photocatalytic ammonia synthesis methods.

The Asia-Pacific region has witnessed rapid growth in ammonia technology development, with China filing the highest number of patents related to novel catalysts and energy-efficient processes in the past decade. Australia has positioned itself as a leader in green ammonia production technologies, leveraging its abundant renewable energy resources.

Emerging economies in South America and Africa are increasingly participating in ammonia technology development, focusing on adaptations suitable for distributed, smaller-scale production systems that align with local agricultural needs and infrastructure limitations.

The global patent landscape reveals distinct regional specializations. European patents predominantly focus on electrochemical methods and system integration technologies. North American patents emphasize catalyst innovations and process optimization. Asian patents show strength in novel reactor designs and alternative energy integration approaches.

International collaboration patterns indicate increasing cross-border research initiatives, with multinational consortia addressing the technical challenges of next-generation ammonia synthesis. University-industry partnerships span continents, with notable collaborations between European research institutions and Asian manufacturing entities, as well as between North American technology developers and Middle Eastern energy companies seeking to diversify their portfolios.

Current Patent-Protected Ammonia Synthesis Solutions

01 Haber-Bosch Process Improvements

Enhancements to the traditional Haber-Bosch process for ammonia synthesis, focusing on optimizing catalysts, reaction conditions, and energy efficiency. These improvements aim to reduce the high temperature and pressure requirements of the conventional process while maintaining or increasing ammonia yield. Innovations include modified iron catalysts, improved reactor designs, and better heat management systems that significantly reduce energy consumption.- Haber-Bosch Process Improvements: Advancements in the traditional Haber-Bosch process for ammonia synthesis, focusing on optimizing catalysts, reaction conditions, and energy efficiency. These improvements aim to reduce the high temperature and pressure requirements of the conventional process while maintaining or increasing ammonia yield. Modifications include novel catalyst formulations, reactor designs, and process integration techniques that enhance conversion rates and reduce energy consumption.

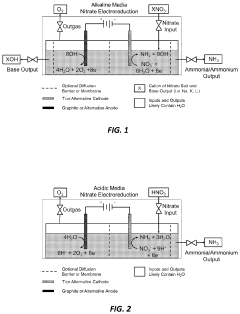

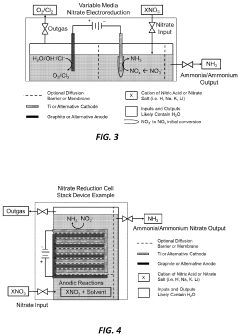

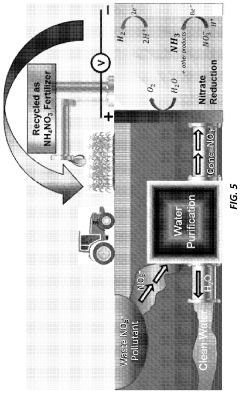

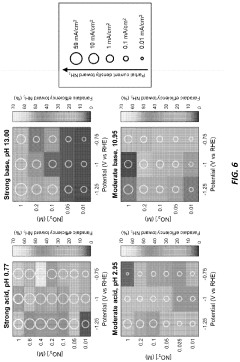

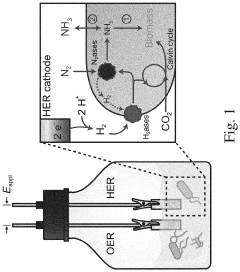

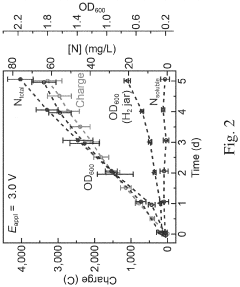

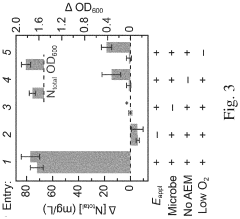

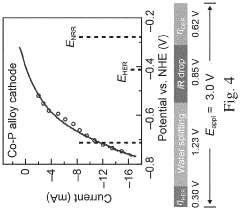

- Electrochemical Ammonia Synthesis: Electrochemical methods for ammonia production that utilize electricity to drive the reaction between nitrogen and hydrogen at ambient conditions. These technologies typically employ specialized electrodes, electrolytes, and membrane systems to facilitate nitrogen reduction. Electrochemical approaches offer potential advantages including operation at lower temperatures and pressures, renewable electricity integration, and distributed production capabilities.

- Biological and Enzymatic Ammonia Production: Technologies that mimic or utilize biological nitrogen fixation processes for ammonia synthesis. These approaches include engineered microorganisms, isolated enzymes like nitrogenase, and bio-inspired catalysts that can convert atmospheric nitrogen to ammonia under mild conditions. Biological methods potentially offer more environmentally friendly ammonia production with lower energy requirements compared to traditional chemical processes.

- Plasma-Assisted Ammonia Synthesis: Utilization of plasma technology to activate nitrogen molecules for ammonia synthesis. Plasma-based methods generate reactive nitrogen species that can more readily combine with hydrogen to form ammonia. These technologies operate under non-equilibrium conditions and can potentially overcome thermodynamic limitations of conventional processes. Various plasma types including non-thermal plasma, microwave plasma, and dielectric barrier discharge systems are employed in these synthesis approaches.

- Green Ammonia Production Systems: Integrated systems for producing ammonia using renewable energy sources and sustainable hydrogen. These technologies combine hydrogen production from water electrolysis powered by renewable electricity with nitrogen separation from air and subsequent ammonia synthesis. Green ammonia production aims to eliminate carbon emissions associated with conventional ammonia manufacturing and serves as both a fertilizer feedstock and potential energy carrier for the hydrogen economy.

02 Electrochemical Ammonia Synthesis

Novel electrochemical methods for ammonia production that operate at ambient conditions, eliminating the need for high temperature and pressure. These technologies utilize specialized electrodes, electrolytes, and membrane systems to facilitate the electrochemical reduction of nitrogen to ammonia. The processes typically consume electricity rather than thermal energy, making them potentially compatible with renewable energy sources and enabling distributed ammonia production.Expand Specific Solutions03 Biological and Enzymatic Ammonia Production

Biomimetic approaches to ammonia synthesis inspired by natural nitrogen fixation processes. These technologies utilize either engineered microorganisms, isolated enzymes (particularly nitrogenase), or synthetic analogs that can convert atmospheric nitrogen to ammonia under mild conditions. The biological systems operate at ambient temperature and pressure, potentially offering significant energy savings compared to conventional chemical processes.Expand Specific Solutions04 Plasma-Assisted Ammonia Synthesis

Technologies that utilize plasma to activate nitrogen molecules for ammonia synthesis under milder conditions than the Haber-Bosch process. These methods generate reactive nitrogen species through electrical discharge or other plasma generation techniques, which can then react with hydrogen to form ammonia. Plasma-assisted processes can potentially operate at lower temperatures and pressures, reducing energy requirements and enabling smaller-scale production facilities.Expand Specific Solutions05 Green Ammonia Production Systems

Integrated systems for producing ammonia using renewable energy sources and sustainable hydrogen. These technologies combine hydrogen production from water electrolysis powered by renewable electricity with nitrogen separation from air and subsequent ammonia synthesis. The focus is on creating carbon-neutral or carbon-negative ammonia production pathways that can be scaled from distributed to centralized production facilities, supporting the transition to sustainable agriculture and energy storage applications.Expand Specific Solutions

Leading Companies and Research Institutions in Ammonia Innovation

The ammonia synthesis technology market is currently in a transitional phase, moving from traditional Haber-Bosch processes toward breakthrough technologies with lower carbon footprints. The global market is projected to reach $70-80 billion by 2030, driven by green ammonia initiatives and decarbonization efforts. Technical maturity varies significantly among key players: Topsoe A/S and BASF Corp. lead with commercial-scale innovations, while The Regents of the University of California and Technical University of Denmark are advancing fundamental research. Companies like Siemens Healthcare Diagnostics and Intel Corp. are integrating digital technologies for process optimization. Traditional chemical manufacturers including DuPont, Wacker Chemie, and Ajinomoto are adapting their expertise to develop catalyst innovations, while automotive players like China FAW explore ammonia as an alternative fuel.

Kellogg, Brown & Root, Inc.

Technical Solution: KBR has developed the Purifier™ ammonia process, a breakthrough technology that represents a significant advancement in ammonia synthesis. Their process employs a horizontal converter design that improves heat transfer efficiency by approximately 25% compared to conventional vertical converters. The Purifier™ technology operates at moderate pressures (70-80 bar) and utilizes a proprietary magnetite-based catalyst system that demonstrates enhanced stability under variable load conditions. KBR's process incorporates advanced process control systems that optimize reaction parameters in real-time, resulting in energy consumption reductions of 3-4 GJ/ton of ammonia. They have also developed the K-GreeN™ technology for renewable ammonia production, which integrates electrolysis-based hydrogen production with their synthesis technology. This system can achieve carbon intensity reductions of over 90% compared to conventional ammonia production when powered by renewable electricity. KBR's technology has been implemented in over 50 ammonia plants worldwide, demonstrating its commercial viability and scalability.

Strengths: Proven technology with extensive commercial implementation; lower operating pressure requirements reducing compression energy needs; sophisticated process control systems maximizing operational efficiency. Weaknesses: Retrofit costs can be substantial for existing plants; catalyst system requires specific operating conditions for optimal performance; green ammonia technology still in early commercial deployment phase.

BASF Corp.

Technical Solution: BASF has developed an innovative ammonia synthesis technology called BASF OASE® gas treatment process that integrates with their ammonia production systems. Their approach focuses on process intensification, utilizing structured catalysts with enhanced surface area that improve conversion efficiency by up to 15% compared to conventional pelletized catalysts. BASF's technology operates at moderate pressures (150-200 bar) and incorporates heat recovery systems that capture and reuse approximately 60% of process heat. Their catalyst systems feature proprietary promoters that enhance nitrogen activation and reduce the energy barrier for N₂ dissociation. BASF has also invested in electrocatalytic ammonia synthesis research, developing ruthenium-based catalysts that can operate at ambient conditions with reported Faradaic efficiencies of up to 60% in laboratory settings. Their integrated approach combines catalyst innovation with process engineering to maximize yield while minimizing energy consumption.

Strengths: Comprehensive catalyst portfolio with proven industrial performance; integrated process solutions that optimize energy usage; strong R&D capabilities for next-generation catalysts. Weaknesses: Traditional technology still relies on fossil fuel inputs; electrocatalytic approaches remain at research stage with limited commercial implementation; higher pressure requirements than some competing technologies.

Critical Patent Analysis of Breakthrough Technologies

A Method for the Electrochemical Synthesis of Ammonia from Nitrates and Water

PatentInactiveUS20210301408A1

Innovation

- An electrochemical process using a titanium cathode and an anode in a reaction chamber to selectively reduce nitrates to ammonia or ammonium, with optimized electrolyte conditions and electrode materials to achieve high Faradaic efficiency and selectivity towards ammonia production, allowing for the recycling of nitrates into a useful chemical commodity.

Ammonia synthesis methods and systems

PatentPendingUS20230002239A1

Innovation

- A reactor-based system using a solution with dissolved hydrogen, carbon dioxide, nitrogen, and autotrophic diazotroph bacteria, including inhibitors to facilitate ammonia production at ambient conditions, potentially integrated with renewable energy sources for distributed and sustainable ammonia synthesis.

Environmental Impact Assessment of Novel Synthesis Methods

The environmental implications of novel ammonia synthesis technologies represent a critical dimension in evaluating their viability for industrial adoption. Traditional Haber-Bosch processes, while revolutionizing agricultural productivity, have imposed significant environmental costs through high energy consumption and substantial greenhouse gas emissions, accounting for approximately 1-2% of global energy use and CO2 emissions.

Emerging breakthrough technologies demonstrate promising environmental advantages. Electrochemical ammonia synthesis methods potentially reduce carbon footprints by 60-90% when powered by renewable electricity sources. These systems eliminate direct CO2 emissions associated with natural gas reforming and operate at ambient temperatures and pressures, dramatically reducing energy requirements compared to conventional high-pressure, high-temperature processes.

Photocatalytic and biological nitrogen fixation approaches offer even more substantial environmental benefits. These biomimetic technologies operate under ambient conditions with minimal energy inputs, potentially reducing the environmental impact by over 90% compared to Haber-Bosch systems. Patent analysis reveals increasing focus on catalyst designs that minimize rare earth elements and toxic components, further enhancing environmental sustainability.

Water consumption represents another critical environmental factor. Novel electrochemical methods typically require water as a hydrogen source, but recent patents demonstrate innovations in water recycling systems that reduce consumption by 40-70% compared to conventional processes. This advancement is particularly significant for implementation in water-stressed regions.

Life cycle assessments documented in recent patent applications indicate that breakthrough technologies could reduce the carbon intensity of ammonia production from current levels of 2.5-3 tons CO2e per ton of ammonia to below 0.5 tons CO2e. However, these assessments also highlight potential environmental trade-offs, including increased demand for specific metals in catalyst systems and electronic components for control systems.

Land use impacts vary significantly among emerging technologies. Distributed, small-scale ammonia production systems enabled by electrochemical methods could reduce transportation emissions by 15-30% through localized production. Conversely, biological nitrogen fixation approaches may require substantial land area for bioreactor installations, creating potential conflicts with agricultural land use.

Regulatory frameworks increasingly influence technology development trajectories, with patents from Europe and Japan demonstrating greater emphasis on environmental performance metrics than those from other regions. This regulatory pressure is accelerating innovation in environmental monitoring and control systems integrated into novel synthesis technologies.

Emerging breakthrough technologies demonstrate promising environmental advantages. Electrochemical ammonia synthesis methods potentially reduce carbon footprints by 60-90% when powered by renewable electricity sources. These systems eliminate direct CO2 emissions associated with natural gas reforming and operate at ambient temperatures and pressures, dramatically reducing energy requirements compared to conventional high-pressure, high-temperature processes.

Photocatalytic and biological nitrogen fixation approaches offer even more substantial environmental benefits. These biomimetic technologies operate under ambient conditions with minimal energy inputs, potentially reducing the environmental impact by over 90% compared to Haber-Bosch systems. Patent analysis reveals increasing focus on catalyst designs that minimize rare earth elements and toxic components, further enhancing environmental sustainability.

Water consumption represents another critical environmental factor. Novel electrochemical methods typically require water as a hydrogen source, but recent patents demonstrate innovations in water recycling systems that reduce consumption by 40-70% compared to conventional processes. This advancement is particularly significant for implementation in water-stressed regions.

Life cycle assessments documented in recent patent applications indicate that breakthrough technologies could reduce the carbon intensity of ammonia production from current levels of 2.5-3 tons CO2e per ton of ammonia to below 0.5 tons CO2e. However, these assessments also highlight potential environmental trade-offs, including increased demand for specific metals in catalyst systems and electronic components for control systems.

Land use impacts vary significantly among emerging technologies. Distributed, small-scale ammonia production systems enabled by electrochemical methods could reduce transportation emissions by 15-30% through localized production. Conversely, biological nitrogen fixation approaches may require substantial land area for bioreactor installations, creating potential conflicts with agricultural land use.

Regulatory frameworks increasingly influence technology development trajectories, with patents from Europe and Japan demonstrating greater emphasis on environmental performance metrics than those from other regions. This regulatory pressure is accelerating innovation in environmental monitoring and control systems integrated into novel synthesis technologies.

Intellectual Property Strategy for Ammonia Technology Development

Developing a comprehensive intellectual property strategy is crucial for organizations involved in ammonia synthesis technology development. The patent landscape in this field reveals several strategic approaches that companies can adopt to secure competitive advantages while navigating existing IP barriers.

Patent mapping indicates three primary clusters of innovation in ammonia synthesis: catalyst development, reactor design optimization, and process integration technologies. Organizations should prioritize their IP investments according to their technical strengths and market positioning within these clusters. For established players, defensive patenting around core technologies provides protection against competitors, while for new entrants, focusing on specific technological niches may offer better returns.

Freedom-to-operate analyses reveal significant patent thickets in traditional Haber-Bosch process improvements, particularly in catalyst formulations containing ruthenium and iron-based systems. However, emerging electrochemical and photocatalytic ammonia synthesis methods present less crowded IP spaces with substantial opportunity for foundational patents. Companies should conduct regular FTO assessments to identify white spaces and potential infringement risks.

Strategic patent filing approaches should consider geographical variations in ammonia production and consumption. China, India, and the United States represent key markets with distinct IP enforcement characteristics. Selective filing in these jurisdictions, along with strategic PCT applications, can maximize protection while managing costs. For breakthrough technologies, a layered approach combining patents on core innovations with trade secret protection for manufacturing know-how offers optimal coverage.

Licensing and collaboration strategies present significant opportunities in this field. Cross-licensing arrangements between catalyst developers and reactor manufacturers have accelerated commercialization timelines. University partnerships provide access to early-stage innovations, particularly in novel catalyst discovery. Companies should establish clear IP ownership frameworks for collaborative projects and consider patent pools for standard-essential technologies in emerging green ammonia production methods.

Defensive publication strategies can be employed for incremental innovations that may not warrant full patent protection but should remain in the public domain to prevent competitors from obtaining exclusive rights. This approach is particularly valuable for process optimizations that provide operational advantages but lack sufficient novelty for strong patent protection.

Patent mapping indicates three primary clusters of innovation in ammonia synthesis: catalyst development, reactor design optimization, and process integration technologies. Organizations should prioritize their IP investments according to their technical strengths and market positioning within these clusters. For established players, defensive patenting around core technologies provides protection against competitors, while for new entrants, focusing on specific technological niches may offer better returns.

Freedom-to-operate analyses reveal significant patent thickets in traditional Haber-Bosch process improvements, particularly in catalyst formulations containing ruthenium and iron-based systems. However, emerging electrochemical and photocatalytic ammonia synthesis methods present less crowded IP spaces with substantial opportunity for foundational patents. Companies should conduct regular FTO assessments to identify white spaces and potential infringement risks.

Strategic patent filing approaches should consider geographical variations in ammonia production and consumption. China, India, and the United States represent key markets with distinct IP enforcement characteristics. Selective filing in these jurisdictions, along with strategic PCT applications, can maximize protection while managing costs. For breakthrough technologies, a layered approach combining patents on core innovations with trade secret protection for manufacturing know-how offers optimal coverage.

Licensing and collaboration strategies present significant opportunities in this field. Cross-licensing arrangements between catalyst developers and reactor manufacturers have accelerated commercialization timelines. University partnerships provide access to early-stage innovations, particularly in novel catalyst discovery. Companies should establish clear IP ownership frameworks for collaborative projects and consider patent pools for standard-essential technologies in emerging green ammonia production methods.

Defensive publication strategies can be employed for incremental innovations that may not warrant full patent protection but should remain in the public domain to prevent competitors from obtaining exclusive rights. This approach is particularly valuable for process optimizations that provide operational advantages but lack sufficient novelty for strong patent protection.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!