Exploring the Role of Emerging Patents in Ammonia Synthesis

OCT 15, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Ammonia Synthesis Technology Evolution and Objectives

Ammonia synthesis represents one of the most significant industrial processes of the 20th century, with its evolution closely tied to global agricultural development and food security. The Haber-Bosch process, developed in the early 1900s, revolutionized ammonia production by enabling the direct combination of nitrogen and hydrogen under high pressure and temperature conditions with iron-based catalysts. This breakthrough transformed agricultural practices worldwide by making nitrogen fertilizers widely available, supporting population growth and food production.

Over the past century, ammonia synthesis technology has progressed through several distinct phases. The initial commercialization phase (1910s-1940s) focused on establishing industrial-scale production facilities. The optimization phase (1950s-1980s) saw improvements in catalyst efficiency and process conditions, reducing energy requirements. The environmental consciousness phase (1990s-2010s) addressed sustainability concerns by attempting to reduce the carbon footprint of traditional synthesis methods.

Currently, we are witnessing an innovation acceleration phase (2010s-present) characterized by the pursuit of green ammonia production pathways. This phase is driven by urgent climate change mitigation needs and the recognition that conventional ammonia synthesis accounts for approximately 1-2% of global carbon dioxide emissions and consumes 1-2% of worldwide energy production.

Patent activity in ammonia synthesis has shown remarkable growth in recent years, with particular emphasis on three key technological objectives: reducing energy intensity, enabling renewable energy integration, and developing novel catalytic materials. The energy reduction objective seeks to lower the extreme pressure (150-300 atm) and temperature (400-500°C) requirements of conventional processes. Renewable energy integration aims to couple ammonia production with intermittent energy sources like wind and solar power, potentially using ammonia as an energy carrier.

The development of advanced catalysts represents perhaps the most patent-rich area, with emerging intellectual property focused on ruthenium-based systems, metal nitrides, and nano-structured materials that can operate under milder conditions. Electrocatalytic and photocatalytic ammonia synthesis pathways are also gaining significant attention in the patent landscape, offering potentially revolutionary approaches to nitrogen fixation.

The technical objectives driving current innovation include achieving ammonia synthesis at ambient conditions, developing economically viable small-scale distributed production systems, and creating closed-loop systems that minimize resource inputs and environmental impacts. These objectives align with broader sustainability goals while addressing the practical needs of various market segments from traditional large-scale fertilizer production to emerging applications in energy storage and transportation.

Over the past century, ammonia synthesis technology has progressed through several distinct phases. The initial commercialization phase (1910s-1940s) focused on establishing industrial-scale production facilities. The optimization phase (1950s-1980s) saw improvements in catalyst efficiency and process conditions, reducing energy requirements. The environmental consciousness phase (1990s-2010s) addressed sustainability concerns by attempting to reduce the carbon footprint of traditional synthesis methods.

Currently, we are witnessing an innovation acceleration phase (2010s-present) characterized by the pursuit of green ammonia production pathways. This phase is driven by urgent climate change mitigation needs and the recognition that conventional ammonia synthesis accounts for approximately 1-2% of global carbon dioxide emissions and consumes 1-2% of worldwide energy production.

Patent activity in ammonia synthesis has shown remarkable growth in recent years, with particular emphasis on three key technological objectives: reducing energy intensity, enabling renewable energy integration, and developing novel catalytic materials. The energy reduction objective seeks to lower the extreme pressure (150-300 atm) and temperature (400-500°C) requirements of conventional processes. Renewable energy integration aims to couple ammonia production with intermittent energy sources like wind and solar power, potentially using ammonia as an energy carrier.

The development of advanced catalysts represents perhaps the most patent-rich area, with emerging intellectual property focused on ruthenium-based systems, metal nitrides, and nano-structured materials that can operate under milder conditions. Electrocatalytic and photocatalytic ammonia synthesis pathways are also gaining significant attention in the patent landscape, offering potentially revolutionary approaches to nitrogen fixation.

The technical objectives driving current innovation include achieving ammonia synthesis at ambient conditions, developing economically viable small-scale distributed production systems, and creating closed-loop systems that minimize resource inputs and environmental impacts. These objectives align with broader sustainability goals while addressing the practical needs of various market segments from traditional large-scale fertilizer production to emerging applications in energy storage and transportation.

Market Analysis of Green Ammonia Production

The green ammonia market is experiencing unprecedented growth, driven by the global push towards decarbonization and sustainable industrial practices. Current market valuations place green ammonia at approximately $72 million in 2022, with projections indicating a compound annual growth rate (CAGR) of 72.9% through 2030, potentially reaching a market size of $7.6 billion. This explosive growth trajectory reflects the increasing recognition of green ammonia as a critical component in the transition to a low-carbon economy.

Demand for green ammonia spans multiple sectors, with fertilizer production currently representing the largest application segment. Agriculture accounts for roughly 80% of conventional ammonia consumption globally, creating a substantial opportunity for green alternatives. Beyond fertilizers, emerging applications in energy storage, maritime fuel, and power generation are expanding the market potential significantly.

Geographically, Europe leads the green ammonia market development, with countries like Germany, the Netherlands, and Denmark making substantial investments in production facilities. The Asia-Pacific region, particularly Japan, South Korea, and Australia, is rapidly accelerating development efforts, leveraging abundant renewable energy resources for production. North America is also gaining momentum, with several large-scale projects announced in the United States and Canada.

The economic feasibility of green ammonia production remains a significant market consideration. Current production costs range between $900-1,600 per ton, substantially higher than conventional ammonia's $200-450 per ton. However, this gap is expected to narrow considerably by 2030 as renewable electricity costs decline and electrolyzer technologies mature. Bloomberg NEF forecasts suggest green ammonia could reach cost parity with conventional production in optimal locations by 2030-2035.

Policy support has emerged as a crucial market driver, with carbon pricing mechanisms, renewable energy subsidies, and targeted green hydrogen strategies creating favorable conditions for investment. The European Union's Hydrogen Strategy and various national hydrogen roadmaps explicitly identify green ammonia as a priority sector, while Japan's Green Growth Strategy includes specific targets for ammonia in its energy mix.

Industry partnerships are reshaping the competitive landscape, with traditional ammonia producers forming strategic alliances with renewable energy developers and technology providers. These collaborations are accelerating commercialization timelines and enabling larger project scales than would otherwise be possible. Notable examples include CF Industries' partnerships with Thyssenkrupp and Yara's collaboration with Ørsted on integrated green ammonia production facilities.

Demand for green ammonia spans multiple sectors, with fertilizer production currently representing the largest application segment. Agriculture accounts for roughly 80% of conventional ammonia consumption globally, creating a substantial opportunity for green alternatives. Beyond fertilizers, emerging applications in energy storage, maritime fuel, and power generation are expanding the market potential significantly.

Geographically, Europe leads the green ammonia market development, with countries like Germany, the Netherlands, and Denmark making substantial investments in production facilities. The Asia-Pacific region, particularly Japan, South Korea, and Australia, is rapidly accelerating development efforts, leveraging abundant renewable energy resources for production. North America is also gaining momentum, with several large-scale projects announced in the United States and Canada.

The economic feasibility of green ammonia production remains a significant market consideration. Current production costs range between $900-1,600 per ton, substantially higher than conventional ammonia's $200-450 per ton. However, this gap is expected to narrow considerably by 2030 as renewable electricity costs decline and electrolyzer technologies mature. Bloomberg NEF forecasts suggest green ammonia could reach cost parity with conventional production in optimal locations by 2030-2035.

Policy support has emerged as a crucial market driver, with carbon pricing mechanisms, renewable energy subsidies, and targeted green hydrogen strategies creating favorable conditions for investment. The European Union's Hydrogen Strategy and various national hydrogen roadmaps explicitly identify green ammonia as a priority sector, while Japan's Green Growth Strategy includes specific targets for ammonia in its energy mix.

Industry partnerships are reshaping the competitive landscape, with traditional ammonia producers forming strategic alliances with renewable energy developers and technology providers. These collaborations are accelerating commercialization timelines and enabling larger project scales than would otherwise be possible. Notable examples include CF Industries' partnerships with Thyssenkrupp and Yara's collaboration with Ørsted on integrated green ammonia production facilities.

Current Challenges in Ammonia Synthesis Technologies

Despite significant advancements in ammonia synthesis over the past century, the industry continues to face substantial challenges that limit efficiency, sustainability, and economic viability. The Haber-Bosch process, while revolutionary, remains energy-intensive, consuming approximately 1-2% of global energy production and contributing significantly to greenhouse gas emissions. This process typically operates under harsh conditions of 400-500°C and 150-300 bar pressure, creating a substantial carbon footprint with 1.5-1.8 tons of CO2 released per ton of ammonia produced.

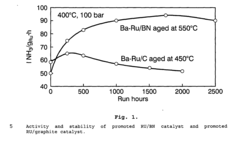

Catalyst efficiency presents another critical challenge. Current industrial catalysts, primarily iron-based, achieve only 10-15% conversion per pass, necessitating gas recycling and increasing operational complexity. While ruthenium catalysts offer improved activity, their high cost and limited availability restrict widespread adoption. The development of catalysts that can operate effectively under milder conditions without sacrificing conversion rates remains an elusive goal.

Renewable integration poses significant technical hurdles. Transitioning from natural gas to renewable hydrogen sources introduces intermittency issues that conflict with the continuous operation requirements of traditional ammonia plants. The mismatch between variable renewable energy production and the steady-state demands of ammonia synthesis creates operational inefficiencies and economic barriers to implementation.

Scale-dependent economics further complicate innovation adoption. Conventional ammonia plants are optimized for large-scale production (1,000-3,000 tons/day), making them capital-intensive and inflexible. This creates barriers to implementing distributed production models that could better utilize localized renewable energy sources and reduce transportation emissions.

Nitrogen activation represents a fundamental scientific challenge. Breaking the strong N≡N triple bond (945 kJ/mol) efficiently at lower temperatures and pressures requires novel approaches beyond traditional thermal catalysis. Alternative activation methods such as electrochemical, photocatalytic, and plasma-assisted processes show promise but currently suffer from low yields, poor selectivity, and high energy requirements.

Separation and purification technologies also present significant bottlenecks. Current cryogenic and pressure-swing adsorption methods for feedstock purification are energy-intensive, while ammonia separation from reaction mixtures requires substantial cooling and compression. More efficient separation technologies could significantly reduce the overall energy footprint of ammonia production.

Addressing these interconnected challenges requires multidisciplinary approaches that span catalyst design, process engineering, renewable energy integration, and fundamental chemical research. Recent patent activities suggest emerging solutions, but significant barriers remain before truly sustainable ammonia synthesis becomes commercially viable at industrial scales.

Catalyst efficiency presents another critical challenge. Current industrial catalysts, primarily iron-based, achieve only 10-15% conversion per pass, necessitating gas recycling and increasing operational complexity. While ruthenium catalysts offer improved activity, their high cost and limited availability restrict widespread adoption. The development of catalysts that can operate effectively under milder conditions without sacrificing conversion rates remains an elusive goal.

Renewable integration poses significant technical hurdles. Transitioning from natural gas to renewable hydrogen sources introduces intermittency issues that conflict with the continuous operation requirements of traditional ammonia plants. The mismatch between variable renewable energy production and the steady-state demands of ammonia synthesis creates operational inefficiencies and economic barriers to implementation.

Scale-dependent economics further complicate innovation adoption. Conventional ammonia plants are optimized for large-scale production (1,000-3,000 tons/day), making them capital-intensive and inflexible. This creates barriers to implementing distributed production models that could better utilize localized renewable energy sources and reduce transportation emissions.

Nitrogen activation represents a fundamental scientific challenge. Breaking the strong N≡N triple bond (945 kJ/mol) efficiently at lower temperatures and pressures requires novel approaches beyond traditional thermal catalysis. Alternative activation methods such as electrochemical, photocatalytic, and plasma-assisted processes show promise but currently suffer from low yields, poor selectivity, and high energy requirements.

Separation and purification technologies also present significant bottlenecks. Current cryogenic and pressure-swing adsorption methods for feedstock purification are energy-intensive, while ammonia separation from reaction mixtures requires substantial cooling and compression. More efficient separation technologies could significantly reduce the overall energy footprint of ammonia production.

Addressing these interconnected challenges requires multidisciplinary approaches that span catalyst design, process engineering, renewable energy integration, and fundamental chemical research. Recent patent activities suggest emerging solutions, but significant barriers remain before truly sustainable ammonia synthesis becomes commercially viable at industrial scales.

Existing Patent-Based Solutions for Ammonia Production

01 Catalysts for ammonia synthesis

Various catalysts have been developed to improve the efficiency of ammonia synthesis. These catalysts typically include iron-based compounds, ruthenium, or other transition metals that facilitate the reaction between nitrogen and hydrogen. The catalysts are often supported on materials such as alumina or carbon to increase their surface area and stability. Innovations in catalyst design focus on increasing conversion rates, reducing energy requirements, and improving catalyst longevity under industrial conditions.- Catalysts for ammonia synthesis: Various catalysts have been developed to improve the efficiency of ammonia synthesis. These catalysts typically include iron-based compounds, ruthenium, or other transition metals that facilitate the reaction between nitrogen and hydrogen. The catalysts are designed to lower the activation energy required for the reaction, allowing ammonia to be produced under milder conditions than the traditional Haber-Bosch process. Innovations in catalyst design focus on increasing activity, selectivity, and stability while reducing the energy requirements of the synthesis process.

- Low-pressure ammonia synthesis methods: Recent innovations in ammonia synthesis have focused on developing processes that operate at lower pressures than the traditional Haber-Bosch process. These methods aim to reduce the energy consumption and capital costs associated with high-pressure operations. Low-pressure synthesis approaches often employ novel catalysts, reactor designs, or process configurations to achieve economically viable conversion rates despite the thermodynamic challenges of ammonia formation at reduced pressures.

- Renewable energy-based ammonia production: Patents in this category focus on integrating renewable energy sources into ammonia production processes. These technologies aim to use electricity from solar, wind, or other renewable sources to power electrolyzers that generate hydrogen, which is then combined with nitrogen to produce ammonia. This approach represents a significant shift from traditional fossil fuel-dependent ammonia synthesis and offers a pathway to carbon-neutral fertilizer production. Some innovations also explore direct electrochemical ammonia synthesis methods that bypass separate hydrogen production.

- Reactor design and process optimization: Innovations in reactor design and process optimization for ammonia synthesis focus on improving heat management, enhancing mass transfer, and increasing overall system efficiency. These patents describe novel reactor configurations, improved heat exchange systems, and optimized process control strategies. Advanced designs may incorporate features such as structured catalyst beds, membrane reactors, or microreactor technology to overcome traditional limitations in ammonia synthesis. Process optimization approaches often leverage computational modeling and advanced control systems to maximize yield while minimizing energy consumption.

- Green ammonia production technologies: Green ammonia production technologies focus on developing environmentally sustainable methods for synthesizing ammonia with minimal carbon emissions. These approaches often combine renewable hydrogen sources with innovative nitrogen separation techniques and energy-efficient synthesis processes. Some patents in this category describe integrated systems that utilize waste heat recovery, advanced separation technologies, or biological processes to reduce the overall environmental footprint of ammonia production. These technologies are particularly important for decarbonizing the fertilizer industry and enabling ammonia's potential use as a carbon-neutral energy carrier.

02 Low-pressure ammonia synthesis processes

Traditional Haber-Bosch ammonia synthesis requires high pressure conditions (150-300 bar), which is energy-intensive. Recent patents focus on developing processes that can operate at lower pressures while maintaining acceptable conversion rates. These innovations include modified reactor designs, improved heat management systems, and specialized catalysts that remain active under less severe conditions. Low-pressure processes significantly reduce energy consumption and capital costs for ammonia production facilities.Expand Specific Solutions03 Green ammonia production methods

Environmentally friendly approaches to ammonia synthesis utilize renewable energy sources and sustainable feedstocks. These methods include electrolysis-based hydrogen production coupled with nitrogen separation from air, followed by ammonia synthesis. Some innovations incorporate direct electrochemical ammonia synthesis from nitrogen and water. Green ammonia production aims to eliminate carbon emissions associated with traditional hydrogen production from natural gas, making ammonia production more sustainable.Expand Specific Solutions04 Reactor design and process optimization

Innovations in reactor design for ammonia synthesis focus on improving heat transfer, optimizing gas flow patterns, and enhancing catalyst bed configurations. Advanced reactor designs include multi-bed systems with inter-stage cooling, membrane reactors that selectively remove ammonia to drive equilibrium conversion, and microreactor technologies that offer better temperature control. These designs aim to increase conversion efficiency, reduce energy consumption, and improve process safety and control.Expand Specific Solutions05 Novel feedstock and synthesis routes

Alternative approaches to ammonia synthesis explore non-traditional feedstocks and reaction pathways. These include biological nitrogen fixation inspired processes, plasma-assisted synthesis, and chemical looping methods. Some innovations utilize nitrogen oxides or other nitrogen compounds as intermediates rather than molecular nitrogen. Novel synthesis routes aim to bypass the limitations of the traditional Haber-Bosch process by operating under milder conditions or using more readily available reactants.Expand Specific Solutions

Leading Companies and Research Institutions in Ammonia Innovation

The ammonia synthesis technology landscape is currently in a transitional phase, evolving from mature Haber-Bosch processes toward more sustainable alternatives. The market is substantial, valued at approximately $70 billion globally, with projected growth due to increasing fertilizer demand and emerging green ammonia applications. The competitive landscape features established chemical giants like BASF, Bayer AG, and Wacker Chemie maintaining strong patent portfolios in traditional synthesis, while specialized players such as Topsoe A/S and Stamicarbon BV focus on process optimization. Recent patent activity shows academic institutions (Delft University, Technical University of Denmark) and emerging companies (Battolyser Holding) driving innovation in electrocatalytic and renewable energy-integrated ammonia production methods, indicating a shift toward more sustainable synthesis technologies.

BASF Corp.

Technical Solution: BASF has developed an innovative approach to ammonia synthesis through their "Ammonia Synthesis 4.0" platform, which integrates advanced catalysts with digital process optimization. Their patented ruthenium-based catalysts operate at lower pressures (40-80 bar) compared to traditional Haber-Bosch processes (150-300 bar), reducing energy requirements by up to 30%. BASF's technology incorporates machine learning algorithms to continuously optimize reaction conditions based on real-time data, allowing for adaptive control of synthesis parameters. The company has also pioneered hybrid systems that can utilize renewable hydrogen sources, making their ammonia synthesis process more sustainable. Their latest patents focus on catalyst formulations with enhanced stability that maintain high conversion rates even under fluctuating input conditions, addressing a key challenge in integrating renewable energy sources with ammonia production.

Strengths: Industry-leading catalyst technology with proven commercial implementation; extensive manufacturing infrastructure; integration of digital technologies for process optimization. Weaknesses: Still primarily dependent on natural gas as feedstock; full transition to renewable hydrogen sources requires significant additional investment.

Stamicarbon BV

Technical Solution: Stamicarbon has developed the "LEAP" (Low Energy Ammonia Process) technology, representing a significant advancement in ammonia synthesis. Their patented approach focuses on process intensification through novel reactor designs that improve heat integration and energy efficiency. The company's innovations include a structured catalyst bed configuration that optimizes gas flow patterns, reducing pressure drop by approximately 25% while maintaining high conversion rates. Stamicarbon's technology incorporates a modular design philosophy, allowing for scalable implementation from small distributed plants to large centralized facilities. Their patents also cover advanced separation techniques that improve ammonia recovery from synthesis gas, increasing overall yield by 5-8%. Additionally, Stamicarbon has developed specialized materials for heat exchangers that withstand the corrosive conditions of ammonia synthesis while improving thermal efficiency by up to 15%, significantly reducing the energy footprint of the process.

Strengths: Specialized expertise in ammonia and urea production technology; strong focus on energy efficiency improvements; modular and scalable solutions suitable for various production scales. Weaknesses: Relatively smaller market presence compared to industry giants; technology primarily focuses on process optimization rather than fundamental catalyst breakthroughs.

Critical Patent Analysis for Novel Ammonia Synthesis Methods

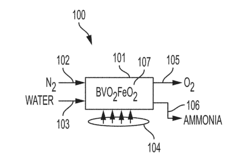

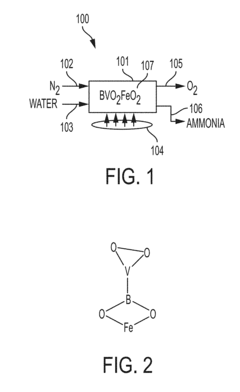

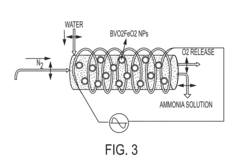

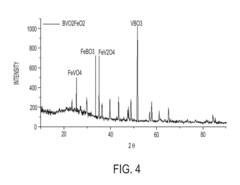

Methods and systems for producing ammonia

PatentInactiveUS20170210632A1

Innovation

- A method involving the use of a superparamagnetic catalyst, such as BVO2FeO2, to facilitate the production of ammonia by contacting nitrogen and water with a fluctuating magnetic field, reducing the need for high temperatures and pressures.

Process for the preparation of ammonia and catalyst therefore

PatentInactiveEP1391428A1

Innovation

- The use of a ruthenium catalyst supported on boron nitride or silicon nitride with a secondary oxide support allows for increased plant capacity and reduced equipment costs by maintaining stability and activity under high-pressure conditions, enabling the addition of smaller converters in existing loops and reducing specific energy consumption.

Environmental Impact Assessment of New Ammonia Technologies

The environmental implications of emerging ammonia synthesis technologies represent a critical dimension in evaluating their viability for widespread adoption. Traditional Haber-Bosch processes, while revolutionizing agricultural productivity over the past century, have imposed significant environmental costs through high energy consumption and greenhouse gas emissions. New patent-protected technologies are fundamentally reshaping this environmental equation.

Recent life cycle assessments reveal that electrochemical ammonia synthesis methods, prominently featured in emerging patents, can reduce carbon emissions by 60-90% compared to conventional processes when powered by renewable energy sources. This dramatic reduction stems from eliminating natural gas as both feedstock and energy source, addressing one of the most environmentally problematic aspects of traditional synthesis.

Water consumption patterns also differ markedly across new technologies. While some electrochemical approaches require substantial water inputs for hydrogen generation, others incorporate atmospheric moisture capture systems that minimize freshwater demands. Patents from companies like ThyssenKrupp and Casale have introduced closed-loop water recycling systems that reduce water requirements by up to 40% compared to conventional plants.

Land use considerations present another environmental dimension. Decentralized production models enabled by smaller-scale technologies could distribute environmental impacts rather than concentrating them at massive industrial facilities. Several patents describe modular systems requiring less than 25% of the land area of traditional plants with equivalent production capacity, potentially reducing habitat disruption and allowing for strategic placement near renewable energy sources.

Nitrogen pollution represents a persistent challenge even with new technologies. While patents from Siemens and Topsoe address ammonia leakage prevention through advanced containment systems, the ultimate environmental impact depends on downstream agricultural application practices. Some integrated patents now incorporate controlled-release mechanisms and precision application technologies that could reduce nitrogen runoff by 30-50%.

Waste generation profiles are also evolving with new catalytic approaches. Several patents describe systems that eliminate toxic byproducts associated with conventional catalysts, while others introduce bio-inspired catalysts that function at ambient conditions without generating hazardous waste streams. These innovations address end-of-life disposal concerns that have historically complicated environmental assessments of industrial chemical processes.

Recent life cycle assessments reveal that electrochemical ammonia synthesis methods, prominently featured in emerging patents, can reduce carbon emissions by 60-90% compared to conventional processes when powered by renewable energy sources. This dramatic reduction stems from eliminating natural gas as both feedstock and energy source, addressing one of the most environmentally problematic aspects of traditional synthesis.

Water consumption patterns also differ markedly across new technologies. While some electrochemical approaches require substantial water inputs for hydrogen generation, others incorporate atmospheric moisture capture systems that minimize freshwater demands. Patents from companies like ThyssenKrupp and Casale have introduced closed-loop water recycling systems that reduce water requirements by up to 40% compared to conventional plants.

Land use considerations present another environmental dimension. Decentralized production models enabled by smaller-scale technologies could distribute environmental impacts rather than concentrating them at massive industrial facilities. Several patents describe modular systems requiring less than 25% of the land area of traditional plants with equivalent production capacity, potentially reducing habitat disruption and allowing for strategic placement near renewable energy sources.

Nitrogen pollution represents a persistent challenge even with new technologies. While patents from Siemens and Topsoe address ammonia leakage prevention through advanced containment systems, the ultimate environmental impact depends on downstream agricultural application practices. Some integrated patents now incorporate controlled-release mechanisms and precision application technologies that could reduce nitrogen runoff by 30-50%.

Waste generation profiles are also evolving with new catalytic approaches. Several patents describe systems that eliminate toxic byproducts associated with conventional catalysts, while others introduce bio-inspired catalysts that function at ambient conditions without generating hazardous waste streams. These innovations address end-of-life disposal concerns that have historically complicated environmental assessments of industrial chemical processes.

Patent Landscape and IP Strategy for Ammonia Synthesis

The patent landscape for ammonia synthesis has evolved significantly over the past century, with distinct phases of innovation reflecting technological advancements and market demands. The Haber-Bosch process patents, dating back to the early 1900s, established the foundation for industrial ammonia production. These fundamental patents have long expired, creating an open innovation space for new technological approaches while maintaining the basic principles of high-pressure, high-temperature synthesis using iron-based catalysts.

Recent patent activity reveals three primary innovation clusters: catalyst development, process optimization, and alternative synthesis methods. Catalyst patents focus on enhancing efficiency through novel materials such as ruthenium-based compounds, which demonstrate superior performance at lower temperatures and pressures compared to traditional iron catalysts. Process optimization patents address energy consumption reduction through improved reactor designs, heat recovery systems, and pressure management techniques.

The most disruptive patent cluster involves electrochemical and photocatalytic ammonia synthesis methods, which aim to operate under ambient conditions using renewable electricity. Companies like BASF, Thyssenkrupp, and Haldor Topsoe dominate traditional ammonia synthesis patents, while startups and research institutions lead in alternative synthesis technologies, creating a dynamic competitive landscape.

Geographically, patent filings show concentration in industrial centers across North America, Europe, and East Asia, with China emerging as the fastest-growing patent jurisdiction for ammonia synthesis innovations. This reflects the strategic importance of ammonia production technology in the global transition to green hydrogen economies and sustainable fertilizer production.

For companies entering this space, a strategic IP approach involves building defensive patent portfolios around specific technological improvements while navigating the extensive existing patent landscape. Cross-licensing agreements have become increasingly common as companies recognize the complementary nature of innovations across the ammonia synthesis value chain.

Freedom-to-operate analyses reveal several white spaces in patent coverage, particularly in the integration of renewable energy sources with ammonia production systems and in the development of specialized catalysts for small-scale, distributed ammonia synthesis. These areas represent significant opportunities for new entrants to establish strong IP positions without directly challenging incumbent patent holders.

Recent patent activity reveals three primary innovation clusters: catalyst development, process optimization, and alternative synthesis methods. Catalyst patents focus on enhancing efficiency through novel materials such as ruthenium-based compounds, which demonstrate superior performance at lower temperatures and pressures compared to traditional iron catalysts. Process optimization patents address energy consumption reduction through improved reactor designs, heat recovery systems, and pressure management techniques.

The most disruptive patent cluster involves electrochemical and photocatalytic ammonia synthesis methods, which aim to operate under ambient conditions using renewable electricity. Companies like BASF, Thyssenkrupp, and Haldor Topsoe dominate traditional ammonia synthesis patents, while startups and research institutions lead in alternative synthesis technologies, creating a dynamic competitive landscape.

Geographically, patent filings show concentration in industrial centers across North America, Europe, and East Asia, with China emerging as the fastest-growing patent jurisdiction for ammonia synthesis innovations. This reflects the strategic importance of ammonia production technology in the global transition to green hydrogen economies and sustainable fertilizer production.

For companies entering this space, a strategic IP approach involves building defensive patent portfolios around specific technological improvements while navigating the extensive existing patent landscape. Cross-licensing agreements have become increasingly common as companies recognize the complementary nature of innovations across the ammonia synthesis value chain.

Freedom-to-operate analyses reveal several white spaces in patent coverage, particularly in the integration of renewable energy sources with ammonia production systems and in the development of specialized catalysts for small-scale, distributed ammonia synthesis. These areas represent significant opportunities for new entrants to establish strong IP positions without directly challenging incumbent patent holders.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!