What Material Advancements Aid Green Ammonia Processes

OCT 15, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Green Ammonia Technology Background and Objectives

Ammonia, a critical compound for fertilizer production and potentially a carbon-free energy carrier, has traditionally been manufactured through the Haber-Bosch process, which consumes approximately 1-2% of global energy and contributes significantly to greenhouse gas emissions. Green ammonia represents a paradigm shift in this industry, utilizing renewable energy sources and sustainable production methods to eliminate carbon emissions from the ammonia synthesis process.

The evolution of green ammonia technology has accelerated in the past decade, driven by increasing environmental concerns and the global push toward decarbonization. Initially focused on electrolysis-based hydrogen production coupled with traditional nitrogen fixation, the field has expanded to include direct electrochemical ammonia synthesis, photocatalytic processes, and biological nitrogen fixation methods.

Current technological trajectories indicate a convergence of materials science, electrochemistry, and catalysis research to overcome the fundamental challenges in green ammonia production. Advanced materials, particularly novel catalysts and electrolytes, are emerging as critical enablers for more efficient and economically viable processes.

The primary objective of green ammonia technology development is to achieve cost parity with conventional production methods while eliminating carbon emissions. This requires significant improvements in energy efficiency, catalyst performance, and system integration. Specifically, reducing the energy requirement below 8 MWh per ton of ammonia (compared to current 10-12 MWh) represents a key technical milestone.

Secondary objectives include developing scalable production systems that can be deployed in distributed configurations, enabling localized production closer to agricultural demand centers. This would reduce transportation emissions and improve energy security in regions dependent on ammonia imports.

Material advancements are central to achieving these objectives, with research focusing on several key areas: low-temperature catalysts that can operate efficiently under milder conditions than traditional iron catalysts; novel electrode materials for electrochemical ammonia synthesis with improved selectivity and faraday efficiency; and advanced membranes and separation technologies to enhance process efficiency.

The timeline for technological maturity suggests that laboratory-scale breakthroughs in materials science could translate to commercial viability within the next 5-10 years, with widespread adoption potentially occurring in the 2030-2040 timeframe as renewable energy costs continue to decline and carbon pricing mechanisms become more prevalent globally.

Ultimately, green ammonia technology aims to transform a carbon-intensive industrial process into a cornerstone of the sustainable economy, serving both as a key agricultural input and as a potential energy carrier in a decarbonized world. The success of this transformation hinges largely on continued advancements in materials science and process engineering.

The evolution of green ammonia technology has accelerated in the past decade, driven by increasing environmental concerns and the global push toward decarbonization. Initially focused on electrolysis-based hydrogen production coupled with traditional nitrogen fixation, the field has expanded to include direct electrochemical ammonia synthesis, photocatalytic processes, and biological nitrogen fixation methods.

Current technological trajectories indicate a convergence of materials science, electrochemistry, and catalysis research to overcome the fundamental challenges in green ammonia production. Advanced materials, particularly novel catalysts and electrolytes, are emerging as critical enablers for more efficient and economically viable processes.

The primary objective of green ammonia technology development is to achieve cost parity with conventional production methods while eliminating carbon emissions. This requires significant improvements in energy efficiency, catalyst performance, and system integration. Specifically, reducing the energy requirement below 8 MWh per ton of ammonia (compared to current 10-12 MWh) represents a key technical milestone.

Secondary objectives include developing scalable production systems that can be deployed in distributed configurations, enabling localized production closer to agricultural demand centers. This would reduce transportation emissions and improve energy security in regions dependent on ammonia imports.

Material advancements are central to achieving these objectives, with research focusing on several key areas: low-temperature catalysts that can operate efficiently under milder conditions than traditional iron catalysts; novel electrode materials for electrochemical ammonia synthesis with improved selectivity and faraday efficiency; and advanced membranes and separation technologies to enhance process efficiency.

The timeline for technological maturity suggests that laboratory-scale breakthroughs in materials science could translate to commercial viability within the next 5-10 years, with widespread adoption potentially occurring in the 2030-2040 timeframe as renewable energy costs continue to decline and carbon pricing mechanisms become more prevalent globally.

Ultimately, green ammonia technology aims to transform a carbon-intensive industrial process into a cornerstone of the sustainable economy, serving both as a key agricultural input and as a potential energy carrier in a decarbonized world. The success of this transformation hinges largely on continued advancements in materials science and process engineering.

Market Analysis for Green Ammonia Applications

The green ammonia market is experiencing significant growth driven by the global push towards decarbonization and sustainable energy solutions. Current market valuations place green ammonia at approximately $72 million in 2022, with projections indicating a compound annual growth rate (CAGR) of 72.9% through 2030, potentially reaching a market size of $7.6 billion. This exponential growth trajectory reflects the increasing recognition of green ammonia's versatility as both an energy carrier and a sustainable chemical feedstock.

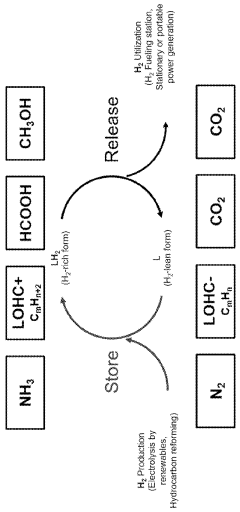

The agricultural sector remains the dominant application area, with green ammonia primarily utilized as a carbon-neutral fertilizer. This market segment accounts for roughly 80% of current ammonia consumption globally. However, emerging applications are rapidly diversifying the demand landscape. The energy sector is increasingly viewing green ammonia as a promising hydrogen carrier and carbon-free fuel, particularly for maritime shipping where direct electrification poses significant challenges.

Industrial decarbonization represents another substantial growth vector, with green ammonia offering pathways to reduce emissions in hard-to-abate sectors such as steel manufacturing and chemical production. Several major industrial players have announced pilot projects incorporating green ammonia as part of their carbon reduction strategies, signaling strong industrial interest.

Geographically, Europe leads in green ammonia project development, driven by stringent emissions regulations and substantial renewable energy investments. The European Union's Hydrogen Strategy explicitly identifies green ammonia as a key component in its decarbonization roadmap. Meanwhile, Australia and the Middle East are positioning themselves as potential export hubs, leveraging abundant renewable resources to produce green ammonia for international markets.

Market barriers include the significant cost differential between conventional and green ammonia production methods. Current production costs for green ammonia range between $900-1,600 per ton compared to $200-450 per ton for conventional ammonia. This price gap is expected to narrow as renewable electricity costs continue to decline and electrolyzer technologies mature.

Policy support mechanisms are emerging as critical market enablers. Carbon pricing schemes, renewable energy subsidies, and targeted green hydrogen incentives are creating favorable economic conditions in several regions. The implementation of carbon border adjustment mechanisms, particularly in Europe, is expected to further strengthen the competitive position of green ammonia against conventional alternatives.

Consumer demand for sustainable products is also driving market growth, with major agricultural companies and food producers increasingly seeking carbon-neutral inputs for their supply chains. This trend is expected to accelerate as corporate sustainability commitments mature and consumer awareness regarding agricultural emissions increases.

The agricultural sector remains the dominant application area, with green ammonia primarily utilized as a carbon-neutral fertilizer. This market segment accounts for roughly 80% of current ammonia consumption globally. However, emerging applications are rapidly diversifying the demand landscape. The energy sector is increasingly viewing green ammonia as a promising hydrogen carrier and carbon-free fuel, particularly for maritime shipping where direct electrification poses significant challenges.

Industrial decarbonization represents another substantial growth vector, with green ammonia offering pathways to reduce emissions in hard-to-abate sectors such as steel manufacturing and chemical production. Several major industrial players have announced pilot projects incorporating green ammonia as part of their carbon reduction strategies, signaling strong industrial interest.

Geographically, Europe leads in green ammonia project development, driven by stringent emissions regulations and substantial renewable energy investments. The European Union's Hydrogen Strategy explicitly identifies green ammonia as a key component in its decarbonization roadmap. Meanwhile, Australia and the Middle East are positioning themselves as potential export hubs, leveraging abundant renewable resources to produce green ammonia for international markets.

Market barriers include the significant cost differential between conventional and green ammonia production methods. Current production costs for green ammonia range between $900-1,600 per ton compared to $200-450 per ton for conventional ammonia. This price gap is expected to narrow as renewable electricity costs continue to decline and electrolyzer technologies mature.

Policy support mechanisms are emerging as critical market enablers. Carbon pricing schemes, renewable energy subsidies, and targeted green hydrogen incentives are creating favorable economic conditions in several regions. The implementation of carbon border adjustment mechanisms, particularly in Europe, is expected to further strengthen the competitive position of green ammonia against conventional alternatives.

Consumer demand for sustainable products is also driving market growth, with major agricultural companies and food producers increasingly seeking carbon-neutral inputs for their supply chains. This trend is expected to accelerate as corporate sustainability commitments mature and consumer awareness regarding agricultural emissions increases.

Current Material Challenges in Green Ammonia Production

Green ammonia production faces significant material challenges that currently limit its widespread adoption and commercial viability. The conventional Haber-Bosch process, while well-established, requires high temperatures (400-500°C) and pressures (150-300 bar), creating extreme operating conditions that demand specialized materials with exceptional durability and performance characteristics.

Catalyst materials represent the most critical challenge in green ammonia synthesis. Traditional iron-based catalysts used in the Haber-Bosch process exhibit limited activity at lower temperatures, necessitating the high energy inputs that make the process carbon-intensive. Ruthenium-based catalysts show better low-temperature performance but suffer from prohibitive costs and limited availability, restricting their industrial application.

Electrolyte materials for electrochemical ammonia synthesis face stability issues under operating conditions. Current solid electrolytes often degrade during extended operation, while liquid electrolytes struggle with ammonia solubility problems that reduce efficiency. The interface between electrolytes and electrodes frequently experiences degradation, leading to decreased performance over time.

Membrane materials used in separation processes exhibit insufficient selectivity for nitrogen and hydrogen, resulting in contamination issues that affect product purity. Additionally, these membranes demonstrate inadequate durability under the harsh conditions required for ammonia synthesis, leading to frequent replacement needs and increased operational costs.

Electrode materials for electrochemical approaches face significant challenges in nitrogen activation efficiency. Current materials show low faradaic efficiency and selectivity toward ammonia production, with competing hydrogen evolution reactions consuming substantial energy. The development of electrode materials that can selectively activate the nitrogen triple bond remains a fundamental challenge.

Storage and transport materials must withstand the corrosive nature of ammonia while maintaining structural integrity. Current metal alloys used in storage tanks and transport vessels experience stress corrosion cracking and hydrogen embrittlement, necessitating frequent inspections and replacements that add to operational costs.

Reactor materials must simultaneously withstand high pressures, elevated temperatures, and the corrosive effects of ammonia and potential intermediates. The development of cost-effective materials that can maintain performance under these conditions while allowing for process intensification remains an ongoing challenge in the field.

Catalyst materials represent the most critical challenge in green ammonia synthesis. Traditional iron-based catalysts used in the Haber-Bosch process exhibit limited activity at lower temperatures, necessitating the high energy inputs that make the process carbon-intensive. Ruthenium-based catalysts show better low-temperature performance but suffer from prohibitive costs and limited availability, restricting their industrial application.

Electrolyte materials for electrochemical ammonia synthesis face stability issues under operating conditions. Current solid electrolytes often degrade during extended operation, while liquid electrolytes struggle with ammonia solubility problems that reduce efficiency. The interface between electrolytes and electrodes frequently experiences degradation, leading to decreased performance over time.

Membrane materials used in separation processes exhibit insufficient selectivity for nitrogen and hydrogen, resulting in contamination issues that affect product purity. Additionally, these membranes demonstrate inadequate durability under the harsh conditions required for ammonia synthesis, leading to frequent replacement needs and increased operational costs.

Electrode materials for electrochemical approaches face significant challenges in nitrogen activation efficiency. Current materials show low faradaic efficiency and selectivity toward ammonia production, with competing hydrogen evolution reactions consuming substantial energy. The development of electrode materials that can selectively activate the nitrogen triple bond remains a fundamental challenge.

Storage and transport materials must withstand the corrosive nature of ammonia while maintaining structural integrity. Current metal alloys used in storage tanks and transport vessels experience stress corrosion cracking and hydrogen embrittlement, necessitating frequent inspections and replacements that add to operational costs.

Reactor materials must simultaneously withstand high pressures, elevated temperatures, and the corrosive effects of ammonia and potential intermediates. The development of cost-effective materials that can maintain performance under these conditions while allowing for process intensification remains an ongoing challenge in the field.

Current Material Solutions for Green Ammonia Processes

01 Catalyst materials for green ammonia synthesis

Advanced catalyst materials are crucial for efficient green ammonia production. These catalysts typically include transition metals, metal oxides, and novel nanostructured materials that can operate at lower temperatures and pressures than traditional Haber-Bosch catalysts. By enhancing the nitrogen reduction reaction kinetics, these catalysts significantly improve energy efficiency and reaction rates in ammonia synthesis processes, making green ammonia production more economically viable.- Advanced catalyst materials for green ammonia synthesis: Novel catalyst materials have been developed to enhance the efficiency of green ammonia production processes. These catalysts typically include transition metals, metal oxides, and composite materials that can operate at lower temperatures and pressures than traditional Haber-Bosch catalysts. The advanced materials significantly reduce the energy requirements for ammonia synthesis while maintaining high conversion rates and selectivity, making the overall process more environmentally friendly and economically viable.

- Renewable energy integration systems for ammonia production: Specialized materials and systems have been developed to effectively integrate renewable energy sources into ammonia production. These include advanced electrode materials for electrolyzers, energy storage components, and smart control systems that can handle the intermittent nature of renewable energy sources like solar and wind. The materials are designed to optimize energy conversion efficiency and ensure stable operation under fluctuating power conditions, enabling truly green ammonia production with minimal carbon footprint.

- Membrane and separation materials for ammonia synthesis: Innovative membrane and separation materials have been developed specifically for green ammonia production processes. These materials include selective permeable membranes, adsorbents, and separation media that can efficiently separate ammonia from reaction mixtures or purify hydrogen feedstock. The advanced materials enhance process efficiency by reducing energy consumption in separation steps and increasing overall yield, while also improving the purity of the final ammonia product.

- Electrochemical materials for direct ammonia synthesis: Novel electrochemical materials have been developed for direct electrochemical synthesis of ammonia from nitrogen and water. These materials include specialized electrocatalysts, electrode structures, and solid electrolytes that enable nitrogen reduction at ambient conditions. The electrochemical approach represents a paradigm shift from traditional thermochemical processes, potentially allowing for distributed, small-scale ammonia production using only renewable electricity, water, and air as inputs.

- Reactor and equipment materials for green ammonia production: Advanced materials for reactors and equipment used in green ammonia production have been developed to withstand the challenging conditions of various synthesis processes. These materials include corrosion-resistant alloys, composite structures, and specialized coatings that can maintain structural integrity under high pressure, temperature, or electrochemical stress. The improved material properties extend equipment lifespan, reduce maintenance requirements, and enhance safety in ammonia production facilities.

02 Electrochemical cell materials for ammonia production

Electrochemical synthesis of ammonia requires specialized materials for electrodes, membranes, and electrolytes. Recent advancements include novel electrode materials with high conductivity and selectivity, ion-exchange membranes that facilitate nitrogen reduction, and stable electrolytes that operate efficiently under various conditions. These materials enable ammonia production directly from nitrogen and water using renewable electricity, eliminating the need for hydrogen production as a separate step.Expand Specific Solutions03 Hydrogen storage and transport materials for ammonia production

Materials for efficient hydrogen storage and transport are essential components of green ammonia production systems. These include metal hydrides, advanced alloys, and composite materials that can safely store hydrogen at high densities. Additionally, specialized materials for pipelines, tanks, and other infrastructure components that can withstand the corrosive properties of ammonia are being developed. These materials help address one of the key challenges in the ammonia value chain by enabling safe and efficient hydrogen handling.Expand Specific Solutions04 Renewable energy integration materials

Materials that enable effective integration of renewable energy sources with ammonia production systems are critical for truly green ammonia. These include advanced materials for solar panels, wind turbines, and energy storage systems specifically designed to handle the intermittent nature of renewable energy. Additionally, smart materials and components that can dynamically adjust production parameters based on energy availability help optimize the overall efficiency of green ammonia production facilities.Expand Specific Solutions05 Membrane and separation materials

Advanced membrane and separation materials play a crucial role in improving the efficiency of green ammonia production. These materials include selective gas separation membranes that can efficiently separate nitrogen from air, hydrogen purification membranes, and ammonia separation materials. Novel polymer composites, ceramic materials, and metal-organic frameworks with precisely engineered pore structures enable more energy-efficient separation processes, reducing the overall energy footprint of ammonia production.Expand Specific Solutions

Key Industry Players in Green Ammonia Development

The green ammonia market is currently in an early growth phase, characterized by rapid technological innovation and increasing commercial interest due to decarbonization imperatives. The global market size is projected to expand significantly, driven by applications in energy storage, transportation, and agriculture. From a technological maturity perspective, the landscape shows varied development stages across key players. Industry leaders like Topsoe A/S and Casale SA have established commercial-scale technologies, while AMOGY, Inc. is advancing ammonia-powered transportation solutions. Academic institutions including Peking University and Fuzhou University are contributing fundamental research on novel catalysts. Companies like BASF Corp. and Wacker Chemie AG are leveraging their chemical expertise to develop material innovations that enhance efficiency and reduce costs. The ecosystem also includes specialized players such as Stamicarbon BV focusing on production technologies and Ductor Oy developing biological ammonia production methods.

Casale SA

Technical Solution: Casale has developed the "Casale Green Ammonia" technology platform that revolutionizes renewable ammonia production through several key innovations. Their system employs a proprietary magnetite-based catalyst with specific surface area exceeding 200 m²/g that demonstrates exceptional activity at lower temperatures (380-420°C) and pressures (80-100 bar). The catalyst incorporates cobalt and potassium promoters in precisely controlled ratios that enhance nitrogen activation while maintaining resistance to oxygen poisoning from variable renewable hydrogen sources. Casale's reactor design features a gradient bed configuration with optimized heat exchange that reduces energy consumption by approximately 20-25% compared to conventional systems. Their process incorporates an advanced pressure swing adsorption system for hydrogen purification that achieves 99.999% purity while recovering over 90% of feed gas. The company has implemented sophisticated digital twin technology for real-time process optimization, allowing their systems to adapt to renewable energy availability with response times under 5 minutes. Casale's modular skid-mounted design enables rapid deployment with 40% reduced installation time compared to traditional ammonia plants.

Strengths: Highly optimized catalyst system specifically designed for renewable operation; excellent process integration and heat recovery; advanced digital control systems; modular design enabling distributed production models. Weaknesses: Technology requires precise control parameters that may be challenging in some renewable contexts; catalyst system still susceptible to certain contaminants; higher upfront engineering costs compared to standardized conventional designs.

Topsoe A/S

Technical Solution: Topsoe has developed the Haldor Topsoe SynCOR Ammonia™ process, a revolutionary green ammonia production technology that integrates renewable hydrogen with their proprietary solid oxide electrolyzer cells (SOEC). Their system achieves energy efficiency up to 88% when coupled with waste heat recovery systems, significantly higher than conventional processes. The technology employs advanced catalysts containing ruthenium and iron that operate at lower temperatures (350-450°C) compared to traditional Haber-Bosch processes (450-500°C), reducing energy requirements by approximately 20-30%. Topsoe's dynamic load response capability allows their system to effectively utilize intermittent renewable energy sources, with their plants able to ramp production from 10% to 100% capacity within 30 minutes. Their SOEC technology operates at high temperatures (700-850°C), enabling direct steam electrolysis with electricity consumption approximately 30% lower than conventional alkaline or PEM electrolyzers.

Strengths: Industry-leading energy efficiency; advanced catalyst technology reducing temperature requirements; excellent dynamic load response for renewable integration; proven commercial-scale implementation. Weaknesses: Higher initial capital investment compared to conventional systems; requires specialized materials that may face supply chain constraints; technology still requires some fossil inputs for optimal performance.

Critical Materials Research for Ammonia Catalysis

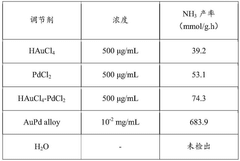

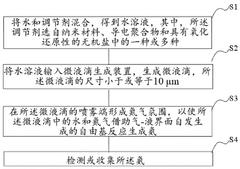

Method for preparing green ammonia on basis of microdroplet gas-liquid interface confined catalytic reaction of water and nitrogen gas

PatentWO2024244033A1

Innovation

- Using a limited-domain catalytic reaction of micro droplet gas-liquid interface based on water and nitrogen, water and nitrogen are self-generated at the gas-liquid interface through a micro droplet generation device, chloramide is directly prepared, and nanomaterials and conductive polymerization are used. The substance acts as a regulator to improve the reaction efficiency.

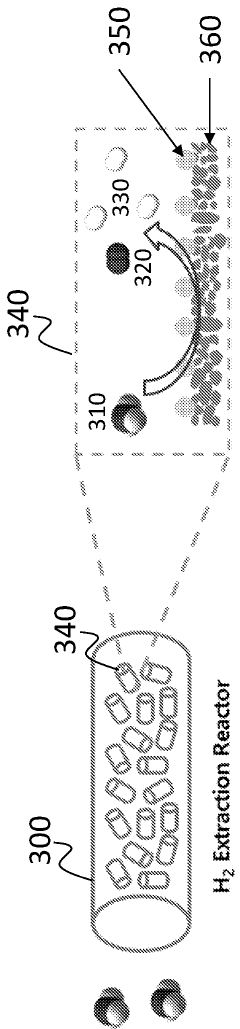

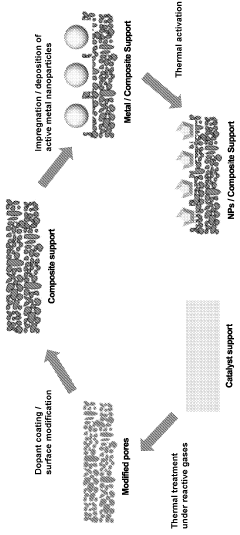

Systems and methods for processing ammonia

PatentWO2024107770A1

Innovation

- Development of improved catalyst materials with modified pore structures and active metal nanoparticle morphologies, combined with specific surface chemistries and support-metal interactions, which enhance dispersion, thermal stability, and heat transfer rates, allowing for efficient ammonia decomposition at lower temperatures with reduced active metal content.

Environmental Impact Assessment of Green Ammonia Production

The environmental impact assessment of green ammonia production reveals significant advantages over conventional methods. Green ammonia production, leveraging renewable energy sources and advanced catalytic materials, demonstrates substantially lower greenhouse gas emissions compared to traditional Haber-Bosch processes. Life cycle assessments indicate potential carbon emission reductions of 80-90% when utilizing wind or solar power coupled with electrolysis for hydrogen production.

Material advancements have played a crucial role in enhancing the environmental profile of green ammonia synthesis. Novel catalysts containing ruthenium, iron, and nickel-based compounds have reduced the energy intensity of the nitrogen reduction reaction, thereby decreasing the overall carbon footprint. These catalysts operate at lower temperatures and pressures than conventional systems, resulting in diminished energy requirements and associated emissions.

Water consumption represents another critical environmental consideration. Traditional ammonia production consumes approximately 3-4 cubic meters of water per ton of ammonia produced. Advanced membrane materials and water recycling systems integrated into green ammonia facilities have demonstrated potential water usage reductions of up to 40%, addressing concerns in water-stressed regions where production facilities might be located.

Land use impacts vary significantly based on the renewable energy source powering green ammonia production. Solar-powered facilities require approximately 5-10 hectares per megawatt of capacity, while wind-powered alternatives necessitate 0.3-1 hectare per megawatt. This land requirement must be balanced against the environmental benefits, particularly when considering conversion of natural habitats or agricultural land.

Regarding air quality impacts, green ammonia production virtually eliminates SOx and NOx emissions associated with fossil fuel combustion in conventional processes. However, potential ammonia leakage during production, storage, and transportation requires robust monitoring and containment systems to prevent localized air quality degradation and nitrogen deposition in sensitive ecosystems.

Waste generation from catalyst production and replacement represents a secondary environmental concern. Recent developments in catalyst design have extended operational lifetimes from 3-5 years to 7-10 years, reducing waste streams. Additionally, emerging recycling technologies can recover up to 85% of precious metals from spent catalysts, further minimizing environmental impacts associated with mining and processing of these materials.

The environmental benefits of green ammonia extend beyond production to end-use applications. When utilized as a carbon-free fuel or hydrogen carrier, green ammonia contributes to decarbonization across multiple sectors, creating cascading environmental benefits throughout its value chain.

Material advancements have played a crucial role in enhancing the environmental profile of green ammonia synthesis. Novel catalysts containing ruthenium, iron, and nickel-based compounds have reduced the energy intensity of the nitrogen reduction reaction, thereby decreasing the overall carbon footprint. These catalysts operate at lower temperatures and pressures than conventional systems, resulting in diminished energy requirements and associated emissions.

Water consumption represents another critical environmental consideration. Traditional ammonia production consumes approximately 3-4 cubic meters of water per ton of ammonia produced. Advanced membrane materials and water recycling systems integrated into green ammonia facilities have demonstrated potential water usage reductions of up to 40%, addressing concerns in water-stressed regions where production facilities might be located.

Land use impacts vary significantly based on the renewable energy source powering green ammonia production. Solar-powered facilities require approximately 5-10 hectares per megawatt of capacity, while wind-powered alternatives necessitate 0.3-1 hectare per megawatt. This land requirement must be balanced against the environmental benefits, particularly when considering conversion of natural habitats or agricultural land.

Regarding air quality impacts, green ammonia production virtually eliminates SOx and NOx emissions associated with fossil fuel combustion in conventional processes. However, potential ammonia leakage during production, storage, and transportation requires robust monitoring and containment systems to prevent localized air quality degradation and nitrogen deposition in sensitive ecosystems.

Waste generation from catalyst production and replacement represents a secondary environmental concern. Recent developments in catalyst design have extended operational lifetimes from 3-5 years to 7-10 years, reducing waste streams. Additionally, emerging recycling technologies can recover up to 85% of precious metals from spent catalysts, further minimizing environmental impacts associated with mining and processing of these materials.

The environmental benefits of green ammonia extend beyond production to end-use applications. When utilized as a carbon-free fuel or hydrogen carrier, green ammonia contributes to decarbonization across multiple sectors, creating cascading environmental benefits throughout its value chain.

Economic Viability of Novel Material Implementation

The economic viability of implementing novel materials in green ammonia production processes represents a critical factor in the technology's commercial adoption. Current cost analyses indicate that green ammonia production using conventional electrolysis and Haber-Bosch processes remains 2-4 times more expensive than traditional fossil fuel-based methods, primarily due to high renewable electricity costs and capital expenditure requirements for specialized equipment.

Novel catalyst materials, particularly those incorporating ruthenium, cobalt, and iron-based compounds, demonstrate potential for significant cost reduction. Economic modeling suggests that advanced ruthenium-based catalysts could reduce energy requirements by up to 30% compared to conventional iron catalysts, translating to operational expenditure savings of approximately $50-75 per ton of ammonia produced. However, the initial investment in these materials presents a substantial barrier, with current production costs for specialized nanocatalysts ranging from $5,000-20,000 per kilogram.

Scale-up economics present both challenges and opportunities. Laboratory-scale synthesis of novel materials often employs expensive precursors and energy-intensive processes that become prohibitively expensive at industrial scales. Recent advancements in continuous flow manufacturing techniques for nanomaterials show promise for reducing production costs by 40-60% when scaled to multi-ton quantities, potentially bringing material costs within commercially viable ranges within 3-5 years.

Life-cycle cost assessments reveal that while initial implementation costs for novel materials may be high, their extended operational lifetimes and improved efficiency can result in favorable total cost of ownership. For instance, metal-organic framework (MOF) catalysts demonstrate degradation rates 50-70% lower than conventional catalysts, potentially extending replacement cycles from 3-5 years to 7-10 years.

Government incentives and carbon pricing mechanisms significantly impact economic viability calculations. In regions with carbon taxes exceeding $50 per ton CO2-equivalent, the economic case for novel material implementation strengthens considerably. Modeling indicates that with carbon pricing at $75-100 per ton, green ammonia production using advanced materials could achieve cost parity with conventional methods by 2027-2030.

Investment recovery periods currently range from 5-8 years for most novel material implementations in ammonia production, exceeding the 2-3 year threshold typically sought by industrial investors. However, declining renewable electricity costs combined with improving material performance and manufacturing efficiencies are projected to reduce this payback period to 3-4 years by 2025, potentially catalyzing widespread industrial adoption.

Novel catalyst materials, particularly those incorporating ruthenium, cobalt, and iron-based compounds, demonstrate potential for significant cost reduction. Economic modeling suggests that advanced ruthenium-based catalysts could reduce energy requirements by up to 30% compared to conventional iron catalysts, translating to operational expenditure savings of approximately $50-75 per ton of ammonia produced. However, the initial investment in these materials presents a substantial barrier, with current production costs for specialized nanocatalysts ranging from $5,000-20,000 per kilogram.

Scale-up economics present both challenges and opportunities. Laboratory-scale synthesis of novel materials often employs expensive precursors and energy-intensive processes that become prohibitively expensive at industrial scales. Recent advancements in continuous flow manufacturing techniques for nanomaterials show promise for reducing production costs by 40-60% when scaled to multi-ton quantities, potentially bringing material costs within commercially viable ranges within 3-5 years.

Life-cycle cost assessments reveal that while initial implementation costs for novel materials may be high, their extended operational lifetimes and improved efficiency can result in favorable total cost of ownership. For instance, metal-organic framework (MOF) catalysts demonstrate degradation rates 50-70% lower than conventional catalysts, potentially extending replacement cycles from 3-5 years to 7-10 years.

Government incentives and carbon pricing mechanisms significantly impact economic viability calculations. In regions with carbon taxes exceeding $50 per ton CO2-equivalent, the economic case for novel material implementation strengthens considerably. Modeling indicates that with carbon pricing at $75-100 per ton, green ammonia production using advanced materials could achieve cost parity with conventional methods by 2027-2030.

Investment recovery periods currently range from 5-8 years for most novel material implementations in ammonia production, exceeding the 2-3 year threshold typically sought by industrial investors. However, declining renewable electricity costs combined with improving material performance and manufacturing efficiencies are projected to reduce this payback period to 3-4 years by 2025, potentially catalyzing widespread industrial adoption.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!