Amorphous Metals: Cross-Section of Industry and Material Science

OCT 1, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Amorphous Metals Evolution and Research Objectives

Amorphous metals, also known as metallic glasses, represent a revolutionary class of materials that defy conventional crystalline structures found in traditional metals. Since their discovery in the 1960s at Caltech, these materials have evolved from laboratory curiosities to engineered materials with significant industrial potential. The historical trajectory of amorphous metals began with rapid quenching techniques that could only produce thin ribbons, but has now advanced to bulk metallic glasses (BMGs) that can be formed in larger dimensions.

The fundamental characteristic that defines amorphous metals is their disordered atomic structure, which results from rapid cooling that prevents atoms from arranging into ordered crystalline patterns. This unique structure confers exceptional properties including high strength, elasticity, corrosion resistance, and soft magnetic behavior that exceed those of their crystalline counterparts. These properties have positioned amorphous metals at the intersection of materials science innovation and industrial application.

Current research objectives in the field focus on several key areas. First, expanding the compositional range of bulk metallic glasses to develop new alloy systems with enhanced glass-forming ability and tailored properties. Second, overcoming the size limitations that still restrict many amorphous metals to relatively small dimensions compared to conventional metals. Third, addressing the inherent brittleness that limits structural applications, particularly through the development of composite structures that combine the strength of amorphous phases with the ductility of crystalline phases.

Another critical research direction involves understanding the fundamental mechanisms of glass formation and deformation at the atomic level. Advanced characterization techniques, including synchrotron X-ray diffraction and atom probe tomography, are being employed to probe the short and medium-range order in these materials, providing insights that can guide alloy design and processing optimization.

From an industrial perspective, research aims to develop cost-effective manufacturing processes that can scale production beyond specialty applications. This includes innovations in casting, thermoplastic forming, and additive manufacturing techniques specifically adapted for amorphous metals. The goal is to bridge the gap between laboratory discoveries and commercial viability.

The convergence of computational materials science with experimental approaches represents another frontier, with machine learning algorithms increasingly being applied to predict glass-forming compositions and properties. This data-driven approach promises to accelerate discovery and optimization of new amorphous metal systems while reducing the empirical trial-and-error traditionally required.

Overall, the evolution of amorphous metals research reflects a maturation from fundamental science to application-driven development, with objectives increasingly focused on addressing specific industrial needs while continuing to expand the theoretical understanding of these unique materials.

The fundamental characteristic that defines amorphous metals is their disordered atomic structure, which results from rapid cooling that prevents atoms from arranging into ordered crystalline patterns. This unique structure confers exceptional properties including high strength, elasticity, corrosion resistance, and soft magnetic behavior that exceed those of their crystalline counterparts. These properties have positioned amorphous metals at the intersection of materials science innovation and industrial application.

Current research objectives in the field focus on several key areas. First, expanding the compositional range of bulk metallic glasses to develop new alloy systems with enhanced glass-forming ability and tailored properties. Second, overcoming the size limitations that still restrict many amorphous metals to relatively small dimensions compared to conventional metals. Third, addressing the inherent brittleness that limits structural applications, particularly through the development of composite structures that combine the strength of amorphous phases with the ductility of crystalline phases.

Another critical research direction involves understanding the fundamental mechanisms of glass formation and deformation at the atomic level. Advanced characterization techniques, including synchrotron X-ray diffraction and atom probe tomography, are being employed to probe the short and medium-range order in these materials, providing insights that can guide alloy design and processing optimization.

From an industrial perspective, research aims to develop cost-effective manufacturing processes that can scale production beyond specialty applications. This includes innovations in casting, thermoplastic forming, and additive manufacturing techniques specifically adapted for amorphous metals. The goal is to bridge the gap between laboratory discoveries and commercial viability.

The convergence of computational materials science with experimental approaches represents another frontier, with machine learning algorithms increasingly being applied to predict glass-forming compositions and properties. This data-driven approach promises to accelerate discovery and optimization of new amorphous metal systems while reducing the empirical trial-and-error traditionally required.

Overall, the evolution of amorphous metals research reflects a maturation from fundamental science to application-driven development, with objectives increasingly focused on addressing specific industrial needs while continuing to expand the theoretical understanding of these unique materials.

Market Applications and Industry Demand Analysis

Amorphous metals, also known as metallic glasses, have witnessed significant market growth over the past decade due to their exceptional mechanical, magnetic, and corrosion-resistant properties. The global market for amorphous metals was valued at approximately $1.2 billion in 2022 and is projected to reach $2.5 billion by 2028, representing a compound annual growth rate of 12.8%. This growth trajectory is primarily driven by increasing demand across multiple industrial sectors.

The electronics industry represents the largest application segment, accounting for nearly 35% of the total market share. Amorphous metal transformers and inductors are highly sought after due to their superior energy efficiency, with power losses reduced by up to 80% compared to conventional silicon steel alternatives. This efficiency translates to substantial energy savings in power distribution systems, aligning with global sustainability initiatives and regulatory requirements for reduced carbon emissions.

Aerospace and defense sectors have emerged as rapidly growing markets for amorphous metals, with applications in structural components, sensors, and specialized equipment. The exceptional strength-to-weight ratio and resistance to extreme environments make these materials particularly valuable for mission-critical applications where performance reliability is paramount.

Medical device manufacturing represents another high-growth application area, with amorphous metals being increasingly utilized in implantable devices, surgical instruments, and diagnostic equipment. The biocompatibility and corrosion resistance of certain amorphous metal compositions have opened new possibilities for long-term implantable devices with reduced rejection risks.

Regional market analysis indicates that Asia-Pacific currently dominates the amorphous metals market, accounting for approximately 45% of global consumption. This is primarily attributed to the region's robust electronics manufacturing base and increasing industrial automation. North America and Europe follow with 30% and 20% market shares respectively, with particular strength in high-value applications within aerospace, defense, and medical sectors.

Industry surveys indicate that over 70% of materials engineers and product designers across various sectors express interest in incorporating amorphous metals into future product designs, citing performance advantages as the primary motivation. However, cost considerations remain a significant barrier to wider adoption, with 65% of potential users identifying high production costs as the main limiting factor.

The market demand is further shaped by emerging applications in renewable energy systems, particularly in wind turbine components and solar power infrastructure, where the unique magnetic properties and corrosion resistance of amorphous metals offer substantial performance improvements over conventional materials.

The electronics industry represents the largest application segment, accounting for nearly 35% of the total market share. Amorphous metal transformers and inductors are highly sought after due to their superior energy efficiency, with power losses reduced by up to 80% compared to conventional silicon steel alternatives. This efficiency translates to substantial energy savings in power distribution systems, aligning with global sustainability initiatives and regulatory requirements for reduced carbon emissions.

Aerospace and defense sectors have emerged as rapidly growing markets for amorphous metals, with applications in structural components, sensors, and specialized equipment. The exceptional strength-to-weight ratio and resistance to extreme environments make these materials particularly valuable for mission-critical applications where performance reliability is paramount.

Medical device manufacturing represents another high-growth application area, with amorphous metals being increasingly utilized in implantable devices, surgical instruments, and diagnostic equipment. The biocompatibility and corrosion resistance of certain amorphous metal compositions have opened new possibilities for long-term implantable devices with reduced rejection risks.

Regional market analysis indicates that Asia-Pacific currently dominates the amorphous metals market, accounting for approximately 45% of global consumption. This is primarily attributed to the region's robust electronics manufacturing base and increasing industrial automation. North America and Europe follow with 30% and 20% market shares respectively, with particular strength in high-value applications within aerospace, defense, and medical sectors.

Industry surveys indicate that over 70% of materials engineers and product designers across various sectors express interest in incorporating amorphous metals into future product designs, citing performance advantages as the primary motivation. However, cost considerations remain a significant barrier to wider adoption, with 65% of potential users identifying high production costs as the main limiting factor.

The market demand is further shaped by emerging applications in renewable energy systems, particularly in wind turbine components and solar power infrastructure, where the unique magnetic properties and corrosion resistance of amorphous metals offer substantial performance improvements over conventional materials.

Global Development Status and Technical Barriers

Amorphous metals, also known as metallic glasses, have witnessed significant global development over the past few decades. The United States, Japan, and several European countries have established themselves as pioneers in this field, with substantial research investments and industrial applications. The U.S. has focused primarily on defense and aerospace applications, leveraging the unique properties of amorphous metals for specialized components. Japan has excelled in consumer electronics and precision instruments, while European research centers have concentrated on automotive and industrial applications.

China has emerged as a rapidly growing player in the amorphous metals sector, with increasing research output and patent filings. The country has made substantial investments in manufacturing capabilities, particularly for amorphous metal transformers and electronic components. South Korea has carved a niche in applying these materials to consumer electronics and medical devices, demonstrating impressive innovation in miniaturization.

Despite this global progress, several significant technical barriers continue to impede the widespread adoption of amorphous metals. The most fundamental challenge remains the critical cooling rate requirement. To achieve the amorphous structure, molten metal must be cooled extremely rapidly (typically 10^4-10^6 K/s), which severely limits the maximum thickness of components that can be produced. This "critical thickness" constraint restricts many potential industrial applications.

Manufacturing scalability presents another major hurdle. Current production methods for amorphous metals, such as melt spinning and rapid solidification processing, are difficult to scale up for mass production while maintaining consistent material properties. This results in higher production costs compared to conventional crystalline metals, limiting commercial viability for many applications.

Material brittleness is a persistent issue for many amorphous metal compositions. While these materials exhibit exceptional strength, their limited ductility and fracture toughness restrict their use in applications requiring plastic deformation or impact resistance. Researchers worldwide are exploring various compositional modifications and processing techniques to address this limitation.

The joining and machining of amorphous metals present additional technical challenges. Conventional welding and machining processes often induce crystallization, negating the beneficial properties of the amorphous structure. This necessitates the development of specialized processing techniques, which further increases manufacturing complexity and cost.

Long-term stability concerns also exist, as some amorphous metals can undergo structural relaxation or crystallization over time, particularly at elevated temperatures. This potential for property degradation creates uncertainty regarding the long-term reliability of components in demanding applications.

China has emerged as a rapidly growing player in the amorphous metals sector, with increasing research output and patent filings. The country has made substantial investments in manufacturing capabilities, particularly for amorphous metal transformers and electronic components. South Korea has carved a niche in applying these materials to consumer electronics and medical devices, demonstrating impressive innovation in miniaturization.

Despite this global progress, several significant technical barriers continue to impede the widespread adoption of amorphous metals. The most fundamental challenge remains the critical cooling rate requirement. To achieve the amorphous structure, molten metal must be cooled extremely rapidly (typically 10^4-10^6 K/s), which severely limits the maximum thickness of components that can be produced. This "critical thickness" constraint restricts many potential industrial applications.

Manufacturing scalability presents another major hurdle. Current production methods for amorphous metals, such as melt spinning and rapid solidification processing, are difficult to scale up for mass production while maintaining consistent material properties. This results in higher production costs compared to conventional crystalline metals, limiting commercial viability for many applications.

Material brittleness is a persistent issue for many amorphous metal compositions. While these materials exhibit exceptional strength, their limited ductility and fracture toughness restrict their use in applications requiring plastic deformation or impact resistance. Researchers worldwide are exploring various compositional modifications and processing techniques to address this limitation.

The joining and machining of amorphous metals present additional technical challenges. Conventional welding and machining processes often induce crystallization, negating the beneficial properties of the amorphous structure. This necessitates the development of specialized processing techniques, which further increases manufacturing complexity and cost.

Long-term stability concerns also exist, as some amorphous metals can undergo structural relaxation or crystallization over time, particularly at elevated temperatures. This potential for property degradation creates uncertainty regarding the long-term reliability of components in demanding applications.

Current Manufacturing Processes and Methods

01 Manufacturing methods for amorphous metals

Various manufacturing techniques are employed to produce amorphous metals, including rapid solidification processes that prevent crystallization. These methods involve cooling molten metal at extremely high rates to maintain the disordered atomic structure characteristic of amorphous metals. Techniques such as melt spinning, gas atomization, and other specialized cooling processes are used to achieve the necessary cooling rates for forming these materials with unique structural properties.- Manufacturing processes for amorphous metals: Various manufacturing processes can be employed to produce amorphous metals, including rapid solidification techniques that prevent crystallization. These methods involve cooling molten metal at extremely high rates to bypass crystal formation, resulting in a disordered atomic structure. Common techniques include melt spinning, splat quenching, and gas atomization. The processing parameters such as cooling rate and composition significantly influence the final properties of the amorphous metal products.

- Composition and alloying elements in amorphous metals: The composition of amorphous metals typically includes specific combinations of elements that enhance glass-forming ability. These alloys often contain transition metals (such as Fe, Ni, Co) combined with metalloids (such as B, Si, P) and sometimes rare earth elements. The precise ratio of these elements determines critical properties including glass transition temperature, thermal stability, and mechanical characteristics. Certain compositions exhibit superior glass-forming ability, allowing for the production of bulk amorphous metals with larger dimensions.

- Mechanical and physical properties of amorphous metals: Amorphous metals exhibit unique mechanical and physical properties due to their lack of crystalline structure. These materials typically demonstrate high strength, hardness, and elastic limits compared to their crystalline counterparts. They also show excellent corrosion resistance, unique magnetic properties, and superior wear resistance. The absence of grain boundaries contributes to their exceptional mechanical behavior, though they may exhibit limited ductility at room temperature. Their elastic modulus and thermal expansion characteristics differ significantly from conventional crystalline metals.

- Applications of amorphous metals in various industries: Amorphous metals find applications across numerous industries due to their exceptional properties. They are used in transformer cores and magnetic devices due to their soft magnetic properties and low core losses. Their high strength-to-weight ratio makes them suitable for sporting goods like golf club heads and tennis rackets. In the medical field, they serve as biocompatible implants. Their corrosion resistance is valuable for protective coatings, while their unique properties enable applications in electronic devices, sensors, and aerospace components.

- Thermal stability and crystallization behavior: The thermal stability of amorphous metals is a critical characteristic that determines their practical applications. These materials exist in a metastable state and will crystallize when heated above their crystallization temperature. The crystallization process typically occurs through nucleation and growth mechanisms, which can be studied using thermal analysis techniques. Understanding and controlling this behavior is essential for applications involving elevated temperatures. Various methods, including the addition of specific elements, can enhance thermal stability by increasing the temperature gap between glass transition and crystallization.

02 Composition and alloying of amorphous metals

The composition of amorphous metals significantly affects their properties and glass-forming ability. Various alloying elements are used to create amorphous metal systems with enhanced stability and performance characteristics. These alloys often contain combinations of transition metals, rare earth elements, and metalloids in specific proportions to promote glass formation and improve mechanical, magnetic, or corrosion resistance properties. The selection of alloying elements is crucial for tailoring amorphous metals for specific applications.Expand Specific Solutions03 Mechanical properties and applications of amorphous metals

Amorphous metals exhibit exceptional mechanical properties including high strength, hardness, elasticity, and wear resistance due to their lack of crystalline structure and grain boundaries. These unique properties make them suitable for various applications such as cutting tools, sporting equipment, electronic casings, and structural components. Their combination of strength and elasticity allows for applications where both durability and flexibility are required, offering advantages over conventional crystalline metals in specific use cases.Expand Specific Solutions04 Magnetic properties of amorphous metals

Amorphous metals often possess superior soft magnetic properties compared to their crystalline counterparts, including high permeability, low coercivity, and reduced core losses. These characteristics make them particularly valuable in electrical and electronic applications such as transformers, inductors, magnetic shields, and sensors. The absence of magnetocrystalline anisotropy in amorphous structures contributes to their excellent magnetic performance, enabling more efficient energy conversion and improved device performance.Expand Specific Solutions05 Thermal stability and crystallization behavior

The thermal stability of amorphous metals is a critical factor affecting their practical applications. These materials exist in a metastable state and can crystallize when exposed to elevated temperatures. Research focuses on understanding and controlling crystallization behavior, developing methods to enhance thermal stability, and creating partially crystallized structures (nanocrystalline materials) with optimized properties. Heat treatment processes are often employed to tailor the microstructure and properties of amorphous metals for specific applications.Expand Specific Solutions

Leading Companies and Research Institutions

Amorphous metals represent a dynamic intersection of materials science and industrial applications, currently in a growth phase with an estimated market size of $500 million and projected annual growth of 10-15%. The technology is transitioning from early commercialization to broader industrial adoption, with varying degrees of maturity across applications. Leading players demonstrate different specialization levels: established manufacturers like Heraeus Amloy Technologies and VACUUMSCHMELZE focus on commercial production; BYD and Samsung explore applications in energy storage and electronics; while research institutions including MIT, Zhejiang University, and National Institute for Materials Science drive fundamental innovation. Academic-industrial partnerships are accelerating development, with companies like Schaeffler and Siemens investing in application-specific implementations to capitalize on amorphous metals' unique mechanical and magnetic properties.

VACUUMSCHMELZE GmbH & Co. KG

Technical Solution: VACUUMSCHMELZE has developed proprietary VITROPERM® and NANOPERM® amorphous metal alloys specifically engineered for high-performance magnetic applications. Their technology involves rapid solidification processes where molten metal is cooled at rates exceeding 1 million degrees per second to create ribbon-like amorphous structures. These materials undergo precise annealing treatments to develop nanocrystalline structures within the amorphous matrix, resulting in exceptional soft magnetic properties. VACUUMSCHMELZE's amorphous metals demonstrate permeability values up to 150,000 and saturation flux densities reaching 1.2 Tesla, with core losses reduced by up to 80% compared to conventional silicon steel. Their manufacturing process includes specialized casting techniques and controlled atmosphere processing to ensure consistent material properties across production batches.

Strengths: Industry-leading magnetic performance with extremely low core losses, enabling highly efficient power transformers and inductors. Their established manufacturing infrastructure allows for consistent large-scale production. Weaknesses: Higher production costs compared to conventional materials, and limited formability restricts certain application geometries.

National Institute for Materials Science IAI

Technical Solution: NIMS has developed advanced melt-spinning techniques for producing amorphous metal ribbons with precisely controlled thicknesses ranging from 20-50 micrometers. Their research focuses on iron-based amorphous alloys containing strategic additions of boron, silicon, phosphorus and rare earth elements to enhance glass-forming ability and functional properties. NIMS has pioneered the development of Fe-Si-B-P-Cu amorphous alloys that demonstrate saturation magnetization exceeding 1.8 Tesla while maintaining low coercivity values below 2 A/m. Their materials science approach includes atomic-scale characterization using advanced synchrotron radiation techniques to understand short-range ordering phenomena in amorphous structures. NIMS researchers have established correlations between processing parameters, structural relaxation behaviors, and resulting mechanical/magnetic properties, enabling tailored material development for specific applications.

Strengths: World-class research capabilities with access to advanced characterization facilities enable fundamental understanding of amorphous metal physics. Their focus on earth-abundant elements creates more sustainable and economically viable amorphous alloys. Weaknesses: As a research institute, NIMS faces challenges in scaling technologies to industrial production volumes, and their materials often require further engineering for commercial applications.

Key Patents and Scientific Breakthroughs

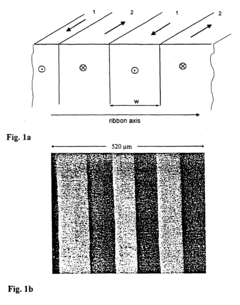

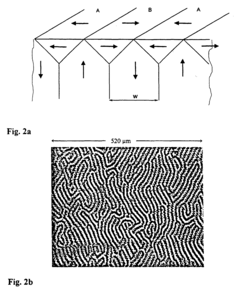

A method of annealing amorphous ribbons and marker for electronic article surveillance

PatentInactiveEP1031121B1

Innovation

- A method of annealing amorphous ferromagnetic metal alloys in a magnetic field with a significant component out of the ribbon plane, inducing an oblique anisotropy that reduces eddy current losses and enhances resonant frequency stability, by applying a magnetic field at an angle between 60° and 89° with respect to the ribbon width, and adjusting the annealing temperature and time to achieve a fine domain structure with domain widths less than 40µm.

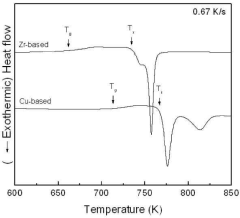

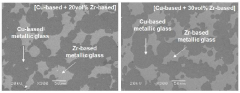

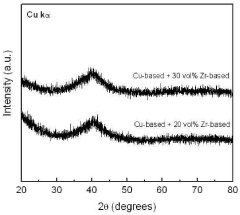

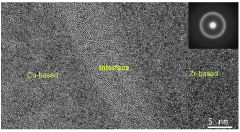

Complex amorphous metallic material and method for manufacturing complex amorphous metallic material

PatentInactiveKR1020140058005A

Innovation

- A composite amorphous metal material is created by mixing two or more amorphous phases with a common supercooled liquid phase region, processed in that temperature range to form a stable and dense interface, using Cu-based and Zr-based amorphous metal materials.

Environmental Impact and Sustainability Factors

Amorphous metals, also known as metallic glasses, present significant environmental advantages compared to their crystalline counterparts. The production of these materials typically requires less energy than conventional metals due to their lower melting points and single-step casting processes. This energy efficiency translates directly to reduced carbon emissions during manufacturing, positioning amorphous metals as potentially more environmentally friendly alternatives in various industrial applications.

The recyclability of amorphous metals represents another important sustainability factor. Unlike many composite materials that pose recycling challenges, amorphous metals can be remelted and reformed without significant degradation of their unique properties. This characteristic supports circular economy principles and reduces the demand for virgin raw materials, thereby decreasing the environmental footprint associated with mining and ore processing activities.

From a lifecycle perspective, the exceptional corrosion resistance of amorphous metals contributes significantly to their sustainability profile. Products manufactured using these materials typically exhibit extended service lives, reducing replacement frequency and associated resource consumption. This durability factor is particularly valuable in marine environments and chemical processing applications where conventional materials often require frequent replacement due to corrosion damage.

The magnetic properties of certain amorphous metal compositions enable the development of more efficient electrical transformers and motors. These components demonstrate reduced core losses compared to silicon steel alternatives, resulting in energy savings during operation. Studies indicate that amorphous metal transformers can achieve efficiency improvements of 40-80% compared to conventional designs, representing substantial energy conservation potential across power distribution networks globally.

However, challenges remain regarding the environmental impact of certain rare elements often incorporated in amorphous metal formulations. Elements such as beryllium, used in some compositions to enhance glass-forming ability, present toxicity concerns during production and end-of-life processing. The industry is actively researching alternative formulations that maintain desirable properties while eliminating environmentally problematic constituents.

Water usage in amorphous metal production presents another environmental consideration. The rapid cooling rates required for glass formation often necessitate significant water resources for quenching processes. Advanced manufacturing techniques, including electromagnetic levitation melting and confined jet melt spinning, are being developed to optimize cooling efficiency while reducing water consumption requirements.

The recyclability of amorphous metals represents another important sustainability factor. Unlike many composite materials that pose recycling challenges, amorphous metals can be remelted and reformed without significant degradation of their unique properties. This characteristic supports circular economy principles and reduces the demand for virgin raw materials, thereby decreasing the environmental footprint associated with mining and ore processing activities.

From a lifecycle perspective, the exceptional corrosion resistance of amorphous metals contributes significantly to their sustainability profile. Products manufactured using these materials typically exhibit extended service lives, reducing replacement frequency and associated resource consumption. This durability factor is particularly valuable in marine environments and chemical processing applications where conventional materials often require frequent replacement due to corrosion damage.

The magnetic properties of certain amorphous metal compositions enable the development of more efficient electrical transformers and motors. These components demonstrate reduced core losses compared to silicon steel alternatives, resulting in energy savings during operation. Studies indicate that amorphous metal transformers can achieve efficiency improvements of 40-80% compared to conventional designs, representing substantial energy conservation potential across power distribution networks globally.

However, challenges remain regarding the environmental impact of certain rare elements often incorporated in amorphous metal formulations. Elements such as beryllium, used in some compositions to enhance glass-forming ability, present toxicity concerns during production and end-of-life processing. The industry is actively researching alternative formulations that maintain desirable properties while eliminating environmentally problematic constituents.

Water usage in amorphous metal production presents another environmental consideration. The rapid cooling rates required for glass formation often necessitate significant water resources for quenching processes. Advanced manufacturing techniques, including electromagnetic levitation melting and confined jet melt spinning, are being developed to optimize cooling efficiency while reducing water consumption requirements.

Cost-Performance Analysis and Economic Viability

The economic viability of amorphous metals remains a critical factor limiting their widespread industrial adoption. Current production costs significantly exceed those of conventional crystalline metals, with price premiums ranging from 200% to 500% depending on composition and manufacturing complexity. This cost differential stems primarily from specialized production equipment, precise process control requirements, and lower production volumes that prevent economies of scale.

Manufacturing amorphous metals requires rapid cooling rates (typically 10^4-10^6 K/s), necessitating sophisticated equipment that represents substantial capital investment. The narrow processing windows demand precision control systems that further increase production costs. Additionally, the limited production scale compared to conventional metals results in higher per-unit costs across the value chain.

Performance advantages must justify these premium costs for commercial viability. In aerospace applications, the weight reduction and superior mechanical properties of amorphous metals can translate to fuel savings that offset the initial material cost over the operational lifetime of components. Similarly, in electronic applications, the unique magnetic properties of certain amorphous alloys deliver efficiency improvements that provide compelling return on investment despite higher upfront costs.

The economic equation varies significantly across industry sectors. In consumer electronics, where product lifecycles are short and price sensitivity high, amorphous metals find limited application despite performance benefits. Conversely, in infrastructure and industrial equipment with decades-long service lives, the extended durability and reduced maintenance requirements can yield favorable lifetime cost analyses.

Recent technological advancements are gradually improving the cost-performance ratio. Innovations in manufacturing processes, particularly in melt spinning and selective laser melting techniques, have reduced production costs by approximately 15-20% over the past five years. Concurrent material science developments have enhanced performance characteristics, creating more compelling value propositions in specific applications.

Market analysis indicates that economic viability thresholds are being reached in select high-value applications, particularly in medical devices, specialized industrial equipment, and advanced energy systems. As production volumes increase and manufacturing technologies mature, broader commercial adoption becomes increasingly feasible. Industry forecasts suggest that production costs could decrease by 30-40% within the next decade, potentially opening significant new market opportunities across multiple sectors.

Manufacturing amorphous metals requires rapid cooling rates (typically 10^4-10^6 K/s), necessitating sophisticated equipment that represents substantial capital investment. The narrow processing windows demand precision control systems that further increase production costs. Additionally, the limited production scale compared to conventional metals results in higher per-unit costs across the value chain.

Performance advantages must justify these premium costs for commercial viability. In aerospace applications, the weight reduction and superior mechanical properties of amorphous metals can translate to fuel savings that offset the initial material cost over the operational lifetime of components. Similarly, in electronic applications, the unique magnetic properties of certain amorphous alloys deliver efficiency improvements that provide compelling return on investment despite higher upfront costs.

The economic equation varies significantly across industry sectors. In consumer electronics, where product lifecycles are short and price sensitivity high, amorphous metals find limited application despite performance benefits. Conversely, in infrastructure and industrial equipment with decades-long service lives, the extended durability and reduced maintenance requirements can yield favorable lifetime cost analyses.

Recent technological advancements are gradually improving the cost-performance ratio. Innovations in manufacturing processes, particularly in melt spinning and selective laser melting techniques, have reduced production costs by approximately 15-20% over the past five years. Concurrent material science developments have enhanced performance characteristics, creating more compelling value propositions in specific applications.

Market analysis indicates that economic viability thresholds are being reached in select high-value applications, particularly in medical devices, specialized industrial equipment, and advanced energy systems. As production volumes increase and manufacturing technologies mature, broader commercial adoption becomes increasingly feasible. Industry forecasts suggest that production costs could decrease by 30-40% within the next decade, potentially opening significant new market opportunities across multiple sectors.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!