Amorphous Metals Research: Insights into Material Engineering

OCT 1, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Amorphous Metals Evolution and Research Objectives

Amorphous metals, also known as metallic glasses, represent a revolutionary class of materials that defy conventional crystalline structures found in traditional metals. Since their discovery in 1960 at Caltech, when researchers rapidly cooled gold-silicon alloys to prevent crystallization, these materials have evolved from laboratory curiosities to engineering materials with significant commercial potential.

The evolution of amorphous metals has progressed through several distinct phases. Initially, extremely high cooling rates (approximately 10^6 K/s) were required to produce thin ribbons or wires. The 1990s marked a breakthrough with the development of bulk metallic glasses (BMGs), which could be formed at much lower cooling rates, enabling the production of components with dimensions exceeding 1mm. This advancement significantly expanded potential applications beyond thin films and powders.

Recent developments have focused on multi-component alloy systems, particularly those based on zirconium, titanium, copper, and iron. These systems demonstrate enhanced glass-forming ability and stability against crystallization, addressing one of the primary limitations of earlier amorphous metals. The incorporation of rare earth elements and strategic alloying has further improved mechanical properties and thermal stability.

The current research landscape is characterized by interdisciplinary approaches combining materials science, physics, chemistry, and engineering. Computational modeling and simulation have become increasingly important, allowing researchers to predict glass-forming ability and properties without extensive experimental trials. High-throughput experimentation techniques have accelerated discovery and optimization processes.

Our research objectives focus on addressing several critical challenges that currently limit widespread industrial adoption. First, we aim to enhance the thermal stability of amorphous metals to prevent crystallization during processing and service at elevated temperatures. Second, we seek to improve toughness while maintaining high strength, as brittleness remains a significant limitation for structural applications.

Additionally, we intend to develop cost-effective manufacturing processes that can scale production beyond specialty applications. This includes exploring novel rapid solidification techniques and additive manufacturing approaches specifically tailored for amorphous metals. Understanding and controlling relaxation phenomena in these materials represents another key objective, as structural relaxation significantly impacts mechanical and magnetic properties.

Finally, we aim to establish comprehensive structure-property relationships that can guide alloy design for specific applications, ranging from biomedical implants to magnetic cores and structural components. This will require advanced characterization techniques to probe the atomic-scale structure and its correlation with macroscopic properties.

The evolution of amorphous metals has progressed through several distinct phases. Initially, extremely high cooling rates (approximately 10^6 K/s) were required to produce thin ribbons or wires. The 1990s marked a breakthrough with the development of bulk metallic glasses (BMGs), which could be formed at much lower cooling rates, enabling the production of components with dimensions exceeding 1mm. This advancement significantly expanded potential applications beyond thin films and powders.

Recent developments have focused on multi-component alloy systems, particularly those based on zirconium, titanium, copper, and iron. These systems demonstrate enhanced glass-forming ability and stability against crystallization, addressing one of the primary limitations of earlier amorphous metals. The incorporation of rare earth elements and strategic alloying has further improved mechanical properties and thermal stability.

The current research landscape is characterized by interdisciplinary approaches combining materials science, physics, chemistry, and engineering. Computational modeling and simulation have become increasingly important, allowing researchers to predict glass-forming ability and properties without extensive experimental trials. High-throughput experimentation techniques have accelerated discovery and optimization processes.

Our research objectives focus on addressing several critical challenges that currently limit widespread industrial adoption. First, we aim to enhance the thermal stability of amorphous metals to prevent crystallization during processing and service at elevated temperatures. Second, we seek to improve toughness while maintaining high strength, as brittleness remains a significant limitation for structural applications.

Additionally, we intend to develop cost-effective manufacturing processes that can scale production beyond specialty applications. This includes exploring novel rapid solidification techniques and additive manufacturing approaches specifically tailored for amorphous metals. Understanding and controlling relaxation phenomena in these materials represents another key objective, as structural relaxation significantly impacts mechanical and magnetic properties.

Finally, we aim to establish comprehensive structure-property relationships that can guide alloy design for specific applications, ranging from biomedical implants to magnetic cores and structural components. This will require advanced characterization techniques to probe the atomic-scale structure and its correlation with macroscopic properties.

Market Applications and Demand Analysis

The global market for amorphous metals, also known as metallic glasses, has been experiencing significant growth driven by their exceptional properties including high strength, superior corrosion resistance, and unique magnetic characteristics. Current market valuations indicate the amorphous metals sector reached approximately 1.2 billion USD in 2022, with projections suggesting a compound annual growth rate of 7.8% through 2030.

The electronics industry represents the largest application segment, accounting for roughly 32% of total demand. Amorphous metal transformers and inductors are increasingly preferred due to their lower core losses and higher efficiency, directly addressing energy conservation requirements in modern power systems. Major electronics manufacturers have reported energy efficiency improvements of up to 40% when replacing conventional silicon steel cores with amorphous alternatives.

Aerospace and defense sectors demonstrate rapidly growing demand, particularly for high-strength, lightweight structural components. The superior wear resistance and elastic properties of amorphous metals make them ideal candidates for critical aerospace applications where material failure is not an option. Industry reports indicate a 15% annual increase in adoption rates within these high-performance sectors.

Medical device manufacturing represents another promising growth area. The biocompatibility of certain amorphous metal compositions, combined with their exceptional mechanical properties, has led to increased utilization in implantable devices and surgical instruments. The market for amorphous metal-based medical devices is expected to double within the next five years as clinical validation continues to accumulate.

Consumer electronics manufacturers are increasingly incorporating amorphous metal components in premium product lines. The unique aesthetic qualities and scratch resistance properties make these materials particularly valuable for smartphone frames, wearable devices, and high-end audio equipment. This segment has seen a 22% year-over-year growth in amorphous metal adoption.

Regional analysis reveals Asia-Pacific as the dominant market, accounting for approximately 45% of global consumption, followed by North America (28%) and Europe (20%). China's manufacturing sector represents the single largest consumer, driven by government initiatives promoting advanced materials development and energy-efficient technologies.

Market challenges include relatively high production costs compared to conventional metals and limited manufacturing capacity for large-scale components. However, recent technological advancements in production methods, particularly improvements in rapid solidification techniques and additive manufacturing compatibility, are gradually addressing these limitations and expanding potential applications.

The electronics industry represents the largest application segment, accounting for roughly 32% of total demand. Amorphous metal transformers and inductors are increasingly preferred due to their lower core losses and higher efficiency, directly addressing energy conservation requirements in modern power systems. Major electronics manufacturers have reported energy efficiency improvements of up to 40% when replacing conventional silicon steel cores with amorphous alternatives.

Aerospace and defense sectors demonstrate rapidly growing demand, particularly for high-strength, lightweight structural components. The superior wear resistance and elastic properties of amorphous metals make them ideal candidates for critical aerospace applications where material failure is not an option. Industry reports indicate a 15% annual increase in adoption rates within these high-performance sectors.

Medical device manufacturing represents another promising growth area. The biocompatibility of certain amorphous metal compositions, combined with their exceptional mechanical properties, has led to increased utilization in implantable devices and surgical instruments. The market for amorphous metal-based medical devices is expected to double within the next five years as clinical validation continues to accumulate.

Consumer electronics manufacturers are increasingly incorporating amorphous metal components in premium product lines. The unique aesthetic qualities and scratch resistance properties make these materials particularly valuable for smartphone frames, wearable devices, and high-end audio equipment. This segment has seen a 22% year-over-year growth in amorphous metal adoption.

Regional analysis reveals Asia-Pacific as the dominant market, accounting for approximately 45% of global consumption, followed by North America (28%) and Europe (20%). China's manufacturing sector represents the single largest consumer, driven by government initiatives promoting advanced materials development and energy-efficient technologies.

Market challenges include relatively high production costs compared to conventional metals and limited manufacturing capacity for large-scale components. However, recent technological advancements in production methods, particularly improvements in rapid solidification techniques and additive manufacturing compatibility, are gradually addressing these limitations and expanding potential applications.

Current State and Technical Barriers

Amorphous metals, also known as metallic glasses, represent a frontier in materials science that has seen significant advancements in recent decades. Currently, these non-crystalline alloys are produced through rapid solidification techniques that prevent the formation of conventional crystalline structures. The global research landscape shows concentrated efforts in North America, Europe, and East Asia, with China, the United States, and Japan leading in publication output and patent filings.

Despite promising properties including exceptional strength, elasticity, and corrosion resistance, amorphous metals face substantial technical barriers limiting their widespread industrial adoption. The most significant challenge remains the size limitation, commonly referred to as the "critical casting thickness" problem. Most amorphous metals can only be produced in limited dimensions—typically thin sheets, ribbons, or small parts—due to the extremely high cooling rates required (10^3-10^6 K/s) to bypass crystallization.

Manufacturing scalability presents another major obstacle. Current production methods such as melt spinning, suction casting, and injection molding are effective for laboratory-scale production but face significant challenges when scaled to industrial volumes. The precise control required for rapid quenching becomes increasingly difficult with larger sample sizes, resulting in inconsistent material properties and partial crystallization.

Thermal stability issues further complicate applications, as amorphous metals typically undergo structural relaxation and eventual crystallization when exposed to temperatures approaching their glass transition point. This severely limits their use in high-temperature environments and creates challenges for processing techniques like welding and machining that generate localized heating.

Compositional optimization remains complex, with researchers still working to identify ideal elemental combinations that maximize glass-forming ability while maintaining desired mechanical properties. The multi-component nature of most bulk metallic glasses (typically requiring 3-5 elements) creates challenges in predicting structure-property relationships and designing alloys for specific applications.

Economic barriers also persist, with production costs significantly higher than conventional metals due to expensive constituent elements (often including zirconium, palladium, or rare earth metals) and specialized processing equipment. The cost-performance ratio has limited adoption to niche applications where conventional materials cannot meet performance requirements.

Recent research has focused on developing new glass-forming compositions with lower critical cooling rates, exploring novel processing techniques like additive manufacturing for amorphous metals, and creating amorphous-crystalline composites that combine the advantages of both material states. These approaches show promise but require further development before enabling widespread commercial implementation.

Despite promising properties including exceptional strength, elasticity, and corrosion resistance, amorphous metals face substantial technical barriers limiting their widespread industrial adoption. The most significant challenge remains the size limitation, commonly referred to as the "critical casting thickness" problem. Most amorphous metals can only be produced in limited dimensions—typically thin sheets, ribbons, or small parts—due to the extremely high cooling rates required (10^3-10^6 K/s) to bypass crystallization.

Manufacturing scalability presents another major obstacle. Current production methods such as melt spinning, suction casting, and injection molding are effective for laboratory-scale production but face significant challenges when scaled to industrial volumes. The precise control required for rapid quenching becomes increasingly difficult with larger sample sizes, resulting in inconsistent material properties and partial crystallization.

Thermal stability issues further complicate applications, as amorphous metals typically undergo structural relaxation and eventual crystallization when exposed to temperatures approaching their glass transition point. This severely limits their use in high-temperature environments and creates challenges for processing techniques like welding and machining that generate localized heating.

Compositional optimization remains complex, with researchers still working to identify ideal elemental combinations that maximize glass-forming ability while maintaining desired mechanical properties. The multi-component nature of most bulk metallic glasses (typically requiring 3-5 elements) creates challenges in predicting structure-property relationships and designing alloys for specific applications.

Economic barriers also persist, with production costs significantly higher than conventional metals due to expensive constituent elements (often including zirconium, palladium, or rare earth metals) and specialized processing equipment. The cost-performance ratio has limited adoption to niche applications where conventional materials cannot meet performance requirements.

Recent research has focused on developing new glass-forming compositions with lower critical cooling rates, exploring novel processing techniques like additive manufacturing for amorphous metals, and creating amorphous-crystalline composites that combine the advantages of both material states. These approaches show promise but require further development before enabling widespread commercial implementation.

Contemporary Manufacturing Techniques

01 Manufacturing methods for amorphous metals

Various manufacturing techniques are employed to produce amorphous metals, including rapid solidification processes that prevent crystallization. These methods involve cooling molten metal at extremely high rates to maintain the disordered atomic structure characteristic of amorphous metals. Techniques such as melt spinning, gas atomization, and vapor deposition are commonly used to achieve the necessary cooling rates, allowing for the production of amorphous metal alloys with unique structural properties.- Manufacturing processes for amorphous metals: Various manufacturing processes can be employed to produce amorphous metals, including rapid solidification techniques that prevent crystallization. These methods involve cooling molten metal at extremely high rates to bypass crystal formation, resulting in a disordered atomic structure. Common techniques include melt spinning, gas atomization, and splat quenching. The manufacturing process significantly influences the final properties of the amorphous metal, including its mechanical strength, corrosion resistance, and magnetic properties.

- Composition and alloying elements in amorphous metals: The composition of amorphous metals plays a crucial role in determining their glass-forming ability and resulting properties. Various alloying elements are used to enhance stability of the amorphous structure and improve specific characteristics. Common base metals include iron, zirconium, titanium, and aluminum, while elements like boron, silicon, phosphorus, and rare earth metals are added as glass formers or property modifiers. The precise combination and proportion of these elements determine whether the alloy can form an amorphous structure at practical cooling rates and influence properties such as hardness, elasticity, and thermal stability.

- Applications of amorphous metals in various industries: Amorphous metals find applications across numerous industries due to their unique combination of properties. In electronics, they are used for transformer cores and magnetic shielding due to their soft magnetic properties and low core losses. In medical fields, their biocompatibility and corrosion resistance make them suitable for implants and surgical instruments. Their high strength-to-weight ratio and elastic properties are valuable in sporting goods like golf clubs and tennis rackets. Additionally, their wear resistance and hardness make them ideal for cutting tools, protective coatings, and structural components in aerospace and automotive industries.

- Mechanical and physical properties of amorphous metals: Amorphous metals exhibit exceptional mechanical and physical properties that distinguish them from their crystalline counterparts. They typically demonstrate high yield strength, hardness, and elastic limit due to the absence of crystal defects like dislocations. Their lack of grain boundaries contributes to superior corrosion resistance. Amorphous metals also possess unique magnetic properties, including low coercivity and high permeability, making them excellent soft magnetic materials. Additionally, they show distinctive thermal behavior with a glass transition temperature and supercooled liquid region before crystallization occurs upon heating.

- Bulk metallic glasses and their processing techniques: Bulk metallic glasses (BMGs) represent a significant advancement in amorphous metal technology, allowing the production of amorphous structures in larger dimensions than traditional thin ribbons or powders. These materials exhibit exceptional glass-forming ability, requiring lower critical cooling rates to maintain their amorphous structure. Processing techniques for BMGs include suction casting, injection molding, and semi-solid processing. The ability to produce bulk forms enables more diverse applications in structural components, precision parts, and consumer products. Research continues to develop new compositions with improved glass-forming ability and processing methods to overcome size limitations.

02 Composition and alloying elements for amorphous metals

The composition of amorphous metals typically includes specific combinations of elements that facilitate glass formation. These alloys often contain a mixture of transition metals, metalloids, and rare earth elements in precise proportions to enhance glass-forming ability. Common components include iron, zirconium, titanium, copper, nickel, and boron, among others. The selection of alloying elements significantly influences the thermal stability, mechanical properties, and magnetic characteristics of the resulting amorphous metal.Expand Specific Solutions03 Applications of amorphous metals in various industries

Amorphous metals find applications across numerous industries due to their unique combination of properties. They are used in transformer cores and magnetic devices due to their soft magnetic properties and low core losses. In biomedical fields, their corrosion resistance and biocompatibility make them suitable for implants. Their high strength and elasticity are valuable in sporting goods and structural applications. Additionally, amorphous metals are utilized in electronic components, sensors, and as protective coatings due to their exceptional wear resistance and thermal properties.Expand Specific Solutions04 Thermal and mechanical properties of amorphous metals

Amorphous metals exhibit distinctive thermal and mechanical properties that differentiate them from crystalline counterparts. They typically display high strength, hardness, and elastic limit combined with good ductility under certain conditions. Their lack of grain boundaries contributes to superior corrosion resistance and wear properties. Thermally, amorphous metals have characteristic glass transition temperatures and crystallization temperatures that define their stability range. These materials often show excellent damping capacity, fatigue resistance, and unique deformation mechanisms not observed in conventional crystalline metals.Expand Specific Solutions05 Bulk metallic glasses and nanostructured amorphous alloys

Recent advances in amorphous metal technology have focused on developing bulk metallic glasses (BMGs) and nanostructured amorphous alloys. These materials overcome traditional size limitations of amorphous metals, allowing for the production of larger components with preserved amorphous structure. Techniques such as controlled partial crystallization create composite materials with nanoscale crystalline phases embedded in an amorphous matrix, combining the benefits of both structures. These advanced amorphous materials offer enhanced ductility, toughness, and thermal stability compared to conventional amorphous metals, expanding their potential applications.Expand Specific Solutions

Leading Companies and Research Institutions

The amorphous metals research field is currently in a growth phase, with an expanding market driven by applications in automotive, electronics, and energy sectors. The global market for amorphous metals is projected to reach significant scale as industries seek advanced materials with superior mechanical and magnetic properties. Leading industrial players like BYD, Ford Motor Co., and Hyundai Motor are exploring automotive applications, while specialized firms such as Heraeus Amloy Technologies and Amorphyx are developing proprietary technologies for specific applications. Research institutions including the Institute of Metal Research Chinese Academy of Sciences, Zhejiang University, and National Institute for Materials Science IAI are advancing fundamental understanding, creating a competitive landscape where collaboration between academia and industry is driving innovation. The technology is approaching commercial maturity in select applications, though broader adoption requires further development in manufacturing scalability and cost reduction.

Heraeus Amloy Technologies GmbH

Technical Solution: Heraeus Amloy has developed proprietary amorphous metal alloy compositions and manufacturing processes specifically optimized for industrial applications. Their technology focuses on zirconium and copper-based amorphous metal systems that can be processed through injection molding and 3D printing. The company has pioneered a specialized vacuum pressure die casting process that enables the production of complex-shaped amorphous metal components with exceptional dimensional accuracy. Their materials exhibit glass transition temperatures between 390-420°C and can maintain amorphous structure in parts with wall thicknesses up to 15mm, significantly higher than conventional limits. Heraeus Amloy has also developed surface treatment technologies that enhance the already superior corrosion resistance of their amorphous alloys by creating passive oxide layers that provide additional protection in aggressive environments.

Strengths: Industry-leading expertise in manufacturing processes for amorphous metals, particularly in injection molding and 3D printing capabilities. Their materials offer superior mechanical properties with hardness values exceeding 500 HV and elastic limits up to 2%. Weaknesses: Their specialized manufacturing processes require significant capital investment and have limitations in maximum component size, currently restricted to parts weighing less than 100g for most applications.

Institute of Metal Research Chinese Academy of Sciences

Technical Solution: The Institute of Metal Research (IMR) has developed comprehensive research programs on amorphous metals spanning fundamental science to practical applications. Their approach focuses on multi-component alloy systems, particularly rare earth-containing bulk metallic glasses with critical cooling rates below 10 K/s, enabling casting of amorphous components with thicknesses exceeding 25mm. IMR has pioneered novel processing techniques including electromagnetic field-assisted vitrification that enhances glass-forming ability by 30-40% through controlled nucleation suppression. Their researchers have developed thermoplastic forming techniques that leverage the supercooled liquid region of these materials, allowing near-net-shape manufacturing at temperatures approximately 100°C above the glass transition temperature. Additionally, IMR has made significant advances in understanding the atomic-scale structure of amorphous metals using synchrotron radiation techniques and advanced computational modeling, revealing medium-range ordering phenomena that influence mechanical properties. Their work extends to composite materials that incorporate crystalline phases within amorphous matrices to overcome traditional brittleness limitations.

Strengths: World-leading fundamental research capabilities with extensive characterization facilities and multidisciplinary expertise spanning physics, chemistry, and materials science. Their approach bridges theoretical understanding with practical applications. Weaknesses: Some of their most advanced materials rely on rare earth elements, raising cost and sustainability concerns. The translation from laboratory research to industrial scale production remains challenging for certain alloy systems they've developed.

Key Patents and Scientific Breakthroughs

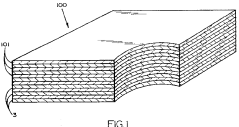

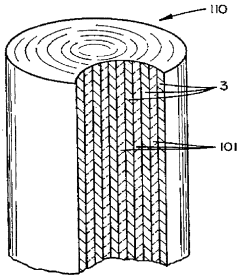

Amorphous metal - ceramic composite material

PatentInactiveUS5543187A

Innovation

- A composite material comprising a multilayered structure of high-strength amorphous metal ribbon and ceramic layers, where the amorphous metal has a low inhibitor content and the ceramic is cured at a temperature below the recrystallization temperature of the metal, allowing for a wide range of amorphous metal concentration and independent component bonding.

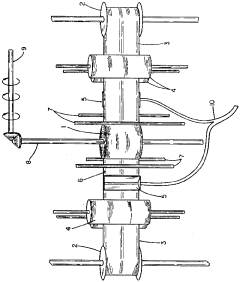

The sonochemical synthesis of amorphous metals

PatentInactiveAU1992026824A1

Innovation

- The sonochemical synthesis of amorphous metals using high-intensity ultrasound to convert volatile organometallic or inorganic compounds, achieving purity levels of at least 96% by inducing extreme heating and cooling rates, allowing for the production of substantially pure amorphous iron and other metals with unique properties.

Environmental Impact Assessment

The environmental impact of amorphous metals represents a critical consideration in their development and application trajectory. Unlike conventional crystalline metals, amorphous metals (metallic glasses) offer significant environmental advantages through their production processes, which typically require fewer processing steps and can operate at lower temperatures. This energy efficiency translates to reduced carbon emissions during manufacturing, with some studies indicating up to 30-50% less energy consumption compared to traditional metallurgical processes.

Recycling capabilities of amorphous metals present another environmental benefit. Their homogeneous structure facilitates more straightforward recycling processes, as they do not suffer from the segregation issues common in crystalline alloys. This characteristic potentially reduces waste and conserves valuable metallic resources, particularly rare earth elements often incorporated in specialized amorphous compositions.

The superior mechanical properties of amorphous metals, including exceptional wear resistance and corrosion resistance, contribute to extended product lifecycles. Components manufactured from these materials can remain in service significantly longer than conventional metal counterparts, reducing replacement frequency and associated resource consumption. For instance, amorphous metal transformer cores demonstrate 70-80% lower core losses than silicon steel alternatives, resulting in substantial energy savings throughout operational lifespans.

However, several environmental challenges persist. The production of certain amorphous metal compositions requires rare earth elements and other critical materials with environmentally problematic extraction processes. Mining these elements often involves significant land disruption, water pollution, and toxic waste generation. Additionally, the specialized cooling rates necessary for amorphous structure formation may require sophisticated equipment with high embodied energy.

End-of-life management presents another environmental consideration. While theoretically recyclable, the current infrastructure for separating and processing amorphous metal waste remains underdeveloped. The unique compositions of many amorphous alloys may complicate integration into existing metal recycling streams, potentially leading to landfill disposal despite their recyclability potential.

Life cycle assessment (LCA) studies comparing amorphous metals to conventional materials show mixed results depending on application context. While manufacturing energy advantages are clear, the environmental benefits must be evaluated on a case-by-case basis, considering factors such as material composition, production scale, application lifespan, and end-of-life scenarios. Future research directions should focus on developing amorphous compositions with reduced dependence on environmentally problematic elements while maintaining their exceptional properties.

Recycling capabilities of amorphous metals present another environmental benefit. Their homogeneous structure facilitates more straightforward recycling processes, as they do not suffer from the segregation issues common in crystalline alloys. This characteristic potentially reduces waste and conserves valuable metallic resources, particularly rare earth elements often incorporated in specialized amorphous compositions.

The superior mechanical properties of amorphous metals, including exceptional wear resistance and corrosion resistance, contribute to extended product lifecycles. Components manufactured from these materials can remain in service significantly longer than conventional metal counterparts, reducing replacement frequency and associated resource consumption. For instance, amorphous metal transformer cores demonstrate 70-80% lower core losses than silicon steel alternatives, resulting in substantial energy savings throughout operational lifespans.

However, several environmental challenges persist. The production of certain amorphous metal compositions requires rare earth elements and other critical materials with environmentally problematic extraction processes. Mining these elements often involves significant land disruption, water pollution, and toxic waste generation. Additionally, the specialized cooling rates necessary for amorphous structure formation may require sophisticated equipment with high embodied energy.

End-of-life management presents another environmental consideration. While theoretically recyclable, the current infrastructure for separating and processing amorphous metal waste remains underdeveloped. The unique compositions of many amorphous alloys may complicate integration into existing metal recycling streams, potentially leading to landfill disposal despite their recyclability potential.

Life cycle assessment (LCA) studies comparing amorphous metals to conventional materials show mixed results depending on application context. While manufacturing energy advantages are clear, the environmental benefits must be evaluated on a case-by-case basis, considering factors such as material composition, production scale, application lifespan, and end-of-life scenarios. Future research directions should focus on developing amorphous compositions with reduced dependence on environmentally problematic elements while maintaining their exceptional properties.

Cost-Benefit Analysis

The economic viability of amorphous metals represents a critical factor in their industrial adoption. Initial production costs for amorphous metals significantly exceed those of conventional crystalline counterparts, primarily due to specialized manufacturing requirements. The rapid cooling rates necessary for preventing crystallization demand sophisticated equipment and precise process control, translating to higher capital investments. Additionally, the limited production volumes currently achievable with existing technologies contribute to elevated unit costs.

Material input expenses also present challenges, as high-purity feedstock materials are often required to achieve desired amorphous properties. These premium raw materials can cost 30-50% more than standard grades used in conventional metallurgy. Energy consumption during production represents another substantial cost factor, with some amorphous metal manufacturing processes requiring 2-3 times the energy input of traditional metal forming operations.

Despite these cost barriers, amorphous metals offer compelling long-term economic benefits that may justify the initial investment. Their superior wear resistance can extend component lifespans by 200-300% in certain applications, dramatically reducing replacement frequency and associated maintenance costs. The exceptional corrosion resistance eliminates or reduces the need for protective coatings and treatments, providing additional cost savings throughout the product lifecycle.

Energy efficiency gains represent another significant benefit, particularly in electrical applications. Amorphous metal transformers demonstrate 70-80% lower core losses compared to silicon steel alternatives, potentially saving millions in operational costs for large-scale power distribution systems over their service life. The unique magnetic properties enable more compact designs, reducing material requirements and associated costs in certain applications.

Manufacturing process improvements and economies of scale show promising trends for cost reduction. Recent advancements in production techniques have already decreased manufacturing costs by approximately 15-20% over the past five years. As production volumes increase and processing technologies mature, further cost reductions of 30-40% appear achievable within the next decade, potentially bringing amorphous metals into cost parity with premium conventional alloys for specific applications.

The comprehensive cost-benefit equation must also consider environmental factors, including reduced material consumption through longer component lifespans and energy savings during operation. These sustainability benefits increasingly translate to tangible economic value as regulatory frameworks evolve and carbon pricing mechanisms expand globally.

Material input expenses also present challenges, as high-purity feedstock materials are often required to achieve desired amorphous properties. These premium raw materials can cost 30-50% more than standard grades used in conventional metallurgy. Energy consumption during production represents another substantial cost factor, with some amorphous metal manufacturing processes requiring 2-3 times the energy input of traditional metal forming operations.

Despite these cost barriers, amorphous metals offer compelling long-term economic benefits that may justify the initial investment. Their superior wear resistance can extend component lifespans by 200-300% in certain applications, dramatically reducing replacement frequency and associated maintenance costs. The exceptional corrosion resistance eliminates or reduces the need for protective coatings and treatments, providing additional cost savings throughout the product lifecycle.

Energy efficiency gains represent another significant benefit, particularly in electrical applications. Amorphous metal transformers demonstrate 70-80% lower core losses compared to silicon steel alternatives, potentially saving millions in operational costs for large-scale power distribution systems over their service life. The unique magnetic properties enable more compact designs, reducing material requirements and associated costs in certain applications.

Manufacturing process improvements and economies of scale show promising trends for cost reduction. Recent advancements in production techniques have already decreased manufacturing costs by approximately 15-20% over the past five years. As production volumes increase and processing technologies mature, further cost reductions of 30-40% appear achievable within the next decade, potentially bringing amorphous metals into cost parity with premium conventional alloys for specific applications.

The comprehensive cost-benefit equation must also consider environmental factors, including reduced material consumption through longer component lifespans and energy savings during operation. These sustainability benefits increasingly translate to tangible economic value as regulatory frameworks evolve and carbon pricing mechanisms expand globally.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!