Examining the Global Market for Amorphous Metals in 2023

OCT 1, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Amorphous Metals Background and Research Objectives

Amorphous metals, also known as metallic glasses, represent a unique class of materials that lack the long-range atomic order characteristic of conventional crystalline metals. First discovered in 1960 at Caltech when researchers rapidly cooled gold-silicon alloys, these materials have evolved significantly over the past six decades. The development trajectory has moved from thin ribbons produced through melt spinning techniques to bulk metallic glasses (BMGs) that can be cast into complex shapes while maintaining their amorphous structure.

The technological evolution of amorphous metals has been marked by several breakthrough periods. The 1970s saw the development of commercial Fe-based amorphous alloys for transformer cores. The 1990s witnessed the emergence of zirconium-based BMGs with critical cooling rates slow enough to allow for practical manufacturing processes. More recently, research has focused on developing amorphous metals with enhanced glass-forming ability, improved mechanical properties, and specialized functional characteristics.

Current global research is primarily concentrated on expanding the application scope of amorphous metals beyond traditional niches. This includes exploring their potential in aerospace components, medical implants, sporting goods, electronic casings, and renewable energy technologies. The exceptional combination of high strength, elasticity, corrosion resistance, and unique magnetic properties positions these materials as solutions to engineering challenges across multiple industries.

The primary objective of this research is to comprehensively assess the global market landscape for amorphous metals in 2023, identifying key growth sectors, technological advancements, and emerging applications. We aim to analyze production capacities, regional market dynamics, and supply chain considerations that influence market development. Additionally, this research seeks to evaluate how recent innovations in manufacturing processes, particularly additive manufacturing techniques, are reshaping the commercial viability of amorphous metals.

Another critical research goal is to examine how amorphous metals are positioned within the broader advanced materials ecosystem, particularly in relation to competing technologies such as advanced composites, high-entropy alloys, and nanomaterials. This comparative analysis will provide insights into the unique value propositions of amorphous metals and their competitive advantages in specific application domains.

Furthermore, this research intends to forecast technological trajectories for amorphous metals over the next decade, identifying potential disruptive innovations that could significantly expand market opportunities. By analyzing patent landscapes, academic research trends, and industrial R&D investments, we aim to identify emerging sub-fields with substantial growth potential and technological significance.

The technological evolution of amorphous metals has been marked by several breakthrough periods. The 1970s saw the development of commercial Fe-based amorphous alloys for transformer cores. The 1990s witnessed the emergence of zirconium-based BMGs with critical cooling rates slow enough to allow for practical manufacturing processes. More recently, research has focused on developing amorphous metals with enhanced glass-forming ability, improved mechanical properties, and specialized functional characteristics.

Current global research is primarily concentrated on expanding the application scope of amorphous metals beyond traditional niches. This includes exploring their potential in aerospace components, medical implants, sporting goods, electronic casings, and renewable energy technologies. The exceptional combination of high strength, elasticity, corrosion resistance, and unique magnetic properties positions these materials as solutions to engineering challenges across multiple industries.

The primary objective of this research is to comprehensively assess the global market landscape for amorphous metals in 2023, identifying key growth sectors, technological advancements, and emerging applications. We aim to analyze production capacities, regional market dynamics, and supply chain considerations that influence market development. Additionally, this research seeks to evaluate how recent innovations in manufacturing processes, particularly additive manufacturing techniques, are reshaping the commercial viability of amorphous metals.

Another critical research goal is to examine how amorphous metals are positioned within the broader advanced materials ecosystem, particularly in relation to competing technologies such as advanced composites, high-entropy alloys, and nanomaterials. This comparative analysis will provide insights into the unique value propositions of amorphous metals and their competitive advantages in specific application domains.

Furthermore, this research intends to forecast technological trajectories for amorphous metals over the next decade, identifying potential disruptive innovations that could significantly expand market opportunities. By analyzing patent landscapes, academic research trends, and industrial R&D investments, we aim to identify emerging sub-fields with substantial growth potential and technological significance.

Global Market Demand Analysis for Amorphous Metals

The global market for amorphous metals, also known as metallic glasses, has demonstrated significant growth potential in 2023, driven by their exceptional mechanical, magnetic, and corrosion-resistant properties. Current market assessments indicate that the amorphous metals market has reached approximately $1.5 billion globally, with projections suggesting a compound annual growth rate of 7.8% through 2028.

The electronics and electrical sector represents the largest demand segment, accounting for roughly 32% of the total market share. This dominance stems from the superior soft magnetic properties of amorphous metals, making them ideal for high-efficiency transformers, inductors, and magnetic sensors. The energy sector follows closely, with increasing adoption in power distribution systems where amorphous metal transformers demonstrate 70-80% lower core losses compared to conventional silicon steel alternatives.

Automotive and aerospace industries have emerged as rapidly expanding markets, growing at nearly 9.5% annually. The lightweight nature of amorphous metals, combined with their exceptional strength-to-weight ratio, positions them as valuable materials for structural components, particularly in electric vehicles where weight reduction directly impacts energy efficiency and range.

Regional analysis reveals Asia-Pacific as the dominant market, representing approximately 45% of global demand. China leads this regional growth, driven by substantial investments in electrical grid infrastructure and manufacturing capabilities. North America and Europe collectively account for roughly 40% of the market, with particular strength in high-end applications within aerospace, medical devices, and specialized industrial equipment.

Consumer electronics represents an emerging application area with substantial growth potential. The miniaturization trend in electronic devices has created demand for materials with superior mechanical properties at reduced dimensions, where amorphous metals excel compared to crystalline counterparts.

Price sensitivity remains a significant factor influencing market penetration. Manufacturing costs for amorphous metals typically exceed those of conventional crystalline metals by 30-50%, primarily due to specialized production processes and equipment requirements. However, this price premium is increasingly justified through lifecycle cost analyses that demonstrate long-term operational savings, particularly in energy-intensive applications.

Supply chain constraints have become evident in 2023, with raw material availability and specialized production capacity limiting market expansion in certain segments. These constraints have prompted increased investment in production facilities, particularly in regions with established technological expertise such as Japan, Germany, and the United States.

The electronics and electrical sector represents the largest demand segment, accounting for roughly 32% of the total market share. This dominance stems from the superior soft magnetic properties of amorphous metals, making them ideal for high-efficiency transformers, inductors, and magnetic sensors. The energy sector follows closely, with increasing adoption in power distribution systems where amorphous metal transformers demonstrate 70-80% lower core losses compared to conventional silicon steel alternatives.

Automotive and aerospace industries have emerged as rapidly expanding markets, growing at nearly 9.5% annually. The lightweight nature of amorphous metals, combined with their exceptional strength-to-weight ratio, positions them as valuable materials for structural components, particularly in electric vehicles where weight reduction directly impacts energy efficiency and range.

Regional analysis reveals Asia-Pacific as the dominant market, representing approximately 45% of global demand. China leads this regional growth, driven by substantial investments in electrical grid infrastructure and manufacturing capabilities. North America and Europe collectively account for roughly 40% of the market, with particular strength in high-end applications within aerospace, medical devices, and specialized industrial equipment.

Consumer electronics represents an emerging application area with substantial growth potential. The miniaturization trend in electronic devices has created demand for materials with superior mechanical properties at reduced dimensions, where amorphous metals excel compared to crystalline counterparts.

Price sensitivity remains a significant factor influencing market penetration. Manufacturing costs for amorphous metals typically exceed those of conventional crystalline metals by 30-50%, primarily due to specialized production processes and equipment requirements. However, this price premium is increasingly justified through lifecycle cost analyses that demonstrate long-term operational savings, particularly in energy-intensive applications.

Supply chain constraints have become evident in 2023, with raw material availability and specialized production capacity limiting market expansion in certain segments. These constraints have prompted increased investment in production facilities, particularly in regions with established technological expertise such as Japan, Germany, and the United States.

Current Technological Status and Production Challenges

Amorphous metals, also known as metallic glasses, have evolved significantly since their discovery in the 1960s. As of 2023, the global technological landscape for these materials exhibits varying degrees of maturity across different regions. The United States, Japan, and several European countries maintain leadership positions in amorphous metal research and production, with China rapidly closing the gap through substantial investments in both academic research and industrial applications.

The current production methods for amorphous metals primarily include rapid solidification techniques, such as melt spinning, gas atomization, and suction casting. These processes require precise control of cooling rates, typically exceeding 10^6 K/s, to prevent crystallization and maintain the amorphous structure. While these techniques have been refined over decades, they still present significant challenges for mass production, particularly for bulk amorphous metals with dimensions exceeding several millimeters.

Scale-up limitations represent one of the most pressing challenges in amorphous metal production. The critical cooling rate requirement inherently restricts the size of components that can be manufactured with fully amorphous structures. This dimensional constraint has significantly limited widespread industrial adoption despite the exceptional properties these materials offer.

Cost factors also present substantial barriers to market expansion. The specialized equipment required for rapid quenching processes, combined with high energy consumption and relatively low production yields, results in manufacturing costs that exceed those of conventional crystalline alloys by factors of 3-10x depending on composition and application. This cost premium has confined amorphous metals primarily to high-value applications where performance benefits justify the increased expense.

Quality control and reproducibility issues further complicate industrial implementation. The amorphous structure is highly sensitive to processing parameters, and minor variations can lead to partial crystallization or inconsistent properties. Current inspection technologies struggle to efficiently detect these subtle structural variations in production environments, leading to reliability concerns among potential industrial adopters.

Environmental considerations are emerging as another significant challenge. While amorphous metals themselves are often more environmentally friendly than their crystalline counterparts due to improved efficiency and longer service life, their production processes can be energy-intensive. The industry faces increasing pressure to develop more sustainable manufacturing approaches that maintain the unique properties of these materials while reducing energy consumption and environmental impact.

Recent technological breakthroughs in additive manufacturing and thermoplastic forming show promise for overcoming some of these challenges, potentially enabling more complex geometries and improved economics. However, these emerging techniques remain in early development stages and require substantial refinement before achieving commercial viability at scale.

The current production methods for amorphous metals primarily include rapid solidification techniques, such as melt spinning, gas atomization, and suction casting. These processes require precise control of cooling rates, typically exceeding 10^6 K/s, to prevent crystallization and maintain the amorphous structure. While these techniques have been refined over decades, they still present significant challenges for mass production, particularly for bulk amorphous metals with dimensions exceeding several millimeters.

Scale-up limitations represent one of the most pressing challenges in amorphous metal production. The critical cooling rate requirement inherently restricts the size of components that can be manufactured with fully amorphous structures. This dimensional constraint has significantly limited widespread industrial adoption despite the exceptional properties these materials offer.

Cost factors also present substantial barriers to market expansion. The specialized equipment required for rapid quenching processes, combined with high energy consumption and relatively low production yields, results in manufacturing costs that exceed those of conventional crystalline alloys by factors of 3-10x depending on composition and application. This cost premium has confined amorphous metals primarily to high-value applications where performance benefits justify the increased expense.

Quality control and reproducibility issues further complicate industrial implementation. The amorphous structure is highly sensitive to processing parameters, and minor variations can lead to partial crystallization or inconsistent properties. Current inspection technologies struggle to efficiently detect these subtle structural variations in production environments, leading to reliability concerns among potential industrial adopters.

Environmental considerations are emerging as another significant challenge. While amorphous metals themselves are often more environmentally friendly than their crystalline counterparts due to improved efficiency and longer service life, their production processes can be energy-intensive. The industry faces increasing pressure to develop more sustainable manufacturing approaches that maintain the unique properties of these materials while reducing energy consumption and environmental impact.

Recent technological breakthroughs in additive manufacturing and thermoplastic forming show promise for overcoming some of these challenges, potentially enabling more complex geometries and improved economics. However, these emerging techniques remain in early development stages and require substantial refinement before achieving commercial viability at scale.

Current Manufacturing Processes and Applications

01 Manufacturing processes for amorphous metals

Various manufacturing processes can be employed to produce amorphous metals, including rapid solidification techniques that prevent crystallization. These methods involve cooling molten metal at extremely high rates to bypass crystal formation, resulting in a disordered atomic structure. Common techniques include melt spinning, gas atomization, and splat quenching. These processes are critical for maintaining the unique properties of amorphous metals, as they prevent the atoms from arranging into an ordered crystalline structure.- Manufacturing processes for amorphous metals: Various manufacturing processes can be employed to produce amorphous metals, including rapid solidification techniques that prevent crystallization. These methods involve cooling molten metal at extremely high rates to bypass crystal formation, resulting in a disordered atomic structure. Techniques include melt spinning, gas atomization, and other specialized cooling processes that maintain the random atomic arrangement characteristic of amorphous metals.

- Composition and alloying elements for amorphous metals: The composition of amorphous metals typically includes specific combinations of elements that facilitate glass formation. These alloys often contain transition metals combined with metalloids or other elements that create atomic size differences and complex interactions, inhibiting crystallization. Common compositions include iron-based, zirconium-based, and palladium-based systems with additions of elements like boron, silicon, phosphorus, and carbon that enhance glass-forming ability.

- Properties and applications of amorphous metals: Amorphous metals exhibit unique properties including high strength, hardness, corrosion resistance, and magnetic characteristics different from their crystalline counterparts. These materials often display excellent elastic properties with high yield strength and good wear resistance. Applications include transformer cores, electronic components, sporting equipment, medical devices, and structural materials where their unique combination of properties provides advantages over conventional crystalline metals.

- Surface treatment and coating technologies for amorphous metals: Surface treatments and coating technologies can enhance the properties of amorphous metals or apply amorphous metal coatings to other substrates. These processes include thermal spray techniques, physical vapor deposition, and specialized heat treatments that maintain the amorphous structure while improving surface characteristics. Such treatments can enhance wear resistance, corrosion protection, and biocompatibility for various applications.

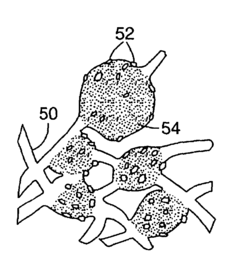

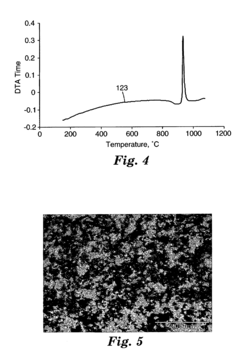

- Bulk metallic glasses and composite materials: Bulk metallic glasses represent a category of amorphous metals that can be produced in larger dimensions than traditional ribbon or powder forms. These materials often incorporate specific alloying elements that enhance glass-forming ability and stability. Additionally, amorphous metal matrix composites combine the benefits of amorphous structures with reinforcing phases to create materials with tailored properties, including improved ductility and fracture toughness while maintaining the advantageous characteristics of amorphous metals.

02 Composition and alloying of amorphous metals

The composition of amorphous metals typically involves specific combinations of elements that enhance glass-forming ability. These alloys often contain a mixture of transition metals with metalloids such as boron, silicon, or phosphorus. Multi-component systems with elements of different atomic sizes help disrupt crystallization. Zirconium, titanium, copper, nickel, and iron are commonly used base elements, with various additives to improve specific properties. The precise ratio of components is crucial for achieving the desired amorphous structure and mechanical characteristics.Expand Specific Solutions03 Mechanical and physical properties of amorphous metals

Amorphous metals exhibit exceptional mechanical and physical properties compared to their crystalline counterparts. They typically demonstrate high strength, hardness, and elastic limits while maintaining good ductility under certain conditions. Their lack of grain boundaries contributes to superior corrosion resistance and unique magnetic properties, including low coercivity and high permeability. These materials also show excellent wear resistance and can absorb energy effectively, making them valuable for various applications. The combination of these properties stems from their disordered atomic structure.Expand Specific Solutions04 Applications of amorphous metals

Amorphous metals find applications across various industries due to their unique properties. They are used in electronic components like transformer cores and magnetic sensors due to their soft magnetic characteristics. Their high strength-to-weight ratio makes them suitable for sporting goods, aerospace components, and medical devices. The corrosion resistance of certain amorphous alloys enables their use in harsh environments. Additionally, they serve as precursors for nanocrystalline materials and are employed in cutting tools, pressure sensors, and military applications.Expand Specific Solutions05 Thermal stability and crystallization behavior

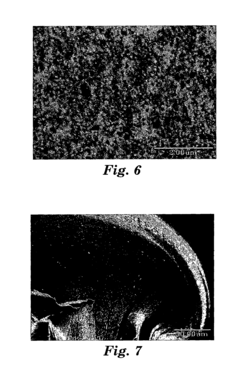

The thermal stability of amorphous metals is a critical characteristic that determines their practical applications. These materials exist in a metastable state and will crystallize when heated above their crystallization temperature. Understanding and controlling this crystallization behavior is essential for processing and application development. Some amorphous alloys demonstrate a wide supercooled liquid region between the glass transition and crystallization temperatures, allowing for thermoplastic forming. Research focuses on developing compositions with enhanced thermal stability and controlled crystallization for specific property improvements.Expand Specific Solutions

Key Industry Players and Competitive Landscape

The global amorphous metals market in 2023 is in a growth phase, characterized by increasing applications across automotive, electronics, and energy sectors. With an estimated market size of $1.5-2 billion and projected CAGR of 8-10%, this specialized materials segment is gaining momentum. Technology maturity varies significantly among key players: established manufacturers like VACUUMSCHMELZE GmbH and Heraeus Amloy Technologies lead commercial production, while research institutions including MIT, Caltech, and Yale University drive fundamental innovation. Companies like BYD and Schaeffler are integrating amorphous metals into automotive applications, while specialized firms such as Amorphyx focus on electronics applications, demonstrating the technology's expanding commercial viability across diverse industrial sectors.

VACUUMSCHMELZE GmbH & Co. KG

Technical Solution: VACUUMSCHMELZE (VAC) has established itself as a global leader in amorphous metal production, particularly with its VITROPERM® and VITROVAC® product lines. Their technology involves rapid solidification processes where molten metal alloys are cooled at rates exceeding 1 million degrees Celsius per second, preventing crystallization and creating amorphous structures. VAC's manufacturing process utilizes precision ribbon casting techniques that allow for consistent production of amorphous metal ribbons with thicknesses between 15-35 μm. Their materials exhibit exceptional magnetic properties with core losses approximately 80% lower than conventional silicon steel, making them ideal for high-efficiency transformers and inductors. VAC has recently expanded their amorphous metal applications beyond traditional power electronics into renewable energy systems, where their nanocrystalline cores have demonstrated efficiency improvements of up to 30% in solar inverters and wind power generators.

Strengths: Industry-leading expertise in precision manufacturing of amorphous metal ribbons with superior magnetic properties; established global distribution network; diverse product portfolio spanning multiple industries. Weaknesses: Higher production costs compared to conventional materials; limited thickness capabilities restricting certain structural applications; manufacturing process requires significant energy input.

Amorphyx, Incorporated

Technical Solution: Amorphyx has developed innovative amorphous metal thin-film technologies specifically targeted at next-generation display applications. Their proprietary deposition process creates ultra-thin amorphous metal layers (5-100nm) with exceptional uniformity and electrical properties. These films serve as the foundation for their Amorphous Metal Thin Film Transistors (AMTFTs) which offer significant advantages over conventional silicon-based transistors in large-area electronics. Amorphyx's technology enables higher electron mobility (>10 cm²/Vs) while maintaining low leakage currents (<1pA) and excellent stability under bias stress conditions. Their manufacturing process is compatible with existing display production infrastructure, requiring fewer mask steps than conventional TFT production, potentially reducing manufacturing costs by 30-40%. In 2023, Amorphyx expanded their technology to include flexible display applications, demonstrating amorphous metal transistors that maintain performance after 100,000+ bending cycles at radii below 5mm. Their materials show exceptional stability under high-intensity light exposure, making them particularly suitable for high-brightness display applications.

Strengths: Unique positioning in the high-growth display technology market; patented thin-film deposition techniques; compatibility with existing manufacturing infrastructure. Weaknesses: Relatively narrow application focus compared to broader amorphous metal market; early commercialization stage with limited production scale; faces competition from alternative emerging display technologies.

Critical Patents and Technical Innovations

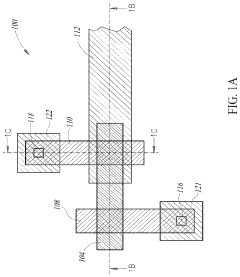

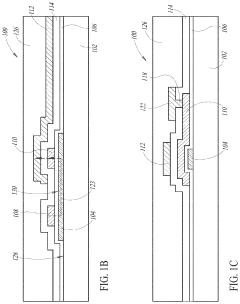

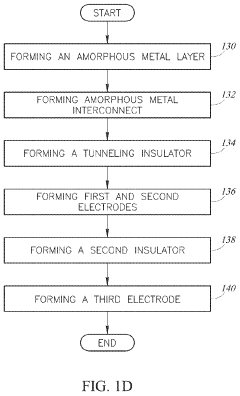

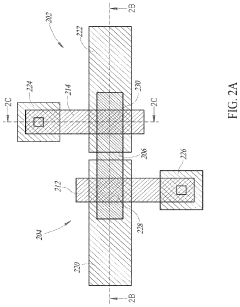

Amorphous metal hot electron transistor

PatentActiveUS20200259008A1

Innovation

- A co-planar amorphous hot electron transistor design with emitter and base electrodes in the same upper layer, separated by a gap, allowing for two-way Fowler-Nordheim tunneling and independent control of hot electron generation and collection, which is extended to a three-terminal device with adjustable I-V performance characteristics without modifying the tunneling dielectric.

Ceramic materials, abrasive particles, abrasive articles, and methods of making and using the same

PatentInactiveUS7510585B2

Innovation

- Development of amorphous materials comprising at least 35% Al2O3 with a metal oxide, heat-treated to form glass-ceramics with improved mechanical properties, which can be used to create abrasive particles for abrasive articles, offering enhanced performance and simplified production.

Supply Chain Analysis and Raw Material Considerations

The global supply chain for amorphous metals in 2023 exhibits significant complexity due to the specialized nature of raw materials and processing requirements. Primary raw materials include high-purity iron, boron, silicon, phosphorus, and rare earth elements, with their availability directly impacting production capabilities and market dynamics. China dominates the rare earth element supply, controlling approximately 85% of global production, creating potential bottlenecks for manufacturers outside Asia.

Material sourcing represents a critical challenge as the production of amorphous metals requires precise composition control and ultra-high purity levels. Even minor contaminants can significantly compromise the unique properties that make these materials valuable. This necessitates sophisticated purification processes and quality control measures throughout the supply chain, adding substantial costs to production.

The manufacturing process involves rapid solidification techniques that demand specialized equipment and expertise, further concentrating production capabilities among a limited number of suppliers. Key production hubs are located in Japan, China, the United States, and Germany, with emerging capacity in South Korea and India. This geographic concentration creates vulnerability to regional disruptions, as evidenced by the significant supply chain disturbances experienced during the COVID-19 pandemic.

Recycling infrastructure for amorphous metals remains underdeveloped compared to conventional metal recycling. The complex composition of these materials presents technical challenges for recovery and reprocessing, though recent advances in separation technologies show promise for improving circularity. Several major manufacturers have initiated closed-loop programs to recapture production scrap, but end-of-life recovery systems remain limited.

Price volatility in raw materials represents another significant challenge. Rare earth elements in particular have experienced substantial fluctuations, with prices for some components increasing by over 40% between 2021 and 2023. These fluctuations have prompted manufacturers to explore alternative formulations and hedging strategies to mitigate supply risks.

Vertical integration has emerged as a strategic approach for leading producers, with companies like Hitachi Metals and Liquidmetal Technologies investing in securing direct access to raw material sources. This trend is expected to continue as manufacturers seek to reduce dependency on external suppliers and stabilize input costs in an increasingly competitive market environment.

Material sourcing represents a critical challenge as the production of amorphous metals requires precise composition control and ultra-high purity levels. Even minor contaminants can significantly compromise the unique properties that make these materials valuable. This necessitates sophisticated purification processes and quality control measures throughout the supply chain, adding substantial costs to production.

The manufacturing process involves rapid solidification techniques that demand specialized equipment and expertise, further concentrating production capabilities among a limited number of suppliers. Key production hubs are located in Japan, China, the United States, and Germany, with emerging capacity in South Korea and India. This geographic concentration creates vulnerability to regional disruptions, as evidenced by the significant supply chain disturbances experienced during the COVID-19 pandemic.

Recycling infrastructure for amorphous metals remains underdeveloped compared to conventional metal recycling. The complex composition of these materials presents technical challenges for recovery and reprocessing, though recent advances in separation technologies show promise for improving circularity. Several major manufacturers have initiated closed-loop programs to recapture production scrap, but end-of-life recovery systems remain limited.

Price volatility in raw materials represents another significant challenge. Rare earth elements in particular have experienced substantial fluctuations, with prices for some components increasing by over 40% between 2021 and 2023. These fluctuations have prompted manufacturers to explore alternative formulations and hedging strategies to mitigate supply risks.

Vertical integration has emerged as a strategic approach for leading producers, with companies like Hitachi Metals and Liquidmetal Technologies investing in securing direct access to raw material sources. This trend is expected to continue as manufacturers seek to reduce dependency on external suppliers and stabilize input costs in an increasingly competitive market environment.

Environmental Impact and Sustainability Factors

The environmental footprint of amorphous metals represents a significant factor in their market adoption and future growth trajectory. Unlike conventional crystalline metals, amorphous metals (metallic glasses) offer substantial sustainability advantages through their production processes and lifecycle characteristics. The manufacturing of amorphous metals typically requires rapid cooling techniques that consume less energy compared to traditional metallurgical processes involving multiple heating and forming steps, potentially reducing carbon emissions by 30-40% in some applications.

Material efficiency stands as another critical environmental benefit. Amorphous metals demonstrate superior mechanical properties including exceptional strength-to-weight ratios and corrosion resistance, enabling the design of lighter components that require less raw material. This efficiency extends product lifespans and reduces replacement frequency, creating cascading environmental benefits throughout supply chains and waste management systems.

Recycling capabilities further enhance the sustainability profile of amorphous metals. Their homogeneous structure facilitates more straightforward recycling processes compared to complex alloys with multiple phases. However, specialized recycling infrastructure remains underdeveloped in many regions, creating a barrier to realizing their full circular economy potential. Industry stakeholders are increasingly investing in closed-loop systems to address this limitation.

Energy applications represent perhaps the most significant environmental contribution of amorphous metals in 2023. Their unique magnetic properties enable the production of highly efficient transformer cores and electric motor components that reduce energy losses by up to 80% compared to silicon steel alternatives. This efficiency translates directly to reduced power consumption and lower greenhouse gas emissions across energy generation and distribution networks.

The sustainability calculus must also consider potential environmental challenges. The production of certain amorphous metal compositions involves rare earth elements with environmentally problematic extraction processes. Additionally, some rapid solidification techniques employ process gases with high global warming potential. Leading manufacturers are addressing these concerns through material substitution strategies and process innovations to minimize environmental impacts.

Regulatory frameworks increasingly influence market dynamics for amorphous metals. The European Union's Circular Economy Action Plan and similar initiatives worldwide are creating both compliance pressures and market opportunities for materials with demonstrable sustainability advantages. Companies positioning amorphous metals as environmentally superior alternatives are gaining competitive advantages in procurement processes where environmental impact assessments factor into purchasing decisions.

Material efficiency stands as another critical environmental benefit. Amorphous metals demonstrate superior mechanical properties including exceptional strength-to-weight ratios and corrosion resistance, enabling the design of lighter components that require less raw material. This efficiency extends product lifespans and reduces replacement frequency, creating cascading environmental benefits throughout supply chains and waste management systems.

Recycling capabilities further enhance the sustainability profile of amorphous metals. Their homogeneous structure facilitates more straightforward recycling processes compared to complex alloys with multiple phases. However, specialized recycling infrastructure remains underdeveloped in many regions, creating a barrier to realizing their full circular economy potential. Industry stakeholders are increasingly investing in closed-loop systems to address this limitation.

Energy applications represent perhaps the most significant environmental contribution of amorphous metals in 2023. Their unique magnetic properties enable the production of highly efficient transformer cores and electric motor components that reduce energy losses by up to 80% compared to silicon steel alternatives. This efficiency translates directly to reduced power consumption and lower greenhouse gas emissions across energy generation and distribution networks.

The sustainability calculus must also consider potential environmental challenges. The production of certain amorphous metal compositions involves rare earth elements with environmentally problematic extraction processes. Additionally, some rapid solidification techniques employ process gases with high global warming potential. Leading manufacturers are addressing these concerns through material substitution strategies and process innovations to minimize environmental impacts.

Regulatory frameworks increasingly influence market dynamics for amorphous metals. The European Union's Circular Economy Action Plan and similar initiatives worldwide are creating both compliance pressures and market opportunities for materials with demonstrable sustainability advantages. Companies positioning amorphous metals as environmentally superior alternatives are gaining competitive advantages in procurement processes where environmental impact assessments factor into purchasing decisions.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!