Exploring the Applications of Amorphous Metals in Biocompatible Devices

OCT 1, 202510 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Amorphous Metals Background and Biocompatibility Goals

Amorphous metals, also known as metallic glasses, represent a unique class of materials that lack the long-range atomic order characteristic of crystalline metals. First discovered in 1960 by Pol Duwez at Caltech, these materials are formed through rapid cooling processes that prevent crystallization, resulting in a disordered atomic structure similar to that of glass. This distinctive structure confers exceptional properties including high strength, elasticity, corrosion resistance, and wear resistance that surpass those of their crystalline counterparts.

The evolution of amorphous metals has progressed through several significant phases. Initial research focused primarily on thin films and ribbons due to the extreme cooling rates required for their formation. The 1990s witnessed a breakthrough with the development of bulk metallic glasses (BMGs), which could be produced in thicker sections at lower cooling rates. Recent advancements have led to the creation of composite structures that combine the benefits of both amorphous and crystalline phases.

In the biomedical field, amorphous metals have emerged as promising candidates for implantable devices due to their superior mechanical properties and exceptional corrosion resistance. Their high elastic limit and low Young's modulus more closely match those of human bone compared to conventional metallic biomaterials, potentially reducing stress shielding effects that can lead to bone resorption around implants.

The biocompatibility of amorphous metals stems from their homogeneous structure, which lacks grain boundaries where corrosion typically initiates in crystalline alloys. Zirconium-based and titanium-based amorphous alloys have demonstrated particularly favorable interactions with biological tissues, exhibiting minimal ion release and inflammatory response in physiological environments.

Current research trends are focusing on tailoring the composition of amorphous metals to enhance their biocompatibility while maintaining their superior mechanical properties. Particular attention is being paid to developing alloys free from potentially toxic elements such as nickel, beryllium, and aluminum, which have been common constituents in many conventional metallic glasses.

The primary technical goals in this field include developing processing methods that allow for the fabrication of complex geometries required for biomedical devices, improving the toughness of amorphous metals to mitigate their inherent brittleness, and establishing standardized testing protocols for evaluating their long-term performance in biological environments.

Future directions point toward the integration of amorphous metals with other advanced materials to create multifunctional biomedical devices. The potential for these materials to serve as platforms for drug delivery, antimicrobial surfaces, or stimuli-responsive implants represents an exciting frontier in biomaterials science that could revolutionize treatment approaches for various medical conditions.

The evolution of amorphous metals has progressed through several significant phases. Initial research focused primarily on thin films and ribbons due to the extreme cooling rates required for their formation. The 1990s witnessed a breakthrough with the development of bulk metallic glasses (BMGs), which could be produced in thicker sections at lower cooling rates. Recent advancements have led to the creation of composite structures that combine the benefits of both amorphous and crystalline phases.

In the biomedical field, amorphous metals have emerged as promising candidates for implantable devices due to their superior mechanical properties and exceptional corrosion resistance. Their high elastic limit and low Young's modulus more closely match those of human bone compared to conventional metallic biomaterials, potentially reducing stress shielding effects that can lead to bone resorption around implants.

The biocompatibility of amorphous metals stems from their homogeneous structure, which lacks grain boundaries where corrosion typically initiates in crystalline alloys. Zirconium-based and titanium-based amorphous alloys have demonstrated particularly favorable interactions with biological tissues, exhibiting minimal ion release and inflammatory response in physiological environments.

Current research trends are focusing on tailoring the composition of amorphous metals to enhance their biocompatibility while maintaining their superior mechanical properties. Particular attention is being paid to developing alloys free from potentially toxic elements such as nickel, beryllium, and aluminum, which have been common constituents in many conventional metallic glasses.

The primary technical goals in this field include developing processing methods that allow for the fabrication of complex geometries required for biomedical devices, improving the toughness of amorphous metals to mitigate their inherent brittleness, and establishing standardized testing protocols for evaluating their long-term performance in biological environments.

Future directions point toward the integration of amorphous metals with other advanced materials to create multifunctional biomedical devices. The potential for these materials to serve as platforms for drug delivery, antimicrobial surfaces, or stimuli-responsive implants represents an exciting frontier in biomaterials science that could revolutionize treatment approaches for various medical conditions.

Market Analysis for Biocompatible Metallic Devices

The global market for biocompatible metallic devices continues to expand rapidly, driven by increasing prevalence of chronic diseases, growing aging population, and advancements in medical technology. The biocompatible metallic devices market was valued at approximately $94.3 billion in 2022 and is projected to reach $152.7 billion by 2030, representing a compound annual growth rate (CAGR) of 6.2% during the forecast period.

Orthopedic implants currently dominate the market share, accounting for nearly 40% of the total biocompatible metallic devices market. This segment's growth is primarily fueled by the rising incidence of musculoskeletal disorders and sports-related injuries. Cardiovascular devices follow closely, representing about 30% of the market, with dental implants and neurological devices comprising the remaining significant portions.

Regionally, North America holds the largest market share at 38%, followed by Europe at 29% and Asia-Pacific at 24%. However, the Asia-Pacific region is expected to witness the highest growth rate during the forecast period, with countries like China, India, and Japan showing substantial market potential due to improving healthcare infrastructure, increasing healthcare expenditure, and growing awareness about advanced medical treatments.

Traditional biocompatible metals such as titanium alloys, stainless steel, and cobalt-chromium alloys currently dominate the market. However, amorphous metals (metallic glasses) are emerging as promising alternatives due to their superior mechanical properties, excellent corrosion resistance, and enhanced biocompatibility. The market for amorphous metal-based biocompatible devices is currently small but growing at an impressive rate of 12.8% annually.

Key market drivers include technological advancements in material science, increasing demand for minimally invasive surgeries, growing prevalence of chronic diseases requiring implantable devices, and rising healthcare expenditure worldwide. The shift toward personalized medicine and 3D-printed implants is also creating new opportunities for amorphous metals in custom biomedical applications.

Market challenges include stringent regulatory approval processes, high development and manufacturing costs, and concerns regarding long-term performance and safety. Additionally, the complex manufacturing processes required for amorphous metals present barriers to widespread commercial adoption.

Consumer preferences are increasingly shifting toward longer-lasting implants with reduced risk of rejection and complications. This trend favors amorphous metals, which offer superior wear resistance and potentially lower inflammatory responses compared to conventional metallic biomaterials.

The competitive landscape is characterized by a mix of established medical device manufacturers and innovative materials science companies. Strategic collaborations between research institutions, material suppliers, and medical device manufacturers are becoming increasingly common to accelerate the development and commercialization of amorphous metal-based biocompatible devices.

Orthopedic implants currently dominate the market share, accounting for nearly 40% of the total biocompatible metallic devices market. This segment's growth is primarily fueled by the rising incidence of musculoskeletal disorders and sports-related injuries. Cardiovascular devices follow closely, representing about 30% of the market, with dental implants and neurological devices comprising the remaining significant portions.

Regionally, North America holds the largest market share at 38%, followed by Europe at 29% and Asia-Pacific at 24%. However, the Asia-Pacific region is expected to witness the highest growth rate during the forecast period, with countries like China, India, and Japan showing substantial market potential due to improving healthcare infrastructure, increasing healthcare expenditure, and growing awareness about advanced medical treatments.

Traditional biocompatible metals such as titanium alloys, stainless steel, and cobalt-chromium alloys currently dominate the market. However, amorphous metals (metallic glasses) are emerging as promising alternatives due to their superior mechanical properties, excellent corrosion resistance, and enhanced biocompatibility. The market for amorphous metal-based biocompatible devices is currently small but growing at an impressive rate of 12.8% annually.

Key market drivers include technological advancements in material science, increasing demand for minimally invasive surgeries, growing prevalence of chronic diseases requiring implantable devices, and rising healthcare expenditure worldwide. The shift toward personalized medicine and 3D-printed implants is also creating new opportunities for amorphous metals in custom biomedical applications.

Market challenges include stringent regulatory approval processes, high development and manufacturing costs, and concerns regarding long-term performance and safety. Additionally, the complex manufacturing processes required for amorphous metals present barriers to widespread commercial adoption.

Consumer preferences are increasingly shifting toward longer-lasting implants with reduced risk of rejection and complications. This trend favors amorphous metals, which offer superior wear resistance and potentially lower inflammatory responses compared to conventional metallic biomaterials.

The competitive landscape is characterized by a mix of established medical device manufacturers and innovative materials science companies. Strategic collaborations between research institutions, material suppliers, and medical device manufacturers are becoming increasingly common to accelerate the development and commercialization of amorphous metal-based biocompatible devices.

Current Status and Challenges in Amorphous Metals

Amorphous metals, also known as metallic glasses, represent a significant advancement in materials science, combining the strength of metals with the formability of glasses. Currently, the global research landscape shows considerable progress in developing biocompatible amorphous metals, with major research centers in the United States, Germany, China, and Japan leading innovation. These materials have demonstrated exceptional mechanical properties, including high strength-to-weight ratios, superior wear resistance, and excellent corrosion resistance, making them particularly attractive for biomedical applications.

Despite these promising attributes, several technical challenges persist in the widespread adoption of amorphous metals for biocompatible devices. The primary limitation remains the critical cooling rate required during manufacturing, which restricts the size and complexity of components that can be produced. While bulk metallic glasses have emerged as a solution, allowing for thicker sections, the production of complex geometries needed for certain biomedical implants remains problematic.

Biocompatibility presents another significant challenge. Although certain zirconium-based and titanium-based amorphous alloys show promising biocompatibility profiles, concerns about potential long-term ion release and tissue reactions continue to necessitate extensive testing. The variability in composition across different amorphous metal formulations further complicates standardization efforts for medical-grade applications.

Manufacturing consistency represents a third major hurdle. The metastable nature of amorphous metals means that slight variations in processing parameters can lead to partial crystallization, compromising the material's unique properties. This sensitivity makes quality control particularly challenging for medical device manufacturers who require exceptional reliability and reproducibility.

Cost factors also constrain wider implementation. The specialized equipment and precise processing conditions required for amorphous metal production result in significantly higher manufacturing costs compared to conventional biomedical alloys like titanium or stainless steel. This economic barrier has limited commercial applications primarily to high-value, specialized devices where performance advantages justify the premium.

Regulatory pathways present additional complexity. The novel nature of these materials means that regulatory frameworks for their use in implantable devices remain underdeveloped. Manufacturers face uncertainty regarding testing requirements and approval processes, further slowing market entry.

Recent technological developments show promise in addressing these challenges. Advanced rapid solidification techniques, including laser-based additive manufacturing, are expanding the geometric possibilities for amorphous metal components. Meanwhile, compositional innovations are yielding new alloy systems with enhanced biocompatibility and lower critical cooling rates. Surface modification technologies are also emerging as potential solutions to improve the biological interface without compromising the bulk material properties.

Despite these promising attributes, several technical challenges persist in the widespread adoption of amorphous metals for biocompatible devices. The primary limitation remains the critical cooling rate required during manufacturing, which restricts the size and complexity of components that can be produced. While bulk metallic glasses have emerged as a solution, allowing for thicker sections, the production of complex geometries needed for certain biomedical implants remains problematic.

Biocompatibility presents another significant challenge. Although certain zirconium-based and titanium-based amorphous alloys show promising biocompatibility profiles, concerns about potential long-term ion release and tissue reactions continue to necessitate extensive testing. The variability in composition across different amorphous metal formulations further complicates standardization efforts for medical-grade applications.

Manufacturing consistency represents a third major hurdle. The metastable nature of amorphous metals means that slight variations in processing parameters can lead to partial crystallization, compromising the material's unique properties. This sensitivity makes quality control particularly challenging for medical device manufacturers who require exceptional reliability and reproducibility.

Cost factors also constrain wider implementation. The specialized equipment and precise processing conditions required for amorphous metal production result in significantly higher manufacturing costs compared to conventional biomedical alloys like titanium or stainless steel. This economic barrier has limited commercial applications primarily to high-value, specialized devices where performance advantages justify the premium.

Regulatory pathways present additional complexity. The novel nature of these materials means that regulatory frameworks for their use in implantable devices remain underdeveloped. Manufacturers face uncertainty regarding testing requirements and approval processes, further slowing market entry.

Recent technological developments show promise in addressing these challenges. Advanced rapid solidification techniques, including laser-based additive manufacturing, are expanding the geometric possibilities for amorphous metal components. Meanwhile, compositional innovations are yielding new alloy systems with enhanced biocompatibility and lower critical cooling rates. Surface modification technologies are also emerging as potential solutions to improve the biological interface without compromising the bulk material properties.

Current Amorphous Metal Solutions for Biodevices

01 Manufacturing processes for amorphous metals

Various manufacturing processes can be employed to produce amorphous metals, including rapid solidification techniques that prevent crystallization. These methods involve cooling molten metal at extremely high rates to bypass crystal formation, resulting in a disordered atomic structure. Common techniques include melt spinning, gas atomization, and splat quenching. The manufacturing process significantly influences the properties and applications of the resulting amorphous metal materials.- Manufacturing processes for amorphous metals: Various manufacturing processes can be employed to produce amorphous metals, including rapid solidification techniques that prevent crystallization. These methods involve cooling molten metal at extremely high rates to bypass crystal formation, resulting in a disordered atomic structure. Common techniques include melt spinning, splat quenching, and gas atomization. These processes are critical for maintaining the unique properties of amorphous metals, as they prevent atoms from arranging into ordered crystalline structures.

- Composition and alloying of amorphous metals: The composition of amorphous metals significantly influences their properties and glass-forming ability. These alloys typically contain multiple elements with different atomic sizes to create atomic-level disorder that inhibits crystallization. Common amorphous metal systems include iron-based, zirconium-based, and palladium-based alloys. The specific combination and proportion of elements determine characteristics such as thermal stability, mechanical properties, and corrosion resistance. Careful selection of alloying elements is essential for tailoring amorphous metals for specific applications.

- Mechanical properties and applications of amorphous metals: Amorphous metals exhibit exceptional mechanical properties including high strength, hardness, and elastic limit compared to their crystalline counterparts. They demonstrate superior wear resistance and can withstand significant deformation without permanent damage. These unique properties make them suitable for various applications including cutting tools, sporting equipment, electronic casings, and biomedical implants. Their combination of strength and elasticity also makes them valuable in high-performance springs, pressure sensors, and structural components where conventional metals would fail.

- Thermal behavior and stability of amorphous metals: Amorphous metals exhibit distinctive thermal behavior characterized by glass transition temperatures and crystallization points. Unlike conventional metals, they transition from a rigid glass-like state to a supercooled liquid region before crystallization occurs. This temperature range allows for thermoplastic forming operations not possible with crystalline metals. However, amorphous metals are metastable and will eventually crystallize when heated sufficiently, which can dramatically alter their properties. Understanding and controlling this thermal behavior is crucial for processing and application development.

- Magnetic and electronic properties of amorphous metals: Amorphous metals possess unique magnetic and electronic properties due to their disordered atomic structure. Many amorphous alloys exhibit soft magnetic characteristics with low coercivity, high permeability, and reduced eddy current losses compared to crystalline counterparts. These properties make them excellent for transformer cores, magnetic shields, and electronic sensors. The absence of grain boundaries also contributes to enhanced corrosion resistance and uniform electrical properties, making amorphous metals valuable in electronic applications where consistent performance is critical.

02 Composition and alloying elements in amorphous metals

The composition of amorphous metals typically includes specific combinations of elements that enhance glass-forming ability and desired properties. These alloys often contain transition metals like iron, nickel, or zirconium combined with metalloids such as boron, silicon, or phosphorus. The precise ratio of elements affects glass transition temperature, mechanical properties, and thermal stability. Multi-component systems with significant atomic size differences between constituent elements tend to have better glass-forming ability.Expand Specific Solutions03 Mechanical and physical properties of amorphous metals

Amorphous metals exhibit unique mechanical and physical properties due to their lack of crystalline structure. They typically demonstrate high strength, hardness, and elastic limit compared to their crystalline counterparts. These materials often show excellent corrosion resistance, magnetic softness, and superior wear resistance. The absence of grain boundaries contributes to their unique combination of properties, including high fracture toughness and resistance to fatigue. Their isotropic nature means properties are uniform in all directions.Expand Specific Solutions04 Applications of amorphous metals in various industries

Amorphous metals find applications across numerous industries due to their exceptional properties. They are used in transformer cores and magnetic sensors due to their soft magnetic characteristics. Their high strength-to-weight ratio makes them suitable for sporting goods like golf club heads and tennis rackets. In the medical field, they serve as biocompatible implants. Their corrosion resistance is valuable for protective coatings, while their unique properties enable applications in electronic devices, aerospace components, and precision instruments.Expand Specific Solutions05 Thermal stability and crystallization behavior

The thermal stability of amorphous metals is a critical characteristic that determines their practical applications. When heated, these materials eventually crystallize at their crystallization temperature, transitioning from amorphous to crystalline structure. This process is accompanied by changes in properties such as brittleness and magnetic behavior. Research focuses on developing amorphous alloys with higher thermal stability and understanding the kinetics of crystallization. Controlled partial crystallization can sometimes be used to create nanocrystalline materials with enhanced properties.Expand Specific Solutions

Key Industry Players in Biocompatible Amorphous Metals

The amorphous metals biocompatible devices market is currently in a growth phase, with increasing applications in medical implants, surgical instruments, and diagnostic equipment. The global market is estimated at $2.5-3 billion, expanding at approximately 8-10% CAGR, driven by demand for materials with superior mechanical properties and biocompatibility. Technology maturity varies across applications, with established players like Biotronik AG and Apple developing proprietary solutions, while research institutions (Institute of Metal Research CAS, National Institute for Materials Science) focus on fundamental advancements. Emerging companies like Life Magnetics and CG Bio are introducing innovative applications, while traditional materials firms such as SAES Getters and Schaeffler Technologies are adapting their expertise to this specialized field. University research from California Institute of Technology, Zhejiang University, and Beihang University is accelerating commercialization through industry partnerships.

Institute of Metal Research Chinese Academy of Sciences

Technical Solution: The Institute of Metal Research (IMR) at the Chinese Academy of Sciences has pioneered innovative titanium-based amorphous metal alloys (Ti-BMGs) specifically designed for load-bearing implants. Their research has focused on developing Ti-Zr-Cu-Pd-Sn systems with elastic moduli closely matching human bone, significantly reducing stress shielding effects that plague conventional metallic implants. IMR has established advanced manufacturing protocols combining rapid solidification techniques with precision control of cooling rates to produce bulk amorphous components with dimensions suitable for clinical applications. Their materials exhibit exceptional wear resistance and corrosion behavior in simulated body fluids, with ion release rates orders of magnitude lower than conventional titanium alloys. The institute has developed surface modification techniques including controlled crystallization of amorphous surfaces to create bioactive interfaces that promote osseointegration while maintaining the bulk amorphous structure's mechanical advantages. Recent innovations include amorphous metal-based scaffolds with hierarchical porosity designed to facilitate bone ingrowth and vascularization, addressing a critical challenge in orthopedic implant design.

Strengths: Superior combination of high strength and low elastic modulus matching bone properties; excellent corrosion resistance in physiological environments; advanced manufacturing capabilities for complex geometries. Weaknesses: Relatively high material costs compared to conventional implant materials; limited clinical validation data; challenges in scaling production while maintaining consistent amorphous structure.

Biotronik AG

Technical Solution: Biotronik AG has developed proprietary amorphous metal alloys specifically designed for cardiovascular implants. Their technology focuses on iron-based bulk metallic glasses (Fe-BMGs) with additions of chromium, molybdenum, and phosphorus to enhance biocompatibility and corrosion resistance. These materials exhibit exceptional mechanical properties with elastic moduli closer to natural bone than conventional titanium alloys, reducing stress shielding effects. Biotronik's amorphous metal stents demonstrate superior flexibility and conformability to vessel anatomy while maintaining necessary radial strength. The company has pioneered surface modification techniques for their amorphous metal implants, creating nano-textured surfaces that promote endothelialization while minimizing thrombogenicity. Clinical studies have shown reduced inflammatory responses compared to crystalline metal counterparts, with controlled degradation profiles that can be tailored for specific therapeutic applications.

Strengths: Superior corrosion resistance in physiological environments; exceptional mechanical properties combining strength and flexibility; customizable degradation rates for different clinical applications. Weaknesses: Higher manufacturing costs compared to conventional materials; limited long-term clinical data beyond 5 years; challenges in scaling production while maintaining amorphous structure consistency.

Critical Patents and Research in Biocompatible Amorphous Alloys

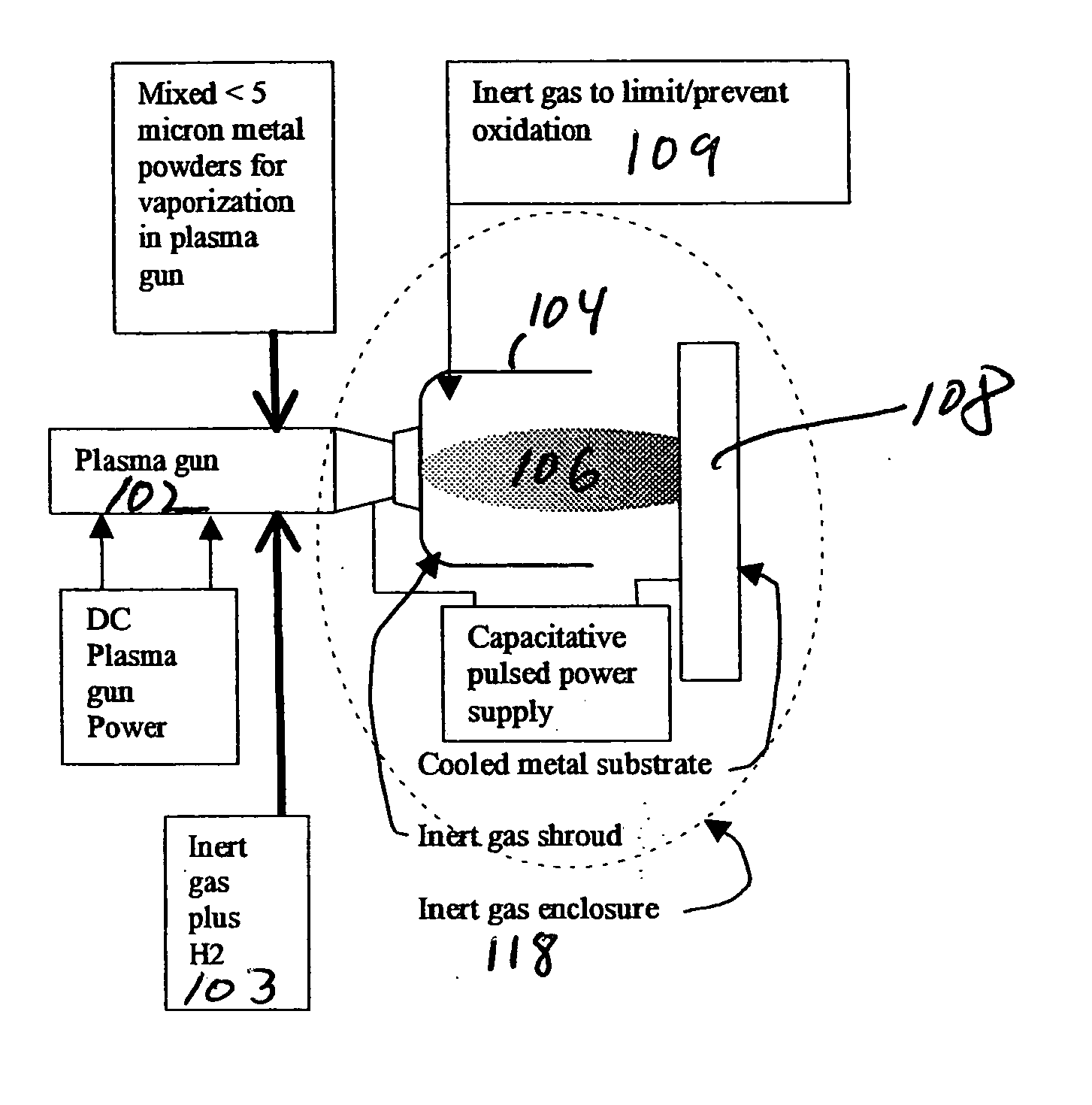

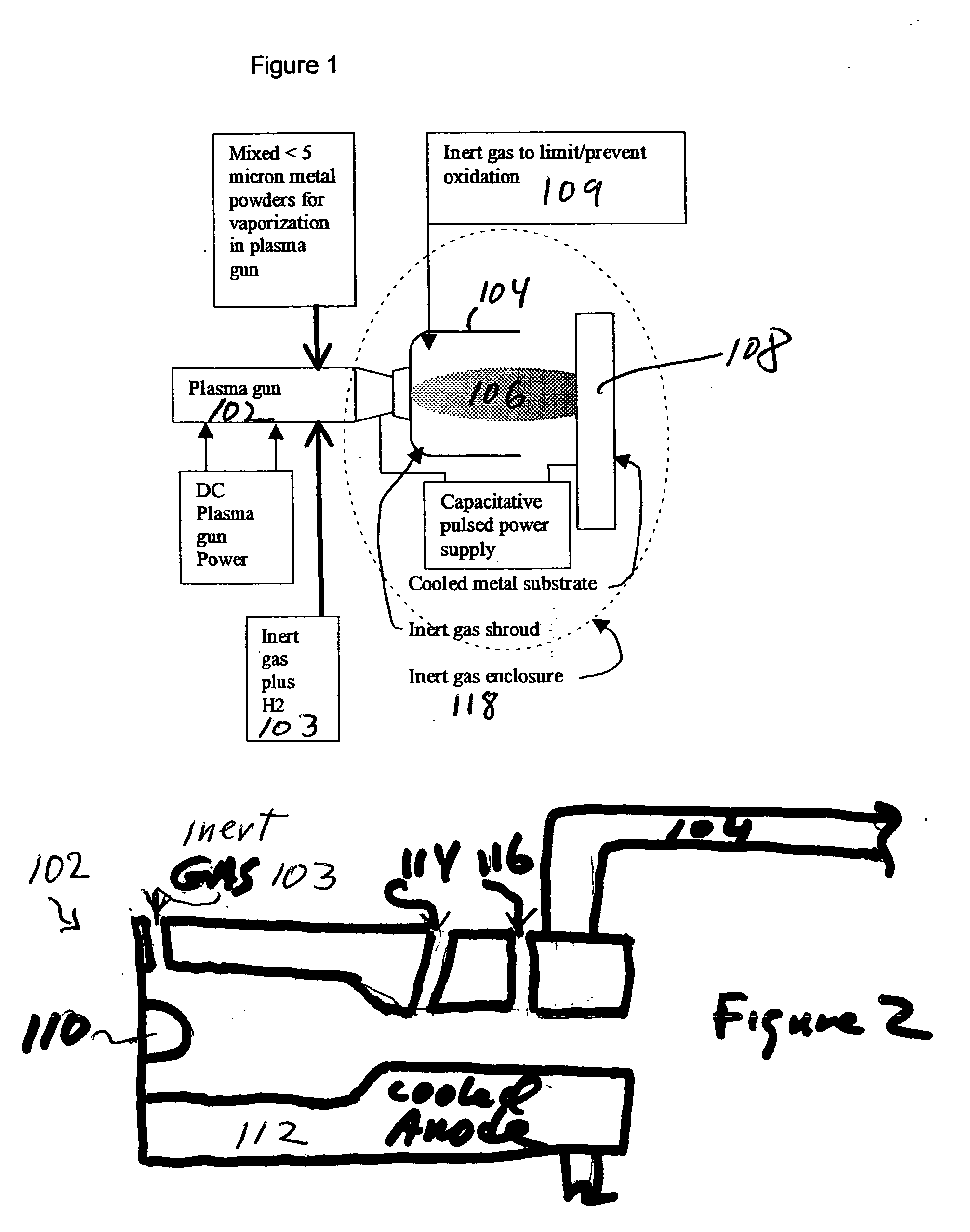

Amorphous metal deposition and new aluminum-based amorphous metals

PatentInactiveUS20050123686A1

Innovation

- The method involves vaporizing small powders of specific metal/metalloid compositions using plasma processing to form amorphous metal alloys, condensing the vapor on a substrate below the crystallization temperature, and using a chemically reducing plasma to prevent oxidation and enhance bonding, allowing for the formation of dense, amorphous metal coatings with improved mechanical properties.

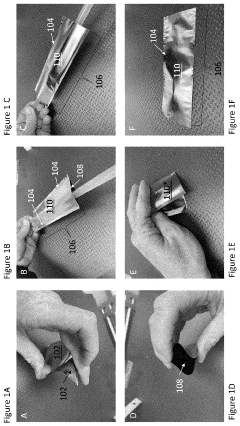

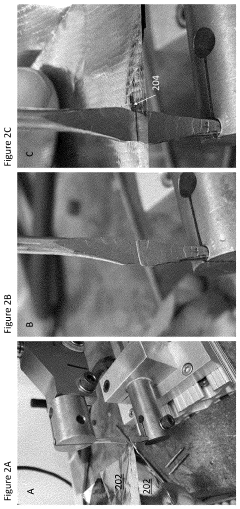

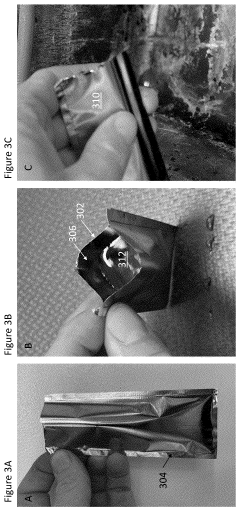

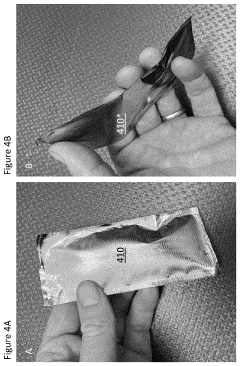

Systems and Methods for Creating Flexible and Rigid Pressure Vessels and Thermal and Fluid Devices Made from Amorphous Metals

PatentPendingUS20240251526A1

Innovation

- The development of thermal management devices using amorphous metal films configured to enclose a volume with a working fluid, which are sealed to form a fluid path and incorporate geometrical shapes for flexibility and vibration isolation, allowing for efficient heat transfer and deployment in flexible systems.

Regulatory Framework for Medical-Grade Metallic Materials

The regulatory landscape for medical-grade metallic materials is complex and multifaceted, particularly when considering novel materials like amorphous metals for biocompatible devices. At the international level, the International Organization for Standardization (ISO) has established several critical standards, including ISO 10993 for biological evaluation of medical devices and ISO 13485 for quality management systems. These standards provide the foundational framework for ensuring material safety and performance in medical applications.

In the United States, the Food and Drug Administration (FDA) regulates medical devices through various pathways, with metallic implants typically classified as Class II or Class III devices. For amorphous metals, manufacturers must navigate the 510(k) clearance process or the more rigorous Premarket Approval (PMA) pathway, depending on the novelty and risk profile of the specific application. The FDA's guidance document on "Technical Considerations for Additive Manufactured Medical Devices" has particular relevance for amorphous metals, as many such materials are fabricated using advanced manufacturing techniques.

The European Union's regulatory framework has undergone significant transformation with the implementation of the Medical Device Regulation (MDR 2017/745), which replaced the previous Medical Device Directive. This regulation imposes stricter requirements for clinical evaluation, post-market surveillance, and technical documentation for all medical devices, including those incorporating metallic materials. Notably, the MDR places greater emphasis on material characterization and long-term safety assessment.

In Asia, Japan's Pharmaceuticals and Medical Devices Agency (PMDA) and China's National Medical Products Administration (NMPA) have established their own regulatory pathways for medical-grade materials. These frameworks often reference international standards but may include country-specific requirements that necessitate additional testing or documentation for amorphous metal applications.

Material-specific regulations are particularly relevant for amorphous metals in biomedical applications. ASTM F2063 (for Nitinol) provides a potential regulatory template, though specific standards for amorphous metal alloys are still evolving. The lack of long-term clinical data for these novel materials often necessitates more extensive preclinical testing, including accelerated aging studies, corrosion resistance evaluation, and comprehensive biocompatibility assessment according to ISO 10993-1.

Regulatory bodies increasingly require manufacturers to implement risk management processes throughout the product lifecycle, as outlined in ISO 14971. For amorphous metals, particular attention must be paid to potential risks associated with ion release, mechanical failure modes, and long-term stability in the biological environment. Manufacturers must develop robust risk mitigation strategies and post-market surveillance plans to address these concerns.

In the United States, the Food and Drug Administration (FDA) regulates medical devices through various pathways, with metallic implants typically classified as Class II or Class III devices. For amorphous metals, manufacturers must navigate the 510(k) clearance process or the more rigorous Premarket Approval (PMA) pathway, depending on the novelty and risk profile of the specific application. The FDA's guidance document on "Technical Considerations for Additive Manufactured Medical Devices" has particular relevance for amorphous metals, as many such materials are fabricated using advanced manufacturing techniques.

The European Union's regulatory framework has undergone significant transformation with the implementation of the Medical Device Regulation (MDR 2017/745), which replaced the previous Medical Device Directive. This regulation imposes stricter requirements for clinical evaluation, post-market surveillance, and technical documentation for all medical devices, including those incorporating metallic materials. Notably, the MDR places greater emphasis on material characterization and long-term safety assessment.

In Asia, Japan's Pharmaceuticals and Medical Devices Agency (PMDA) and China's National Medical Products Administration (NMPA) have established their own regulatory pathways for medical-grade materials. These frameworks often reference international standards but may include country-specific requirements that necessitate additional testing or documentation for amorphous metal applications.

Material-specific regulations are particularly relevant for amorphous metals in biomedical applications. ASTM F2063 (for Nitinol) provides a potential regulatory template, though specific standards for amorphous metal alloys are still evolving. The lack of long-term clinical data for these novel materials often necessitates more extensive preclinical testing, including accelerated aging studies, corrosion resistance evaluation, and comprehensive biocompatibility assessment according to ISO 10993-1.

Regulatory bodies increasingly require manufacturers to implement risk management processes throughout the product lifecycle, as outlined in ISO 14971. For amorphous metals, particular attention must be paid to potential risks associated with ion release, mechanical failure modes, and long-term stability in the biological environment. Manufacturers must develop robust risk mitigation strategies and post-market surveillance plans to address these concerns.

Manufacturing Processes and Scalability Considerations

The manufacturing of amorphous metals for biocompatible devices presents unique challenges compared to conventional crystalline materials. Traditional manufacturing methods like casting and forging are often unsuitable due to the rapid cooling rates required to maintain the amorphous structure. Currently, melt spinning represents the most established technique for producing amorphous metal ribbons, achieving cooling rates of 10^4-10^6 K/s by ejecting molten metal onto a rapidly rotating copper wheel.

For biomedical applications requiring complex geometries, selective laser melting (SLM) and other additive manufacturing techniques have emerged as promising approaches. These methods allow for the fabrication of intricate structures while maintaining the amorphous state through precise control of energy input and cooling rates. However, the process parameters must be carefully optimized to prevent crystallization, which remains a significant challenge for larger components.

Injection molding of bulk metallic glasses (BMGs) offers another viable manufacturing route for biocompatible devices. This technique leverages the thermoplastic-like behavior of amorphous metals in their supercooled liquid region, enabling the production of near-net-shape components with excellent dimensional accuracy. The process is particularly suitable for smaller biomedical implants and surgical instruments.

Scalability considerations present significant hurdles for widespread adoption. The critical cooling rate requirement limits the maximum thickness (critical casting thickness) of fully amorphous components, typically restricting dimensions to several millimeters for most biocompatible compositions. This size limitation constrains the range of potential applications and increases production costs for larger devices.

Economic factors also impact scalability, as specialized equipment and precise process control add to manufacturing expenses. The high raw material costs of biocompatible elements like Ti, Zr, and noble metals further challenge cost-effective mass production. Additionally, quality control measures must be more stringent than for conventional materials, as even minor crystallization can compromise biocompatibility and mechanical properties.

Recent advances in manufacturing technology show promise for overcoming these limitations. Thermoplastic forming techniques that operate in the supercooled liquid region are enabling more complex geometries while maintaining amorphous structures. Composite approaches, where thin amorphous coatings are applied to conventional substrates, offer a practical compromise between performance and manufacturability for certain applications.

For successful commercialization, standardization of manufacturing protocols and quality assessment methods specific to amorphous metals in biomedical applications will be essential. This includes developing non-destructive testing methods to verify the amorphous state throughout complex components and establishing regulatory pathways for these novel materials.

For biomedical applications requiring complex geometries, selective laser melting (SLM) and other additive manufacturing techniques have emerged as promising approaches. These methods allow for the fabrication of intricate structures while maintaining the amorphous state through precise control of energy input and cooling rates. However, the process parameters must be carefully optimized to prevent crystallization, which remains a significant challenge for larger components.

Injection molding of bulk metallic glasses (BMGs) offers another viable manufacturing route for biocompatible devices. This technique leverages the thermoplastic-like behavior of amorphous metals in their supercooled liquid region, enabling the production of near-net-shape components with excellent dimensional accuracy. The process is particularly suitable for smaller biomedical implants and surgical instruments.

Scalability considerations present significant hurdles for widespread adoption. The critical cooling rate requirement limits the maximum thickness (critical casting thickness) of fully amorphous components, typically restricting dimensions to several millimeters for most biocompatible compositions. This size limitation constrains the range of potential applications and increases production costs for larger devices.

Economic factors also impact scalability, as specialized equipment and precise process control add to manufacturing expenses. The high raw material costs of biocompatible elements like Ti, Zr, and noble metals further challenge cost-effective mass production. Additionally, quality control measures must be more stringent than for conventional materials, as even minor crystallization can compromise biocompatibility and mechanical properties.

Recent advances in manufacturing technology show promise for overcoming these limitations. Thermoplastic forming techniques that operate in the supercooled liquid region are enabling more complex geometries while maintaining amorphous structures. Composite approaches, where thin amorphous coatings are applied to conventional substrates, offer a practical compromise between performance and manufacturability for certain applications.

For successful commercialization, standardization of manufacturing protocols and quality assessment methods specific to amorphous metals in biomedical applications will be essential. This includes developing non-destructive testing methods to verify the amorphous state throughout complex components and establishing regulatory pathways for these novel materials.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!