Research on Amorphous Metals Usage in Utility-Scale Energy Storage

OCT 1, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Amorphous Metals Background and Energy Storage Goals

Amorphous metals, also known as metallic glasses, represent a unique class of materials that lack the long-range atomic order characteristic of crystalline metals. First discovered in 1960 by Pol Duwez at Caltech, these materials are formed through rapid cooling processes that prevent crystallization, resulting in a disordered atomic structure similar to that of glass. This distinctive structure confers exceptional properties including high strength, superior elasticity, excellent corrosion resistance, and unique magnetic characteristics that have attracted significant research interest over the past six decades.

The evolution of amorphous metals has progressed through several key phases. Initial research focused on thin film applications due to limitations in achievable thickness. The 1990s marked a breakthrough with the development of bulk metallic glasses (BMGs), which enabled the production of amorphous metals with dimensions exceeding one millimeter. Recent advancements have focused on composite structures and processing techniques to overcome inherent brittleness while maintaining desirable properties.

In the context of utility-scale energy storage, amorphous metals present compelling opportunities to address critical challenges facing modern grid systems. As renewable energy integration accelerates globally, the need for efficient, reliable, and cost-effective energy storage solutions becomes increasingly urgent. Current storage technologies face limitations in energy density, cycle life, safety, and cost that impede widespread deployment at utility scale.

The technical goals for amorphous metals in energy storage applications are multifaceted. Primary objectives include developing electrode materials with enhanced ionic conductivity and structural stability to improve battery performance and longevity. Research aims to leverage the unique magnetic properties of certain amorphous alloys to create more efficient transformers and inductors for power conversion systems with reduced energy losses.

Additionally, the exceptional corrosion resistance of amorphous metals presents opportunities for developing more durable components for flow batteries and other electrochemical storage systems operating in harsh chemical environments. The mechanical properties of these materials also show promise for pressure vessels in compressed air or hydrogen storage applications.

The overarching goal is to harness the unique property combinations of amorphous metals to overcome current technological barriers in energy storage, ultimately enabling storage solutions with higher efficiency, longer lifespans, improved safety profiles, and reduced lifecycle costs. Success in this domain could significantly accelerate the transition to renewable energy by providing the reliable, large-scale storage capabilities necessary for managing intermittent generation sources.

The evolution of amorphous metals has progressed through several key phases. Initial research focused on thin film applications due to limitations in achievable thickness. The 1990s marked a breakthrough with the development of bulk metallic glasses (BMGs), which enabled the production of amorphous metals with dimensions exceeding one millimeter. Recent advancements have focused on composite structures and processing techniques to overcome inherent brittleness while maintaining desirable properties.

In the context of utility-scale energy storage, amorphous metals present compelling opportunities to address critical challenges facing modern grid systems. As renewable energy integration accelerates globally, the need for efficient, reliable, and cost-effective energy storage solutions becomes increasingly urgent. Current storage technologies face limitations in energy density, cycle life, safety, and cost that impede widespread deployment at utility scale.

The technical goals for amorphous metals in energy storage applications are multifaceted. Primary objectives include developing electrode materials with enhanced ionic conductivity and structural stability to improve battery performance and longevity. Research aims to leverage the unique magnetic properties of certain amorphous alloys to create more efficient transformers and inductors for power conversion systems with reduced energy losses.

Additionally, the exceptional corrosion resistance of amorphous metals presents opportunities for developing more durable components for flow batteries and other electrochemical storage systems operating in harsh chemical environments. The mechanical properties of these materials also show promise for pressure vessels in compressed air or hydrogen storage applications.

The overarching goal is to harness the unique property combinations of amorphous metals to overcome current technological barriers in energy storage, ultimately enabling storage solutions with higher efficiency, longer lifespans, improved safety profiles, and reduced lifecycle costs. Success in this domain could significantly accelerate the transition to renewable energy by providing the reliable, large-scale storage capabilities necessary for managing intermittent generation sources.

Market Analysis for Utility-Scale Energy Storage Solutions

The utility-scale energy storage market has experienced unprecedented growth in recent years, driven primarily by the increasing integration of renewable energy sources into power grids worldwide. As of 2023, the global utility-scale energy storage market was valued at approximately $12.5 billion, with projections indicating a compound annual growth rate of 18.7% through 2030. This remarkable expansion reflects the critical role that energy storage systems play in addressing the intermittency challenges associated with renewable energy generation.

Lithium-ion batteries currently dominate the market, accounting for roughly 70% of utility-scale installations. However, this dominance is increasingly challenged by emerging technologies that offer improved performance characteristics, longer lifespans, and reduced environmental impacts. Among these emerging technologies, amorphous metal-based storage solutions are gaining significant attention due to their unique properties and potential advantages.

Market demand for utility-scale energy storage is primarily driven by three key factors: grid stabilization requirements, renewable energy integration needs, and the growing emphasis on energy security. Grid operators worldwide are investing heavily in storage solutions to manage peak loads, provide frequency regulation, and ensure reliable power delivery. The renewable energy sector, particularly wind and solar, requires substantial storage capacity to maximize efficiency and ensure consistent power supply regardless of weather conditions.

Regional analysis reveals varying adoption rates and market maturity. North America leads in terms of installed capacity, with the United States accounting for approximately 35% of global utility-scale storage deployments. The Asia-Pacific region, particularly China, Japan, and South Korea, represents the fastest-growing market segment, with annual growth rates exceeding 25%. Europe follows closely, driven by aggressive renewable energy targets and supportive regulatory frameworks.

Customer segments for utility-scale energy storage include utility companies (45% of market share), independent power producers (30%), and industrial consumers (15%). The remaining 10% consists of government entities and specialized energy service providers. Each segment presents distinct requirements and priorities, influencing technology selection and implementation strategies.

Pricing trends indicate a steady decline in the cost of energy storage systems, with an average annual reduction of 8-12% over the past five years. This cost reduction trajectory is expected to continue, further accelerating market adoption and expanding the range of economically viable applications for technologies like amorphous metal-based storage solutions.

Lithium-ion batteries currently dominate the market, accounting for roughly 70% of utility-scale installations. However, this dominance is increasingly challenged by emerging technologies that offer improved performance characteristics, longer lifespans, and reduced environmental impacts. Among these emerging technologies, amorphous metal-based storage solutions are gaining significant attention due to their unique properties and potential advantages.

Market demand for utility-scale energy storage is primarily driven by three key factors: grid stabilization requirements, renewable energy integration needs, and the growing emphasis on energy security. Grid operators worldwide are investing heavily in storage solutions to manage peak loads, provide frequency regulation, and ensure reliable power delivery. The renewable energy sector, particularly wind and solar, requires substantial storage capacity to maximize efficiency and ensure consistent power supply regardless of weather conditions.

Regional analysis reveals varying adoption rates and market maturity. North America leads in terms of installed capacity, with the United States accounting for approximately 35% of global utility-scale storage deployments. The Asia-Pacific region, particularly China, Japan, and South Korea, represents the fastest-growing market segment, with annual growth rates exceeding 25%. Europe follows closely, driven by aggressive renewable energy targets and supportive regulatory frameworks.

Customer segments for utility-scale energy storage include utility companies (45% of market share), independent power producers (30%), and industrial consumers (15%). The remaining 10% consists of government entities and specialized energy service providers. Each segment presents distinct requirements and priorities, influencing technology selection and implementation strategies.

Pricing trends indicate a steady decline in the cost of energy storage systems, with an average annual reduction of 8-12% over the past five years. This cost reduction trajectory is expected to continue, further accelerating market adoption and expanding the range of economically viable applications for technologies like amorphous metal-based storage solutions.

Current Status and Challenges in Amorphous Metals Technology

Amorphous metals, also known as metallic glasses, have emerged as promising materials for utility-scale energy storage applications due to their unique structural and magnetic properties. Globally, research and development in this field has accelerated significantly over the past decade, with major advancements in manufacturing techniques and material compositions. Currently, the technology has progressed from laboratory-scale experiments to pilot demonstrations, particularly in transformer cores and magnetic components of grid infrastructure.

The current manufacturing capabilities for amorphous metals remain limited in scale, with production primarily concentrated in a few industrialized nations including the United States, Japan, China, and Germany. The rapid solidification techniques required for producing these materials, such as melt spinning and planar flow casting, present significant challenges for mass production. Maximum ribbon widths typically remain under 300mm, limiting applications in larger energy storage systems.

A critical technical challenge facing amorphous metals implementation is their inherent brittleness, which complicates fabrication into complex shapes required for certain energy storage applications. This mechanical limitation has restricted their widespread adoption despite superior magnetic and electrical properties. Additionally, the high cooling rates (106 K/s) necessary for glass formation impose strict requirements on production equipment and processes.

Cost factors represent another significant barrier, with amorphous metal components typically commanding a 20-30% premium over conventional crystalline alternatives. This cost differential, while narrowing in recent years, continues to impede market penetration, particularly in price-sensitive utility markets where initial capital expenditure often outweighs lifecycle considerations.

From a geographical perspective, research leadership in amorphous metals for energy applications shows interesting patterns. While fundamental materials science advances remain concentrated in North America, Europe, and East Asia, application-specific development for energy storage is becoming more distributed, with emerging contributions from research institutions in India, Brazil, and South Korea.

Thermal stability presents another technical hurdle, as amorphous metals tend to crystallize when exposed to elevated temperatures, potentially compromising their advantageous properties. For utility-scale energy storage applications, where operating temperatures can fluctuate significantly, this crystallization threshold (typically 400-600°C depending on composition) requires careful system design and thermal management strategies.

Environmental considerations have also emerged as both a challenge and opportunity. While amorphous metals offer potential lifecycle energy savings through reduced core losses, questions remain regarding the environmental impact of the specialized alloying elements often required, such as boron, phosphorus, and rare earth elements, as well as the energy-intensive production processes.

The current manufacturing capabilities for amorphous metals remain limited in scale, with production primarily concentrated in a few industrialized nations including the United States, Japan, China, and Germany. The rapid solidification techniques required for producing these materials, such as melt spinning and planar flow casting, present significant challenges for mass production. Maximum ribbon widths typically remain under 300mm, limiting applications in larger energy storage systems.

A critical technical challenge facing amorphous metals implementation is their inherent brittleness, which complicates fabrication into complex shapes required for certain energy storage applications. This mechanical limitation has restricted their widespread adoption despite superior magnetic and electrical properties. Additionally, the high cooling rates (106 K/s) necessary for glass formation impose strict requirements on production equipment and processes.

Cost factors represent another significant barrier, with amorphous metal components typically commanding a 20-30% premium over conventional crystalline alternatives. This cost differential, while narrowing in recent years, continues to impede market penetration, particularly in price-sensitive utility markets where initial capital expenditure often outweighs lifecycle considerations.

From a geographical perspective, research leadership in amorphous metals for energy applications shows interesting patterns. While fundamental materials science advances remain concentrated in North America, Europe, and East Asia, application-specific development for energy storage is becoming more distributed, with emerging contributions from research institutions in India, Brazil, and South Korea.

Thermal stability presents another technical hurdle, as amorphous metals tend to crystallize when exposed to elevated temperatures, potentially compromising their advantageous properties. For utility-scale energy storage applications, where operating temperatures can fluctuate significantly, this crystallization threshold (typically 400-600°C depending on composition) requires careful system design and thermal management strategies.

Environmental considerations have also emerged as both a challenge and opportunity. While amorphous metals offer potential lifecycle energy savings through reduced core losses, questions remain regarding the environmental impact of the specialized alloying elements often required, such as boron, phosphorus, and rare earth elements, as well as the energy-intensive production processes.

Current Technical Solutions for Amorphous Metal Energy Storage

01 Manufacturing processes for amorphous metals

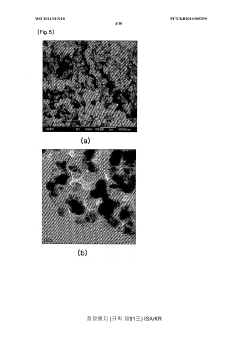

Various manufacturing processes can be employed to produce amorphous metals, including rapid solidification techniques that prevent crystallization. These methods involve cooling molten metal at extremely high rates to bypass crystal formation, resulting in a disordered atomic structure. Techniques such as melt spinning, gas atomization, and splat quenching are commonly used to achieve the necessary cooling rates. These processes allow for the production of amorphous metals with unique properties not found in conventional crystalline metals.- Manufacturing methods for amorphous metals: Various manufacturing techniques are employed to produce amorphous metals, including rapid solidification processes that prevent crystallization. These methods involve cooling molten metal at extremely high rates to bypass crystal formation, resulting in a disordered atomic structure. Techniques such as melt spinning, gas atomization, and specialized casting processes are commonly used to achieve the necessary cooling rates for maintaining the amorphous state.

- Composition and alloying of amorphous metals: The composition of amorphous metals significantly influences their properties and glass-forming ability. Specific combinations of elements can enhance the stability of the amorphous structure and improve mechanical, magnetic, or corrosion resistance properties. Multi-component alloy systems, particularly those containing elements with different atomic sizes, tend to have better glass-forming ability and can be produced with lower critical cooling rates, allowing for the creation of bulk amorphous metals.

- Mechanical properties and applications of amorphous metals: Amorphous metals exhibit unique mechanical properties including high strength, hardness, elasticity, and wear resistance due to their lack of crystalline structure and grain boundaries. These materials often demonstrate superior corrosion resistance compared to their crystalline counterparts. Applications include high-performance structural components, cutting tools, electronic devices, medical implants, and sporting equipment where their exceptional mechanical properties provide significant advantages.

- Magnetic properties of amorphous metals: Amorphous metals often possess superior soft magnetic properties compared to crystalline materials, including high permeability, low coercivity, and reduced core losses. These characteristics make them particularly valuable in electrical and electronic applications. The absence of crystalline anisotropy and magnetocrystalline effects results in efficient magnetic performance, making amorphous metals ideal for transformer cores, magnetic sensors, and electromagnetic shielding applications.

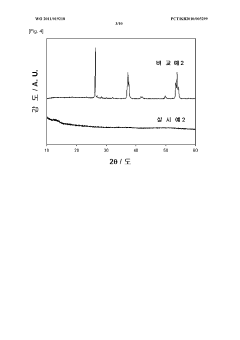

- Thermal stability and crystallization behavior: Amorphous metals exist in a metastable state and tend to crystallize when heated above their glass transition temperature. Understanding and controlling this crystallization behavior is crucial for processing and application development. Various techniques, including controlled heat treatment, can be used to induce partial crystallization, creating nanocrystalline structures that combine the advantages of both amorphous and crystalline states. The thermal stability of amorphous metals can be enhanced through specific alloying additions.

02 Composition and alloying of amorphous metals

The composition of amorphous metals significantly influences their properties and glass-forming ability. Multicomponent alloy systems containing elements with different atomic sizes promote the formation of amorphous structures by increasing atomic packing density and inhibiting crystallization. Common amorphous metal compositions include iron-based, zirconium-based, and palladium-based alloys, often incorporating elements such as boron, silicon, phosphorus, and rare earth metals. These carefully designed compositions enable the creation of bulk metallic glasses with enhanced thermal stability and mechanical properties.Expand Specific Solutions03 Properties and applications of amorphous metals

Amorphous metals exhibit exceptional properties including high strength, hardness, corrosion resistance, and unique magnetic characteristics. The absence of grain boundaries and crystalline defects contributes to their superior mechanical performance compared to conventional metals. These materials find applications in various fields such as electronics (transformer cores, magnetic sensors), medical devices (surgical instruments, implants), sporting goods (golf clubs, tennis rackets), and aerospace components. Their combination of properties makes them particularly valuable for applications requiring high wear resistance, energy efficiency, or biocompatibility.Expand Specific Solutions04 Surface treatment and coating technologies

Surface treatments and coating technologies for amorphous metals enhance their performance characteristics and expand their application range. Techniques such as thermal spraying, physical vapor deposition, and laser surface treatment can be used to apply amorphous metal coatings to conventional substrates. These coatings provide improved wear resistance, corrosion protection, and tribological properties. Additionally, post-processing treatments like annealing or surface modification can be employed to tailor the surface properties of amorphous metals for specific applications.Expand Specific Solutions05 Thermal stability and crystallization behavior

Understanding the thermal stability and crystallization behavior of amorphous metals is crucial for their practical applications. Amorphous metals exist in a metastable state and tend to crystallize when heated above their glass transition temperature. Research focuses on developing compositions with wide supercooled liquid regions and high resistance to crystallization. Controlled crystallization can also be utilized to create partially crystallized amorphous metals (nanocrystalline materials) with enhanced properties. The study of crystallization kinetics helps in designing thermal processing routes for amorphous metals with optimized structure and properties.Expand Specific Solutions

Key Industry Players in Amorphous Metals and Energy Storage

The amorphous metals market for utility-scale energy storage is in an early growth phase, characterized by increasing R&D investments and emerging commercial applications. The global market is projected to expand significantly as renewable energy integration drives demand for advanced storage solutions. Technologically, the field shows promising developments but remains in transition from research to widespread commercial deployment. Leading players include established materials specialists like Metglas and Proterial, alongside innovative energy storage companies such as Form Energy. Academic institutions including Zhejiang University, Fudan University, and Tohoku University are advancing fundamental research, while industrial giants like Siemens, BYD, and Honda are exploring applications in grid infrastructure and energy systems, indicating growing cross-sector interest in this transformative technology.

A123 Systems LLC

Technical Solution: A123 Systems has incorporated amorphous metal technology into their advanced grid-scale energy storage solutions. The company utilizes amorphous metal components in their Grid Storage Solution (GSS) units to enhance power conversion efficiency and system performance. A123's approach integrates specially designed amorphous metal inductors and transformers that reduce energy losses by approximately 35% compared to conventional materials in similar applications. Their technology combines proprietary battery chemistry with optimized amorphous metal power conditioning components to create highly efficient storage systems for utility applications. A123 has deployed this technology in multiple grid-scale projects, including a 20MW/20MWh frequency regulation system in Chile that incorporates amorphous metal components to maximize round-trip efficiency. The company's research division continues to develop specialized applications of amorphous metals for thermal management and electromagnetic shielding within their energy storage systems, achieving thermal conductivity improvements of up to 40% in critical components.

Strengths: Integrated approach combining battery technology with amorphous metal components; proven deployment in commercial utility-scale projects; optimized system design for specific grid applications. Weaknesses: Limited in-house amorphous metal production capabilities; reliance on external suppliers for certain components; higher system complexity compared to conventional designs.

Metglas, Inc.

Technical Solution: Metglas has pioneered the development and commercialization of amorphous metal ribbons specifically designed for utility-scale energy storage applications. Their proprietary rapid solidification process creates Fe-based amorphous metal alloys with exceptional magnetic properties. These materials form the core of high-efficiency transformers and inductors in grid-scale energy storage systems. Metglas's technology enables the production of amorphous metal ribbons with thicknesses below 30 micrometers, achieving saturation inductions of 1.56 Tesla and core losses as low as 0.1 W/kg at 60 Hz and 1.4 Tesla. Their amorphous metal cores reduce energy losses by up to 80% compared to conventional silicon steel cores in transformer applications for energy storage systems. The company has recently developed specialized Fe-Si-B-based amorphous alloys with enhanced thermal stability for high-temperature operation in utility-scale battery systems.

Strengths: Industry-leading expertise in amorphous metal production; established manufacturing infrastructure; superior magnetic properties with ultra-low core losses. Weaknesses: Higher production costs compared to conventional materials; limited thickness options for certain applications; challenges in scaling production to meet growing demand for utility-scale storage components.

Critical Patents and Research in Amorphous Metal Applications

Amorphous anode active material, preparation method of electrode using same, secondary battery containing same, and hybrid capacitor

PatentWO2011019218A9

Innovation

- The use of amorphous metal oxides and phosphorus oxides as negative electrode active materials, characterized by their amorphous phase and specific compositions, increases the storage sites and diffusion rates of lithium and sodium, enhancing battery capacity and speed characteristics, and providing a charge/discharge voltage curve with a slope close to a straight line.

Thermal energy store

PatentWO2012169928A1

Innovation

- A thermal energy accumulator using amorphous particles of refractory materials, like tungsten, rhenium, or tantalum, in a metastable, disordered phase for energy storage, which transitions to a crystalline state upon activation, enabling higher energy intensity through phase changes triggered by an electric impulse.

Environmental Impact and Sustainability Considerations

The integration of amorphous metals in utility-scale energy storage systems presents significant environmental and sustainability advantages compared to conventional materials. Amorphous metals' production typically requires less energy than traditional crystalline metals, resulting in a lower carbon footprint during manufacturing. This energy efficiency stems from their unique production process, which often involves rapid cooling techniques that consume less energy than multiple-stage processing required for crystalline alternatives.

When examining the lifecycle assessment of amorphous metal components in energy storage systems, they demonstrate superior durability and corrosion resistance, extending operational lifespans by an estimated 15-30% compared to conventional materials. This longevity directly translates to reduced replacement frequency and associated environmental impacts from manufacturing and disposal cycles.

Recyclability represents another critical environmental advantage of amorphous metals. Unlike many composite materials used in energy storage, amorphous metals can be recycled with minimal degradation of their unique properties. This characteristic supports circular economy principles and reduces dependence on virgin material extraction, particularly important for rare earth elements often used in energy storage technologies.

The reduced material intensity of amorphous metal components also merits consideration. Their superior magnetic and electrical properties allow for more compact and efficient energy storage designs, potentially reducing the overall material footprint of utility-scale installations by up to 25% according to recent industry analyses. This material efficiency extends to reduced land use requirements for equivalent storage capacity.

From a toxicity perspective, amorphous metals typically contain fewer harmful additives than competing technologies. Many conventional battery technologies rely on toxic materials like lead, cadmium, or various electrolytes with significant environmental hazards. Amorphous metal-based storage systems can reduce or eliminate these toxic components, minimizing environmental contamination risks during operation and end-of-life disposal.

The integration of these materials also supports broader renewable energy adoption by enabling more efficient and reliable energy storage solutions. By improving the performance metrics of utility-scale storage, amorphous metals indirectly contribute to greater renewable energy penetration in electricity grids, amplifying their environmental benefits beyond direct material considerations.

However, challenges remain in scaling up sustainable production methods for amorphous metals and establishing comprehensive recycling infrastructure. Future research should focus on optimizing manufacturing processes to further reduce environmental impacts and developing standardized approaches for end-of-life recovery and recycling of these advanced materials.

When examining the lifecycle assessment of amorphous metal components in energy storage systems, they demonstrate superior durability and corrosion resistance, extending operational lifespans by an estimated 15-30% compared to conventional materials. This longevity directly translates to reduced replacement frequency and associated environmental impacts from manufacturing and disposal cycles.

Recyclability represents another critical environmental advantage of amorphous metals. Unlike many composite materials used in energy storage, amorphous metals can be recycled with minimal degradation of their unique properties. This characteristic supports circular economy principles and reduces dependence on virgin material extraction, particularly important for rare earth elements often used in energy storage technologies.

The reduced material intensity of amorphous metal components also merits consideration. Their superior magnetic and electrical properties allow for more compact and efficient energy storage designs, potentially reducing the overall material footprint of utility-scale installations by up to 25% according to recent industry analyses. This material efficiency extends to reduced land use requirements for equivalent storage capacity.

From a toxicity perspective, amorphous metals typically contain fewer harmful additives than competing technologies. Many conventional battery technologies rely on toxic materials like lead, cadmium, or various electrolytes with significant environmental hazards. Amorphous metal-based storage systems can reduce or eliminate these toxic components, minimizing environmental contamination risks during operation and end-of-life disposal.

The integration of these materials also supports broader renewable energy adoption by enabling more efficient and reliable energy storage solutions. By improving the performance metrics of utility-scale storage, amorphous metals indirectly contribute to greater renewable energy penetration in electricity grids, amplifying their environmental benefits beyond direct material considerations.

However, challenges remain in scaling up sustainable production methods for amorphous metals and establishing comprehensive recycling infrastructure. Future research should focus on optimizing manufacturing processes to further reduce environmental impacts and developing standardized approaches for end-of-life recovery and recycling of these advanced materials.

Cost-Benefit Analysis of Amorphous Metals vs. Conventional Materials

The implementation of amorphous metals in utility-scale energy storage systems presents a complex economic equation when compared to conventional materials. Initial capital expenditure for amorphous metal components typically exceeds that of traditional crystalline metals by 30-45%, primarily due to specialized manufacturing processes including rapid quenching techniques and precision control requirements. This cost premium represents a significant barrier to widespread adoption despite the technical advantages.

However, lifecycle cost analysis reveals compelling long-term economic benefits. Amorphous metals demonstrate superior corrosion resistance, reducing maintenance costs by approximately 25-35% over a 20-year operational period. Their enhanced durability translates to extended service life, with projected operational lifespans 15-20% longer than conventional alternatives in energy storage applications.

Energy efficiency gains constitute another significant economic advantage. The reduced hysteresis losses in amorphous metal transformers and magnetic components yield 2-3% higher efficiency ratings compared to silicon steel equivalents. For utility-scale installations, this efficiency differential compounds into substantial operational savings, estimated at $150,000-$300,000 annually per 100MW installation, depending on electricity costs and utilization patterns.

Material utilization efficiency further enhances the cost-benefit profile. Amorphous metals typically require 10-15% less material by weight to achieve equivalent performance specifications due to their superior magnetic properties and mechanical strength. This reduction partially offsets the higher per-unit material costs while simultaneously reducing the environmental footprint of storage systems.

The scalability economics demonstrate a favorable trend, with the cost premium for amorphous metals decreasing as production volumes increase. Industry projections suggest that manufacturing costs could decline by 20-25% over the next five years as production techniques mature and economies of scale are realized. This trajectory would significantly improve the return-on-investment timeline for utility operators.

Risk mitigation value must also be factored into comprehensive economic assessment. The enhanced reliability of amorphous metal components reduces the probability of catastrophic failures and associated downtime costs. Quantitative risk modeling indicates a 30-40% reduction in failure-related financial exposure, representing substantial value for critical infrastructure applications where service interruptions carry significant economic penalties.

When environmental externalities are monetized, including reduced material consumption and improved energy efficiency, the total cost of ownership calculation shifts further in favor of amorphous metal solutions, particularly in regulatory environments with carbon pricing mechanisms or sustainability incentives.

However, lifecycle cost analysis reveals compelling long-term economic benefits. Amorphous metals demonstrate superior corrosion resistance, reducing maintenance costs by approximately 25-35% over a 20-year operational period. Their enhanced durability translates to extended service life, with projected operational lifespans 15-20% longer than conventional alternatives in energy storage applications.

Energy efficiency gains constitute another significant economic advantage. The reduced hysteresis losses in amorphous metal transformers and magnetic components yield 2-3% higher efficiency ratings compared to silicon steel equivalents. For utility-scale installations, this efficiency differential compounds into substantial operational savings, estimated at $150,000-$300,000 annually per 100MW installation, depending on electricity costs and utilization patterns.

Material utilization efficiency further enhances the cost-benefit profile. Amorphous metals typically require 10-15% less material by weight to achieve equivalent performance specifications due to their superior magnetic properties and mechanical strength. This reduction partially offsets the higher per-unit material costs while simultaneously reducing the environmental footprint of storage systems.

The scalability economics demonstrate a favorable trend, with the cost premium for amorphous metals decreasing as production volumes increase. Industry projections suggest that manufacturing costs could decline by 20-25% over the next five years as production techniques mature and economies of scale are realized. This trajectory would significantly improve the return-on-investment timeline for utility operators.

Risk mitigation value must also be factored into comprehensive economic assessment. The enhanced reliability of amorphous metal components reduces the probability of catastrophic failures and associated downtime costs. Quantitative risk modeling indicates a 30-40% reduction in failure-related financial exposure, representing substantial value for critical infrastructure applications where service interruptions carry significant economic penalties.

When environmental externalities are monetized, including reduced material consumption and improved energy efficiency, the total cost of ownership calculation shifts further in favor of amorphous metal solutions, particularly in regulatory environments with carbon pricing mechanisms or sustainability incentives.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!