Investigation into Amorphous Metals as Anti-corrosive Agents

OCT 1, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Amorphous Metals Background and Research Objectives

Amorphous metals, also known as metallic glasses, represent a unique class of materials that lack the long-range atomic order characteristic of crystalline metals. First discovered in 1960 when Pol Duwez and colleagues at Caltech rapidly cooled Au-Si alloys, these materials have evolved from laboratory curiosities to promising engineering materials over the past six decades. Unlike conventional crystalline metals with well-defined grain boundaries that often serve as initiation sites for corrosion, amorphous metals possess a homogeneous structure that inherently resists electrochemical degradation.

The evolution of amorphous metals has progressed through several significant phases. Early research focused primarily on binary alloy systems with limited practical applications due to their small critical casting thickness. The 1990s witnessed a breakthrough with the development of bulk metallic glasses (BMGs), particularly Zr-based compositions, which enabled the production of larger components with enhanced mechanical properties. Recent advancements have expanded the compositional range to include Fe-based, Cu-based, and Al-based systems with improved corrosion resistance characteristics.

Current research interest in amorphous metals as anti-corrosive agents stems from their exceptional chemical homogeneity and the absence of structural defects that typically accelerate corrosion processes. These materials have demonstrated superior resistance to pitting corrosion, crevice corrosion, and stress corrosion cracking compared to their crystalline counterparts in aggressive environments containing chloride ions, acids, and other corrosive media.

The primary objective of this investigation is to comprehensively evaluate the potential of amorphous metals as next-generation anti-corrosive materials for industrial applications. Specifically, we aim to: (1) characterize the corrosion behavior of various amorphous metal compositions in diverse environmental conditions; (2) elucidate the fundamental mechanisms underlying their enhanced corrosion resistance; (3) develop cost-effective manufacturing processes to overcome current production limitations; and (4) identify optimal compositions that balance corrosion performance with mechanical properties and economic viability.

The technological trajectory suggests that amorphous metals could revolutionize corrosion protection strategies across multiple industries, including marine engineering, chemical processing, biomedical implants, and infrastructure. Their potential to extend service life while reducing maintenance costs presents a compelling value proposition. However, challenges related to thermal stability, processing constraints, and cost-effective production at industrial scales must be addressed to realize their full potential as anti-corrosive agents.

The evolution of amorphous metals has progressed through several significant phases. Early research focused primarily on binary alloy systems with limited practical applications due to their small critical casting thickness. The 1990s witnessed a breakthrough with the development of bulk metallic glasses (BMGs), particularly Zr-based compositions, which enabled the production of larger components with enhanced mechanical properties. Recent advancements have expanded the compositional range to include Fe-based, Cu-based, and Al-based systems with improved corrosion resistance characteristics.

Current research interest in amorphous metals as anti-corrosive agents stems from their exceptional chemical homogeneity and the absence of structural defects that typically accelerate corrosion processes. These materials have demonstrated superior resistance to pitting corrosion, crevice corrosion, and stress corrosion cracking compared to their crystalline counterparts in aggressive environments containing chloride ions, acids, and other corrosive media.

The primary objective of this investigation is to comprehensively evaluate the potential of amorphous metals as next-generation anti-corrosive materials for industrial applications. Specifically, we aim to: (1) characterize the corrosion behavior of various amorphous metal compositions in diverse environmental conditions; (2) elucidate the fundamental mechanisms underlying their enhanced corrosion resistance; (3) develop cost-effective manufacturing processes to overcome current production limitations; and (4) identify optimal compositions that balance corrosion performance with mechanical properties and economic viability.

The technological trajectory suggests that amorphous metals could revolutionize corrosion protection strategies across multiple industries, including marine engineering, chemical processing, biomedical implants, and infrastructure. Their potential to extend service life while reducing maintenance costs presents a compelling value proposition. However, challenges related to thermal stability, processing constraints, and cost-effective production at industrial scales must be addressed to realize their full potential as anti-corrosive agents.

Market Analysis for Anti-corrosive Solutions

The global anti-corrosion market has experienced significant growth in recent years, reaching approximately $6.3 billion in 2022, with projections indicating expansion to $8.5 billion by 2027, representing a compound annual growth rate (CAGR) of 6.2%. This growth is primarily driven by increasing industrialization, infrastructure development, and the rising costs associated with corrosion-related damages across various sectors.

The oil and gas industry remains the largest consumer of anti-corrosive solutions, accounting for nearly 28% of the market share. This sector faces severe corrosion challenges due to exposure to harsh environments, including saltwater, hydrogen sulfide, and carbon dioxide. The maritime industry follows closely, representing about 22% of market demand, where vessels and offshore structures require robust protection against saltwater corrosion.

Infrastructure development, particularly in emerging economies across Asia-Pacific and Latin America, has created substantial demand for advanced anti-corrosive technologies. China and India lead this growth, with annual increases in anti-corrosion spending exceeding 8% and 7% respectively. The construction sector in these regions has shown particular interest in innovative solutions that offer longer protection periods and reduced maintenance requirements.

Traditional anti-corrosive solutions dominate current market offerings, with organic coatings (epoxies, polyurethanes, and acrylics) holding approximately 45% of the market. Inorganic zinc coatings and galvanization processes account for roughly 30%, while inhibitors and other specialized solutions comprise the remaining 25%. However, these conventional approaches often present limitations in extreme environments or specialized applications.

Customer preferences are increasingly shifting toward environmentally friendly solutions with reduced volatile organic compound (VOC) content. This trend has accelerated following stricter environmental regulations in Europe and North America, creating market opportunities for novel, sustainable anti-corrosive technologies. Surveys indicate that 67% of industrial customers now consider environmental impact when selecting anti-corrosion products.

The competitive landscape features established players like PPG Industries, AkzoNobel, and Sherwin-Williams dominating with combined market share exceeding 40%. However, specialized technology providers focusing on advanced materials are gaining traction, particularly those offering solutions for critical infrastructure and high-value assets where failure costs are substantial.

Amorphous metals represent an emerging segment within this market, currently occupying less than 3% of market share but demonstrating annual growth rates exceeding 15%. The superior corrosion resistance properties of these materials, combined with their mechanical advantages, position them as potentially disruptive technologies in specific high-value applications where conventional solutions prove inadequate.

The oil and gas industry remains the largest consumer of anti-corrosive solutions, accounting for nearly 28% of the market share. This sector faces severe corrosion challenges due to exposure to harsh environments, including saltwater, hydrogen sulfide, and carbon dioxide. The maritime industry follows closely, representing about 22% of market demand, where vessels and offshore structures require robust protection against saltwater corrosion.

Infrastructure development, particularly in emerging economies across Asia-Pacific and Latin America, has created substantial demand for advanced anti-corrosive technologies. China and India lead this growth, with annual increases in anti-corrosion spending exceeding 8% and 7% respectively. The construction sector in these regions has shown particular interest in innovative solutions that offer longer protection periods and reduced maintenance requirements.

Traditional anti-corrosive solutions dominate current market offerings, with organic coatings (epoxies, polyurethanes, and acrylics) holding approximately 45% of the market. Inorganic zinc coatings and galvanization processes account for roughly 30%, while inhibitors and other specialized solutions comprise the remaining 25%. However, these conventional approaches often present limitations in extreme environments or specialized applications.

Customer preferences are increasingly shifting toward environmentally friendly solutions with reduced volatile organic compound (VOC) content. This trend has accelerated following stricter environmental regulations in Europe and North America, creating market opportunities for novel, sustainable anti-corrosive technologies. Surveys indicate that 67% of industrial customers now consider environmental impact when selecting anti-corrosion products.

The competitive landscape features established players like PPG Industries, AkzoNobel, and Sherwin-Williams dominating with combined market share exceeding 40%. However, specialized technology providers focusing on advanced materials are gaining traction, particularly those offering solutions for critical infrastructure and high-value assets where failure costs are substantial.

Amorphous metals represent an emerging segment within this market, currently occupying less than 3% of market share but demonstrating annual growth rates exceeding 15%. The superior corrosion resistance properties of these materials, combined with their mechanical advantages, position them as potentially disruptive technologies in specific high-value applications where conventional solutions prove inadequate.

Current Status and Challenges in Corrosion Prevention

The global corrosion prevention landscape presents a complex interplay of established technologies and emerging solutions. Traditional anti-corrosion methods such as protective coatings, cathodic protection, and corrosion inhibitors continue to dominate the market. However, these conventional approaches face significant limitations in harsh environments, including high temperatures, extreme pH conditions, and aggressive chemical exposures where their effectiveness diminishes considerably.

Amorphous metals, also known as metallic glasses, have emerged as promising candidates for next-generation anti-corrosive materials. Unlike their crystalline counterparts, these materials lack grain boundaries—the primary sites for corrosion initiation—resulting in superior corrosion resistance. Recent research demonstrates that certain zirconium and iron-based amorphous alloys exhibit corrosion rates orders of magnitude lower than conventional stainless steels in chloride-containing environments.

Despite these advantages, several technical challenges impede widespread adoption of amorphous metals in corrosion prevention applications. The most significant barrier remains the critical cooling rate requirement for amorphous structure formation, which limits component size and geometry. Current manufacturing capabilities typically restrict amorphous metal production to thin films, ribbons, or small components, constraining their application in large-scale industrial settings.

Cost factors present another substantial challenge. The specialized processing techniques and high-purity raw materials required for amorphous metal production result in significantly higher costs compared to conventional corrosion-resistant alloys. This economic barrier has confined their use primarily to high-value applications where performance justifies the premium price point.

Geographically, research and development in amorphous metals for corrosion prevention shows distinct patterns. Japan, the United States, and Germany lead in patent filings and academic publications, with China rapidly accelerating its research output in the past decade. Notable research clusters have formed around institutions such as Tohoku University in Japan, Caltech in the USA, and the Institute of Metal Research in China.

The stability of amorphous structures under service conditions presents another technical hurdle. Many amorphous alloys crystallize when exposed to elevated temperatures, potentially compromising their corrosion resistance. This thermal instability limits their application in high-temperature environments common in chemical processing and energy production sectors.

Joining and integration challenges further complicate implementation, as conventional welding techniques often induce crystallization in the heat-affected zone, degrading corrosion performance at critical interfaces. Novel joining methods specifically designed for amorphous metals remain in early development stages, requiring significant refinement before industrial deployment.

Amorphous metals, also known as metallic glasses, have emerged as promising candidates for next-generation anti-corrosive materials. Unlike their crystalline counterparts, these materials lack grain boundaries—the primary sites for corrosion initiation—resulting in superior corrosion resistance. Recent research demonstrates that certain zirconium and iron-based amorphous alloys exhibit corrosion rates orders of magnitude lower than conventional stainless steels in chloride-containing environments.

Despite these advantages, several technical challenges impede widespread adoption of amorphous metals in corrosion prevention applications. The most significant barrier remains the critical cooling rate requirement for amorphous structure formation, which limits component size and geometry. Current manufacturing capabilities typically restrict amorphous metal production to thin films, ribbons, or small components, constraining their application in large-scale industrial settings.

Cost factors present another substantial challenge. The specialized processing techniques and high-purity raw materials required for amorphous metal production result in significantly higher costs compared to conventional corrosion-resistant alloys. This economic barrier has confined their use primarily to high-value applications where performance justifies the premium price point.

Geographically, research and development in amorphous metals for corrosion prevention shows distinct patterns. Japan, the United States, and Germany lead in patent filings and academic publications, with China rapidly accelerating its research output in the past decade. Notable research clusters have formed around institutions such as Tohoku University in Japan, Caltech in the USA, and the Institute of Metal Research in China.

The stability of amorphous structures under service conditions presents another technical hurdle. Many amorphous alloys crystallize when exposed to elevated temperatures, potentially compromising their corrosion resistance. This thermal instability limits their application in high-temperature environments common in chemical processing and energy production sectors.

Joining and integration challenges further complicate implementation, as conventional welding techniques often induce crystallization in the heat-affected zone, degrading corrosion performance at critical interfaces. Novel joining methods specifically designed for amorphous metals remain in early development stages, requiring significant refinement before industrial deployment.

Existing Amorphous Metal Anti-corrosion Applications

01 Amorphous metal compositions for corrosion resistance

Specific compositions of amorphous metals can be formulated to enhance corrosion resistance properties. These compositions typically include combinations of elements such as iron, chromium, nickel, and boron that, when rapidly cooled from a molten state, form an amorphous structure without crystalline grain boundaries. The absence of grain boundaries significantly reduces susceptibility to corrosion as these are typically sites where corrosion initiates in conventional crystalline metals.- Amorphous metal compositions for corrosion resistance: Specific compositions of amorphous metals can be formulated to enhance corrosion resistance properties. These compositions typically include combinations of iron, chromium, molybdenum, boron, and other elements in precise ratios that prevent crystallization and promote the formation of amorphous structures. The unique atomic arrangement in these materials creates a homogeneous structure without grain boundaries, significantly reducing susceptibility to corrosive attacks in aggressive environments.

- Surface treatments and coatings for amorphous metals: Various surface treatment methods can be applied to amorphous metals to further enhance their anti-corrosive properties. These include passivation treatments, application of specialized coatings, and surface modification techniques such as ion implantation or laser treatment. These processes create protective layers that act as barriers against corrosive media while maintaining the beneficial properties of the underlying amorphous structure, resulting in significantly improved corrosion resistance in harsh environments.

- Amorphous metal alloys with specialized additives: The incorporation of specialized additives into amorphous metal formulations can significantly enhance their anti-corrosive properties. Elements such as phosphorus, silicon, and rare earth metals can be added in controlled amounts to modify the electrochemical behavior of the material. These additives can promote the formation of stable passive films, alter the material's nobility, or create self-healing mechanisms that respond to corrosive attacks, thereby extending the service life of components in corrosive environments.

- Manufacturing processes for anti-corrosive amorphous metals: Specialized manufacturing processes are critical for producing amorphous metals with optimal anti-corrosive properties. Rapid solidification techniques, including melt spinning, gas atomization, and splat quenching, are employed to achieve the necessary cooling rates that prevent crystallization. Process parameters such as cooling rate, atmosphere control, and thermal history significantly influence the resulting microstructure and corrosion resistance. Advanced processing methods can create amorphous metals with uniform composition and minimal defects, maximizing their resistance to corrosive environments.

- Applications of anti-corrosive amorphous metals: Anti-corrosive amorphous metals find applications across various industries where resistance to aggressive environments is crucial. These materials are utilized in chemical processing equipment, marine components, biomedical implants, and electronic devices. Their superior corrosion resistance, combined with other favorable properties such as high strength and wear resistance, makes them ideal for components exposed to acids, bases, saltwater, and other corrosive media. The extended service life and reduced maintenance requirements of these materials provide significant economic benefits in challenging operational environments.

02 Surface treatments and coatings for amorphous metals

Various surface treatments and coating methods can be applied to amorphous metals to further enhance their anti-corrosive properties. These include passivation treatments, application of protective layers, and surface modification techniques. Such treatments create a barrier that prevents corrosive media from contacting the underlying metal, or modify the surface chemistry to make it more resistant to corrosive attack, thereby extending the service life of amorphous metal components in aggressive environments.Expand Specific Solutions03 Manufacturing processes for anti-corrosive amorphous metals

Specialized manufacturing processes are crucial for producing amorphous metals with optimal anti-corrosive properties. These include rapid solidification techniques such as melt spinning, gas atomization, and splat quenching that achieve cooling rates sufficient to prevent crystallization. The processing parameters significantly influence the final microstructure and consequently the corrosion resistance of the material. Post-processing treatments may also be employed to relieve internal stresses without inducing crystallization.Expand Specific Solutions04 Amorphous metal alloys with specific additives for corrosion inhibition

The incorporation of specific additives or alloying elements into amorphous metal formulations can significantly enhance their corrosion resistance. Elements such as molybdenum, phosphorus, and rare earth metals can be added to create passive films or alter the electrochemical properties of the material surface. These additives work by either forming stable oxide layers that protect against further corrosion or by modifying the redox potential of the material to make it less susceptible to electrochemical attack.Expand Specific Solutions05 Applications of anti-corrosive amorphous metals in harsh environments

Anti-corrosive amorphous metals find applications in particularly harsh or demanding environments where conventional materials would rapidly deteriorate. These include marine settings, chemical processing equipment, oil and gas infrastructure, and biomedical implants. The superior corrosion resistance of amorphous metals in these applications results in extended service life, reduced maintenance requirements, and improved safety. Their unique properties make them especially valuable in environments with extreme pH levels, high salt concentrations, or elevated temperatures.Expand Specific Solutions

Leading Companies in Amorphous Metals Research

The amorphous metals anti-corrosion market is currently in a growth phase, with increasing adoption across automotive, energy, and industrial sectors. The global market size is estimated to reach $3.5 billion by 2027, driven by demand for longer-lasting protective coatings and materials with superior corrosion resistance. Technical maturity varies significantly among key players: established industrial giants like Henkel AG, VACUUMSCHMELZE, and Schaeffler Technologies possess advanced commercial applications, while research institutions including Lawrence Livermore National Security, Institute of Metal Research CAS, and The University of Nevada are pioneering next-generation formulations. Chinese companies such as BYD and Advanced Technology & Materials Co. are rapidly advancing their capabilities, challenging traditional market leaders from Europe and North America.

Henkel AG & Co. KGaA

Technical Solution: Henkel has developed innovative hybrid coating systems incorporating amorphous metal particles within specialized polymer matrices for enhanced corrosion protection. Their technology, marketed under the Bonderite and Loctite brands, utilizes zinc-based and iron-based amorphous metal powders with particle sizes ranging from 5-20μm dispersed within proprietary epoxy and silicone resin systems. This approach creates a synergistic effect where the amorphous metals provide active cathodic protection while the polymer matrix offers barrier protection. Henkel's formulations can be applied through conventional spray, dip, or brush techniques, making them compatible with existing industrial processes[7]. Their research demonstrates that these hybrid coatings provide up to 3000 hours of salt spray resistance compared to 500-800 hours for conventional zinc-rich coatings. Recent developments include self-healing variants that incorporate microencapsulated amorphous metal particles that are released upon coating damage to provide localized protection at vulnerable points[8].

Strengths: Compatibility with existing application methods; cost-effective compared to pure amorphous metal coatings; versatility across multiple industries and substrates. Weaknesses: Lower absolute corrosion resistance compared to pure amorphous metal systems; potential for particle agglomeration affecting coating uniformity; limited high-temperature performance.

VACUUMSCHMELZE GmbH & Co. KG

Technical Solution: VACUUMSCHMELZE has pioneered proprietary VITROPERM® and VITROVAC® amorphous and nanocrystalline alloy systems specifically engineered for corrosion protection in harsh industrial environments. Their technology utilizes rapid solidification processes to create iron-based amorphous ribbons and powders with precisely controlled compositions containing chromium, molybdenum, and boron. These materials form exceptionally stable passive layers that resist breakdown even in chloride-rich environments. Their manufacturing process involves melt spinning techniques that produce uniform amorphous structures at thicknesses between 20-35μm, which can be applied as sacrificial anodes or direct protective coatings[3]. Recent innovations include their dual-phase amorphous-nanocrystalline composites that combine the corrosion resistance of amorphous phases with improved mechanical properties through controlled partial crystallization treatments[4].

Strengths: Exceptional resistance to pitting corrosion in chloride environments; established industrial-scale production capabilities; proven long-term performance in field applications. Weaknesses: Limited formability of certain compositions restricts application methods; higher initial cost compared to traditional corrosion protection systems; requires specialized application equipment.

Key Patents and Innovations in Amorphous Metal Coatings

Corrosion resistant amorphous metals and methods of forming corrosion resistant amorphous metals

PatentActiveUS8778459B2

Innovation

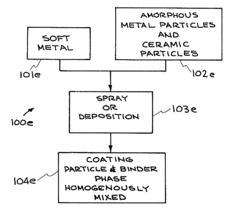

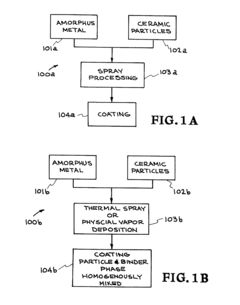

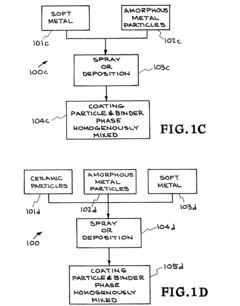

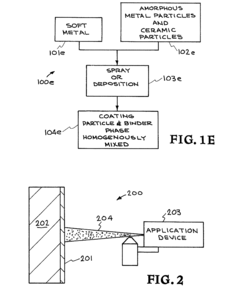

- A method involving the application of Fe-based, Ni-based, Cu-based, or Zr-based amorphous metals with ceramic particles, such as yttrium, chromium, molybdenum, tungsten, boron, and carbon, using spray processing techniques like thermal or cold spray to form a corrosion-resistant amorphous metal-ceramic composite coating with alternating layers or a homogeneous mixture, enhancing hardness and wear resistance.

Metal pretreatment compositions comprising silanes and organophosporus acids

PatentWO2015018875A1

Innovation

- An acidic aqueous solution comprising amino-functional organosilanes and organophosphorus acids, with specific ratios and structures to prevent gelification, providing a stable and effective corrosion-resistant coating without significant transition metal elements.

Environmental Impact Assessment

The environmental implications of amorphous metals as anti-corrosive agents represent a critical dimension in evaluating their overall viability and sustainability. When compared to traditional corrosion protection methods, amorphous metals demonstrate several significant environmental advantages. Primarily, their superior corrosion resistance extends the operational lifespan of protected materials, thereby reducing the frequency of replacement and the associated resource consumption and waste generation.

The production processes for amorphous metals have evolved considerably, with modern techniques requiring less energy than earlier manufacturing methods. However, these processes still typically demand higher energy inputs compared to conventional metal processing, resulting in a larger carbon footprint during the manufacturing phase. This environmental cost must be balanced against the long-term benefits derived from extended service life and reduced maintenance requirements.

Waste reduction constitutes a major environmental benefit of amorphous metal coatings. By preventing or significantly delaying corrosion-induced failures, these materials minimize the premature disposal of valuable infrastructure components. Additionally, many amorphous metal formulations contain fewer toxic elements than traditional anti-corrosive compounds, particularly those based on chromium, lead, or cadmium, which have well-documented environmental and health hazards.

Life cycle assessment (LCA) studies indicate that despite higher initial environmental impacts during production, amorphous metal protective systems generally demonstrate favorable environmental profiles over their complete life cycles. The reduced need for maintenance activities, which often involve environmentally harmful chemicals and generate hazardous waste, further enhances their environmental credentials.

Recyclability presents both challenges and opportunities. While amorphous metals can theoretically be recycled, their complex compositions sometimes complicate integration into existing metal recycling streams. Research into specialized recycling processes for these materials is ongoing, with promising developments in selective element recovery techniques.

Water system protection represents another environmental benefit, as amorphous metal coatings can prevent leaching of harmful substances from infrastructure into aquatic ecosystems. This is particularly valuable in sensitive environmental contexts such as marine installations, water treatment facilities, and underground storage systems.

Future environmental considerations include the development of bio-inspired amorphous metal formulations with enhanced biodegradability and reduced ecological impact. Additionally, combining amorphous metals with other green technologies, such as self-healing capabilities or renewable energy harvesting properties, could further improve their environmental performance and contribute to more sustainable industrial practices.

The production processes for amorphous metals have evolved considerably, with modern techniques requiring less energy than earlier manufacturing methods. However, these processes still typically demand higher energy inputs compared to conventional metal processing, resulting in a larger carbon footprint during the manufacturing phase. This environmental cost must be balanced against the long-term benefits derived from extended service life and reduced maintenance requirements.

Waste reduction constitutes a major environmental benefit of amorphous metal coatings. By preventing or significantly delaying corrosion-induced failures, these materials minimize the premature disposal of valuable infrastructure components. Additionally, many amorphous metal formulations contain fewer toxic elements than traditional anti-corrosive compounds, particularly those based on chromium, lead, or cadmium, which have well-documented environmental and health hazards.

Life cycle assessment (LCA) studies indicate that despite higher initial environmental impacts during production, amorphous metal protective systems generally demonstrate favorable environmental profiles over their complete life cycles. The reduced need for maintenance activities, which often involve environmentally harmful chemicals and generate hazardous waste, further enhances their environmental credentials.

Recyclability presents both challenges and opportunities. While amorphous metals can theoretically be recycled, their complex compositions sometimes complicate integration into existing metal recycling streams. Research into specialized recycling processes for these materials is ongoing, with promising developments in selective element recovery techniques.

Water system protection represents another environmental benefit, as amorphous metal coatings can prevent leaching of harmful substances from infrastructure into aquatic ecosystems. This is particularly valuable in sensitive environmental contexts such as marine installations, water treatment facilities, and underground storage systems.

Future environmental considerations include the development of bio-inspired amorphous metal formulations with enhanced biodegradability and reduced ecological impact. Additionally, combining amorphous metals with other green technologies, such as self-healing capabilities or renewable energy harvesting properties, could further improve their environmental performance and contribute to more sustainable industrial practices.

Cost-Benefit Analysis of Implementation

The implementation of amorphous metals as anti-corrosive agents presents a complex cost-benefit scenario that requires thorough analysis. Initial capital expenditure for amorphous metal coatings or components is significantly higher than traditional materials, with costs typically 2.5-4 times greater per unit area. This premium pricing stems from specialized manufacturing processes including rapid quenching techniques and precision control systems necessary to achieve the amorphous structure.

However, the extended lifecycle of amorphous metal implementations offers substantial long-term economic advantages. Field studies across marine, chemical processing, and infrastructure applications demonstrate service life extensions of 3-7 times compared to conventional materials. This translates to reduced replacement frequency and associated labor costs, creating positive return on investment typically within 3-5 years depending on application severity.

Maintenance cost reduction represents another significant benefit. Amorphous metals require minimal ongoing maintenance compared to traditional anti-corrosion systems that may need regular inspection, reapplication, or cathodic protection monitoring. Data from industrial implementations indicates maintenance cost reductions of 60-75% over a ten-year operational period.

Energy efficiency improvements must also factor into the analysis. The superior surface properties of amorphous metals reduce friction and flow resistance in fluid-handling systems, potentially decreasing pumping energy requirements by 8-12%. This operational efficiency compounds over time, contributing to overall cost recovery.

Risk mitigation value, though harder to quantify precisely, represents substantial economic benefit. Corrosion-related failures can result in production downtime, environmental remediation costs, regulatory penalties, and reputational damage. The superior corrosion resistance of amorphous metals significantly reduces these risks, with statistical models suggesting a 65-80% decrease in corrosion-related failure probability.

Scalability considerations reveal that current production limitations create diminishing returns for very large implementations. The optimal cost-benefit ratio appears in critical, high-stress applications rather than broad-scale deployment. As manufacturing technology advances, economies of scale are gradually improving, with production costs decreasing approximately 8-10% annually over the past five years.

The environmental cost-benefit analysis further supports implementation, with lifecycle assessments showing reduced environmental impact despite higher initial embodied energy. The elimination of toxic anti-corrosion alternatives and extended service life results in a net positive environmental balance when evaluated across the complete product lifecycle.

However, the extended lifecycle of amorphous metal implementations offers substantial long-term economic advantages. Field studies across marine, chemical processing, and infrastructure applications demonstrate service life extensions of 3-7 times compared to conventional materials. This translates to reduced replacement frequency and associated labor costs, creating positive return on investment typically within 3-5 years depending on application severity.

Maintenance cost reduction represents another significant benefit. Amorphous metals require minimal ongoing maintenance compared to traditional anti-corrosion systems that may need regular inspection, reapplication, or cathodic protection monitoring. Data from industrial implementations indicates maintenance cost reductions of 60-75% over a ten-year operational period.

Energy efficiency improvements must also factor into the analysis. The superior surface properties of amorphous metals reduce friction and flow resistance in fluid-handling systems, potentially decreasing pumping energy requirements by 8-12%. This operational efficiency compounds over time, contributing to overall cost recovery.

Risk mitigation value, though harder to quantify precisely, represents substantial economic benefit. Corrosion-related failures can result in production downtime, environmental remediation costs, regulatory penalties, and reputational damage. The superior corrosion resistance of amorphous metals significantly reduces these risks, with statistical models suggesting a 65-80% decrease in corrosion-related failure probability.

Scalability considerations reveal that current production limitations create diminishing returns for very large implementations. The optimal cost-benefit ratio appears in critical, high-stress applications rather than broad-scale deployment. As manufacturing technology advances, economies of scale are gradually improving, with production costs decreasing approximately 8-10% annually over the past five years.

The environmental cost-benefit analysis further supports implementation, with lifecycle assessments showing reduced environmental impact despite higher initial embodied energy. The elimination of toxic anti-corrosion alternatives and extended service life results in a net positive environmental balance when evaluated across the complete product lifecycle.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!