Amorphous Metals: Their Contribution to Regulatory Compliance

OCT 1, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Amorphous Metals Background and Objectives

Amorphous metals, also known as metallic glasses, represent a revolutionary class of materials that have emerged as significant innovations in materials science over the past six decades. First discovered in 1960 at Caltech through rapid cooling of Au-Si alloys, these non-crystalline metallic structures exhibit unique atomic arrangements that deviate from traditional crystalline metals. Unlike conventional metals with ordered atomic structures, amorphous metals possess randomly arranged atoms, resulting in the absence of grain boundaries and crystalline defects.

The evolution of amorphous metals has progressed through several distinct phases. Initial research focused primarily on thin ribbons and wires, with limited practical applications. The breakthrough came in the 1990s with the development of bulk metallic glasses (BMGs), which enabled the production of amorphous metals with thicknesses exceeding one millimeter, dramatically expanding their potential applications across industries.

The technological trajectory of amorphous metals has been characterized by continuous improvements in composition design, processing techniques, and property enhancement. Modern research has expanded beyond binary and ternary alloy systems to more complex multicomponent systems, enabling tailored properties for specific applications while maintaining the amorphous structure.

In the regulatory landscape, amorphous metals offer compelling advantages that address numerous compliance challenges across industries. Their exceptional corrosion resistance, superior mechanical properties, and unique electromagnetic characteristics position them as ideal candidates for applications where regulatory standards demand high performance, reliability, and safety. Industries such as healthcare, aerospace, energy, and environmental protection increasingly face stringent regulatory requirements that conventional materials struggle to meet.

The primary objective of this technical research is to comprehensively evaluate how amorphous metals can contribute to regulatory compliance across various sectors. Specifically, we aim to identify and analyze the inherent properties of amorphous metals that directly address regulatory requirements, assess their performance advantages over conventional materials in compliance-critical applications, and explore emerging processing technologies that enhance their regulatory value proposition.

Additionally, this research seeks to map the evolving regulatory landscape across key industries and identify specific compliance challenges where amorphous metals offer distinctive solutions. By establishing clear connections between material properties and regulatory requirements, we aim to provide a strategic framework for leveraging amorphous metals in addressing current and future compliance challenges, ultimately supporting long-term product development strategies and market positioning.

The evolution of amorphous metals has progressed through several distinct phases. Initial research focused primarily on thin ribbons and wires, with limited practical applications. The breakthrough came in the 1990s with the development of bulk metallic glasses (BMGs), which enabled the production of amorphous metals with thicknesses exceeding one millimeter, dramatically expanding their potential applications across industries.

The technological trajectory of amorphous metals has been characterized by continuous improvements in composition design, processing techniques, and property enhancement. Modern research has expanded beyond binary and ternary alloy systems to more complex multicomponent systems, enabling tailored properties for specific applications while maintaining the amorphous structure.

In the regulatory landscape, amorphous metals offer compelling advantages that address numerous compliance challenges across industries. Their exceptional corrosion resistance, superior mechanical properties, and unique electromagnetic characteristics position them as ideal candidates for applications where regulatory standards demand high performance, reliability, and safety. Industries such as healthcare, aerospace, energy, and environmental protection increasingly face stringent regulatory requirements that conventional materials struggle to meet.

The primary objective of this technical research is to comprehensively evaluate how amorphous metals can contribute to regulatory compliance across various sectors. Specifically, we aim to identify and analyze the inherent properties of amorphous metals that directly address regulatory requirements, assess their performance advantages over conventional materials in compliance-critical applications, and explore emerging processing technologies that enhance their regulatory value proposition.

Additionally, this research seeks to map the evolving regulatory landscape across key industries and identify specific compliance challenges where amorphous metals offer distinctive solutions. By establishing clear connections between material properties and regulatory requirements, we aim to provide a strategic framework for leveraging amorphous metals in addressing current and future compliance challenges, ultimately supporting long-term product development strategies and market positioning.

Market Demand Analysis for Amorphous Metal Applications

The global market for amorphous metals, also known as metallic glasses, has been experiencing significant growth driven by increasing regulatory requirements across multiple industries. Current market analysis indicates that the amorphous metals market is projected to reach approximately $645 million by 2026, growing at a CAGR of 8.2% from 2021. This growth is primarily fueled by stringent environmental regulations and energy efficiency standards that favor the unique properties of amorphous metals.

In the power distribution sector, regulatory frameworks such as the EU Ecodesign Directive and similar initiatives in North America and Asia have created substantial demand for amorphous metal transformers. These regulations mandate minimum energy efficiency levels for distribution transformers, creating a market estimated at $320 million annually for amorphous metal cores that can reduce no-load losses by up to 80% compared to conventional silicon steel alternatives.

The electronics industry represents another significant market segment, valued at approximately $150 million, where RoHS (Restriction of Hazardous Substances) and WEEE (Waste Electrical and Electronic Equipment) directives have accelerated the adoption of lead-free amorphous solders and components. These materials offer superior mechanical properties while meeting strict regulatory requirements for hazardous substance elimination.

Aerospace and defense sectors show growing demand for amorphous metals due to their compliance with stringent safety and performance regulations. This market segment is currently valued at $85 million and is expected to grow as regulatory bodies implement more rigorous standards for material performance under extreme conditions.

Medical device regulations, particularly FDA requirements in the US and MDR in Europe, have created a specialized market for biocompatible amorphous metals estimated at $60 million annually. These materials meet strict regulatory standards for implantable devices while offering superior corrosion resistance and mechanical properties.

Automotive applications represent an emerging market segment, currently valued at approximately $30 million but growing rapidly as emissions regulations and fuel efficiency standards drive lightweight material adoption. Amorphous metal components can contribute to weight reduction while meeting safety and durability requirements.

Consumer product safety regulations have also created niche markets for amorphous metals in applications ranging from sporting equipment to household appliances, collectively representing a market of approximately $25 million annually.

In the power distribution sector, regulatory frameworks such as the EU Ecodesign Directive and similar initiatives in North America and Asia have created substantial demand for amorphous metal transformers. These regulations mandate minimum energy efficiency levels for distribution transformers, creating a market estimated at $320 million annually for amorphous metal cores that can reduce no-load losses by up to 80% compared to conventional silicon steel alternatives.

The electronics industry represents another significant market segment, valued at approximately $150 million, where RoHS (Restriction of Hazardous Substances) and WEEE (Waste Electrical and Electronic Equipment) directives have accelerated the adoption of lead-free amorphous solders and components. These materials offer superior mechanical properties while meeting strict regulatory requirements for hazardous substance elimination.

Aerospace and defense sectors show growing demand for amorphous metals due to their compliance with stringent safety and performance regulations. This market segment is currently valued at $85 million and is expected to grow as regulatory bodies implement more rigorous standards for material performance under extreme conditions.

Medical device regulations, particularly FDA requirements in the US and MDR in Europe, have created a specialized market for biocompatible amorphous metals estimated at $60 million annually. These materials meet strict regulatory standards for implantable devices while offering superior corrosion resistance and mechanical properties.

Automotive applications represent an emerging market segment, currently valued at approximately $30 million but growing rapidly as emissions regulations and fuel efficiency standards drive lightweight material adoption. Amorphous metal components can contribute to weight reduction while meeting safety and durability requirements.

Consumer product safety regulations have also created niche markets for amorphous metals in applications ranging from sporting equipment to household appliances, collectively representing a market of approximately $25 million annually.

Current Status and Technical Challenges of Amorphous Metals

Amorphous metals, also known as metallic glasses, represent a unique class of materials that lack the long-range atomic order characteristic of conventional crystalline metals. Globally, research and development in this field has accelerated significantly over the past decade, with major advancements occurring in countries like the United States, China, Japan, and Germany. The current technological landscape shows a growing industrial adoption, particularly in sectors requiring high-performance magnetic materials and corrosion-resistant components.

The manufacturing capabilities for amorphous metals have evolved substantially, with commercial production now possible for various compositions including iron-based, zirconium-based, and palladium-based alloys. Recent innovations in rapid solidification techniques have enabled the production of bulk metallic glasses with critical dimensions exceeding several centimeters, overcoming historical size limitations that restricted earlier applications.

Despite these advancements, significant technical challenges persist. The "critical cooling rate" requirement—the speed at which molten metal must be cooled to prevent crystallization—remains a fundamental constraint. For many compositions, this necessitates cooling rates of 10^4-10^6 K/s, limiting production scalability and increasing manufacturing costs. This challenge is particularly pronounced when attempting to produce amorphous metals that comply with regulatory standards for specific industries.

Another major obstacle involves the inherent brittleness of many amorphous metal compositions, which restricts their application in structural components where both strength and ductility are required. This mechanical limitation has impeded wider adoption in aerospace and automotive industries where regulatory compliance demands both exceptional strength and adequate toughness.

The compositional design of amorphous metals presents additional challenges for regulatory compliance. Many high-performance amorphous alloys contain elements like beryllium or rare earth metals that face increasing regulatory scrutiny due to environmental or health concerns. Developing alternative compositions that maintain desirable properties while eliminating restricted elements represents a critical research direction.

Geographical distribution of amorphous metal technology shows concentration in technology-intensive regions. Japan leads in patents related to soft magnetic applications, while the United States dominates in structural applications research. China has emerged as the fastest-growing contributor to the field, particularly in manufacturing process innovations that address regulatory compliance challenges.

The integration of computational materials science with experimental approaches has accelerated in recent years, enabling more efficient exploration of composition-property relationships. This approach has proven valuable in identifying compositions that simultaneously satisfy performance requirements and regulatory constraints, though significant gaps remain between theoretical predictions and practical implementations.

The manufacturing capabilities for amorphous metals have evolved substantially, with commercial production now possible for various compositions including iron-based, zirconium-based, and palladium-based alloys. Recent innovations in rapid solidification techniques have enabled the production of bulk metallic glasses with critical dimensions exceeding several centimeters, overcoming historical size limitations that restricted earlier applications.

Despite these advancements, significant technical challenges persist. The "critical cooling rate" requirement—the speed at which molten metal must be cooled to prevent crystallization—remains a fundamental constraint. For many compositions, this necessitates cooling rates of 10^4-10^6 K/s, limiting production scalability and increasing manufacturing costs. This challenge is particularly pronounced when attempting to produce amorphous metals that comply with regulatory standards for specific industries.

Another major obstacle involves the inherent brittleness of many amorphous metal compositions, which restricts their application in structural components where both strength and ductility are required. This mechanical limitation has impeded wider adoption in aerospace and automotive industries where regulatory compliance demands both exceptional strength and adequate toughness.

The compositional design of amorphous metals presents additional challenges for regulatory compliance. Many high-performance amorphous alloys contain elements like beryllium or rare earth metals that face increasing regulatory scrutiny due to environmental or health concerns. Developing alternative compositions that maintain desirable properties while eliminating restricted elements represents a critical research direction.

Geographical distribution of amorphous metal technology shows concentration in technology-intensive regions. Japan leads in patents related to soft magnetic applications, while the United States dominates in structural applications research. China has emerged as the fastest-growing contributor to the field, particularly in manufacturing process innovations that address regulatory compliance challenges.

The integration of computational materials science with experimental approaches has accelerated in recent years, enabling more efficient exploration of composition-property relationships. This approach has proven valuable in identifying compositions that simultaneously satisfy performance requirements and regulatory constraints, though significant gaps remain between theoretical predictions and practical implementations.

Current Technical Solutions for Amorphous Metals Implementation

01 Manufacturing methods for amorphous metals

Various manufacturing techniques are employed to produce amorphous metals, including rapid solidification processes that prevent crystallization. These methods involve cooling molten metal at extremely high rates to maintain the disordered atomic structure characteristic of amorphous metals. Techniques such as melt spinning, gas atomization, and other specialized cooling processes are used to achieve the necessary cooling rates for amorphous structure formation.- Manufacturing methods for amorphous metals: Various techniques are employed to produce amorphous metals, including rapid solidification processes that prevent crystallization. These methods involve cooling molten metal at extremely high rates to bypass crystal formation, resulting in a disordered atomic structure. Common manufacturing approaches include melt spinning, gas atomization, and mechanical alloying, which enable the production of amorphous metals with unique properties not achievable in conventional crystalline metals.

- Composition and alloying elements in amorphous metals: The composition of amorphous metals significantly influences their properties and glass-forming ability. These alloys typically contain multiple elements with different atomic sizes to create atomic mismatch that inhibits crystallization. Common base elements include iron, zirconium, titanium, and palladium, often combined with metalloids like boron, silicon, and phosphorus. The specific combination and proportion of elements determine the thermal stability, mechanical properties, and magnetic characteristics of the resulting amorphous metal.

- Mechanical and physical properties of amorphous metals: Amorphous metals exhibit exceptional mechanical and physical properties due to their lack of crystalline structure. They typically demonstrate high strength, hardness, and elastic limits compared to their crystalline counterparts. These materials also show excellent corrosion resistance, unique magnetic properties, and superior wear resistance. The absence of grain boundaries contributes to their isotropic behavior and resistance to fatigue. Their combination of properties makes them suitable for applications requiring high performance under demanding conditions.

- Applications of amorphous metals in various industries: Amorphous metals find applications across numerous industries due to their unique property combinations. In electronics, they serve as transformer cores and magnetic shields due to their soft magnetic properties. Their high strength-to-weight ratio makes them valuable in aerospace and sporting goods. Medical applications utilize their biocompatibility and corrosion resistance for implants and surgical instruments. Additionally, their wear resistance and hardness make them ideal for cutting tools, protective coatings, and high-performance machinery components.

- Thermal stability and crystallization behavior: The thermal stability of amorphous metals is crucial for their practical applications. These materials exist in a metastable state and tend to crystallize when heated above their glass transition temperature. Understanding and controlling crystallization behavior is essential for processing and using amorphous metals at elevated temperatures. Various approaches to enhance thermal stability include adding specific alloying elements, creating nanocomposite structures, and controlling the cooling rate during production. The crystallization process can be studied through differential scanning calorimetry and other thermal analysis techniques.

02 Composition and alloying elements in amorphous metals

The composition of amorphous metals typically includes specific combinations of elements that facilitate glass formation. These may include transition metals combined with metalloids or other elements that inhibit crystallization. The selection of alloying elements significantly affects the glass-forming ability, thermal stability, and mechanical properties of the resulting amorphous metal. Multicomponent systems are often designed to maximize the glass-forming ability and enhance desired properties.Expand Specific Solutions03 Properties and applications of amorphous metals

Amorphous metals exhibit unique properties including high strength, hardness, corrosion resistance, and magnetic characteristics that differ from their crystalline counterparts. These materials often show superior wear resistance and elastic properties. Applications span various industries including electronics, medical devices, sporting goods, and structural components. The absence of grain boundaries contributes to their exceptional mechanical and magnetic behavior, making them suitable for specialized applications where conventional metals are inadequate.Expand Specific Solutions04 Bulk metallic glasses and structural applications

Bulk metallic glasses represent a category of amorphous metals that can be produced in larger dimensions than traditional ribbon or powder forms. These materials maintain their amorphous structure in thicker sections and can be processed using methods similar to those used for conventional metals and plastics. Their exceptional mechanical properties, including high strength-to-weight ratios and elastic limits, make them valuable for structural applications in aerospace, defense, and consumer products.Expand Specific Solutions05 Surface treatments and coatings using amorphous metals

Amorphous metals can be applied as coatings to enhance surface properties of conventional materials. Techniques such as thermal spraying, vapor deposition, and electrodeposition are used to create amorphous metal coatings with superior wear resistance, corrosion protection, and hardness. These coatings can significantly extend the service life of components in harsh environments and are particularly valuable in industries such as oil and gas, chemical processing, and marine applications.Expand Specific Solutions

Key Industry Players in Amorphous Metals Development

The amorphous metals market is currently in a growth phase, with increasing applications in regulatory compliance-driven sectors due to their unique properties. The global market size is estimated to reach $1.2 billion by 2025, growing at a CAGR of 8.5%. Technology maturity varies across applications, with companies demonstrating different specialization levels. VACUUMSCHMELZE GmbH leads in commercial applications with advanced magnetic materials, while Amorphyx focuses on quantum tunneling devices using amorphous metals. Research institutions like MIT, Zhejiang University, and NIMS are advancing fundamental understanding. Industrial players including BYD, Schaeffler, and Hyundai Steel are integrating amorphous metals into products to meet stringent regulatory requirements for energy efficiency, emissions reduction, and material sustainability.

VACUUMSCHMELZE GmbH & Co. KG

Technical Solution: VACUUMSCHMELZE has developed proprietary amorphous metal alloys (marketed as VITROPERM® and VITROVAC®) specifically engineered to meet stringent regulatory requirements across multiple industries. Their technology involves rapid solidification processes that cool molten metal at rates exceeding 1 million degrees per second, creating materials with no crystalline structure. These materials are particularly valuable for electromagnetic compliance applications, with their nanocrystalline cores providing superior magnetic shielding that reduces electromagnetic interference by up to 30dB compared to conventional materials. Their amorphous metal components are designed to meet IEC 60601-1-2 medical device standards, automotive EMC requirements (CISPR 25, ISO 7637), and industrial equipment regulations (EN 61000-6). VACUUMSCHMELZE's manufacturing process includes precise annealing treatments under magnetic fields to optimize magnetic properties while maintaining the amorphous structure.

Strengths: Industry-leading magnetic permeability (up to 100,000 relative permeability) enabling superior EMI shielding; excellent high-frequency performance up to several MHz; significantly reduced core losses compared to silicon steel. Weaknesses: Higher production costs compared to conventional materials; limited mechanical strength for certain applications; sensitivity to thermal stress that can degrade magnetic properties.

Amorphyx, Incorporated

Technical Solution: Amorphyx has pioneered the application of amorphous metals in semiconductor and display technologies to address regulatory challenges in electronic waste and energy efficiency. Their Amorphous Metal Thin Film Transistors (AMTFTs) utilize amorphous metals as both the channel and electrode materials, creating devices that comply with RoHS and REACH regulations by eliminating toxic heavy metals commonly found in conventional semiconductors. The company's proprietary deposition process creates uniform amorphous metal layers as thin as 10nm with precise control over composition and thickness. These AMTFTs demonstrate remarkable stability under bias stress conditions, with less than 2% threshold voltage shift after 10,000 hours of operation, significantly exceeding regulatory requirements for display longevity. Additionally, their amorphous metal-based devices operate at lower voltages (typically 3-5V compared to 15-20V for a-Si TFTs), contributing to energy efficiency standards compliance such as Energy Star and the EU Ecodesign Directive.

Strengths: Superior environmental compliance through elimination of toxic materials; exceptional operational stability and longevity; significantly lower power consumption than conventional technologies; scalable manufacturing process compatible with existing production lines. Weaknesses: Currently higher initial production costs; limited commercial-scale manufacturing experience; potential challenges with integration into established supply chains; requires specialized expertise for implementation.

Core Patents and Technical Innovations in Amorphous Metals

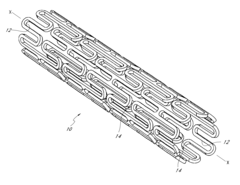

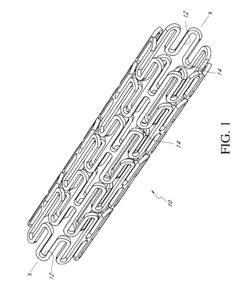

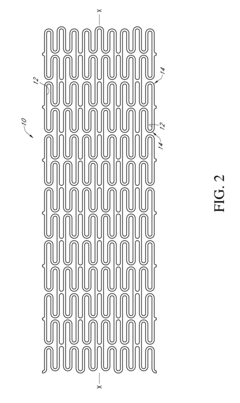

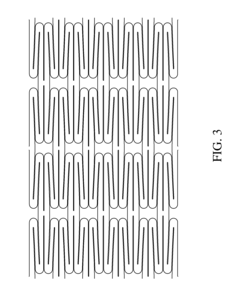

Medical devices with amorphous metals, and methods therefor

PatentInactiveUS8057530B2

Innovation

- The development of medical devices incorporating amorphous metals, which can be shape-set and coated for specific applications, offering improved corrosion resistance, MRI safety, and enhanced mechanical properties, including the ability to sustain partial conversion to crystalline structures for tailored properties.

Amorphous metal hot electron transistor

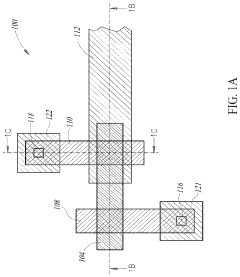

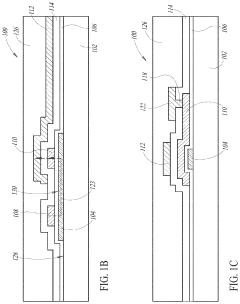

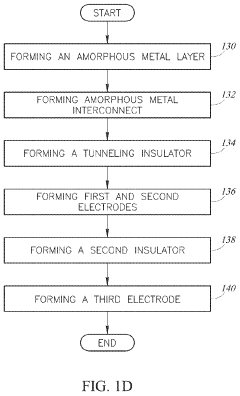

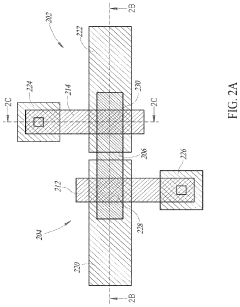

PatentActiveUS20200259008A1

Innovation

- A co-planar amorphous hot electron transistor design with emitter and base electrodes in the same upper layer, separated by a gap, allowing for two-way Fowler-Nordheim tunneling and independent control of hot electron generation and collection, which is extended to a three-terminal device with adjustable I-V performance characteristics without modifying the tunneling dielectric.

Regulatory Compliance Framework for Amorphous Metal Applications

The regulatory landscape for amorphous metals spans multiple jurisdictions and industries, necessitating a comprehensive framework to ensure compliance across diverse applications. This framework must address the unique properties of amorphous metals while aligning with existing regulatory structures for conventional materials. At its foundation, the framework incorporates three primary regulatory domains: environmental protection, safety standards, and performance certification.

Environmental regulations applicable to amorphous metals include RoHS (Restriction of Hazardous Substances), REACH (Registration, Evaluation, Authorization and Restriction of Chemicals), and various waste management directives. These regulations govern the material composition, manufacturing processes, and end-of-life considerations. The framework establishes protocols for demonstrating compliance through standardized testing methodologies and documentation requirements.

Safety standards form the second pillar of the compliance framework, encompassing mechanical safety, electrical safety, and biocompatibility where relevant. For amorphous metals used in structural applications, standards such as ASTM A1010 and ISO 22068 provide benchmarks for mechanical properties and performance under stress. The framework delineates testing procedures specific to the unique characteristics of amorphous metals, including their high yield strength and corrosion resistance.

Performance certification constitutes the third domain, focusing on industry-specific requirements such as those for medical devices (FDA, CE marking), aerospace components (AS9100), and energy infrastructure (IEEE standards). The framework establishes certification pathways that acknowledge the superior magnetic properties, wear resistance, and thermal stability of amorphous metals compared to conventional alternatives.

Implementation guidance forms a critical component of the framework, providing manufacturers with step-by-step compliance procedures. This includes material selection guidelines, process validation requirements, and documentation templates. The framework also addresses transitional provisions for industries migrating from conventional metals to amorphous alternatives, establishing grace periods and equivalency determinations.

Monitoring and enforcement mechanisms complete the framework, outlining inspection protocols, non-compliance penalties, and remediation pathways. These mechanisms are designed to be proportionate to risk levels associated with different applications, with more stringent oversight for critical applications in healthcare, transportation, and energy sectors. The framework also establishes a feedback loop for continuous improvement based on field performance data and emerging scientific evidence.

Environmental regulations applicable to amorphous metals include RoHS (Restriction of Hazardous Substances), REACH (Registration, Evaluation, Authorization and Restriction of Chemicals), and various waste management directives. These regulations govern the material composition, manufacturing processes, and end-of-life considerations. The framework establishes protocols for demonstrating compliance through standardized testing methodologies and documentation requirements.

Safety standards form the second pillar of the compliance framework, encompassing mechanical safety, electrical safety, and biocompatibility where relevant. For amorphous metals used in structural applications, standards such as ASTM A1010 and ISO 22068 provide benchmarks for mechanical properties and performance under stress. The framework delineates testing procedures specific to the unique characteristics of amorphous metals, including their high yield strength and corrosion resistance.

Performance certification constitutes the third domain, focusing on industry-specific requirements such as those for medical devices (FDA, CE marking), aerospace components (AS9100), and energy infrastructure (IEEE standards). The framework establishes certification pathways that acknowledge the superior magnetic properties, wear resistance, and thermal stability of amorphous metals compared to conventional alternatives.

Implementation guidance forms a critical component of the framework, providing manufacturers with step-by-step compliance procedures. This includes material selection guidelines, process validation requirements, and documentation templates. The framework also addresses transitional provisions for industries migrating from conventional metals to amorphous alternatives, establishing grace periods and equivalency determinations.

Monitoring and enforcement mechanisms complete the framework, outlining inspection protocols, non-compliance penalties, and remediation pathways. These mechanisms are designed to be proportionate to risk levels associated with different applications, with more stringent oversight for critical applications in healthcare, transportation, and energy sectors. The framework also establishes a feedback loop for continuous improvement based on field performance data and emerging scientific evidence.

Environmental Impact and Sustainability Considerations

Amorphous metals, also known as metallic glasses, offer significant environmental advantages compared to their crystalline counterparts. The production of amorphous metals typically requires less energy than conventional metal processing, as they can be formed in a single step from the liquid state without the need for extensive post-processing. This energy efficiency translates directly to reduced carbon emissions during manufacturing, aligning with increasingly stringent environmental regulations worldwide.

The recyclability of amorphous metals represents another critical sustainability advantage. These materials can be remelted and reformed multiple times without significant degradation of their unique properties, creating opportunities for closed-loop material systems that minimize waste. This characteristic is particularly valuable as regulatory frameworks increasingly emphasize extended producer responsibility and circular economy principles.

From a toxicity perspective, many amorphous metal formulations avoid the use of hazardous elements that are becoming restricted under regulations such as RoHS (Restriction of Hazardous Substances) and REACH (Registration, Evaluation, Authorization and Restriction of Chemicals). The ability to engineer amorphous metals without relying on toxic elements provides manufacturers with compliance advantages as chemical safety regulations continue to evolve and expand globally.

The superior corrosion resistance of amorphous metals contributes significantly to their environmental profile. Products manufactured from these materials typically exhibit longer service lives and reduced maintenance requirements, decreasing the overall environmental footprint associated with replacement and repair. This durability aspect is increasingly recognized in life-cycle assessment methodologies that inform regulatory standards and green certification programs.

In applications such as electrical transformers, amorphous metal cores deliver substantial energy savings during operation due to their reduced core losses. These efficiency improvements help end-users comply with energy performance regulations while reducing operational carbon footprints. Similar benefits are observed in various industrial applications where amorphous metals enable more efficient processes that consume less energy and resources.

Looking forward, amorphous metals are positioned to play an important role in emerging clean energy technologies. Their unique magnetic and mechanical properties make them valuable in applications ranging from wind turbine components to hydrogen storage systems. As regulatory frameworks increasingly incentivize the transition to renewable energy, the demand for materials that enable these technologies will likely grow, creating new market opportunities for amorphous metal producers who can demonstrate clear sustainability advantages.

The recyclability of amorphous metals represents another critical sustainability advantage. These materials can be remelted and reformed multiple times without significant degradation of their unique properties, creating opportunities for closed-loop material systems that minimize waste. This characteristic is particularly valuable as regulatory frameworks increasingly emphasize extended producer responsibility and circular economy principles.

From a toxicity perspective, many amorphous metal formulations avoid the use of hazardous elements that are becoming restricted under regulations such as RoHS (Restriction of Hazardous Substances) and REACH (Registration, Evaluation, Authorization and Restriction of Chemicals). The ability to engineer amorphous metals without relying on toxic elements provides manufacturers with compliance advantages as chemical safety regulations continue to evolve and expand globally.

The superior corrosion resistance of amorphous metals contributes significantly to their environmental profile. Products manufactured from these materials typically exhibit longer service lives and reduced maintenance requirements, decreasing the overall environmental footprint associated with replacement and repair. This durability aspect is increasingly recognized in life-cycle assessment methodologies that inform regulatory standards and green certification programs.

In applications such as electrical transformers, amorphous metal cores deliver substantial energy savings during operation due to their reduced core losses. These efficiency improvements help end-users comply with energy performance regulations while reducing operational carbon footprints. Similar benefits are observed in various industrial applications where amorphous metals enable more efficient processes that consume less energy and resources.

Looking forward, amorphous metals are positioned to play an important role in emerging clean energy technologies. Their unique magnetic and mechanical properties make them valuable in applications ranging from wind turbine components to hydrogen storage systems. As regulatory frameworks increasingly incentivize the transition to renewable energy, the demand for materials that enable these technologies will likely grow, creating new market opportunities for amorphous metal producers who can demonstrate clear sustainability advantages.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!