Amorphous Metals: Technological Advancement in Heat Exchangers

OCT 1, 202510 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Amorphous Metals Evolution and Heat Exchanger Goals

Amorphous metals, also known as metallic glasses, represent a revolutionary class of materials that lack the crystalline structure typical of conventional metals. Since their discovery in the 1960s, these materials have evolved from laboratory curiosities to engineered materials with significant industrial potential. The unique atomic arrangement of amorphous metals confers exceptional properties including superior corrosion resistance, high strength-to-weight ratios, and remarkable thermal conductivity characteristics that make them particularly promising for heat exchange applications.

The evolution of amorphous metals has been marked by significant breakthroughs in manufacturing techniques. Early production was limited to rapid quenching methods that could only produce thin ribbons or wires. However, advancements in processing technologies such as suction casting, spark plasma sintering, and selective laser melting have enabled the production of bulk amorphous metals with greater dimensional versatility, opening new avenues for practical applications.

In the context of heat exchangers, the technological trajectory has been driven by increasing demands for energy efficiency, miniaturization, and performance in extreme environments. Conventional heat exchanger materials like copper, aluminum, and stainless steel face limitations in harsh conditions involving high temperatures, corrosive media, or high-pressure environments. Amorphous metals offer a compelling alternative due to their unique combination of properties.

The primary technological goal for amorphous metals in heat exchanger applications is to leverage their superior thermal conductivity while addressing the challenges of manufacturing complexity and cost. Research aims to develop amorphous metal alloy compositions that maintain their non-crystalline structure during processing while exhibiting optimal heat transfer characteristics. This includes exploring zirconium, titanium, and palladium-based alloy systems that demonstrate promising thermal properties.

Another critical objective is to overcome the inherent brittleness of many amorphous metal compositions, which can limit their practical application in heat exchangers that may experience thermal cycling and mechanical stress. Developing composite structures or partially crystallized amorphous metals (dual-phase materials) represents a promising approach to balancing mechanical resilience with thermal performance.

From an industrial perspective, the goal is to establish scalable, cost-effective manufacturing processes that can produce amorphous metal heat exchangers in commercially viable volumes. This includes adapting existing production techniques or developing novel approaches specifically tailored to heat exchanger geometries and performance requirements.

The ultimate technological aim is to create next-generation heat exchangers that significantly outperform conventional systems in efficiency, durability, and operational range, particularly in challenging environments such as chemical processing, aerospace applications, and renewable energy systems where traditional materials face limitations.

The evolution of amorphous metals has been marked by significant breakthroughs in manufacturing techniques. Early production was limited to rapid quenching methods that could only produce thin ribbons or wires. However, advancements in processing technologies such as suction casting, spark plasma sintering, and selective laser melting have enabled the production of bulk amorphous metals with greater dimensional versatility, opening new avenues for practical applications.

In the context of heat exchangers, the technological trajectory has been driven by increasing demands for energy efficiency, miniaturization, and performance in extreme environments. Conventional heat exchanger materials like copper, aluminum, and stainless steel face limitations in harsh conditions involving high temperatures, corrosive media, or high-pressure environments. Amorphous metals offer a compelling alternative due to their unique combination of properties.

The primary technological goal for amorphous metals in heat exchanger applications is to leverage their superior thermal conductivity while addressing the challenges of manufacturing complexity and cost. Research aims to develop amorphous metal alloy compositions that maintain their non-crystalline structure during processing while exhibiting optimal heat transfer characteristics. This includes exploring zirconium, titanium, and palladium-based alloy systems that demonstrate promising thermal properties.

Another critical objective is to overcome the inherent brittleness of many amorphous metal compositions, which can limit their practical application in heat exchangers that may experience thermal cycling and mechanical stress. Developing composite structures or partially crystallized amorphous metals (dual-phase materials) represents a promising approach to balancing mechanical resilience with thermal performance.

From an industrial perspective, the goal is to establish scalable, cost-effective manufacturing processes that can produce amorphous metal heat exchangers in commercially viable volumes. This includes adapting existing production techniques or developing novel approaches specifically tailored to heat exchanger geometries and performance requirements.

The ultimate technological aim is to create next-generation heat exchangers that significantly outperform conventional systems in efficiency, durability, and operational range, particularly in challenging environments such as chemical processing, aerospace applications, and renewable energy systems where traditional materials face limitations.

Market Demand Analysis for Advanced Heat Exchangers

The global market for advanced heat exchangers is experiencing robust growth driven by increasing demands for energy efficiency across multiple industries. Current market valuation stands at approximately 16.5 billion USD with projections indicating growth to reach 22.3 billion USD by 2027, representing a compound annual growth rate of 6.2%. This expansion is primarily fueled by stringent environmental regulations mandating reduced energy consumption and carbon emissions in industrial processes.

The industrial sector constitutes the largest market segment, with chemical processing, power generation, and HVAC applications leading demand. These industries require heat exchangers capable of withstanding harsh operating conditions while maintaining optimal thermal efficiency. Particularly, petrochemical and refining industries are seeking solutions that can handle corrosive environments and high-temperature operations without compromising performance or requiring frequent maintenance.

Emerging economies, particularly in Asia-Pacific, represent the fastest-growing regional market for advanced heat exchangers. China and India are investing heavily in industrial infrastructure development, creating substantial demand for efficient thermal management solutions. Meanwhile, North America and Europe maintain significant market shares driven by replacement of aging infrastructure and adoption of energy-efficient technologies.

A notable market trend is the increasing preference for compact heat exchangers that offer higher efficiency while requiring less installation space. This trend is particularly evident in the automotive and aerospace sectors, where weight and space constraints are critical design considerations. The miniaturization of heat exchangers without sacrificing performance represents a key market opportunity.

The renewable energy sector presents another substantial growth avenue for advanced heat exchangers. Solar thermal systems, geothermal power plants, and waste heat recovery applications all require specialized heat transfer solutions. The global push toward sustainable energy sources is expected to accelerate demand in this segment by 8.7% annually over the next five years.

Healthcare and pharmaceutical industries are emerging as significant new markets, requiring specialized heat exchangers for precise temperature control in manufacturing processes and medical equipment. These applications demand materials with exceptional cleanliness, biocompatibility, and resistance to sterilization procedures.

Customer requirements are increasingly focused on total cost of ownership rather than initial acquisition costs. End-users are willing to invest in premium solutions that offer longer service life, reduced maintenance requirements, and lower operational energy consumption. This shift in purchasing behavior favors advanced materials like amorphous metals that can deliver superior performance characteristics despite higher upfront costs.

The industrial sector constitutes the largest market segment, with chemical processing, power generation, and HVAC applications leading demand. These industries require heat exchangers capable of withstanding harsh operating conditions while maintaining optimal thermal efficiency. Particularly, petrochemical and refining industries are seeking solutions that can handle corrosive environments and high-temperature operations without compromising performance or requiring frequent maintenance.

Emerging economies, particularly in Asia-Pacific, represent the fastest-growing regional market for advanced heat exchangers. China and India are investing heavily in industrial infrastructure development, creating substantial demand for efficient thermal management solutions. Meanwhile, North America and Europe maintain significant market shares driven by replacement of aging infrastructure and adoption of energy-efficient technologies.

A notable market trend is the increasing preference for compact heat exchangers that offer higher efficiency while requiring less installation space. This trend is particularly evident in the automotive and aerospace sectors, where weight and space constraints are critical design considerations. The miniaturization of heat exchangers without sacrificing performance represents a key market opportunity.

The renewable energy sector presents another substantial growth avenue for advanced heat exchangers. Solar thermal systems, geothermal power plants, and waste heat recovery applications all require specialized heat transfer solutions. The global push toward sustainable energy sources is expected to accelerate demand in this segment by 8.7% annually over the next five years.

Healthcare and pharmaceutical industries are emerging as significant new markets, requiring specialized heat exchangers for precise temperature control in manufacturing processes and medical equipment. These applications demand materials with exceptional cleanliness, biocompatibility, and resistance to sterilization procedures.

Customer requirements are increasingly focused on total cost of ownership rather than initial acquisition costs. End-users are willing to invest in premium solutions that offer longer service life, reduced maintenance requirements, and lower operational energy consumption. This shift in purchasing behavior favors advanced materials like amorphous metals that can deliver superior performance characteristics despite higher upfront costs.

Current State and Challenges in Amorphous Metal Technology

Amorphous metals, also known as metallic glasses, represent a significant frontier in materials science with unique properties that distinguish them from conventional crystalline metals. Globally, research and development in amorphous metal technology has accelerated over the past decade, with major advancements occurring in North America, Europe, and East Asia, particularly Japan and China. These regions have established robust research ecosystems combining academic institutions, government laboratories, and industrial partners.

The current technological landscape reveals several key challenges that impede wider adoption of amorphous metals in heat exchanger applications. Foremost among these is the critical cooling rate requirement—amorphous metals must be cooled extremely rapidly (typically 10^4-10^6 K/s) to prevent crystallization. This fundamental constraint limits the maximum thickness achievable in bulk metallic glass production, typically restricting components to dimensions below 10mm, which presents significant manufacturing barriers for large-scale heat exchanger components.

Production scalability remains problematic, with current manufacturing processes struggling to consistently produce amorphous metal components with uniform properties at industrial scales. The specialized equipment required for rapid solidification techniques such as melt spinning, splat quenching, and suction casting further increases production costs, making amorphous metal heat exchangers economically challenging compared to conventional alternatives.

Material stability presents another significant hurdle. While amorphous metals exhibit exceptional corrosion resistance and thermal conductivity in their glassy state, they can undergo structural relaxation or crystallization when exposed to elevated temperatures for extended periods. This thermodynamic instability potentially compromises their long-term performance in heat exchanger applications where thermal cycling is common.

Joining and assembly techniques represent a technical bottleneck, as conventional welding methods often induce crystallization in the heat-affected zone, degrading the unique properties that make amorphous metals valuable. Alternative joining methods such as laser welding, diffusion bonding, and mechanical fastening each present their own complications when applied to amorphous metal components.

Computational modeling of amorphous metal behavior remains underdeveloped compared to crystalline materials. The lack of long-range atomic order complicates the development of accurate simulation tools for predicting thermal-mechanical performance, limiting design optimization capabilities for heat exchanger applications.

Standardization and certification processes for amorphous metal components lag behind conventional materials, creating regulatory uncertainties that discourage adoption in critical applications. The absence of established testing protocols and performance standards specifically tailored to amorphous metals creates additional barriers to market entry.

Despite these challenges, recent breakthroughs in composition design and processing techniques have expanded the range of achievable properties and dimensions, suggesting that solutions to these technical limitations are emerging through continued research and development efforts.

The current technological landscape reveals several key challenges that impede wider adoption of amorphous metals in heat exchanger applications. Foremost among these is the critical cooling rate requirement—amorphous metals must be cooled extremely rapidly (typically 10^4-10^6 K/s) to prevent crystallization. This fundamental constraint limits the maximum thickness achievable in bulk metallic glass production, typically restricting components to dimensions below 10mm, which presents significant manufacturing barriers for large-scale heat exchanger components.

Production scalability remains problematic, with current manufacturing processes struggling to consistently produce amorphous metal components with uniform properties at industrial scales. The specialized equipment required for rapid solidification techniques such as melt spinning, splat quenching, and suction casting further increases production costs, making amorphous metal heat exchangers economically challenging compared to conventional alternatives.

Material stability presents another significant hurdle. While amorphous metals exhibit exceptional corrosion resistance and thermal conductivity in their glassy state, they can undergo structural relaxation or crystallization when exposed to elevated temperatures for extended periods. This thermodynamic instability potentially compromises their long-term performance in heat exchanger applications where thermal cycling is common.

Joining and assembly techniques represent a technical bottleneck, as conventional welding methods often induce crystallization in the heat-affected zone, degrading the unique properties that make amorphous metals valuable. Alternative joining methods such as laser welding, diffusion bonding, and mechanical fastening each present their own complications when applied to amorphous metal components.

Computational modeling of amorphous metal behavior remains underdeveloped compared to crystalline materials. The lack of long-range atomic order complicates the development of accurate simulation tools for predicting thermal-mechanical performance, limiting design optimization capabilities for heat exchanger applications.

Standardization and certification processes for amorphous metal components lag behind conventional materials, creating regulatory uncertainties that discourage adoption in critical applications. The absence of established testing protocols and performance standards specifically tailored to amorphous metals creates additional barriers to market entry.

Despite these challenges, recent breakthroughs in composition design and processing techniques have expanded the range of achievable properties and dimensions, suggesting that solutions to these technical limitations are emerging through continued research and development efforts.

Current Technical Solutions for Amorphous Metal Heat Exchangers

01 Manufacturing processes for amorphous metals

Various manufacturing processes can be employed to produce amorphous metals, including rapid solidification techniques that prevent crystallization. These methods involve cooling molten metal at extremely high rates to bypass crystal formation, resulting in a disordered atomic structure. Common techniques include melt spinning, gas atomization, and splat quenching, which enable the production of amorphous metal ribbons, powders, and bulk forms with unique structural properties.- Manufacturing processes for amorphous metals: Various manufacturing processes can be employed to produce amorphous metals, including rapid solidification techniques that prevent crystallization. These methods involve cooling molten metal at extremely high rates to bypass crystal formation, resulting in a disordered atomic structure. Common techniques include melt spinning, splat quenching, and gas atomization. These processes are critical for maintaining the unique properties of amorphous metals, such as high strength and corrosion resistance.

- Composition and alloying of amorphous metals: The composition of amorphous metals significantly affects their properties and glass-forming ability. Multicomponent alloy systems containing elements with different atomic sizes promote the formation of amorphous structures by increasing atomic packing density and inhibiting crystallization. Common amorphous metal compositions include iron-based, zirconium-based, and palladium-based alloys, often incorporating elements like boron, silicon, and phosphorus as glass formers. These compositional strategies enhance thermal stability and mechanical properties.

- Applications of amorphous metals: Amorphous metals find applications across various industries due to their unique combination of properties. They are used in transformer cores and magnetic devices due to their soft magnetic properties and low core losses. Their high strength and corrosion resistance make them suitable for structural components, medical implants, and sporting goods. Additionally, their unique surface properties enable applications in coatings, electronic devices, and sensors. The absence of grain boundaries contributes to their superior performance in many applications.

- Bulk metallic glasses and their properties: Bulk metallic glasses (BMGs) are amorphous metals that can be produced in thicker sections than traditional amorphous ribbons. They exhibit exceptional mechanical properties, including high strength, hardness, and elastic limit, combined with good corrosion resistance. Their unique atomic structure results in isotropic properties and the absence of defects like grain boundaries found in crystalline metals. BMGs also demonstrate interesting thermal behavior, including a distinct glass transition temperature and supercooled liquid region that allows for thermoplastic forming.

- Surface treatment and modification of amorphous metals: Surface treatments can enhance the properties and performance of amorphous metals. Techniques include laser surface treatment, ion implantation, and various coating methods to improve hardness, wear resistance, and corrosion protection. Surface crystallization can be induced in a controlled manner to create composite structures with unique properties. Additionally, surface patterning and texturing methods can be applied to amorphous metals to enhance their functional characteristics for specific applications.

02 Composition and alloying of amorphous metals

The composition of amorphous metals significantly influences their glass-forming ability and resulting properties. These alloys typically contain multiple elements with different atomic sizes to create atomic mismatch that inhibits crystallization. Common amorphous metal systems include iron-based, zirconium-based, titanium-based, and palladium-based alloys. The specific combination and proportion of elements determine characteristics such as thermal stability, mechanical strength, and magnetic properties.Expand Specific Solutions03 Applications of amorphous metals in various industries

Amorphous metals find applications across numerous industries due to their unique combination of properties. They are used in transformer cores and electronic components due to their soft magnetic properties and low core losses. Their high strength and corrosion resistance make them suitable for structural applications and medical implants. Additionally, their unique surface properties enable applications in coatings, while their elasticity and energy absorption capabilities are valuable in sporting goods and impact-resistant structures.Expand Specific Solutions04 Mechanical and physical properties of amorphous metals

Amorphous metals exhibit exceptional mechanical and physical properties that distinguish them from their crystalline counterparts. They typically demonstrate high strength, hardness, and elastic limit combined with good ductility under certain conditions. Their lack of grain boundaries contributes to superior corrosion resistance and wear resistance. Additionally, amorphous metals often display unique magnetic properties, including low coercivity and high permeability, making them valuable in electromagnetic applications.Expand Specific Solutions05 Processing and forming techniques for amorphous metals

Specialized processing and forming techniques have been developed to overcome the challenges associated with amorphous metals. These include thermoplastic forming, which exploits the supercooled liquid region between the glass transition and crystallization temperatures to shape these materials. Other methods include selective laser melting for additive manufacturing, powder consolidation techniques, and specialized joining processes. These approaches enable the production of complex shapes while maintaining the amorphous structure and its associated properties.Expand Specific Solutions

Key Industry Players in Amorphous Metal Heat Exchangers

The amorphous metals market for heat exchangers is in an early growth phase, characterized by increasing technological maturity and expanding applications. The global market shows promising growth potential as industries seek more efficient thermal management solutions. Key players represent diverse sectors: established industrial manufacturers (Caterpillar, Modine, Danfoss), specialized materials developers (Metglas, Nelumbo), automotive companies (DENSO, Dana), and research institutions (Caltech, Lawrence Livermore). The technology is advancing from research to commercial applications, with companies like Metglas leading in amorphous metal production while newer entrants like Amorphyx and Nelumbo focus on innovative applications. The competitive landscape combines traditional heat exchanger manufacturers with materials science specialists, creating a dynamic environment for technological advancement.

California Institute of Technology

Technical Solution: Caltech has developed groundbreaking research in amorphous metal heat exchangers through their Materials Science department. Their approach focuses on bulk metallic glasses (BMGs) with carefully controlled compositions of Zr, Ti, Cu, Ni, and Be that demonstrate glass-forming ability while maintaining excellent thermal conductivity. Caltech researchers have pioneered novel manufacturing techniques using thermoplastic forming of BMGs at temperatures above their glass transition but below crystallization, allowing complex heat exchanger geometries previously impossible with conventional materials. Their patented microstructural control methods create nanoscale heterogeneities that enhance mechanical properties while preserving the amorphous structure's inherent corrosion resistance. Caltech has demonstrated prototype micro-channel heat exchangers with feature sizes below 100 microns, achieving heat transfer efficiencies up to 3 times higher than conventional stainless steel designs. Their research includes computational modeling of thermal-mechanical behavior during cyclic loading, predicting service lifetimes exceeding 20 years for optimized compositions.

Strengths: Cutting-edge fundamental research capabilities; access to advanced characterization techniques; innovative manufacturing approaches for complex geometries; strong intellectual property portfolio. Weaknesses: Limited focus on scale-up and commercialization; higher material costs compared to conventional alternatives; some compositions contain beryllium which presents environmental and safety challenges; technology remains primarily at laboratory/prototype scale.

Metglas, Inc.

Technical Solution: Metglas has pioneered the development of amorphous metal foils specifically engineered for heat exchanger applications. Their proprietary rapid solidification process creates ultra-thin ribbons (typically 20-25 microns) with exceptional thermal conductivity properties. The company's METGLAS® amorphous alloy heat exchangers utilize Fe-based and Co-based compositions that exhibit superior corrosion resistance in aggressive environments while maintaining structural integrity at elevated temperatures. Their technology incorporates specialized surface treatments to enhance heat transfer coefficients by up to 40% compared to conventional crystalline metal exchangers. Metglas has developed modular heat exchanger designs that can be customized for various industrial applications, including waste heat recovery systems, chemical processing, and HVAC systems. The amorphous structure provides unique advantages in thermal cycling scenarios, with demonstrated lifespans exceeding 15 years in high-temperature industrial settings.

Strengths: Industry-leading expertise in amorphous metal production at commercial scale; proprietary alloy compositions optimized specifically for heat transfer applications; established manufacturing infrastructure. Weaknesses: Higher initial production costs compared to conventional materials; limited maximum operating temperature (typically below 600°C) compared to some specialized crystalline alloys; challenges in joining and fabrication techniques for complex geometries.

Core Patents and Innovations in Amorphous Metal Heat Transfer

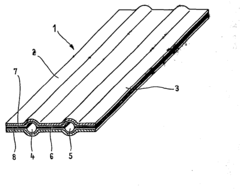

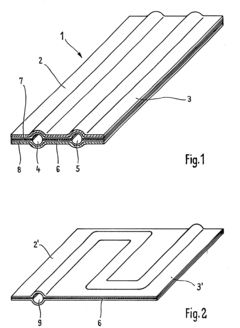

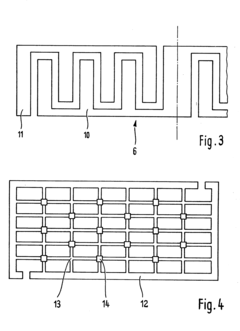

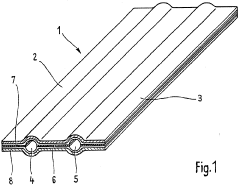

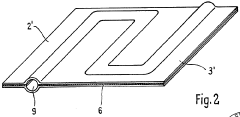

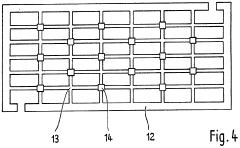

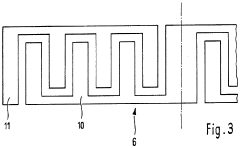

Flat heat exchange plate and method of making it

PatentInactiveEP0110311A1

Innovation

- A flat heat exchanger plate design utilizing two metal plates with an amorphous metal adhesive layer, made of nickel, iron, or copper alloys with crystallization-retarding components, and covered with corrosion-resistant metals like titanium or tantalum, connected via cold roll cladding, allowing for the use of previously unplateable metals and simplifying production.

Heat exchanger panel and manufacturing method thereof

PatentWO1984002178A1

Innovation

- A flat heat exchanger plate made from non-plateable materials with an amorphous metal adhesive layer between two copper or copper alloy plates, connected by cold roll plating, and coated with corrosion-resistant materials like titanium or tantalum for enhanced durability and corrosion resistance.

Energy Efficiency and Sustainability Implications

The integration of amorphous metals in heat exchanger technology represents a significant advancement in energy efficiency and sustainability within industrial and commercial applications. Amorphous metals, with their unique atomic structure, demonstrate superior thermal conductivity compared to conventional crystalline metals, enabling more efficient heat transfer with reduced energy input. This efficiency gain translates directly into lower operational energy consumption, with preliminary studies indicating potential energy savings of 15-30% in various heat exchange applications.

Beyond immediate energy savings, the corrosion resistance of amorphous metals substantially extends the operational lifespan of heat exchangers. Traditional heat exchangers often require replacement every 5-7 years due to corrosion and fouling issues, whereas amorphous metal variants have demonstrated potential lifespans exceeding 15 years under similar conditions. This longevity reduces the environmental impact associated with manufacturing replacement units and minimizes waste generation throughout the product lifecycle.

The manufacturing process for amorphous metal heat exchangers, while initially more energy-intensive than conventional methods, demonstrates favorable sustainability metrics when assessed through comprehensive life cycle analysis. The energy investment in production is typically recovered within 2-3 years of operation through improved efficiency, creating a positive energy balance over the product lifespan. Additionally, the rapid cooling techniques employed in amorphous metal production can be optimized to reduce overall energy consumption in manufacturing.

From a materials perspective, amorphous metals offer significant advantages in resource utilization. Their superior mechanical properties allow for thinner material profiles while maintaining structural integrity, reducing the overall material requirements by up to 40% compared to conventional heat exchangers. This material efficiency contributes to conservation of finite metal resources and reduces the environmental footprint associated with mining and refining operations.

Carbon footprint assessments reveal that widespread adoption of amorphous metal heat exchangers could contribute significantly to greenhouse gas reduction targets across multiple industries. In high-energy industrial sectors such as petrochemical processing and power generation, the implementation of these advanced heat exchangers could potentially reduce carbon emissions by 3-5% sector-wide, representing a meaningful contribution to climate change mitigation efforts without requiring fundamental changes to existing industrial processes.

Water conservation represents another sustainability benefit, as the reduced fouling characteristics of amorphous metal surfaces decrease the frequency and intensity of cleaning operations. This translates to lower water consumption and reduced use of potentially harmful cleaning chemicals throughout the operational life of the equipment, aligning with global water conservation initiatives.

Beyond immediate energy savings, the corrosion resistance of amorphous metals substantially extends the operational lifespan of heat exchangers. Traditional heat exchangers often require replacement every 5-7 years due to corrosion and fouling issues, whereas amorphous metal variants have demonstrated potential lifespans exceeding 15 years under similar conditions. This longevity reduces the environmental impact associated with manufacturing replacement units and minimizes waste generation throughout the product lifecycle.

The manufacturing process for amorphous metal heat exchangers, while initially more energy-intensive than conventional methods, demonstrates favorable sustainability metrics when assessed through comprehensive life cycle analysis. The energy investment in production is typically recovered within 2-3 years of operation through improved efficiency, creating a positive energy balance over the product lifespan. Additionally, the rapid cooling techniques employed in amorphous metal production can be optimized to reduce overall energy consumption in manufacturing.

From a materials perspective, amorphous metals offer significant advantages in resource utilization. Their superior mechanical properties allow for thinner material profiles while maintaining structural integrity, reducing the overall material requirements by up to 40% compared to conventional heat exchangers. This material efficiency contributes to conservation of finite metal resources and reduces the environmental footprint associated with mining and refining operations.

Carbon footprint assessments reveal that widespread adoption of amorphous metal heat exchangers could contribute significantly to greenhouse gas reduction targets across multiple industries. In high-energy industrial sectors such as petrochemical processing and power generation, the implementation of these advanced heat exchangers could potentially reduce carbon emissions by 3-5% sector-wide, representing a meaningful contribution to climate change mitigation efforts without requiring fundamental changes to existing industrial processes.

Water conservation represents another sustainability benefit, as the reduced fouling characteristics of amorphous metal surfaces decrease the frequency and intensity of cleaning operations. This translates to lower water consumption and reduced use of potentially harmful cleaning chemicals throughout the operational life of the equipment, aligning with global water conservation initiatives.

Manufacturing Processes and Scalability Challenges

The manufacturing of amorphous metals for heat exchanger applications presents unique challenges due to their distinct material properties. Traditional manufacturing methods often fail to preserve the amorphous structure, which is critical for maintaining the superior thermal conductivity and corrosion resistance that make these materials valuable for heat exchange applications. The rapid solidification required to form amorphous structures necessitates specialized production techniques such as melt spinning, which can produce thin ribbons or foils with thicknesses typically ranging from 20 to 100 micrometers.

Scale-up of these manufacturing processes represents a significant hurdle in the commercialization of amorphous metal heat exchangers. While laboratory-scale production has demonstrated promising results, transitioning to industrial-scale manufacturing introduces complications in maintaining consistent material properties across larger dimensions. The critical cooling rates required (often exceeding 10^4 K/s) limit the thickness of amorphous components, restricting design options for heat exchanger geometries.

Recent advancements in manufacturing technologies have begun to address these limitations. Powder metallurgy approaches, including gas atomization and mechanical alloying, enable the production of amorphous metal powders that can be consolidated through techniques such as spark plasma sintering or hot isostatic pressing. These methods allow for more complex geometries while preserving the amorphous structure, though challenges remain in achieving full density without crystallization.

Additive manufacturing presents another promising avenue for fabricating amorphous metal heat exchangers. Selective laser melting and electron beam melting technologies can create complex three-dimensional structures with localized rapid cooling rates sufficient to maintain amorphous phases. However, process optimization is critical, as parameters including laser power, scan speed, and layer thickness significantly impact the final microstructure and performance characteristics.

Cost considerations remain a substantial barrier to widespread adoption. Current manufacturing processes for amorphous metals are energy-intensive and require specialized equipment, resulting in production costs significantly higher than conventional heat exchanger materials. Economic viability depends on achieving manufacturing efficiencies through process optimization and economies of scale, as well as demonstrating performance advantages that justify the premium cost.

Quality control presents additional challenges, as non-destructive testing methods for verifying the amorphous structure throughout complex components are still developing. X-ray diffraction and differential scanning calorimetry provide valuable insights but may be difficult to implement for in-line production monitoring. Advanced techniques such as neutron diffraction and synchrotron radiation analysis offer more comprehensive characterization but are primarily limited to research environments rather than production settings.

Scale-up of these manufacturing processes represents a significant hurdle in the commercialization of amorphous metal heat exchangers. While laboratory-scale production has demonstrated promising results, transitioning to industrial-scale manufacturing introduces complications in maintaining consistent material properties across larger dimensions. The critical cooling rates required (often exceeding 10^4 K/s) limit the thickness of amorphous components, restricting design options for heat exchanger geometries.

Recent advancements in manufacturing technologies have begun to address these limitations. Powder metallurgy approaches, including gas atomization and mechanical alloying, enable the production of amorphous metal powders that can be consolidated through techniques such as spark plasma sintering or hot isostatic pressing. These methods allow for more complex geometries while preserving the amorphous structure, though challenges remain in achieving full density without crystallization.

Additive manufacturing presents another promising avenue for fabricating amorphous metal heat exchangers. Selective laser melting and electron beam melting technologies can create complex three-dimensional structures with localized rapid cooling rates sufficient to maintain amorphous phases. However, process optimization is critical, as parameters including laser power, scan speed, and layer thickness significantly impact the final microstructure and performance characteristics.

Cost considerations remain a substantial barrier to widespread adoption. Current manufacturing processes for amorphous metals are energy-intensive and require specialized equipment, resulting in production costs significantly higher than conventional heat exchanger materials. Economic viability depends on achieving manufacturing efficiencies through process optimization and economies of scale, as well as demonstrating performance advantages that justify the premium cost.

Quality control presents additional challenges, as non-destructive testing methods for verifying the amorphous structure throughout complex components are still developing. X-ray diffraction and differential scanning calorimetry provide valuable insights but may be difficult to implement for in-line production monitoring. Advanced techniques such as neutron diffraction and synchrotron radiation analysis offer more comprehensive characterization but are primarily limited to research environments rather than production settings.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!