Comparative Case Analysis of Amorphous Metals and Glass-Ceramics

OCT 1, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Amorphous Metals and Glass-Ceramics: Background and Objectives

Amorphous metals and glass-ceramics represent two distinct classes of advanced materials that have revolutionized various industrial applications over the past several decades. The evolution of these materials traces back to the mid-20th century, with significant breakthroughs occurring in the 1960s when the first amorphous metal alloys were successfully produced through rapid solidification techniques. Concurrently, glass-ceramics emerged as a promising material category following S.D. Stookey's pioneering work at Corning Glass Works in the 1950s.

The technological trajectory of amorphous metals, also known as metallic glasses, has been characterized by continuous innovation in processing methods, from early melt spinning techniques to more recent bulk metallic glass production. These materials exhibit a disordered atomic structure that confers unique properties, including exceptional strength, elasticity, and corrosion resistance, distinguishing them from conventional crystalline metals.

Glass-ceramics, conversely, have evolved from their initial applications in cookware to sophisticated technical components in electronics, medicine, and aerospace. Their development has been marked by increasingly precise control over nucleation and crystallization processes, enabling tailored microstructures and properties for specific applications.

Current research trends indicate a growing interest in hybrid approaches that combine aspects of both material classes, particularly in exploring the controlled crystallization of amorphous metals to create novel composite structures with enhanced performance characteristics. This convergence represents a significant frontier in materials science.

The global market for these advanced materials has expanded substantially, driven by demands for higher performance in extreme environments, miniaturization in electronics, and sustainability concerns in manufacturing. Both material categories have demonstrated remarkable versatility across diverse sectors, from biomedical implants to energy storage systems.

The primary objective of this comparative analysis is to systematically evaluate the fundamental properties, processing methodologies, and application potentials of amorphous metals and glass-ceramics. By examining their respective strengths and limitations, we aim to identify complementary characteristics that could inform future material design strategies.

Furthermore, this investigation seeks to establish a comprehensive framework for understanding how these materials respond to various operational conditions, including mechanical stress, thermal cycling, and chemical exposure. Such insights are crucial for predicting long-term performance and reliability in practical applications.

Ultimately, this technical exploration aims to illuminate pathways for next-generation material development that leverages the distinctive attributes of both amorphous metals and glass-ceramics, potentially leading to breakthrough solutions for existing technological challenges across multiple industries.

The technological trajectory of amorphous metals, also known as metallic glasses, has been characterized by continuous innovation in processing methods, from early melt spinning techniques to more recent bulk metallic glass production. These materials exhibit a disordered atomic structure that confers unique properties, including exceptional strength, elasticity, and corrosion resistance, distinguishing them from conventional crystalline metals.

Glass-ceramics, conversely, have evolved from their initial applications in cookware to sophisticated technical components in electronics, medicine, and aerospace. Their development has been marked by increasingly precise control over nucleation and crystallization processes, enabling tailored microstructures and properties for specific applications.

Current research trends indicate a growing interest in hybrid approaches that combine aspects of both material classes, particularly in exploring the controlled crystallization of amorphous metals to create novel composite structures with enhanced performance characteristics. This convergence represents a significant frontier in materials science.

The global market for these advanced materials has expanded substantially, driven by demands for higher performance in extreme environments, miniaturization in electronics, and sustainability concerns in manufacturing. Both material categories have demonstrated remarkable versatility across diverse sectors, from biomedical implants to energy storage systems.

The primary objective of this comparative analysis is to systematically evaluate the fundamental properties, processing methodologies, and application potentials of amorphous metals and glass-ceramics. By examining their respective strengths and limitations, we aim to identify complementary characteristics that could inform future material design strategies.

Furthermore, this investigation seeks to establish a comprehensive framework for understanding how these materials respond to various operational conditions, including mechanical stress, thermal cycling, and chemical exposure. Such insights are crucial for predicting long-term performance and reliability in practical applications.

Ultimately, this technical exploration aims to illuminate pathways for next-generation material development that leverages the distinctive attributes of both amorphous metals and glass-ceramics, potentially leading to breakthrough solutions for existing technological challenges across multiple industries.

Market Applications and Demand Analysis

The market for both amorphous metals and glass-ceramics has shown significant growth trajectories, though with distinct application profiles and demand drivers. Amorphous metals (metallic glasses) have experienced increasing demand in high-performance applications, particularly in aerospace, defense, and specialized industrial sectors where their unique combination of strength, elasticity, and corrosion resistance provides substantial advantages over conventional crystalline metals.

The global amorphous metals market was valued at approximately $1.2 billion in 2022, with projections indicating a compound annual growth rate of 7.8% through 2030. This growth is primarily driven by expanding applications in electronic devices, particularly for transformer cores where their low hysteresis losses and high magnetic permeability offer significant energy efficiency improvements. The sporting goods sector represents another growth area, with high-end golf clubs and tennis rackets utilizing amorphous metals for their superior vibration damping properties.

Glass-ceramics, meanwhile, have established a strong market presence in consumer goods, particularly in cookware and stovetops, where their thermal shock resistance and aesthetic qualities command premium pricing. The market size reached $1.7 billion in 2022, with expected growth of 6.5% annually through 2030. Dental applications represent the fastest-growing segment for glass-ceramics, with CAD/CAM dental restorations increasingly utilizing these materials for their biocompatibility and natural appearance.

Regional market distribution shows interesting patterns, with North America and Europe dominating the high-end applications for both materials, while Asia-Pacific represents the fastest-growing market, particularly for electronic and industrial applications. China has emerged as both a major consumer and producer of amorphous metals, driven by government initiatives to develop advanced materials capabilities.

Industry surveys indicate that customer requirements are evolving toward more specialized performance characteristics. For amorphous metals, there is increasing demand for larger-format products that overcome traditional size limitations, while glass-ceramics face market pressure for improved mechanical properties and manufacturing efficiency.

Cross-industry adoption trends suggest that both materials are finding new applications in emerging technologies. Amorphous metals are gaining traction in medical implants and additive manufacturing, while glass-ceramics are seeing increased utilization in optoelectronics and as substrates for advanced electronics. The renewable energy sector represents a significant growth opportunity for both materials, with solar panel components and energy storage systems increasingly incorporating these advanced materials.

The global amorphous metals market was valued at approximately $1.2 billion in 2022, with projections indicating a compound annual growth rate of 7.8% through 2030. This growth is primarily driven by expanding applications in electronic devices, particularly for transformer cores where their low hysteresis losses and high magnetic permeability offer significant energy efficiency improvements. The sporting goods sector represents another growth area, with high-end golf clubs and tennis rackets utilizing amorphous metals for their superior vibration damping properties.

Glass-ceramics, meanwhile, have established a strong market presence in consumer goods, particularly in cookware and stovetops, where their thermal shock resistance and aesthetic qualities command premium pricing. The market size reached $1.7 billion in 2022, with expected growth of 6.5% annually through 2030. Dental applications represent the fastest-growing segment for glass-ceramics, with CAD/CAM dental restorations increasingly utilizing these materials for their biocompatibility and natural appearance.

Regional market distribution shows interesting patterns, with North America and Europe dominating the high-end applications for both materials, while Asia-Pacific represents the fastest-growing market, particularly for electronic and industrial applications. China has emerged as both a major consumer and producer of amorphous metals, driven by government initiatives to develop advanced materials capabilities.

Industry surveys indicate that customer requirements are evolving toward more specialized performance characteristics. For amorphous metals, there is increasing demand for larger-format products that overcome traditional size limitations, while glass-ceramics face market pressure for improved mechanical properties and manufacturing efficiency.

Cross-industry adoption trends suggest that both materials are finding new applications in emerging technologies. Amorphous metals are gaining traction in medical implants and additive manufacturing, while glass-ceramics are seeing increased utilization in optoelectronics and as substrates for advanced electronics. The renewable energy sector represents a significant growth opportunity for both materials, with solar panel components and energy storage systems increasingly incorporating these advanced materials.

Technical Status and Challenges in Material Science

The global landscape of advanced materials research shows significant progress in both amorphous metals (metallic glasses) and glass-ceramics, though with distinct developmental trajectories. Amorphous metals have seen accelerated research in the United States, Japan, and China, with notable advancements in bulk metallic glass (BMG) production techniques. Meanwhile, glass-ceramics research remains concentrated in traditional ceramics powerhouses including Germany, Japan, and the United States, with emerging contributions from China and South Korea.

Current technical challenges for amorphous metals primarily revolve around size limitations and processing difficulties. Despite decades of research, the production of large-scale amorphous metal components remains problematic due to critical cooling rate requirements. Most commercially viable BMGs are limited to thicknesses below 10mm, restricting their application potential. Additionally, these materials exhibit limited ductility at room temperature, presenting significant barriers to widespread industrial adoption.

Glass-ceramics face different technical hurdles, particularly in controlling crystallization processes with precision across large components. The nucleation and growth mechanisms that determine final properties remain incompletely understood, especially for novel compositions. Furthermore, the energy-intensive production processes present sustainability challenges that must be addressed to meet modern environmental standards.

From a manufacturing perspective, both material classes suffer from scalability issues. Amorphous metals require specialized rapid solidification techniques that are difficult to implement in mass production environments. Glass-ceramics demand precise thermal treatment protocols that become increasingly difficult to maintain uniformly as component size increases.

The characterization of these advanced materials presents another significant challenge. Traditional testing methodologies often prove inadequate for capturing the unique property combinations of amorphous metals and glass-ceramics. This necessitates the development of specialized testing protocols and equipment, further complicating research and development efforts.

Economically, cost factors remain prohibitive for both material classes. The specialized equipment, precise processing conditions, and high-purity raw materials required drive production costs significantly higher than conventional alternatives. This economic barrier has largely confined these materials to high-value applications where performance advantages justify premium pricing.

Recent research indicates promising directions for overcoming these challenges, including computational materials science approaches, novel processing techniques like additive manufacturing, and hybrid material systems that combine the advantages of both material classes while mitigating their individual limitations.

Current technical challenges for amorphous metals primarily revolve around size limitations and processing difficulties. Despite decades of research, the production of large-scale amorphous metal components remains problematic due to critical cooling rate requirements. Most commercially viable BMGs are limited to thicknesses below 10mm, restricting their application potential. Additionally, these materials exhibit limited ductility at room temperature, presenting significant barriers to widespread industrial adoption.

Glass-ceramics face different technical hurdles, particularly in controlling crystallization processes with precision across large components. The nucleation and growth mechanisms that determine final properties remain incompletely understood, especially for novel compositions. Furthermore, the energy-intensive production processes present sustainability challenges that must be addressed to meet modern environmental standards.

From a manufacturing perspective, both material classes suffer from scalability issues. Amorphous metals require specialized rapid solidification techniques that are difficult to implement in mass production environments. Glass-ceramics demand precise thermal treatment protocols that become increasingly difficult to maintain uniformly as component size increases.

The characterization of these advanced materials presents another significant challenge. Traditional testing methodologies often prove inadequate for capturing the unique property combinations of amorphous metals and glass-ceramics. This necessitates the development of specialized testing protocols and equipment, further complicating research and development efforts.

Economically, cost factors remain prohibitive for both material classes. The specialized equipment, precise processing conditions, and high-purity raw materials required drive production costs significantly higher than conventional alternatives. This economic barrier has largely confined these materials to high-value applications where performance advantages justify premium pricing.

Recent research indicates promising directions for overcoming these challenges, including computational materials science approaches, novel processing techniques like additive manufacturing, and hybrid material systems that combine the advantages of both material classes while mitigating their individual limitations.

Current Manufacturing Processes and Methodologies

01 Composition and structure of amorphous metals

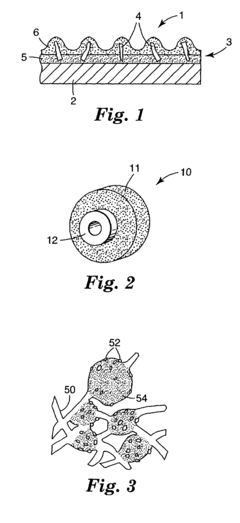

Amorphous metals, also known as metallic glasses, are characterized by their non-crystalline atomic structure. These materials possess unique properties due to their disordered atomic arrangement. The composition typically includes combinations of transition metals with metalloids or other elements that help stabilize the amorphous structure. The absence of grain boundaries and crystalline defects contributes to their enhanced mechanical, magnetic, and corrosion resistance properties compared to conventional crystalline metals.- Composition and structure of amorphous metals: Amorphous metals, also known as metallic glasses, are characterized by their non-crystalline atomic structure. These materials possess unique properties due to their disordered atomic arrangement, which is achieved through rapid cooling techniques that prevent crystallization. The composition typically includes combinations of transition metals with metalloids or other elements that help stabilize the amorphous structure. These materials exhibit superior mechanical properties, including high strength, hardness, and elastic limit compared to their crystalline counterparts.

- Manufacturing processes for amorphous metals and glass-ceramics: Various manufacturing techniques are employed to produce amorphous metals and glass-ceramics. For amorphous metals, rapid solidification processes such as melt spinning, splat quenching, and gas atomization are commonly used to achieve cooling rates sufficient to prevent crystallization. For glass-ceramics, controlled crystallization of glass through nucleation and crystal growth is employed. Advanced processing methods include selective laser melting, powder metallurgy, and mechanical alloying, which allow for the production of bulk amorphous metals with specific shapes and dimensions.

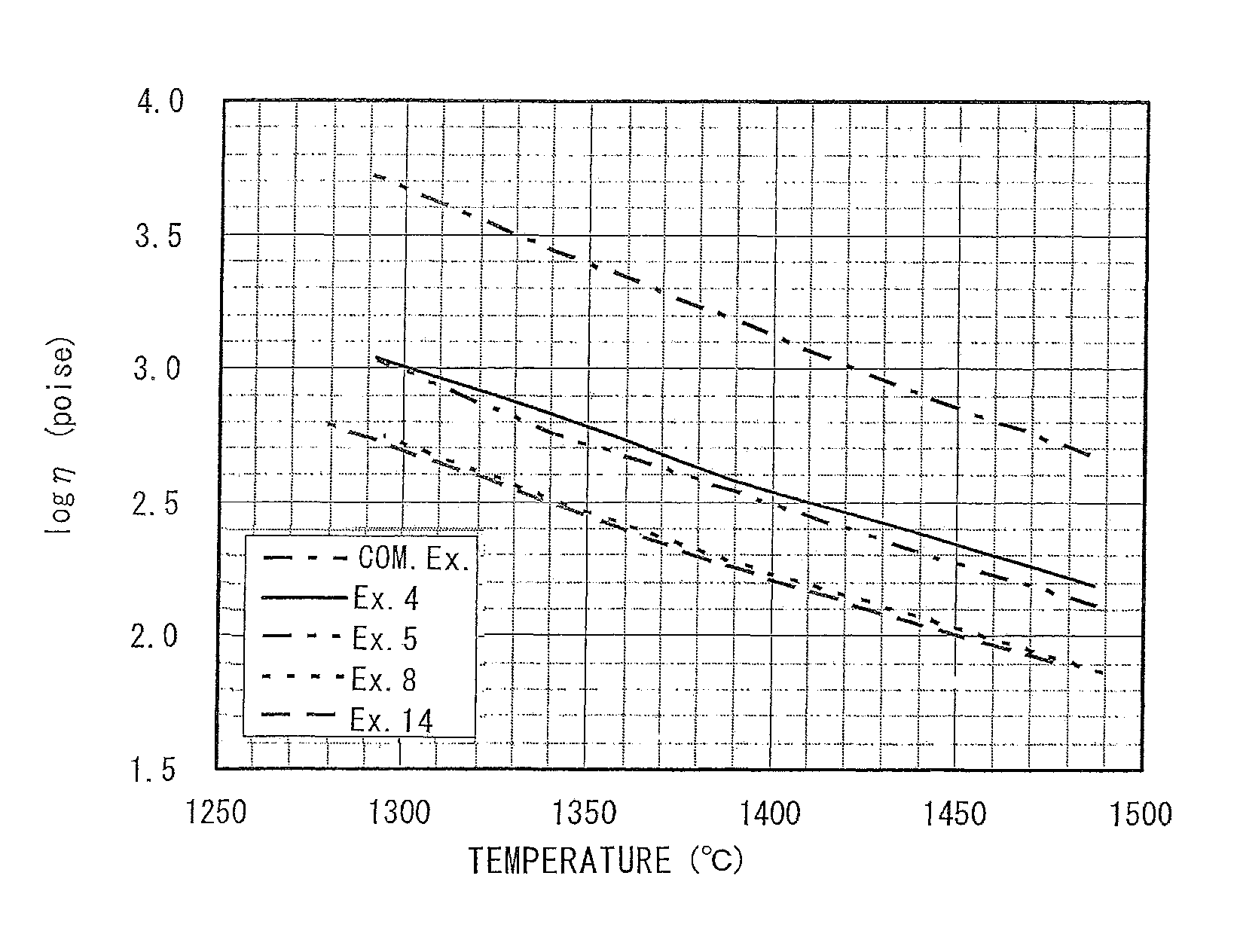

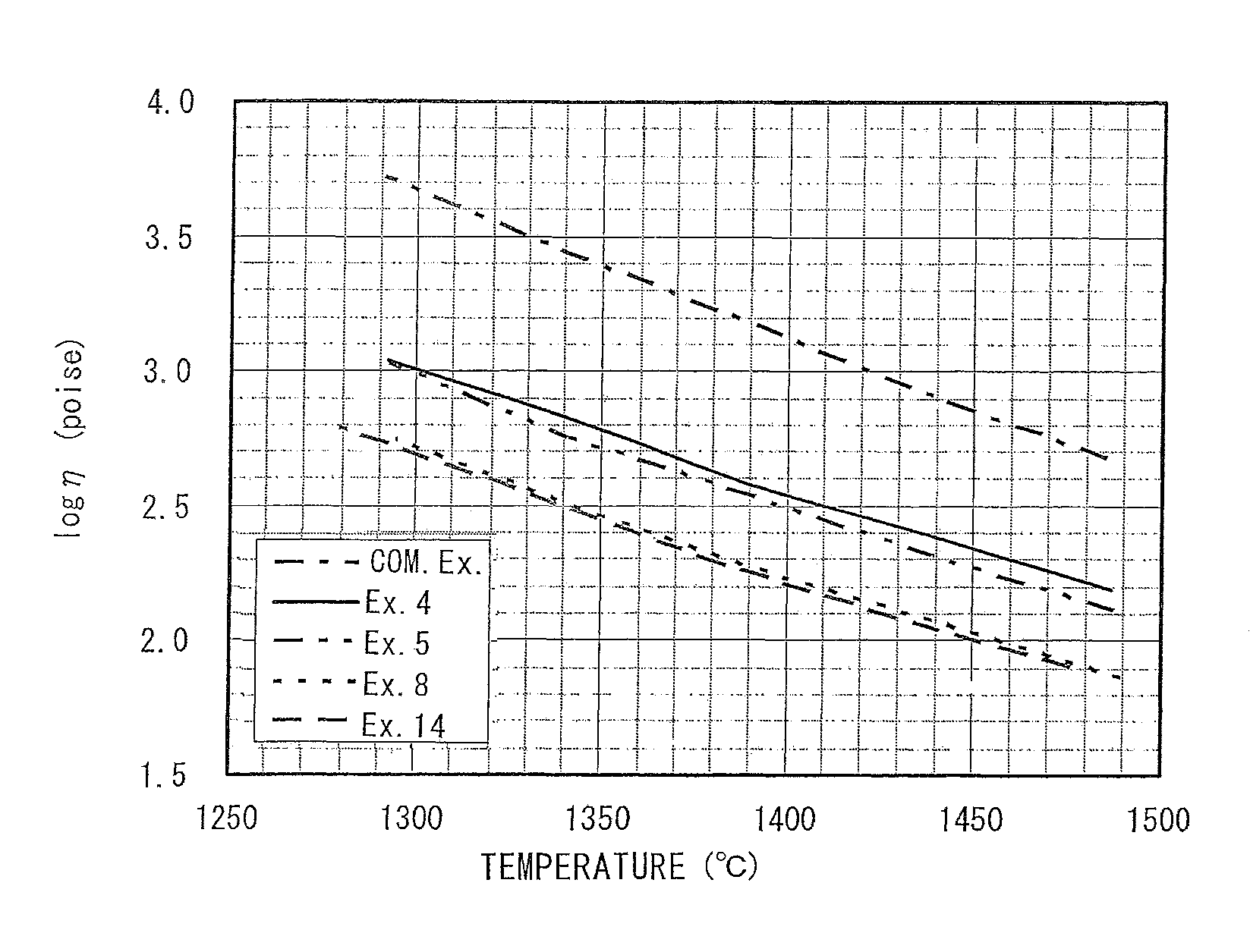

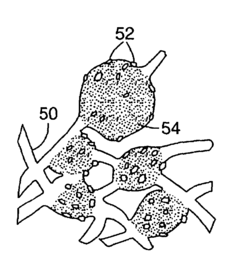

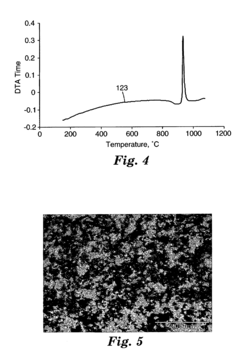

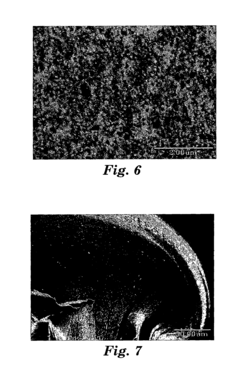

- Transformation and crystallization behavior: The transformation from amorphous to crystalline states in metallic glasses and the controlled crystallization in glass-ceramics are critical aspects of these materials. The crystallization process can be manipulated through heat treatment protocols to develop specific microstructures and properties. Glass-ceramics undergo controlled crystallization where nucleation agents promote the formation of fine crystalline phases within the glass matrix. Understanding the kinetics of crystallization and phase transformation is essential for designing materials with tailored properties for specific applications.

- Applications in electronics and energy storage: Amorphous metals and glass-ceramics find significant applications in electronics and energy storage systems. Their unique magnetic properties make them suitable for transformer cores, magnetic sensors, and electromagnetic shielding. In energy applications, they are used in battery electrodes, fuel cells, and solar energy systems. Glass-ceramics with specific electrical properties serve as substrates for electronic components and as solid electrolytes in batteries. The combination of electrical, thermal, and mechanical properties makes these materials valuable for advanced electronic devices and energy conversion systems.

- Mechanical properties and structural applications: The exceptional mechanical properties of amorphous metals and glass-ceramics make them suitable for various structural applications. These materials exhibit high strength-to-weight ratios, excellent wear resistance, and superior elastic properties. They are used in cutting tools, sporting goods, aerospace components, and biomedical implants. Glass-ceramics offer advantages such as near-zero thermal expansion, high temperature stability, and excellent chemical durability. The combination of these properties enables the development of components that can withstand extreme mechanical and environmental conditions.

02 Manufacturing processes for amorphous metals

Various manufacturing techniques are employed to produce amorphous metals, with rapid solidification being the most common method. This involves cooling the molten metal at extremely high rates (typically 10^4-10^6 K/s) to prevent crystallization. Techniques include melt spinning, splat quenching, and gas atomization. Alternative methods include mechanical alloying, solid-state amorphization, and vapor deposition. These processes are critical in determining the final properties and applications of the amorphous metals.Expand Specific Solutions03 Glass-ceramic formation and crystallization processes

Glass-ceramics are produced through controlled crystallization of glass, involving nucleation and crystal growth stages. The process begins with the formation of a homogeneous glass, followed by heat treatment that induces partial crystallization. This controlled devitrification results in a material with both amorphous and crystalline phases. The crystallization process can be tailored to achieve specific microstructures and properties by adjusting the composition and heat treatment parameters, allowing for customization of mechanical, thermal, and optical properties.Expand Specific Solutions04 Applications of amorphous metals in electronics and energy

Amorphous metals find significant applications in electronics and energy sectors due to their unique magnetic and electrical properties. They are used in transformer cores, magnetic shields, and power distribution systems where their low core losses and high magnetic permeability offer energy efficiency advantages. In energy storage, amorphous metals serve as electrode materials in batteries and fuel cells. Their corrosion resistance and electrical conductivity properties also make them suitable for various electronic components and renewable energy applications.Expand Specific Solutions05 Advanced structural applications of glass-ceramics

Glass-ceramics are extensively used in structural applications due to their exceptional mechanical properties, thermal stability, and chemical durability. These materials find use in architectural elements, dental restorations, cookware, and high-temperature components. Their low thermal expansion coefficients make them resistant to thermal shock, while their biocompatibility enables medical applications. Advanced glass-ceramics are also employed in aerospace, defense, and optical systems where precision, durability, and specialized properties are required under demanding environmental conditions.Expand Specific Solutions

Leading Manufacturers and Research Institutions

The field of amorphous metals and glass-ceramics is currently in a growth phase, with an estimated global market size of $2-3 billion and projected annual growth of 8-10%. The competitive landscape features a mix of established industrial players (3M, Corning, Schaeffler, Honeywell) and emerging specialized manufacturers like Henan Zhongyue. Academic institutions, particularly Chinese universities (Tsinghua, Zhejiang, Huazhong UST), are driving fundamental research advancements. Technology maturity varies significantly across applications - with amorphous metals well-established in transformer cores and electronic components, while newer applications in biomedical implants and high-performance coatings remain in early commercialization stages. The industry is characterized by increasing collaboration between academic institutions and industrial partners to bridge fundamental research and commercial applications.

University of Science & Technology Beijing

Technical Solution: University of Science & Technology Beijing has established a leading research program on amorphous metals, particularly focusing on Fe-based and Ti-based systems for structural and functional applications. Their innovative approach combines computational materials design with advanced processing techniques to develop amorphous alloys with enhanced glass-forming ability and property combinations. USTB researchers have developed Fe-based amorphous compositions with critical cooling rates below 100 K/s, enabling production of bulk specimens with thicknesses exceeding 5mm using conventional copper mold casting. Their Ti-based bulk metallic glasses (typically Ti40Zr25Ni8Cu9Be18) demonstrate exceptional specific strength (strength-to-weight ratio) exceeding 300 MPa·cm³/g and corrosion resistance in aggressive environments. USTB has pioneered selective laser melting techniques for amorphous metals, achieving fully amorphous structures in complex geometries through precise control of laser parameters and scanning strategies. Their comparative studies between amorphous metals and conventional crystalline counterparts have established quantitative relationships between atomic structure and macroscopic properties, particularly regarding wear resistance, where amorphous alloys demonstrate up to 5× improvement over conventional materials.

Strengths: Strong integration of computational modeling with experimental validation, enabling rapid development of new compositions with predictable properties. Their expertise spans from fundamental atomic structure to practical processing techniques. Weaknesses: Research primarily focuses on amorphous metals rather than glass-ceramics, limiting comparative analysis between these material systems. Some advanced compositions contain expensive elements like beryllium or noble metals, affecting economic viability.

Honeywell International Technologies Ltd.

Technical Solution: Honeywell has developed advanced amorphous metal technologies for aerospace and industrial applications, focusing on high-performance Fe-Co-based and Zr-based bulk metallic glasses (BMGs). Their proprietary manufacturing process employs specialized vacuum induction melting followed by copper mold casting to produce amorphous components with thicknesses exceeding 10mm. Honeywell's Zr-based BMGs (typically Zr55Cu30Al10Ni5) demonstrate exceptional mechanical properties, including yield strengths above 1.8 GPa and elastic strain limits approaching 2% - nearly double that of conventional titanium alloys. For magnetic applications, their Fe-Co-based amorphous alloys achieve saturation magnetization values up to 1.8T while maintaining extremely low coercivity (<2 A/m). Honeywell has pioneered thermoplastic forming techniques that exploit the supercooled liquid region of BMGs, enabling precision net-shape manufacturing at temperatures approximately 50-100°C above the glass transition temperature. This process achieves dimensional tolerances within ±0.005mm while preserving the amorphous structure and associated mechanical properties.

Strengths: Capability to produce bulk amorphous metals with exceptional mechanical properties and precision forming techniques that enable complex geometries. Their materials offer unique combinations of strength, elasticity, and magnetic properties. Weaknesses: Manufacturing requires specialized equipment and precise process control, limiting production scale and increasing costs. Some compositions contain expensive elements like zirconium, cobalt, or noble metals, affecting economic viability for certain applications.

Key Patents and Scientific Breakthroughs

Glass-ceramics

PatentInactiveUS8257831B2

Innovation

- Glass-ceramics comprising SiO2, Al2O3, and Li2O with specific crystal phases, such as β-quartz and β-spodumene, are developed, offering high heat resistance, mechanical strength, and super flatness, suitable for vertical magnetic recording systems and press molding.

Ceramic materials, abrasive particles, abrasive articles, and methods of making and using the same

PatentInactiveUS7510585B2

Innovation

- Development of amorphous materials comprising at least 35% Al2O3 with a metal oxide, heat-treated to form glass-ceramics with improved mechanical properties, which can be used to create abrasive particles for abrasive articles, offering enhanced performance and simplified production.

Sustainability and Environmental Impact Assessment

The environmental impact of materials production and usage has become a critical consideration in modern manufacturing and engineering. When comparing amorphous metals and glass-ceramics from a sustainability perspective, several key factors emerge that differentiate these advanced materials in terms of their ecological footprint.

Amorphous metals demonstrate significant sustainability advantages through their energy-efficient production processes. Unlike conventional crystalline metals that require multiple heating and cooling cycles, amorphous metals can be produced in fewer processing steps, potentially reducing energy consumption by 30-50%. Their exceptional strength-to-weight ratio also enables material reduction in final products, decreasing resource extraction demands and associated environmental impacts.

Glass-ceramics, conversely, often utilize abundant raw materials like silica and alumina, reducing dependence on rare or environmentally problematic elements. Their production typically involves controlled crystallization processes that can be optimized for lower energy consumption compared to traditional ceramics manufacturing. Many glass-ceramic formulations also incorporate recycled materials, particularly waste glass, creating circular economy opportunities.

Life cycle assessment (LCA) studies indicate that both material classes offer reduced carbon footprints compared to conventional alternatives when considering their extended service life and performance characteristics. Amorphous metals' superior corrosion resistance extends product lifespans, reducing replacement frequency and associated environmental impacts. Similarly, glass-ceramics' durability and thermal stability contribute to longer service lives in demanding applications.

End-of-life considerations reveal important distinctions. Amorphous metals maintain homogeneous compositions without alloying elements segregating during solidification, potentially simplifying recycling processes. However, their complex compositions may present separation challenges in current recycling streams. Glass-ceramics demonstrate excellent recyclability within closed-loop systems but may require specialized processing facilities not widely available in all regions.

Toxicity profiles also differ significantly. Many glass-ceramic formulations are biologically inert, presenting minimal environmental hazards during production, use, or disposal. Certain amorphous metal compositions, however, may contain elements like beryllium or nickel that require careful handling and disposal protocols to prevent environmental contamination.

Future sustainability improvements for both materials will likely focus on renewable energy integration in production processes, development of compositions optimized for circular economy principles, and design approaches that facilitate eventual disassembly and material recovery. Regulatory frameworks increasingly emphasize these considerations, potentially accelerating innovation in environmentally optimized formulations and manufacturing techniques.

Amorphous metals demonstrate significant sustainability advantages through their energy-efficient production processes. Unlike conventional crystalline metals that require multiple heating and cooling cycles, amorphous metals can be produced in fewer processing steps, potentially reducing energy consumption by 30-50%. Their exceptional strength-to-weight ratio also enables material reduction in final products, decreasing resource extraction demands and associated environmental impacts.

Glass-ceramics, conversely, often utilize abundant raw materials like silica and alumina, reducing dependence on rare or environmentally problematic elements. Their production typically involves controlled crystallization processes that can be optimized for lower energy consumption compared to traditional ceramics manufacturing. Many glass-ceramic formulations also incorporate recycled materials, particularly waste glass, creating circular economy opportunities.

Life cycle assessment (LCA) studies indicate that both material classes offer reduced carbon footprints compared to conventional alternatives when considering their extended service life and performance characteristics. Amorphous metals' superior corrosion resistance extends product lifespans, reducing replacement frequency and associated environmental impacts. Similarly, glass-ceramics' durability and thermal stability contribute to longer service lives in demanding applications.

End-of-life considerations reveal important distinctions. Amorphous metals maintain homogeneous compositions without alloying elements segregating during solidification, potentially simplifying recycling processes. However, their complex compositions may present separation challenges in current recycling streams. Glass-ceramics demonstrate excellent recyclability within closed-loop systems but may require specialized processing facilities not widely available in all regions.

Toxicity profiles also differ significantly. Many glass-ceramic formulations are biologically inert, presenting minimal environmental hazards during production, use, or disposal. Certain amorphous metal compositions, however, may contain elements like beryllium or nickel that require careful handling and disposal protocols to prevent environmental contamination.

Future sustainability improvements for both materials will likely focus on renewable energy integration in production processes, development of compositions optimized for circular economy principles, and design approaches that facilitate eventual disassembly and material recovery. Regulatory frameworks increasingly emphasize these considerations, potentially accelerating innovation in environmentally optimized formulations and manufacturing techniques.

Comparative Performance Metrics and Testing Standards

The standardized evaluation of amorphous metals and glass-ceramics requires comprehensive performance metrics and testing protocols to ensure accurate comparison across different material compositions and manufacturing processes. Current industry standards primarily focus on mechanical properties, with ASTM E1820 and ISO 12135 being widely adopted for fracture toughness assessment, while ASTM E8 and ISO 6892 govern tensile strength testing methodologies.

For thermal stability evaluation, Differential Scanning Calorimetry (DSC) according to ASTM E1269 provides critical data on crystallization temperatures and glass transition points. This metric is particularly significant for amorphous metals, where thermal stability directly correlates with practical application limitations. Complementary to DSC, Thermomechanical Analysis (TMA) following ASTM E831 standards measures dimensional changes during thermal cycling.

Corrosion resistance testing follows ASTM G31 for immersion tests and ASTM G5 for electrochemical testing, with specialized protocols developed for specific environments such as biological systems or high-temperature applications. Recent developments have introduced accelerated testing methods that can predict long-term performance in weeks rather than years.

Magnetic and electrical property characterization follows IEEE 393 and ASTM A977 standards, with particular attention to saturation magnetization and coercivity for amorphous metals used in transformer cores and electromagnetic shielding. For glass-ceramics, dielectric strength testing according to ASTM D149 remains the predominant standard.

Wear resistance evaluation employs ASTM G99 (pin-on-disk) and ASTM G65 (abrasion) methodologies, with specialized adaptations for dental and biomedical applications. Recent innovations include nano-indentation techniques (ISO 14577) that provide insights into localized mechanical behavior at microscopic scales.

Biocompatibility assessment follows ISO 10993 series standards, with particular emphasis on cytotoxicity (ISO 10993-5) and implantation tests (ISO 10993-6) for materials intended for medical applications. These standards have been recently updated to include specific protocols for metallic glass materials used in implantable devices.

Emerging performance metrics focus on functional properties such as catalytic activity, hydrogen storage capacity, and radiation shielding effectiveness. These newer metrics often lack standardized testing protocols, with research institutions developing proprietary methodologies that complicate direct comparison between published results. Industry consortia are currently working to establish unified testing standards for these emerging applications.

For thermal stability evaluation, Differential Scanning Calorimetry (DSC) according to ASTM E1269 provides critical data on crystallization temperatures and glass transition points. This metric is particularly significant for amorphous metals, where thermal stability directly correlates with practical application limitations. Complementary to DSC, Thermomechanical Analysis (TMA) following ASTM E831 standards measures dimensional changes during thermal cycling.

Corrosion resistance testing follows ASTM G31 for immersion tests and ASTM G5 for electrochemical testing, with specialized protocols developed for specific environments such as biological systems or high-temperature applications. Recent developments have introduced accelerated testing methods that can predict long-term performance in weeks rather than years.

Magnetic and electrical property characterization follows IEEE 393 and ASTM A977 standards, with particular attention to saturation magnetization and coercivity for amorphous metals used in transformer cores and electromagnetic shielding. For glass-ceramics, dielectric strength testing according to ASTM D149 remains the predominant standard.

Wear resistance evaluation employs ASTM G99 (pin-on-disk) and ASTM G65 (abrasion) methodologies, with specialized adaptations for dental and biomedical applications. Recent innovations include nano-indentation techniques (ISO 14577) that provide insights into localized mechanical behavior at microscopic scales.

Biocompatibility assessment follows ISO 10993 series standards, with particular emphasis on cytotoxicity (ISO 10993-5) and implantation tests (ISO 10993-6) for materials intended for medical applications. These standards have been recently updated to include specific protocols for metallic glass materials used in implantable devices.

Emerging performance metrics focus on functional properties such as catalytic activity, hydrogen storage capacity, and radiation shielding effectiveness. These newer metrics often lack standardized testing protocols, with research institutions developing proprietary methodologies that complicate direct comparison between published results. Industry consortia are currently working to establish unified testing standards for these emerging applications.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!