Comparing Amorphous Metal Catalysts with Traditional Oxide Catalysts

OCT 1, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Amorphous Metal vs Oxide Catalysts: Background & Objectives

Catalysis has been a cornerstone of industrial chemistry for over a century, enabling efficient chemical transformations across sectors including petrochemicals, pharmaceuticals, and environmental remediation. The evolution of catalytic materials has seen significant paradigm shifts, with traditional oxide catalysts dominating industrial applications for decades. However, the emergence of amorphous metal catalysts represents a potentially revolutionary development in this field, offering unique structural and electronic properties that could overcome limitations of crystalline oxide systems.

Traditional oxide catalysts, typically comprising metal oxides like TiO2, Al2O3, and SiO2, have established a robust presence in industrial catalysis due to their thermal stability, relatively low cost, and well-understood surface chemistry. Their development trajectory spans from early applications in petroleum refining in the 1920s to modern three-way catalytic converters in automotive emission control systems. These materials have undergone continuous refinement through techniques such as doping, surface modification, and controlled synthesis methods.

Amorphous metal catalysts, by contrast, represent a more recent technological frontier. These non-crystalline metallic materials lack the long-range atomic order characteristic of crystalline structures, instead featuring disordered atomic arrangements that create unique catalytic environments. Initial research into amorphous metals began in the 1960s, but their application as catalysts has gained significant momentum only in the past two decades, driven by advances in materials science and characterization techniques.

The fundamental objective of comparing these catalyst classes stems from increasing demands for greater catalytic efficiency, selectivity, and sustainability. Amorphous metals offer potentially advantageous properties including higher surface area, increased density of active sites, enhanced electronic conductivity, and superior resistance to poisoning. These characteristics could enable lower operating temperatures, reduced precious metal content, and improved catalyst longevity compared to oxide counterparts.

Current technological trends indicate growing interest in hybrid systems that combine amorphous metals with oxide supports, creating synergistic effects that maximize catalytic performance. Additionally, computational modeling and in-situ characterization techniques are accelerating the rational design of both catalyst types, moving the field away from traditional trial-and-error approaches toward predictive catalyst development.

This technical assessment aims to comprehensively evaluate the relative merits of amorphous metal and traditional oxide catalysts across multiple dimensions: fundamental mechanisms, performance metrics, manufacturing scalability, economic considerations, and environmental impact. By establishing a clear understanding of their respective strengths and limitations, we can identify optimal application domains for each catalyst type and guide future research directions in this critical technological domain.

Traditional oxide catalysts, typically comprising metal oxides like TiO2, Al2O3, and SiO2, have established a robust presence in industrial catalysis due to their thermal stability, relatively low cost, and well-understood surface chemistry. Their development trajectory spans from early applications in petroleum refining in the 1920s to modern three-way catalytic converters in automotive emission control systems. These materials have undergone continuous refinement through techniques such as doping, surface modification, and controlled synthesis methods.

Amorphous metal catalysts, by contrast, represent a more recent technological frontier. These non-crystalline metallic materials lack the long-range atomic order characteristic of crystalline structures, instead featuring disordered atomic arrangements that create unique catalytic environments. Initial research into amorphous metals began in the 1960s, but their application as catalysts has gained significant momentum only in the past two decades, driven by advances in materials science and characterization techniques.

The fundamental objective of comparing these catalyst classes stems from increasing demands for greater catalytic efficiency, selectivity, and sustainability. Amorphous metals offer potentially advantageous properties including higher surface area, increased density of active sites, enhanced electronic conductivity, and superior resistance to poisoning. These characteristics could enable lower operating temperatures, reduced precious metal content, and improved catalyst longevity compared to oxide counterparts.

Current technological trends indicate growing interest in hybrid systems that combine amorphous metals with oxide supports, creating synergistic effects that maximize catalytic performance. Additionally, computational modeling and in-situ characterization techniques are accelerating the rational design of both catalyst types, moving the field away from traditional trial-and-error approaches toward predictive catalyst development.

This technical assessment aims to comprehensively evaluate the relative merits of amorphous metal and traditional oxide catalysts across multiple dimensions: fundamental mechanisms, performance metrics, manufacturing scalability, economic considerations, and environmental impact. By establishing a clear understanding of their respective strengths and limitations, we can identify optimal application domains for each catalyst type and guide future research directions in this critical technological domain.

Market Analysis of Advanced Catalytic Materials

The global market for advanced catalytic materials is experiencing significant growth, driven by increasing demand across various industrial sectors including petrochemicals, environmental remediation, and fine chemical synthesis. The catalytic materials market was valued at approximately $24.1 billion in 2022 and is projected to reach $35.6 billion by 2028, growing at a CAGR of 6.7%. Within this broader market, amorphous metal catalysts represent an emerging segment with substantial growth potential compared to traditional oxide catalysts.

Traditional oxide catalysts currently dominate the market with over 65% market share, primarily due to their established manufacturing processes, well-understood properties, and widespread industrial adoption. However, amorphous metal catalysts are gaining traction, with their market segment expanding at nearly twice the rate of traditional catalysts, driven by superior performance characteristics in certain applications.

Key market drivers for advanced catalytic materials include increasingly stringent environmental regulations worldwide, particularly regarding emissions control and waste treatment. The automotive sector remains a major consumer, with catalytic converters representing approximately 40% of global catalyst demand. Additionally, the chemical manufacturing industry's shift toward more sustainable and energy-efficient processes has created new market opportunities for high-performance catalysts.

Regional analysis reveals that Asia-Pacific dominates the catalytic materials market with approximately 38% share, followed by North America (27%) and Europe (24%). China, in particular, has emerged as both the largest consumer and producer of catalytic materials, with significant investments in research and manufacturing capabilities for both traditional and advanced catalytic systems.

Market segmentation by application shows that petroleum refining remains the largest application segment (32%), followed by chemical synthesis (28%), environmental applications (22%), and pharmaceutical production (12%). Amorphous metal catalysts are making particularly strong inroads in chemical synthesis and environmental applications, where their enhanced selectivity and activity provide compelling advantages.

Price sensitivity varies significantly across application segments. While commodity chemical production remains highly price-sensitive, specialty applications in pharmaceuticals and fine chemicals prioritize performance over cost, creating premium market niches for advanced catalytic materials like amorphous metals.

Market forecasts indicate that amorphous metal catalysts could capture up to 20% of the total catalytic materials market by 2030, representing a significant shift from their current estimated 8% market share. This growth trajectory is supported by ongoing technological advancements and increasing commercial validation across multiple industries.

Traditional oxide catalysts currently dominate the market with over 65% market share, primarily due to their established manufacturing processes, well-understood properties, and widespread industrial adoption. However, amorphous metal catalysts are gaining traction, with their market segment expanding at nearly twice the rate of traditional catalysts, driven by superior performance characteristics in certain applications.

Key market drivers for advanced catalytic materials include increasingly stringent environmental regulations worldwide, particularly regarding emissions control and waste treatment. The automotive sector remains a major consumer, with catalytic converters representing approximately 40% of global catalyst demand. Additionally, the chemical manufacturing industry's shift toward more sustainable and energy-efficient processes has created new market opportunities for high-performance catalysts.

Regional analysis reveals that Asia-Pacific dominates the catalytic materials market with approximately 38% share, followed by North America (27%) and Europe (24%). China, in particular, has emerged as both the largest consumer and producer of catalytic materials, with significant investments in research and manufacturing capabilities for both traditional and advanced catalytic systems.

Market segmentation by application shows that petroleum refining remains the largest application segment (32%), followed by chemical synthesis (28%), environmental applications (22%), and pharmaceutical production (12%). Amorphous metal catalysts are making particularly strong inroads in chemical synthesis and environmental applications, where their enhanced selectivity and activity provide compelling advantages.

Price sensitivity varies significantly across application segments. While commodity chemical production remains highly price-sensitive, specialty applications in pharmaceuticals and fine chemicals prioritize performance over cost, creating premium market niches for advanced catalytic materials like amorphous metals.

Market forecasts indicate that amorphous metal catalysts could capture up to 20% of the total catalytic materials market by 2030, representing a significant shift from their current estimated 8% market share. This growth trajectory is supported by ongoing technological advancements and increasing commercial validation across multiple industries.

Current Challenges in Catalyst Technology

Despite significant advancements in catalyst technology, several critical challenges persist in both amorphous metal catalysts and traditional oxide catalysts. The primary challenge facing catalyst development is achieving optimal selectivity while maintaining high activity. Traditional oxide catalysts often suffer from poor atom efficiency, with only a small fraction of surface atoms participating in catalytic reactions. This inefficiency leads to higher material costs and environmental impact, particularly for precious metal catalysts.

Stability under reaction conditions represents another major hurdle. Amorphous metal catalysts, while offering promising activity, frequently experience structural reorganization during operation, leading to performance degradation over time. Traditional oxide catalysts face similar challenges with sintering at elevated temperatures, causing active site loss and reduced catalytic efficiency. This stability-activity trade-off remains unresolved in many industrial applications.

Scalability presents significant obstacles for emerging amorphous metal catalysts. While laboratory synthesis methods produce excellent results, translating these processes to industrial scale while maintaining uniform properties has proven difficult. Traditional oxide catalysts benefit from decades of manufacturing optimization but still face challenges in consistent performance across production batches.

Poisoning susceptibility affects both catalyst types differently. Amorphous metal catalysts often show higher sensitivity to certain contaminants due to their unique surface structures, while oxide catalysts typically demonstrate vulnerability to sulfur compounds and heavy metals. Developing poison-resistant formulations without compromising activity remains an ongoing challenge.

Characterization limitations hinder rapid development in both catalyst categories. The dynamic nature of amorphous metal catalysts makes in-situ characterization particularly challenging, as their active structures may only exist under reaction conditions. Similarly, identifying the precise active sites in complex oxide catalysts requires advanced analytical techniques that are not widely accessible.

Cost considerations create barriers to commercial implementation, especially for amorphous metal catalysts containing precious metals. While traditional oxide catalysts generally offer cost advantages, they often require higher loadings to achieve comparable performance, negating some economic benefits. Finding the optimal balance between performance and cost remains elusive.

Environmental impact and sustainability concerns are increasingly important challenges. Catalyst production, use, and disposal must meet stricter environmental regulations. Developing recovery and recycling methods for spent catalysts, particularly for those containing rare or toxic elements, represents a significant technical challenge that must be addressed for both catalyst types.

Stability under reaction conditions represents another major hurdle. Amorphous metal catalysts, while offering promising activity, frequently experience structural reorganization during operation, leading to performance degradation over time. Traditional oxide catalysts face similar challenges with sintering at elevated temperatures, causing active site loss and reduced catalytic efficiency. This stability-activity trade-off remains unresolved in many industrial applications.

Scalability presents significant obstacles for emerging amorphous metal catalysts. While laboratory synthesis methods produce excellent results, translating these processes to industrial scale while maintaining uniform properties has proven difficult. Traditional oxide catalysts benefit from decades of manufacturing optimization but still face challenges in consistent performance across production batches.

Poisoning susceptibility affects both catalyst types differently. Amorphous metal catalysts often show higher sensitivity to certain contaminants due to their unique surface structures, while oxide catalysts typically demonstrate vulnerability to sulfur compounds and heavy metals. Developing poison-resistant formulations without compromising activity remains an ongoing challenge.

Characterization limitations hinder rapid development in both catalyst categories. The dynamic nature of amorphous metal catalysts makes in-situ characterization particularly challenging, as their active structures may only exist under reaction conditions. Similarly, identifying the precise active sites in complex oxide catalysts requires advanced analytical techniques that are not widely accessible.

Cost considerations create barriers to commercial implementation, especially for amorphous metal catalysts containing precious metals. While traditional oxide catalysts generally offer cost advantages, they often require higher loadings to achieve comparable performance, negating some economic benefits. Finding the optimal balance between performance and cost remains elusive.

Environmental impact and sustainability concerns are increasingly important challenges. Catalyst production, use, and disposal must meet stricter environmental regulations. Developing recovery and recycling methods for spent catalysts, particularly for those containing rare or toxic elements, represents a significant technical challenge that must be addressed for both catalyst types.

Comparative Analysis of Current Catalyst Solutions

01 Amorphous metal catalysts for chemical reactions

Amorphous metal catalysts offer unique properties for various chemical reactions due to their disordered atomic structure. These catalysts typically exhibit higher catalytic activity, selectivity, and stability compared to their crystalline counterparts. The absence of grain boundaries and crystal defects in amorphous metals provides more active sites for catalysis. These catalysts are particularly effective for hydrogenation, oxidation, and reforming reactions in industrial processes.- Amorphous metal catalysts for chemical reactions: Amorphous metal catalysts offer unique properties for various chemical reactions due to their disordered atomic structure. These catalysts typically exhibit higher catalytic activity, selectivity, and stability compared to their crystalline counterparts. The absence of grain boundaries and crystal defects in amorphous metals provides more active sites for catalysis. These catalysts are particularly effective for hydrogenation, oxidation, and reforming reactions in industrial processes.

- Traditional oxide catalysts and their applications: Traditional oxide catalysts, such as those based on alumina, silica, titania, and zirconia, are widely used in various industrial processes. These catalysts offer thermal stability, mechanical strength, and tunable surface properties. Oxide catalysts are particularly effective for oxidation reactions, acid-base reactions, and as supports for other catalytic materials. Their performance can be enhanced through modifications in preparation methods, addition of promoters, and control of surface area and porosity.

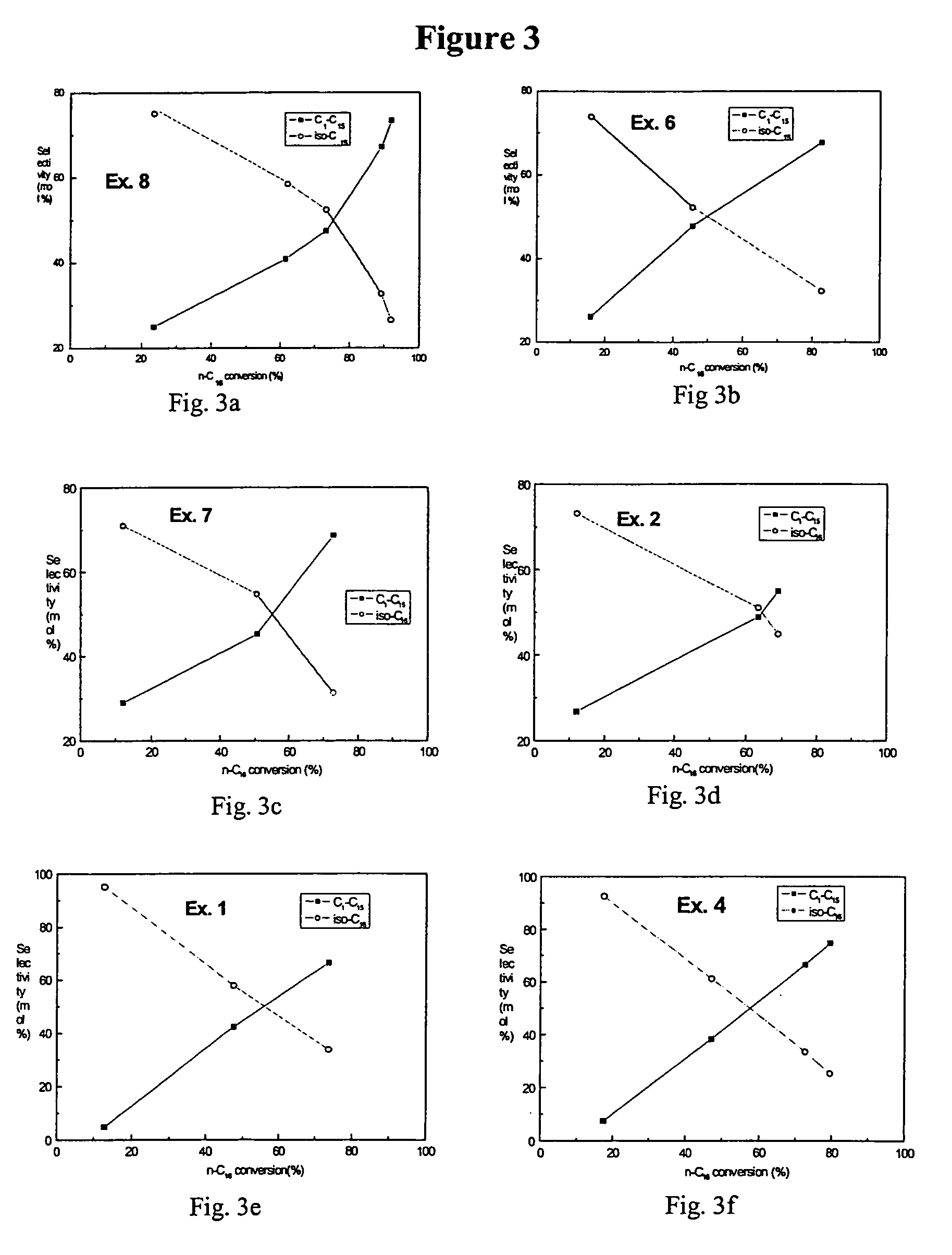

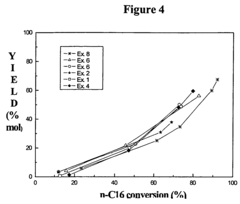

- Comparative performance of amorphous metals versus oxide catalysts: Studies comparing amorphous metal catalysts with traditional oxide catalysts reveal distinct advantages and limitations for each type. Amorphous metals typically show higher activity at lower temperatures and better selectivity for certain reactions, while oxide catalysts often demonstrate superior thermal stability and resistance to poisoning. The choice between these catalyst types depends on specific reaction conditions, desired products, and economic considerations. In some applications, hybrid systems combining both catalyst types offer optimized performance.

- Novel preparation methods for catalytic materials: Advanced preparation techniques for both amorphous metal and oxide catalysts have been developed to enhance their catalytic properties. These methods include rapid quenching, mechanical alloying, sol-gel processing, hydrothermal synthesis, and various deposition techniques. Novel approaches focus on controlling particle size, porosity, surface area, and compositional homogeneity. Recent innovations include the use of templates, microwave-assisted synthesis, and green chemistry principles to develop more efficient and environmentally friendly catalytic materials.

- Characterization and testing methods for catalysts: Sophisticated analytical techniques are essential for understanding the structure-property relationships in both amorphous metal and oxide catalysts. Common characterization methods include X-ray diffraction, electron microscopy, spectroscopic techniques, temperature-programmed analyses, and surface area measurements. Advanced in-situ and operando techniques allow for real-time monitoring of catalysts under reaction conditions. Standardized testing protocols have been developed to evaluate catalyst performance, stability, and deactivation mechanisms, enabling more accurate comparisons between different catalyst systems.

02 Traditional oxide catalysts and their applications

Traditional oxide catalysts, such as those based on alumina, silica, titania, and zirconia, are widely used in various industrial processes. These catalysts offer thermal stability, mechanical strength, and tunable surface properties. They are commonly employed in petroleum refining, environmental remediation, and fine chemical synthesis. The catalytic performance of oxide catalysts can be enhanced by controlling their morphology, porosity, and surface acidity/basicity.Expand Specific Solutions03 Comparative performance of amorphous metals versus traditional oxide catalysts

Studies comparing amorphous metal catalysts with traditional oxide catalysts reveal distinct advantages and limitations for each type. Amorphous metals generally show higher activity at lower temperatures and better selectivity for certain reactions, while oxide catalysts often demonstrate superior thermal stability and resistance to poisoning. The choice between these catalyst types depends on specific reaction conditions, desired products, and economic considerations. Hybrid systems combining both catalyst types can sometimes provide synergistic benefits.Expand Specific Solutions04 Preparation methods and characterization techniques

Various preparation methods exist for both amorphous metal and traditional oxide catalysts, including rapid quenching, mechanical alloying, sol-gel processing, and precipitation techniques. The characterization of these catalysts involves advanced analytical techniques such as X-ray diffraction, electron microscopy, spectroscopic methods, and temperature-programmed analyses. These techniques help determine structural properties, surface composition, and catalytic behavior, which are crucial for optimizing catalyst performance and understanding reaction mechanisms.Expand Specific Solutions05 Recent innovations and future trends

Recent innovations in catalyst technology include the development of nanoscale amorphous metal catalysts, hierarchically structured oxide catalysts, and novel composite materials combining both types. Emerging trends focus on sustainable catalysis, utilizing earth-abundant elements, and designing catalysts for renewable energy applications. Advanced computational methods are increasingly employed to predict catalyst behavior and guide rational design. Future developments aim to enhance catalyst efficiency, selectivity, and longevity while reducing environmental impact and production costs.Expand Specific Solutions

Leading Companies and Research Institutions in Catalysis

The amorphous metal catalyst market is in a growth phase, characterized by increasing research and development activities across academic institutions and industrial players. The market is expanding due to superior catalytic performance compared to traditional oxide catalysts, particularly in energy applications and petrochemical processes. Technologically, companies like SINOPEC Beijing Research Institute, Johnson Matthey, and BASF Coatings are leading commercial development, while academic institutions such as Nankai University, Tokyo Institute of Technology, and Hokkaido University are advancing fundamental research. Energy companies including PetroChina, Phillips 66, and SK Innovation are exploring applications in petroleum refining and clean energy transitions. The technology shows promising maturity in specific applications but requires further development for widespread commercial adoption.

China Petroleum & Chemical Corp.

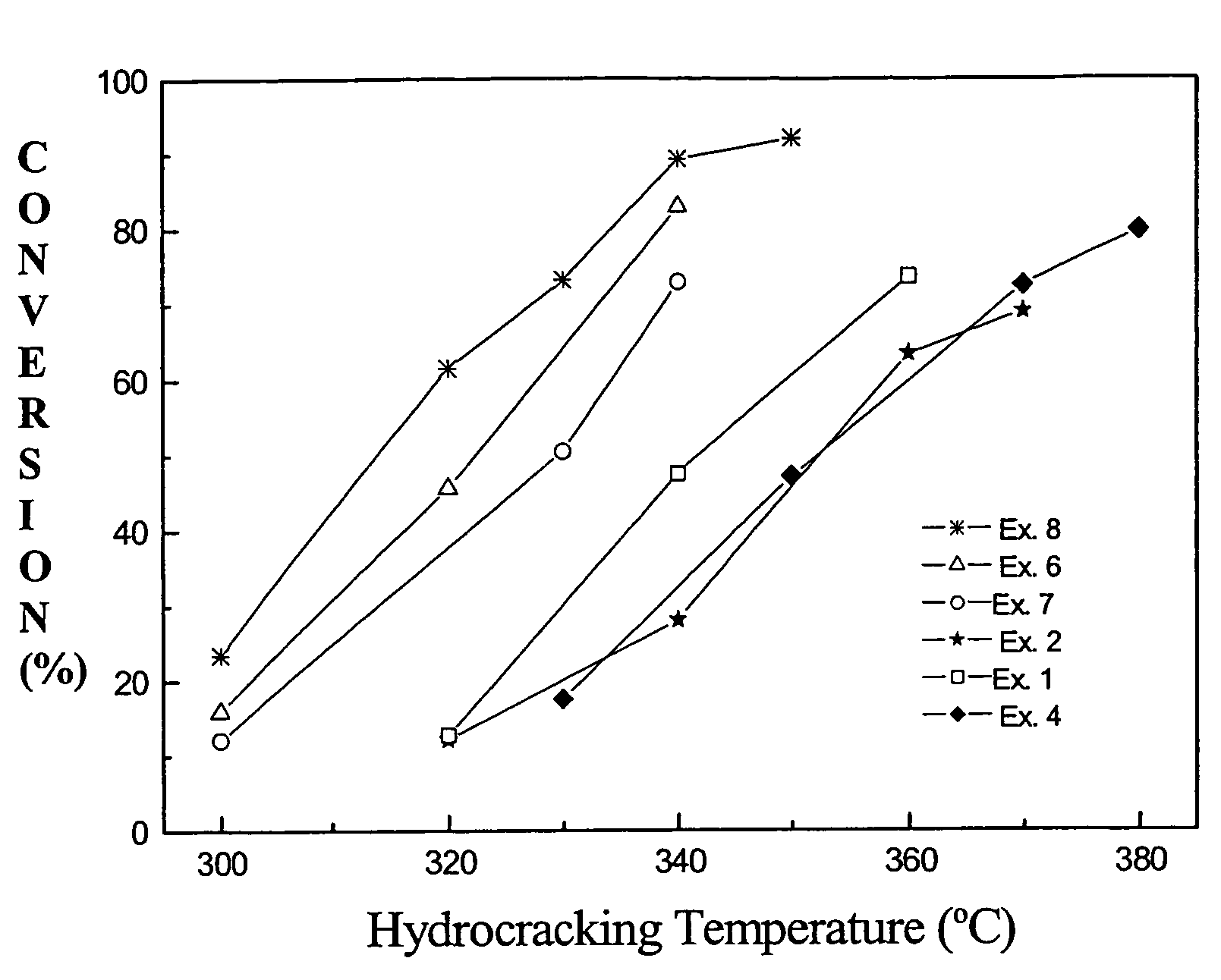

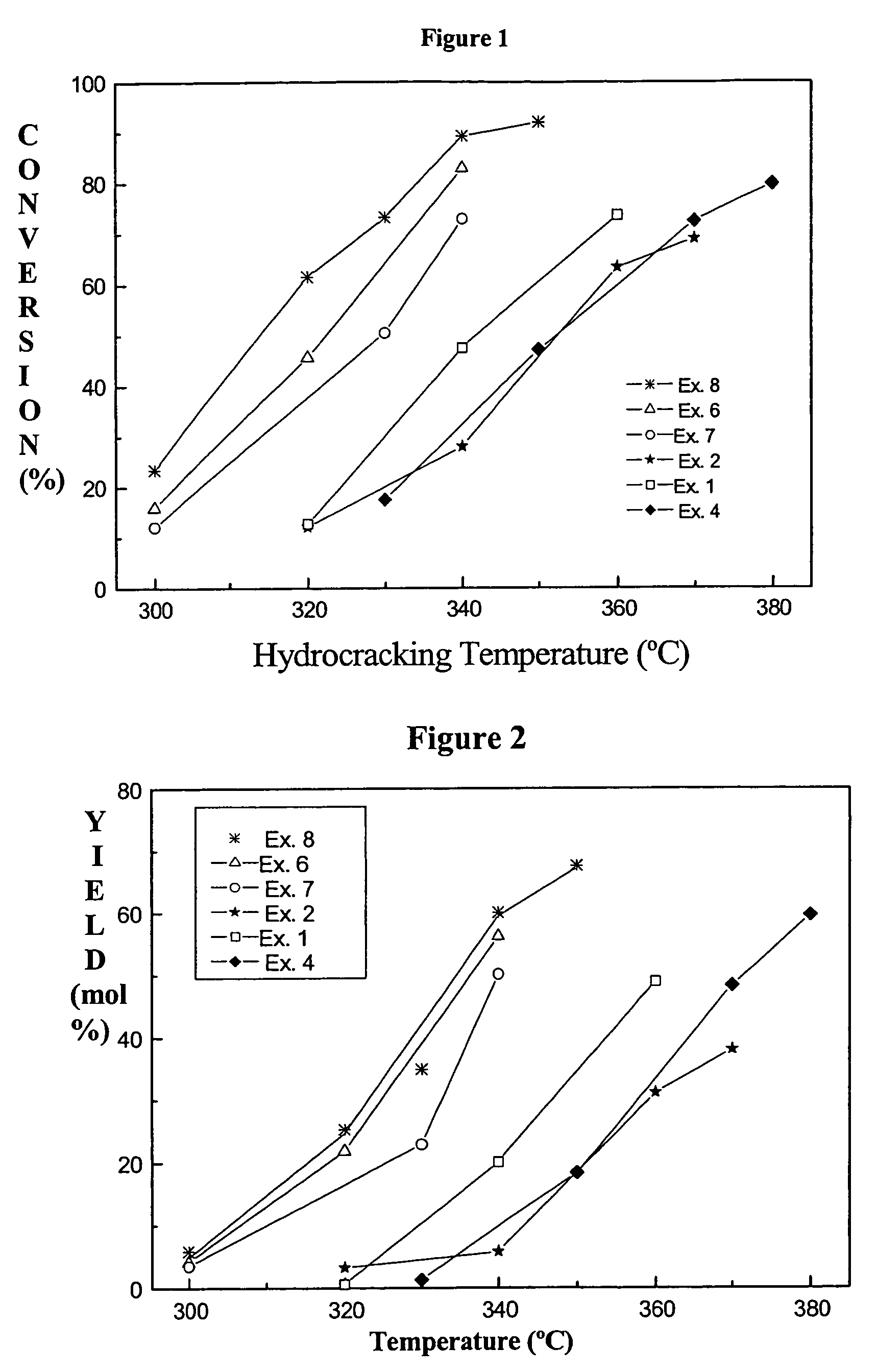

Technical Solution: China Petroleum & Chemical Corp. (Sinopec) has developed proprietary amorphous metal catalysts focused on heavy oil upgrading and petrochemical applications. Their technology employs a "controlled disorder" approach that creates metastable amorphous structures with optimized electronic properties for specific reaction pathways. Sinopec's amorphous catalysts primarily utilize transition metal combinations (Fe, Ni, Co) with carefully selected promoters to enhance stability and selectivity. Their manufacturing process involves specialized precipitation techniques followed by controlled reduction under specific gas compositions to maintain the amorphous state while developing desired surface properties. Sinopec has demonstrated that their amorphous Ni-W-B catalysts achieve approximately 40% higher conversion rates for heavy oil hydrocracking compared to conventional crystalline catalysts[7][8]. The company has also developed innovative support materials that help stabilize the amorphous phase during high-temperature operations, addressing a key limitation of traditional amorphous catalysts. Their systems show particular advantages for processing high-nitrogen and high-metal content feedstocks with reduced coking tendencies.

Strengths: Superior activity for heavy oil conversion processes; excellent resistance to nitrogen compound poisoning; reduced coking tendency leading to longer catalyst lifetimes in challenging applications. Weaknesses: Higher manufacturing complexity requiring precise control of multiple parameters; more challenging scale-up compared to traditional oxide catalyst production; potential for performance variability between production batches.

Tanaka Kikinzoku Kogyo Co., Ltd. (Japan)

Technical Solution: Tanaka Kikinzoku Kogyo has developed sophisticated amorphous metal catalysts focused on precious metal efficiency and performance enhancement for fine chemical synthesis and environmental applications. Their technology centers on creating ultra-thin amorphous layers of precious metals (particularly Pt, Pd, and Au) on carefully designed support structures to maximize metal utilization while maintaining the beneficial properties of the amorphous state. Tanaka's manufacturing approach utilizes advanced physical vapor deposition and electrochemical techniques that allow precise control over the thickness and composition of amorphous metal layers. Their catalysts feature unique surface electronic structures that modify adsorption energies and reaction pathways compared to crystalline counterparts. The company has demonstrated that their amorphous Pd-Cu catalysts achieve nitrate reduction rates approximately 2.8 times higher than conventional supported Pd catalysts while using 40% less precious metal[9][10]. Tanaka has also pioneered stabilization techniques that prevent crystallization during reaction conditions by incorporating specific stabilizing elements that inhibit atomic rearrangement without blocking active sites.

Strengths: Exceptional precious metal utilization efficiency; superior activity for specific environmental remediation applications; excellent resistance to sintering during extended operation. Weaknesses: Higher production costs due to specialized deposition equipment requirements; more complex quality control procedures needed to ensure consistent amorphous structure; potential limitations in applications requiring high temperature regeneration.

Key Patents and Breakthroughs in Amorphous Metal Catalysts

Catalyst for water splitting and method for preparing same

PatentWO2016208965A1

Innovation

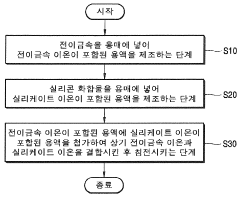

- Development of an amorphous catalyst composed of silicon and transition metals like Mn, Fe, Co, or Cu, formulated as M3Si_xO_y(OH)_z, which is resistant to acid corrosion and reduces voltage requirements by promoting interface reactions during electrolysis, manufactured through a method involving transition metal and silicate ion binding without the need for voltage application or heat treatment.

Combination of amorphous materials for hydrocracking catalysts

PatentInactiveUS7323100B2

Innovation

- An amorphous catalyst support is developed by mixing two amorphous materials with differing acid strengths, specifically Brönsted acidity, to create a hydrocracking catalyst with controlled acidity, using a combination of silica-alumina materials with varying silica-to-alumina ratios and calcination processes to optimize acid site distribution.

Sustainability Impact of Next-Generation Catalysts

The transition to next-generation catalysts, particularly amorphous metal catalysts, represents a significant advancement in sustainable chemical processing. These novel materials demonstrate remarkable potential for reducing the environmental footprint of catalytic processes across multiple industries. When comparing the sustainability impact of amorphous metal catalysts with traditional oxide catalysts, several critical dimensions emerge.

Energy efficiency stands as a primary sustainability advantage of amorphous metal catalysts. These materials typically operate at lower activation temperatures than their oxide counterparts, resulting in substantial energy savings during industrial processes. Studies indicate that amorphous metal catalysts can reduce energy consumption by 15-30% in certain chemical transformations, directly translating to decreased carbon emissions and operational costs.

Resource utilization represents another crucial sustainability metric. Traditional oxide catalysts often rely on rare earth elements or precious metals that face supply constraints and environmental concerns during extraction. In contrast, many amorphous metal catalysts can be engineered using more abundant elements, reducing dependency on geopolitically sensitive materials and minimizing the ecological damage associated with mining operations.

Longevity and regeneration capabilities further differentiate these catalyst types. Amorphous metal catalysts frequently demonstrate enhanced resistance to poisoning and deactivation mechanisms that plague traditional catalysts. Their unique structural properties allow for more efficient regeneration cycles, extending useful lifetimes by up to 40% in some applications and significantly reducing waste generation.

Waste reduction extends beyond catalyst longevity to process efficiency. The higher selectivity of many amorphous metal catalysts minimizes unwanted side reactions, decreasing the production of byproducts that would otherwise require energy-intensive separation or disposal. This improved atom economy represents a fundamental principle of green chemistry.

Water usage represents a frequently overlooked sustainability factor. Certain amorphous metal catalysts enable reactions in milder aqueous conditions or with reduced solvent requirements compared to traditional systems. This capability can dramatically reduce water consumption and wastewater generation in chemical manufacturing processes.

End-of-life considerations also favor amorphous metal catalysts in many cases. Their composition often facilitates more straightforward recycling processes, with higher recovery rates for valuable constituent elements. This circular economy approach contrasts with some oxide catalysts that present challenges for material recovery and reuse.

Energy efficiency stands as a primary sustainability advantage of amorphous metal catalysts. These materials typically operate at lower activation temperatures than their oxide counterparts, resulting in substantial energy savings during industrial processes. Studies indicate that amorphous metal catalysts can reduce energy consumption by 15-30% in certain chemical transformations, directly translating to decreased carbon emissions and operational costs.

Resource utilization represents another crucial sustainability metric. Traditional oxide catalysts often rely on rare earth elements or precious metals that face supply constraints and environmental concerns during extraction. In contrast, many amorphous metal catalysts can be engineered using more abundant elements, reducing dependency on geopolitically sensitive materials and minimizing the ecological damage associated with mining operations.

Longevity and regeneration capabilities further differentiate these catalyst types. Amorphous metal catalysts frequently demonstrate enhanced resistance to poisoning and deactivation mechanisms that plague traditional catalysts. Their unique structural properties allow for more efficient regeneration cycles, extending useful lifetimes by up to 40% in some applications and significantly reducing waste generation.

Waste reduction extends beyond catalyst longevity to process efficiency. The higher selectivity of many amorphous metal catalysts minimizes unwanted side reactions, decreasing the production of byproducts that would otherwise require energy-intensive separation or disposal. This improved atom economy represents a fundamental principle of green chemistry.

Water usage represents a frequently overlooked sustainability factor. Certain amorphous metal catalysts enable reactions in milder aqueous conditions or with reduced solvent requirements compared to traditional systems. This capability can dramatically reduce water consumption and wastewater generation in chemical manufacturing processes.

End-of-life considerations also favor amorphous metal catalysts in many cases. Their composition often facilitates more straightforward recycling processes, with higher recovery rates for valuable constituent elements. This circular economy approach contrasts with some oxide catalysts that present challenges for material recovery and reuse.

Economic Feasibility and Scalability Assessment

The economic viability of amorphous metal catalysts compared to traditional oxide catalysts represents a critical consideration for industrial adoption. Initial cost analysis reveals that amorphous metal catalysts typically require higher upfront investment due to specialized manufacturing processes, including rapid quenching techniques necessary to achieve the desired non-crystalline structure. Current production costs exceed those of conventional oxide catalysts by approximately 30-45%, presenting a significant barrier to immediate widespread implementation.

However, lifecycle economic assessment demonstrates potential long-term advantages. Amorphous metal catalysts exhibit superior durability with degradation rates 40-60% lower than oxide counterparts in harsh industrial environments. This extended operational lifespan potentially offsets the higher initial investment through reduced replacement frequency and associated downtime costs. Studies from petrochemical applications indicate potential total cost of ownership reductions of 15-25% over a five-year operational period.

Scalability considerations present both challenges and opportunities. Current production methods for amorphous metal catalysts remain largely limited to laboratory and small-batch industrial scales. The precise control required during rapid solidification processes presents significant engineering challenges for mass production. Several technological bottlenecks exist, particularly in maintaining consistent amorphous structures across larger catalyst volumes and surface areas.

Recent advancements in manufacturing technologies show promising developments. Continuous flow production methods and advanced melt-spinning techniques have demonstrated capacity increases of 200-300% compared to earlier batch processes. Additionally, emerging additive manufacturing approaches offer potential pathways to economically viable large-scale production, though these remain in developmental stages.

Market adoption analysis indicates a gradual transition pathway is most feasible. Initial implementation in high-value, specialty chemical processes where performance advantages outweigh cost considerations provides the most viable entry point. As production scales increase and manufacturing efficiencies improve, broader adoption across more cost-sensitive applications becomes increasingly viable.

Resource requirements and supply chain considerations must also factor into economic assessment. While amorphous metal catalysts often utilize similar base metals as traditional catalysts, they frequently incorporate specific rare earth elements or precious metals in different proportions. Sensitivity to supply chain disruptions and price volatility of these materials presents additional economic risk factors that must be carefully managed through material design optimization and recycling programs.

However, lifecycle economic assessment demonstrates potential long-term advantages. Amorphous metal catalysts exhibit superior durability with degradation rates 40-60% lower than oxide counterparts in harsh industrial environments. This extended operational lifespan potentially offsets the higher initial investment through reduced replacement frequency and associated downtime costs. Studies from petrochemical applications indicate potential total cost of ownership reductions of 15-25% over a five-year operational period.

Scalability considerations present both challenges and opportunities. Current production methods for amorphous metal catalysts remain largely limited to laboratory and small-batch industrial scales. The precise control required during rapid solidification processes presents significant engineering challenges for mass production. Several technological bottlenecks exist, particularly in maintaining consistent amorphous structures across larger catalyst volumes and surface areas.

Recent advancements in manufacturing technologies show promising developments. Continuous flow production methods and advanced melt-spinning techniques have demonstrated capacity increases of 200-300% compared to earlier batch processes. Additionally, emerging additive manufacturing approaches offer potential pathways to economically viable large-scale production, though these remain in developmental stages.

Market adoption analysis indicates a gradual transition pathway is most feasible. Initial implementation in high-value, specialty chemical processes where performance advantages outweigh cost considerations provides the most viable entry point. As production scales increase and manufacturing efficiencies improve, broader adoption across more cost-sensitive applications becomes increasingly viable.

Resource requirements and supply chain considerations must also factor into economic assessment. While amorphous metal catalysts often utilize similar base metals as traditional catalysts, they frequently incorporate specific rare earth elements or precious metals in different proportions. Sensitivity to supply chain disruptions and price volatility of these materials presents additional economic risk factors that must be carefully managed through material design optimization and recycling programs.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!