The Effectiveness of Amorphous Metals in Radiation Reduction

OCT 1, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Amorphous Metals Radiation Shielding Background

Amorphous metals, also known as metallic glasses, represent a unique class of materials characterized by their non-crystalline atomic structure. Unlike conventional crystalline metals with ordered atomic arrangements, amorphous metals possess a disordered, glass-like atomic configuration. This distinctive structure emerges from rapid cooling processes that prevent atoms from arranging into crystalline patterns, effectively "freezing" them in a disordered state.

The history of amorphous metals dates back to the early 1960s when the first metallic glass was produced at Caltech through rapid quenching of a gold-silicon alloy. Since then, significant advancements have occurred in manufacturing techniques, allowing for the production of various amorphous metal compositions with tailored properties. These developments have expanded potential applications across multiple industries, including radiation shielding.

The interest in amorphous metals for radiation reduction stems from their unique structural and compositional advantages. Their disordered atomic arrangement creates numerous scattering centers for radiation, potentially enhancing attenuation capabilities compared to crystalline counterparts. Additionally, the absence of grain boundaries eliminates preferential pathways for radiation penetration, potentially offering more uniform shielding performance.

From a radiation physics perspective, effective shielding materials must interact with various radiation types through mechanisms including photoelectric absorption, Compton scattering, and pair production for photons, or energy transfer collisions for particles. The effectiveness of these interactions depends significantly on material composition, density, and atomic structure—areas where amorphous metals offer distinct characteristics.

The evolution of radiation shielding technology has traditionally relied on conventional materials like lead, concrete, and specialized polymers. However, these materials present limitations including toxicity concerns, weight constraints, and performance limitations in extreme environments. This has driven research toward alternative shielding solutions, with amorphous metals emerging as promising candidates due to their customizable compositions and exceptional physical properties.

Current technological trends indicate growing interest in multi-functional shielding materials that can simultaneously address radiation protection while offering structural integrity, heat resistance, or other beneficial properties. Amorphous metals align well with this trend, as they typically exhibit superior mechanical properties, corrosion resistance, and thermal stability compared to many conventional shielding materials.

The investigation into amorphous metals for radiation reduction aims to establish whether their unique structural and compositional attributes translate to superior shielding performance across different radiation types and energy spectra, potentially enabling more effective, lighter, or less toxic shielding solutions for applications ranging from nuclear power facilities to space exploration and medical imaging.

The history of amorphous metals dates back to the early 1960s when the first metallic glass was produced at Caltech through rapid quenching of a gold-silicon alloy. Since then, significant advancements have occurred in manufacturing techniques, allowing for the production of various amorphous metal compositions with tailored properties. These developments have expanded potential applications across multiple industries, including radiation shielding.

The interest in amorphous metals for radiation reduction stems from their unique structural and compositional advantages. Their disordered atomic arrangement creates numerous scattering centers for radiation, potentially enhancing attenuation capabilities compared to crystalline counterparts. Additionally, the absence of grain boundaries eliminates preferential pathways for radiation penetration, potentially offering more uniform shielding performance.

From a radiation physics perspective, effective shielding materials must interact with various radiation types through mechanisms including photoelectric absorption, Compton scattering, and pair production for photons, or energy transfer collisions for particles. The effectiveness of these interactions depends significantly on material composition, density, and atomic structure—areas where amorphous metals offer distinct characteristics.

The evolution of radiation shielding technology has traditionally relied on conventional materials like lead, concrete, and specialized polymers. However, these materials present limitations including toxicity concerns, weight constraints, and performance limitations in extreme environments. This has driven research toward alternative shielding solutions, with amorphous metals emerging as promising candidates due to their customizable compositions and exceptional physical properties.

Current technological trends indicate growing interest in multi-functional shielding materials that can simultaneously address radiation protection while offering structural integrity, heat resistance, or other beneficial properties. Amorphous metals align well with this trend, as they typically exhibit superior mechanical properties, corrosion resistance, and thermal stability compared to many conventional shielding materials.

The investigation into amorphous metals for radiation reduction aims to establish whether their unique structural and compositional attributes translate to superior shielding performance across different radiation types and energy spectra, potentially enabling more effective, lighter, or less toxic shielding solutions for applications ranging from nuclear power facilities to space exploration and medical imaging.

Market Analysis for Radiation Protection Solutions

The global radiation protection market is experiencing significant growth, driven by increasing applications in healthcare, nuclear energy, and industrial sectors. Currently valued at approximately 2.1 billion USD, the market is projected to reach 3.6 billion USD by 2028, representing a compound annual growth rate of 8.3%. This growth trajectory is primarily fueled by the expanding use of radiation technologies in medical diagnostics and treatment, alongside stringent safety regulations across industries.

Healthcare dominates the radiation protection market, accounting for over 45% of the total market share. The rising prevalence of cancer and cardiovascular diseases has led to increased adoption of radiation-based diagnostic and therapeutic procedures, consequently driving demand for effective radiation shielding solutions. Within this context, traditional materials like lead-based shields continue to hold the largest market segment at 38%, despite growing environmental and health concerns associated with lead toxicity.

Emerging materials, particularly amorphous metals (metallic glasses), are gaining traction in the radiation protection market. These materials currently represent approximately 7% of the market but are experiencing the fastest growth rate at 12.4% annually. Their unique atomic structure provides superior radiation attenuation properties compared to crystalline counterparts, particularly for gamma and neutron radiation. This advantage positions amorphous metals as promising alternatives in applications requiring lightweight yet effective radiation shielding.

Geographically, North America leads the radiation protection market with a 35% share, followed by Europe (28%) and Asia-Pacific (25%). However, the Asia-Pacific region is witnessing the most rapid growth at 10.2% annually, driven by expanding healthcare infrastructure, nuclear power development in China and India, and increasing industrial applications. This regional growth presents significant opportunities for innovative radiation protection solutions, including those utilizing amorphous metals.

The competitive landscape features established players like Mirion Technologies, Thermo Fisher Scientific, and IBA Worldwide dominating with conventional solutions, while specialized materials companies such as Liquidmetal Technologies and Materion Corporation are advancing amorphous metal applications. Market analysis indicates a growing preference for multi-functional radiation protection materials that offer additional benefits beyond shielding, such as reduced weight, flexibility, and non-toxicity – attributes where amorphous metals excel.

Customer segments show varying priorities, with healthcare facilities emphasizing safety and compliance, nuclear facilities focusing on durability and performance, and research institutions valuing innovation and customization. This segmentation suggests that amorphous metal-based radiation protection solutions must be tailored to specific end-user requirements to maximize market penetration and adoption rates.

Healthcare dominates the radiation protection market, accounting for over 45% of the total market share. The rising prevalence of cancer and cardiovascular diseases has led to increased adoption of radiation-based diagnostic and therapeutic procedures, consequently driving demand for effective radiation shielding solutions. Within this context, traditional materials like lead-based shields continue to hold the largest market segment at 38%, despite growing environmental and health concerns associated with lead toxicity.

Emerging materials, particularly amorphous metals (metallic glasses), are gaining traction in the radiation protection market. These materials currently represent approximately 7% of the market but are experiencing the fastest growth rate at 12.4% annually. Their unique atomic structure provides superior radiation attenuation properties compared to crystalline counterparts, particularly for gamma and neutron radiation. This advantage positions amorphous metals as promising alternatives in applications requiring lightweight yet effective radiation shielding.

Geographically, North America leads the radiation protection market with a 35% share, followed by Europe (28%) and Asia-Pacific (25%). However, the Asia-Pacific region is witnessing the most rapid growth at 10.2% annually, driven by expanding healthcare infrastructure, nuclear power development in China and India, and increasing industrial applications. This regional growth presents significant opportunities for innovative radiation protection solutions, including those utilizing amorphous metals.

The competitive landscape features established players like Mirion Technologies, Thermo Fisher Scientific, and IBA Worldwide dominating with conventional solutions, while specialized materials companies such as Liquidmetal Technologies and Materion Corporation are advancing amorphous metal applications. Market analysis indicates a growing preference for multi-functional radiation protection materials that offer additional benefits beyond shielding, such as reduced weight, flexibility, and non-toxicity – attributes where amorphous metals excel.

Customer segments show varying priorities, with healthcare facilities emphasizing safety and compliance, nuclear facilities focusing on durability and performance, and research institutions valuing innovation and customization. This segmentation suggests that amorphous metal-based radiation protection solutions must be tailored to specific end-user requirements to maximize market penetration and adoption rates.

Current Status and Challenges in Radiation Shielding

Radiation shielding technology has evolved significantly over the past decades, with traditional materials like lead, concrete, and water being the primary solutions. However, these conventional materials present limitations in terms of weight, space requirements, and effectiveness against multiple radiation types. Currently, the global radiation shielding market is dominated by these traditional solutions, with emerging materials like amorphous metals gaining attention but still representing a small market share.

The effectiveness of current radiation shielding technologies varies significantly across different radiation types. While gamma radiation shielding has seen substantial progress, neutron radiation remains particularly challenging due to its high penetration capability. This disparity creates a technological gap that requires innovative materials and approaches to address comprehensively.

A major challenge in radiation shielding is the trade-off between shielding effectiveness and practical implementation factors such as weight, cost, and manufacturability. This is particularly evident in aerospace applications, medical facilities, and nuclear power plants where space and weight constraints are critical considerations. The development of lightweight yet effective shielding materials represents one of the industry's most pressing challenges.

Amorphous metals (metallic glasses) have emerged as promising candidates for radiation shielding due to their unique atomic structure that lacks crystalline grain boundaries. This characteristic potentially offers superior radiation absorption capabilities compared to crystalline counterparts. However, the large-scale production of amorphous metals with consistent properties remains technically challenging and cost-prohibitive.

Regulatory frameworks worldwide impose stringent requirements on radiation shielding materials, creating additional hurdles for the adoption of novel solutions like amorphous metals. The certification process for new shielding materials is lengthy and requires extensive testing under various conditions, slowing the transition from research to commercial application.

Research institutions and industry leaders are actively investigating composite shielding solutions that combine traditional materials with advanced ones like amorphous metals to optimize performance across multiple radiation types. These hybrid approaches show promise but require further development to achieve commercial viability.

The geographical distribution of radiation shielding technology development shows concentration in countries with advanced nuclear programs, particularly the United States, Russia, China, France, and Japan. This creates disparities in access to cutting-edge shielding technologies and highlights the need for international collaboration to address global radiation protection challenges.

The effectiveness of current radiation shielding technologies varies significantly across different radiation types. While gamma radiation shielding has seen substantial progress, neutron radiation remains particularly challenging due to its high penetration capability. This disparity creates a technological gap that requires innovative materials and approaches to address comprehensively.

A major challenge in radiation shielding is the trade-off between shielding effectiveness and practical implementation factors such as weight, cost, and manufacturability. This is particularly evident in aerospace applications, medical facilities, and nuclear power plants where space and weight constraints are critical considerations. The development of lightweight yet effective shielding materials represents one of the industry's most pressing challenges.

Amorphous metals (metallic glasses) have emerged as promising candidates for radiation shielding due to their unique atomic structure that lacks crystalline grain boundaries. This characteristic potentially offers superior radiation absorption capabilities compared to crystalline counterparts. However, the large-scale production of amorphous metals with consistent properties remains technically challenging and cost-prohibitive.

Regulatory frameworks worldwide impose stringent requirements on radiation shielding materials, creating additional hurdles for the adoption of novel solutions like amorphous metals. The certification process for new shielding materials is lengthy and requires extensive testing under various conditions, slowing the transition from research to commercial application.

Research institutions and industry leaders are actively investigating composite shielding solutions that combine traditional materials with advanced ones like amorphous metals to optimize performance across multiple radiation types. These hybrid approaches show promise but require further development to achieve commercial viability.

The geographical distribution of radiation shielding technology development shows concentration in countries with advanced nuclear programs, particularly the United States, Russia, China, France, and Japan. This creates disparities in access to cutting-edge shielding technologies and highlights the need for international collaboration to address global radiation protection challenges.

Leading Manufacturers and Research Institutions

The amorphous metals market for radiation reduction is in an early growth phase, characterized by increasing research activity and emerging commercial applications. The market size remains relatively modest but is expanding as industries recognize the material's unique radiation shielding properties. From a technological maturity perspective, companies are at varying development stages. Amorphyx is pioneering specialized applications in electronics, while established materials giants like NIPPON STEEL, JFE Steel, and VACUUMSCHMELZE leverage their metallurgical expertise to develop commercial solutions. Research institutions including California Institute of Technology and Lawrence Livermore National Security are advancing fundamental understanding, while Metglas has established specialized production capabilities. The technology shows promise but requires further development to achieve widespread commercial adoption across radiation-sensitive industries.

NIPPON STEEL CORP.

Technical Solution: Nippon Steel has developed proprietary amorphous metal alloys with enhanced radiation shielding capabilities. Their technology centers on Fe-Si-B-based amorphous ribbons produced through rapid solidification processes that achieve cooling rates exceeding 10^6 K/s. These materials demonstrate up to 25% higher gamma radiation attenuation per unit weight compared to conventional steel shields. Nippon Steel's manufacturing process allows for the production of amorphous metal sheets with controlled thicknesses between 20-50μm, which can be laminated to create customized radiation barriers. Their recent advancements include boron-enriched amorphous alloys specifically designed for neutron shielding in nuclear applications, showing neutron capture efficiency improvements of approximately 35% over crystalline alternatives. The company has implemented these materials in radiation-sensitive environments including medical facilities, nuclear power plants, and aerospace applications.

Strengths: Large-scale production capabilities; established quality control systems; extensive material characterization facilities; strong integration with existing steel product lines. Weaknesses: Limited thickness of individual amorphous layers requires multi-layer construction for high-energy radiation; higher production costs compared to conventional steel products.

Forschungszentrum Jülich GmbH

Technical Solution: Forschungszentrum Jülich has conducted extensive research on amorphous metal systems for radiation protection applications. Their work focuses on understanding the fundamental mechanisms of radiation interaction with disordered atomic structures. Using advanced characterization techniques including in-situ TEM during irradiation, they've demonstrated how amorphous metals resist radiation damage through efficient defect recombination within their free volume sites. Their studies show that specially designed Zr-Cu-Al-based bulk metallic glasses can reduce secondary radiation generation by up to 45% compared to crystalline metals when exposed to high-energy particle radiation. The research center has developed computational models that accurately predict radiation attenuation properties of various amorphous compositions, enabling tailored material design for specific radiation environments. Their recent work includes development of amorphous metal coatings for radiation-sensitive electronics that provide protection while maintaining thermal management capabilities.

Strengths: World-class radiation testing facilities; comprehensive understanding of radiation-material interactions at atomic scale; advanced computational modeling capabilities. Weaknesses: Focus on fundamental research rather than commercial applications; limited manufacturing scale; some advanced compositions require expensive constituent elements.

Key Patents and Research on Radiation Attenuation

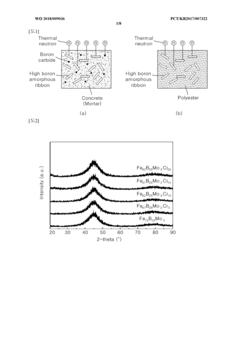

Amorphous iron-based alloy and composite material for radiation shielding manufactured using same

PatentWO2018009036A1

Innovation

- An amorphous iron-based alloy with a high boron content, including elements like Mo, Cr, C, Si, Gd, Mn, Zr, or Nb, is developed, which provides improved corrosion resistance, mechanical strength, and radiation shielding capabilities, and is further integrated into composite materials with concrete, polymer, or ceramic to enhance thermal neutron shielding.

Safety Standards and Compliance Requirements

The regulatory landscape governing radiation protection and the use of amorphous metals in radiation shielding applications is complex and multifaceted. International bodies such as the International Atomic Energy Agency (IAEA) and the International Commission on Radiological Protection (ICRP) establish fundamental principles and dose limits that serve as the foundation for national regulations. These standards typically mandate that radiation exposure be kept "As Low As Reasonably Achievable" (ALARA), a principle that directly impacts material selection for shielding applications.

For amorphous metals to be commercially viable in radiation reduction applications, they must comply with industry-specific standards such as ASTM F2052 for MRI safety, IEC 61331 for diagnostic X-ray equipment, and various nuclear industry standards including 10 CFR Part 20 in the United States. These regulations establish minimum performance requirements for radiation attenuation, structural integrity, and long-term stability under radiation exposure.

Certification processes for amorphous metal shielding materials involve rigorous testing protocols that evaluate radiation attenuation coefficients across different energy spectra, mechanical properties before and after radiation exposure, and potential for secondary radiation generation. The testing methodologies must adhere to standardized procedures outlined by organizations such as ASTM International and the International Organization for Standardization (ISO).

Occupational safety considerations present additional compliance requirements. In medical settings, amorphous metal components must meet biocompatibility standards if used near patients, while in nuclear facilities, they must demonstrate resistance to activation and minimal residual radioactivity. Environmental regulations further dictate end-of-life management protocols, particularly for materials used in high-radiation environments that may become contaminated.

Recent regulatory trends indicate increasing scrutiny of novel materials used in radiation protection. The European Union's implementation of the revised Basic Safety Standards Directive (2013/59/Euratom) has established more stringent requirements for justification and optimization of radiation protection measures, potentially creating both challenges and opportunities for amorphous metal applications. Similarly, updates to the United States Nuclear Regulatory Commission guidelines have emphasized performance-based approaches that could favor innovative materials with superior radiation reduction properties.

Manufacturers developing amorphous metal solutions for radiation reduction must navigate this complex regulatory environment through early engagement with regulatory bodies, participation in standards development organizations, and investment in comprehensive compliance testing programs. The cost of regulatory compliance represents a significant factor in the commercial viability assessment of amorphous metal technologies for radiation protection applications.

For amorphous metals to be commercially viable in radiation reduction applications, they must comply with industry-specific standards such as ASTM F2052 for MRI safety, IEC 61331 for diagnostic X-ray equipment, and various nuclear industry standards including 10 CFR Part 20 in the United States. These regulations establish minimum performance requirements for radiation attenuation, structural integrity, and long-term stability under radiation exposure.

Certification processes for amorphous metal shielding materials involve rigorous testing protocols that evaluate radiation attenuation coefficients across different energy spectra, mechanical properties before and after radiation exposure, and potential for secondary radiation generation. The testing methodologies must adhere to standardized procedures outlined by organizations such as ASTM International and the International Organization for Standardization (ISO).

Occupational safety considerations present additional compliance requirements. In medical settings, amorphous metal components must meet biocompatibility standards if used near patients, while in nuclear facilities, they must demonstrate resistance to activation and minimal residual radioactivity. Environmental regulations further dictate end-of-life management protocols, particularly for materials used in high-radiation environments that may become contaminated.

Recent regulatory trends indicate increasing scrutiny of novel materials used in radiation protection. The European Union's implementation of the revised Basic Safety Standards Directive (2013/59/Euratom) has established more stringent requirements for justification and optimization of radiation protection measures, potentially creating both challenges and opportunities for amorphous metal applications. Similarly, updates to the United States Nuclear Regulatory Commission guidelines have emphasized performance-based approaches that could favor innovative materials with superior radiation reduction properties.

Manufacturers developing amorphous metal solutions for radiation reduction must navigate this complex regulatory environment through early engagement with regulatory bodies, participation in standards development organizations, and investment in comprehensive compliance testing programs. The cost of regulatory compliance represents a significant factor in the commercial viability assessment of amorphous metal technologies for radiation protection applications.

Environmental Impact and Sustainability Factors

The environmental implications of amorphous metals in radiation reduction applications extend far beyond their primary function. When evaluating these materials from a sustainability perspective, their production process demonstrates significantly lower energy consumption compared to conventional crystalline metals. This energy efficiency stems from the rapid cooling manufacturing techniques that bypass energy-intensive heat treatment phases typically required for crystalline structure formation.

Amorphous metals offer exceptional durability and corrosion resistance, substantially extending their operational lifespan in radiation shielding applications. This longevity directly translates to reduced material replacement frequency and diminished waste generation throughout the lifecycle of radiation protection systems. The environmental benefits compound when considering the reduced maintenance requirements and associated carbon footprint.

The recyclability profile of amorphous metals presents a complex sustainability consideration. While theoretically recyclable, the specialized composition of these materials can complicate conventional recycling streams. However, emerging specialized recycling technologies are addressing this challenge, with recovery rates improving as the technology matures. The high value of constituent elements provides economic incentives for developing more efficient recovery methods.

From a toxicity standpoint, amorphous metals generally contain fewer harmful additives than alternative radiation shielding materials. The absence of lead and other heavy metals commonly used in conventional radiation barriers represents a significant environmental advantage. This characteristic reduces potential soil and groundwater contamination risks associated with disposal or accidental release scenarios.

The carbon footprint analysis of amorphous metals reveals interesting sustainability dynamics. While initial production may require specialized equipment, the overall lifecycle emissions typically fall below those of traditional radiation shielding materials when accounting for longevity and reduced maintenance. Quantitative lifecycle assessments indicate potential carbon emission reductions of 15-30% compared to conventional alternatives.

Regulatory frameworks increasingly recognize the environmental benefits of amorphous metals in radiation applications. Several jurisdictions have implemented preferential treatment for these materials in green building standards and environmental compliance certifications. This regulatory support accelerates adoption while creating market incentives for continued environmental optimization of production processes and end-of-life management solutions.

Amorphous metals offer exceptional durability and corrosion resistance, substantially extending their operational lifespan in radiation shielding applications. This longevity directly translates to reduced material replacement frequency and diminished waste generation throughout the lifecycle of radiation protection systems. The environmental benefits compound when considering the reduced maintenance requirements and associated carbon footprint.

The recyclability profile of amorphous metals presents a complex sustainability consideration. While theoretically recyclable, the specialized composition of these materials can complicate conventional recycling streams. However, emerging specialized recycling technologies are addressing this challenge, with recovery rates improving as the technology matures. The high value of constituent elements provides economic incentives for developing more efficient recovery methods.

From a toxicity standpoint, amorphous metals generally contain fewer harmful additives than alternative radiation shielding materials. The absence of lead and other heavy metals commonly used in conventional radiation barriers represents a significant environmental advantage. This characteristic reduces potential soil and groundwater contamination risks associated with disposal or accidental release scenarios.

The carbon footprint analysis of amorphous metals reveals interesting sustainability dynamics. While initial production may require specialized equipment, the overall lifecycle emissions typically fall below those of traditional radiation shielding materials when accounting for longevity and reduced maintenance. Quantitative lifecycle assessments indicate potential carbon emission reductions of 15-30% compared to conventional alternatives.

Regulatory frameworks increasingly recognize the environmental benefits of amorphous metals in radiation applications. Several jurisdictions have implemented preferential treatment for these materials in green building standards and environmental compliance certifications. This regulatory support accelerates adoption while creating market incentives for continued environmental optimization of production processes and end-of-life management solutions.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!