Comparative Study of Amorphous Metals and Conventional Materials

OCT 1, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Amorphous Metals Evolution and Research Objectives

Amorphous metals, also known as metallic glasses, represent a revolutionary class of materials that defy conventional crystalline structures. Since their discovery in 1960 at Caltech, when researchers rapidly cooled Au-Si alloys to prevent crystallization, these materials have evolved through several distinct phases of development. Initially confined to thin ribbons due to critical cooling rate limitations, the field experienced a significant breakthrough in the 1990s with the development of bulk metallic glasses (BMGs), allowing for thicker samples and broader applications.

The evolution of amorphous metals has been characterized by continuous improvements in processing techniques. Early methods relied on rapid quenching approaches such as melt spinning, which limited production to thin films and ribbons. Modern techniques including suction casting, copper mold casting, and spark plasma sintering have enabled the production of larger components with more complex geometries, expanding potential applications across industries.

Compositional development represents another critical evolutionary path. From binary alloys, researchers have progressed to multicomponent systems that demonstrate superior glass-forming ability. The development of empirical rules like the Inoue criteria has provided valuable guidelines for designing new amorphous compositions with enhanced stability and properties. Recent advances in computational materials science have accelerated this process through predictive modeling of glass-forming compositions.

The primary research objectives in this comparative study focus on establishing comprehensive performance benchmarks between amorphous metals and conventional crystalline materials across multiple dimensions. We aim to quantify the advantages and limitations of amorphous metals in terms of mechanical properties, including strength-to-weight ratios, elastic limits, and fatigue resistance. Additionally, we seek to evaluate corrosion resistance, magnetic properties, and thermal stability under various environmental conditions.

Another key objective involves analyzing manufacturing scalability and cost-effectiveness. While amorphous metals offer superior properties in many respects, their widespread adoption has been hindered by processing challenges and higher production costs. This study will assess recent manufacturing innovations that may bridge this gap and identify specific applications where the performance benefits of amorphous metals justify their premium cost.

The final research objective encompasses sustainability considerations, examining the life-cycle environmental impact of amorphous metals compared to conventional materials. This includes analysis of raw material requirements, energy consumption during production, recyclability, and end-of-life disposal implications. Through this comprehensive evaluation, we aim to provide a foundation for informed material selection decisions across diverse industrial applications.

The evolution of amorphous metals has been characterized by continuous improvements in processing techniques. Early methods relied on rapid quenching approaches such as melt spinning, which limited production to thin films and ribbons. Modern techniques including suction casting, copper mold casting, and spark plasma sintering have enabled the production of larger components with more complex geometries, expanding potential applications across industries.

Compositional development represents another critical evolutionary path. From binary alloys, researchers have progressed to multicomponent systems that demonstrate superior glass-forming ability. The development of empirical rules like the Inoue criteria has provided valuable guidelines for designing new amorphous compositions with enhanced stability and properties. Recent advances in computational materials science have accelerated this process through predictive modeling of glass-forming compositions.

The primary research objectives in this comparative study focus on establishing comprehensive performance benchmarks between amorphous metals and conventional crystalline materials across multiple dimensions. We aim to quantify the advantages and limitations of amorphous metals in terms of mechanical properties, including strength-to-weight ratios, elastic limits, and fatigue resistance. Additionally, we seek to evaluate corrosion resistance, magnetic properties, and thermal stability under various environmental conditions.

Another key objective involves analyzing manufacturing scalability and cost-effectiveness. While amorphous metals offer superior properties in many respects, their widespread adoption has been hindered by processing challenges and higher production costs. This study will assess recent manufacturing innovations that may bridge this gap and identify specific applications where the performance benefits of amorphous metals justify their premium cost.

The final research objective encompasses sustainability considerations, examining the life-cycle environmental impact of amorphous metals compared to conventional materials. This includes analysis of raw material requirements, energy consumption during production, recyclability, and end-of-life disposal implications. Through this comprehensive evaluation, we aim to provide a foundation for informed material selection decisions across diverse industrial applications.

Market Applications and Demand Analysis

The global market for amorphous metals, also known as metallic glasses, has been experiencing significant growth driven by their superior mechanical, magnetic, and corrosion-resistant properties compared to conventional crystalline materials. Current market valuations indicate the amorphous metals market reached approximately 1.5 billion USD in 2022, with projections suggesting a compound annual growth rate of 7.8% through 2030, significantly outpacing traditional metallurgical sectors.

The electronics industry represents the largest application segment, accounting for nearly 35% of total demand. Amorphous metal transformers and inductors have gained substantial traction due to their reduced core losses and higher efficiency, directly addressing energy conservation imperatives in modern power systems. Major utility companies across North America and Europe have begun implementing amorphous core transformers, reporting energy savings of 60-70% compared to conventional silicon steel alternatives.

Aerospace and defense sectors have emerged as high-growth application areas, with demand increasing at approximately 9.2% annually. The exceptional strength-to-weight ratio and superior elastic properties of amorphous metals make them ideal for critical components in aircraft structures and defense systems. Several major aerospace manufacturers have initiated research programs to incorporate these materials into next-generation aircraft designs.

Medical device manufacturing represents another rapidly expanding market segment. The biocompatibility and corrosion resistance of certain amorphous metal compositions have enabled breakthrough applications in implantable devices and surgical instruments. The market for amorphous metal-based medical devices is projected to double within the next five years, driven by aging populations and increased healthcare spending globally.

Industrial machinery and automotive sectors demonstrate growing demand for wear-resistant components manufactured from amorphous metals. Their superior hardness and tribological properties extend component lifespans by 3-4 times compared to conventional materials, offering significant lifetime cost advantages despite higher initial investment. Several automotive manufacturers have begun incorporating amorphous metal components in high-stress drivetrain applications.

Regional analysis reveals Asia-Pacific as the dominant market, accounting for approximately 42% of global consumption, followed by North America and Europe. China has emerged as both the largest producer and consumer, with substantial government investment in advanced materials research and manufacturing infrastructure. However, North American and European markets show the highest growth rates in high-value applications requiring precision engineering and specialized compositions.

Consumer electronics represents an emerging application area with substantial growth potential, particularly for amorphous metal casings in premium smartphones and wearable devices, where their exceptional strength and scratch resistance offer compelling advantages over conventional materials.

The electronics industry represents the largest application segment, accounting for nearly 35% of total demand. Amorphous metal transformers and inductors have gained substantial traction due to their reduced core losses and higher efficiency, directly addressing energy conservation imperatives in modern power systems. Major utility companies across North America and Europe have begun implementing amorphous core transformers, reporting energy savings of 60-70% compared to conventional silicon steel alternatives.

Aerospace and defense sectors have emerged as high-growth application areas, with demand increasing at approximately 9.2% annually. The exceptional strength-to-weight ratio and superior elastic properties of amorphous metals make them ideal for critical components in aircraft structures and defense systems. Several major aerospace manufacturers have initiated research programs to incorporate these materials into next-generation aircraft designs.

Medical device manufacturing represents another rapidly expanding market segment. The biocompatibility and corrosion resistance of certain amorphous metal compositions have enabled breakthrough applications in implantable devices and surgical instruments. The market for amorphous metal-based medical devices is projected to double within the next five years, driven by aging populations and increased healthcare spending globally.

Industrial machinery and automotive sectors demonstrate growing demand for wear-resistant components manufactured from amorphous metals. Their superior hardness and tribological properties extend component lifespans by 3-4 times compared to conventional materials, offering significant lifetime cost advantages despite higher initial investment. Several automotive manufacturers have begun incorporating amorphous metal components in high-stress drivetrain applications.

Regional analysis reveals Asia-Pacific as the dominant market, accounting for approximately 42% of global consumption, followed by North America and Europe. China has emerged as both the largest producer and consumer, with substantial government investment in advanced materials research and manufacturing infrastructure. However, North American and European markets show the highest growth rates in high-value applications requiring precision engineering and specialized compositions.

Consumer electronics represents an emerging application area with substantial growth potential, particularly for amorphous metal casings in premium smartphones and wearable devices, where their exceptional strength and scratch resistance offer compelling advantages over conventional materials.

Current Status and Technical Barriers

Amorphous metals, also known as metallic glasses, have garnered significant attention in materials science over the past few decades. Currently, these materials have advanced from laboratory curiosities to commercially viable alternatives in select applications. The global market for amorphous metals reached approximately $1.2 billion in 2022, with projections indicating growth to $2.5 billion by 2028, representing a CAGR of 12.9%.

The production technology for amorphous metals has evolved substantially, with rapid solidification techniques being the predominant manufacturing method. Recent advancements include suction casting, melt spinning, and gas atomization processes that have improved production efficiency. However, a significant technical barrier remains in scaling up production while maintaining the amorphous structure, as critical cooling rates typically exceed 10^3-10^6 K/s for most compositions.

When compared to conventional crystalline materials, amorphous metals demonstrate superior mechanical properties including higher yield strength (typically 1.6-2.2 GPa versus 0.5-1.5 GPa for conventional alloys) and elastic limits (2% versus 0.2%). Their corrosion resistance often surpasses that of stainless steel by an order of magnitude in certain environments. However, their widespread adoption faces challenges due to inherent brittleness and limited plastic deformation capability.

Geographically, research and development in amorphous metals shows distinct patterns. Japan and the United States lead in patent filings (approximately 35% and 28% respectively), followed by China (20%) which has demonstrated the fastest growth rate in the past five years. European contributions center around Germany and France, focusing primarily on specialized applications in aerospace and medical devices.

The size limitation represents another significant technical barrier. While conventional materials can be produced in virtually unlimited dimensions, bulk metallic glasses are typically restricted to critical dimensions below 10-50mm depending on the alloy system. This constraint severely limits their application in large-scale structural components.

Cost factors present additional challenges, with amorphous metals typically commanding a 3-5x price premium over conventional counterparts. This differential stems from complex processing requirements, specialized equipment needs, and lower production volumes. The high purity requirements for raw materials further exacerbate the cost disparity.

Environmental stability poses another technical challenge, as some amorphous compositions exhibit structural relaxation or crystallization at elevated temperatures (typically above 0.7-0.8 of their glass transition temperature), compromising their unique properties. This thermal instability restricts their use in high-temperature applications where conventional crystalline materials often excel.

The production technology for amorphous metals has evolved substantially, with rapid solidification techniques being the predominant manufacturing method. Recent advancements include suction casting, melt spinning, and gas atomization processes that have improved production efficiency. However, a significant technical barrier remains in scaling up production while maintaining the amorphous structure, as critical cooling rates typically exceed 10^3-10^6 K/s for most compositions.

When compared to conventional crystalline materials, amorphous metals demonstrate superior mechanical properties including higher yield strength (typically 1.6-2.2 GPa versus 0.5-1.5 GPa for conventional alloys) and elastic limits (2% versus 0.2%). Their corrosion resistance often surpasses that of stainless steel by an order of magnitude in certain environments. However, their widespread adoption faces challenges due to inherent brittleness and limited plastic deformation capability.

Geographically, research and development in amorphous metals shows distinct patterns. Japan and the United States lead in patent filings (approximately 35% and 28% respectively), followed by China (20%) which has demonstrated the fastest growth rate in the past five years. European contributions center around Germany and France, focusing primarily on specialized applications in aerospace and medical devices.

The size limitation represents another significant technical barrier. While conventional materials can be produced in virtually unlimited dimensions, bulk metallic glasses are typically restricted to critical dimensions below 10-50mm depending on the alloy system. This constraint severely limits their application in large-scale structural components.

Cost factors present additional challenges, with amorphous metals typically commanding a 3-5x price premium over conventional counterparts. This differential stems from complex processing requirements, specialized equipment needs, and lower production volumes. The high purity requirements for raw materials further exacerbate the cost disparity.

Environmental stability poses another technical challenge, as some amorphous compositions exhibit structural relaxation or crystallization at elevated temperatures (typically above 0.7-0.8 of their glass transition temperature), compromising their unique properties. This thermal instability restricts their use in high-temperature applications where conventional crystalline materials often excel.

Conventional vs. Amorphous Metal Solutions

01 Manufacturing processes for amorphous metals

Various manufacturing processes can be employed to produce amorphous metals, including rapid solidification techniques that prevent crystallization. These methods involve quickly cooling molten metal to bypass crystal formation, resulting in a disordered atomic structure. Common techniques include melt spinning, gas atomization, and other specialized cooling processes that maintain the random atomic arrangement characteristic of amorphous metals.- Manufacturing processes for amorphous metals: Various manufacturing processes can be employed to produce amorphous metals, including rapid solidification techniques that prevent crystallization. These methods involve cooling molten metal at extremely high rates to bypass crystal formation, resulting in a disordered atomic structure. Common techniques include melt spinning, splat quenching, and gas atomization. The processing parameters such as cooling rate and composition significantly influence the final properties of the amorphous metal products.

- Composition and alloying elements for amorphous metals: The composition of amorphous metals typically includes specific combinations of elements that enhance glass-forming ability. These alloys often contain transition metals (such as Fe, Ni, Co) combined with metalloids (such as B, Si, P) and sometimes rare earth elements. The precise ratio of these components is critical for achieving the amorphous structure. Multi-component systems with significant atomic size differences between constituent elements tend to have better glass-forming ability and superior mechanical properties.

- Mechanical and physical properties of amorphous metals: Amorphous metals exhibit unique mechanical and physical properties due to their lack of crystalline structure. They typically demonstrate high strength, hardness, and elastic limit compared to their crystalline counterparts. These materials also show excellent corrosion resistance, good magnetic properties, and high electrical resistivity. The absence of grain boundaries contributes to their superior wear resistance and fatigue strength. However, they often exhibit limited ductility at room temperature, which can be addressed through composite formation or controlled partial crystallization.

- Applications of amorphous metals in various industries: Amorphous metals find applications across numerous industries due to their exceptional properties. They are used in transformer cores and magnetic sensors due to their soft magnetic characteristics. Their high strength-to-weight ratio makes them suitable for sporting goods like golf club heads and tennis rackets. In the medical field, they serve as biocompatible implants. Their corrosion resistance is valuable for protective coatings, while their unique properties enable applications in electronic devices, aerospace components, and precision instruments.

- Bulk metallic glasses and nanostructured amorphous alloys: Recent advancements have led to the development of bulk metallic glasses (BMGs) and nanostructured amorphous alloys. These materials can be produced in larger dimensions than traditional amorphous ribbons or powders. BMGs combine the advantages of amorphous structure with practical size requirements for engineering applications. Nanostructured amorphous alloys, which contain nanoscale crystalline phases within an amorphous matrix, offer enhanced ductility while maintaining high strength. These materials represent the cutting edge of amorphous metal research and development.

02 Composition and alloying elements for amorphous metals

The composition of amorphous metals typically includes specific combinations of elements that facilitate glass formation. These may include transition metals combined with metalloids or other elements that inhibit crystallization. The selection of alloying elements significantly affects properties such as glass-forming ability, thermal stability, mechanical strength, and corrosion resistance. Careful control of composition is essential for achieving desired amorphous structures.Expand Specific Solutions03 Properties and applications of amorphous metals

Amorphous metals exhibit unique properties including high strength, excellent elasticity, superior corrosion resistance, and distinctive magnetic characteristics. These materials find applications in various fields such as electronic devices, medical implants, sporting equipment, and industrial machinery. Their combination of properties makes them particularly valuable in applications requiring high wear resistance, magnetic efficiency, or biocompatibility.Expand Specific Solutions04 Thermal stability and crystallization behavior

Amorphous metals exist in a metastable state and can crystallize when exposed to sufficient thermal energy. Understanding and controlling the crystallization behavior is crucial for both processing and application. Research focuses on enhancing thermal stability through composition adjustments and processing techniques. The glass transition temperature and crystallization kinetics are important parameters that determine the operational temperature range and long-term stability of amorphous metal products.Expand Specific Solutions05 Bulk amorphous metal formation and processing

Developing bulk amorphous metals (also known as bulk metallic glasses) presents unique challenges compared to thin amorphous ribbons or powders. Specialized techniques have been developed to create larger amorphous metal components while maintaining their non-crystalline structure. These include suction casting, injection molding, and other methods that allow for the production of three-dimensional amorphous metal parts with practical dimensions for structural applications.Expand Specific Solutions

Leading Manufacturers and Research Institutions

The amorphous metals market is in a growth phase, characterized by increasing applications across automotive, electronics, and industrial sectors. The global market size is estimated to reach $1.5 billion by 2025, with a CAGR of approximately 8%. Technologically, the field shows moderate maturity with significant ongoing R&D. Leading players include academic institutions like California Institute of Technology and Zhejiang University conducting fundamental research, while companies such as VACUUMSCHMELZE, Amorphyx, and Hitachi are commercializing applications. National Institute for Materials Science and Lawrence Livermore National Security provide critical research infrastructure. Industrial giants including 3M, Qualcomm, and Samsung are integrating amorphous metals into consumer products, while specialized manufacturers like Proterial and LG Chem are developing advanced material formulations for specific applications.

VACUUMSCHMELZE GmbH & Co. KG

Technical Solution: VACUUMSCHMELZE has pioneered advanced manufacturing techniques for amorphous and nanocrystalline soft magnetic materials, particularly their VITROPERM® and VITROVAC® product lines. Their technology involves rapid solidification processes where molten alloys are cooled at rates exceeding 1 million °C/second to prevent crystallization. This creates ribbon materials with thicknesses typically between 15-35 μm that exhibit exceptional magnetic properties. Their proprietary compositions, often based on Fe-Si-B systems with additions of Cu, Nb, and other elements, are optimized for specific applications. VACUUMSCHMELZE has developed specialized annealing treatments under magnetic fields to induce controlled nanocrystallization in initially amorphous precursors, creating materials with permeabilities exceeding 100,000 and core losses significantly lower than conventional silicon steel. Their manufacturing process includes precision winding techniques for creating toroidal cores with minimal air gaps, critical for maintaining high performance in power electronics applications.

Strengths: Exceptional magnetic properties including high permeability, low coercivity, and minimal core losses; excellent frequency response up to the MHz range; and superior temperature stability compared to ferrites. Weaknesses: Higher material costs compared to conventional silicon steel; limited mechanical strength requiring careful handling during assembly; and size/shape constraints due to the ribbon-based manufacturing process.

Amorphyx, Incorporated

Technical Solution: Amorphyx has developed proprietary amorphous metal thin-film transistors (AMTFTs) that leverage the unique properties of amorphous metals for display applications. Their technology utilizes amorphous metals as both the channel and electrode materials in thin-film transistors, creating devices with superior electrical stability and performance compared to conventional amorphous silicon or oxide semiconductor TFTs. The company's approach involves specialized deposition techniques that maintain the amorphous structure while achieving precise thickness control, typically in the 10-100nm range. These AMTFTs demonstrate excellent uniformity across large areas, making them particularly suitable for next-generation display technologies. Amorphyx's process also incorporates proprietary annealing methods that optimize the electronic properties of the amorphous metal films without inducing crystallization, preserving the advantageous characteristics of the amorphous state.

Strengths: Superior electrical stability compared to conventional TFTs, excellent uniformity across large areas, and compatibility with existing manufacturing infrastructure. The amorphous structure provides enhanced resistance to electromigration and mechanical stress. Weaknesses: May require specialized deposition equipment, potentially higher initial manufacturing costs, and limited track record in mass production environments compared to established technologies.

Key Patents and Scientific Breakthroughs

Hypoeutectic amorphous metal-based materials for additive manufacturing

PatentWO2018218077A1

Innovation

- The development of hypoeutectic amorphous metal alloys with higher main metal content and lower glass forming ability, combined with fast cooling rates in additive manufacturing processes, to produce bulk amorphous metal parts with enhanced toughness and fragility, allowing for the creation of parts with notch toughness greater than 60 MPa m1/2 through processes like powder bed fusion and directed energy deposition.

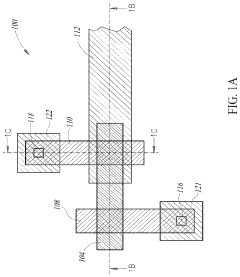

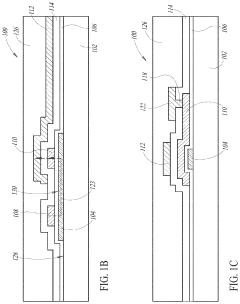

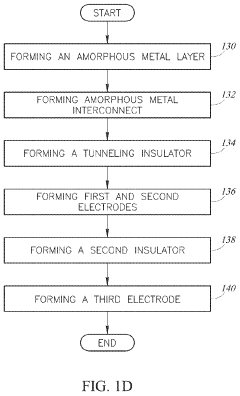

Amorphous metal hot electron transistor

PatentActiveUS20200259008A1

Innovation

- A co-planar amorphous hot electron transistor design with emitter and base electrodes in the same upper layer, separated by a gap, allowing for two-way Fowler-Nordheim tunneling and independent control of hot electron generation and collection, which is extended to a three-terminal device with adjustable I-V performance characteristics without modifying the tunneling dielectric.

Manufacturing Process Comparison

The manufacturing processes for amorphous metals differ significantly from those used for conventional crystalline materials, primarily due to the need for rapid cooling to prevent crystallization. Conventional metals are typically produced through casting, forging, or rolling processes that allow for controlled cooling and crystallization. In contrast, amorphous metals require cooling rates of approximately 10^6 K/s to maintain their non-crystalline structure, necessitating specialized production techniques.

Rapid solidification processing (RSP) represents the cornerstone of amorphous metal manufacturing. Melt spinning, the most widely employed RSP technique, involves ejecting molten metal onto a rapidly rotating copper wheel, producing thin ribbons typically 20-50 μm thick. This process achieves the critical cooling rates necessary for amorphization but limits product geometry to thin sections. Conventional materials face no such geometric constraints, allowing for diverse product forms through traditional manufacturing routes.

Powder metallurgy approaches have emerged as alternatives for producing bulk amorphous metals. Gas atomization creates amorphous powder particles that can be consolidated through hot isostatic pressing or spark plasma sintering. These techniques enable larger amorphous components but introduce complexity and cost compared to conventional powder metallurgy processes, which typically operate at higher temperatures with less stringent cooling requirements.

Recent advancements in additive manufacturing have created new possibilities for both material classes. For amorphous metals, selective laser melting can maintain the required cooling rates within localized melt pools, enabling complex geometries previously unattainable. Conventional materials also benefit from additive processes but with less restrictive processing parameters regarding cooling rates and thermal management.

The economic implications of these manufacturing differences are substantial. Conventional material processing typically involves lower energy costs, simpler equipment, and higher production volumes. Amorphous metal production remains more energy-intensive and technically demanding, resulting in higher unit costs. However, the performance advantages of amorphous metals in specific applications can offset these manufacturing disadvantages through extended service life and improved system efficiency.

Environmental considerations also differentiate these manufacturing approaches. Amorphous metal production often requires less material due to superior properties, potentially reducing resource consumption. However, the higher energy requirements for rapid cooling present environmental challenges. Conventional material processing, while more established and often less energy-intensive per unit, may require additional post-processing steps and material usage to achieve comparable performance.

Rapid solidification processing (RSP) represents the cornerstone of amorphous metal manufacturing. Melt spinning, the most widely employed RSP technique, involves ejecting molten metal onto a rapidly rotating copper wheel, producing thin ribbons typically 20-50 μm thick. This process achieves the critical cooling rates necessary for amorphization but limits product geometry to thin sections. Conventional materials face no such geometric constraints, allowing for diverse product forms through traditional manufacturing routes.

Powder metallurgy approaches have emerged as alternatives for producing bulk amorphous metals. Gas atomization creates amorphous powder particles that can be consolidated through hot isostatic pressing or spark plasma sintering. These techniques enable larger amorphous components but introduce complexity and cost compared to conventional powder metallurgy processes, which typically operate at higher temperatures with less stringent cooling requirements.

Recent advancements in additive manufacturing have created new possibilities for both material classes. For amorphous metals, selective laser melting can maintain the required cooling rates within localized melt pools, enabling complex geometries previously unattainable. Conventional materials also benefit from additive processes but with less restrictive processing parameters regarding cooling rates and thermal management.

The economic implications of these manufacturing differences are substantial. Conventional material processing typically involves lower energy costs, simpler equipment, and higher production volumes. Amorphous metal production remains more energy-intensive and technically demanding, resulting in higher unit costs. However, the performance advantages of amorphous metals in specific applications can offset these manufacturing disadvantages through extended service life and improved system efficiency.

Environmental considerations also differentiate these manufacturing approaches. Amorphous metal production often requires less material due to superior properties, potentially reducing resource consumption. However, the higher energy requirements for rapid cooling present environmental challenges. Conventional material processing, while more established and often less energy-intensive per unit, may require additional post-processing steps and material usage to achieve comparable performance.

Sustainability and Environmental Impact

The environmental impact of materials production and usage has become a critical consideration in modern engineering and manufacturing. Amorphous metals, also known as metallic glasses, demonstrate significant sustainability advantages over conventional crystalline materials across multiple environmental dimensions.

From a production energy perspective, amorphous metals typically require less energy-intensive processing. While conventional metals often undergo multiple heating, forming, and finishing steps, amorphous metals can be produced through rapid solidification techniques that bypass several energy-consuming processes. Research indicates that the net energy consumption for producing certain amorphous metal components can be 30-40% lower than their conventional counterparts, particularly when considering the entire lifecycle.

Material efficiency represents another substantial environmental benefit. Amorphous metals exhibit superior wear resistance and corrosion resistance, extending product lifespans significantly. This durability translates directly to reduced replacement frequency and consequently lower material consumption over time. Studies examining industrial applications have documented service life extensions of 2-3 times compared to conventional materials in corrosive or high-wear environments.

The recyclability profile of amorphous metals presents both opportunities and challenges. Their homogeneous structure theoretically makes them ideal candidates for recycling without property degradation. However, the specialized composition of many amorphous alloys can complicate integration into existing recycling streams. Recent developments in sorting technologies and dedicated recycling pathways are gradually addressing this limitation.

Carbon footprint analyses reveal that amorphous metals can contribute to emissions reduction through multiple pathways. Their superior magnetic properties enable more efficient electrical transformers and motors, reducing operational energy consumption. When implemented in transportation applications, their strength-to-weight advantages translate to fuel efficiency improvements. Life cycle assessments indicate potential carbon emission reductions of 15-25% compared to conventional materials in specific applications.

Toxicity considerations also favor amorphous metals in many cases. Their production typically involves fewer hazardous chemicals and generates less toxic waste than conventional metallurgical processes. Additionally, their exceptional corrosion resistance minimizes leaching of potentially harmful elements during use and disposal phases.

Looking forward, the sustainability profile of amorphous metals continues to improve as production scales increase and specialized recycling infrastructure develops. Their potential to enable more efficient energy systems, lighter transportation, and longer-lasting industrial components positions them as valuable contributors to broader environmental sustainability goals.

From a production energy perspective, amorphous metals typically require less energy-intensive processing. While conventional metals often undergo multiple heating, forming, and finishing steps, amorphous metals can be produced through rapid solidification techniques that bypass several energy-consuming processes. Research indicates that the net energy consumption for producing certain amorphous metal components can be 30-40% lower than their conventional counterparts, particularly when considering the entire lifecycle.

Material efficiency represents another substantial environmental benefit. Amorphous metals exhibit superior wear resistance and corrosion resistance, extending product lifespans significantly. This durability translates directly to reduced replacement frequency and consequently lower material consumption over time. Studies examining industrial applications have documented service life extensions of 2-3 times compared to conventional materials in corrosive or high-wear environments.

The recyclability profile of amorphous metals presents both opportunities and challenges. Their homogeneous structure theoretically makes them ideal candidates for recycling without property degradation. However, the specialized composition of many amorphous alloys can complicate integration into existing recycling streams. Recent developments in sorting technologies and dedicated recycling pathways are gradually addressing this limitation.

Carbon footprint analyses reveal that amorphous metals can contribute to emissions reduction through multiple pathways. Their superior magnetic properties enable more efficient electrical transformers and motors, reducing operational energy consumption. When implemented in transportation applications, their strength-to-weight advantages translate to fuel efficiency improvements. Life cycle assessments indicate potential carbon emission reductions of 15-25% compared to conventional materials in specific applications.

Toxicity considerations also favor amorphous metals in many cases. Their production typically involves fewer hazardous chemicals and generates less toxic waste than conventional metallurgical processes. Additionally, their exceptional corrosion resistance minimizes leaching of potentially harmful elements during use and disposal phases.

Looking forward, the sustainability profile of amorphous metals continues to improve as production scales increase and specialized recycling infrastructure develops. Their potential to enable more efficient energy systems, lighter transportation, and longer-lasting industrial components positions them as valuable contributors to broader environmental sustainability goals.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!