Regulatory Implications for the Use of Amorphous Metals in Defense

OCT 1, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Amorphous Metals in Defense: Background and Objectives

Amorphous metals, also known as metallic glasses, represent a revolutionary class of materials that have emerged as potential game-changers in defense applications. Unlike conventional crystalline metals with ordered atomic structures, amorphous metals possess a non-crystalline, disordered atomic arrangement that confers unique mechanical, magnetic, and chemical properties. The development of these materials dates back to the 1960s when the first amorphous metal alloys were produced through rapid cooling techniques, preventing the formation of crystalline structures.

Over the past six decades, significant advancements in processing technologies have expanded the range of achievable amorphous compositions and bulk production capabilities. The evolution trajectory has progressed from thin ribbons and wires to bulk metallic glasses (BMGs) with critical dimensions exceeding several centimeters, marking a transformative shift in potential applications.

The defense sector has shown increasing interest in amorphous metals due to their exceptional combination of properties: ultra-high strength (often 2-3 times stronger than conventional steel alloys), enhanced elasticity, superior wear resistance, excellent corrosion resistance, and unique magnetic characteristics. These properties align perfectly with the demanding requirements of modern defense systems that face increasingly sophisticated threats and operational environments.

Current technological objectives for amorphous metals in defense applications focus on overcoming several key limitations. Primary among these is addressing the inherent brittleness that can limit their structural applications. Research aims to develop composite structures or processing techniques that enhance toughness while maintaining the desirable properties of amorphous metals. Additionally, scaling production to meet defense manufacturing requirements remains a significant challenge requiring innovative processing approaches.

The regulatory landscape surrounding amorphous metals in defense applications is complex and evolving. As these materials transition from laboratory curiosities to deployable technologies, regulatory frameworks must adapt to address their unique characteristics. Current objectives include establishing standardized testing protocols specific to amorphous metals, developing certification pathways for critical defense components, and ensuring compliance with international arms control agreements when these materials are incorporated into weapons systems.

Looking forward, the technological trajectory for amorphous metals in defense applications is expected to focus on multi-functional capabilities—materials that simultaneously provide structural support, ballistic protection, sensing capabilities, and adaptive responses to environmental conditions. This evolution aligns with broader defense trends toward integrated systems that maximize performance while minimizing weight, volume, and power requirements.

Over the past six decades, significant advancements in processing technologies have expanded the range of achievable amorphous compositions and bulk production capabilities. The evolution trajectory has progressed from thin ribbons and wires to bulk metallic glasses (BMGs) with critical dimensions exceeding several centimeters, marking a transformative shift in potential applications.

The defense sector has shown increasing interest in amorphous metals due to their exceptional combination of properties: ultra-high strength (often 2-3 times stronger than conventional steel alloys), enhanced elasticity, superior wear resistance, excellent corrosion resistance, and unique magnetic characteristics. These properties align perfectly with the demanding requirements of modern defense systems that face increasingly sophisticated threats and operational environments.

Current technological objectives for amorphous metals in defense applications focus on overcoming several key limitations. Primary among these is addressing the inherent brittleness that can limit their structural applications. Research aims to develop composite structures or processing techniques that enhance toughness while maintaining the desirable properties of amorphous metals. Additionally, scaling production to meet defense manufacturing requirements remains a significant challenge requiring innovative processing approaches.

The regulatory landscape surrounding amorphous metals in defense applications is complex and evolving. As these materials transition from laboratory curiosities to deployable technologies, regulatory frameworks must adapt to address their unique characteristics. Current objectives include establishing standardized testing protocols specific to amorphous metals, developing certification pathways for critical defense components, and ensuring compliance with international arms control agreements when these materials are incorporated into weapons systems.

Looking forward, the technological trajectory for amorphous metals in defense applications is expected to focus on multi-functional capabilities—materials that simultaneously provide structural support, ballistic protection, sensing capabilities, and adaptive responses to environmental conditions. This evolution aligns with broader defense trends toward integrated systems that maximize performance while minimizing weight, volume, and power requirements.

Defense Market Demand Analysis for Amorphous Metals

The defense sector represents a significant and growing market for amorphous metals, driven by their exceptional mechanical properties and strategic advantages. Current market analysis indicates that the global defense industry's demand for advanced materials is expanding at a compound annual growth rate of approximately 5.7%, with amorphous metals capturing an increasing share of this growth. This demand is primarily fueled by the need for lighter, stronger, and more durable components in military equipment and weapons systems.

The United States Department of Defense has allocated substantial funding for research and development of advanced materials, with amorphous metals receiving particular attention for applications in armor systems, projectiles, and structural components. The European Defence Agency has similarly prioritized the development and integration of novel metallic materials, including amorphous alloys, in their strategic planning documents.

Market segmentation reveals that naval applications currently constitute the largest defense market segment for amorphous metals, particularly in corrosion-resistant components for submarines and surface vessels. Aerospace applications follow closely, with amorphous metal components being evaluated for use in aircraft engines, landing gear, and structural elements where weight reduction is critical.

The ballistic protection segment shows the most rapid growth potential, with amorphous metal-based armor systems demonstrating superior performance against kinetic energy penetrators compared to conventional armor materials. Testing data from military research laboratories indicates that certain amorphous metal compositions can provide equivalent protection at 15-20% less weight than traditional armor steel.

Defense contractors are increasingly incorporating amorphous metals into their product development roadmaps, with major players like Lockheed Martin, BAE Systems, and Raytheon investing in manufacturing capabilities for these materials. This trend is expected to accelerate as regulatory frameworks evolve to accommodate these novel materials.

Market forecasts suggest that the defense sector demand for amorphous metals could reach 12,000 metric tons annually by 2030, representing a significant opportunity for materials manufacturers and processing companies. However, this growth is contingent upon addressing current production scalability challenges and establishing clear regulatory pathways for certification and approval.

Regional analysis shows North America leading in defense applications of amorphous metals, followed by Europe and Asia-Pacific. Emerging economies with growing defense budgets, particularly India and Brazil, represent expanding markets as they modernize their military capabilities with advanced materials technology.

The United States Department of Defense has allocated substantial funding for research and development of advanced materials, with amorphous metals receiving particular attention for applications in armor systems, projectiles, and structural components. The European Defence Agency has similarly prioritized the development and integration of novel metallic materials, including amorphous alloys, in their strategic planning documents.

Market segmentation reveals that naval applications currently constitute the largest defense market segment for amorphous metals, particularly in corrosion-resistant components for submarines and surface vessels. Aerospace applications follow closely, with amorphous metal components being evaluated for use in aircraft engines, landing gear, and structural elements where weight reduction is critical.

The ballistic protection segment shows the most rapid growth potential, with amorphous metal-based armor systems demonstrating superior performance against kinetic energy penetrators compared to conventional armor materials. Testing data from military research laboratories indicates that certain amorphous metal compositions can provide equivalent protection at 15-20% less weight than traditional armor steel.

Defense contractors are increasingly incorporating amorphous metals into their product development roadmaps, with major players like Lockheed Martin, BAE Systems, and Raytheon investing in manufacturing capabilities for these materials. This trend is expected to accelerate as regulatory frameworks evolve to accommodate these novel materials.

Market forecasts suggest that the defense sector demand for amorphous metals could reach 12,000 metric tons annually by 2030, representing a significant opportunity for materials manufacturers and processing companies. However, this growth is contingent upon addressing current production scalability challenges and establishing clear regulatory pathways for certification and approval.

Regional analysis shows North America leading in defense applications of amorphous metals, followed by Europe and Asia-Pacific. Emerging economies with growing defense budgets, particularly India and Brazil, represent expanding markets as they modernize their military capabilities with advanced materials technology.

Current State and Challenges in Amorphous Metals Technology

Amorphous metals, also known as metallic glasses, represent a significant frontier in materials science with promising applications in defense technologies. Currently, the global development of amorphous metals technology demonstrates considerable regional variation. The United States, Japan, and several European nations lead in research and commercial applications, while China has been rapidly accelerating its capabilities in recent years. This geographical distribution of expertise creates both collaborative opportunities and competitive challenges in the defense sector.

The current technological landscape for amorphous metals is characterized by significant advancements in manufacturing processes, particularly in rapid solidification techniques and powder metallurgy. These improvements have enabled the production of amorphous metals with enhanced mechanical properties, corrosion resistance, and magnetic characteristics. However, production remains limited in scale, with most manufacturing capabilities restricted to specialized facilities that can achieve the necessary cooling rates exceeding 10^6 K/s.

Despite progress, several critical challenges persist in amorphous metals technology. Size limitations represent a primary constraint, as the production of bulk metallic glasses with dimensions exceeding several centimeters remains difficult due to critical cooling rate requirements. This limitation significantly impacts potential defense applications requiring larger structural components.

Cost factors present another substantial barrier to widespread adoption. Current production methods for amorphous metals are considerably more expensive than conventional metal processing, making large-scale implementation economically prohibitive for many defense applications. The specialized equipment and precise processing conditions required contribute significantly to these elevated costs.

Technical challenges in joining and machining amorphous metals further complicate their integration into defense systems. Traditional welding techniques often induce crystallization, compromising the unique properties that make these materials valuable. Additionally, the extreme hardness of many amorphous alloys creates difficulties in conventional machining processes.

Standardization represents another significant hurdle. The absence of universally accepted testing protocols and material specifications complicates quality assurance and regulatory compliance for defense applications. This lack of standardization creates uncertainty in performance prediction and reliability assessment, particularly problematic in defense contexts where material failure could have catastrophic consequences.

The regulatory framework surrounding amorphous metals in defense applications remains underdeveloped, with inconsistent approaches across different countries. This regulatory uncertainty creates additional barriers to technology transfer and international collaboration, potentially slowing innovation and implementation in critical defense technologies.

The current technological landscape for amorphous metals is characterized by significant advancements in manufacturing processes, particularly in rapid solidification techniques and powder metallurgy. These improvements have enabled the production of amorphous metals with enhanced mechanical properties, corrosion resistance, and magnetic characteristics. However, production remains limited in scale, with most manufacturing capabilities restricted to specialized facilities that can achieve the necessary cooling rates exceeding 10^6 K/s.

Despite progress, several critical challenges persist in amorphous metals technology. Size limitations represent a primary constraint, as the production of bulk metallic glasses with dimensions exceeding several centimeters remains difficult due to critical cooling rate requirements. This limitation significantly impacts potential defense applications requiring larger structural components.

Cost factors present another substantial barrier to widespread adoption. Current production methods for amorphous metals are considerably more expensive than conventional metal processing, making large-scale implementation economically prohibitive for many defense applications. The specialized equipment and precise processing conditions required contribute significantly to these elevated costs.

Technical challenges in joining and machining amorphous metals further complicate their integration into defense systems. Traditional welding techniques often induce crystallization, compromising the unique properties that make these materials valuable. Additionally, the extreme hardness of many amorphous alloys creates difficulties in conventional machining processes.

Standardization represents another significant hurdle. The absence of universally accepted testing protocols and material specifications complicates quality assurance and regulatory compliance for defense applications. This lack of standardization creates uncertainty in performance prediction and reliability assessment, particularly problematic in defense contexts where material failure could have catastrophic consequences.

The regulatory framework surrounding amorphous metals in defense applications remains underdeveloped, with inconsistent approaches across different countries. This regulatory uncertainty creates additional barriers to technology transfer and international collaboration, potentially slowing innovation and implementation in critical defense technologies.

Current Regulatory Frameworks for Defense Materials

01 Manufacturing processes for amorphous metals

Various manufacturing processes can be employed to produce amorphous metals, including rapid solidification techniques that prevent crystallization. These methods involve cooling molten metal at extremely high rates to bypass crystal formation, resulting in a disordered atomic structure. Common techniques include melt spinning, splat quenching, and gas atomization. The processing parameters must be carefully controlled to achieve the desired amorphous structure and properties.- Manufacturing methods for amorphous metals: Various techniques are employed to produce amorphous metals, including rapid solidification processes that prevent crystallization. These methods involve cooling molten metal at extremely high rates to bypass crystal formation, resulting in a disordered atomic structure. Common manufacturing approaches include melt spinning, gas atomization, and mechanical alloying, which enable the production of amorphous metals with unique properties not achievable in conventional crystalline metals.

- Composition and alloying elements in amorphous metals: The composition of amorphous metals significantly influences their properties and glass-forming ability. These alloys typically contain multiple elements with different atomic sizes to create atomic mismatch that inhibits crystallization. Common base elements include iron, zirconium, titanium, and palladium, while additions of elements like boron, silicon, phosphorus, and rare earth metals enhance glass-forming ability and stability. The specific combination and proportion of elements determine the thermal stability, mechanical properties, and magnetic characteristics of the resulting amorphous metal.

- Mechanical and physical properties of amorphous metals: Amorphous metals exhibit exceptional mechanical and physical properties due to their lack of crystalline structure. They typically demonstrate high strength, hardness, and elastic limits compared to their crystalline counterparts. The absence of grain boundaries contributes to superior corrosion resistance and wear resistance. Additionally, many amorphous metals display unique magnetic properties, including low coercivity and high permeability, making them valuable for electromagnetic applications. Their combination of strength, elasticity, and resistance to permanent deformation enables applications requiring high resilience and durability.

- Applications of amorphous metals in various industries: Amorphous metals find applications across diverse industries due to their unique properties. In electronics, they serve as transformer cores and magnetic shields due to their soft magnetic characteristics. Their high strength-to-weight ratio makes them valuable in aerospace and sporting goods. The biocompatibility of certain amorphous alloys enables medical applications like surgical instruments and implants. Their corrosion resistance is utilized in chemical processing equipment, while their ability to store hydrogen makes them potential candidates for energy storage. Additionally, their aesthetic appeal and scratch resistance have led to applications in luxury consumer goods and jewelry.

- Thermal stability and crystallization behavior: The thermal stability of amorphous metals is crucial for their practical applications, as they exist in a metastable state and tend to crystallize when heated. The temperature range between glass transition and crystallization defines their stability and processability window. Various techniques are employed to enhance thermal stability, including careful composition design and minor element additions. Understanding crystallization kinetics is essential for processing amorphous metals at elevated temperatures without losing their amorphous structure. The controlled crystallization can also be utilized to develop partially crystallized materials with optimized properties for specific applications.

02 Composition and alloying elements for amorphous metals

The composition of amorphous metals significantly influences their glass-forming ability and resulting properties. Specific alloying elements can enhance the stability of the amorphous structure by creating atomic size mismatches that inhibit crystallization. Common amorphous metal systems include iron-based, zirconium-based, and palladium-based alloys. These compositions are carefully designed to achieve optimal combinations of strength, corrosion resistance, magnetic properties, and thermal stability.Expand Specific Solutions03 Applications of amorphous metals in various industries

Amorphous metals find applications across numerous industries due to their unique combination of properties. They are used in transformer cores and magnetic sensors due to their soft magnetic properties with low core losses. Their high strength and corrosion resistance make them suitable for structural components, sporting goods, and medical implants. Additionally, their biocompatibility enables applications in healthcare, while their unique mechanical properties are valuable in precision instruments and electronic devices.Expand Specific Solutions04 Mechanical and physical properties of amorphous metals

Amorphous metals exhibit exceptional mechanical and physical properties compared to their crystalline counterparts. They typically demonstrate high strength, hardness, and elastic limit due to the absence of crystalline defects like dislocations. Their lack of grain boundaries contributes to superior corrosion resistance. These materials also possess unique magnetic properties, including low coercivity and high permeability, making them excellent soft magnetic materials. However, they often show limited ductility at room temperature, which can be addressed through composite structures or controlled partial crystallization.Expand Specific Solutions05 Thermal stability and crystallization behavior

The thermal stability of amorphous metals is a critical characteristic that determines their practical applications. When heated, these materials eventually crystallize at their crystallization temperature, transforming from amorphous to crystalline structures. This process can be controlled to create partially crystallized materials with enhanced properties. Understanding and controlling crystallization kinetics is essential for processing amorphous metals and developing materials with optimized performance characteristics. Various techniques can be employed to enhance thermal stability, including specific alloying additions and processing methods.Expand Specific Solutions

Key Industry Players in Defense-Grade Amorphous Metals

The regulatory landscape for amorphous metals in defense applications is evolving within a competitive market characterized by early growth phase and increasing technological maturity. The global market for military-grade amorphous metals is expanding as defense agencies recognize their superior mechanical and magnetic properties. Companies like VACUUMSCHMELZE, Lawrence Livermore National Security, and Amorphyx are leading technological innovation, while established defense contractors such as the United States Army and National Technology & Engineering Solutions of Sandia are driving adoption. Academic institutions including Zhejiang University and Oklahoma State University are contributing significant research. The regulatory framework remains complex, balancing national security concerns with the need to advance material science capabilities, particularly regarding export controls and defense procurement standards.

VACUUMSCHMELZE GmbH & Co. KG

Technical Solution: VACUUMSCHMELZE has developed proprietary amorphous metal alloys specifically engineered to meet defense regulatory requirements while delivering exceptional magnetic and mechanical properties. Their VITROPERM® and VITROVAC® series of amorphous and nanocrystalline materials are manufactured using a specialized rapid solidification process that ensures consistent material properties critical for defense applications. The company has implemented comprehensive quality control systems that align with defense procurement standards, including specialized testing for electromagnetic interference shielding capabilities. Their amorphous metal components have been successfully integrated into radar systems, electronic warfare equipment, and sensor technologies where their unique magnetic properties provide significant performance advantages. VACUUMSCHMELZE has worked closely with European defense regulatory bodies to ensure their manufacturing processes comply with REACH regulations and other environmental directives, particularly regarding the use of rare earth elements and potential environmental impacts during disposal.

Strengths: Established manufacturing infrastructure capable of producing defense-grade materials at scale; extensive experience with European defense procurement regulations; proven track record of delivering qualified materials for sensitive applications. Weaknesses: Higher production costs compared to conventional materials; challenges in scaling certain specialized alloy compositions; potential supply chain vulnerabilities for certain raw materials.

Lawrence Livermore National Security LLC

Technical Solution: Lawrence Livermore National Security (LLNS) has developed advanced amorphous metal alloys specifically designed for defense applications with enhanced radiation resistance and structural integrity. Their proprietary manufacturing process creates bulk metallic glasses (BMGs) with superior mechanical properties compared to crystalline counterparts. LLNS's technology focuses on high-strength amorphous metal components for weapons systems that maintain structural integrity under extreme conditions. Their research has demonstrated that these materials can absorb significant impact energy without brittle failure, making them ideal for armor applications. LLNS has also addressed regulatory concerns by developing comprehensive testing protocols that verify compliance with military specifications and environmental regulations, particularly regarding the leaching of constituent elements under various operational conditions.

Strengths: Superior strength-to-weight ratio compared to conventional metals; exceptional corrosion resistance in harsh environments; ability to be precision-cast into complex shapes without secondary machining. Weaknesses: Higher production costs than conventional metals; limited size of components due to critical cooling rate requirements; regulatory uncertainty regarding long-term environmental impacts.

Critical Patents and Technical Literature Review

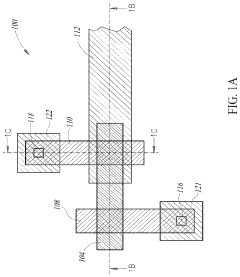

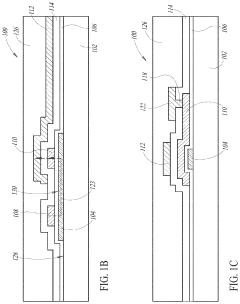

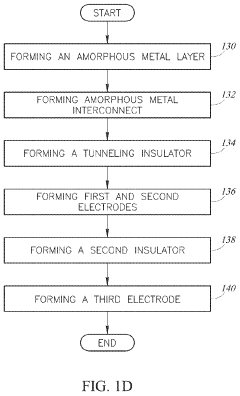

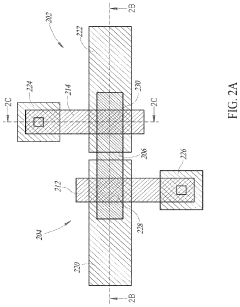

Amorphous metal hot electron transistor

PatentActiveUS20200259008A1

Innovation

- A co-planar amorphous hot electron transistor design with emitter and base electrodes in the same upper layer, separated by a gap, allowing for two-way Fowler-Nordheim tunneling and independent control of hot electron generation and collection, which is extended to a three-terminal device with adjustable I-V performance characteristics without modifying the tunneling dielectric.

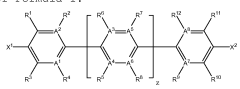

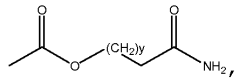

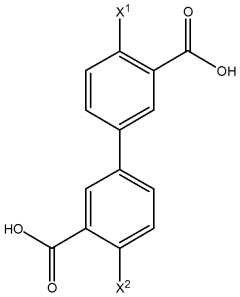

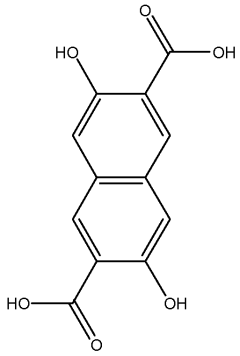

Metal-organic frameworks with exceptionally large PORE aperatures

PatentWO2013112212A2

Innovation

- A novel series of isoreticular MOFs (IRMOFs) with non-interpenetrating structures are synthesized using progressively longer organic links, maintaining a short axis and incorporating infinite rod-shaped metal oxide secondary building units, which forbids interpenetration and enhances stability, resulting in pore apertures ranging from 14 to 98 Å.

Export Control and International Trade Considerations

The international trade of amorphous metals for defense applications is subject to stringent regulatory frameworks designed to protect national security interests while facilitating legitimate commercial activities. The International Traffic in Arms Regulations (ITAR) in the United States specifically categorizes advanced materials with military applications, including certain amorphous metal alloys, as controlled items requiring export licenses. Similarly, the European Union's Dual-Use Regulation (EC) No 428/2009 imposes restrictions on materials that could have both civilian and military applications, creating compliance challenges for manufacturers and suppliers operating across borders.

Amorphous metals present unique regulatory considerations due to their superior mechanical properties and potential applications in advanced weapons systems, armor, and other defense technologies. The Wassenaar Arrangement, a multilateral export control regime with 42 participating states, specifically addresses materials with unique structural properties, creating an additional layer of international oversight for cross-border transfers of amorphous metal technologies.

Companies developing defense applications using amorphous metals must navigate complex country-specific technical parameters that determine control status. For instance, certain compositions containing zirconium or beryllium may trigger stricter controls due to their potential applications in nuclear-related technologies. The Chemical Weapons Convention also imposes restrictions on certain precursor materials that might be used in amorphous metal production processes, requiring careful supply chain documentation and end-use certification.

Recent geopolitical tensions have resulted in increased scrutiny of technology transfers involving advanced materials. Countries like China, Russia, and Iran face enhanced restrictions under various sanctions regimes, limiting their access to amorphous metal technologies with defense applications. This has created segmented global markets and complex compliance requirements for multinational defense contractors and their suppliers.

Trade secret protection represents another significant consideration, as proprietary manufacturing processes for amorphous metals often constitute valuable intellectual property. International agreements like the Agreement on Trade-Related Aspects of Intellectual Property Rights (TRIPS) provide frameworks for protection, but enforcement varies significantly across jurisdictions, creating additional compliance burdens for companies operating globally.

The regulatory landscape continues to evolve as technologies advance. Recent amendments to export control regulations in major manufacturing countries have expanded the definition of controlled technical data to include manufacturing know-how and design specifications for advanced materials, potentially encompassing previously unregulated aspects of amorphous metal production and application development.

Amorphous metals present unique regulatory considerations due to their superior mechanical properties and potential applications in advanced weapons systems, armor, and other defense technologies. The Wassenaar Arrangement, a multilateral export control regime with 42 participating states, specifically addresses materials with unique structural properties, creating an additional layer of international oversight for cross-border transfers of amorphous metal technologies.

Companies developing defense applications using amorphous metals must navigate complex country-specific technical parameters that determine control status. For instance, certain compositions containing zirconium or beryllium may trigger stricter controls due to their potential applications in nuclear-related technologies. The Chemical Weapons Convention also imposes restrictions on certain precursor materials that might be used in amorphous metal production processes, requiring careful supply chain documentation and end-use certification.

Recent geopolitical tensions have resulted in increased scrutiny of technology transfers involving advanced materials. Countries like China, Russia, and Iran face enhanced restrictions under various sanctions regimes, limiting their access to amorphous metal technologies with defense applications. This has created segmented global markets and complex compliance requirements for multinational defense contractors and their suppliers.

Trade secret protection represents another significant consideration, as proprietary manufacturing processes for amorphous metals often constitute valuable intellectual property. International agreements like the Agreement on Trade-Related Aspects of Intellectual Property Rights (TRIPS) provide frameworks for protection, but enforcement varies significantly across jurisdictions, creating additional compliance burdens for companies operating globally.

The regulatory landscape continues to evolve as technologies advance. Recent amendments to export control regulations in major manufacturing countries have expanded the definition of controlled technical data to include manufacturing know-how and design specifications for advanced materials, potentially encompassing previously unregulated aspects of amorphous metal production and application development.

Security Classification and Handling Requirements

The handling of information related to amorphous metals in defense applications requires strict adherence to security protocols due to their strategic importance. Documents containing specifications, performance data, and applications of amorphous metals in military systems must be classified according to their sensitivity level, typically ranging from Unclassified to Top Secret. Materials discussing novel manufacturing techniques or unique military applications may require higher classification levels, while general research papers might remain at lower sensitivity tiers.

Defense contractors and research institutions working with amorphous metals must implement robust document control systems that track access, distribution, and storage of related technical information. Physical documents should be stored in approved security containers, while digital files must reside on authorized secure networks with appropriate encryption protocols. Personnel accessing this information must possess the requisite security clearances and demonstrate a clear "need-to-know" basis for their access.

International collaboration on amorphous metals research presents additional security challenges. Export control regulations, including the International Traffic in Arms Regulations (ITAR) and Export Administration Regulations (EAR), strictly govern the sharing of defense-related materials technology across borders. Violations can result in severe penalties, including substantial fines and potential criminal charges. Organizations must establish comprehensive compliance programs to prevent unauthorized technology transfer.

Marking requirements for documents containing amorphous metals information must follow standardized protocols. Each page should display appropriate classification markings at the top and bottom, with portion markings indicating the sensitivity level of specific sections. Cover sheets must be attached to physical documents when not in secure storage, and digital files require electronic headers and footers denoting classification status.

Periodic security reviews are mandatory to reassess the classification status of amorphous metals documentation. As technologies mature and enter wider commercial applications, some information may be eligible for declassification or downgrading. Conversely, emerging applications with heightened military significance may require upgrading classification levels to protect national security interests.

Training programs for personnel handling amorphous metals information must emphasize security awareness and proper handling procedures. Regular security audits should verify compliance with established protocols and identify potential vulnerabilities in the information protection framework. Incident response plans must be developed to address potential security breaches, including unauthorized disclosure or compromise of sensitive amorphous metals technology.

Defense contractors and research institutions working with amorphous metals must implement robust document control systems that track access, distribution, and storage of related technical information. Physical documents should be stored in approved security containers, while digital files must reside on authorized secure networks with appropriate encryption protocols. Personnel accessing this information must possess the requisite security clearances and demonstrate a clear "need-to-know" basis for their access.

International collaboration on amorphous metals research presents additional security challenges. Export control regulations, including the International Traffic in Arms Regulations (ITAR) and Export Administration Regulations (EAR), strictly govern the sharing of defense-related materials technology across borders. Violations can result in severe penalties, including substantial fines and potential criminal charges. Organizations must establish comprehensive compliance programs to prevent unauthorized technology transfer.

Marking requirements for documents containing amorphous metals information must follow standardized protocols. Each page should display appropriate classification markings at the top and bottom, with portion markings indicating the sensitivity level of specific sections. Cover sheets must be attached to physical documents when not in secure storage, and digital files require electronic headers and footers denoting classification status.

Periodic security reviews are mandatory to reassess the classification status of amorphous metals documentation. As technologies mature and enter wider commercial applications, some information may be eligible for declassification or downgrading. Conversely, emerging applications with heightened military significance may require upgrading classification levels to protect national security interests.

Training programs for personnel handling amorphous metals information must emphasize security awareness and proper handling procedures. Regular security audits should verify compliance with established protocols and identify potential vulnerabilities in the information protection framework. Incident response plans must be developed to address potential security breaches, including unauthorized disclosure or compromise of sensitive amorphous metals technology.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!