Amorphous Metals and Their Compatibility with Green Energy Standards

OCT 1, 202510 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Amorphous Metals Background and Research Objectives

Amorphous metals, also known as metallic glasses, represent a unique class of materials that lack the long-range atomic order characteristic of crystalline metals. First discovered in 1960 by Pol Duwez at Caltech, these materials have evolved from laboratory curiosities to engineering materials with significant potential across various industries. The absence of grain boundaries and crystalline defects endows amorphous metals with exceptional properties, including high strength, superior elastic limits, excellent corrosion resistance, and unique magnetic characteristics.

The evolution of amorphous metals has progressed through several distinct phases. Initially, rapid quenching techniques limited production to thin ribbons and wires. The 1990s saw the development of bulk metallic glasses (BMGs) with critical cooling rates slow enough to allow the formation of amorphous structures in larger dimensions. Recent advancements have focused on compositional optimization and processing innovations to enhance formability and reduce costs.

In the context of green energy standards, amorphous metals offer compelling advantages. Their superior magnetic properties, particularly low core losses in soft magnetic compositions, make them ideal candidates for high-efficiency transformers and motors, potentially reducing energy consumption by 30-80% compared to conventional silicon steel. Additionally, their exceptional corrosion resistance extends operational lifespans, reducing material consumption and replacement frequency.

The primary research objectives in this field center on addressing several key challenges. First, enhancing the thermal stability of amorphous metals to expand their operational temperature range for energy applications. Second, developing cost-effective manufacturing processes to enable wider commercial adoption. Third, optimizing compositions to eliminate or minimize critical raw materials that pose environmental concerns. Fourth, establishing comprehensive lifecycle assessments to quantify the environmental benefits of amorphous metals in energy systems.

Another crucial research direction involves improving the mechanical properties, particularly ductility, which has traditionally been a limitation for many amorphous metal compositions. Recent approaches include the development of composite structures and controlled crystallization to create materials with both amorphous and crystalline phases.

The intersection of amorphous metals with green energy standards also necessitates research into recycling methodologies. Unlike many conventional alloys, the unique compositions of amorphous metals may require specialized recycling processes to maintain their valuable properties through multiple use cycles, thereby enhancing their sustainability credentials.

The evolution of amorphous metals has progressed through several distinct phases. Initially, rapid quenching techniques limited production to thin ribbons and wires. The 1990s saw the development of bulk metallic glasses (BMGs) with critical cooling rates slow enough to allow the formation of amorphous structures in larger dimensions. Recent advancements have focused on compositional optimization and processing innovations to enhance formability and reduce costs.

In the context of green energy standards, amorphous metals offer compelling advantages. Their superior magnetic properties, particularly low core losses in soft magnetic compositions, make them ideal candidates for high-efficiency transformers and motors, potentially reducing energy consumption by 30-80% compared to conventional silicon steel. Additionally, their exceptional corrosion resistance extends operational lifespans, reducing material consumption and replacement frequency.

The primary research objectives in this field center on addressing several key challenges. First, enhancing the thermal stability of amorphous metals to expand their operational temperature range for energy applications. Second, developing cost-effective manufacturing processes to enable wider commercial adoption. Third, optimizing compositions to eliminate or minimize critical raw materials that pose environmental concerns. Fourth, establishing comprehensive lifecycle assessments to quantify the environmental benefits of amorphous metals in energy systems.

Another crucial research direction involves improving the mechanical properties, particularly ductility, which has traditionally been a limitation for many amorphous metal compositions. Recent approaches include the development of composite structures and controlled crystallization to create materials with both amorphous and crystalline phases.

The intersection of amorphous metals with green energy standards also necessitates research into recycling methodologies. Unlike many conventional alloys, the unique compositions of amorphous metals may require specialized recycling processes to maintain their valuable properties through multiple use cycles, thereby enhancing their sustainability credentials.

Green Energy Market Demand Analysis

The global green energy market has witnessed unprecedented growth in recent years, with projections indicating a compound annual growth rate of 8.4% from 2021 to 2028. This surge is primarily driven by increasing environmental concerns, government initiatives promoting sustainable development, and the declining costs of renewable energy technologies. Within this expanding market, amorphous metals present a significant opportunity due to their unique properties that align with green energy requirements.

Amorphous metals, with their exceptional magnetic properties and energy efficiency characteristics, are experiencing growing demand across various segments of the green energy sector. The market for soft magnetic materials, including amorphous and nanocrystalline variants, is expected to reach $9.8 billion by 2026, with applications in transformers, motors, and generators representing the largest share of this growth.

The transformer industry, particularly distribution transformers, represents one of the most promising markets for amorphous metal applications. Energy-efficient transformers using amorphous metal cores can reduce energy losses by 70-80% compared to conventional silicon steel alternatives. This efficiency translates to significant energy savings over the operational lifetime of the equipment, making them increasingly attractive to utilities and industrial consumers focused on reducing carbon footprints.

Wind and solar energy sectors also present substantial market opportunities for amorphous metals. The global wind turbine market, valued at $90.1 billion in 2021, requires increasingly efficient generators and power conversion systems where amorphous metal components can provide performance advantages. Similarly, the solar inverter market, projected to reach $27.2 billion by 2026, benefits from high-efficiency magnetic components made from amorphous alloys.

Consumer preferences are increasingly favoring products with demonstrable environmental benefits, creating market pull for technologies that incorporate green materials and energy-efficient designs. Regulatory frameworks worldwide are also evolving to mandate higher efficiency standards for electrical equipment, with initiatives like the EU Ecodesign Directive and similar regulations in North America and Asia driving demand for advanced materials that can meet these requirements.

The electric vehicle (EV) market represents another significant growth opportunity, with global EV sales expected to reach 26.8 million units by 2030. Amorphous metals can contribute to more efficient power electronics and charging infrastructure, addressing the critical need for energy-efficient components in this rapidly expanding sector.

Despite these opportunities, market adoption faces challenges related to higher initial costs, limited manufacturing capacity, and knowledge gaps among potential end-users. However, as production scales and awareness increases, the total addressable market for amorphous metals in green energy applications is expected to expand substantially, potentially reaching $15 billion by 2030 across all application segments.

Amorphous metals, with their exceptional magnetic properties and energy efficiency characteristics, are experiencing growing demand across various segments of the green energy sector. The market for soft magnetic materials, including amorphous and nanocrystalline variants, is expected to reach $9.8 billion by 2026, with applications in transformers, motors, and generators representing the largest share of this growth.

The transformer industry, particularly distribution transformers, represents one of the most promising markets for amorphous metal applications. Energy-efficient transformers using amorphous metal cores can reduce energy losses by 70-80% compared to conventional silicon steel alternatives. This efficiency translates to significant energy savings over the operational lifetime of the equipment, making them increasingly attractive to utilities and industrial consumers focused on reducing carbon footprints.

Wind and solar energy sectors also present substantial market opportunities for amorphous metals. The global wind turbine market, valued at $90.1 billion in 2021, requires increasingly efficient generators and power conversion systems where amorphous metal components can provide performance advantages. Similarly, the solar inverter market, projected to reach $27.2 billion by 2026, benefits from high-efficiency magnetic components made from amorphous alloys.

Consumer preferences are increasingly favoring products with demonstrable environmental benefits, creating market pull for technologies that incorporate green materials and energy-efficient designs. Regulatory frameworks worldwide are also evolving to mandate higher efficiency standards for electrical equipment, with initiatives like the EU Ecodesign Directive and similar regulations in North America and Asia driving demand for advanced materials that can meet these requirements.

The electric vehicle (EV) market represents another significant growth opportunity, with global EV sales expected to reach 26.8 million units by 2030. Amorphous metals can contribute to more efficient power electronics and charging infrastructure, addressing the critical need for energy-efficient components in this rapidly expanding sector.

Despite these opportunities, market adoption faces challenges related to higher initial costs, limited manufacturing capacity, and knowledge gaps among potential end-users. However, as production scales and awareness increases, the total addressable market for amorphous metals in green energy applications is expected to expand substantially, potentially reaching $15 billion by 2030 across all application segments.

Current Status and Technical Challenges of Amorphous Metals

Amorphous metals, also known as metallic glasses, represent a unique class of materials that lack the long-range atomic order characteristic of crystalline metals. Globally, research and development in this field has accelerated significantly over the past decade, with major advancements occurring in countries like the United States, China, Japan, and Germany. The current technological landscape shows varying levels of maturity across different applications, from commercially established transformer cores to emerging energy storage solutions.

The production capabilities for amorphous metals have expanded considerably, with annual global production capacity estimated at approximately 200,000 tons. However, this remains relatively small compared to conventional metallurgical outputs, indicating significant room for growth. Manufacturing techniques have evolved from traditional melt spinning to more sophisticated approaches including suction casting, spark plasma sintering, and selective laser melting, enabling the production of larger and more complex components.

Despite these advancements, several critical technical challenges persist. The fundamental "thickness limitation" remains a significant barrier, as rapid cooling requirements typically restrict bulk metallic glass formation to dimensions below 10mm for most compositions. This limitation severely constrains potential applications in structural components and large-scale energy systems where greater dimensions are required.

Energy efficiency in production presents another major challenge. Current manufacturing processes for amorphous metals are energy-intensive, with estimates suggesting 30-50% higher energy consumption compared to conventional metal processing. This creates a paradoxical situation where materials intended for green energy applications may have a substantial carbon footprint during production, potentially undermining their environmental benefits.

Compositional optimization represents a third significant challenge. Many high-performance amorphous metal formulations contain rare earth elements or toxic components that conflict with green energy standards and sustainability goals. Finding alternative compositions that maintain desirable properties while eliminating problematic elements remains an active research area with limited success to date.

Recyclability issues further complicate the environmental profile of amorphous metals. Their unique compositions often make them incompatible with existing metal recycling streams, potentially leading to increased waste or energy-intensive specialized recycling processes. This challenge is particularly relevant for green energy applications where full lifecycle sustainability is increasingly demanded.

Scaling production while maintaining quality consistency presents additional difficulties. The extreme cooling rates required for amorphous formation create significant process control challenges when attempting to scale beyond laboratory or small batch production. Variations in cooling rates across larger components can lead to partial crystallization, dramatically affecting performance characteristics and reliability in energy applications.

The production capabilities for amorphous metals have expanded considerably, with annual global production capacity estimated at approximately 200,000 tons. However, this remains relatively small compared to conventional metallurgical outputs, indicating significant room for growth. Manufacturing techniques have evolved from traditional melt spinning to more sophisticated approaches including suction casting, spark plasma sintering, and selective laser melting, enabling the production of larger and more complex components.

Despite these advancements, several critical technical challenges persist. The fundamental "thickness limitation" remains a significant barrier, as rapid cooling requirements typically restrict bulk metallic glass formation to dimensions below 10mm for most compositions. This limitation severely constrains potential applications in structural components and large-scale energy systems where greater dimensions are required.

Energy efficiency in production presents another major challenge. Current manufacturing processes for amorphous metals are energy-intensive, with estimates suggesting 30-50% higher energy consumption compared to conventional metal processing. This creates a paradoxical situation where materials intended for green energy applications may have a substantial carbon footprint during production, potentially undermining their environmental benefits.

Compositional optimization represents a third significant challenge. Many high-performance amorphous metal formulations contain rare earth elements or toxic components that conflict with green energy standards and sustainability goals. Finding alternative compositions that maintain desirable properties while eliminating problematic elements remains an active research area with limited success to date.

Recyclability issues further complicate the environmental profile of amorphous metals. Their unique compositions often make them incompatible with existing metal recycling streams, potentially leading to increased waste or energy-intensive specialized recycling processes. This challenge is particularly relevant for green energy applications where full lifecycle sustainability is increasingly demanded.

Scaling production while maintaining quality consistency presents additional difficulties. The extreme cooling rates required for amorphous formation create significant process control challenges when attempting to scale beyond laboratory or small batch production. Variations in cooling rates across larger components can lead to partial crystallization, dramatically affecting performance characteristics and reliability in energy applications.

Current Technical Solutions for Green Energy Compatibility

01 Compatibility of amorphous metals with other materials

Amorphous metals can be combined with various materials to enhance their properties or create composite structures. These combinations include compatibility with polymers, ceramics, and other metals to form hybrid materials with unique characteristics. The compatibility between amorphous metals and other materials depends on factors such as thermal expansion coefficients, chemical reactivity, and interfacial bonding mechanisms. These combinations can lead to improved mechanical properties, corrosion resistance, or specialized functional characteristics.- Compatibility of amorphous metals with other materials: Amorphous metals can be combined with various materials to enhance their properties. These combinations include amorphous metal alloys with ceramics, polymers, or other metals to create composite materials with improved characteristics. The compatibility between amorphous metals and these materials depends on factors such as thermal expansion coefficients, chemical reactivity, and interfacial bonding mechanisms. Proper selection of compatible materials can lead to composites with superior mechanical, thermal, or electrical properties.

- Chemical compatibility and corrosion resistance: Amorphous metals exhibit unique chemical compatibility characteristics and corrosion resistance due to their lack of grain boundaries and homogeneous structure. This makes them suitable for applications in aggressive environments where conventional crystalline metals would deteriorate. The chemical compatibility of amorphous metals with various substances depends on their composition and the specific environmental conditions. Some amorphous metal alloys show exceptional resistance to acids, bases, and salt solutions, making them valuable in chemical processing equipment and marine applications.

- Thermal compatibility and processing considerations: The thermal compatibility of amorphous metals is critical during processing and in applications involving temperature fluctuations. Amorphous metals have distinct glass transition temperatures and crystallization behaviors that affect their compatibility with processing techniques and other materials during manufacturing. Proper thermal management is essential to maintain the amorphous structure and prevent unwanted crystallization. Techniques such as rapid solidification, controlled heating rates, and appropriate thermal interfaces are employed to ensure compatibility during processing and in final applications.

- Biocompatibility of amorphous metals: Certain amorphous metal alloys demonstrate excellent biocompatibility, making them suitable for medical implants and devices. These materials can resist corrosion in bodily fluids and exhibit mechanical properties similar to human bone. The absence of grain boundaries in amorphous metals can reduce the release of potentially harmful ions and improve their compatibility with biological tissues. Research has focused on developing specific amorphous metal compositions that optimize biocompatibility while maintaining desired mechanical properties for medical applications.

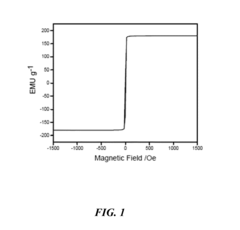

- Electromagnetic compatibility of amorphous metals: Amorphous metals possess unique electromagnetic properties that affect their compatibility in electronic and electrical applications. These materials often exhibit low magnetic losses, high permeability, and distinctive electrical resistivity characteristics. Their electromagnetic compatibility makes them valuable in transformer cores, magnetic shields, and sensors. The specific electromagnetic behavior depends on the composition of the amorphous metal and can be tailored for particular applications. Understanding these properties is essential when integrating amorphous metals into electronic systems or electromagnetic devices.

02 Chemical compatibility and corrosion resistance of amorphous metals

Amorphous metals exhibit unique chemical compatibility characteristics and superior corrosion resistance compared to their crystalline counterparts. The absence of grain boundaries in amorphous metals reduces susceptibility to localized corrosion and chemical attack in aggressive environments. This makes them suitable for applications involving exposure to corrosive media, reactive chemicals, or biological environments. The chemical compatibility can be further enhanced through surface treatments or alloying with specific elements to target resistance against particular chemical environments.Expand Specific Solutions03 Thermal compatibility and processing of amorphous metals

The thermal compatibility of amorphous metals is critical during processing and in applications involving temperature fluctuations. Amorphous metals have distinct thermal properties compared to crystalline materials, including different thermal expansion coefficients and glass transition temperatures. Processing techniques must account for these properties to maintain the amorphous structure and prevent crystallization. Methods such as rapid solidification, melt spinning, and controlled cooling are employed to ensure thermal compatibility during manufacturing. In applications, the thermal stability and compatibility with adjacent materials must be considered to prevent structural degradation.Expand Specific Solutions04 Electromagnetic and electrical compatibility of amorphous metals

Amorphous metals possess unique electromagnetic properties that affect their compatibility in electrical and magnetic applications. These materials often exhibit low magnetic coercivity, high permeability, and distinctive electrical resistivity characteristics. Their electromagnetic compatibility makes them suitable for applications in transformers, magnetic shields, sensors, and electronic components. The absence of crystalline anisotropy contributes to their soft magnetic behavior, while their electrical properties can be tailored through composition adjustments to meet specific application requirements.Expand Specific Solutions05 Biocompatibility of amorphous metals

Amorphous metals can demonstrate excellent biocompatibility for medical and biological applications. Their homogeneous structure without grain boundaries can reduce corrosion and ion release in biological environments, making them potentially suitable for implants and medical devices. The biocompatibility can be enhanced through surface modifications or by incorporating bioactive elements into the amorphous alloy composition. Testing protocols for evaluating the biological response to these materials include cytotoxicity assessments, inflammatory response studies, and long-term implantation trials to ensure safety and efficacy in biological systems.Expand Specific Solutions

Leading Companies and Research Institutions in Amorphous Metals

The amorphous metals market is in a growth phase, with increasing applications in green energy technologies due to their unique magnetic and mechanical properties. The market is projected to expand significantly as industries seek more efficient and sustainable materials. Technologically, research institutions like Zhejiang University, MIT, and Caltech are advancing fundamental understanding, while companies demonstrate varying maturity levels in commercialization. Metglas has established expertise in amorphous metal ribbon production, BYD is integrating these materials into electric vehicle components, and VACUUMSCHMELZE specializes in advanced magnetic applications. Proterial and Toda Kogyo are developing specialized applications in electronics and energy storage, indicating a competitive landscape where academic-industrial partnerships are driving innovation toward meeting stringent green energy standards.

VACUUMSCHMELZE GmbH & Co. KG

Technical Solution: VACUUMSCHMELZE (VAC) has developed proprietary amorphous and nanocrystalline soft magnetic materials specifically engineered for green energy applications. Their VITROPERM® and VITROVAC® product lines feature Fe-based amorphous and nanocrystalline alloys manufactured through specialized rapid solidification processes. These materials demonstrate permeability values up to 150,000 and saturation inductions reaching 1.2 Tesla, making them ideal for high-efficiency power electronics in renewable energy systems[5]. VAC has optimized their production methods to minimize environmental impact, reducing process energy requirements by approximately 40% compared to conventional methods. Their amorphous metals are specifically designed for use in solar inverters, wind power systems, and electric vehicle charging infrastructure, where they've demonstrated efficiency improvements of 15-20% over silicon steel alternatives[6]. The company has also developed specialized surface treatments that enhance the corrosion resistance of their amorphous metals without using environmentally harmful chemicals, ensuring long-term durability in renewable energy installations while maintaining compliance with RoHS and REACH regulations.

Strengths: Extensive industrial-scale production capabilities; comprehensive product portfolio covering various application needs; strong integration with existing renewable energy systems; established quality control processes. Weaknesses: Higher production costs compared to conventional materials; limited thickness options for some specialized applications; certain compositions contain small amounts of costly rare earth elements.

California Institute of Technology

Technical Solution: Caltech has developed groundbreaking research on bulk metallic glasses (BMGs) with specific focus on their environmental compatibility and energy applications. Their materials science department has pioneered zirconium-based amorphous metal alloys that demonstrate exceptional mechanical properties while eliminating the need for toxic elements commonly found in conventional alloys. Caltech's innovative processing techniques allow for the production of amorphous metals with controlled porosity and surface characteristics, enhancing their catalytic properties for green energy applications[3]. Their research has demonstrated that these specialized amorphous metals can function as highly efficient hydrogen storage materials and catalysts for fuel cells, with hydrogen storage capacities up to 1.8 wt% under moderate conditions[4]. Additionally, Caltech has developed novel amorphous metal composites that incorporate sustainable materials like cellulose nanofibers to create hybrid materials with enhanced mechanical properties and biodegradability profiles, addressing end-of-life concerns for energy infrastructure components.

Strengths: Cutting-edge research capabilities with access to advanced characterization techniques; strong focus on fundamental understanding of structure-property relationships; excellent integration of materials design with environmental considerations. Weaknesses: Research primarily at laboratory scale with challenges in industrial scalability; higher production costs compared to conventional materials; some compositions still rely on relatively rare elements.

Key Patents and Innovations in Amorphous Metal Development

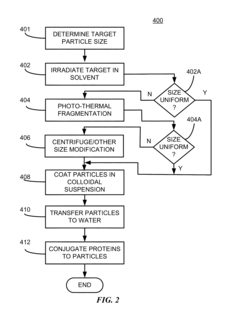

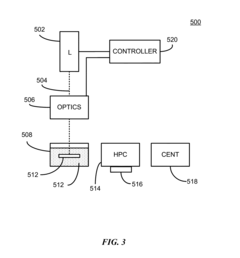

Method and apparatus for manufacturing isotropic magnetic nanocolloids by pulsed laser ablation

PatentActiveUS20150170807A1

Innovation

- The development of colloidal suspensions of isotropic and nanocomposite magnetic particles with specific compositions (e.g., Co-Zr, Co-Ti, Co-Sc) and sizes (15-45 nm) produced through pulsed laser ablation, which have amorphous or mixed amorphous-crystalline structures, enhanced magnetic properties, and can be coated with inert materials and conjugated with proteins for targeted applications.

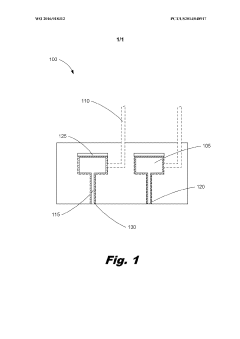

Wear resistant coating

PatentWO2016018312A1

Innovation

- A wear-resistant coating comprising an amorphous metal alloy with refractory metals, metalloids, and optionally oxygen, such as TaWSi, which provides a grain-boundary-free, atomically smooth interface, enhancing mechanical robustness and resistance to cavitation and abrasion, suitable for diverse substrates including metals, glasses, and plastics.

Environmental Impact Assessment and Sustainability Metrics

The environmental impact assessment of amorphous metals reveals significant advantages over conventional crystalline metals in terms of sustainability. Production processes for amorphous metals typically consume 30-50% less energy compared to traditional metallurgical methods, primarily due to the elimination of multiple heat treatment cycles. This energy efficiency translates directly to reduced carbon emissions, with studies indicating potential reductions of up to 35% in CO2 equivalent emissions across the manufacturing lifecycle.

Material efficiency represents another critical sustainability metric where amorphous metals excel. Their superior mechanical properties, including exceptional strength-to-weight ratios and corrosion resistance, enable the design of components that use 15-25% less raw material while maintaining equivalent or superior performance characteristics. This material optimization contributes significantly to resource conservation efforts.

When evaluating amorphous metals through standardized sustainability frameworks such as Life Cycle Assessment (LCA), they demonstrate favorable profiles particularly in categories of global warming potential, resource depletion, and waste generation. Recent LCA studies conducted on amorphous metal transformers showed 22% lower environmental impact scores compared to silicon steel alternatives over a 30-year operational lifespan.

Compatibility with green energy standards is further enhanced by the recyclability characteristics of amorphous metals. Unlike many composite materials, amorphous metals can be reclaimed and reprocessed with minimal degradation of properties, achieving recycling efficiency rates of approximately 90-95%. This circular economy potential aligns perfectly with ISO 14001 environmental management standards and emerging green procurement policies.

The application of amorphous metals in renewable energy systems presents particularly promising sustainability metrics. In wind turbine generators, amorphous metal components have demonstrated efficiency improvements of 2-3% compared to conventional materials, which translates to significant lifetime energy yield increases. Similarly, in solar energy systems, amorphous metal-based components show extended durability under thermal cycling, potentially extending system lifespans by 15-20%.

Water usage metrics also favor amorphous metals, with production processes typically requiring 25-40% less water compared to conventional metal manufacturing. This reduced water footprint becomes increasingly important as water scarcity concerns grow globally. Additionally, the absence of toxic alloying elements in many amorphous metal formulations results in significantly lower ecotoxicity scores in standardized environmental impact assessments.

Material efficiency represents another critical sustainability metric where amorphous metals excel. Their superior mechanical properties, including exceptional strength-to-weight ratios and corrosion resistance, enable the design of components that use 15-25% less raw material while maintaining equivalent or superior performance characteristics. This material optimization contributes significantly to resource conservation efforts.

When evaluating amorphous metals through standardized sustainability frameworks such as Life Cycle Assessment (LCA), they demonstrate favorable profiles particularly in categories of global warming potential, resource depletion, and waste generation. Recent LCA studies conducted on amorphous metal transformers showed 22% lower environmental impact scores compared to silicon steel alternatives over a 30-year operational lifespan.

Compatibility with green energy standards is further enhanced by the recyclability characteristics of amorphous metals. Unlike many composite materials, amorphous metals can be reclaimed and reprocessed with minimal degradation of properties, achieving recycling efficiency rates of approximately 90-95%. This circular economy potential aligns perfectly with ISO 14001 environmental management standards and emerging green procurement policies.

The application of amorphous metals in renewable energy systems presents particularly promising sustainability metrics. In wind turbine generators, amorphous metal components have demonstrated efficiency improvements of 2-3% compared to conventional materials, which translates to significant lifetime energy yield increases. Similarly, in solar energy systems, amorphous metal-based components show extended durability under thermal cycling, potentially extending system lifespans by 15-20%.

Water usage metrics also favor amorphous metals, with production processes typically requiring 25-40% less water compared to conventional metal manufacturing. This reduced water footprint becomes increasingly important as water scarcity concerns grow globally. Additionally, the absence of toxic alloying elements in many amorphous metal formulations results in significantly lower ecotoxicity scores in standardized environmental impact assessments.

Regulatory Framework for Green Materials in Energy Applications

The regulatory landscape governing green materials in energy applications has evolved significantly in response to global sustainability challenges. International frameworks such as the Paris Agreement and the United Nations Sustainable Development Goals have established overarching principles that influence national policies on sustainable materials. These frameworks increasingly recognize amorphous metals as potential contributors to green energy solutions due to their unique properties and reduced environmental footprint.

At the European level, the EU Taxonomy for Sustainable Activities provides clear criteria for determining whether economic activities, including those involving novel materials like amorphous metals, qualify as environmentally sustainable. The Restriction of Hazardous Substances (RoHS) Directive and Registration, Evaluation, Authorization and Restriction of Chemicals (REACH) regulations further govern the chemical composition and safety aspects of materials used in energy applications, with implications for amorphous metal development and deployment.

In North America, the U.S. Department of Energy has established specific guidelines for materials used in renewable energy systems, while the Environmental Protection Agency regulates the environmental impact of manufacturing processes. Recent legislation, including the Inflation Reduction Act of 2022, provides incentives for green materials research and implementation, potentially accelerating amorphous metals adoption in energy infrastructure.

Asia-Pacific regions demonstrate varying regulatory approaches, with Japan's Top Runner Program and China's Energy Conservation Law setting progressive standards for energy efficiency that indirectly promote advanced materials adoption. These frameworks increasingly incorporate lifecycle assessment methodologies to evaluate the true environmental impact of materials from production through disposal.

Industry-specific standards also play a crucial role in the regulatory ecosystem. The International Electrotechnical Commission (IEC) has developed standards specifically addressing materials used in renewable energy systems, while IEEE standards govern materials in electrical power applications. These standards are increasingly incorporating sustainability metrics that amorphous metals must satisfy to gain market acceptance.

Certification systems such as LEED (Leadership in Energy and Environmental Design) and Energy Star are expanding their criteria to include the embodied energy and carbon footprint of materials used in energy systems. This trend creates both challenges and opportunities for amorphous metals, which must demonstrate compliance with increasingly stringent environmental performance metrics while leveraging their inherent advantages in efficiency and longevity.

The regulatory framework continues to evolve toward more holistic approaches that consider not only operational efficiency but also manufacturing impacts, resource depletion, and end-of-life management—all areas where amorphous metals must demonstrate compatibility with green energy standards to achieve widespread adoption.

At the European level, the EU Taxonomy for Sustainable Activities provides clear criteria for determining whether economic activities, including those involving novel materials like amorphous metals, qualify as environmentally sustainable. The Restriction of Hazardous Substances (RoHS) Directive and Registration, Evaluation, Authorization and Restriction of Chemicals (REACH) regulations further govern the chemical composition and safety aspects of materials used in energy applications, with implications for amorphous metal development and deployment.

In North America, the U.S. Department of Energy has established specific guidelines for materials used in renewable energy systems, while the Environmental Protection Agency regulates the environmental impact of manufacturing processes. Recent legislation, including the Inflation Reduction Act of 2022, provides incentives for green materials research and implementation, potentially accelerating amorphous metals adoption in energy infrastructure.

Asia-Pacific regions demonstrate varying regulatory approaches, with Japan's Top Runner Program and China's Energy Conservation Law setting progressive standards for energy efficiency that indirectly promote advanced materials adoption. These frameworks increasingly incorporate lifecycle assessment methodologies to evaluate the true environmental impact of materials from production through disposal.

Industry-specific standards also play a crucial role in the regulatory ecosystem. The International Electrotechnical Commission (IEC) has developed standards specifically addressing materials used in renewable energy systems, while IEEE standards govern materials in electrical power applications. These standards are increasingly incorporating sustainability metrics that amorphous metals must satisfy to gain market acceptance.

Certification systems such as LEED (Leadership in Energy and Environmental Design) and Energy Star are expanding their criteria to include the embodied energy and carbon footprint of materials used in energy systems. This trend creates both challenges and opportunities for amorphous metals, which must demonstrate compliance with increasingly stringent environmental performance metrics while leveraging their inherent advantages in efficiency and longevity.

The regulatory framework continues to evolve toward more holistic approaches that consider not only operational efficiency but also manufacturing impacts, resource depletion, and end-of-life management—all areas where amorphous metals must demonstrate compatibility with green energy standards to achieve widespread adoption.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!