Why Amorphous Metals are Preferred in High-Frequency Applications

OCT 1, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Amorphous Metals Evolution and Application Goals

Amorphous metals, also known as metallic glasses, have evolved significantly since their discovery in the early 1960s at Caltech. Initially, these materials could only be produced in thin ribbon forms through rapid solidification techniques, limiting their practical applications. The evolution of amorphous metals has been marked by continuous improvements in manufacturing processes, enabling the production of bulk metallic glasses (BMGs) with thicknesses exceeding several millimeters by the 1990s.

The fundamental characteristic that distinguishes amorphous metals is their non-crystalline atomic structure, which results from rapid cooling that prevents atoms from arranging into ordered lattices. This disordered structure gives rise to unique electrical, magnetic, and mechanical properties that are particularly advantageous in high-frequency applications.

In the realm of high-frequency electronics and power systems, amorphous metals have demonstrated superior performance compared to their crystalline counterparts. The absence of grain boundaries in amorphous structures significantly reduces eddy current losses and hysteresis losses, making these materials exceptionally efficient at high frequencies. This characteristic has positioned amorphous metals as preferred materials for transformers, inductors, and magnetic cores in advanced power electronics.

The technological trajectory of amorphous metals has been driven by increasing demands for energy efficiency in power transmission and distribution systems. As global energy consumption continues to rise, the need for materials that can minimize energy losses becomes increasingly critical. Amorphous metal cores in distribution transformers can reduce no-load losses by up to 80% compared to conventional silicon steel cores, representing a significant advancement in energy conservation.

Recent developments have focused on enhancing the thermal stability and mechanical properties of amorphous metals while preserving their exceptional magnetic characteristics. Research efforts are directed toward expanding the composition range of bulk metallic glasses and developing cost-effective production methods to make these materials more accessible for widespread industrial applications.

The primary technical goals in amorphous metals research include increasing the critical cooling rate to facilitate easier production of bulk samples, improving toughness and ductility without sacrificing magnetic properties, and developing specialized compositions tailored for specific high-frequency applications. Additionally, there is significant interest in creating amorphous metal composites that combine the advantages of both amorphous and crystalline phases.

Looking forward, the evolution of amorphous metals is expected to continue toward more sophisticated alloy designs using computational methods and high-throughput experimentation. The ultimate objective is to develop materials that can operate efficiently at even higher frequencies, supporting the advancement of next-generation power electronics, wireless communication systems, and renewable energy technologies.

The fundamental characteristic that distinguishes amorphous metals is their non-crystalline atomic structure, which results from rapid cooling that prevents atoms from arranging into ordered lattices. This disordered structure gives rise to unique electrical, magnetic, and mechanical properties that are particularly advantageous in high-frequency applications.

In the realm of high-frequency electronics and power systems, amorphous metals have demonstrated superior performance compared to their crystalline counterparts. The absence of grain boundaries in amorphous structures significantly reduces eddy current losses and hysteresis losses, making these materials exceptionally efficient at high frequencies. This characteristic has positioned amorphous metals as preferred materials for transformers, inductors, and magnetic cores in advanced power electronics.

The technological trajectory of amorphous metals has been driven by increasing demands for energy efficiency in power transmission and distribution systems. As global energy consumption continues to rise, the need for materials that can minimize energy losses becomes increasingly critical. Amorphous metal cores in distribution transformers can reduce no-load losses by up to 80% compared to conventional silicon steel cores, representing a significant advancement in energy conservation.

Recent developments have focused on enhancing the thermal stability and mechanical properties of amorphous metals while preserving their exceptional magnetic characteristics. Research efforts are directed toward expanding the composition range of bulk metallic glasses and developing cost-effective production methods to make these materials more accessible for widespread industrial applications.

The primary technical goals in amorphous metals research include increasing the critical cooling rate to facilitate easier production of bulk samples, improving toughness and ductility without sacrificing magnetic properties, and developing specialized compositions tailored for specific high-frequency applications. Additionally, there is significant interest in creating amorphous metal composites that combine the advantages of both amorphous and crystalline phases.

Looking forward, the evolution of amorphous metals is expected to continue toward more sophisticated alloy designs using computational methods and high-throughput experimentation. The ultimate objective is to develop materials that can operate efficiently at even higher frequencies, supporting the advancement of next-generation power electronics, wireless communication systems, and renewable energy technologies.

Market Demand Analysis for High-Frequency Materials

The high-frequency materials market has experienced substantial growth in recent years, primarily driven by the expanding telecommunications sector, particularly with the global rollout of 5G networks. Market research indicates that the high-frequency materials market was valued at approximately $1.2 billion in 2022 and is projected to reach $2.5 billion by 2028, representing a compound annual growth rate (CAGR) of 12.8% during the forecast period.

Amorphous metals, also known as metallic glasses, have emerged as preferred materials in high-frequency applications due to their unique electromagnetic properties. The demand for these materials is particularly strong in sectors requiring efficient power conversion and minimal energy losses, such as renewable energy systems, electric vehicles, and advanced computing infrastructure.

The telecommunications industry represents the largest market segment for high-frequency materials, accounting for roughly 35% of the total market share. The continuous evolution of wireless communication standards necessitates materials capable of operating at increasingly higher frequencies with minimal signal loss. Amorphous metals meet these requirements exceptionally well, explaining their growing adoption in antenna systems, base stations, and satellite communication equipment.

Consumer electronics constitutes another significant market segment, representing approximately 28% of the demand. The miniaturization trend in electronic devices, coupled with the need for improved performance and energy efficiency, has created substantial demand for amorphous metals in components such as transformers, inductors, and electromagnetic interference (EMI) shielding.

Regionally, Asia-Pacific dominates the high-frequency materials market with a 45% share, followed by North America (30%) and Europe (20%). China, Japan, and South Korea are the primary consumers in Asia-Pacific, driven by their robust electronics manufacturing sectors and aggressive 5G deployment strategies.

Industry surveys reveal that 78% of electronics manufacturers consider high-frequency performance a critical factor in material selection for next-generation products. Furthermore, 65% of respondents indicated plans to increase their utilization of amorphous metals in high-frequency applications over the next three years.

The market is also witnessing increased demand from emerging applications such as Internet of Things (IoT) devices, autonomous vehicles, and advanced medical equipment. These applications require materials capable of supporting high-frequency operation while maintaining energy efficiency and reliability, further expanding the potential market for amorphous metals.

Amorphous metals, also known as metallic glasses, have emerged as preferred materials in high-frequency applications due to their unique electromagnetic properties. The demand for these materials is particularly strong in sectors requiring efficient power conversion and minimal energy losses, such as renewable energy systems, electric vehicles, and advanced computing infrastructure.

The telecommunications industry represents the largest market segment for high-frequency materials, accounting for roughly 35% of the total market share. The continuous evolution of wireless communication standards necessitates materials capable of operating at increasingly higher frequencies with minimal signal loss. Amorphous metals meet these requirements exceptionally well, explaining their growing adoption in antenna systems, base stations, and satellite communication equipment.

Consumer electronics constitutes another significant market segment, representing approximately 28% of the demand. The miniaturization trend in electronic devices, coupled with the need for improved performance and energy efficiency, has created substantial demand for amorphous metals in components such as transformers, inductors, and electromagnetic interference (EMI) shielding.

Regionally, Asia-Pacific dominates the high-frequency materials market with a 45% share, followed by North America (30%) and Europe (20%). China, Japan, and South Korea are the primary consumers in Asia-Pacific, driven by their robust electronics manufacturing sectors and aggressive 5G deployment strategies.

Industry surveys reveal that 78% of electronics manufacturers consider high-frequency performance a critical factor in material selection for next-generation products. Furthermore, 65% of respondents indicated plans to increase their utilization of amorphous metals in high-frequency applications over the next three years.

The market is also witnessing increased demand from emerging applications such as Internet of Things (IoT) devices, autonomous vehicles, and advanced medical equipment. These applications require materials capable of supporting high-frequency operation while maintaining energy efficiency and reliability, further expanding the potential market for amorphous metals.

Current State and Challenges in Amorphous Metal Technology

Amorphous metals, also known as metallic glasses, have gained significant traction in high-frequency applications globally. Currently, these materials are produced through rapid solidification techniques that prevent crystallization, with commercial production methods including melt spinning, gas atomization, and selective laser melting. The global market for amorphous metals reached approximately $1.2 billion in 2022, with projections indicating growth to $2.5 billion by 2028, driven primarily by electronics and power distribution applications.

Despite their promising properties, amorphous metals face several critical challenges. The most significant limitation is size constraint, as rapid cooling requirements restrict production to thin ribbons, wires, or powders, typically under 100 micrometers in thickness. This dimensional limitation severely impacts their application in larger structural components where high-frequency performance would be beneficial.

Manufacturing scalability presents another major hurdle. Current production techniques struggle with consistent quality control across larger batches, leading to variations in magnetic and electrical properties that can compromise performance in high-frequency applications. The cost of production remains 30-50% higher than conventional crystalline counterparts, creating a significant barrier to widespread adoption.

From a technical perspective, amorphous metals exhibit composition-dependent properties that are not fully predictable. This variability complicates design processes for high-frequency applications, where precise electrical and magnetic characteristics are essential. Additionally, thermal stability issues arise as these materials tend to crystallize when exposed to temperatures above their glass transition point, which can be as low as 400°C for some compositions.

Geographically, research and production capabilities are concentrated in specific regions. Japan leads with approximately 40% of patents and commercial production, followed by the United States (25%), China (20%), and Europe (15%). This distribution creates supply chain vulnerabilities for industries dependent on these materials for high-frequency applications.

Recent advancements have partially addressed these challenges through compositional optimization and processing innovations. For instance, the development of Fe-based amorphous alloys with higher saturation flux density has improved performance in high-frequency transformers. However, the fundamental trade-off between manufacturing feasibility and optimal high-frequency performance remains unresolved, necessitating continued research into alternative production methods and compositional designs that can maintain amorphous structure while enabling larger-scale production.

Despite their promising properties, amorphous metals face several critical challenges. The most significant limitation is size constraint, as rapid cooling requirements restrict production to thin ribbons, wires, or powders, typically under 100 micrometers in thickness. This dimensional limitation severely impacts their application in larger structural components where high-frequency performance would be beneficial.

Manufacturing scalability presents another major hurdle. Current production techniques struggle with consistent quality control across larger batches, leading to variations in magnetic and electrical properties that can compromise performance in high-frequency applications. The cost of production remains 30-50% higher than conventional crystalline counterparts, creating a significant barrier to widespread adoption.

From a technical perspective, amorphous metals exhibit composition-dependent properties that are not fully predictable. This variability complicates design processes for high-frequency applications, where precise electrical and magnetic characteristics are essential. Additionally, thermal stability issues arise as these materials tend to crystallize when exposed to temperatures above their glass transition point, which can be as low as 400°C for some compositions.

Geographically, research and production capabilities are concentrated in specific regions. Japan leads with approximately 40% of patents and commercial production, followed by the United States (25%), China (20%), and Europe (15%). This distribution creates supply chain vulnerabilities for industries dependent on these materials for high-frequency applications.

Recent advancements have partially addressed these challenges through compositional optimization and processing innovations. For instance, the development of Fe-based amorphous alloys with higher saturation flux density has improved performance in high-frequency transformers. However, the fundamental trade-off between manufacturing feasibility and optimal high-frequency performance remains unresolved, necessitating continued research into alternative production methods and compositional designs that can maintain amorphous structure while enabling larger-scale production.

Current Technical Solutions for High-Frequency Applications

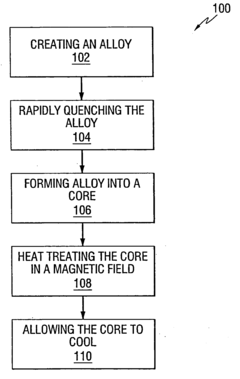

01 Manufacturing processes for amorphous metals

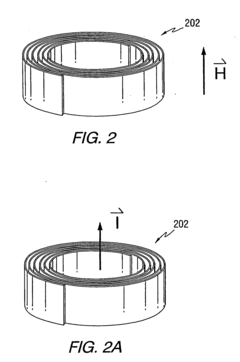

Various manufacturing processes can be employed to produce amorphous metals, including rapid solidification techniques that prevent crystallization. These methods involve cooling molten metal at extremely high rates to bypass crystal formation, resulting in a disordered atomic structure. Common techniques include melt spinning, gas atomization, and splat quenching. These processes are critical for maintaining the unique properties of amorphous metals, as they prevent the atoms from arranging into an ordered crystalline structure.- Manufacturing processes for amorphous metals: Various manufacturing processes can be employed to produce amorphous metals, including rapid solidification techniques that prevent crystallization. These methods involve cooling molten metal at extremely high rates to bypass crystal formation, resulting in a disordered atomic structure. Common techniques include melt spinning, gas atomization, and splat quenching, which enable the production of amorphous metal ribbons, powders, and bulk forms with unique structural properties.

- Composition and alloying of amorphous metals: The composition of amorphous metals significantly influences their glass-forming ability and resulting properties. These alloys typically contain multiple elements with different atomic sizes to create atomic mismatch that inhibits crystallization. Common amorphous metal systems include iron-based, zirconium-based, and palladium-based alloys, often incorporating elements like boron, silicon, phosphorus, and rare earth metals to enhance glass formation and stability while providing specific functional properties.

- Mechanical properties and applications of amorphous metals: Amorphous metals exhibit exceptional mechanical properties including high strength, hardness, elastic limit, and wear resistance due to their lack of crystalline defects and grain boundaries. These materials often demonstrate superior corrosion resistance and unique magnetic properties compared to their crystalline counterparts. Applications include high-performance structural components, cutting tools, electronic devices, transformers, and biomedical implants where their combination of properties provides significant advantages over conventional materials.

- Thermal stability and crystallization behavior: Amorphous metals exist in a metastable state and tend to crystallize when heated above their glass transition temperature. Understanding and controlling this crystallization behavior is crucial for processing and application development. Various techniques can enhance thermal stability, including precise alloying, addition of microalloying elements, and controlled partial crystallization to form glass-matrix composites. These approaches extend the temperature range for practical applications while maintaining desirable properties.

- Surface treatment and coating applications: Amorphous metals can be applied as protective coatings to enhance surface properties of conventional materials. Techniques such as thermal spraying, laser cladding, and physical vapor deposition enable the formation of amorphous metal layers with superior hardness, wear resistance, and corrosion protection. These coatings find applications in industries requiring protection against extreme environments, including aerospace, chemical processing, and marine applications, where they significantly extend component lifetimes.

02 Composition and alloying of amorphous metals

The composition of amorphous metals typically involves specific combinations of elements that enhance glass-forming ability. These alloys often contain a mixture of transition metals with metalloids such as boron, silicon, or phosphorus. Multi-component systems with elements of varying atomic sizes help disrupt crystallization. Zirconium, titanium, copper, nickel, and iron are commonly used base elements, with precise ratios of constituent elements being crucial for achieving the amorphous structure and desired properties.Expand Specific Solutions03 Mechanical and physical properties of amorphous metals

Amorphous metals exhibit exceptional mechanical and physical properties compared to their crystalline counterparts. They typically demonstrate high strength, hardness, and elastic limits while maintaining good ductility under certain conditions. The absence of grain boundaries contributes to their superior corrosion resistance and unique magnetic properties. These materials often show excellent wear resistance, high electrical resistivity, and distinctive thermal behavior, including lower thermal conductivity than crystalline metals and specific glass transition temperatures.Expand Specific Solutions04 Applications of amorphous metals

Amorphous metals find applications across various industries due to their unique properties. They are used in electronic devices as transformer cores and magnetic sensors due to their soft magnetic properties. In medical fields, they serve as biocompatible implants and surgical instruments. Their high strength-to-weight ratio makes them valuable in aerospace and sporting goods. Additionally, they are employed in cutting tools, wear-resistant coatings, and high-performance springs. Emerging applications include energy storage components and precision instruments where dimensional stability is crucial.Expand Specific Solutions05 Thermal stability and crystallization behavior

The thermal stability of amorphous metals is a critical characteristic that determines their practical applications. When heated, these materials eventually undergo crystallization at specific temperatures, transforming from amorphous to crystalline structures. This process can be controlled and utilized for certain applications or avoided to maintain amorphous properties. Research focuses on developing compositions with enhanced thermal stability and understanding the kinetics of crystallization. Heat treatment protocols can be designed to achieve partial crystallization, resulting in composite materials with combined properties of both amorphous and crystalline phases.Expand Specific Solutions

Key Industry Players in Amorphous Metal Production

Amorphous metals are increasingly preferred in high-frequency applications due to their unique structural and magnetic properties. The market is currently in a growth phase, with an expanding global demand driven by telecommunications, power electronics, and renewable energy sectors. The technology has reached moderate maturity with established manufacturing processes, though innovation continues rapidly. Key players include Metglas, Inc., a pioneer specializing in amorphous metal ribbon production, and Advanced Technology & Materials Co., which has developed proprietary technologies for strategic industries. Proterial Ltd. and Hitachi contribute significant advancements in magnetic materials, while research institutions like California Institute of Technology and Carnegie Mellon University drive fundamental breakthroughs. Companies like BYD and Murata Manufacturing are integrating these materials into commercial applications, particularly for electric vehicles and electronic components.

Metglas, Inc.

Technical Solution: Metglas has pioneered the commercial production of amorphous metal ribbons using rapid solidification technology. Their FINEMET® and NANOPERM® series utilize iron-based amorphous alloys with nanocrystalline structures that exhibit superior magnetic properties at high frequencies. The manufacturing process involves melt spinning techniques where molten metal is rapidly quenched at cooling rates of approximately 10^6 K/s, preventing crystallization and creating a disordered atomic structure. This results in materials with extremely low core losses (less than 1/5 of conventional silicon steel) and high permeability (up to 100,000) maintained across frequencies ranging from 10kHz to 100kHz. Metglas's amorphous cores demonstrate exceptional performance in power transformers, achieving efficiency improvements of 70-80% compared to conventional materials when operating at frequencies above 20kHz.

Strengths: Industry-leading expertise in rapid solidification technology; exceptional magnetic properties with core losses 80% lower than silicon steel; established manufacturing infrastructure. Weaknesses: Higher material costs compared to conventional materials; limitations in thickness (typically <50μm) due to manufacturing constraints; mechanical brittleness requiring special handling.

AMOTECH CO LTD

Technical Solution: AMOTECH has developed specialized amorphous metal-based components specifically engineered for high-frequency wireless power transfer and EMI suppression applications. Their technology utilizes iron-based amorphous alloys with carefully controlled additions of cobalt and phosphorus to achieve optimal magnetic properties in the 100kHz-10MHz frequency range. AMOTECH's manufacturing process incorporates proprietary rapid solidification techniques followed by precision shaping and laser cutting to create complex geometries while maintaining the amorphous structure. Their AMOSIELD® series of EMI suppression components utilizes layered amorphous metal sheets with specialized insulating materials, achieving insertion losses exceeding 40dB across broad frequency ranges (1-100MHz) while maintaining compact dimensions. For wireless power applications, their AMOCOIL® series demonstrates quality factors 30-40% higher than comparable ferrite solutions, enabling more efficient power transfer with reduced thermal issues.

Strengths: Specialized expertise in high-frequency applications; advanced manufacturing capabilities for complex geometries; excellent thermal stability across wide temperature ranges. Weaknesses: Limited production capacity compared to larger competitors; higher cost structure for specialized applications; requires careful design integration for optimal performance.

Core Innovations in Amorphous Metal Structure and Properties

Amorphous alloys for electromagnetic devices

PatentInactiveEP0119432A3

Innovation

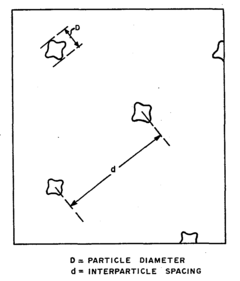

- An iron-based boron and chromium alloy with a composition of FeaBbSicCd, where 'a', 'b', 'c', and 'd' are atomic percentages ranging from 75 to 83, 15 to 17, 4.5 to 5.5, and 0.1 to 0.75, respectively, is annealed to induce precipitation of discrete particles in an amorphous metal matrix, forming a chromium oxide layer, and quenched at a rate of 10 to 106°C/sec to produce a ribbon with improved magnetic properties.

Soft magnetic alloy and uses thereof

PatentActiveUS20100265028A1

Innovation

- A soft magnetic nanocomposite alloy comprising an amorphous phase and a crystalline phase, specifically an Fe1-x-yCoxMy)100-a-b-cTaBbNc composition, where M is Ni or Mn, T includes Nb, W, Ta, Hf, Ti, Cr, Cu, Mo, and N is Si, Ge, C, P, or Al, with controlled atomic percentages to form fine crystalline particles embedded in an amorphous matrix, enhancing magnetic properties.

Manufacturing Processes and Scalability Considerations

The manufacturing of amorphous metals for high-frequency applications presents unique challenges and opportunities that significantly impact their commercial viability. Traditional manufacturing methods for crystalline metals cannot be directly applied due to the need for rapid cooling rates—typically 10^4 to 10^6 K/s—to prevent crystallization and maintain the amorphous structure. This requirement has led to the development of specialized production techniques.

Rapid solidification processes, particularly melt spinning, remain the dominant manufacturing method for amorphous metal ribbons used in high-frequency transformers and inductors. In this process, molten metal is ejected onto a rapidly rotating copper wheel, creating thin ribbons with thicknesses ranging from 20 to 50 micrometers. While effective for producing high-quality amorphous materials, this method faces limitations in terms of ribbon width and thickness control.

For bulk amorphous metals, suction casting and copper mold casting have emerged as viable production methods. These techniques allow for the creation of larger components, though dimensional constraints remain significant compared to conventional metal manufacturing. Recent advancements in selective laser melting (SLM) and other additive manufacturing approaches show promise for creating complex amorphous metal components with customized geometries suited for specific high-frequency applications.

Scalability considerations present significant challenges for widespread adoption. Current production volumes remain relatively low compared to crystalline alternatives, resulting in higher unit costs despite the superior performance characteristics. The specialized equipment required for rapid cooling adds capital expense to manufacturing facilities, creating barriers to entry for smaller producers.

Quality control represents another critical manufacturing consideration. The performance of amorphous metals in high-frequency applications depends heavily on structural homogeneity and the absence of crystalline inclusions. Advanced inspection techniques including X-ray diffraction and differential scanning calorimetry are essential but add complexity and cost to the manufacturing process.

Recent innovations in manufacturing technology show promising directions for improved scalability. Continuous casting methods are being developed to increase production throughput, while advances in precision cooling control are enabling the creation of thicker amorphous sections without crystallization. These developments may significantly reduce production costs in the coming years, potentially expanding the economic viability of amorphous metals across a broader range of high-frequency applications.

Rapid solidification processes, particularly melt spinning, remain the dominant manufacturing method for amorphous metal ribbons used in high-frequency transformers and inductors. In this process, molten metal is ejected onto a rapidly rotating copper wheel, creating thin ribbons with thicknesses ranging from 20 to 50 micrometers. While effective for producing high-quality amorphous materials, this method faces limitations in terms of ribbon width and thickness control.

For bulk amorphous metals, suction casting and copper mold casting have emerged as viable production methods. These techniques allow for the creation of larger components, though dimensional constraints remain significant compared to conventional metal manufacturing. Recent advancements in selective laser melting (SLM) and other additive manufacturing approaches show promise for creating complex amorphous metal components with customized geometries suited for specific high-frequency applications.

Scalability considerations present significant challenges for widespread adoption. Current production volumes remain relatively low compared to crystalline alternatives, resulting in higher unit costs despite the superior performance characteristics. The specialized equipment required for rapid cooling adds capital expense to manufacturing facilities, creating barriers to entry for smaller producers.

Quality control represents another critical manufacturing consideration. The performance of amorphous metals in high-frequency applications depends heavily on structural homogeneity and the absence of crystalline inclusions. Advanced inspection techniques including X-ray diffraction and differential scanning calorimetry are essential but add complexity and cost to the manufacturing process.

Recent innovations in manufacturing technology show promising directions for improved scalability. Continuous casting methods are being developed to increase production throughput, while advances in precision cooling control are enabling the creation of thicker amorphous sections without crystallization. These developments may significantly reduce production costs in the coming years, potentially expanding the economic viability of amorphous metals across a broader range of high-frequency applications.

Environmental Impact and Sustainability of Amorphous Metals

The environmental impact of amorphous metals in high-frequency applications represents a significant advantage over their crystalline counterparts. The production of amorphous metals typically requires less energy consumption compared to conventional crystalline metals, as the rapid cooling process eliminates the need for extended heat treatments and multiple processing steps. This energy efficiency translates directly into reduced carbon emissions during manufacturing, contributing to a smaller carbon footprint across the product lifecycle.

Amorphous metals also demonstrate superior durability and corrosion resistance, extending their operational lifespan in high-frequency applications. This longevity reduces the frequency of replacements and consequently minimizes waste generation. The enhanced magnetic properties at high frequencies allow for smaller component sizes, which further reduces material consumption and associated environmental impacts.

From a resource perspective, amorphous metals offer notable sustainability benefits. Their production can utilize recycled materials without compromising performance, as the amorphous structure is achieved through processing techniques rather than specific material compositions. This recyclability creates a potential circular economy pathway for high-frequency electronic components, addressing growing concerns about electronic waste.

The reduced core losses in amorphous metal transformers and inductors translate into significant energy savings during operation. Studies indicate that amorphous metal transformers can reduce energy losses by 70-80% compared to conventional silicon steel alternatives, resulting in substantial energy conservation over the device lifetime. This operational efficiency is particularly valuable in renewable energy systems and grid infrastructure, where high-frequency applications are increasingly prevalent.

Additionally, many amorphous metal alloys contain fewer toxic elements compared to some specialized crystalline alloys used in high-frequency applications. This composition advantage reduces potential environmental contamination during both manufacturing and end-of-life disposal phases. Some manufacturers have developed amorphous metal formulations specifically designed to minimize environmental impact while maintaining optimal high-frequency performance characteristics.

Looking forward, the sustainability profile of amorphous metals continues to improve as manufacturing processes become more refined. Emerging techniques for amorphous metal production are focusing on reducing process temperatures and implementing closed-loop cooling systems, further decreasing environmental impact. These advancements position amorphous metals as an environmentally preferable material choice for next-generation high-frequency applications in renewable energy, electric vehicles, and smart grid technologies.

Amorphous metals also demonstrate superior durability and corrosion resistance, extending their operational lifespan in high-frequency applications. This longevity reduces the frequency of replacements and consequently minimizes waste generation. The enhanced magnetic properties at high frequencies allow for smaller component sizes, which further reduces material consumption and associated environmental impacts.

From a resource perspective, amorphous metals offer notable sustainability benefits. Their production can utilize recycled materials without compromising performance, as the amorphous structure is achieved through processing techniques rather than specific material compositions. This recyclability creates a potential circular economy pathway for high-frequency electronic components, addressing growing concerns about electronic waste.

The reduced core losses in amorphous metal transformers and inductors translate into significant energy savings during operation. Studies indicate that amorphous metal transformers can reduce energy losses by 70-80% compared to conventional silicon steel alternatives, resulting in substantial energy conservation over the device lifetime. This operational efficiency is particularly valuable in renewable energy systems and grid infrastructure, where high-frequency applications are increasingly prevalent.

Additionally, many amorphous metal alloys contain fewer toxic elements compared to some specialized crystalline alloys used in high-frequency applications. This composition advantage reduces potential environmental contamination during both manufacturing and end-of-life disposal phases. Some manufacturers have developed amorphous metal formulations specifically designed to minimize environmental impact while maintaining optimal high-frequency performance characteristics.

Looking forward, the sustainability profile of amorphous metals continues to improve as manufacturing processes become more refined. Emerging techniques for amorphous metal production are focusing on reducing process temperatures and implementing closed-loop cooling systems, further decreasing environmental impact. These advancements position amorphous metals as an environmentally preferable material choice for next-generation high-frequency applications in renewable energy, electric vehicles, and smart grid technologies.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!