Analysis of Composite coatings for friction and wear reduction in machinery

SEP 28, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Composite Coating Technology Evolution and Objectives

Composite coating technology has evolved significantly over the past several decades, transforming from simple single-layer protective surfaces to sophisticated multi-functional systems. The journey began in the 1950s with basic hard chrome and electroplated coatings, which provided minimal wear resistance but lacked the comprehensive protection needed for advanced machinery applications. By the 1970s, thermal spray techniques emerged, allowing for thicker coatings with improved wear characteristics, though adhesion and uniformity remained problematic.

The 1980s marked a pivotal shift with the introduction of physical vapor deposition (PVD) and chemical vapor deposition (CVD) technologies, enabling the creation of thin, highly adherent coatings with superior hardness. These developments laid the groundwork for the composite coating revolution that followed in the 1990s, when researchers began experimenting with embedding particles of different materials within coating matrices to achieve synergistic properties.

The early 2000s witnessed the integration of nanotechnology into composite coating development, dramatically enhancing performance capabilities. Nano-structured composite coatings demonstrated unprecedented combinations of hardness, toughness, and lubricity. This period also saw the emergence of self-lubricating composite coatings incorporating solid lubricants like graphite, MoS2, and PTFE within harder matrices, providing continuous lubrication during operation.

Current technological trends focus on smart composite coatings with adaptive properties that respond to environmental changes. These include self-healing capabilities, where coating damage triggers an automatic repair process, and condition-responsive lubrication that activates under specific temperature or pressure conditions. Additionally, environmentally friendly alternatives to traditional toxic coating processes are gaining prominence, with water-based and solvent-free systems showing promising results.

The primary objectives of modern composite coating research center on achieving multi-functional performance that simultaneously addresses friction reduction, wear resistance, corrosion protection, and thermal stability. Researchers aim to develop coatings that maintain their integrity under extreme operating conditions, including high temperatures, heavy loads, and corrosive environments. Another critical goal is extending machinery service life while reducing maintenance frequency and associated downtime costs.

Looking forward, the field is moving toward customizable coating solutions tailored to specific industrial applications, with precise control over composition, structure, and properties at the nanoscale. The ultimate objective remains creating sustainable coating technologies that maximize equipment efficiency and longevity while minimizing environmental impact and resource consumption throughout the product lifecycle.

The 1980s marked a pivotal shift with the introduction of physical vapor deposition (PVD) and chemical vapor deposition (CVD) technologies, enabling the creation of thin, highly adherent coatings with superior hardness. These developments laid the groundwork for the composite coating revolution that followed in the 1990s, when researchers began experimenting with embedding particles of different materials within coating matrices to achieve synergistic properties.

The early 2000s witnessed the integration of nanotechnology into composite coating development, dramatically enhancing performance capabilities. Nano-structured composite coatings demonstrated unprecedented combinations of hardness, toughness, and lubricity. This period also saw the emergence of self-lubricating composite coatings incorporating solid lubricants like graphite, MoS2, and PTFE within harder matrices, providing continuous lubrication during operation.

Current technological trends focus on smart composite coatings with adaptive properties that respond to environmental changes. These include self-healing capabilities, where coating damage triggers an automatic repair process, and condition-responsive lubrication that activates under specific temperature or pressure conditions. Additionally, environmentally friendly alternatives to traditional toxic coating processes are gaining prominence, with water-based and solvent-free systems showing promising results.

The primary objectives of modern composite coating research center on achieving multi-functional performance that simultaneously addresses friction reduction, wear resistance, corrosion protection, and thermal stability. Researchers aim to develop coatings that maintain their integrity under extreme operating conditions, including high temperatures, heavy loads, and corrosive environments. Another critical goal is extending machinery service life while reducing maintenance frequency and associated downtime costs.

Looking forward, the field is moving toward customizable coating solutions tailored to specific industrial applications, with precise control over composition, structure, and properties at the nanoscale. The ultimate objective remains creating sustainable coating technologies that maximize equipment efficiency and longevity while minimizing environmental impact and resource consumption throughout the product lifecycle.

Market Analysis for Friction-Reducing Coating Solutions

The global market for friction-reducing coating solutions has experienced significant growth over the past decade, driven primarily by increasing demands for energy efficiency and extended machinery lifespan across various industrial sectors. Current market valuations indicate that the composite coatings segment for friction and wear reduction reached approximately 8.2 billion USD in 2022, with projections suggesting a compound annual growth rate (CAGR) of 6.3% through 2028.

Manufacturing industries, particularly automotive and aerospace, represent the largest market segments, collectively accounting for over 45% of the total market share. This dominance stems from stringent regulatory requirements for fuel efficiency and emissions reduction, which have accelerated the adoption of advanced coating technologies to minimize frictional losses in engines and moving components.

Regionally, North America and Europe currently lead the market with combined revenue exceeding 5 billion USD, attributed to their established industrial bases and substantial R&D investments. However, the Asia-Pacific region, particularly China and India, demonstrates the highest growth potential with anticipated CAGR of 8.7% through 2028, driven by rapid industrialization and manufacturing expansion.

Customer demand patterns reveal a clear shift toward environmentally sustainable coating solutions with reduced VOC emissions and hazardous materials. This trend has catalyzed innovation in water-based and powder coating technologies, which now represent approximately 37% of new installations, up from just 22% five years ago.

Price sensitivity varies significantly across application sectors. High-performance applications in aerospace and precision machinery demonstrate low price elasticity, with customers prioritizing performance and reliability. Conversely, general industrial applications exhibit greater price sensitivity, creating distinct market segments with different value propositions.

The competitive landscape features both established players with comprehensive product portfolios and specialized niche providers focusing on specific coating technologies or application sectors. Recent market consolidation through mergers and acquisitions indicates industry maturation, with larger corporations seeking to expand their technological capabilities through strategic acquisitions of innovative smaller firms.

Future market growth will likely be driven by three key factors: increasing regulatory pressure for energy efficiency, growing awareness of lifecycle cost benefits from reduced maintenance requirements, and technological advancements enabling more durable and effective coating solutions. Emerging applications in renewable energy infrastructure and electric vehicle components represent particularly promising growth segments, with potential to reshape market dynamics over the next decade.

Manufacturing industries, particularly automotive and aerospace, represent the largest market segments, collectively accounting for over 45% of the total market share. This dominance stems from stringent regulatory requirements for fuel efficiency and emissions reduction, which have accelerated the adoption of advanced coating technologies to minimize frictional losses in engines and moving components.

Regionally, North America and Europe currently lead the market with combined revenue exceeding 5 billion USD, attributed to their established industrial bases and substantial R&D investments. However, the Asia-Pacific region, particularly China and India, demonstrates the highest growth potential with anticipated CAGR of 8.7% through 2028, driven by rapid industrialization and manufacturing expansion.

Customer demand patterns reveal a clear shift toward environmentally sustainable coating solutions with reduced VOC emissions and hazardous materials. This trend has catalyzed innovation in water-based and powder coating technologies, which now represent approximately 37% of new installations, up from just 22% five years ago.

Price sensitivity varies significantly across application sectors. High-performance applications in aerospace and precision machinery demonstrate low price elasticity, with customers prioritizing performance and reliability. Conversely, general industrial applications exhibit greater price sensitivity, creating distinct market segments with different value propositions.

The competitive landscape features both established players with comprehensive product portfolios and specialized niche providers focusing on specific coating technologies or application sectors. Recent market consolidation through mergers and acquisitions indicates industry maturation, with larger corporations seeking to expand their technological capabilities through strategic acquisitions of innovative smaller firms.

Future market growth will likely be driven by three key factors: increasing regulatory pressure for energy efficiency, growing awareness of lifecycle cost benefits from reduced maintenance requirements, and technological advancements enabling more durable and effective coating solutions. Emerging applications in renewable energy infrastructure and electric vehicle components represent particularly promising growth segments, with potential to reshape market dynamics over the next decade.

Current Challenges in Tribological Coating Technologies

Despite significant advancements in tribological coating technologies, several critical challenges continue to impede optimal performance and widespread industrial adoption. The primary challenge remains achieving the ideal balance between hardness and toughness in composite coatings. While increased hardness typically enhances wear resistance, it often comes at the expense of toughness, leading to premature coating failure under high-stress conditions or impact loading scenarios common in industrial machinery.

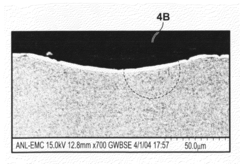

Adhesion between the coating and substrate presents another persistent challenge. Thermal expansion coefficient mismatches between composite coatings and metal substrates frequently result in delamination during thermal cycling, particularly in high-temperature applications such as combustion engines or industrial furnaces. This issue is exacerbated when coating thickness exceeds critical thresholds, creating internal stress concentrations that compromise structural integrity.

Uniformity in coating deposition across complex geometries remains problematic. Current technologies struggle to achieve consistent thickness and composition when coating irregular surfaces, internal cavities, or high-aspect-ratio features. This non-uniformity creates weak points in the tribological system, leading to localized wear and eventual system failure.

The environmental stability of advanced composite coatings presents significant challenges, particularly in corrosive or oxidizing environments. Many high-performance coatings that excel in wear resistance demonstrate poor chemical resistance, limiting their application in harsh industrial settings. Conversely, coatings with superior chemical resistance often underperform in mechanical wear scenarios.

Cost-effectiveness and scalability continue to hinder widespread industrial implementation. Many advanced coating technologies that demonstrate excellent laboratory performance require expensive equipment, specialized expertise, or time-consuming processes that make them economically unfeasible for mass production. The high capital investment required for technologies like physical vapor deposition (PVD) or chemical vapor deposition (CVD) systems restricts their adoption to high-value applications.

Reproducibility and quality control represent significant challenges in manufacturing environments. Slight variations in process parameters can dramatically alter coating properties, making consistent production difficult to maintain across batches. This variability complicates quality assurance protocols and increases production costs through higher rejection rates.

Finally, the environmental impact of coating processes poses increasing challenges as regulatory frameworks become more stringent. Traditional coating technologies often involve toxic precursors, generate hazardous waste, or consume substantial energy, creating both compliance issues and sustainability concerns for manufacturers seeking to reduce their environmental footprint.

Adhesion between the coating and substrate presents another persistent challenge. Thermal expansion coefficient mismatches between composite coatings and metal substrates frequently result in delamination during thermal cycling, particularly in high-temperature applications such as combustion engines or industrial furnaces. This issue is exacerbated when coating thickness exceeds critical thresholds, creating internal stress concentrations that compromise structural integrity.

Uniformity in coating deposition across complex geometries remains problematic. Current technologies struggle to achieve consistent thickness and composition when coating irregular surfaces, internal cavities, or high-aspect-ratio features. This non-uniformity creates weak points in the tribological system, leading to localized wear and eventual system failure.

The environmental stability of advanced composite coatings presents significant challenges, particularly in corrosive or oxidizing environments. Many high-performance coatings that excel in wear resistance demonstrate poor chemical resistance, limiting their application in harsh industrial settings. Conversely, coatings with superior chemical resistance often underperform in mechanical wear scenarios.

Cost-effectiveness and scalability continue to hinder widespread industrial implementation. Many advanced coating technologies that demonstrate excellent laboratory performance require expensive equipment, specialized expertise, or time-consuming processes that make them economically unfeasible for mass production. The high capital investment required for technologies like physical vapor deposition (PVD) or chemical vapor deposition (CVD) systems restricts their adoption to high-value applications.

Reproducibility and quality control represent significant challenges in manufacturing environments. Slight variations in process parameters can dramatically alter coating properties, making consistent production difficult to maintain across batches. This variability complicates quality assurance protocols and increases production costs through higher rejection rates.

Finally, the environmental impact of coating processes poses increasing challenges as regulatory frameworks become more stringent. Traditional coating technologies often involve toxic precursors, generate hazardous waste, or consume substantial energy, creating both compliance issues and sustainability concerns for manufacturers seeking to reduce their environmental footprint.

State-of-the-Art Composite Coating Solutions

01 Metal matrix composite coatings for wear resistance

Metal matrix composite coatings incorporate hard particles such as carbides, nitrides, or ceramics into a metal matrix to enhance wear resistance and reduce friction. These coatings provide superior mechanical properties and durability in high-wear applications. The metal matrix provides toughness and ductility while the hard particles resist abrasion, making these composites ideal for industrial components subjected to severe wear conditions.- Metal matrix composite coatings for wear resistance: Metal matrix composite coatings incorporate hard particles or reinforcements within a metal matrix to enhance wear resistance and reduce friction. These coatings typically use metals like nickel, copper, or aluminum as the matrix with reinforcements such as carbides, oxides, or ceramic particles. The combination provides superior hardness, durability, and tribological properties compared to single-phase coatings, making them suitable for high-wear applications in industrial equipment and machinery.

- Polymer-based composite coatings with lubricating properties: Polymer-based composite coatings incorporate solid lubricants or nanoparticles to reduce friction and improve wear resistance. These coatings combine polymers like PTFE, polyimide, or epoxy with additives such as graphene, molybdenum disulfide, or PTFE particles to create self-lubricating surfaces. The polymer matrix provides flexibility and adhesion while the additives reduce the coefficient of friction and enhance durability, making these coatings ideal for applications requiring low friction without external lubrication.

- Ceramic and cermet composite coatings for extreme wear conditions: Ceramic and cermet composite coatings provide exceptional wear resistance in extreme conditions. These coatings typically consist of ceramic materials like aluminum oxide, zirconium oxide, or silicon carbide, sometimes combined with metallic binders to form cermets. The resulting composites offer excellent hardness, thermal stability, and chemical resistance, making them suitable for high-temperature applications, cutting tools, and components exposed to severe abrasive wear. Advanced deposition techniques like plasma spraying or physical vapor deposition are used to apply these coatings.

- Nanocomposite coatings with enhanced tribological properties: Nanocomposite coatings incorporate nanoscale particles or structures to achieve superior tribological properties. These coatings typically feature nanoparticles such as carbon nanotubes, graphene, nano-ceramics, or metal nanoparticles dispersed within a matrix material. The nanoscale reinforcements create unique interfaces and structures that significantly reduce friction and enhance wear resistance beyond what conventional composites can achieve. The small size of the reinforcements allows for more uniform distribution and better mechanical properties, while maintaining smooth surfaces essential for reducing friction.

- Self-healing composite coatings for extended wear life: Self-healing composite coatings incorporate materials that can repair damage automatically, extending the service life of components subject to wear. These innovative coatings typically contain microcapsules filled with healing agents, shape memory materials, or reversible chemical bonds that activate when damage occurs. When the coating experiences wear or cracking, the healing mechanism is triggered to fill gaps and restore the protective barrier. This self-repair capability significantly extends coating lifetime and maintains consistent friction properties over longer periods, reducing maintenance requirements and downtime in industrial applications.

02 Polymer-based composite coatings with lubricating properties

Polymer-based composite coatings incorporate solid lubricants or nanoparticles to reduce friction and improve wear resistance. These coatings provide self-lubricating properties, reducing the coefficient of friction between contacting surfaces. The polymer matrix offers corrosion protection and flexibility, while additives such as PTFE, graphene, or molybdenum disulfide enhance the tribological performance, making these coatings suitable for applications where liquid lubricants are impractical.Expand Specific Solutions03 Ceramic and cermet composite coatings for extreme conditions

Ceramic and cermet composite coatings provide exceptional wear resistance in extreme temperature and harsh chemical environments. These coatings combine the hardness of ceramics with the toughness of metals to create surfaces that withstand severe abrasion, erosion, and thermal cycling. Advanced deposition techniques like plasma spraying or physical vapor deposition are used to apply these coatings, which find applications in aerospace, cutting tools, and high-temperature industrial processes.Expand Specific Solutions04 Nanocomposite coatings with enhanced tribological properties

Nanocomposite coatings incorporate nanoscale particles or structures to achieve superior friction and wear performance. The nanoscale reinforcements create unique interfaces and mechanical properties that cannot be achieved with conventional materials. These coatings exhibit exceptional hardness-to-toughness ratios, self-healing capabilities, and reduced friction coefficients. The nanoscale architecture allows for precise control of tribological properties, making these coatings ideal for precision components and advanced mechanical systems.Expand Specific Solutions05 Self-lubricating composite coatings with solid lubricant phases

Self-lubricating composite coatings incorporate solid lubricant phases that are released or exposed during wear to continuously provide lubrication. These coatings contain materials such as graphite, molybdenum disulfide, or hexagonal boron nitride embedded in a durable matrix. As the coating surface wears, fresh lubricant is continuously exposed, maintaining low friction without requiring external lubrication. This technology is particularly valuable in applications where conventional liquid lubricants cannot be used or maintained.Expand Specific Solutions

Leading Manufacturers and Research Institutions

The composite coatings market for friction and wear reduction in machinery is in a growth phase, driven by increasing demand for enhanced equipment durability and efficiency. The market is expanding rapidly with an estimated global value exceeding $5 billion, fueled by applications across automotive, manufacturing, and heavy equipment sectors. Technologically, the field shows varying maturity levels, with companies like Oerlikon Surface Solutions and Oerlikon Metco leading in advanced thermal spray technologies, while Caterpillar and Mercedes-Benz focus on application-specific solutions for heavy machinery. SKF (Svenska Kullagerfabriken) and NGK Insulators have developed specialized ceramic-based composite coatings, while PPG Industries and Dow Silicones are advancing polymer-composite coating technologies. Research institutions like Argonne National Laboratory and Shinshu University are pushing boundaries with nanomaterial-enhanced coatings.

Caterpillar, Inc.

Technical Solution: Caterpillar has developed proprietary composite coating systems specifically engineered for heavy machinery operating in extreme wear environments. Their Advanced Surface Technology (AST) program has yielded thermal spray composite coatings combining chromium carbide with nickel-chromium matrices, achieving hardness values exceeding 1000 HV while maintaining impact resistance necessary for earth-moving equipment. Caterpillar's innovation includes gradient-layered composite structures where coating composition transitions from ductile substrate-adjacent layers to wear-resistant outer surfaces, minimizing delamination risks. Their patented process incorporates post-coating laser treatment that creates controlled microcracking networks to improve thermal shock resistance while maintaining wear protection. Field testing has demonstrated service life improvements of 2-3 times compared to conventional hardfacing in mining applications, with documented friction coefficient reductions of approximately 30% in sliding contact conditions, resulting in measurable fuel efficiency improvements in their heavy equipment.

Strengths: Coatings specifically engineered for extreme-duty applications with proven field performance; integrated design approach considering both coating and component design; extensive real-world validation data. Weaknesses: Solutions primarily optimized for their own equipment; higher implementation costs compared to standard treatments; some coating systems require specialized maintenance procedures.

Oerlikon Metco (US), Inc.

Technical Solution: Oerlikon Metco has developed advanced thermal spray composite coating solutions specifically designed for friction and wear reduction in machinery. Their technology utilizes High Velocity Oxygen Fuel (HVOF) and Plasma Spray processes to apply metal matrix composite (MMC) coatings containing hard ceramic particles (such as WC, Cr3C2) embedded in metal matrices (Co, Ni, or CoCr alloys). These coatings achieve exceptional hardness (>1200 HV) while maintaining adequate toughness. Their proprietary powder manufacturing process ensures optimal particle size distribution and homogeneous dispersion of reinforcement phases, resulting in coatings with friction coefficients as low as 0.2 against steel counterfaces under lubricated conditions. Oerlikon's recent innovations include nanostructured cermet coatings that demonstrate up to 40% improved wear resistance compared to conventional microstructured variants when tested under ASTM G65 standards.

Strengths: Industry-leading thermal spray technology with precise control over coating microstructure; extensive material portfolio allowing customization for specific applications; global technical support network. Weaknesses: Higher initial implementation cost compared to conventional surface treatments; requires specialized equipment and expertise for application; some coating solutions may have thickness limitations affecting dimensional tolerances.

Key Patents and Innovations in Wear-Resistant Coatings

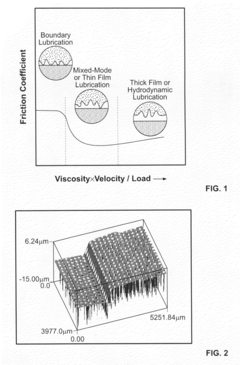

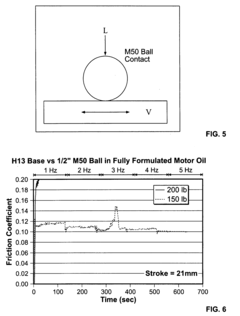

Modulated composite surfaces

PatentInactiveUS20080057272A1

Innovation

- The creation of structurally and compositionally modulated composite surfaces with concave textures, such as nano-to-micro size pores or dimples, filled with soft or hard coatings like copper or superhard nanocomposites, to enhance friction reduction and resistance to wear and scuffing under severe loading conditions.

Composite coatings for whisker reduction

PatentInactiveUS20090145764A1

Innovation

- A method of depositing composite coatings comprising tin and non-metallic particles, such as fluoropolymer particles, onto metal surfaces using electrolytic plating, which reduces tin whisker formation, increases wear resistance, and enhances corrosion resistance by incorporating surfactant-coated particles to stabilize and distribute the non-metallic particles uniformly.

Environmental Impact and Sustainability Considerations

The environmental impact of composite coatings for friction and wear reduction extends far beyond their immediate mechanical benefits. Traditional lubricants and coatings often contain harmful substances such as heavy metals, volatile organic compounds (VOCs), and persistent pollutants that can contaminate soil and water systems during production, application, and disposal phases. Composite coatings, particularly those incorporating nanomaterials and bio-based components, offer significant environmental advantages through reduced toxicity profiles and longer service lifespans.

Recent life cycle assessment (LCA) studies demonstrate that advanced composite coatings can reduce the environmental footprint of machinery operations by up to 30% compared to conventional solutions. This reduction stems primarily from decreased energy consumption during operation, extended maintenance intervals, and reduced raw material requirements over the equipment lifecycle. For instance, ceramic-polymer composite coatings have shown potential to extend component life by 2-3 times while reducing friction-related energy losses by 15-25%.

The sustainability aspects of composite coatings are increasingly driving research and development efforts. Bio-based composites utilizing renewable resources such as cellulose nanocrystals, lignin derivatives, and plant oils are emerging as environmentally responsible alternatives to petroleum-based components. These materials offer biodegradability advantages while maintaining competitive performance characteristics. A notable example is the development of soybean oil-based composite coatings that have demonstrated wear resistance comparable to synthetic counterparts while being 85% biodegradable.

Regulatory frameworks worldwide are evolving to prioritize environmentally friendly coating technologies. The European Union's REACH regulations and similar initiatives in North America and Asia are restricting the use of hazardous substances in coatings, accelerating the transition toward greener alternatives. This regulatory landscape is reshaping industry practices and creating market opportunities for sustainable composite coating solutions.

Circular economy principles are increasingly being applied to composite coating development. Researchers are exploring methods for coating recovery, recycling, and remanufacturing to minimize waste and maximize resource efficiency. Techniques such as mechanical separation, solvent-based recovery, and thermal decomposition show promise for reclaiming valuable components from spent composite coatings, though significant technical challenges remain in achieving economically viable recovery processes.

Water-based composite coating systems represent another significant advancement in environmental sustainability. These formulations drastically reduce VOC emissions compared to solvent-based alternatives, improving workplace safety and reducing atmospheric pollution. Recent innovations in water-based ceramic-polymer composites have achieved performance metrics approaching those of traditional solvent-based systems while reducing harmful emissions by over 90%.

Recent life cycle assessment (LCA) studies demonstrate that advanced composite coatings can reduce the environmental footprint of machinery operations by up to 30% compared to conventional solutions. This reduction stems primarily from decreased energy consumption during operation, extended maintenance intervals, and reduced raw material requirements over the equipment lifecycle. For instance, ceramic-polymer composite coatings have shown potential to extend component life by 2-3 times while reducing friction-related energy losses by 15-25%.

The sustainability aspects of composite coatings are increasingly driving research and development efforts. Bio-based composites utilizing renewable resources such as cellulose nanocrystals, lignin derivatives, and plant oils are emerging as environmentally responsible alternatives to petroleum-based components. These materials offer biodegradability advantages while maintaining competitive performance characteristics. A notable example is the development of soybean oil-based composite coatings that have demonstrated wear resistance comparable to synthetic counterparts while being 85% biodegradable.

Regulatory frameworks worldwide are evolving to prioritize environmentally friendly coating technologies. The European Union's REACH regulations and similar initiatives in North America and Asia are restricting the use of hazardous substances in coatings, accelerating the transition toward greener alternatives. This regulatory landscape is reshaping industry practices and creating market opportunities for sustainable composite coating solutions.

Circular economy principles are increasingly being applied to composite coating development. Researchers are exploring methods for coating recovery, recycling, and remanufacturing to minimize waste and maximize resource efficiency. Techniques such as mechanical separation, solvent-based recovery, and thermal decomposition show promise for reclaiming valuable components from spent composite coatings, though significant technical challenges remain in achieving economically viable recovery processes.

Water-based composite coating systems represent another significant advancement in environmental sustainability. These formulations drastically reduce VOC emissions compared to solvent-based alternatives, improving workplace safety and reducing atmospheric pollution. Recent innovations in water-based ceramic-polymer composites have achieved performance metrics approaching those of traditional solvent-based systems while reducing harmful emissions by over 90%.

Cost-Benefit Analysis of Advanced Coating Implementation

Implementing advanced composite coatings for friction and wear reduction in machinery represents a significant investment decision for organizations. This cost-benefit analysis examines the financial implications of adopting these technologies across various industrial applications.

Initial implementation costs for advanced composite coatings typically range from $5,000 to $50,000 per application, depending on coating complexity, surface area requirements, and application method. These figures include material costs, specialized equipment, and technical expertise required for proper application. For large-scale industrial operations, implementation across multiple machinery components can represent a capital expenditure of $100,000 to $500,000.

The return on investment timeline varies significantly by industry and application. Manufacturing operations typically see ROI within 12-24 months, while heavy industrial applications may achieve payback in as little as 6-9 months due to more severe wear conditions and higher replacement costs. Energy sector implementations often demonstrate ROI within 18-36 months.

Operational cost reductions represent the primary financial benefit, with documented decreases in maintenance costs ranging from 30-60%. Extended component lifespans of 2-5 times original duration directly reduce replacement part expenses and minimize costly production downtime. Energy efficiency improvements of 5-15% have been consistently reported across various applications due to reduced friction coefficients.

Indirect financial benefits include reduced lubricant consumption (typically 20-40% reduction), decreased waste disposal costs, and improved product quality through more consistent machine performance. Additionally, organizations implementing advanced coatings report fewer workplace accidents related to equipment failure, potentially reducing insurance premiums and liability exposure.

Risk factors affecting financial outcomes include coating failure due to improper application (occurring in approximately 8-12% of implementations), unexpected chemical incompatibilities with operating environments, and potential production disruptions during initial installation. These risks can be mitigated through proper testing protocols and phased implementation strategies.

Long-term financial modeling suggests that organizations adopting comprehensive coating strategies across critical machinery components can expect overall operational cost reductions of 15-25% over a five-year period, with the most significant savings occurring after the initial implementation and adjustment period.

Initial implementation costs for advanced composite coatings typically range from $5,000 to $50,000 per application, depending on coating complexity, surface area requirements, and application method. These figures include material costs, specialized equipment, and technical expertise required for proper application. For large-scale industrial operations, implementation across multiple machinery components can represent a capital expenditure of $100,000 to $500,000.

The return on investment timeline varies significantly by industry and application. Manufacturing operations typically see ROI within 12-24 months, while heavy industrial applications may achieve payback in as little as 6-9 months due to more severe wear conditions and higher replacement costs. Energy sector implementations often demonstrate ROI within 18-36 months.

Operational cost reductions represent the primary financial benefit, with documented decreases in maintenance costs ranging from 30-60%. Extended component lifespans of 2-5 times original duration directly reduce replacement part expenses and minimize costly production downtime. Energy efficiency improvements of 5-15% have been consistently reported across various applications due to reduced friction coefficients.

Indirect financial benefits include reduced lubricant consumption (typically 20-40% reduction), decreased waste disposal costs, and improved product quality through more consistent machine performance. Additionally, organizations implementing advanced coatings report fewer workplace accidents related to equipment failure, potentially reducing insurance premiums and liability exposure.

Risk factors affecting financial outcomes include coating failure due to improper application (occurring in approximately 8-12% of implementations), unexpected chemical incompatibilities with operating environments, and potential production disruptions during initial installation. These risks can be mitigated through proper testing protocols and phased implementation strategies.

Long-term financial modeling suggests that organizations adopting comprehensive coating strategies across critical machinery components can expect overall operational cost reductions of 15-25% over a five-year period, with the most significant savings occurring after the initial implementation and adjustment period.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!