Composite coatings standards and qualification pathways for industrial use

SEP 28, 202510 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Composite Coating Standards Evolution and Objectives

Composite coatings have evolved significantly over the past several decades, transforming from simple protective layers to sophisticated engineered systems with multiple functionalities. The development of these coatings began in the mid-20th century with basic polymer-matrix composites, primarily focused on corrosion protection. By the 1970s, ceramic-matrix and metal-matrix composite coatings emerged, expanding the application scope to high-temperature and high-wear environments in industrial settings.

The evolution of standards for composite coatings has followed a parallel trajectory to technological advancements. Early standards primarily addressed basic performance metrics such as adhesion strength and corrosion resistance. The 1980s saw the introduction of more comprehensive standards by organizations like ASTM International and ISO, which began to incorporate durability testing protocols and environmental exposure requirements.

A significant shift occurred in the 1990s when industry-specific standards began to emerge, particularly in aerospace, automotive, and marine sectors. These standards reflected the growing specialization of composite coatings for particular operational environments and performance requirements. The early 2000s marked another milestone with the integration of environmental considerations into standards, addressing VOC emissions, hazardous material content, and end-of-life disposal concerns.

Currently, composite coating standards are undergoing another transformation driven by digitalization and sustainability imperatives. Modern standards increasingly incorporate lifecycle assessment methodologies, accelerated testing protocols, and predictive performance modeling. The trend toward harmonization of international standards is also evident, with efforts to create globally recognized qualification pathways that reduce redundant testing and certification processes.

The primary objective of contemporary composite coating standards development is to establish robust, scientifically-based frameworks that ensure consistent performance across diverse industrial applications while accommodating rapid technological innovation. These standards aim to balance rigorous performance requirements with practical implementation considerations, enabling manufacturers to develop compliant products without stifling innovation.

Additional objectives include the development of standardized test methods that accurately predict long-term performance in real-world conditions, the establishment of clear qualification pathways for new coating technologies, and the creation of standards that address emerging applications such as smart coatings with embedded sensors or self-healing capabilities. The ultimate goal is to create a standards ecosystem that supports both incremental improvements and disruptive innovations in composite coating technology while ensuring safety, reliability, and sustainability across industrial sectors.

The evolution of standards for composite coatings has followed a parallel trajectory to technological advancements. Early standards primarily addressed basic performance metrics such as adhesion strength and corrosion resistance. The 1980s saw the introduction of more comprehensive standards by organizations like ASTM International and ISO, which began to incorporate durability testing protocols and environmental exposure requirements.

A significant shift occurred in the 1990s when industry-specific standards began to emerge, particularly in aerospace, automotive, and marine sectors. These standards reflected the growing specialization of composite coatings for particular operational environments and performance requirements. The early 2000s marked another milestone with the integration of environmental considerations into standards, addressing VOC emissions, hazardous material content, and end-of-life disposal concerns.

Currently, composite coating standards are undergoing another transformation driven by digitalization and sustainability imperatives. Modern standards increasingly incorporate lifecycle assessment methodologies, accelerated testing protocols, and predictive performance modeling. The trend toward harmonization of international standards is also evident, with efforts to create globally recognized qualification pathways that reduce redundant testing and certification processes.

The primary objective of contemporary composite coating standards development is to establish robust, scientifically-based frameworks that ensure consistent performance across diverse industrial applications while accommodating rapid technological innovation. These standards aim to balance rigorous performance requirements with practical implementation considerations, enabling manufacturers to develop compliant products without stifling innovation.

Additional objectives include the development of standardized test methods that accurately predict long-term performance in real-world conditions, the establishment of clear qualification pathways for new coating technologies, and the creation of standards that address emerging applications such as smart coatings with embedded sensors or self-healing capabilities. The ultimate goal is to create a standards ecosystem that supports both incremental improvements and disruptive innovations in composite coating technology while ensuring safety, reliability, and sustainability across industrial sectors.

Industrial Market Demand Analysis for Composite Coatings

The global market for composite coatings has been experiencing robust growth, driven primarily by increasing demand across automotive, aerospace, industrial equipment, and marine sectors. Current market valuations indicate that the composite coatings market is projected to grow at a compound annual growth rate of 7.2% through 2028, reflecting the expanding industrial applications and technological advancements in coating formulations.

Industrial sectors are increasingly demanding composite coatings that offer superior performance characteristics compared to traditional coating systems. The automotive industry, representing approximately 30% of the total market share, requires coatings that provide enhanced corrosion resistance, improved aesthetic appeal, and reduced environmental impact. Similarly, the aerospace sector demands coatings that can withstand extreme temperature variations, offer weight reduction benefits, and maintain structural integrity under harsh operating conditions.

The industrial equipment manufacturing segment shows growing interest in composite coatings that extend machinery lifespan and reduce maintenance costs. This sector particularly values coatings that provide wear resistance, chemical resistance, and thermal stability. Market research indicates that maintenance cost reduction potential is a primary driver, with companies reporting up to 40% decrease in maintenance expenses after implementing advanced composite coating solutions.

Regional analysis reveals that Asia-Pacific currently dominates the market with the highest growth rate, followed by North America and Europe. China and India are emerging as significant manufacturing hubs, contributing substantially to the increasing demand for industrial composite coatings. The shift of manufacturing activities to these regions has created new market opportunities for coating suppliers and technology providers.

Environmental regulations are significantly influencing market dynamics, with stricter VOC emission standards driving demand for water-based and powder composite coating systems. The European Union's REACH regulations and similar frameworks in North America have accelerated the transition toward environmentally friendly coating solutions, creating both challenges and opportunities for market players.

End-user industries are increasingly seeking customized coating solutions that address specific performance requirements. This trend has led to the development of specialized composite coatings designed for particular industrial applications, such as anti-fouling coatings for marine equipment, thermal barrier coatings for turbine components, and self-healing coatings for critical infrastructure.

The lack of standardized testing protocols and qualification pathways remains a significant barrier to wider adoption of composite coatings in certain industrial sectors. Manufacturers and end-users alike express the need for comprehensive standards that can reliably predict coating performance across various operating conditions and environments.

Industrial sectors are increasingly demanding composite coatings that offer superior performance characteristics compared to traditional coating systems. The automotive industry, representing approximately 30% of the total market share, requires coatings that provide enhanced corrosion resistance, improved aesthetic appeal, and reduced environmental impact. Similarly, the aerospace sector demands coatings that can withstand extreme temperature variations, offer weight reduction benefits, and maintain structural integrity under harsh operating conditions.

The industrial equipment manufacturing segment shows growing interest in composite coatings that extend machinery lifespan and reduce maintenance costs. This sector particularly values coatings that provide wear resistance, chemical resistance, and thermal stability. Market research indicates that maintenance cost reduction potential is a primary driver, with companies reporting up to 40% decrease in maintenance expenses after implementing advanced composite coating solutions.

Regional analysis reveals that Asia-Pacific currently dominates the market with the highest growth rate, followed by North America and Europe. China and India are emerging as significant manufacturing hubs, contributing substantially to the increasing demand for industrial composite coatings. The shift of manufacturing activities to these regions has created new market opportunities for coating suppliers and technology providers.

Environmental regulations are significantly influencing market dynamics, with stricter VOC emission standards driving demand for water-based and powder composite coating systems. The European Union's REACH regulations and similar frameworks in North America have accelerated the transition toward environmentally friendly coating solutions, creating both challenges and opportunities for market players.

End-user industries are increasingly seeking customized coating solutions that address specific performance requirements. This trend has led to the development of specialized composite coatings designed for particular industrial applications, such as anti-fouling coatings for marine equipment, thermal barrier coatings for turbine components, and self-healing coatings for critical infrastructure.

The lack of standardized testing protocols and qualification pathways remains a significant barrier to wider adoption of composite coatings in certain industrial sectors. Manufacturers and end-users alike express the need for comprehensive standards that can reliably predict coating performance across various operating conditions and environments.

Global Technical Landscape and Standardization Challenges

The composite coatings industry faces significant challenges in standardization across global markets. Currently, there exists a fragmented landscape of standards and qualification protocols that vary substantially between regions, creating barriers to international trade and technology transfer. In North America, ASTM International and NACE standards dominate, while Europe relies heavily on ISO and regional standards like DIN in Germany and BSI in the UK. Meanwhile, Asian markets, particularly China and Japan, have developed their own certification frameworks that often differ in testing methodologies and performance criteria.

This technical fragmentation has created a complex environment where manufacturers must navigate multiple certification processes to access global markets, significantly increasing compliance costs and time-to-market. The lack of harmonized standards particularly affects emerging composite coating technologies, where established testing protocols may not adequately address novel performance characteristics or application environments.

Recent efforts toward standardization have shown promising developments. The International Organization for Standardization (ISO) has established technical committees focused specifically on composite materials and protective coatings, working to develop unified testing methodologies and performance criteria. Similarly, industry consortia comprising major coating manufacturers, end-users, and research institutions have initiated collaborative projects to establish common qualification pathways.

A critical challenge in standardization efforts is balancing the need for rigorous qualification with practical implementation considerations. Accelerated testing methods that reliably predict long-term performance remain particularly contentious, as correlation between laboratory results and real-world performance varies significantly across different environmental conditions and substrate materials.

Digital transformation is reshaping standardization approaches, with increasing adoption of data-driven qualification methods. Advanced analytics and machine learning algorithms are being employed to establish correlations between manufacturing parameters, material properties, and in-service performance, potentially enabling more adaptive and responsive standardization frameworks.

Regulatory considerations further complicate the standardization landscape, with environmental regulations like REACH in Europe and similar frameworks in other regions imposing additional compliance requirements. The transition toward more sustainable coating technologies introduces new parameters that must be incorporated into existing standards, including end-of-life considerations and environmental impact assessments.

For multinational industrial users, navigating this complex standardization environment requires strategic approaches to qualification, often involving parallel certification processes and region-specific product variants. Leading organizations are increasingly adopting modular testing approaches that can be adapted to meet various regional requirements while maintaining core performance validation protocols.

This technical fragmentation has created a complex environment where manufacturers must navigate multiple certification processes to access global markets, significantly increasing compliance costs and time-to-market. The lack of harmonized standards particularly affects emerging composite coating technologies, where established testing protocols may not adequately address novel performance characteristics or application environments.

Recent efforts toward standardization have shown promising developments. The International Organization for Standardization (ISO) has established technical committees focused specifically on composite materials and protective coatings, working to develop unified testing methodologies and performance criteria. Similarly, industry consortia comprising major coating manufacturers, end-users, and research institutions have initiated collaborative projects to establish common qualification pathways.

A critical challenge in standardization efforts is balancing the need for rigorous qualification with practical implementation considerations. Accelerated testing methods that reliably predict long-term performance remain particularly contentious, as correlation between laboratory results and real-world performance varies significantly across different environmental conditions and substrate materials.

Digital transformation is reshaping standardization approaches, with increasing adoption of data-driven qualification methods. Advanced analytics and machine learning algorithms are being employed to establish correlations between manufacturing parameters, material properties, and in-service performance, potentially enabling more adaptive and responsive standardization frameworks.

Regulatory considerations further complicate the standardization landscape, with environmental regulations like REACH in Europe and similar frameworks in other regions imposing additional compliance requirements. The transition toward more sustainable coating technologies introduces new parameters that must be incorporated into existing standards, including end-of-life considerations and environmental impact assessments.

For multinational industrial users, navigating this complex standardization environment requires strategic approaches to qualification, often involving parallel certification processes and region-specific product variants. Leading organizations are increasingly adopting modular testing approaches that can be adapted to meet various regional requirements while maintaining core performance validation protocols.

Current Qualification Frameworks and Testing Methodologies

01 Standards for composite coating testing and certification

Various standards exist for testing and certifying composite coatings, ensuring they meet specific quality and performance requirements. These standards outline testing methodologies, acceptance criteria, and certification processes that manufacturers must follow to validate their coating systems. The standardization process helps ensure consistency and reliability in composite coating applications across different industries, particularly in aerospace, automotive, and construction sectors.- Standards for composite coating testing and qualification: Various standards exist for testing and qualifying composite coatings, including methods for evaluating coating performance, durability, and adherence to quality specifications. These standards provide systematic approaches to assess coating properties such as adhesion strength, wear resistance, and environmental durability. Qualification pathways typically involve a series of standardized tests that composite coatings must pass to be certified for specific applications, particularly in industries with strict performance requirements.

- Certification processes for composite coating applications: Certification processes for composite coatings involve systematic evaluation against established criteria to ensure they meet industry-specific requirements. These processes typically include documentation of material properties, performance testing under simulated conditions, and verification of manufacturing consistency. Certification pathways may vary by industry but generally require demonstration of compliance with relevant standards, quality control procedures, and performance benchmarks before coatings can be approved for specific applications.

- Quality control systems for composite coating manufacturing: Quality control systems for composite coating manufacturing involve comprehensive monitoring and testing protocols throughout the production process. These systems typically include raw material verification, process parameter monitoring, in-process testing, and final product evaluation to ensure consistent coating quality. Advanced quality control approaches may incorporate statistical process control, automated inspection technologies, and traceability systems to maintain manufacturing standards and detect deviations before they affect coating performance.

- Performance validation methodologies for composite coatings: Performance validation methodologies for composite coatings encompass a range of testing procedures designed to evaluate coating behavior under various conditions. These methodologies typically include accelerated aging tests, environmental exposure simulations, mechanical property assessments, and application-specific performance evaluations. Validation approaches may combine laboratory testing with field trials to comprehensively assess coating durability, functionality, and reliability before approval for specific applications.

- Digital certification and qualification tracking systems: Digital systems for tracking and managing composite coating certifications provide streamlined approaches to qualification documentation and compliance verification. These platforms typically offer capabilities for storing test results, certification documentation, and qualification status information in secure digital environments. Advanced systems may incorporate blockchain technology for immutable record-keeping, automated notification of certification expirations, and integration with supply chain management systems to ensure continuous compliance with relevant standards throughout the coating lifecycle.

02 Qualification pathways for composite coating applications

Qualification pathways for composite coatings involve systematic procedures to validate coating performance under specific conditions. These pathways typically include material characterization, application process validation, performance testing, and final approval processes. The qualification process ensures that composite coatings meet industry-specific requirements before being approved for use in critical applications, particularly in environments where coating failure could lead to significant consequences.Expand Specific Solutions03 Quality control systems for composite coating manufacturing

Quality control systems for composite coating manufacturing involve monitoring and verification processes throughout the production cycle. These systems incorporate automated inspection technologies, statistical process control methods, and documentation protocols to ensure consistent coating quality. Advanced quality control approaches may include real-time monitoring of application parameters, curing conditions, and final coating properties to detect and address deviations before they affect product quality.Expand Specific Solutions04 Certification and compliance frameworks for specialized applications

Certification and compliance frameworks for composite coatings in specialized applications establish specific requirements based on the intended use environment. These frameworks address factors such as chemical resistance, temperature tolerance, wear resistance, and environmental impact. Industry-specific certification processes may involve third-party testing, documentation of performance data, and periodic recertification to maintain compliance with evolving standards and regulations.Expand Specific Solutions05 Digital systems for composite coating qualification management

Digital systems for managing composite coating qualification processes leverage software platforms to streamline documentation, testing, and approval workflows. These systems facilitate data collection, analysis, and reporting throughout the qualification process, enabling more efficient tracking of compliance with standards. Advanced digital solutions may incorporate machine learning algorithms to predict coating performance based on formulation and application parameters, potentially reducing the time and resources required for qualification.Expand Specific Solutions

Leading Organizations and Certification Bodies in Coating Standards

The composite coatings industry is currently in a growth phase, with increasing demand across automotive, aerospace, and industrial sectors. The global market is estimated to reach $30-35 billion by 2025, driven by stringent environmental regulations and performance requirements. Technologically, the field shows varying maturity levels, with established players like PPG Industries, BASF Coatings, and Nippon Paint leading conventional applications, while companies such as Jiangsu Favored Nanotechnology and Nano & Advanced Materials Institute are advancing nano-coating innovations. Major industrial users including Boeing, Airbus, and Petróleo Brasileiro are driving qualification standards development. Research institutions like Jilin University and University of Houston collaborate with industry to bridge fundamental research and commercial applications, creating a competitive landscape balanced between established corporations and emerging technology specialists.

PPG Industries Ohio, Inc.

Technical Solution: PPG has developed ENVIROCRON® and POWERCRON® composite coating systems that combine epoxy, polyester, and acrylic technologies to create high-performance industrial finishes. Their approach incorporates multi-layer systems with specialized primers, intermediate coats, and topcoats that work synergistically to provide corrosion protection, chemical resistance, and aesthetic properties. PPG's qualification pathway includes comprehensive testing according to ASTM B117 for salt spray resistance, ASTM D4585 for humidity resistance, and ASTM D4060 for abrasion resistance. The company has established a standardized approach to coating qualification that includes both laboratory testing and field exposure trials in various industrial environments. Their composite coatings undergo rigorous chemical resistance testing against industrial fluids, solvents, and cleaning agents according to ASTM D1308 protocols. PPG has pioneered electrodeposition coating technologies for complex metal parts that ensure uniform coverage and exceptional corrosion protection while meeting automotive industry specifications. Their qualification process includes extensive documentation and traceability systems that align with ISO 9001 quality management requirements, ensuring consistent performance across global manufacturing facilities.

Strengths: Extensive global manufacturing network enabling consistent quality and availability; comprehensive technical service support for implementation and troubleshooting; strong track record of innovation in environmentally compliant coating technologies. Weaknesses: Complex qualification processes that can extend development timelines; higher implementation costs for specialized application equipment; challenges in maintaining color consistency across different substrate materials.

Nippon Paint (China) Co. Ltd.

Technical Solution: Nippon Paint has developed advanced composite coating systems under their NIPPELUX® and NIPPE CERAMO® brands that incorporate ceramic particles and fluoropolymers to enhance durability and performance. Their approach focuses on multi-functional coatings that provide corrosion protection, chemical resistance, and thermal stability in a single system. Nippon Paint's qualification pathway follows GB/T standards in China while also aligning with international standards such as ISO 12944 and ASTM D5894. Their composite coatings undergo comprehensive testing including QUV accelerated weathering (ASTM G154), salt spray resistance (ASTM B117), and adhesion testing (ASTM D3359). The company has pioneered self-stratifying coating technologies that automatically form optimal layer structures during curing, simplifying application processes while maintaining performance requirements. Nippon Paint has established a comprehensive qualification matrix that evaluates coatings across multiple performance parameters simultaneously, including corrosion protection, chemical resistance, and mechanical properties. Their testing protocols include both laboratory accelerated testing and real-world exposure in various industrial environments to validate performance claims and establish service life expectations.

Strengths: Strong position in Asian markets with deep understanding of regional industrial requirements; advanced R&D capabilities focused on environmentally compliant technologies; comprehensive technical support network throughout Asia. Weaknesses: Less established presence in Western markets compared to competitors; qualification pathways sometimes more aligned with regional rather than global standards; challenges in standardizing performance claims across different regulatory environments.

Key Technical Specifications and Performance Requirements

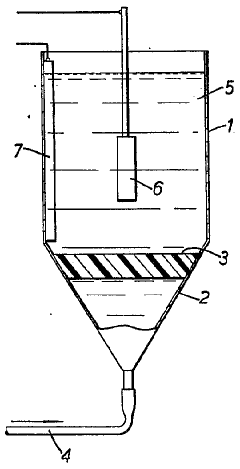

Improvements in and relating to electrodeposited composite coatings

PatentInactiveGB1236954A

Innovation

- The process involves electrodepositing a metal or alloy matrix with particles in an electroplating solution while introducing a stream of gas bubbles with diameters less than one millimeter, which reduces agglomeration by forming a thin oxide layer and physically preventing particle buildup, using a sintered material with fine passages to produce bubbles of optimal size and direction for improved coating quality.

Method and system for recommending a machine learning pipeline for an industrial use case

PatentWO2024223425A1

Innovation

- A method and system that utilize a graph database, language model, and neural networks to recommend a machine learning pipeline by embedding user-provided descriptions and attributes, leveraging connectivity patterns and relevance scoring to suggest suitable pipelines based on previous industrial use cases.

Regulatory Compliance and International Harmonization Efforts

The global regulatory landscape for composite coatings is characterized by a complex web of standards, certifications, and compliance requirements that vary significantly across regions. In North America, the American Society for Testing and Materials (ASTM) and the National Association of Corrosion Engineers (NACE) have established comprehensive standards for industrial coatings, with particular emphasis on corrosion protection and durability metrics. These standards are widely adopted by industries ranging from aerospace to maritime applications, forming the backbone of quality assurance protocols.

European regulatory frameworks, primarily driven by the European Committee for Standardization (CEN) and the Registration, Evaluation, Authorization and Restriction of Chemicals (REACH) regulations, place greater emphasis on environmental impact and chemical safety. The EU's approach tends to be more precautionary, requiring extensive documentation of chemical constituents and their potential health effects before market approval.

Asia-Pacific regions demonstrate considerable variation in regulatory maturity, with Japan and South Korea maintaining stringent standards comparable to Western counterparts, while emerging economies often adopt modified versions of international standards. China's recent development of the GB standards for composite coatings represents a significant step toward regulatory sophistication in the region.

International harmonization efforts have gained momentum in the past decade, primarily through the International Organization for Standardization (ISO) technical committees dedicated to paints and coatings. ISO 12944 and ISO 20340 have emerged as globally recognized benchmarks for corrosion protection in various environmental exposure categories, facilitating cross-border trade and technology transfer.

Industry consortia and professional associations play a crucial role in bridging regulatory gaps and establishing common qualification pathways. Organizations such as the Powder Coating Institute (PCI) and the European Coatings Association have developed certification programs that complement formal regulatory requirements, providing manufacturers with additional credibility in competitive markets.

Recent trends indicate movement toward performance-based standards rather than prescriptive requirements, allowing for greater innovation while maintaining safety and quality objectives. This shift acknowledges the rapid pace of technological advancement in composite coating formulations and application techniques, particularly in nanomaterial integration and environmentally friendly solutions.

Mutual recognition agreements between major regulatory bodies represent a promising development for reducing compliance burdens. The bilateral agreements between the EU and US FDA for certain industrial applications have created templates for future harmonization efforts, potentially streamlining qualification processes for multinational manufacturers.

European regulatory frameworks, primarily driven by the European Committee for Standardization (CEN) and the Registration, Evaluation, Authorization and Restriction of Chemicals (REACH) regulations, place greater emphasis on environmental impact and chemical safety. The EU's approach tends to be more precautionary, requiring extensive documentation of chemical constituents and their potential health effects before market approval.

Asia-Pacific regions demonstrate considerable variation in regulatory maturity, with Japan and South Korea maintaining stringent standards comparable to Western counterparts, while emerging economies often adopt modified versions of international standards. China's recent development of the GB standards for composite coatings represents a significant step toward regulatory sophistication in the region.

International harmonization efforts have gained momentum in the past decade, primarily through the International Organization for Standardization (ISO) technical committees dedicated to paints and coatings. ISO 12944 and ISO 20340 have emerged as globally recognized benchmarks for corrosion protection in various environmental exposure categories, facilitating cross-border trade and technology transfer.

Industry consortia and professional associations play a crucial role in bridging regulatory gaps and establishing common qualification pathways. Organizations such as the Powder Coating Institute (PCI) and the European Coatings Association have developed certification programs that complement formal regulatory requirements, providing manufacturers with additional credibility in competitive markets.

Recent trends indicate movement toward performance-based standards rather than prescriptive requirements, allowing for greater innovation while maintaining safety and quality objectives. This shift acknowledges the rapid pace of technological advancement in composite coating formulations and application techniques, particularly in nanomaterial integration and environmentally friendly solutions.

Mutual recognition agreements between major regulatory bodies represent a promising development for reducing compliance burdens. The bilateral agreements between the EU and US FDA for certain industrial applications have created templates for future harmonization efforts, potentially streamlining qualification processes for multinational manufacturers.

Environmental Sustainability and Life Cycle Assessment Protocols

The environmental impact of composite coatings has become increasingly significant as industries face stricter regulations and growing consumer demand for sustainable products. Life Cycle Assessment (LCA) protocols provide a systematic framework for evaluating the environmental footprint of composite coatings throughout their entire lifecycle, from raw material extraction to end-of-life disposal. These assessments typically measure key environmental indicators including greenhouse gas emissions, energy consumption, water usage, and waste generation.

Current LCA methodologies for composite coatings follow ISO 14040 and 14044 standards, which establish the principles, framework, requirements, and guidelines for conducting comprehensive environmental assessments. However, the complex nature of composite materials, with their multiple components and varied application methods, presents unique challenges for standardized assessment protocols. Industry-specific adaptations of these protocols have emerged to address the particular characteristics of aerospace, automotive, and marine applications.

Recent advancements in LCA tools specifically designed for coating technologies have improved the accuracy of environmental impact measurements. These tools incorporate databases of material properties and processing parameters that enable more precise calculations of environmental burdens. The European Chemical Agency (ECHA) and the Environmental Protection Agency (EPA) have developed specialized frameworks that account for the toxicity profiles of coating components and their potential environmental persistence.

Qualification pathways for environmentally sustainable composite coatings now commonly include criteria for VOC (Volatile Organic Compound) content, heavy metal absence, and biodegradability metrics. The Green Screen for Safer Chemicals and CleanGredients certification programs provide benchmarks for evaluating the environmental performance of coating formulations. Additionally, the Environmental Product Declaration (EPD) system offers a standardized method for communicating verified environmental information across the coating supply chain.

Emerging trends in environmental sustainability for composite coatings include the development of bio-based alternatives to traditional petroleum-derived components. These innovations aim to reduce carbon footprints while maintaining or enhancing coating performance characteristics. Circular economy principles are also being integrated into coating standards, with increasing emphasis on recyclability, reusability, and waste minimization throughout the coating lifecycle.

The economic implications of adopting environmentally sustainable coating practices are becoming more favorable as regulatory pressures increase and production scales improve. Cost-benefit analyses now frequently demonstrate that investments in greener coating technologies yield returns through reduced compliance costs, improved market access, and enhanced brand reputation. This economic reality is accelerating the industry's transition toward more sustainable coating solutions and driving the evolution of corresponding assessment protocols.

Current LCA methodologies for composite coatings follow ISO 14040 and 14044 standards, which establish the principles, framework, requirements, and guidelines for conducting comprehensive environmental assessments. However, the complex nature of composite materials, with their multiple components and varied application methods, presents unique challenges for standardized assessment protocols. Industry-specific adaptations of these protocols have emerged to address the particular characteristics of aerospace, automotive, and marine applications.

Recent advancements in LCA tools specifically designed for coating technologies have improved the accuracy of environmental impact measurements. These tools incorporate databases of material properties and processing parameters that enable more precise calculations of environmental burdens. The European Chemical Agency (ECHA) and the Environmental Protection Agency (EPA) have developed specialized frameworks that account for the toxicity profiles of coating components and their potential environmental persistence.

Qualification pathways for environmentally sustainable composite coatings now commonly include criteria for VOC (Volatile Organic Compound) content, heavy metal absence, and biodegradability metrics. The Green Screen for Safer Chemicals and CleanGredients certification programs provide benchmarks for evaluating the environmental performance of coating formulations. Additionally, the Environmental Product Declaration (EPD) system offers a standardized method for communicating verified environmental information across the coating supply chain.

Emerging trends in environmental sustainability for composite coatings include the development of bio-based alternatives to traditional petroleum-derived components. These innovations aim to reduce carbon footprints while maintaining or enhancing coating performance characteristics. Circular economy principles are also being integrated into coating standards, with increasing emphasis on recyclability, reusability, and waste minimization throughout the coating lifecycle.

The economic implications of adopting environmentally sustainable coating practices are becoming more favorable as regulatory pressures increase and production scales improve. Cost-benefit analyses now frequently demonstrate that investments in greener coating technologies yield returns through reduced compliance costs, improved market access, and enhanced brand reputation. This economic reality is accelerating the industry's transition toward more sustainable coating solutions and driving the evolution of corresponding assessment protocols.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!