Comparative analysis of Composite coatings coating strategies and material selection

SEP 28, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Composite Coating Evolution and Objectives

Composite coatings have evolved significantly over the past several decades, transforming from simple protective layers to sophisticated engineered materials with multifunctional capabilities. The development trajectory began in the 1950s with basic polymer-matrix composites, progressing through metal-matrix and ceramic-matrix systems in subsequent decades. By the 1990s, nanocomposite coatings emerged, revolutionizing the field with unprecedented property enhancements at minimal thickness.

The current technological landscape features advanced composite coatings incorporating various reinforcement materials including ceramics, carbon-based materials, and metallic particles, each selected to impart specific properties such as wear resistance, corrosion protection, thermal stability, or electrical conductivity. Recent innovations have focused on self-healing capabilities, stimuli-responsive behaviors, and environmentally sustainable formulations.

Market demands have driven coating evolution toward multifunctionality, with modern applications requiring simultaneous performance across multiple parameters. Aerospace applications demand thermal resistance alongside weight reduction, while medical implants require biocompatibility with antimicrobial properties. This convergence of requirements has accelerated research into hybrid composite systems that synergistically combine multiple materials and deposition techniques.

The primary objective in composite coating development is achieving optimal property combinations through strategic material selection and processing methods. This includes maximizing adhesion strength between coating and substrate, ensuring uniform dispersion of reinforcement materials, and maintaining coating integrity under operational conditions. Secondary objectives include cost-effectiveness, scalability for industrial implementation, and compliance with increasingly stringent environmental regulations.

Technical challenges persist in several areas, particularly in achieving uniform dispersion of reinforcement materials within the matrix, preventing agglomeration of nanoparticles, and ensuring strong interfacial bonding between disparate materials. These challenges have spurred innovations in surface functionalization techniques, novel deposition methods, and advanced characterization tools.

Looking forward, the field aims to develop predictive models for composite coating performance, enabling design optimization before physical prototyping. Additional objectives include extending service lifetimes through enhanced durability, reducing environmental impact through green chemistry approaches, and developing coatings with in-situ monitoring capabilities through embedded sensors or smart materials.

The convergence of nanotechnology, materials science, and surface engineering continues to expand the possibilities for composite coatings, with recent breakthroughs in graphene-reinforced systems, ceramic-metal hybrids, and bioinspired structures demonstrating the vast untapped potential in this field.

The current technological landscape features advanced composite coatings incorporating various reinforcement materials including ceramics, carbon-based materials, and metallic particles, each selected to impart specific properties such as wear resistance, corrosion protection, thermal stability, or electrical conductivity. Recent innovations have focused on self-healing capabilities, stimuli-responsive behaviors, and environmentally sustainable formulations.

Market demands have driven coating evolution toward multifunctionality, with modern applications requiring simultaneous performance across multiple parameters. Aerospace applications demand thermal resistance alongside weight reduction, while medical implants require biocompatibility with antimicrobial properties. This convergence of requirements has accelerated research into hybrid composite systems that synergistically combine multiple materials and deposition techniques.

The primary objective in composite coating development is achieving optimal property combinations through strategic material selection and processing methods. This includes maximizing adhesion strength between coating and substrate, ensuring uniform dispersion of reinforcement materials, and maintaining coating integrity under operational conditions. Secondary objectives include cost-effectiveness, scalability for industrial implementation, and compliance with increasingly stringent environmental regulations.

Technical challenges persist in several areas, particularly in achieving uniform dispersion of reinforcement materials within the matrix, preventing agglomeration of nanoparticles, and ensuring strong interfacial bonding between disparate materials. These challenges have spurred innovations in surface functionalization techniques, novel deposition methods, and advanced characterization tools.

Looking forward, the field aims to develop predictive models for composite coating performance, enabling design optimization before physical prototyping. Additional objectives include extending service lifetimes through enhanced durability, reducing environmental impact through green chemistry approaches, and developing coatings with in-situ monitoring capabilities through embedded sensors or smart materials.

The convergence of nanotechnology, materials science, and surface engineering continues to expand the possibilities for composite coatings, with recent breakthroughs in graphene-reinforced systems, ceramic-metal hybrids, and bioinspired structures demonstrating the vast untapped potential in this field.

Market Applications and Industry Demand Analysis

The composite coatings market has witnessed substantial growth in recent years, driven by increasing demand across multiple industrial sectors. The global market for composite coatings was valued at approximately 11.7 billion USD in 2022 and is projected to reach 17.2 billion USD by 2028, representing a compound annual growth rate of 6.5%. This growth trajectory is primarily fueled by expanding applications in aerospace, automotive, marine, and industrial equipment sectors.

In the aerospace industry, composite coatings have become indispensable for enhancing aircraft performance and durability. The sector demands coatings that provide exceptional resistance to extreme temperatures, corrosion, and wear while maintaining minimal weight impact. With commercial aviation projected to double its fleet size over the next two decades, the demand for advanced composite coating solutions continues to accelerate.

The automotive industry represents another significant market driver, with manufacturers increasingly adopting composite coatings to address challenges related to fuel efficiency, emissions reduction, and vehicle longevity. Particularly noteworthy is the growing electric vehicle segment, which requires specialized coating solutions for battery components and lightweight body structures. Industry analysts estimate that automotive applications account for approximately 28% of the total composite coatings market.

Marine and offshore applications constitute a rapidly expanding market segment, with particular emphasis on anti-corrosion and anti-fouling properties. The harsh saltwater environment necessitates coating solutions that can withstand extreme conditions while providing long-term protection. The offshore energy sector, including wind farms and oil platforms, has emerged as a significant consumer of specialized composite coating technologies.

Industrial equipment manufacturers increasingly rely on composite coatings to extend machinery lifespan and reduce maintenance costs. The industrial sector values coatings that provide resistance to chemical exposure, abrasion, and thermal cycling. This market segment has shown particular interest in environmentally friendly coating alternatives that comply with increasingly stringent regulations regarding volatile organic compounds (VOCs) and hazardous air pollutants.

Regional analysis reveals that North America and Europe currently dominate the composite coatings market, accounting for approximately 60% of global demand. However, the Asia-Pacific region, particularly China and India, demonstrates the highest growth rate, driven by rapid industrialization and infrastructure development. Emerging economies in Latin America and the Middle East are also showing increased adoption of advanced coating technologies across various industrial applications.

In the aerospace industry, composite coatings have become indispensable for enhancing aircraft performance and durability. The sector demands coatings that provide exceptional resistance to extreme temperatures, corrosion, and wear while maintaining minimal weight impact. With commercial aviation projected to double its fleet size over the next two decades, the demand for advanced composite coating solutions continues to accelerate.

The automotive industry represents another significant market driver, with manufacturers increasingly adopting composite coatings to address challenges related to fuel efficiency, emissions reduction, and vehicle longevity. Particularly noteworthy is the growing electric vehicle segment, which requires specialized coating solutions for battery components and lightweight body structures. Industry analysts estimate that automotive applications account for approximately 28% of the total composite coatings market.

Marine and offshore applications constitute a rapidly expanding market segment, with particular emphasis on anti-corrosion and anti-fouling properties. The harsh saltwater environment necessitates coating solutions that can withstand extreme conditions while providing long-term protection. The offshore energy sector, including wind farms and oil platforms, has emerged as a significant consumer of specialized composite coating technologies.

Industrial equipment manufacturers increasingly rely on composite coatings to extend machinery lifespan and reduce maintenance costs. The industrial sector values coatings that provide resistance to chemical exposure, abrasion, and thermal cycling. This market segment has shown particular interest in environmentally friendly coating alternatives that comply with increasingly stringent regulations regarding volatile organic compounds (VOCs) and hazardous air pollutants.

Regional analysis reveals that North America and Europe currently dominate the composite coatings market, accounting for approximately 60% of global demand. However, the Asia-Pacific region, particularly China and India, demonstrates the highest growth rate, driven by rapid industrialization and infrastructure development. Emerging economies in Latin America and the Middle East are also showing increased adoption of advanced coating technologies across various industrial applications.

Current Technological Limitations and Challenges

Despite significant advancements in composite coating technologies, several critical limitations and challenges persist across the global landscape. The primary technical constraint remains the trade-off between coating properties - enhancing one characteristic often compromises another. For instance, improving wear resistance frequently reduces corrosion protection or increases brittleness, creating a persistent engineering dilemma that limits application versatility.

Adhesion issues continue to plague many composite coating systems, particularly when applied to complex geometries or substrates with varying surface properties. The interface between coating and substrate represents a critical vulnerability point, with delamination and adhesion failure occurring under thermal cycling, mechanical stress, or chemical exposure conditions. This challenge is especially pronounced in harsh operating environments where multiple stressors act simultaneously.

Scalability presents another significant hurdle, as many promising laboratory-scale coating techniques struggle with industrial implementation. The transition from controlled research environments to mass production often reveals inconsistencies in coating quality, thickness uniformity, and performance reproducibility. This scaling gap has slowed commercial adoption of several innovative coating technologies.

Material compatibility constraints further complicate coating development, with certain substrate-coating combinations exhibiting poor interfacial bonding or undesirable chemical interactions. These incompatibilities necessitate additional processing steps like surface treatments or primer layers, increasing production complexity and costs while potentially introducing new failure modes.

Environmental and regulatory challenges have intensified as traditional coating components face increasing restrictions. The phase-out of chromates, certain solvents, and other environmentally problematic materials has forced rapid reformulation without compromising performance, creating significant technical hurdles for coating developers and manufacturers.

Process control limitations affect coating quality consistency, with parameters like temperature, humidity, and application technique significantly influencing final properties. The sensitivity of composite coating performance to processing variables makes standardization difficult and increases rejection rates in production environments.

Characterization and testing methodologies remain inadequate for predicting long-term performance, particularly for novel coating systems. Accelerated testing protocols often fail to accurately simulate real-world degradation mechanisms, creating uncertainty in lifetime predictions and reliability assessments. This testing gap hampers industry confidence in adopting new coating technologies despite promising initial results.

Adhesion issues continue to plague many composite coating systems, particularly when applied to complex geometries or substrates with varying surface properties. The interface between coating and substrate represents a critical vulnerability point, with delamination and adhesion failure occurring under thermal cycling, mechanical stress, or chemical exposure conditions. This challenge is especially pronounced in harsh operating environments where multiple stressors act simultaneously.

Scalability presents another significant hurdle, as many promising laboratory-scale coating techniques struggle with industrial implementation. The transition from controlled research environments to mass production often reveals inconsistencies in coating quality, thickness uniformity, and performance reproducibility. This scaling gap has slowed commercial adoption of several innovative coating technologies.

Material compatibility constraints further complicate coating development, with certain substrate-coating combinations exhibiting poor interfacial bonding or undesirable chemical interactions. These incompatibilities necessitate additional processing steps like surface treatments or primer layers, increasing production complexity and costs while potentially introducing new failure modes.

Environmental and regulatory challenges have intensified as traditional coating components face increasing restrictions. The phase-out of chromates, certain solvents, and other environmentally problematic materials has forced rapid reformulation without compromising performance, creating significant technical hurdles for coating developers and manufacturers.

Process control limitations affect coating quality consistency, with parameters like temperature, humidity, and application technique significantly influencing final properties. The sensitivity of composite coating performance to processing variables makes standardization difficult and increases rejection rates in production environments.

Characterization and testing methodologies remain inadequate for predicting long-term performance, particularly for novel coating systems. Accelerated testing protocols often fail to accurately simulate real-world degradation mechanisms, creating uncertainty in lifetime predictions and reliability assessments. This testing gap hampers industry confidence in adopting new coating technologies despite promising initial results.

Contemporary Coating Strategies Comparison

01 Metal-based composite coatings for corrosion protection

Metal-based composite coatings provide enhanced corrosion protection for various substrates. These coatings typically incorporate metal particles or compounds such as zinc, aluminum, or nickel within a matrix to create a protective barrier. The composite structure offers improved adhesion, durability, and resistance to environmental factors compared to traditional single-layer coatings. These coatings can be applied through various methods including electroplating, thermal spraying, or chemical deposition techniques.- Metal-based composite coatings: Metal-based composite coatings involve the application of metallic materials combined with other substances to create protective layers with enhanced properties. These coatings typically incorporate metals such as aluminum, zinc, or copper with polymers or ceramic particles to improve corrosion resistance, wear resistance, and thermal stability. The metal components provide structural integrity while the additional materials contribute specific functional properties, resulting in coatings suitable for industrial applications requiring durability under harsh conditions.

- Polymer-ceramic composite coatings: Polymer-ceramic composite coatings combine organic polymers with inorganic ceramic particles to create versatile protective layers. These coatings leverage the flexibility and adhesion properties of polymers with the hardness and thermal resistance of ceramics. The resulting composites offer improved scratch resistance, chemical stability, and thermal insulation properties. Applications include automotive parts, electronic components, and architectural surfaces where both protection and specific functional properties are required.

- Nanocomposite coating technologies: Nanocomposite coatings incorporate nanoscale particles or structures within a matrix material to achieve superior performance characteristics. By dispersing nanoparticles such as carbon nanotubes, graphene, or metal oxide nanoparticles throughout the coating matrix, these technologies create materials with exceptional strength-to-weight ratios, self-healing capabilities, and enhanced barrier properties. The nanoscale components significantly improve wear resistance, corrosion protection, and can introduce novel functionalities such as antimicrobial properties or electrical conductivity.

- Environmental-friendly composite coating formulations: Environmental-friendly composite coating formulations focus on reducing harmful substances while maintaining high performance. These coatings utilize water-based systems, bio-derived materials, and low-VOC (volatile organic compound) components to minimize environmental impact. Sustainable raw materials such as plant-based polymers, natural minerals, and recycled content are incorporated to create eco-friendly alternatives to traditional coatings. These formulations address increasing regulatory requirements and consumer demand for sustainable products while providing effective protection and aesthetic properties.

- Multi-functional protective composite coatings: Multi-functional protective composite coatings are engineered to provide multiple performance benefits simultaneously. These advanced coating systems combine various materials to deliver properties such as corrosion resistance, thermal insulation, impact resistance, and self-cleaning capabilities in a single application. By strategically layering different materials or creating specialized composite structures, these coatings can adapt to changing environmental conditions and provide long-term protection across diverse applications including aerospace, marine environments, and infrastructure protection.

02 Polymer-based composite coatings with enhanced properties

Polymer-based composite coatings combine polymeric materials with various additives to achieve specific performance characteristics. These coatings incorporate fillers, reinforcing agents, or functional additives within a polymer matrix to enhance properties such as wear resistance, chemical resistance, or thermal stability. The polymer matrix provides flexibility and adhesion while the additives contribute specialized properties. Applications include protective finishes for industrial equipment, automotive components, and consumer products.Expand Specific Solutions03 Ceramic and inorganic composite coatings for high-temperature applications

Ceramic and inorganic composite coatings are designed for extreme environments requiring high-temperature resistance. These coatings typically combine ceramic materials with other inorganic compounds to create protective layers that can withstand thermal cycling, oxidation, and mechanical stress. The composite structure allows for improved thermal barrier properties while maintaining structural integrity. These coatings find applications in aerospace components, industrial furnaces, and other high-temperature environments.Expand Specific Solutions04 Nanocomposite coatings with advanced functional properties

Nanocomposite coatings incorporate nanoscale particles or structures within a coating matrix to achieve enhanced functional properties. These coatings utilize the unique properties of nanomaterials to improve characteristics such as hardness, scratch resistance, self-cleaning capabilities, or antimicrobial properties. The nanoscale components create a large interfacial area within the coating, leading to synergistic effects that cannot be achieved with conventional materials. Applications include protective coatings for electronics, medical devices, and architectural surfaces.Expand Specific Solutions05 Environmentally friendly composite coating formulations

Environmentally friendly composite coating formulations focus on reducing environmental impact while maintaining performance requirements. These coatings utilize water-based systems, bio-derived components, or low-VOC formulations to create sustainable alternatives to traditional solvent-based coatings. The composite structure often incorporates renewable materials or recycled content while achieving comparable protection and durability. These green coating technologies address increasing regulatory requirements and consumer demand for environmentally responsible products.Expand Specific Solutions

Leading Manufacturers and Research Institutions

The composite coatings market is in a growth phase, characterized by increasing demand across aerospace, automotive, and industrial sectors. The market size is expanding due to rising applications in corrosion protection and performance enhancement, estimated to reach significant value in the coming years. Technologically, the field shows varying maturity levels with established players like Boeing, DuPont, and PPG Industries leading conventional applications, while companies such as Crompton Technology Group and Nano & Advanced Materials Institute are advancing innovative solutions. Universities including Central South University and Nanyang Technological University contribute significantly to R&D. The competitive landscape features diversification between traditional coating manufacturers and specialized technology firms, with increasing focus on environmentally sustainable solutions and nano-enhanced composites.

The Boeing Co.

Technical Solution: Boeing has developed sophisticated composite coating systems specifically engineered for aerospace applications that combine exceptional durability with minimal weight penalties. Their approach involves multi-layer architectures with specialized interlayer adhesion promoters that maintain structural integrity under extreme thermal cycling (-65°C to +180°C). Boeing's proprietary composite coatings incorporate ceramic nanoparticles (10-30nm) that enhance erosion resistance while maintaining flexibility necessary for aircraft components that experience continuous vibration and flexing. Their research has demonstrated that precisely controlled particle size distribution and surface functionalization are critical for achieving optimal dispersion and mechanical properties. Boeing's advanced coating systems feature specialized top coats with hydrophobic and ice-phobic properties that reduce drag and prevent ice accumulation, improving fuel efficiency by approximately 2-3%. Their composite coating strategy includes electrically conductive layers that provide electromagnetic interference (EMI) shielding and lightning strike protection while maintaining the lightweight advantages of composite structures.

Strengths: Exceptional resistance to extreme environmental conditions; superior erosion protection at high speeds; excellent chemical resistance against aviation fluids; multifunctional performance including EMI shielding. Weaknesses: Extremely high production costs; complex application procedures requiring specialized equipment; longer curing and quality verification processes; limited repairability in field conditions.

PPG Industries Ohio, Inc.

Technical Solution: PPG has developed an innovative composite coating strategy centered around their proprietary "Stratified Layer Technology" that creates functionally graded coatings with optimized performance at each layer. Their approach involves careful material selection combining organic and inorganic components to achieve synergistic effects. PPG's advanced composite coatings incorporate specially engineered nanoparticles (15-40nm) that enhance mechanical properties without compromising optical clarity. Their research has demonstrated that controlled distribution of these nanoparticles throughout the coating matrix can increase scratch resistance by up to 60% while maintaining excellent gloss retention. PPG's water-based composite formulations achieve VOC levels below 100 g/L through innovative polymer chemistry that maintains performance comparable to traditional solvent-based systems. Their multi-layer approach includes specialized interlayer bonding technologies that prevent delamination under thermal cycling and mechanical stress, extending coating lifespans by approximately 35% compared to conventional systems.

Strengths: Exceptional weatherability with industry-leading UV resistance; superior scratch and mar resistance; environmentally compliant formulations; excellent color stability and appearance retention. Weaknesses: Higher initial cost compared to conventional coating systems; more complex application process requiring precise control of environmental conditions; longer curing times for certain specialized formulations.

Key Material Selection Criteria and Properties

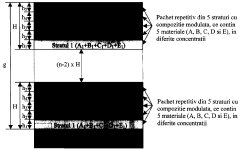

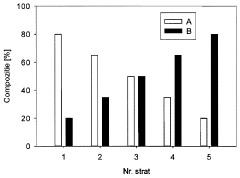

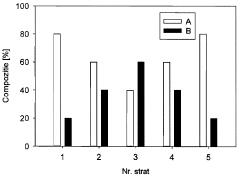

Processes, materials, material selection criteria, and optimization principles for preparing tribological coatings with repetitive structure and modulated composition

PatentUndeterminedRO131273A0

Innovation

- The development of tribological coatings with a repetitive structure and modulated composition using advanced deposition methods like PVD, IPVD, and open atmosphere techniques, which allow for the simultaneous deposition of multiple materials in varying concentrations, ensuring synergistic cumulation of properties like modulus of elasticity, hardness, thermal conductivity, and electronegativity.

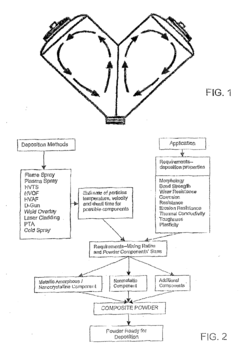

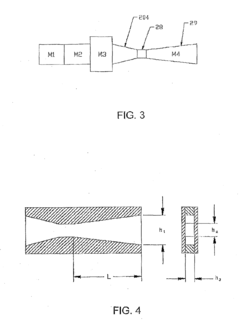

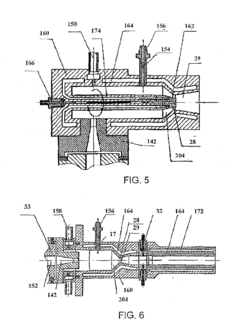

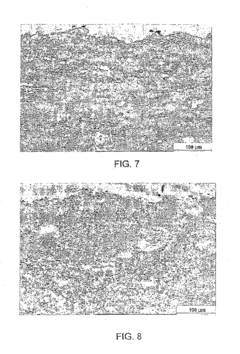

Deposition System, Method And Materials For Composite Coatings

PatentInactiveUS20130098267A1

Innovation

- Development of composite metal-ceramic powders with amorphous or nanocrystalline metallic components, combined with nonmetallic components, to form coatings that exhibit high corrosion resistance and structural properties, using thermal spraying processes that control particle temperature and velocity to prevent splashing and enhance bonding.

Environmental Impact and Sustainability Factors

The environmental impact of composite coating processes has become a critical consideration in material selection and application strategies. Traditional coating methods often involve volatile organic compounds (VOCs) and hazardous air pollutants that contribute significantly to air quality degradation and pose health risks to workers. Recent regulatory frameworks, including the European Union's REACH regulation and the United States EPA's Clean Air Act amendments, have accelerated the transition toward more environmentally responsible coating technologies.

Water-based composite coating systems have emerged as promising alternatives, reducing VOC emissions by up to 80% compared to solvent-based counterparts. However, these systems often present challenges in terms of performance characteristics such as corrosion resistance and durability, necessitating careful formulation and application techniques to achieve comparable protection levels.

Life cycle assessment (LCA) studies reveal that the environmental footprint of composite coatings extends beyond application processes to include raw material extraction, manufacturing, transportation, and end-of-life disposal. Powder coating technologies demonstrate particular promise, with zero VOC emissions and the ability to reclaim and reuse overspray material, resulting in waste reduction rates of approximately 95% compared to conventional liquid coating systems.

Material selection significantly influences sustainability profiles, with bio-based components increasingly incorporated into composite coating formulations. Resins derived from renewable resources such as vegetable oils, lignin, and cellulose have demonstrated comparable performance to petroleum-based alternatives while reducing carbon footprints by 30-50%. These materials also typically exhibit lower toxicity profiles throughout their lifecycle.

Energy consumption represents another critical sustainability factor, with thermal curing processes accounting for up to 70% of the total energy expenditure in coating operations. Advanced technologies such as UV-curable and electron beam-curable composite coatings offer substantial energy savings, reducing curing energy requirements by 75-90% while simultaneously accelerating production cycles.

End-of-life considerations have gained prominence in sustainability assessments, with coating recyclability and biodegradability becoming important selection criteria. Thermoplastic-based composite coatings offer advantages in this regard, as they can be more readily separated and recovered during recycling processes compared to thermoset alternatives, which typically require energy-intensive pyrolysis or chemical degradation methods.

The development of self-healing composite coatings represents a significant advancement in extending service life and reducing maintenance-related environmental impacts. These intelligent materials can repair minor damage autonomously, potentially doubling coating lifespans and substantially reducing material consumption and waste generation over asset lifecycles.

Water-based composite coating systems have emerged as promising alternatives, reducing VOC emissions by up to 80% compared to solvent-based counterparts. However, these systems often present challenges in terms of performance characteristics such as corrosion resistance and durability, necessitating careful formulation and application techniques to achieve comparable protection levels.

Life cycle assessment (LCA) studies reveal that the environmental footprint of composite coatings extends beyond application processes to include raw material extraction, manufacturing, transportation, and end-of-life disposal. Powder coating technologies demonstrate particular promise, with zero VOC emissions and the ability to reclaim and reuse overspray material, resulting in waste reduction rates of approximately 95% compared to conventional liquid coating systems.

Material selection significantly influences sustainability profiles, with bio-based components increasingly incorporated into composite coating formulations. Resins derived from renewable resources such as vegetable oils, lignin, and cellulose have demonstrated comparable performance to petroleum-based alternatives while reducing carbon footprints by 30-50%. These materials also typically exhibit lower toxicity profiles throughout their lifecycle.

Energy consumption represents another critical sustainability factor, with thermal curing processes accounting for up to 70% of the total energy expenditure in coating operations. Advanced technologies such as UV-curable and electron beam-curable composite coatings offer substantial energy savings, reducing curing energy requirements by 75-90% while simultaneously accelerating production cycles.

End-of-life considerations have gained prominence in sustainability assessments, with coating recyclability and biodegradability becoming important selection criteria. Thermoplastic-based composite coatings offer advantages in this regard, as they can be more readily separated and recovered during recycling processes compared to thermoset alternatives, which typically require energy-intensive pyrolysis or chemical degradation methods.

The development of self-healing composite coatings represents a significant advancement in extending service life and reducing maintenance-related environmental impacts. These intelligent materials can repair minor damage autonomously, potentially doubling coating lifespans and substantially reducing material consumption and waste generation over asset lifecycles.

Performance Testing and Quality Assurance Methods

Performance testing and quality assurance for composite coatings require systematic methodologies to evaluate durability, adhesion strength, and protective capabilities. Industry standards such as ASTM D4541 for pull-off adhesion testing and ASTM B117 for salt spray resistance provide foundational frameworks for consistent evaluation across different coating systems. These standardized tests ensure reproducibility and comparability of results, which is crucial when assessing various composite coating formulations.

Accelerated weathering tests represent a critical component of performance evaluation, simulating years of environmental exposure within compressed timeframes. UV exposure chambers, thermal cycling, and humidity control systems work in concert to replicate real-world conditions that coatings must withstand. Modern testing protocols increasingly incorporate cyclic testing regimes that alternate between different environmental stressors to more accurately reflect actual service conditions.

Mechanical property assessment includes scratch resistance testing, impact resistance, and flexibility measurements. These tests evaluate how composite coatings respond to physical stresses encountered during product lifecycles. Advanced instrumentation such as nanoindentation equipment allows for precise characterization of hardness and elastic modulus at microscopic scales, providing insights into coating behavior at fundamental levels.

Corrosion resistance testing represents perhaps the most critical quality assurance measure for protective composite coatings. Electrochemical impedance spectroscopy (EIS) offers quantitative data on coating barrier properties and degradation mechanisms over time. Potentiodynamic polarization tests complement these measurements by assessing the coating's ability to prevent substrate oxidation under electrical potential differences.

Quality assurance protocols must extend beyond laboratory testing to include in-process monitoring systems. Spectroscopic techniques for real-time chemical composition analysis, thickness measurement systems, and automated visual inspection technologies ensure consistency throughout production. Statistical process control methodologies help identify variations before they manifest as coating failures.

Field testing remains an essential complement to laboratory evaluation, with test panels deployed in relevant environments providing validation of accelerated testing results. The correlation between accelerated and natural weathering data requires careful analysis to develop predictive models for coating performance. These models increasingly incorporate machine learning algorithms to improve lifetime predictions based on early performance indicators.

Documentation and traceability systems form the backbone of quality assurance programs, with detailed records of raw materials, process parameters, and test results maintained throughout the coating lifecycle. This comprehensive approach ensures that performance testing translates directly to quality assurance, providing manufacturers and end-users with confidence in composite coating performance.

Accelerated weathering tests represent a critical component of performance evaluation, simulating years of environmental exposure within compressed timeframes. UV exposure chambers, thermal cycling, and humidity control systems work in concert to replicate real-world conditions that coatings must withstand. Modern testing protocols increasingly incorporate cyclic testing regimes that alternate between different environmental stressors to more accurately reflect actual service conditions.

Mechanical property assessment includes scratch resistance testing, impact resistance, and flexibility measurements. These tests evaluate how composite coatings respond to physical stresses encountered during product lifecycles. Advanced instrumentation such as nanoindentation equipment allows for precise characterization of hardness and elastic modulus at microscopic scales, providing insights into coating behavior at fundamental levels.

Corrosion resistance testing represents perhaps the most critical quality assurance measure for protective composite coatings. Electrochemical impedance spectroscopy (EIS) offers quantitative data on coating barrier properties and degradation mechanisms over time. Potentiodynamic polarization tests complement these measurements by assessing the coating's ability to prevent substrate oxidation under electrical potential differences.

Quality assurance protocols must extend beyond laboratory testing to include in-process monitoring systems. Spectroscopic techniques for real-time chemical composition analysis, thickness measurement systems, and automated visual inspection technologies ensure consistency throughout production. Statistical process control methodologies help identify variations before they manifest as coating failures.

Field testing remains an essential complement to laboratory evaluation, with test panels deployed in relevant environments providing validation of accelerated testing results. The correlation between accelerated and natural weathering data requires careful analysis to develop predictive models for coating performance. These models increasingly incorporate machine learning algorithms to improve lifetime predictions based on early performance indicators.

Documentation and traceability systems form the backbone of quality assurance programs, with detailed records of raw materials, process parameters, and test results maintained throughout the coating lifecycle. This comprehensive approach ensures that performance testing translates directly to quality assurance, providing manufacturers and end-users with confidence in composite coating performance.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!