Evaluation of Composite coatings for compliance with international standards and regulations

SEP 28, 202510 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Composite Coating Standards Background and Objectives

Composite coatings have evolved significantly over the past several decades, transitioning from simple protective layers to sophisticated engineered materials with multifunctional properties. The development trajectory began in the 1950s with basic polymer-based coatings and has since expanded to include metal matrix composites, ceramic matrix composites, and hybrid systems that combine multiple material classes. This evolution has been driven by increasing demands across industries for coatings that can withstand extreme conditions while providing enhanced functionality.

The global regulatory landscape for composite coatings has become increasingly complex, with standards varying significantly across regions and applications. Key regulatory bodies include the International Organization for Standardization (ISO), ASTM International, the European Committee for Standardization (CEN), and various national standards organizations. These entities have established frameworks for testing, certification, and compliance that manufacturers must navigate to ensure market access and product safety.

Environmental considerations have become paramount in recent years, with regulations such as REACH in Europe, the Clean Air Act in the United States, and similar frameworks in Asia imposing strict limitations on volatile organic compounds (VOCs), heavy metals, and other potentially harmful substances in coating formulations. This regulatory pressure has accelerated innovation in water-based and powder coating technologies as alternatives to traditional solvent-based systems.

The primary technical objective of this evaluation is to establish a comprehensive framework for assessing composite coating compliance with international standards across multiple dimensions: mechanical performance, chemical resistance, environmental impact, and long-term durability. This framework must account for application-specific requirements while maintaining alignment with broader regulatory trends toward sustainability and reduced environmental footprint.

Secondary objectives include identifying gaps in current testing methodologies that may not adequately address the unique properties of advanced composite coatings, particularly those incorporating nanomaterials or biobased components. Additionally, this evaluation aims to anticipate emerging regulatory requirements that may impact future coating development and application, providing strategic guidance for research and development initiatives.

The technological trajectory suggests continued movement toward multi-functional coatings that simultaneously address multiple performance requirements while meeting increasingly stringent environmental standards. This includes self-healing capabilities, antimicrobial properties, and enhanced corrosion resistance with minimal environmental impact. Understanding this trajectory is essential for developing compliance strategies that remain viable as standards evolve in response to technological innovation and changing societal priorities.

The global regulatory landscape for composite coatings has become increasingly complex, with standards varying significantly across regions and applications. Key regulatory bodies include the International Organization for Standardization (ISO), ASTM International, the European Committee for Standardization (CEN), and various national standards organizations. These entities have established frameworks for testing, certification, and compliance that manufacturers must navigate to ensure market access and product safety.

Environmental considerations have become paramount in recent years, with regulations such as REACH in Europe, the Clean Air Act in the United States, and similar frameworks in Asia imposing strict limitations on volatile organic compounds (VOCs), heavy metals, and other potentially harmful substances in coating formulations. This regulatory pressure has accelerated innovation in water-based and powder coating technologies as alternatives to traditional solvent-based systems.

The primary technical objective of this evaluation is to establish a comprehensive framework for assessing composite coating compliance with international standards across multiple dimensions: mechanical performance, chemical resistance, environmental impact, and long-term durability. This framework must account for application-specific requirements while maintaining alignment with broader regulatory trends toward sustainability and reduced environmental footprint.

Secondary objectives include identifying gaps in current testing methodologies that may not adequately address the unique properties of advanced composite coatings, particularly those incorporating nanomaterials or biobased components. Additionally, this evaluation aims to anticipate emerging regulatory requirements that may impact future coating development and application, providing strategic guidance for research and development initiatives.

The technological trajectory suggests continued movement toward multi-functional coatings that simultaneously address multiple performance requirements while meeting increasingly stringent environmental standards. This includes self-healing capabilities, antimicrobial properties, and enhanced corrosion resistance with minimal environmental impact. Understanding this trajectory is essential for developing compliance strategies that remain viable as standards evolve in response to technological innovation and changing societal priorities.

Market Demand Analysis for Compliant Composite Coatings

The global market for compliant composite coatings has experienced significant growth in recent years, driven by stringent international regulations and increasing awareness of environmental and health concerns. The demand for these specialized coatings is primarily fueled by industries such as aerospace, automotive, marine, and construction, where adherence to standards is non-negotiable for market access and operational approval.

Analysis of market trends reveals that the composite coatings sector is projected to grow at a compound annual growth rate of 5.8% through 2028, with the compliant coatings segment outpacing this growth due to regulatory pressures. This acceleration is particularly evident in developed markets where environmental regulations are most stringent, including the European Union, North America, and parts of Asia-Pacific.

Consumer preferences are increasingly shifting toward sustainable and environmentally friendly coating solutions, creating a premium market segment for compliant products. This shift is reflected in procurement policies of major corporations and government entities that now mandate compliance with international standards as a prerequisite for supplier qualification.

The healthcare and food processing industries represent emerging markets for compliant composite coatings, driven by heightened safety concerns and regulatory oversight. These sectors demand coatings that not only meet performance requirements but also comply with specific health and safety standards such as FDA regulations in the United States and similar frameworks globally.

Regional analysis indicates varying levels of market maturity. While North America and Europe lead in adoption due to established regulatory frameworks like REACH and EPA guidelines, emerging economies in Asia and Latin America are experiencing rapid growth as they align with global standards to participate in international trade.

Market research indicates that price sensitivity remains a significant factor, with many end-users reluctant to absorb the premium costs associated with compliant coatings. This creates a market segmentation between early adopters willing to pay for compliance and those delaying adoption until absolutely necessary.

Industry surveys highlight that technical performance remains paramount, with buyers unwilling to compromise on durability, corrosion resistance, and aesthetic qualities even as they seek compliant alternatives. This has created a competitive landscape where manufacturers must innovate to maintain performance while achieving compliance.

The aftermarket and maintenance sectors present substantial opportunities, as existing installations require upgrading to meet evolving standards. This retrofit market is expected to grow significantly as compliance deadlines approach in various jurisdictions worldwide.

Analysis of market trends reveals that the composite coatings sector is projected to grow at a compound annual growth rate of 5.8% through 2028, with the compliant coatings segment outpacing this growth due to regulatory pressures. This acceleration is particularly evident in developed markets where environmental regulations are most stringent, including the European Union, North America, and parts of Asia-Pacific.

Consumer preferences are increasingly shifting toward sustainable and environmentally friendly coating solutions, creating a premium market segment for compliant products. This shift is reflected in procurement policies of major corporations and government entities that now mandate compliance with international standards as a prerequisite for supplier qualification.

The healthcare and food processing industries represent emerging markets for compliant composite coatings, driven by heightened safety concerns and regulatory oversight. These sectors demand coatings that not only meet performance requirements but also comply with specific health and safety standards such as FDA regulations in the United States and similar frameworks globally.

Regional analysis indicates varying levels of market maturity. While North America and Europe lead in adoption due to established regulatory frameworks like REACH and EPA guidelines, emerging economies in Asia and Latin America are experiencing rapid growth as they align with global standards to participate in international trade.

Market research indicates that price sensitivity remains a significant factor, with many end-users reluctant to absorb the premium costs associated with compliant coatings. This creates a market segmentation between early adopters willing to pay for compliance and those delaying adoption until absolutely necessary.

Industry surveys highlight that technical performance remains paramount, with buyers unwilling to compromise on durability, corrosion resistance, and aesthetic qualities even as they seek compliant alternatives. This has created a competitive landscape where manufacturers must innovate to maintain performance while achieving compliance.

The aftermarket and maintenance sectors present substantial opportunities, as existing installations require upgrading to meet evolving standards. This retrofit market is expected to grow significantly as compliance deadlines approach in various jurisdictions worldwide.

Global Regulatory Landscape and Technical Challenges

The composite coatings industry faces an increasingly complex global regulatory landscape that varies significantly across regions. In North America, the EPA's TSCA (Toxic Substances Control Act) and Canada's CEPA (Canadian Environmental Protection Act) impose strict requirements on chemical substances used in coatings, with particular emphasis on VOC (Volatile Organic Compound) emissions and hazardous materials restrictions. The EU's regulatory framework is even more stringent, with REACH (Registration, Evaluation, Authorization and Restriction of Chemicals) and RoHS (Restriction of Hazardous Substances) directives creating comprehensive compliance challenges for manufacturers.

In Asia-Pacific markets, regulatory frameworks are evolving rapidly, with China's MEE (Ministry of Ecology and Environment) implementing increasingly strict environmental standards that often mirror European approaches but with unique implementation timelines and testing requirements. Japan maintains its own chemical substances control law (CSCL) with specific reporting and testing protocols that differ from Western standards.

A significant technical challenge lies in the development of testing methodologies that can accurately assess compliance across multiple jurisdictional requirements. Current testing protocols often lack standardization across regions, creating redundant testing requirements and increasing compliance costs. For instance, leaching tests for heavy metals follow different procedures in the EU (EN 71-3) versus the US (ASTM F963), requiring manufacturers to conduct multiple tests on identical products.

Nanomaterials present a particularly complex regulatory challenge, as their classification and risk assessment frameworks remain inconsistent globally. The EU has implemented specific nano-registration requirements under REACH, while the US FDA and EPA have different approaches to nanomaterial regulation, creating significant uncertainty for innovative composite coating technologies incorporating these materials.

Fire resistance standards represent another area of regulatory divergence, with the EU following EN 13501 classifications while North America adheres to ASTM E84 and NFPA standards. These differences necessitate multiple formulations of essentially similar products to meet regional market requirements.

The accelerating pace of regulatory change compounds these challenges. The EU's Chemical Strategy for Sustainability and various global initiatives to restrict PFAS (per- and polyfluoroalkyl substances) are creating moving compliance targets that require continuous monitoring and formulation adjustments. Many manufacturers struggle to maintain regulatory intelligence capabilities sufficient to track these developments across all markets.

Harmonization efforts through ISO standards provide some relief, but significant gaps remain between theoretical standardization and practical implementation at national levels. This regulatory fragmentation creates substantial barriers to market entry for innovative composite coating technologies and increases development costs throughout the industry.

In Asia-Pacific markets, regulatory frameworks are evolving rapidly, with China's MEE (Ministry of Ecology and Environment) implementing increasingly strict environmental standards that often mirror European approaches but with unique implementation timelines and testing requirements. Japan maintains its own chemical substances control law (CSCL) with specific reporting and testing protocols that differ from Western standards.

A significant technical challenge lies in the development of testing methodologies that can accurately assess compliance across multiple jurisdictional requirements. Current testing protocols often lack standardization across regions, creating redundant testing requirements and increasing compliance costs. For instance, leaching tests for heavy metals follow different procedures in the EU (EN 71-3) versus the US (ASTM F963), requiring manufacturers to conduct multiple tests on identical products.

Nanomaterials present a particularly complex regulatory challenge, as their classification and risk assessment frameworks remain inconsistent globally. The EU has implemented specific nano-registration requirements under REACH, while the US FDA and EPA have different approaches to nanomaterial regulation, creating significant uncertainty for innovative composite coating technologies incorporating these materials.

Fire resistance standards represent another area of regulatory divergence, with the EU following EN 13501 classifications while North America adheres to ASTM E84 and NFPA standards. These differences necessitate multiple formulations of essentially similar products to meet regional market requirements.

The accelerating pace of regulatory change compounds these challenges. The EU's Chemical Strategy for Sustainability and various global initiatives to restrict PFAS (per- and polyfluoroalkyl substances) are creating moving compliance targets that require continuous monitoring and formulation adjustments. Many manufacturers struggle to maintain regulatory intelligence capabilities sufficient to track these developments across all markets.

Harmonization efforts through ISO standards provide some relief, but significant gaps remain between theoretical standardization and practical implementation at national levels. This regulatory fragmentation creates substantial barriers to market entry for innovative composite coating technologies and increases development costs throughout the industry.

Current Compliance Testing Methodologies

01 Regulatory compliance for composite coatings

Composite coatings must adhere to various regulatory standards and compliance requirements. These regulations may include environmental protection standards, safety requirements, and industry-specific guidelines. Compliance management systems can help track and ensure adherence to these regulations, reducing the risk of non-compliance penalties and ensuring product safety and quality.- Regulatory compliance systems for composite coatings: Systems and methods for ensuring regulatory compliance in the development and application of composite coatings. These systems track and manage compliance requirements across different jurisdictions, providing automated updates on regulatory changes affecting coating formulations. They include features for documentation management, certification tracking, and compliance reporting to meet industry standards and governmental regulations for composite coating materials.

- Environmental compliance for composite coating compositions: Formulations and methods focused on environmental compliance aspects of composite coatings. These innovations address VOC limitations, hazardous material restrictions, and sustainable material usage in coating compositions. The technologies include environmentally friendly alternatives to traditional coating components, methods for reducing environmental impact during application and disposal, and systems for monitoring environmental compliance throughout the coating lifecycle.

- Quality control systems for compliant composite coatings: Advanced quality control methodologies and systems designed specifically for ensuring compliance of composite coatings with industry specifications. These systems incorporate testing protocols, inspection techniques, and monitoring tools to verify coating performance characteristics such as adhesion, durability, and resistance properties. They enable manufacturers to maintain consistent quality while meeting regulatory requirements through automated quality assurance processes.

- Digital compliance management for coating operations: Digital platforms and software solutions for managing compliance aspects of composite coating operations. These technologies provide comprehensive tracking of coating materials, application processes, and compliance documentation. Features include digital record-keeping, automated compliance verification, real-time monitoring of coating parameters, and integration with enterprise management systems to streamline compliance workflows and reduce administrative burden.

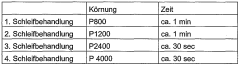

- Compliant composite coating application technologies: Specialized equipment and methodologies for applying composite coatings in compliance with technical and regulatory requirements. These innovations focus on precise application techniques, curing processes, and surface preparation methods that ensure consistent coating performance while meeting compliance standards. They include automated application systems, monitoring technologies for coating thickness and uniformity, and process controls that maintain compliance throughout the coating application process.

02 Documentation and certification systems for coating compliance

Documentation and certification systems play a crucial role in demonstrating compliance of composite coatings. These systems involve maintaining records of material composition, testing results, and manufacturing processes. Digital platforms can streamline the documentation process, making it easier to generate compliance reports, obtain necessary certifications, and respond to regulatory audits.Expand Specific Solutions03 Testing methods for composite coating compliance

Various testing methods are employed to verify the compliance of composite coatings with industry standards and regulations. These tests may evaluate properties such as adhesion strength, chemical resistance, durability, and environmental impact. Standardized testing protocols ensure consistency in quality assessment and help manufacturers demonstrate compliance with specific requirements for different applications.Expand Specific Solutions04 Automated compliance monitoring systems

Automated systems can be implemented to monitor compliance of composite coatings throughout their lifecycle. These systems may include sensors for real-time monitoring of coating performance, software for tracking regulatory changes, and algorithms for predicting potential compliance issues. Automation reduces human error in compliance processes and provides timely alerts when parameters deviate from acceptable ranges.Expand Specific Solutions05 Sustainable and eco-friendly compliance approaches

Developing composite coatings that meet sustainability and eco-friendly compliance requirements is becoming increasingly important. This involves formulating coatings with reduced volatile organic compounds (VOCs), eliminating hazardous substances, and considering the entire lifecycle environmental impact. Green certification programs provide frameworks for demonstrating environmental compliance and can offer market advantages for compliant coating products.Expand Specific Solutions

Key Industry Players and Certification Bodies

The composite coatings market is currently in a growth phase, with increasing demand driven by stringent international compliance requirements across aerospace, automotive, and industrial sectors. The market is estimated to exceed $1.5 billion globally, with projected annual growth of 5-7%. Leading players include established chemical giants like PPG Industries, DuPont, and BASF SE, who leverage extensive R&D capabilities to develop standards-compliant solutions. Aerospace leaders Boeing and Airbus are driving innovation in high-performance applications, while specialized coating manufacturers like Axalta and Kansai Paint focus on sector-specific compliance. Academic institutions including South China University of Technology and University of Houston collaborate with industry to advance coating technologies that meet evolving international regulations for environmental safety, durability, and performance.

PPG Industries Ohio, Inc.

Technical Solution: PPG has developed a comprehensive evaluation framework for composite coatings that integrates multiple international standards including ISO 12944, ASTM D5162, and NACE standards. Their approach utilizes advanced electrochemical impedance spectroscopy (EIS) to assess coating degradation mechanisms and predict long-term performance. PPG's evaluation protocol incorporates accelerated weathering tests with real-time monitoring systems that collect data on coating performance under various environmental stressors. Their proprietary Coating Evaluation Management System (CEMS) digitally tracks compliance across different regulatory frameworks including REACH, RoHS, and region-specific VOC regulations. The system automatically flags potential compliance issues and generates documentation required for certification in different markets. PPG has also pioneered the use of non-destructive testing methods that correlate with traditional destructive tests, allowing for more comprehensive in-field evaluations without compromising coating integrity.

Strengths: Comprehensive digital tracking system that integrates multiple regulatory frameworks; advanced non-destructive testing capabilities; global laboratory network for region-specific compliance testing. Weaknesses: Higher implementation costs compared to traditional evaluation methods; requires specialized training for technicians; system updates needed when regulations change.

DuPont de Nemours, Inc.

Technical Solution: DuPont has established a multi-tiered evaluation protocol for composite coatings that addresses both performance standards and regulatory compliance simultaneously. Their approach begins with a pre-compliance assessment that maps coating formulations against global chemical inventories and restricted substance lists. For performance evaluation, DuPont employs a combination of standardized tests (ASTM D4541, ISO 4624) and proprietary accelerated testing protocols that simulate specific industrial environments. Their Regulatory Compliance Verification (RCV) system maintains a continuously updated database of over 6,000 chemicals and their regulatory status across 45+ countries, enabling rapid assessment of formulation compliance. DuPont's evaluation methodology incorporates lifecycle assessment principles, evaluating not just initial compliance but also long-term environmental impact through degradation studies and leachate analysis. Their testing protocols are specifically designed to address emerging regulations like the EU's microplastics restrictions and nanomaterial reporting requirements.

Strengths: Comprehensive global regulatory database with regular updates; integration of performance and compliance testing; advanced predictive modeling for regulatory trends. Weaknesses: System complexity requires significant expertise to operate effectively; higher costs associated with comprehensive testing protocols; some proprietary methods lack third-party validation.

Critical Technical Requirements and Specifications

Dyed fluoropolymers

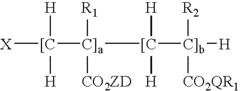

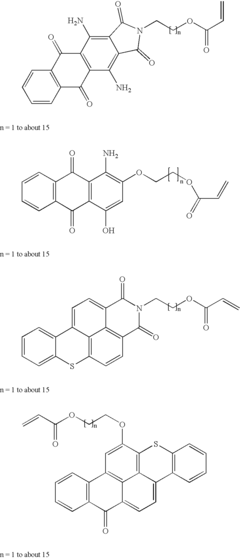

PatentInactiveUS6894105B2

Innovation

- Development of dyed fluoropolymers where the dye is covalently bonded to the polymer, using fluorochemical (meth)acrylate monomers and (meth)acrylate functional dyes, providing improved thermal stability, adhesion, and resistance to leaching, without the need for a cure mechanism.

Object with a stratified composite material

PatentWO2004092256A1

Innovation

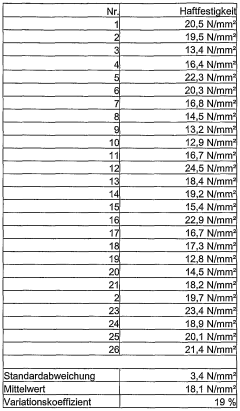

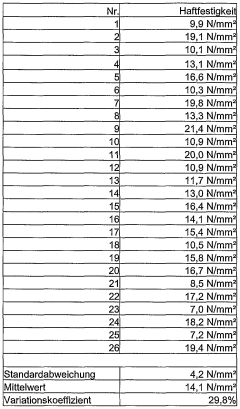

- A layered composite with a non-metallic polymer layer and a metallic layer applied without chemical pretreatment, featuring a rough boundary with an R_a value of up to 5 μm and adhesion strength of at least 12 N/mm², achieved through rapid prototyping processes like stereolithography or laser sintering, ensuring uniform adhesion across the surface.

Environmental Impact and Sustainability Considerations

The environmental impact of composite coatings has become a critical consideration in regulatory compliance frameworks worldwide. Current international standards increasingly emphasize sustainability metrics alongside traditional performance requirements. Composite coatings, while offering superior protection and durability, often contain volatile organic compounds (VOCs), heavy metals, and other potentially harmful substances that pose significant environmental challenges throughout their lifecycle.

Recent regulatory developments, particularly in the European Union under REACH (Registration, Evaluation, Authorization and Restriction of Chemicals) and RoHS (Restriction of Hazardous Substances) directives, have established strict limitations on hazardous materials in coatings. Similarly, the United States EPA has implemented the National Emission Standards for Hazardous Air Pollutants (NESHAP) specifically addressing surface coating operations. These regulations have fundamentally transformed formulation requirements for composite coatings across global markets.

Life Cycle Assessment (LCA) methodologies have emerged as essential tools for evaluating the environmental footprint of composite coatings. Comprehensive LCAs examine environmental impacts from raw material extraction through manufacturing, application, service life, and ultimate disposal. Industry leaders now routinely conduct these assessments to demonstrate regulatory compliance and identify opportunities for environmental optimization.

Water-based and powder coating technologies represent significant advancements in environmentally compliant composite systems. These formulations substantially reduce VOC emissions compared to traditional solvent-based alternatives while maintaining comparable performance characteristics. Bio-based composite coatings derived from renewable resources such as vegetable oils and natural polymers are gaining traction as sustainable alternatives that align with circular economy principles.

End-of-life considerations have become increasingly prominent in regulatory frameworks. The recyclability and biodegradability of composite coatings now factor into compliance assessments, with particular emphasis on preventing microplastic pollution and facilitating material recovery. Several certification systems, including Cradle to Cradle and Environmental Product Declarations (EPDs), provide standardized frameworks for communicating environmental performance data to stakeholders.

Carbon footprint reduction represents another critical dimension of environmental compliance for composite coatings. Energy-efficient manufacturing processes, locally sourced raw materials, and formulations designed for ambient-temperature curing contribute significantly to greenhouse gas emission reductions. These factors increasingly influence procurement decisions in sectors prioritizing sustainability commitments.

The integration of environmental considerations into international standards for composite coatings continues to evolve rapidly. Forward-thinking manufacturers are adopting proactive approaches to compliance, viewing environmental regulations not merely as constraints but as catalysts for innovation and market differentiation in an increasingly sustainability-conscious global marketplace.

Recent regulatory developments, particularly in the European Union under REACH (Registration, Evaluation, Authorization and Restriction of Chemicals) and RoHS (Restriction of Hazardous Substances) directives, have established strict limitations on hazardous materials in coatings. Similarly, the United States EPA has implemented the National Emission Standards for Hazardous Air Pollutants (NESHAP) specifically addressing surface coating operations. These regulations have fundamentally transformed formulation requirements for composite coatings across global markets.

Life Cycle Assessment (LCA) methodologies have emerged as essential tools for evaluating the environmental footprint of composite coatings. Comprehensive LCAs examine environmental impacts from raw material extraction through manufacturing, application, service life, and ultimate disposal. Industry leaders now routinely conduct these assessments to demonstrate regulatory compliance and identify opportunities for environmental optimization.

Water-based and powder coating technologies represent significant advancements in environmentally compliant composite systems. These formulations substantially reduce VOC emissions compared to traditional solvent-based alternatives while maintaining comparable performance characteristics. Bio-based composite coatings derived from renewable resources such as vegetable oils and natural polymers are gaining traction as sustainable alternatives that align with circular economy principles.

End-of-life considerations have become increasingly prominent in regulatory frameworks. The recyclability and biodegradability of composite coatings now factor into compliance assessments, with particular emphasis on preventing microplastic pollution and facilitating material recovery. Several certification systems, including Cradle to Cradle and Environmental Product Declarations (EPDs), provide standardized frameworks for communicating environmental performance data to stakeholders.

Carbon footprint reduction represents another critical dimension of environmental compliance for composite coatings. Energy-efficient manufacturing processes, locally sourced raw materials, and formulations designed for ambient-temperature curing contribute significantly to greenhouse gas emission reductions. These factors increasingly influence procurement decisions in sectors prioritizing sustainability commitments.

The integration of environmental considerations into international standards for composite coatings continues to evolve rapidly. Forward-thinking manufacturers are adopting proactive approaches to compliance, viewing environmental regulations not merely as constraints but as catalysts for innovation and market differentiation in an increasingly sustainability-conscious global marketplace.

Risk Assessment and Liability Management

Risk assessment in composite coating compliance involves systematic identification and evaluation of potential hazards throughout the product lifecycle. When evaluating composite coatings against international standards, organizations must implement comprehensive risk management frameworks that address both technical compliance failures and associated legal exposures. The primary risk categories include non-compliance with chemical composition requirements (particularly regarding restricted substances like VOCs, heavy metals, and carcinogens), performance failures under specified conditions, and inadequate documentation or certification.

Liability management requires establishing clear chains of responsibility across the supply chain, from raw material suppliers to coating manufacturers and end-users. Companies must develop robust contractual frameworks that explicitly define compliance responsibilities, testing requirements, and liability allocation between parties. These agreements should include indemnification clauses, warranty limitations, and dispute resolution mechanisms specifically addressing regulatory compliance issues.

Insurance coverage represents a critical component of liability management strategy. Organizations should secure specialized policies covering regulatory compliance failures, product recalls, and environmental remediation costs. The insurance landscape for composite coatings has evolved significantly, with carriers now offering tailored coverage for specific regulatory frameworks like REACH, RoHS, and industry-specific standards.

Documentation practices serve as both risk mitigation tools and liability defenses. Companies must maintain comprehensive technical files including test reports, compliance declarations, material safety data sheets, and certification documentation. These records should demonstrate due diligence in compliance efforts and provide traceability throughout the product lifecycle. Implementing digital compliance management systems can significantly enhance documentation integrity and accessibility during regulatory inspections or litigation.

Proactive compliance monitoring represents another essential risk management practice. Organizations should establish regular testing schedules, supplier qualification processes, and market surveillance programs to identify potential compliance issues before regulatory intervention. This includes monitoring regulatory developments across target markets to anticipate compliance requirements and adjust formulations accordingly. Companies demonstrating proactive compliance efforts typically face reduced penalties and enforcement actions when violations occur.

Finally, incident response planning is crucial for managing compliance failures when they occur. Organizations should develop clear protocols for product recalls, regulatory notifications, and customer communications. These plans should identify decision-making authorities, establish communication channels, and outline remediation steps to minimize both regulatory penalties and reputational damage.

Liability management requires establishing clear chains of responsibility across the supply chain, from raw material suppliers to coating manufacturers and end-users. Companies must develop robust contractual frameworks that explicitly define compliance responsibilities, testing requirements, and liability allocation between parties. These agreements should include indemnification clauses, warranty limitations, and dispute resolution mechanisms specifically addressing regulatory compliance issues.

Insurance coverage represents a critical component of liability management strategy. Organizations should secure specialized policies covering regulatory compliance failures, product recalls, and environmental remediation costs. The insurance landscape for composite coatings has evolved significantly, with carriers now offering tailored coverage for specific regulatory frameworks like REACH, RoHS, and industry-specific standards.

Documentation practices serve as both risk mitigation tools and liability defenses. Companies must maintain comprehensive technical files including test reports, compliance declarations, material safety data sheets, and certification documentation. These records should demonstrate due diligence in compliance efforts and provide traceability throughout the product lifecycle. Implementing digital compliance management systems can significantly enhance documentation integrity and accessibility during regulatory inspections or litigation.

Proactive compliance monitoring represents another essential risk management practice. Organizations should establish regular testing schedules, supplier qualification processes, and market surveillance programs to identify potential compliance issues before regulatory intervention. This includes monitoring regulatory developments across target markets to anticipate compliance requirements and adjust formulations accordingly. Companies demonstrating proactive compliance efforts typically face reduced penalties and enforcement actions when violations occur.

Finally, incident response planning is crucial for managing compliance failures when they occur. Organizations should develop clear protocols for product recalls, regulatory notifications, and customer communications. These plans should identify decision-making authorities, establish communication channels, and outline remediation steps to minimize both regulatory penalties and reputational damage.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!