Research on Composite coatings for EV battery thermal and corrosion protection

SEP 28, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

EV Battery Protection Coating Background and Objectives

The evolution of electric vehicles (EVs) has accelerated dramatically over the past decade, with global adoption rates increasing exponentially as governments worldwide implement stringent emission regulations and consumers become more environmentally conscious. Within this rapidly expanding sector, battery technology represents both the cornerstone of EV functionality and one of its most significant technical challenges. Battery thermal management and corrosion protection have emerged as critical factors affecting performance, safety, and longevity of EV power systems.

Composite coatings for EV batteries have developed from rudimentary thermal insulation materials to sophisticated multi-functional protective systems. Early iterations focused primarily on basic thermal management, while contemporary solutions integrate thermal regulation, corrosion resistance, fire retardancy, and mechanical protection into unified coating systems. This technological progression reflects the industry's growing understanding of the complex operational demands placed on EV battery systems.

The primary technical objective of composite coating research is to develop materials that can effectively manage the thermal profile of battery cells while simultaneously providing robust protection against environmental factors that accelerate degradation. Specifically, these coatings must maintain battery operating temperatures within the optimal 15-35°C range during both charging and discharging cycles, while preventing moisture ingress and chemical corrosion that can lead to catastrophic failure.

Current research trajectories indicate a convergence toward nano-engineered composite materials that combine ceramic particles, polymer matrices, and phase-change materials to create multi-functional protective layers. These advanced composites aim to address the inherent trade-offs between thermal conductivity, electrical insulation, weight considerations, and manufacturing scalability that have historically limited coating effectiveness.

The technical evolution in this field is increasingly driven by demands for extended battery life cycles, faster charging capabilities, and enhanced safety profiles. As EVs transition from early adoption to mass market penetration, the performance requirements for battery protection systems have become more stringent, necessitating innovations that can withstand more extreme operational conditions while maintaining cost-effectiveness at production scale.

Looking forward, the technical objectives for next-generation composite coatings include achieving thermal conductivity values exceeding 5 W/m·K while maintaining electrical resistivity above 10^9 Ω·cm, with corrosion protection capabilities that can withstand 1000+ hours of salt spray testing. Additionally, these coatings must demonstrate compatibility with automated manufacturing processes to enable integration into high-volume production environments without compromising performance characteristics.

Composite coatings for EV batteries have developed from rudimentary thermal insulation materials to sophisticated multi-functional protective systems. Early iterations focused primarily on basic thermal management, while contemporary solutions integrate thermal regulation, corrosion resistance, fire retardancy, and mechanical protection into unified coating systems. This technological progression reflects the industry's growing understanding of the complex operational demands placed on EV battery systems.

The primary technical objective of composite coating research is to develop materials that can effectively manage the thermal profile of battery cells while simultaneously providing robust protection against environmental factors that accelerate degradation. Specifically, these coatings must maintain battery operating temperatures within the optimal 15-35°C range during both charging and discharging cycles, while preventing moisture ingress and chemical corrosion that can lead to catastrophic failure.

Current research trajectories indicate a convergence toward nano-engineered composite materials that combine ceramic particles, polymer matrices, and phase-change materials to create multi-functional protective layers. These advanced composites aim to address the inherent trade-offs between thermal conductivity, electrical insulation, weight considerations, and manufacturing scalability that have historically limited coating effectiveness.

The technical evolution in this field is increasingly driven by demands for extended battery life cycles, faster charging capabilities, and enhanced safety profiles. As EVs transition from early adoption to mass market penetration, the performance requirements for battery protection systems have become more stringent, necessitating innovations that can withstand more extreme operational conditions while maintaining cost-effectiveness at production scale.

Looking forward, the technical objectives for next-generation composite coatings include achieving thermal conductivity values exceeding 5 W/m·K while maintaining electrical resistivity above 10^9 Ω·cm, with corrosion protection capabilities that can withstand 1000+ hours of salt spray testing. Additionally, these coatings must demonstrate compatibility with automated manufacturing processes to enable integration into high-volume production environments without compromising performance characteristics.

Market Analysis for EV Battery Thermal-Corrosion Protection Solutions

The global market for EV battery thermal and corrosion protection solutions is experiencing robust growth, driven by the rapid expansion of electric vehicle adoption worldwide. Current market valuations indicate that the composite coatings segment for EV batteries reached approximately $2.3 billion in 2022 and is projected to grow at a CAGR of 18.7% through 2030, significantly outpacing traditional automotive coating markets.

Regional analysis reveals that Asia-Pacific, particularly China, leads the market with over 45% share, followed by Europe at 30% and North America at 20%. This distribution closely mirrors the global EV manufacturing landscape, with China maintaining its position as the world's largest EV producer and consumer.

Demand patterns show distinct segmentation based on vehicle categories. The passenger EV segment currently dominates the market demand for advanced thermal-corrosion protection solutions, accounting for approximately 78% of total consumption. Commercial EVs, though smaller in volume, are showing accelerated growth rates due to fleet electrification initiatives across major economies.

Market drivers extend beyond simple volume growth. Increasingly stringent safety regulations, particularly following high-profile battery thermal incidents, have elevated thermal management requirements. Additionally, consumer expectations for longer battery warranties and vehicle lifespans are pushing manufacturers toward more durable protection solutions.

Price sensitivity analysis indicates that while premium protection solutions command higher margins, the market is experiencing downward price pressure as production scales and competition intensifies. Current price points range from $8-25 per kWh of battery capacity protected, depending on the sophistication of the solution and production volume.

Distribution channels are evolving rapidly, with tier-1 automotive suppliers increasingly integrating coating solutions into their battery module and pack offerings rather than leaving application to final assembly. This vertical integration trend is reshaping the competitive landscape and creating new partnership opportunities.

Customer requirements analysis reveals growing demand for multifunctional coatings that address multiple protection needs simultaneously. Battery manufacturers are prioritizing solutions that offer not only thermal and corrosion protection but also electrical insulation, fire retardancy, and lightweight properties without compromising thermal conductivity.

Market forecasts suggest that next-generation composite coatings incorporating nanomaterials and phase-change components will capture increasing market share, potentially reaching 40% of the total market by 2028 as manufacturers seek enhanced performance characteristics.

Regional analysis reveals that Asia-Pacific, particularly China, leads the market with over 45% share, followed by Europe at 30% and North America at 20%. This distribution closely mirrors the global EV manufacturing landscape, with China maintaining its position as the world's largest EV producer and consumer.

Demand patterns show distinct segmentation based on vehicle categories. The passenger EV segment currently dominates the market demand for advanced thermal-corrosion protection solutions, accounting for approximately 78% of total consumption. Commercial EVs, though smaller in volume, are showing accelerated growth rates due to fleet electrification initiatives across major economies.

Market drivers extend beyond simple volume growth. Increasingly stringent safety regulations, particularly following high-profile battery thermal incidents, have elevated thermal management requirements. Additionally, consumer expectations for longer battery warranties and vehicle lifespans are pushing manufacturers toward more durable protection solutions.

Price sensitivity analysis indicates that while premium protection solutions command higher margins, the market is experiencing downward price pressure as production scales and competition intensifies. Current price points range from $8-25 per kWh of battery capacity protected, depending on the sophistication of the solution and production volume.

Distribution channels are evolving rapidly, with tier-1 automotive suppliers increasingly integrating coating solutions into their battery module and pack offerings rather than leaving application to final assembly. This vertical integration trend is reshaping the competitive landscape and creating new partnership opportunities.

Customer requirements analysis reveals growing demand for multifunctional coatings that address multiple protection needs simultaneously. Battery manufacturers are prioritizing solutions that offer not only thermal and corrosion protection but also electrical insulation, fire retardancy, and lightweight properties without compromising thermal conductivity.

Market forecasts suggest that next-generation composite coatings incorporating nanomaterials and phase-change components will capture increasing market share, potentially reaching 40% of the total market by 2028 as manufacturers seek enhanced performance characteristics.

Current Challenges in Composite Coating Technologies

Despite significant advancements in composite coating technologies for EV battery protection, several critical challenges persist that impede optimal performance and widespread adoption. The primary challenge lies in achieving the delicate balance between thermal conductivity and electrical insulation properties. Current composite coatings often sacrifice one property to enhance the other, creating a fundamental trade-off that limits overall effectiveness in battery thermal management systems.

Material compatibility presents another significant hurdle, as coatings must adhere properly to various battery components while maintaining structural integrity under thermal cycling conditions. Many existing solutions exhibit delamination or cracking after repeated thermal expansion and contraction cycles, compromising long-term protection capabilities and potentially creating safety hazards.

Durability against harsh environmental conditions remains problematic, particularly in terms of chemical resistance. Battery systems are exposed to various electrolytes and potentially corrosive substances, yet many composite coatings degrade over time when in continuous contact with these chemicals. This degradation not only reduces protective capabilities but can introduce contamination into the battery system.

Manufacturing scalability constitutes a substantial barrier to widespread implementation. Current high-performance composite coatings often require complex application processes involving precise control of multiple parameters, specialized equipment, and extended curing times. These requirements significantly increase production costs and limit integration into high-volume manufacturing environments typical in the EV industry.

Uniformity in coating thickness and composition represents another persistent challenge. Variations in application can create hotspots or weak points in the protective layer, compromising the overall effectiveness of the thermal management system. Achieving consistent quality across large surface areas and complex geometries remains technically difficult.

Environmental and regulatory concerns further complicate development efforts. Many effective coating formulations contain compounds facing increasing regulatory scrutiny, including certain flame retardants, solvents, and processing aids. Reformulating these coatings to meet evolving environmental standards while maintaining performance characteristics presents significant research challenges.

Cost-effectiveness remains perhaps the most pressing practical challenge. Advanced composite coatings that successfully address thermal and corrosion protection needs often incorporate expensive materials like specialized ceramics, nanomaterials, or high-performance polymers. These material costs, combined with complex processing requirements, create barriers to adoption in cost-sensitive EV markets where battery pack costs are already a significant concern.

Material compatibility presents another significant hurdle, as coatings must adhere properly to various battery components while maintaining structural integrity under thermal cycling conditions. Many existing solutions exhibit delamination or cracking after repeated thermal expansion and contraction cycles, compromising long-term protection capabilities and potentially creating safety hazards.

Durability against harsh environmental conditions remains problematic, particularly in terms of chemical resistance. Battery systems are exposed to various electrolytes and potentially corrosive substances, yet many composite coatings degrade over time when in continuous contact with these chemicals. This degradation not only reduces protective capabilities but can introduce contamination into the battery system.

Manufacturing scalability constitutes a substantial barrier to widespread implementation. Current high-performance composite coatings often require complex application processes involving precise control of multiple parameters, specialized equipment, and extended curing times. These requirements significantly increase production costs and limit integration into high-volume manufacturing environments typical in the EV industry.

Uniformity in coating thickness and composition represents another persistent challenge. Variations in application can create hotspots or weak points in the protective layer, compromising the overall effectiveness of the thermal management system. Achieving consistent quality across large surface areas and complex geometries remains technically difficult.

Environmental and regulatory concerns further complicate development efforts. Many effective coating formulations contain compounds facing increasing regulatory scrutiny, including certain flame retardants, solvents, and processing aids. Reformulating these coatings to meet evolving environmental standards while maintaining performance characteristics presents significant research challenges.

Cost-effectiveness remains perhaps the most pressing practical challenge. Advanced composite coatings that successfully address thermal and corrosion protection needs often incorporate expensive materials like specialized ceramics, nanomaterials, or high-performance polymers. These material costs, combined with complex processing requirements, create barriers to adoption in cost-sensitive EV markets where battery pack costs are already a significant concern.

Current Composite Coating Solutions for Dual Protection

01 Metal-based composite coatings for thermal and corrosion protection

Metal-based composite coatings provide excellent thermal and corrosion protection for various substrates. These coatings typically incorporate metals such as aluminum, nickel, or zinc, often combined with ceramic particles or other additives to enhance their protective properties. The metal components provide corrosion resistance through sacrificial protection or barrier effects, while the composite structure improves thermal insulation and mechanical durability. These coatings can be applied through various methods including thermal spraying, electroplating, or physical vapor deposition.- Ceramic-based composite coatings for thermal and corrosion protection: Ceramic-based composite coatings provide excellent thermal barrier properties and corrosion resistance for various substrates. These coatings typically consist of ceramic materials such as zirconia, alumina, or silica, which offer high temperature stability and low thermal conductivity. The ceramic components can be combined with other materials to enhance adhesion and durability. These composite coatings are particularly useful for protecting metal components in high-temperature environments such as gas turbines, aerospace applications, and industrial equipment.

- Metal-matrix composite coatings with enhanced thermal and corrosion resistance: Metal-matrix composite coatings incorporate reinforcing particles or fibers within a metal matrix to provide both thermal protection and corrosion resistance. These coatings typically use aluminum, nickel, or copper as the matrix material, with reinforcements such as carbides, nitrides, or oxides. The metal matrix provides ductility and thermal conductivity control, while the reinforcements enhance wear resistance and mechanical strength. These coatings can be applied through various methods including thermal spraying, electroplating, or powder metallurgy techniques, offering protection for components in harsh operating environments.

- Polymer-based composite coatings for thermal insulation and corrosion protection: Polymer-based composite coatings combine organic polymers with inorganic fillers to create effective barriers against both heat transfer and corrosive environments. These coatings typically incorporate materials such as epoxy, polyurethane, or silicone as the matrix, with additives like ceramic particles, glass flakes, or metal oxides to enhance thermal insulation and corrosion resistance. The polymer matrix provides flexibility and adhesion to various substrates, while the fillers create tortuous paths that inhibit the penetration of corrosive agents and reduce thermal conductivity. These coatings are particularly suitable for applications requiring moderate temperature resistance combined with excellent chemical resistance.

- Multi-layer composite coating systems for comprehensive protection: Multi-layer composite coating systems consist of strategically designed layers that work together to provide both thermal insulation and corrosion protection. These systems typically include a primer layer for adhesion, intermediate layers for corrosion resistance, and top layers for thermal protection and environmental resistance. The combination of different materials in each layer creates a synergistic effect that offers superior performance compared to single-layer coatings. These multi-layer systems can be customized for specific operating conditions and substrate materials, providing long-term protection for critical components in extreme environments.

- Nanocomposite coatings with advanced thermal and corrosion protective properties: Nanocomposite coatings incorporate nanoscale particles or structures to achieve superior thermal insulation and corrosion resistance. These coatings utilize nanomaterials such as carbon nanotubes, graphene, nano-ceramics, or metal nanoparticles dispersed within a suitable matrix. The nanoscale components create unique interfaces and structures that effectively block heat transfer pathways and corrosion mechanisms. The high surface area and quantum effects of nanomaterials contribute to enhanced performance at reduced coating thicknesses. These advanced coatings offer exceptional durability and protection for applications in aerospace, electronics, and energy sectors where extreme conditions are encountered.

02 Ceramic-based thermal barrier coatings

Ceramic-based thermal barrier coatings (TBCs) are designed primarily to provide thermal insulation for components exposed to high temperatures. These coatings typically consist of ceramic materials such as zirconia, alumina, or other refractory oxides that have low thermal conductivity. The ceramic layer is often applied over a metallic bond coat that provides adhesion to the substrate and additional corrosion protection. These multi-layer systems can significantly reduce heat transfer to the substrate, protecting it from thermal degradation while simultaneously offering some degree of corrosion resistance.Expand Specific Solutions03 Polymer-based composite coatings with thermal and corrosion resistance

Polymer-based composite coatings combine organic polymers with various fillers and additives to create protective layers with both thermal and corrosion resistance properties. These coatings often incorporate materials such as epoxy, polyurethane, or silicone as the matrix, filled with particles that enhance thermal insulation and corrosion protection. Additives may include flame retardants, UV stabilizers, and corrosion inhibitors. The polymer matrix provides a barrier against corrosive media, while the composite structure creates thermal insulation. These coatings are typically lightweight and can be applied to various substrates using conventional coating methods.Expand Specific Solutions04 Nanocomposite coatings for enhanced thermal and corrosion protection

Nanocomposite coatings represent an advanced approach to thermal and corrosion protection, utilizing nanoscale materials to achieve superior performance. These coatings incorporate nanoparticles, nanotubes, or nanosheets dispersed within a matrix material, creating unique structures with enhanced properties. The nanoscale components can include ceramic nanoparticles, carbon nanotubes, graphene, or metal nanoparticles. The small size and high surface area of these materials lead to improved thermal insulation, better corrosion resistance, and enhanced mechanical properties compared to conventional coatings. The nanoscale features can fill defects, create tortuous paths for corrosive media, and scatter thermal energy effectively.Expand Specific Solutions05 Multi-layer composite coating systems

Multi-layer composite coating systems combine different materials in distinct layers to provide comprehensive thermal and corrosion protection. These systems typically consist of a primer layer for adhesion and initial corrosion protection, intermediate layers with specific functional properties, and a top coat for environmental protection. Each layer serves a specific purpose in the overall protection scheme, with materials selected to complement each other's properties. The layered structure allows for optimization of both thermal insulation and corrosion resistance, with the possibility to incorporate different mechanisms of protection in a single coating system. These systems can be customized for specific operating environments and substrate materials.Expand Specific Solutions

Leading Companies in EV Battery Protection Materials

The composite coatings market for EV battery thermal and corrosion protection is in a growth phase, driven by increasing EV adoption worldwide. The market is projected to expand significantly as battery safety and longevity become critical competitive factors. Major players represent diverse industrial backgrounds, with companies like 3M, Henkel, and PPG Industries bringing established coating expertise, while automotive manufacturers such as BYD, Nissan, and Mercedes-Benz are developing proprietary solutions. Battery specialists including SK Innovation and Aspen Aerogels are advancing thermal management technologies. The competitive landscape shows varying levels of technical maturity, with some companies focusing on nano-composite solutions while others emphasize environmentally friendly formulations. Research collaborations between industry leaders and institutions like Colorado State University indicate ongoing innovation to address thermal runaway prevention and extended battery lifecycle challenges.

3M Innovative Properties Co.

Technical Solution: 3M has developed advanced composite coating solutions for EV battery thermal management and corrosion protection that combine multiple functional layers. Their technology utilizes fluoropolymer-based coatings with ceramic fillers to create thermally conductive yet electrically insulating barriers. The system typically consists of a primer layer for adhesion to battery cell surfaces, a middle layer containing ceramic particles for thermal conductivity (typically 1-5 W/m·K), and a top coat providing chemical and moisture resistance. 3M's coatings incorporate proprietary flame-retardant additives that can withstand temperatures up to 800°C while maintaining structural integrity. Their water-based formulations reduce VOC emissions during application while providing excellent adhesion to various substrates including aluminum, steel, and polymers used in battery enclosures. The coatings also feature self-healing properties that can repair minor scratches through thermal activation, extending the protective lifetime of the battery systems.

Strengths: Excellent thermal conductivity combined with electrical insulation properties; strong adhesion to multiple substrate materials; environmentally friendly water-based formulations; self-healing capabilities. Weaknesses: Higher cost compared to conventional coatings; requires specialized application equipment; may add weight to battery systems; performance may degrade under extreme temperature cycling conditions.

BYD Co., Ltd.

Technical Solution: BYD has developed an integrated composite coating system for their EV batteries that addresses both thermal management and corrosion protection challenges. Their proprietary "Battery Shield" technology utilizes a multi-functional approach combining ceramic-reinforced polymers with phase change materials (PCMs) that absorb excess heat during operation. The base layer contains aluminum oxide and silicon carbide particles dispersed in an epoxy matrix, providing thermal conductivity of 2-4 W/m·K while maintaining electrical isolation properties. This layer bonds directly to battery cell surfaces and contains corrosion inhibitors including benzotriazole derivatives that form protective films on metal substrates. The middle layer incorporates microencapsulated PCMs with melting points calibrated to 45-55°C, absorbing up to 200-250 J/g during thermal events. The outer protective layer features fluorinated polymers with hydrophobic properties (water contact angle >120°) and chemical resistance to automotive fluids. BYD's coating system is applied through automated processes with precise thickness control (150-350 μm) and has demonstrated durability through 1000+ thermal cycles without performance degradation. The system has been implemented across BYD's Blade Battery platform, contributing to its industry-leading safety performance in nail penetration and thermal runaway tests.

Strengths: Integrated thermal management with phase change materials provides active temperature regulation; excellent adhesion to various battery cell formats; proven performance in commercial applications; automated application process suitable for mass production. Weaknesses: Proprietary nature limits adoption by other manufacturers; relatively higher weight compared to some competing solutions; optimal performance dependent on specific battery cell chemistry and design; potential for reduced effectiveness after extended aging.

Key Patents and Research in Thermal-Corrosion Resistant Coatings

Thermal barrier material for electric vehicle battery applications

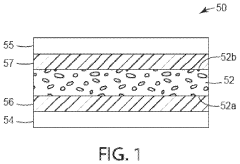

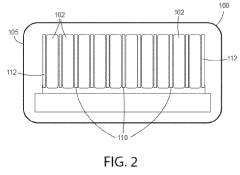

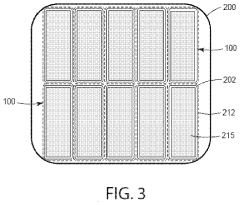

PatentInactiveUS20210376405A1

Innovation

- A composite thermal barrier material comprising a porous core layer with flame retardant layers on either side and a radiant barrier layer in between, which includes a thermally expandable layer and radiant barrier layers to disperse heat and maintain a significant temperature difference across the material.

Corrosion protection coating

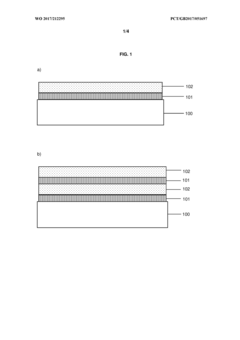

PatentWO2017212295A1

Innovation

- An electrically conductive composite coating comprising a carbon-based material, an azole-containing corrosion inhibitor, and a tin layer, applied to substrates to minimize corrosion and maintain conductivity, with the carbon-based material including carbon black, graphite, or nanotubes, and the azole inhibitor being benzotriazole, applied in specific weight percentages and thicknesses to achieve optimal performance.

Environmental Impact and Sustainability Considerations

The development of composite coatings for EV battery thermal and corrosion protection must be evaluated not only for technical performance but also for environmental sustainability throughout their lifecycle. Current coating technologies often involve volatile organic compounds (VOCs), heavy metals, and other environmentally harmful substances that pose significant ecological risks during manufacturing, application, and disposal phases.

Water-based composite coating systems have emerged as promising alternatives, reducing VOC emissions by up to 90% compared to traditional solvent-based systems. These formulations maintain comparable thermal conductivity (2-5 W/m·K) while dramatically decreasing air pollution and worker exposure to hazardous chemicals. Life cycle assessment (LCA) studies indicate that water-based systems can reduce the carbon footprint of coating processes by 30-45%.

Bio-based components derived from renewable resources are increasingly incorporated into composite coating formulations. Lignin-based additives, cellulose nanocrystals, and plant oil-derived polymers provide sustainable alternatives to petroleum-based materials while offering comparable or enhanced thermal stability and corrosion resistance. These bio-based components typically biodegrade 40-60% faster than conventional coating materials.

End-of-life considerations represent a critical sustainability challenge for composite coatings. Current thermoset-based systems are difficult to separate and recycle, often becoming permanent waste after the battery's useful life. Recent innovations in reversible cross-linking chemistries and stimuli-responsive polymers enable coating materials that can be selectively degraded under controlled conditions, facilitating material recovery and recycling. These technologies have demonstrated recovery rates of 75-85% for valuable components.

Energy consumption during coating application and curing processes contributes significantly to the environmental footprint. Traditional thermal curing methods require temperatures of 120-180°C maintained for extended periods. UV-curable and electron-beam curable composite coatings reduce energy requirements by 60-70% while accelerating production speeds. Additionally, room-temperature curing systems activated by atmospheric moisture or chemical catalysts further minimize energy demands in coating operations.

Regulatory frameworks worldwide are increasingly restricting environmentally harmful substances in coating formulations. The EU's REACH regulations, China's VOC emission standards, and California's Proposition 65 all impact coating development strategies. Forward-looking manufacturers are proactively reformulating composite coatings to eliminate substances of very high concern (SVHCs), ensuring compliance with emerging global regulations while maintaining thermal and corrosion protection performance.

Water-based composite coating systems have emerged as promising alternatives, reducing VOC emissions by up to 90% compared to traditional solvent-based systems. These formulations maintain comparable thermal conductivity (2-5 W/m·K) while dramatically decreasing air pollution and worker exposure to hazardous chemicals. Life cycle assessment (LCA) studies indicate that water-based systems can reduce the carbon footprint of coating processes by 30-45%.

Bio-based components derived from renewable resources are increasingly incorporated into composite coating formulations. Lignin-based additives, cellulose nanocrystals, and plant oil-derived polymers provide sustainable alternatives to petroleum-based materials while offering comparable or enhanced thermal stability and corrosion resistance. These bio-based components typically biodegrade 40-60% faster than conventional coating materials.

End-of-life considerations represent a critical sustainability challenge for composite coatings. Current thermoset-based systems are difficult to separate and recycle, often becoming permanent waste after the battery's useful life. Recent innovations in reversible cross-linking chemistries and stimuli-responsive polymers enable coating materials that can be selectively degraded under controlled conditions, facilitating material recovery and recycling. These technologies have demonstrated recovery rates of 75-85% for valuable components.

Energy consumption during coating application and curing processes contributes significantly to the environmental footprint. Traditional thermal curing methods require temperatures of 120-180°C maintained for extended periods. UV-curable and electron-beam curable composite coatings reduce energy requirements by 60-70% while accelerating production speeds. Additionally, room-temperature curing systems activated by atmospheric moisture or chemical catalysts further minimize energy demands in coating operations.

Regulatory frameworks worldwide are increasingly restricting environmentally harmful substances in coating formulations. The EU's REACH regulations, China's VOC emission standards, and California's Proposition 65 all impact coating development strategies. Forward-looking manufacturers are proactively reformulating composite coatings to eliminate substances of very high concern (SVHCs), ensuring compliance with emerging global regulations while maintaining thermal and corrosion protection performance.

Safety Standards and Testing Protocols for Battery Coatings

The safety standards and testing protocols for battery coatings in electric vehicles have evolved significantly in response to increasing concerns about battery thermal runaway and corrosion-related failures. International organizations such as ISO, IEC, and UL have established comprehensive frameworks that specifically address protective coatings for EV batteries. These standards typically require coatings to maintain integrity under extreme temperature conditions ranging from -40°C to 150°C, reflecting real-world operational scenarios.

Key testing protocols for thermal protection include cyclic heat exposure tests, where coatings must withstand repeated thermal cycling without degradation or delamination. The UL 94 flammability test has become particularly critical, requiring battery coatings to achieve V-0 rating, indicating self-extinguishing properties within seconds of flame removal. Additionally, thermal conductivity measurements following ASTM E1530 standards ensure coatings provide optimal heat dissipation characteristics.

For corrosion protection, accelerated environmental testing protocols such as ASTM B117 salt spray tests and humidity cycling tests (ASTM D2247) evaluate coating performance under aggressive conditions. These tests typically require 1,000+ hours of exposure without significant degradation. Electrochemical impedance spectroscopy (EIS) has emerged as a sophisticated analytical method to quantify coating barrier properties and predict long-term performance.

Impact and mechanical testing protocols have gained prominence, with standards requiring coatings to maintain protective properties after physical trauma. The ASTM D2794 impact resistance test and adhesion tests following ASTM D3359 ensure coatings remain intact during vehicle operation and potential collision scenarios.

Regulatory compliance frameworks vary globally, with China's GB/T 31467.3 standard imposing stringent requirements for battery coating materials, while European regulations under ECE R100 focus on electrical isolation properties of protective coatings. The United States relies heavily on SAE J2464 and UL 2580 standards, which emphasize thermal management aspects of battery protection systems.

Recent developments include the integration of real-time monitoring capabilities into testing protocols, allowing for continuous assessment of coating performance under simulated operational conditions. This approach provides more comprehensive data on coating behavior throughout the battery lifecycle, enabling manufacturers to optimize formulations for specific vehicle applications and usage patterns.

Key testing protocols for thermal protection include cyclic heat exposure tests, where coatings must withstand repeated thermal cycling without degradation or delamination. The UL 94 flammability test has become particularly critical, requiring battery coatings to achieve V-0 rating, indicating self-extinguishing properties within seconds of flame removal. Additionally, thermal conductivity measurements following ASTM E1530 standards ensure coatings provide optimal heat dissipation characteristics.

For corrosion protection, accelerated environmental testing protocols such as ASTM B117 salt spray tests and humidity cycling tests (ASTM D2247) evaluate coating performance under aggressive conditions. These tests typically require 1,000+ hours of exposure without significant degradation. Electrochemical impedance spectroscopy (EIS) has emerged as a sophisticated analytical method to quantify coating barrier properties and predict long-term performance.

Impact and mechanical testing protocols have gained prominence, with standards requiring coatings to maintain protective properties after physical trauma. The ASTM D2794 impact resistance test and adhesion tests following ASTM D3359 ensure coatings remain intact during vehicle operation and potential collision scenarios.

Regulatory compliance frameworks vary globally, with China's GB/T 31467.3 standard imposing stringent requirements for battery coating materials, while European regulations under ECE R100 focus on electrical isolation properties of protective coatings. The United States relies heavily on SAE J2464 and UL 2580 standards, which emphasize thermal management aspects of battery protection systems.

Recent developments include the integration of real-time monitoring capabilities into testing protocols, allowing for continuous assessment of coating performance under simulated operational conditions. This approach provides more comprehensive data on coating behavior throughout the battery lifecycle, enabling manufacturers to optimize formulations for specific vehicle applications and usage patterns.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!