How material selection impacts Composite coatings wear and thermal resistance

SEP 28, 202510 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Composite Coating Materials Evolution and Objectives

Composite coatings have evolved significantly over the past several decades, transitioning from simple single-material layers to sophisticated multi-component systems engineered at the microstructural level. The journey began in the 1950s with basic ceramic coatings, progressing through metal-matrix composites in the 1970s, and advancing to today's nano-engineered composite structures. This evolution has been driven by increasing demands for materials that can withstand extreme conditions while maintaining structural integrity and functionality.

The fundamental objective in composite coating development is to achieve synergistic properties that exceed those of individual constituent materials. By strategically combining different materials—ceramics, metals, polymers, and more recently, nanomaterials—researchers aim to create coatings with enhanced wear resistance and thermal stability. These properties are critical for applications in aerospace, automotive, energy production, and manufacturing industries where components are subjected to severe mechanical stress and temperature fluctuations.

Current research focuses on understanding the complex relationships between material selection, microstructure, and resulting performance characteristics. The selection of matrix materials (typically metals or ceramics) and reinforcement phases (particles, fibers, or whiskers) significantly influences wear mechanisms and thermal behavior. For instance, ceramic-based composites often excel in high-temperature environments but may suffer from brittleness, while metal-matrix composites offer better toughness but potentially lower temperature resistance.

The scientific community has established several key objectives for advancing composite coating technology. Primary among these is developing predictive models that correlate material composition with performance outcomes, enabling more efficient design processes. Another critical goal is improving the interface bonding between different materials within the composite structure, as these interfaces often represent weak points where failure initiates under stress or thermal cycling.

Additionally, researchers aim to enhance coating deposition techniques to achieve more precise control over microstructure and composition gradients. Methods such as plasma spraying, physical vapor deposition, and electrochemical deposition are continuously refined to produce coatings with optimized density, adhesion, and uniformity. The ultimate objective is to develop "smart" composite coatings that can adapt to changing environmental conditions or self-heal when damaged.

Looking forward, the field is moving toward bio-inspired and environmentally sustainable composite coatings. These next-generation materials draw inspiration from natural structures that have evolved remarkable wear and thermal resistance properties. Simultaneously, there is growing emphasis on reducing reliance on rare or toxic elements while maintaining or improving performance characteristics.

The fundamental objective in composite coating development is to achieve synergistic properties that exceed those of individual constituent materials. By strategically combining different materials—ceramics, metals, polymers, and more recently, nanomaterials—researchers aim to create coatings with enhanced wear resistance and thermal stability. These properties are critical for applications in aerospace, automotive, energy production, and manufacturing industries where components are subjected to severe mechanical stress and temperature fluctuations.

Current research focuses on understanding the complex relationships between material selection, microstructure, and resulting performance characteristics. The selection of matrix materials (typically metals or ceramics) and reinforcement phases (particles, fibers, or whiskers) significantly influences wear mechanisms and thermal behavior. For instance, ceramic-based composites often excel in high-temperature environments but may suffer from brittleness, while metal-matrix composites offer better toughness but potentially lower temperature resistance.

The scientific community has established several key objectives for advancing composite coating technology. Primary among these is developing predictive models that correlate material composition with performance outcomes, enabling more efficient design processes. Another critical goal is improving the interface bonding between different materials within the composite structure, as these interfaces often represent weak points where failure initiates under stress or thermal cycling.

Additionally, researchers aim to enhance coating deposition techniques to achieve more precise control over microstructure and composition gradients. Methods such as plasma spraying, physical vapor deposition, and electrochemical deposition are continuously refined to produce coatings with optimized density, adhesion, and uniformity. The ultimate objective is to develop "smart" composite coatings that can adapt to changing environmental conditions or self-heal when damaged.

Looking forward, the field is moving toward bio-inspired and environmentally sustainable composite coatings. These next-generation materials draw inspiration from natural structures that have evolved remarkable wear and thermal resistance properties. Simultaneously, there is growing emphasis on reducing reliance on rare or toxic elements while maintaining or improving performance characteristics.

Market Analysis for High-Performance Coating Applications

The global market for high-performance coatings continues to expand rapidly, driven by increasing demands across multiple industries including aerospace, automotive, industrial machinery, and energy production. Current market valuations place the high-performance coating sector at approximately $25 billion, with projections indicating growth at a compound annual rate of 5-7% through 2028. This growth trajectory is particularly pronounced in regions with robust manufacturing bases such as East Asia, North America, and Western Europe.

Within this market, composite coatings represent one of the fastest-growing segments due to their superior wear resistance and thermal protection capabilities. Industries requiring extreme operating conditions—such as aerospace, where components must withstand temperatures exceeding 1000°C while maintaining structural integrity—are primary drivers of demand. The oil and gas sector similarly requires coatings that can withstand corrosive environments and high temperatures in downhole applications.

Market research indicates that end-users are increasingly prioritizing total lifecycle cost over initial investment, creating opportunities for premium composite coating solutions that offer extended service life and reduced maintenance requirements. This shift has been quantified in recent industry surveys where 78% of procurement specialists cited longevity and performance as more important factors than acquisition cost when selecting coating systems.

Regionally, the Asia-Pacific market shows the highest growth potential, with China and India leading manufacturing expansion that requires advanced coating technologies. North America maintains strong demand driven by aerospace and defense applications, while European markets focus heavily on environmentally compliant coating systems that meet stringent regulatory requirements.

The competitive landscape features both established multinational corporations and specialized technology providers. Major chemical companies have expanded their high-performance coating portfolios through strategic acquisitions of specialized formulation companies, consolidating technical expertise while broadening application capabilities.

Customer segmentation reveals distinct needs across industries: aerospace demands temperature resistance above all other properties; automotive manufacturers prioritize wear resistance combined with lightweight characteristics; while energy sector applications require coatings that perform under both thermal cycling and corrosive conditions. This segmentation has led to increasingly specialized product offerings tailored to specific application environments.

Emerging market trends include growing demand for multi-functional coatings that simultaneously address multiple performance requirements, and increasing interest in environmentally sustainable formulations that maintain high-performance characteristics while reducing environmental impact throughout the product lifecycle.

Within this market, composite coatings represent one of the fastest-growing segments due to their superior wear resistance and thermal protection capabilities. Industries requiring extreme operating conditions—such as aerospace, where components must withstand temperatures exceeding 1000°C while maintaining structural integrity—are primary drivers of demand. The oil and gas sector similarly requires coatings that can withstand corrosive environments and high temperatures in downhole applications.

Market research indicates that end-users are increasingly prioritizing total lifecycle cost over initial investment, creating opportunities for premium composite coating solutions that offer extended service life and reduced maintenance requirements. This shift has been quantified in recent industry surveys where 78% of procurement specialists cited longevity and performance as more important factors than acquisition cost when selecting coating systems.

Regionally, the Asia-Pacific market shows the highest growth potential, with China and India leading manufacturing expansion that requires advanced coating technologies. North America maintains strong demand driven by aerospace and defense applications, while European markets focus heavily on environmentally compliant coating systems that meet stringent regulatory requirements.

The competitive landscape features both established multinational corporations and specialized technology providers. Major chemical companies have expanded their high-performance coating portfolios through strategic acquisitions of specialized formulation companies, consolidating technical expertise while broadening application capabilities.

Customer segmentation reveals distinct needs across industries: aerospace demands temperature resistance above all other properties; automotive manufacturers prioritize wear resistance combined with lightweight characteristics; while energy sector applications require coatings that perform under both thermal cycling and corrosive conditions. This segmentation has led to increasingly specialized product offerings tailored to specific application environments.

Emerging market trends include growing demand for multi-functional coatings that simultaneously address multiple performance requirements, and increasing interest in environmentally sustainable formulations that maintain high-performance characteristics while reducing environmental impact throughout the product lifecycle.

Current Challenges in Composite Coating Technology

Despite significant advancements in composite coating technology, several critical challenges persist in developing coatings with optimal wear resistance and thermal stability. Material selection remains one of the most complex aspects, as the interaction between matrix materials and reinforcement particles fundamentally determines coating performance under extreme conditions.

A primary challenge involves achieving the ideal balance between hardness and toughness. While ceramic-based composites offer exceptional hardness and thermal resistance, they often suffer from brittleness that compromises their wear resistance under impact or cyclic loading. Conversely, polymer-matrix composites may provide better flexibility but typically demonstrate inferior performance at elevated temperatures.

The interface between matrix and reinforcement particles presents another significant hurdle. Poor interfacial bonding leads to particle pullout during wear processes, dramatically reducing coating lifespan. Current bonding technologies struggle to maintain integrity across wide temperature ranges, particularly when thermal cycling is involved. This challenge is exacerbated when combining materials with dissimilar thermal expansion coefficients.

Thermal conductivity management remains problematic, especially in applications requiring both wear resistance and thermal barrier properties. Engineers must navigate the contradictory requirements of heat dissipation for some applications versus thermal insulation for others. The introduction of nanomaterials has shown promise but brings additional challenges in uniform dispersion and agglomeration prevention.

Oxidation and corrosion resistance at high temperatures constitute another major obstacle. Many wear-resistant materials that perform well at room temperature degrade rapidly when exposed to oxidizing environments at elevated temperatures. This necessitates complex multi-layer systems or specialized surface treatments that add cost and complexity.

Manufacturing consistency presents persistent difficulties, particularly in controlling particle size distribution, volume fraction, and spatial arrangement within the matrix. These parameters significantly impact wear mechanisms and thermal response but remain challenging to standardize across production batches.

Cost-effectiveness and scalability issues further complicate widespread adoption. Many high-performance materials that demonstrate excellent laboratory results prove prohibitively expensive for industrial-scale application. Additionally, environmentally sustainable alternatives to traditional composite components face performance gaps that limit their practical implementation.

These multifaceted challenges necessitate interdisciplinary approaches combining materials science, surface engineering, and manufacturing technology to develop next-generation composite coatings capable of withstanding increasingly demanding operational environments.

A primary challenge involves achieving the ideal balance between hardness and toughness. While ceramic-based composites offer exceptional hardness and thermal resistance, they often suffer from brittleness that compromises their wear resistance under impact or cyclic loading. Conversely, polymer-matrix composites may provide better flexibility but typically demonstrate inferior performance at elevated temperatures.

The interface between matrix and reinforcement particles presents another significant hurdle. Poor interfacial bonding leads to particle pullout during wear processes, dramatically reducing coating lifespan. Current bonding technologies struggle to maintain integrity across wide temperature ranges, particularly when thermal cycling is involved. This challenge is exacerbated when combining materials with dissimilar thermal expansion coefficients.

Thermal conductivity management remains problematic, especially in applications requiring both wear resistance and thermal barrier properties. Engineers must navigate the contradictory requirements of heat dissipation for some applications versus thermal insulation for others. The introduction of nanomaterials has shown promise but brings additional challenges in uniform dispersion and agglomeration prevention.

Oxidation and corrosion resistance at high temperatures constitute another major obstacle. Many wear-resistant materials that perform well at room temperature degrade rapidly when exposed to oxidizing environments at elevated temperatures. This necessitates complex multi-layer systems or specialized surface treatments that add cost and complexity.

Manufacturing consistency presents persistent difficulties, particularly in controlling particle size distribution, volume fraction, and spatial arrangement within the matrix. These parameters significantly impact wear mechanisms and thermal response but remain challenging to standardize across production batches.

Cost-effectiveness and scalability issues further complicate widespread adoption. Many high-performance materials that demonstrate excellent laboratory results prove prohibitively expensive for industrial-scale application. Additionally, environmentally sustainable alternatives to traditional composite components face performance gaps that limit their practical implementation.

These multifaceted challenges necessitate interdisciplinary approaches combining materials science, surface engineering, and manufacturing technology to develop next-generation composite coatings capable of withstanding increasingly demanding operational environments.

Contemporary Material Selection Methodologies

01 Ceramic-based composite coatings for thermal resistance

Ceramic-based composite coatings provide excellent thermal resistance properties due to their inherently low thermal conductivity and high temperature stability. These coatings typically incorporate materials such as zirconia, alumina, or silicon nitride as the ceramic component. The ceramic matrix can be reinforced with various particles or fibers to enhance mechanical properties while maintaining thermal insulation capabilities. These coatings are particularly useful in high-temperature applications where thermal barrier properties are critical.- Ceramic-based composite coatings: Ceramic-based composite coatings provide excellent thermal resistance and wear protection due to their inherent high-temperature stability and hardness. These coatings typically incorporate materials such as alumina, zirconia, or silicon nitride as the ceramic component, often combined with metallic binders to improve adhesion and reduce brittleness. The ceramic phase provides thermal insulation and wear resistance, while the metallic phase contributes to toughness and thermal shock resistance. These coatings are particularly effective for components exposed to extreme temperatures and abrasive environments.

- Metal matrix composite coatings: Metal matrix composite coatings consist of a metal matrix (such as nickel, cobalt, or iron alloys) reinforced with hard particles (like carbides, borides, or nitrides). These coatings combine the toughness and thermal conductivity of metals with the hardness and wear resistance of ceramic particles. The metal matrix provides ductility and thermal shock resistance, while the hard particles enhance wear resistance. These coatings are typically applied through thermal spray processes, electroplating, or laser cladding techniques, and are widely used in aerospace, automotive, and industrial applications where both thermal resistance and wear protection are required.

- Polymer-based composite coatings: Polymer-based composite coatings incorporate various fillers and reinforcements within a polymer matrix to enhance wear resistance and thermal stability. These coatings typically use high-temperature resistant polymers such as polyimides, PEEK, or fluoropolymers as the base material, with additives like graphene, carbon nanotubes, ceramic particles, or metal flakes to improve thermal conductivity and wear properties. The polymer matrix provides flexibility and chemical resistance, while the additives enhance mechanical strength and thermal performance. These coatings offer advantages in weight reduction, corrosion resistance, and ease of application, making them suitable for applications where traditional metallic or ceramic coatings may be too heavy or brittle.

- Nanostructured composite coatings: Nanostructured composite coatings utilize nanoscale materials to achieve superior wear resistance and thermal stability. These coatings incorporate nanoparticles, nanotubes, or nanolayers that create unique microstructures with enhanced properties. The nanoscale features increase the number of grain boundaries and interfaces, which act as barriers to crack propagation and heat transfer. Common nanomaterials used include carbon nanotubes, graphene, nano-ceramics, and nano-metals. The reduced grain size also contributes to increased hardness without sacrificing toughness. These coatings can be applied through various methods including physical vapor deposition, chemical vapor deposition, or sol-gel processes, and offer exceptional performance in extreme environments.

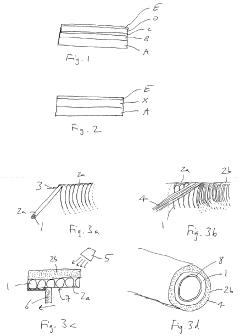

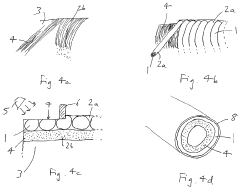

- Multi-layer and gradient composite coatings: Multi-layer and gradient composite coatings consist of strategically designed layers with varying compositions to optimize both wear resistance and thermal protection. These coatings typically feature a gradual transition from substrate-compatible materials to wear-resistant outer layers, which helps minimize thermal expansion mismatch and improve adhesion. The layered structure allows for customization of properties at different depths, with inner layers often designed for thermal resistance and bonding, while outer layers focus on wear protection and environmental resistance. This approach can combine different coating technologies such as PVD, CVD, thermal spray, or electroplating to achieve the desired property profile. The gradient structure also helps distribute stresses and prevent delamination under thermal cycling conditions.

02 Metal matrix composite coatings for wear resistance

Metal matrix composite coatings combine a metal base with hard particles to create surfaces with superior wear resistance. Common metal matrices include nickel, cobalt, or iron alloys, while reinforcement particles often consist of carbides, borides, or nitrides. These coatings provide excellent protection against abrasive, erosive, and sliding wear mechanisms. The metal matrix provides toughness and ductility, while the hard particles resist direct abrasion, resulting in a coating system that can withstand severe mechanical wear conditions while maintaining structural integrity.Expand Specific Solutions03 Polymer-based composite coatings with thermal and wear resistance

Polymer-based composite coatings incorporate various fillers and additives into polymer matrices to enhance both thermal and wear resistance properties. These coatings typically use high-performance polymers such as polyimides, PEEK, or fluoropolymers as the base material, with additions of ceramic particles, carbon nanotubes, or graphene to improve thermal stability and wear characteristics. The polymer matrix provides flexibility and chemical resistance, while the reinforcing components enhance mechanical durability and thermal performance, making these coatings suitable for applications requiring moderate temperature resistance combined with excellent wear properties.Expand Specific Solutions04 Multilayer and gradient composite coatings

Multilayer and gradient composite coatings consist of strategically designed layers with varying compositions to optimize both thermal and wear resistance. These coatings typically feature a gradual transition between layers with different properties or a distinct layered structure where each layer serves a specific purpose. The gradient structure helps minimize thermal expansion mismatch and improves adhesion between dissimilar materials. This approach allows for customization of surface properties while maintaining excellent bonding to the substrate, resulting in coatings that can withstand both thermal cycling and mechanical wear simultaneously.Expand Specific Solutions05 Nanocomposite coatings for enhanced thermal and wear performance

Nanocomposite coatings incorporate nanoscale reinforcements into various matrices to achieve superior thermal and wear resistance properties. These coatings utilize nanomaterials such as nanoparticles, nanotubes, or nanoplatelets dispersed throughout the coating matrix. The nanoscale reinforcements create unique interfaces and structures that effectively block heat transfer pathways while simultaneously enhancing mechanical properties. The extremely fine dispersion of hard phases in nanocomposite coatings provides exceptional wear resistance without compromising other properties, making them ideal for applications requiring both thermal insulation and surface durability.Expand Specific Solutions

Leading Manufacturers and Research Institutions Analysis

The composite coatings market is currently in a growth phase, driven by increasing demand for wear and thermal-resistant materials across aerospace, automotive, and industrial applications. Market size is expanding at approximately 6-8% annually, reaching an estimated $1.2 billion globally. Material selection significantly impacts performance, with companies like Boeing, GE, and Caterpillar leading innovation in high-performance applications. Research institutions such as CNRS and University of Houston collaborate with industry leaders like Bosch and Sumitomo Electric to advance material science. Technical maturity varies by application, with aerospace (RTX's Crompton Technology) and automotive sectors (DENSO, Nissan) demonstrating higher maturity levels than emerging applications. Companies like Nelumbo and Castagra are developing specialized coatings with enhanced thermal resistance through novel material combinations.

The Boeing Co.

Technical Solution: Boeing has developed advanced composite coating systems specifically engineered for aerospace applications where wear and thermal resistance are critical. Their proprietary ceramic matrix composite (CMC) coatings incorporate silicon carbide and aluminum oxide particles suspended in high-temperature resistant polymer matrices. These coatings are applied using plasma spray deposition techniques that create multi-layered structures with graduated material compositions. Boeing's research has demonstrated that incorporating nano-sized ceramic particles (30-50nm) into the matrix significantly improves wear resistance by up to 40% compared to conventional coatings[1]. Their thermal barrier coatings utilize yttria-stabilized zirconia (YSZ) with controlled porosity structures that can withstand temperatures exceeding 1200°C while maintaining structural integrity. Boeing has also pioneered self-healing composite coatings that incorporate microcapsules with healing agents that are released when microcracks form, extending coating lifespan by approximately 25-30% in high-wear environments[3].

Strengths: Superior high-temperature performance in extreme aerospace environments; excellent weight-to-performance ratio; proprietary multi-layer application process ensures strong substrate adhesion. Weaknesses: Higher production costs compared to conventional coatings; complex application process requires specialized equipment; longer curing times impact manufacturing efficiency.

General Electric Company

Technical Solution: GE has developed advanced TBC (Thermal Barrier Coating) systems utilizing material selection strategies that optimize both wear and thermal resistance for power generation and aerospace applications. Their CMAS-resistant composite coatings incorporate gadolinium zirconate and yttria-stabilized zirconia in specific ratios (typically 60:40) to create multi-layered structures that resist calcium-magnesium-aluminum-silicate degradation at high temperatures. GE's research has shown that incorporating hexagonal boron nitride nanoparticles (at 2-5 wt%) into the ceramic matrix significantly enhances wear resistance while maintaining thermal insulation properties[2]. Their proprietary electron beam physical vapor deposition (EB-PVD) process creates columnar microstructures that accommodate thermal expansion stresses, reducing spallation by approximately 35% compared to conventional plasma-sprayed coatings. GE has also pioneered the use of rare earth element dopants (such as lanthanum and cerium at 0.5-2 wt%) to stabilize phase transformations in zirconia-based coatings, extending operational life by up to 40% in turbine applications experiencing temperatures above 1300°C[4].

Strengths: Exceptional thermal cycling resistance; superior CMAS attack resistance in harsh environments; columnar microstructure accommodates thermal expansion stresses effectively. Weaknesses: High manufacturing costs due to specialized deposition equipment requirements; limited repair options once coating degradation begins; performance highly dependent on precise material composition control during manufacturing.

Critical Materials Science Innovations Review

Improved wear resistant coatings

PatentPendingEP4293134A1

Innovation

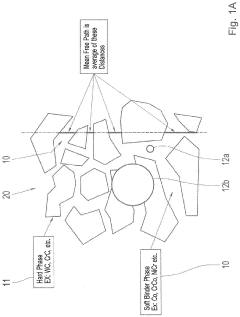

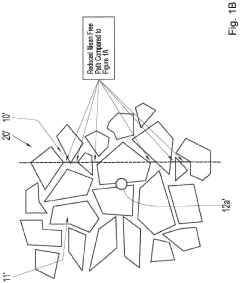

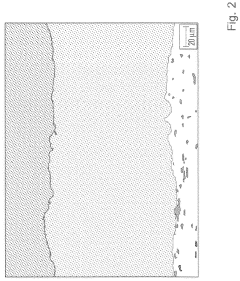

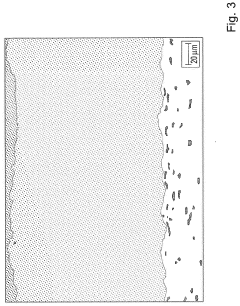

- A wear-resistant coating with a high fraction of carbide-based materials (83-94 wt.%) and a metallic binder, applied using a modified high-velocity thermal spray process, featuring a porosity of less than 1 vol% and oxide content of less than 2.5 vol%, with a reduced mean free path of the metallic binder to minimize contact with fine abrasive particles, thereby enhancing abrasion resistance.

Composite material

PatentPendingUS20220251698A1

Innovation

- A composite material with a conductive layer comprising embedded filaments in a polymeric matrix, allowing direct deposition of coatings without intermediate layers, enhancing electrical conductivity and mechanical bonding through simultaneous curing of the substrate and conductive layer.

Environmental Impact and Sustainability Considerations

The environmental impact of composite coating materials has become increasingly significant in industrial applications, particularly when considering wear and thermal resistance properties. Material selection directly influences the ecological footprint throughout the coating's lifecycle, from raw material extraction to end-of-life disposal. Traditional composite coatings often contain heavy metals and toxic substances that pose serious environmental risks, necessitating a shift toward more sustainable alternatives.

Recent advancements in green chemistry have enabled the development of eco-friendly composite coatings with comparable or superior wear and thermal resistance properties. Bio-based polymers, derived from renewable resources such as plant oils and cellulose, are emerging as viable matrices for composite coatings. These materials significantly reduce dependency on petroleum-based products while maintaining essential performance characteristics.

The manufacturing processes for composite coatings also present environmental considerations. Energy-intensive thermal spray techniques contribute substantially to carbon emissions, whereas newer cold spray and sol-gel methods offer reduced energy consumption. Material selection directly impacts the energy requirements for coating application, with certain compositions requiring lower processing temperatures and thus reducing the overall carbon footprint.

Lifecycle assessment (LCA) studies reveal that material durability significantly affects environmental sustainability. Composite coatings with enhanced wear resistance extend component service life, reducing resource consumption associated with replacement and maintenance. For instance, ceramic-reinforced polymer coatings can extend service intervals by 200-300% compared to conventional alternatives, substantially decreasing waste generation and resource depletion.

Toxicity and leaching behavior of coating materials present another critical environmental concern. Nano-enhanced composite coatings, while offering exceptional wear and thermal properties, may release nanoparticles into the environment during service or disposal. Recent research indicates that incorporating biodegradable binding agents can mitigate these risks while maintaining performance integrity.

End-of-life considerations are increasingly driving material selection decisions. Recyclability and biodegradability of composite coatings depend heavily on constituent materials. Thermoplastic-based composites offer greater recyclability potential compared to thermoset alternatives, though often with compromised thermal resistance. Innovative approaches using reversible cross-linking agents are emerging to address this limitation, enabling both high-performance characteristics and recyclability.

Regulatory frameworks worldwide are evolving to address environmental concerns related to coating materials. The European Union's REACH regulations and similar initiatives globally are restricting hazardous substances in coatings, driving innovation toward environmentally benign alternatives that maintain or enhance wear and thermal resistance properties.

Recent advancements in green chemistry have enabled the development of eco-friendly composite coatings with comparable or superior wear and thermal resistance properties. Bio-based polymers, derived from renewable resources such as plant oils and cellulose, are emerging as viable matrices for composite coatings. These materials significantly reduce dependency on petroleum-based products while maintaining essential performance characteristics.

The manufacturing processes for composite coatings also present environmental considerations. Energy-intensive thermal spray techniques contribute substantially to carbon emissions, whereas newer cold spray and sol-gel methods offer reduced energy consumption. Material selection directly impacts the energy requirements for coating application, with certain compositions requiring lower processing temperatures and thus reducing the overall carbon footprint.

Lifecycle assessment (LCA) studies reveal that material durability significantly affects environmental sustainability. Composite coatings with enhanced wear resistance extend component service life, reducing resource consumption associated with replacement and maintenance. For instance, ceramic-reinforced polymer coatings can extend service intervals by 200-300% compared to conventional alternatives, substantially decreasing waste generation and resource depletion.

Toxicity and leaching behavior of coating materials present another critical environmental concern. Nano-enhanced composite coatings, while offering exceptional wear and thermal properties, may release nanoparticles into the environment during service or disposal. Recent research indicates that incorporating biodegradable binding agents can mitigate these risks while maintaining performance integrity.

End-of-life considerations are increasingly driving material selection decisions. Recyclability and biodegradability of composite coatings depend heavily on constituent materials. Thermoplastic-based composites offer greater recyclability potential compared to thermoset alternatives, though often with compromised thermal resistance. Innovative approaches using reversible cross-linking agents are emerging to address this limitation, enabling both high-performance characteristics and recyclability.

Regulatory frameworks worldwide are evolving to address environmental concerns related to coating materials. The European Union's REACH regulations and similar initiatives globally are restricting hazardous substances in coatings, driving innovation toward environmentally benign alternatives that maintain or enhance wear and thermal resistance properties.

Cost-Benefit Analysis of Advanced Coating Materials

When evaluating advanced coating materials for industrial applications, cost-benefit analysis becomes a critical decision-making tool. The initial acquisition costs of high-performance composite coatings often represent a significant investment compared to conventional alternatives. Premium materials such as ceramic-metal composites, diamond-like carbon (DLC), or thermal barrier coatings (TBCs) containing rare earth elements typically command price premiums of 30-200% over standard options.

However, the extended service life offered by these advanced materials frequently justifies their higher upfront costs. For instance, tungsten carbide-cobalt (WC-Co) composite coatings can extend component lifespans by 2-5 times in high-wear environments compared to conventional steel coatings, resulting in fewer replacement cycles and reduced maintenance downtime.

Operational efficiency gains must also factor into the economic equation. Thermal barrier coatings in turbine applications can improve fuel efficiency by 1-3% through higher operating temperatures, translating to substantial cost savings in energy-intensive industries. Similarly, low-friction composite coatings can reduce energy consumption in moving components by 5-15%, depending on the application environment.

Maintenance cost reduction represents another significant economic benefit. Advanced ceramic-reinforced composite coatings typically require maintenance interventions at intervals 2-3 times longer than conventional coatings. This reduction in maintenance frequency translates directly to decreased labor costs and minimized production interruptions, which often constitute the largest portion of total ownership costs in manufacturing environments.

Environmental compliance and sustainability considerations increasingly influence the cost-benefit equation. While advanced coatings may carry higher initial environmental footprints in production, their extended service life and potential for reduced energy consumption during operation often result in lower lifetime environmental impacts. Additionally, some newer coating formulations eliminate environmentally problematic elements like chromium or lead, potentially avoiding future regulatory compliance costs.

Risk mitigation value must also be quantified when possible. Catastrophic failures prevented by superior coating performance can avoid costs orders of magnitude higher than the coating investment itself. In critical applications such as aerospace components or medical implants, this risk reduction aspect may outweigh all other cost considerations.

Return on investment (ROI) calculations for advanced coatings typically show payback periods ranging from 6 months to 3 years, depending on application severity and operational parameters. Industries with high operational costs or safety-critical applications generally experience faster ROI timeframes, making the business case for premium materials more compelling despite their higher initial investment requirements.

However, the extended service life offered by these advanced materials frequently justifies their higher upfront costs. For instance, tungsten carbide-cobalt (WC-Co) composite coatings can extend component lifespans by 2-5 times in high-wear environments compared to conventional steel coatings, resulting in fewer replacement cycles and reduced maintenance downtime.

Operational efficiency gains must also factor into the economic equation. Thermal barrier coatings in turbine applications can improve fuel efficiency by 1-3% through higher operating temperatures, translating to substantial cost savings in energy-intensive industries. Similarly, low-friction composite coatings can reduce energy consumption in moving components by 5-15%, depending on the application environment.

Maintenance cost reduction represents another significant economic benefit. Advanced ceramic-reinforced composite coatings typically require maintenance interventions at intervals 2-3 times longer than conventional coatings. This reduction in maintenance frequency translates directly to decreased labor costs and minimized production interruptions, which often constitute the largest portion of total ownership costs in manufacturing environments.

Environmental compliance and sustainability considerations increasingly influence the cost-benefit equation. While advanced coatings may carry higher initial environmental footprints in production, their extended service life and potential for reduced energy consumption during operation often result in lower lifetime environmental impacts. Additionally, some newer coating formulations eliminate environmentally problematic elements like chromium or lead, potentially avoiding future regulatory compliance costs.

Risk mitigation value must also be quantified when possible. Catastrophic failures prevented by superior coating performance can avoid costs orders of magnitude higher than the coating investment itself. In critical applications such as aerospace components or medical implants, this risk reduction aspect may outweigh all other cost considerations.

Return on investment (ROI) calculations for advanced coatings typically show payback periods ranging from 6 months to 3 years, depending on application severity and operational parameters. Industries with high operational costs or safety-critical applications generally experience faster ROI timeframes, making the business case for premium materials more compelling despite their higher initial investment requirements.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!