Research on Composite coatings for biomedical and high performance device applications

SEP 28, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Biomedical Coating Evolution and Objectives

Composite coatings for biomedical and high-performance device applications have evolved significantly over the past decades, transitioning from simple protective layers to sophisticated multifunctional systems. The journey began in the 1960s with basic metallic coatings primarily focused on corrosion resistance, followed by ceramic coatings in the 1970s that introduced improved biocompatibility for early implantable devices.

The 1980s marked a pivotal shift with the introduction of hydroxyapatite coatings for orthopedic implants, representing one of the first purposefully designed bioactive interfaces. By the 1990s, polymer-based coatings emerged, offering drug delivery capabilities and further enhancing biocompatibility. This evolution continued into the 2000s with the development of hybrid organic-inorganic composites that combined the advantages of multiple material classes.

Recent advancements have been driven by the increasing demands of modern healthcare and high-performance applications. The integration of nanotechnology since 2010 has enabled unprecedented control over surface properties at the molecular level. Simultaneously, the incorporation of bioactive compounds, antimicrobial agents, and growth factors has transformed passive coatings into active therapeutic interfaces capable of promoting healing and preventing complications.

Current technological trajectories point toward intelligent composite coatings with stimuli-responsive properties, allowing for on-demand drug release or adaptive surface characteristics. The emergence of 3D printing technologies has further expanded possibilities for spatially controlled coating deposition with precise architectural features tailored to specific anatomical requirements.

The primary objectives of contemporary research in this field include developing coatings with enhanced integration with biological tissues, prolonged functional lifespans, and reduced rejection rates. Researchers aim to create multifunctional surfaces that simultaneously address multiple challenges such as wear resistance, corrosion protection, biocompatibility, and therapeutic delivery.

Another critical goal is the development of environmentally sustainable coating technologies that minimize toxic components while maintaining performance standards. The industry is also focused on scaling manufacturing processes to ensure consistent quality across mass-produced medical devices and implants, addressing the growing global demand for advanced healthcare solutions.

Looking forward, the field is moving toward personalized coating solutions tailored to individual patient profiles, potentially incorporating patient-derived biological materials to optimize compatibility and functional outcomes. This patient-specific approach represents the next frontier in biomedical coating technology, promising to significantly improve treatment efficacy and quality of life for millions of patients worldwide.

The 1980s marked a pivotal shift with the introduction of hydroxyapatite coatings for orthopedic implants, representing one of the first purposefully designed bioactive interfaces. By the 1990s, polymer-based coatings emerged, offering drug delivery capabilities and further enhancing biocompatibility. This evolution continued into the 2000s with the development of hybrid organic-inorganic composites that combined the advantages of multiple material classes.

Recent advancements have been driven by the increasing demands of modern healthcare and high-performance applications. The integration of nanotechnology since 2010 has enabled unprecedented control over surface properties at the molecular level. Simultaneously, the incorporation of bioactive compounds, antimicrobial agents, and growth factors has transformed passive coatings into active therapeutic interfaces capable of promoting healing and preventing complications.

Current technological trajectories point toward intelligent composite coatings with stimuli-responsive properties, allowing for on-demand drug release or adaptive surface characteristics. The emergence of 3D printing technologies has further expanded possibilities for spatially controlled coating deposition with precise architectural features tailored to specific anatomical requirements.

The primary objectives of contemporary research in this field include developing coatings with enhanced integration with biological tissues, prolonged functional lifespans, and reduced rejection rates. Researchers aim to create multifunctional surfaces that simultaneously address multiple challenges such as wear resistance, corrosion protection, biocompatibility, and therapeutic delivery.

Another critical goal is the development of environmentally sustainable coating technologies that minimize toxic components while maintaining performance standards. The industry is also focused on scaling manufacturing processes to ensure consistent quality across mass-produced medical devices and implants, addressing the growing global demand for advanced healthcare solutions.

Looking forward, the field is moving toward personalized coating solutions tailored to individual patient profiles, potentially incorporating patient-derived biological materials to optimize compatibility and functional outcomes. This patient-specific approach represents the next frontier in biomedical coating technology, promising to significantly improve treatment efficacy and quality of life for millions of patients worldwide.

Market Analysis for High-Performance Biomedical Coatings

The global market for high-performance biomedical coatings is experiencing robust growth, driven by increasing demand for advanced medical devices and implants. Currently valued at approximately 15 billion USD, this market is projected to grow at a compound annual growth rate of 7.8% through 2028, significantly outpacing general industrial coatings markets.

Healthcare expenditure trends strongly correlate with biomedical coating market expansion, particularly in regions with aging populations such as North America, Europe, and Japan. The orthopedic implant segment represents the largest application area, accounting for nearly 30% of the total market share, followed by cardiovascular devices at 25% and dental implants at 18%.

Technological advancements in composite coatings are reshaping market dynamics. Antimicrobial coatings have gained substantial traction, growing at 9.2% annually due to heightened infection control concerns in healthcare settings. Similarly, drug-eluting coatings have carved a specialized niche, particularly for stents and other cardiovascular applications, with premium pricing structures reflecting their therapeutic value.

Regional analysis reveals North America as the dominant market, holding 38% of global share, followed by Europe at 29% and Asia-Pacific at 24%. However, the fastest growth is occurring in emerging economies, particularly China and India, where healthcare infrastructure development and increasing medical tourism are creating new opportunities for coating technologies.

Customer segmentation shows hospitals and specialized clinics as primary end-users, accounting for 45% of purchases, while medical device manufacturers represent 40%. The remaining market consists of research institutions and specialty healthcare providers. This distribution highlights the importance of both B2B relationships with device manufacturers and direct engagement with healthcare providers.

Price sensitivity varies significantly across application segments. While basic antimicrobial coatings face price pressure due to increasing competition, specialized composite coatings for high-performance applications command premium prices, with profit margins exceeding 40% in some cases. This price differentiation reflects the critical nature of coating performance in biomedical applications where failure risks are unacceptable.

Market barriers include stringent regulatory requirements, particularly FDA and EU MDR compliance, which can extend product development cycles by 2-3 years. Additionally, intellectual property landscapes are increasingly complex, with major players holding extensive patent portfolios that create significant entry barriers for new competitors.

Future market growth will likely be driven by personalized medicine trends, with custom-engineered coatings designed for specific patient populations emerging as a high-value segment. Additionally, sustainability concerns are beginning to influence purchasing decisions, creating opportunities for bio-based and environmentally friendly coating alternatives.

Healthcare expenditure trends strongly correlate with biomedical coating market expansion, particularly in regions with aging populations such as North America, Europe, and Japan. The orthopedic implant segment represents the largest application area, accounting for nearly 30% of the total market share, followed by cardiovascular devices at 25% and dental implants at 18%.

Technological advancements in composite coatings are reshaping market dynamics. Antimicrobial coatings have gained substantial traction, growing at 9.2% annually due to heightened infection control concerns in healthcare settings. Similarly, drug-eluting coatings have carved a specialized niche, particularly for stents and other cardiovascular applications, with premium pricing structures reflecting their therapeutic value.

Regional analysis reveals North America as the dominant market, holding 38% of global share, followed by Europe at 29% and Asia-Pacific at 24%. However, the fastest growth is occurring in emerging economies, particularly China and India, where healthcare infrastructure development and increasing medical tourism are creating new opportunities for coating technologies.

Customer segmentation shows hospitals and specialized clinics as primary end-users, accounting for 45% of purchases, while medical device manufacturers represent 40%. The remaining market consists of research institutions and specialty healthcare providers. This distribution highlights the importance of both B2B relationships with device manufacturers and direct engagement with healthcare providers.

Price sensitivity varies significantly across application segments. While basic antimicrobial coatings face price pressure due to increasing competition, specialized composite coatings for high-performance applications command premium prices, with profit margins exceeding 40% in some cases. This price differentiation reflects the critical nature of coating performance in biomedical applications where failure risks are unacceptable.

Market barriers include stringent regulatory requirements, particularly FDA and EU MDR compliance, which can extend product development cycles by 2-3 years. Additionally, intellectual property landscapes are increasingly complex, with major players holding extensive patent portfolios that create significant entry barriers for new competitors.

Future market growth will likely be driven by personalized medicine trends, with custom-engineered coatings designed for specific patient populations emerging as a high-value segment. Additionally, sustainability concerns are beginning to influence purchasing decisions, creating opportunities for bio-based and environmentally friendly coating alternatives.

Current Challenges in Composite Coating Technology

Despite significant advancements in composite coating technologies for biomedical and high-performance device applications, several critical challenges continue to impede broader implementation and optimal performance. One of the most persistent issues is achieving consistent adhesion between the coating and substrate materials across diverse environmental conditions. This challenge is particularly pronounced in biomedical implants where the coating must maintain integrity despite constant exposure to bodily fluids and mechanical stresses.

Biocompatibility remains a complex hurdle, as composite coatings must simultaneously fulfill multiple requirements: non-toxicity, resistance to protein adsorption, prevention of bacterial colonization, and promotion of appropriate cellular responses. The balance between these sometimes contradictory properties presents significant formulation challenges, especially when incorporating active pharmaceutical ingredients or antimicrobial components.

Durability under cyclic loading conditions represents another major technical obstacle. Many biomedical devices and high-performance applications experience repeated stress cycles that can lead to coating delamination, cracking, or wear. Current composite coating technologies often demonstrate excellent initial properties but suffer from performance degradation over extended service periods, particularly at interfaces between dissimilar materials.

Manufacturing scalability presents significant barriers to commercialization. Laboratory-scale coating processes that produce excellent results often encounter difficulties when scaled to industrial production volumes. Issues such as process variability, quality control, and cost-effectiveness become increasingly problematic at larger scales, limiting market penetration of advanced composite coating technologies.

The multifunctional requirements of modern applications create substantial design challenges. For instance, orthopedic implant coatings must simultaneously provide corrosion resistance, wear protection, antimicrobial properties, and osseointegration promotion. Achieving this complex property profile within a single coating system remains technically demanding, often requiring multi-layer approaches that introduce additional interface challenges.

Regulatory hurdles constitute a significant non-technical barrier, particularly for biomedical applications. The extensive testing required to demonstrate safety and efficacy of novel coating compositions substantially increases development timelines and costs. This regulatory burden disproportionately affects innovative coating technologies that incorporate new materials or mechanisms of action.

Environmental and sustainability concerns are increasingly important considerations. Traditional coating processes often involve toxic solvents, energy-intensive curing steps, or environmentally persistent compounds. Developing green alternatives that maintain performance specifications while reducing environmental impact represents an emerging challenge for the industry, particularly as regulatory frameworks evolve toward stricter environmental standards.

Biocompatibility remains a complex hurdle, as composite coatings must simultaneously fulfill multiple requirements: non-toxicity, resistance to protein adsorption, prevention of bacterial colonization, and promotion of appropriate cellular responses. The balance between these sometimes contradictory properties presents significant formulation challenges, especially when incorporating active pharmaceutical ingredients or antimicrobial components.

Durability under cyclic loading conditions represents another major technical obstacle. Many biomedical devices and high-performance applications experience repeated stress cycles that can lead to coating delamination, cracking, or wear. Current composite coating technologies often demonstrate excellent initial properties but suffer from performance degradation over extended service periods, particularly at interfaces between dissimilar materials.

Manufacturing scalability presents significant barriers to commercialization. Laboratory-scale coating processes that produce excellent results often encounter difficulties when scaled to industrial production volumes. Issues such as process variability, quality control, and cost-effectiveness become increasingly problematic at larger scales, limiting market penetration of advanced composite coating technologies.

The multifunctional requirements of modern applications create substantial design challenges. For instance, orthopedic implant coatings must simultaneously provide corrosion resistance, wear protection, antimicrobial properties, and osseointegration promotion. Achieving this complex property profile within a single coating system remains technically demanding, often requiring multi-layer approaches that introduce additional interface challenges.

Regulatory hurdles constitute a significant non-technical barrier, particularly for biomedical applications. The extensive testing required to demonstrate safety and efficacy of novel coating compositions substantially increases development timelines and costs. This regulatory burden disproportionately affects innovative coating technologies that incorporate new materials or mechanisms of action.

Environmental and sustainability concerns are increasingly important considerations. Traditional coating processes often involve toxic solvents, energy-intensive curing steps, or environmentally persistent compounds. Developing green alternatives that maintain performance specifications while reducing environmental impact represents an emerging challenge for the industry, particularly as regulatory frameworks evolve toward stricter environmental standards.

Contemporary Composite Coating Methodologies

01 Metal-based composite coatings

Metal-based composite coatings combine metallic materials with other components to enhance properties such as corrosion resistance, wear resistance, and durability. These coatings often incorporate particles or fibers within a metal matrix to create superior surface protection. The combination of different metals or metal with non-metallic components creates synergistic effects that improve overall coating performance in harsh environments and high-stress applications.- Metal-based composite coatings: Metal-based composite coatings combine metallic materials with other components to enhance properties such as corrosion resistance, wear resistance, and durability. These coatings often incorporate metal particles, alloys, or compounds dispersed in a matrix to create protective layers on various substrates. The combination of different metals or metal compounds allows for customized properties suitable for specific industrial applications, particularly in harsh environments.

- Polymer-based composite coatings: Polymer-based composite coatings utilize various polymeric materials as matrices, often reinforced with additives to enhance specific properties. These coatings provide benefits such as chemical resistance, flexibility, and improved adhesion to different substrates. The polymeric matrices can be thermoplastic or thermoset materials, and may incorporate functional additives to achieve desired characteristics such as hydrophobicity, UV resistance, or antimicrobial properties.

- Ceramic and inorganic composite coatings: Ceramic and inorganic composite coatings consist of ceramic materials or other inorganic compounds that provide exceptional thermal resistance, hardness, and chemical stability. These coatings often incorporate materials such as oxides, carbides, nitrides, or silicates to create protective layers that can withstand extreme temperatures and harsh conditions. The combination of different ceramic phases or inorganic components allows for tailored properties suitable for high-temperature applications or environments with severe chemical exposure.

- Nanocomposite coating technologies: Nanocomposite coatings incorporate nanoscale particles or structures within a matrix material to achieve enhanced properties not possible with conventional materials. These coatings utilize the unique properties of nanomaterials to improve characteristics such as hardness, wear resistance, thermal conductivity, or optical properties. The nanoscale components can include nanoparticles, nanotubes, nanowires, or other nanostructured materials that significantly alter the performance of the coating while maintaining a thin profile.

- Environmentally friendly composite coating formulations: Environmentally friendly composite coating formulations focus on reducing environmental impact by utilizing sustainable materials, water-based systems, or low-VOC components. These coatings are designed to provide effective protection while minimizing harmful emissions and environmental contamination. The formulations may incorporate bio-based materials, recycled content, or naturally derived components that offer comparable performance to conventional coatings but with reduced ecological footprint.

02 Polymer-based composite coatings

Polymer-based composite coatings utilize various polymeric materials as the matrix, enhanced with additives or reinforcing agents. These coatings provide benefits such as flexibility, chemical resistance, and improved adhesion to different substrates. The incorporation of functional additives into polymer matrices creates versatile coating systems that can be tailored for specific applications, including protective finishes, decorative surfaces, and specialized industrial uses.Expand Specific Solutions03 Ceramic and inorganic composite coatings

Ceramic and inorganic composite coatings combine ceramic materials with other components to create high-performance surface treatments. These coatings excel in high-temperature applications, offering exceptional hardness, thermal resistance, and chemical stability. The integration of different ceramic phases or the combination of ceramics with other materials creates coatings that can withstand extreme conditions while providing protective barriers against oxidation, corrosion, and mechanical wear.Expand Specific Solutions04 Nanocomposite coating technologies

Nanocomposite coatings incorporate nanoscale particles or structures within a coating matrix to achieve enhanced properties. These advanced coatings exhibit improved hardness, wear resistance, and self-healing capabilities due to the unique properties that emerge at the nanoscale. The uniform distribution of nanoparticles throughout the coating matrix creates materials with exceptional performance characteristics, including antimicrobial properties, enhanced durability, and superior barrier protection.Expand Specific Solutions05 Environmentally friendly composite coatings

Environmentally friendly composite coatings focus on sustainable materials and processes that reduce environmental impact while maintaining high performance. These coatings utilize bio-based components, water-based formulations, or low-VOC systems to create eco-conscious surface treatments. The development of green coating technologies addresses growing regulatory requirements and market demand for sustainable solutions without compromising on protective qualities, durability, or application performance.Expand Specific Solutions

Leading Manufacturers and Research Institutions

The composite coatings market for biomedical and high-performance device applications is in a growth phase, with increasing demand driven by advancements in medical technology. The market is characterized by a mix of established medical device manufacturers (Boston Scientific, Medtronic, Ethicon) and research institutions (Wuhan University of Technology, Northwestern Polytechnical University) collaborating to develop innovative solutions. Technical maturity varies across applications, with cardiovascular coatings being more established while antimicrobial and drug-eluting coatings represent emerging segments. Companies like Surmodics and Biocompatibles UK are developing specialized coating technologies, while major players such as Boston Scientific and Medtronic are integrating these innovations into commercial medical devices, indicating a trend toward consolidation and strategic partnerships in this high-value market segment.

Boston Scientific Scimed, Inc.

Technical Solution: Boston Scientific Scimed has developed advanced drug-eluting composite coatings for implantable medical devices, particularly stents and catheters. Their proprietary technology combines biodegradable polymers with therapeutic agents in multi-layered structures that provide controlled drug release profiles. The company utilizes specialized hydrophilic and hydrophobic polymer blends to optimize biocompatibility while maintaining mechanical integrity during implantation. Their research focuses on surface modification techniques that reduce thrombogenicity and inflammatory responses while promoting endothelialization. Boston Scientific's composite coatings incorporate antimicrobial components and can be customized for different anatomical environments, offering tailored solutions for various clinical applications in cardiovascular, neurological, and peripheral vascular interventions.

Strengths: Extensive clinical validation data supporting safety and efficacy; sophisticated manufacturing capabilities allowing precise control of coating thickness and drug distribution; strong intellectual property portfolio. Weaknesses: Higher production costs compared to non-coated alternatives; potential for batch-to-batch variability in drug elution kinetics; limited shelf life for some drug-polymer combinations.

Medtronic Vascular, Inc.

Technical Solution: Medtronic Vascular has pioneered composite coating technologies that combine bioactive ceramics with polymer matrices for enhanced biocompatibility in vascular implants. Their proprietary EnduraCoat platform integrates hydroxyapatite nanoparticles within hydrogel networks to create surfaces that actively promote endothelialization while preventing protein adsorption and subsequent thrombus formation. The company employs plasma-enhanced chemical vapor deposition techniques to achieve nanometer-scale control over coating architecture and composition. Medtronic's research has demonstrated that their composite coatings can reduce the required dosage of antiproliferative drugs in drug-eluting stents by optimizing the drug release kinetics through engineered porosity. Their coatings undergo rigorous mechanical testing to ensure durability during crimping, deployment, and long-term implantation under pulsatile conditions.

Strengths: Comprehensive integration with device delivery systems; excellent adhesion properties even under deformation; proven clinical outcomes with reduced restenosis rates. Weaknesses: Complex manufacturing process requiring specialized equipment; higher regulatory hurdles due to novel material combinations; potential for mechanical delamination in certain anatomical locations with extreme mechanical stress.

Key Patents and Innovations in Biocompatible Coatings

Process for forming bioactive composite coatings on implantable devices

PatentInactiveCA2073781A1

Innovation

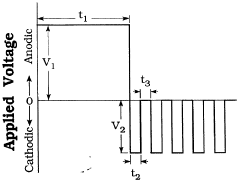

- A two-layer composite coating process using a single electrolyte bath with Ca- and P-containing ions, comprising a base layer of metal oxide and an outer layer of calcium phosphate compounds like tricalcium phosphate or hydroxyapatite, formed through anodic and cathodic current electrodeposition, to improve corrosion resistance and bioactivity.

Bioceramic composite coatings and process for making same

PatentInactiveUS20060199876A1

Innovation

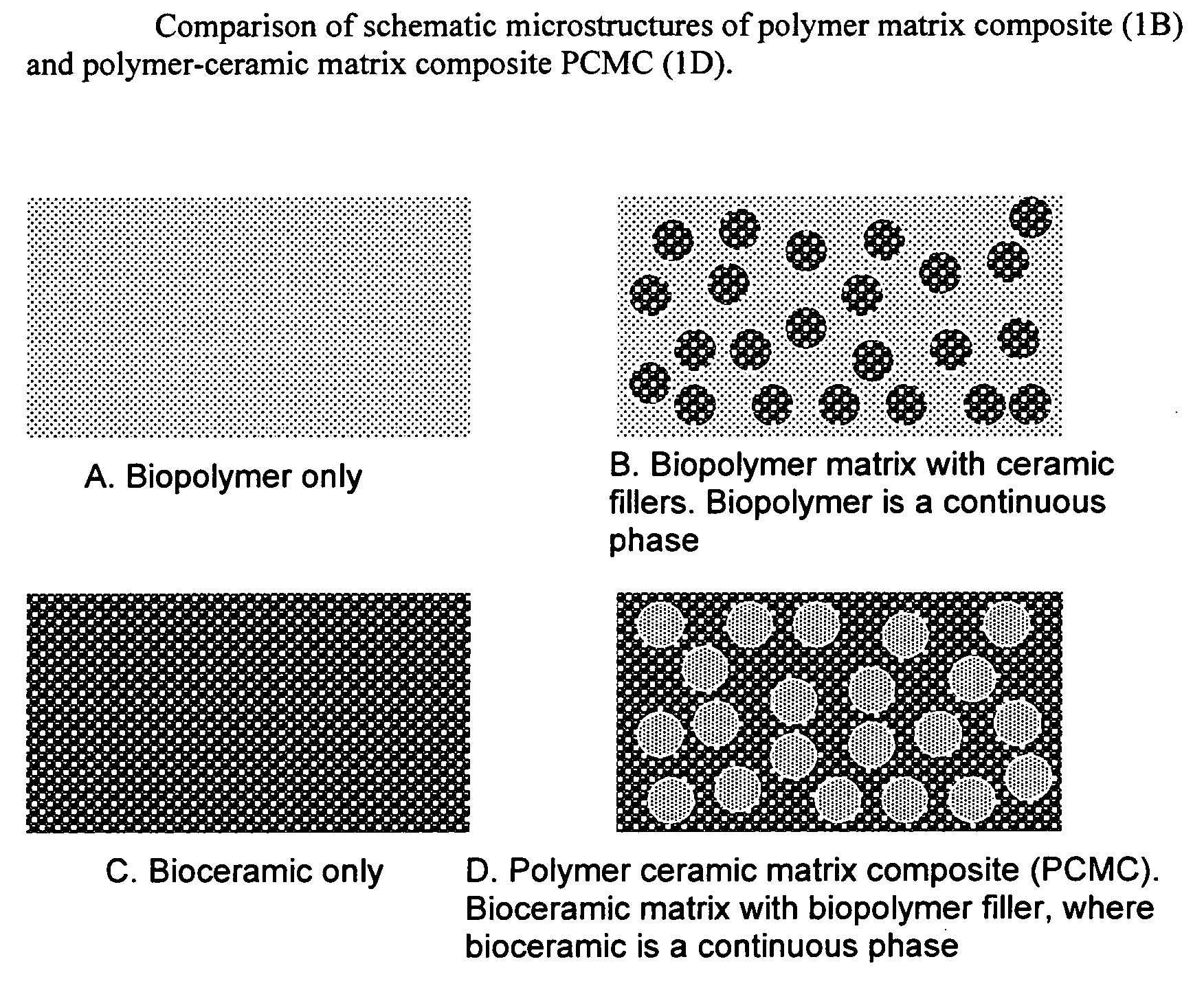

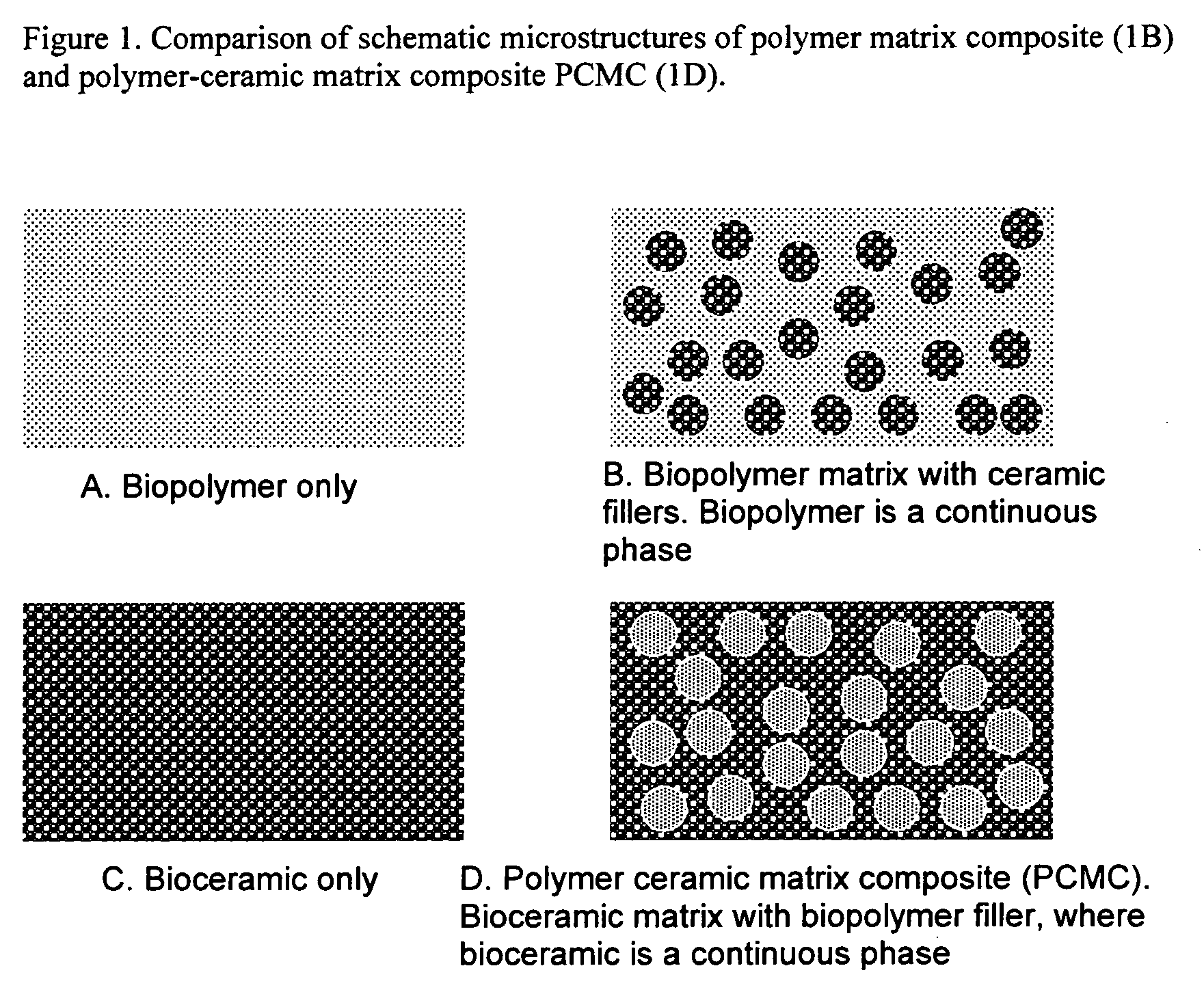

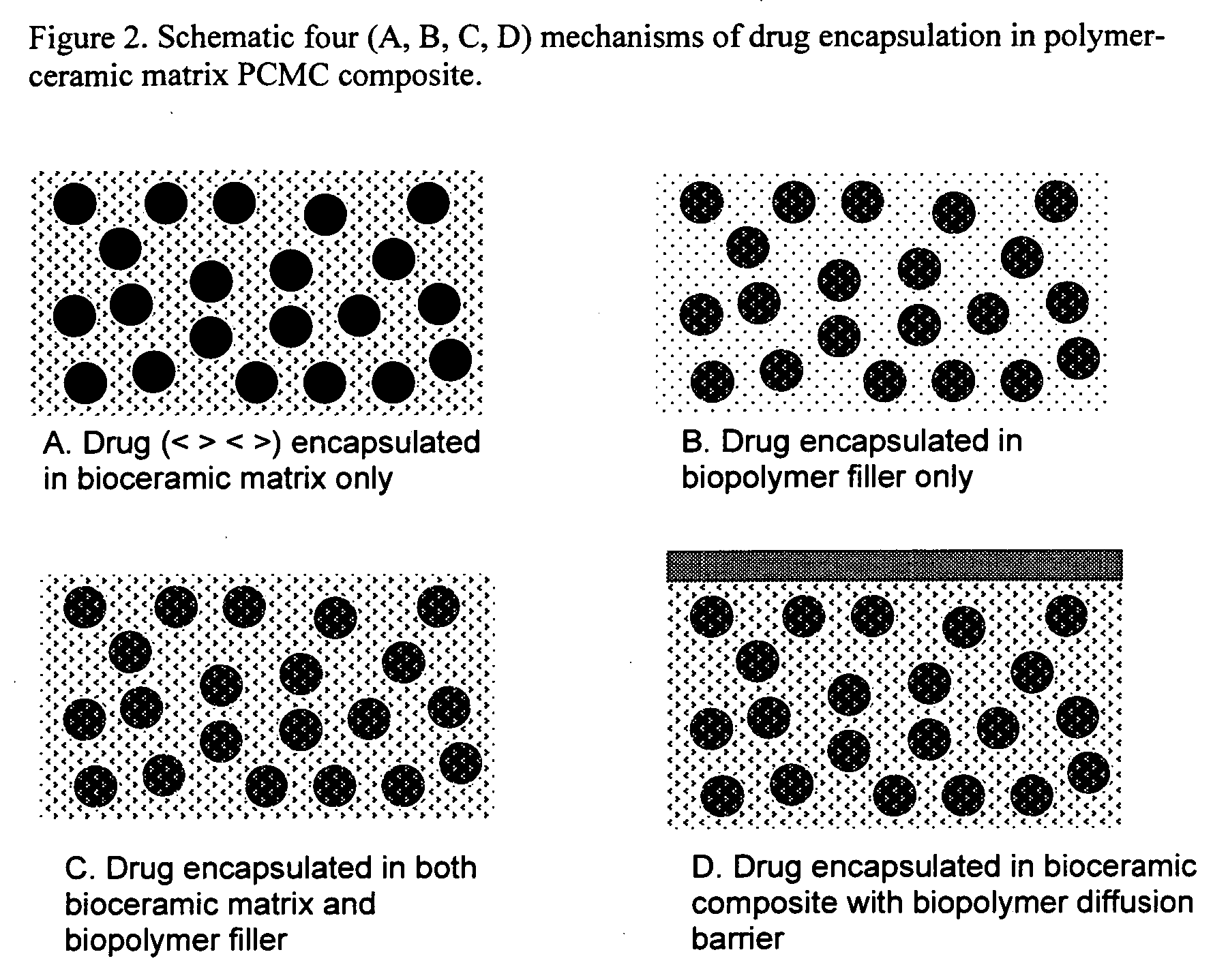

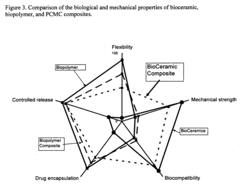

- Development of novel polymer-ceramic matrix composites with a continuous bio-ceramic phase and a reinforcing bio-polymer phase, using processes like sol-gel coating, thermal spray coating, and biomimetic deposition to create porous coatings with controlled porosity and bioactive agent encapsulation, allowing for tailored mechanical and biological properties and controlled drug release.

Biocompatibility and Safety Standards

Biomedical composite coatings must adhere to stringent biocompatibility and safety standards to ensure patient safety and regulatory compliance. The ISO 10993 series represents the cornerstone of biocompatibility evaluation, with ISO 10993-1 providing the framework for biological evaluation of medical devices. These standards mandate comprehensive testing protocols including cytotoxicity, sensitization, irritation, acute systemic toxicity, and hemocompatibility assessments for blood-contacting devices.

For composite coatings in implantable applications, long-term biocompatibility testing becomes essential, requiring subchronic toxicity, genotoxicity, and implantation studies. The FDA's guidance document "Use of International Standard ISO 10993-1" provides additional regulatory context for manufacturers navigating the complex landscape of biocompatibility requirements in the United States.

Material safety standards vary significantly based on the intended application. Orthopedic implant coatings must comply with ASTM F1185 for composition and ASTM F1160 for mechanical testing, while cardiovascular device coatings follow specific ISO 25539 series standards. Dental applications adhere to ISO 7405, which outlines preclinical evaluation of biocompatibility for dental materials.

The European Medical Device Regulation (MDR 2017/745) has intensified safety requirements for composite coatings, particularly regarding leachables and extractables. This regulation mandates chemical characterization following ISO 10993-18 guidelines to identify potentially harmful substances that might migrate from the coating during clinical use.

Emerging standards are addressing novel composite coating technologies, with ISO/TC 194 developing specific guidance for nanomaterials in medical devices. Similarly, antimicrobial coatings are subject to additional testing requirements outlined in ASTM E2180 and ISO 22196 to validate their efficacy while ensuring they don't compromise overall biocompatibility.

Risk management principles outlined in ISO 14971 must be integrated throughout the development process of composite coatings. This approach requires manufacturers to identify potential biological risks, implement mitigation strategies, and continuously monitor performance through post-market surveillance.

The global regulatory landscape presents significant challenges, as requirements vary between jurisdictions. While the Medical Device Single Audit Program (MDSAP) has harmonized some aspects across Australia, Brazil, Canada, Japan, and the United States, manufacturers must still navigate region-specific requirements, particularly for novel composite coating technologies that may not fit neatly into established regulatory frameworks.

For composite coatings in implantable applications, long-term biocompatibility testing becomes essential, requiring subchronic toxicity, genotoxicity, and implantation studies. The FDA's guidance document "Use of International Standard ISO 10993-1" provides additional regulatory context for manufacturers navigating the complex landscape of biocompatibility requirements in the United States.

Material safety standards vary significantly based on the intended application. Orthopedic implant coatings must comply with ASTM F1185 for composition and ASTM F1160 for mechanical testing, while cardiovascular device coatings follow specific ISO 25539 series standards. Dental applications adhere to ISO 7405, which outlines preclinical evaluation of biocompatibility for dental materials.

The European Medical Device Regulation (MDR 2017/745) has intensified safety requirements for composite coatings, particularly regarding leachables and extractables. This regulation mandates chemical characterization following ISO 10993-18 guidelines to identify potentially harmful substances that might migrate from the coating during clinical use.

Emerging standards are addressing novel composite coating technologies, with ISO/TC 194 developing specific guidance for nanomaterials in medical devices. Similarly, antimicrobial coatings are subject to additional testing requirements outlined in ASTM E2180 and ISO 22196 to validate their efficacy while ensuring they don't compromise overall biocompatibility.

Risk management principles outlined in ISO 14971 must be integrated throughout the development process of composite coatings. This approach requires manufacturers to identify potential biological risks, implement mitigation strategies, and continuously monitor performance through post-market surveillance.

The global regulatory landscape presents significant challenges, as requirements vary between jurisdictions. While the Medical Device Single Audit Program (MDSAP) has harmonized some aspects across Australia, Brazil, Canada, Japan, and the United States, manufacturers must still navigate region-specific requirements, particularly for novel composite coating technologies that may not fit neatly into established regulatory frameworks.

Sustainability Aspects of Medical Coating Materials

The sustainability of medical coating materials has become a critical consideration in the biomedical industry, driven by increasing environmental awareness and regulatory pressures. Current composite coating technologies for medical devices often utilize materials and processes that pose significant environmental challenges throughout their lifecycle. Traditional coating methods frequently employ volatile organic compounds (VOCs), heavy metals, and other environmentally harmful substances that contribute to pollution and resource depletion.

Recent advancements in green chemistry approaches have led to the development of more sustainable coating alternatives. Water-based coating systems have emerged as promising substitutes for solvent-based coatings, significantly reducing VOC emissions during application processes. Additionally, biobased polymers derived from renewable resources such as cellulose, chitosan, and alginate are increasingly being incorporated into composite coating formulations, decreasing dependence on petroleum-based materials.

Life cycle assessment (LCA) studies of medical coating materials reveal substantial environmental impact differences between traditional and newer sustainable alternatives. These assessments typically evaluate factors including raw material extraction, manufacturing energy requirements, waste generation, and end-of-life disposal options. Research indicates that sustainable coating technologies can reduce carbon footprints by 30-45% compared to conventional approaches, while maintaining comparable performance characteristics.

Regulatory frameworks worldwide are evolving to promote sustainability in medical materials. The European Union's REACH regulations and the United States FDA's initiatives on green chemistry are driving manufacturers toward more environmentally responsible coating solutions. These regulations increasingly require documentation of environmental impact data and encourage adoption of less hazardous alternatives when available.

End-of-life management presents particular challenges for composite coatings in medical applications. The intimate mixing of different materials often complicates recycling efforts, while the biological contamination of used medical devices creates additional disposal concerns. Emerging technologies focusing on biodegradable coating components and design-for-disassembly approaches show promise in addressing these issues, potentially enabling more components to enter recycling streams rather than landfills.

Economic considerations remain significant barriers to widespread adoption of sustainable coating technologies. Higher initial costs for green materials and processes often deter implementation despite long-term environmental benefits. However, market analysis suggests this gap is narrowing as economies of scale develop and as healthcare institutions increasingly incorporate sustainability metrics into procurement decisions.

Recent advancements in green chemistry approaches have led to the development of more sustainable coating alternatives. Water-based coating systems have emerged as promising substitutes for solvent-based coatings, significantly reducing VOC emissions during application processes. Additionally, biobased polymers derived from renewable resources such as cellulose, chitosan, and alginate are increasingly being incorporated into composite coating formulations, decreasing dependence on petroleum-based materials.

Life cycle assessment (LCA) studies of medical coating materials reveal substantial environmental impact differences between traditional and newer sustainable alternatives. These assessments typically evaluate factors including raw material extraction, manufacturing energy requirements, waste generation, and end-of-life disposal options. Research indicates that sustainable coating technologies can reduce carbon footprints by 30-45% compared to conventional approaches, while maintaining comparable performance characteristics.

Regulatory frameworks worldwide are evolving to promote sustainability in medical materials. The European Union's REACH regulations and the United States FDA's initiatives on green chemistry are driving manufacturers toward more environmentally responsible coating solutions. These regulations increasingly require documentation of environmental impact data and encourage adoption of less hazardous alternatives when available.

End-of-life management presents particular challenges for composite coatings in medical applications. The intimate mixing of different materials often complicates recycling efforts, while the biological contamination of used medical devices creates additional disposal concerns. Emerging technologies focusing on biodegradable coating components and design-for-disassembly approaches show promise in addressing these issues, potentially enabling more components to enter recycling streams rather than landfills.

Economic considerations remain significant barriers to widespread adoption of sustainable coating technologies. Higher initial costs for green materials and processes often deter implementation despite long-term environmental benefits. However, market analysis suggests this gap is narrowing as economies of scale develop and as healthcare institutions increasingly incorporate sustainability metrics into procurement decisions.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!